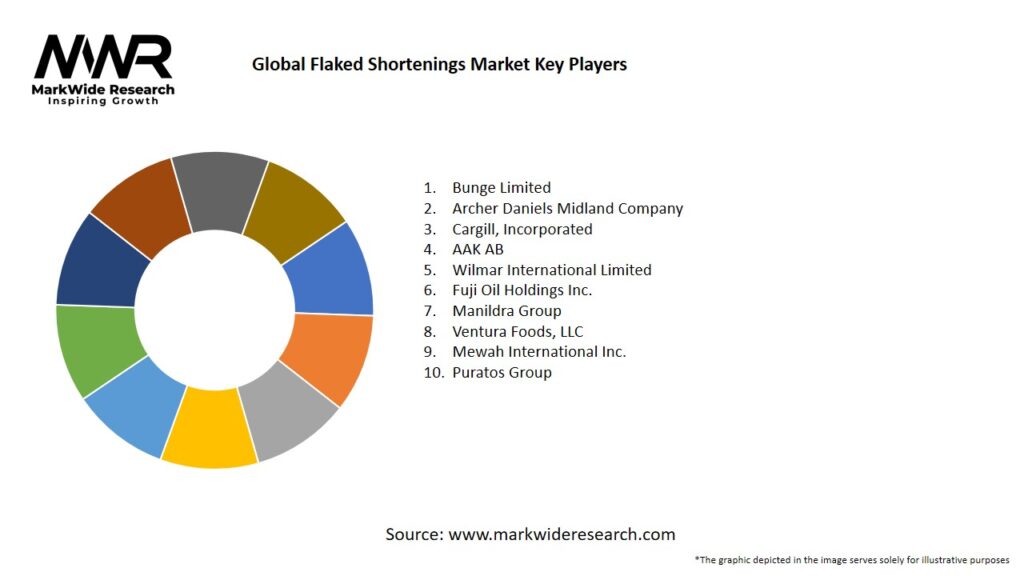

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Health-Driven Reformulations: Transition to zero-trans and low-saturated fat shortenings is reshaping product portfolios.

-

Convenience Foods Trend: Rising consumption of ready-to-bake and frozen pastries boosts demand for flaked shortenings.

-

Technological Advances: Continuous innovations in crystallization and flaking technologies improve flake consistency and functionality.

-

Emerging Market Growth: Asia-Pacific’s bakery sector is rapidly expanding, offering substantial growth potential.

-

Sustainability Focus: Rising demand for non-GMO and sustainably sourced vegetable oils influences raw material sourcing.

Market Drivers

-

Increasing Bakery Consumption: Growing urban populations and rising disposable incomes fuel bakery and confectionery consumption.

-

Convenience and Frozen Foods: Consumers’ busy lifestyles drive demand for frozen pastries and ready-to-eat baked goods utilizing flaked shortenings.

-

Healthier Formulations: Adoption of interesterified fats and enzymatically modified oils enables trans-free, low-saturate flaked shortenings.

-

Retail and Foodservice Expansion: Proliferation of cafés, quick-service restaurants, and in-store bakeries increases industrial demand.

-

Process Efficiency: Flaked shortenings reduce mixing time and improve dough handling, appealing to large-scale bakeries.

Market Restraints

-

Raw Material Price Volatility: Fluctuations in vegetable oil prices impact production costs and profit margins.

-

Regulatory Scrutiny: Stricter labeling and health regulations on fats and trans fats create compliance challenges.

-

Competition from Alternatives: Liquid shortenings and new fat replacers (oleogels, emulsions) compete in certain applications.

-

Supply Chain Complexity: Ensuring consistent, high-quality flakes requires precise temperature and humidity controls, increasing logistical complexity.

-

Consumer Health Concerns: Growing awareness of dietary fats could temper demand for traditional shortenings, even when flaked.

Market Opportunities

-

Clean-Label Innovations: Development of flaked shortenings using non-hydrogenated, enzymatically interesterified, or naturally hardened oils.

-

Specialty Applications: Tailored blends for gluten-free, keto, and vegan bakery segments.

-

Private Label Growth: Retailers launching proprietary frozen bakery ranges can drive flaked shortening volumes.

-

Emerging Regions: Investment in local flaking facilities in Asia, Latin America, and Africa to capture high-growth markets.

-

Circular Economy Practices: Utilizing by-products and waste oils for sustainable flaked shortening production.

Market Dynamics

-

Supply Side: Advanced flaking lines with precise temperature-controlled crystallizers enhance flake uniformity. Partnerships with palm, sunflower, and canola oil suppliers ensure raw material security.

-

Demand Side: Consumer preference for authentic, artisanal textures in pastries drives technical requirements for flaked shortenings. Co-development with large bakery chains ensures product-market fit.

-

Economic Factors: Rising economies increase bakery investment; however, inflationary pressures on wheat and oils may dampen end-product affordability.

Regional Analysis

-

North America: Largest market due to mature bakery industry and stringent trans-fat bans driving flaked shortening reformulations.

-

Europe: High demand for premium pastries; strong clean-label movement accelerates uptake of non-hydrogenated flakes.

-

Asia-Pacific: Fastest growth—China, India, and Southeast Asia expand industrial bakery and convenience segments. Local production facilities emerging.

-

Latin America: Urbanization and rising Western dietary habits drive bakery consumption; reliance on imported flaked shortenings is high.

-

Middle East & Africa: Growing foodservice and retail bakery sectors present nascent opportunities; logistics and cold chain remain challenges.

Competitive Landscape

Leading Companies in the Global Flaked Shortenings Market:

- Bunge Limited

- Archer Daniels Midland Company

- Cargill, Incorporated

- AAK AB

- Wilmar International Limited

- Fuji Oil Holdings Inc.

- Manildra Group

- Ventura Foods, LLC

- Mewah International Inc.

- Puratos Group

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

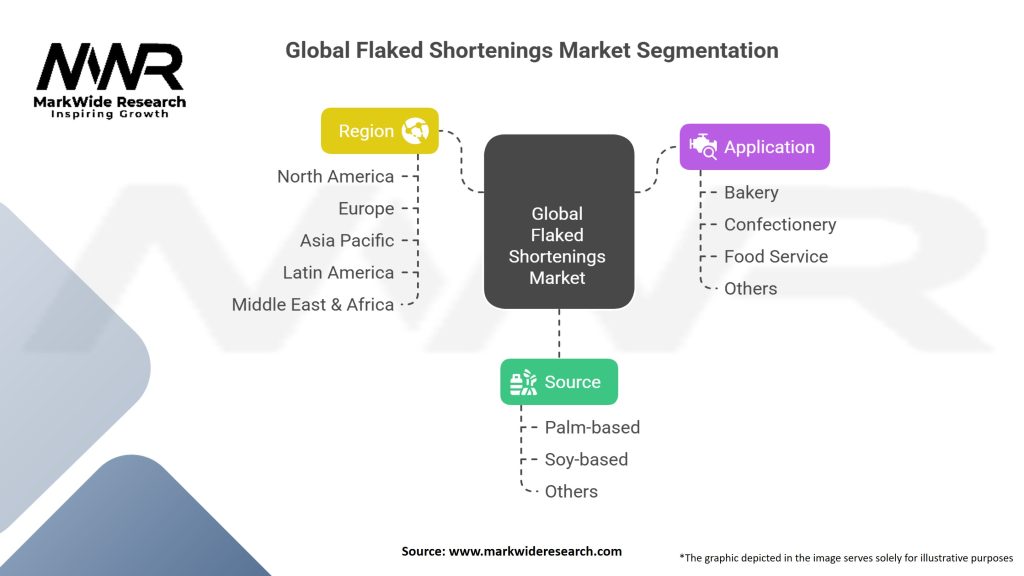

Segmentation

-

By Oil Source:

-

Palm-based flakes

-

Soy-based flakes

-

Sunflower/canola-based flakes

-

Specialty oil blends (coconut, shea)

-

-

By Application:

-

Puff pastry, Danish, croissants

-

Pie crusts and tarts

-

Biscuits and cookies

-

Cakes and muffins

-

-

By Formulation:

-

Hydrogenated flakes

-

Interesterified/trans-free flakes

-

Enzymatically modified flakes

-

-

By End User:

-

Industrial bakeries

-

Foodservice (QSR, café chains)

-

Retail (frozen bakery segments)

-

-

By Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Category-wise Insights

-

Puff Pastry & Danish: Demand for ultra-flaky textures makes rapid-melting, uniform flakes essential.

-

Pie Crusts: Lower fat migration and controlled plasticity are key flake properties.

-

Cookies & Biscuits: Even fat dispersion from flakes ensures consistent spread and texture.

-

Cakes & Muffins: Flakes support aeration and crumb structure, offering clean-label opportunities when trans-free.

Key Benefits for Industry Participants and Stakeholders

-

Enhanced Product Quality: Uniform flake distribution delivers consistent mouthfeel and flakiness.

-

Operational Efficiency: Flakes reduce chunking, lower mixing energy, and shorten processing times.

-

Formulation Flexibility: Custom melt profiles enable precise textural control across bakery applications.

-

Cost Management: Optimized flaking processes and interesterified blends help manage raw material costs and regulatory compliance.

-

Sustainability Gains: Adoption of palm-sourced RSPO-certified oils and by-product utilization supports corporate sustainability goals.

SWOT Analysis

-

Strengths: Superior functional performance; alignment with clean-label trends when trans-free; efficient handling.

-

Weaknesses: Dependence on volatile oil prices; higher processing complexity vs. liquid shortenings.

-

Opportunities: Growth in emerging markets; innovation in specialty blend flakes for health-focused segments.

-

Threats: Competition from alternative fat systems; regulatory shifts toward saturated fat reduction may require new formulations.

Market Key Trends

-

Clean-Label Focus: Surge in trans-free, non-hydrogenated interesterified flakes.

-

Health & Wellness: Introduction of flakes fortified with omega‑3 or MCT oils targeting functional bakery.

-

Automation & Industry 4.0: Smart flaking lines with in-line quality monitoring for consistent flake size and crystallinity.

-

Localized Production: Regional flaking plants reduce import costs and carbon footprint.

-

Ingredient Transparency: Blockchain traceability from oil sourcing through flaking process.

Covid-19 Impact

-

Bakery Demand Spike: Home baking trend and surge in packaged bakery goods boosted flaked shortening usage.

-

Supply Chain Resilience: Disruptions prompted multi-sourcing of oils and investment in local flaking capacity.

-

Hygiene & Safety: Contactless, flake-based handling gained favor over block fats requiring manual portioning.

-

Digital Ordering: Foodservice pivot to delivery increased demand for frozen pastry products using flakes.

Key Industry Developments

-

New Plant Commissionings: Major players expanding flaking capacity in Asia-Pacific and Latin America.

-

R&D Collaborations: Joint development projects between oilseed processors and bakery OEMs to optimize flake formulations.

-

Sustainability Certifications: Companies achieving RSPO/ISCC Plus certifications for palm-based flakes.

-

Innovative Packaging: Nitrogen-flushed, multi-layer packaging preserves flake integrity and extends shelf life.

-

Strategic Acquisitions: Consolidation in specialty fats to secure flake technology and market share.

Analyst Suggestions

-

Invest in Trans-Free Technologies: Accelerate development and commercialization of enzymatically interesterified flakes.

-

Expand Regional Footprint: Prioritize greenfield flaking facilities in fast-growing Asia-Pacific and Latin America markets.

-

Leverage Digitalization: Implement Industry 4.0 solutions for real-time monitoring of flake quality and process efficiency.

-

Forge Co-Development Partnerships: Collaborate with bakery chains to tailor flakes for signature product lines.

-

Enhance Traceability: Adopt end-to-end blockchain tracking for oil sourcing through final flake delivery to build consumer trust.

Future Outlook

The Global Flaked Shortenings Market is set for steady growth, underpinned by:

-

Continued Baker’s Demand: Ongoing expansion of industrial bakeries and frozen convenience segments.

-

Health-Driven Reformulations: The transition away from trans fats toward clean-label bolster trans-free flake adoption.

-

Emerging Market Maturation: Asia-Pacific and Latin America to contribute the largest incremental volumes.

-

Technological Differentiation: Next‑gen crystallization and flaking processes enabling novel fat systems.

-

Sustainability Imperatives: Growth aligned with certified, responsibly sourced oil supply chains.

Conclusion

Flaked shortenings represent a critical innovation in modern baking, combining functional performance with processing efficiency. As global consumption of baked and convenience foods rises, and as health and sustainability considerations reshape ingredient choices, flaked shortenings—especially trans-free, custom‑blended flakes—will play an increasingly central role. Industry participants who invest in advanced flaking technologies, regional capacity expansion, and clean-label formulations will be best positioned to capture the substantial growth opportunities in this dynamic market.