444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The global fine art insurance market is a specialized sector of the insurance industry that provides coverage for valuable and unique works of art. It caters to the needs of collectors, galleries, museums, auction houses, and other entities involved in the art market. Fine art insurance is designed to protect artworks from a range of risks, including theft, damage, loss, and natural disasters. As the art market continues to expand globally, the demand for comprehensive insurance coverage for fine art has witnessed significant growth.

Meaning

Fine art insurance refers to the insurance coverage provided for valuable and unique works of art. This type of insurance offers protection against various risks, such as theft, damage, loss, and natural disasters. It ensures that art collectors, galleries, museums, and other stakeholders in the art industry have financial security in the event of unforeseen circumstances that could damage or destroy artwork.

Executive Summary

The global fine art insurance market has experienced steady growth in recent years, driven by the increasing value and demand for artworks worldwide. Artworks are becoming increasingly valuable assets, making insurance coverage a necessity for collectors and art institutions. The market offers specialized insurance products tailored to the unique needs of the art industry, providing comprehensive protection and peace of mind to art owners and stakeholders.

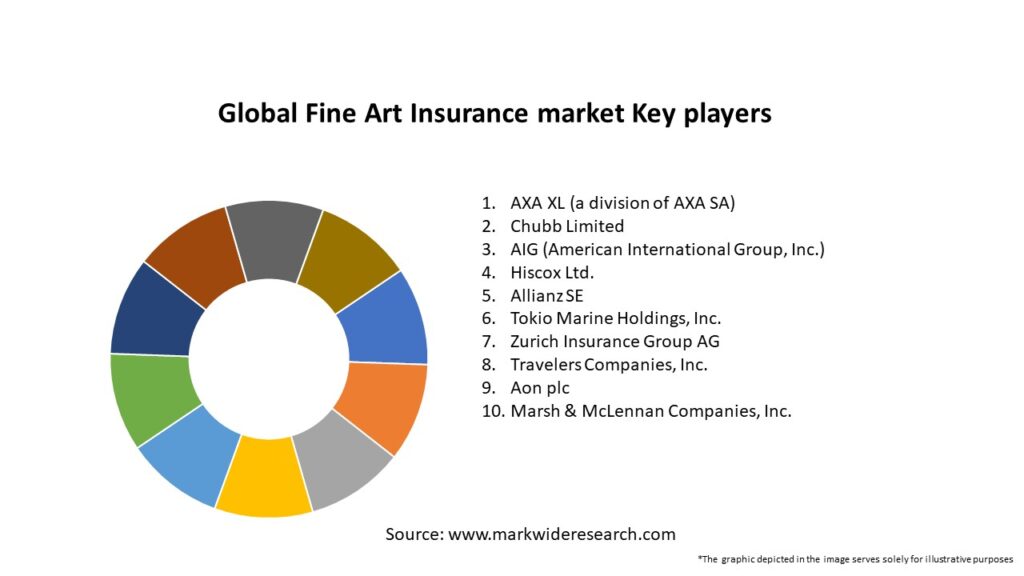

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The global fine art insurance market operates in a dynamic environment influenced by various factors, including market trends, economic conditions, technological advancements, and regulatory changes. The market is characterized by constant innovation and adaptation to address evolving risks in the art industry. Insurers continuously refine their products and services to meet the changing needs of art owners, collectors, and institutions.

The market dynamics are also shaped by the interplay between insurers, art industry stakeholders, and customers. Insurance providers collaborate with art market participants to gain insights into emerging risks and develop customized insurance solutions. Art owners and institutions, in turn, rely on insurers to provide comprehensive coverage and risk management expertise.

Regional Analysis

The global fine art insurance market exhibits regional variations due to differences in art market maturity, cultural heritage, and economic factors. Some regions, such as North America and Europe, have well-established art markets and a long history of art insurance. These regions have a higher adoption rate of fine art insurance and a larger pool of insurers specializing in this segment.

Emerging economies in Asia-Pacific, Latin America, and the Middle East are witnessing rapid growth in their art markets. These regions present significant opportunities for the fine art insurance market, as collectors and institutions increasingly recognize the importance of insurance coverage for their valuable artworks.

In terms of regulations, each region may have specific requirements for art insurance providers. Insurers must navigate these regulatory frameworks to offer compliant products and operate within legal boundaries.

Competitive Landscape

Leading Companies in the Global Fine Art Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The global fine art insurance market can be segmented based on various criteria, including type of coverage, end-users, and geographical regions. The following are common segments within the market:

Segmentation allows insurers to tailor their products and services to the specific needs of different customer groups and geographic regions, ensuring that they provide relevant coverage and meet the unique requirements of each segment.

Category-wise Insights

Each category of artworks and collectibles presents unique challenges and risks that need to be addressed through tailored insurance coverage. Insurers must understand the specific characteristics and value drivers of each category to provide appropriate coverage options.

Key Benefits for Industry Participants and Stakeholders

The global fine art insurance market offers several benefits to industry participants and stakeholders, including:

SWOT Analysis

A SWOT analysis of the global fine art insurance market provides insights into its strengths, weaknesses, opportunities, and threats:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

The global fine art insurance market is influenced by several key trends:

Covid-19 Impact

The global Covid-19 pandemic had a significant impact on the fine art insurance market. The art industry, including galleries, museums, and auction houses, faced unprecedented challenges due to lockdowns, travel restrictions, and temporary closures. This resulted in a decline in art sales, reduced exhibition opportunities, and a shift towards online art transactions.

The pandemic also highlighted the importance of insurance coverage for art owners. The uncertainty surrounding the art market and the increased vulnerability of artworks during periods of restricted access underscored the need for comprehensive insurance protection.

Insurance providers responded to the Covid-19 impact by adapting their policies and services to meet the changing needs of art owners and institutions. They offered flexible coverage options, extended policy terms, and adjusted premiums to accommodate the challenging circumstances faced by the art industry.

Additionally, insurers provided guidance on risk mitigation strategies, such as remote monitoring of art collections, virtual exhibitions, and enhanced security measures during temporary closures. This proactive approach helped art owners and institutions navigate the uncertainties of the pandemic and safeguard their valuable assets.

Key Industry Developments

The global fine art insurance market has witnessed several key industry developments:

Analyst Suggestions

Based on the market trends and developments, analysts offer the following suggestions for insurance providers in the fine art insurance market:

Future Outlook

The future outlook for the global fine art insurance market is optimistic, driven by several factors:

In conclusion, the global fine art insurance market is poised for continued growth and innovation. The increasing value of artworks, expanding art markets, and evolving risks in the industry create opportunities for insurance providers to offer comprehensive coverage and tailored services. By embracing technological advancements, collaborating with art industry stakeholders, and staying attuned to market trends, insurers can thrive in this specialized market and provide essential protection for the valuable artworks that shape our cultural heritage.

Conclusion

The global fine art insurance market plays a vital role in protecting valuable artworks and providing financial security to art owners, collectors, galleries, museums, and other stakeholders in the art industry. As the art market continues to expand globally, the demand for comprehensive insurance coverage for fine art is on the rise.

The market has witnessed significant growth driven by factors such as the increasing value of artworks, growing awareness among art owners, and the evolving risk landscape. Insurance providers have responded to these trends by developing specialized coverage options, enhancing risk assessment capabilities, and offering value-added services. The market is not without its challenges, including high premiums, lack of awareness, and the complex valuation process for artworks. However, there are ample opportunities for insurers to tap into emerging markets, collaborate with art industry stakeholders, and leverage technological advancements to provide innovative solutions.

What is Fine Art Insurance?

Fine Art Insurance is a specialized type of insurance that provides coverage for artworks, including paintings, sculptures, and collectibles, against risks such as theft, damage, and loss. This insurance is essential for collectors, galleries, and museums to protect their valuable assets.

What are the key players in the Global Fine Art Insurance market?

Key players in the Global Fine Art Insurance market include Hiscox, AXA Art, Chubb, and Lloyd’s of London, which offer tailored insurance solutions for art collectors and institutions. These companies provide various policies that cater to the unique needs of the fine art sector, among others.

What are the growth factors driving the Global Fine Art Insurance market?

The Global Fine Art Insurance market is driven by increasing art investments, a growing number of art collectors, and rising awareness about the importance of protecting valuable artworks. Additionally, the expansion of online art sales platforms has contributed to the demand for comprehensive insurance coverage.

What challenges does the Global Fine Art Insurance market face?

The Global Fine Art Insurance market faces challenges such as fluctuating art values, difficulties in accurately assessing the worth of unique pieces, and the risk of fraud. These factors can complicate underwriting processes and affect policy pricing.

What opportunities exist in the Global Fine Art Insurance market?

Opportunities in the Global Fine Art Insurance market include the development of innovative insurance products tailored for digital art and NFTs, as well as expanding coverage options for emerging markets. The increasing integration of technology in art transactions also presents new avenues for growth.

What trends are shaping the Global Fine Art Insurance market?

Trends shaping the Global Fine Art Insurance market include the rise of online art sales, increased collaboration between insurers and art institutions, and a growing focus on sustainability in art preservation. These trends are influencing how insurance products are designed and marketed.

Global Fine Art Insurance market

| Segmentation Details | Description |

|---|---|

| Coverage Type | All-Risk, Named Perils, Specified Perils, Fine Art Collections |

| Client Type | Individual Collectors, Galleries, Museums, Corporations |

| Policy Duration | Short-Term, Long-Term, Annual, Multi-Year |

| Valuation Method | Market Value, Appraised Value, Replacement Cost, Auction Value |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Global Fine Art Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at