444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The global filters market was valued at approximately USD 58 billion in 2023 and is projected to grow at a CAGR of 5–6% through 2030. Filters—devices or materials that remove unwanted particles, contaminants, or impurities from fluids (liquids and gases)—are critical across industrial, commercial, and residential applications. Key segments include water filtration, air purification, industrial process filtration, automotive cabin and engine filtration, healthcare and pharmaceutical-grade filters, and oil & gas separation. Drivers such as tightening environmental regulations, rising air and water quality concerns, expanding industrial capacity, and the electrification of vehicles are fueling demand for advanced filter media and systems. Technological advances in nanofiber membranes, high-efficiency particulate air (HEPA) filters, and smart sensor-integrated modules are reshaping the market with higher performance and lower lifecycle costs.

Meaning

In filtration, “filters” encompass a broad array of products—sand and multimedia filters, cartridge filters, bag filters, membrane filters (e.g., reverse osmosis, ultrafiltration), gas filters (e.g., HEPA, activated carbon), and coalescers—designed to separate solids, liquids, or gases by size exclusion, adsorption, or electrostatic capture. Filter performance is characterized by metrics such as micron rating, beta ratio, flow rate, and pressure drop. Choosing the right filter involves balancing efficiency, capacity, operating costs, and compatibility with the application’s physical and chemical conditions.

Executive Summary

The global filters market is poised for steady growth, underpinned by accelerating industrialization in Asia Pacific, stringent clean-air policies in North America and Europe, and increasing investment in water and wastewater treatment worldwide. In automotive, stricter emissions standards and the shift to electric vehicles are driving demand for advanced cabin air and battery cooling filters. Healthcare and pharmaceuticals require ultra-pure filtration systems, supporting high-value growth in single-use membrane cartridges. Meanwhile, smart filters equipped with sensors and IoT connectivity enable predictive maintenance and optimized energy consumption, emerging as a key differentiator for suppliers. Industry consolidation through M&A and the rise of specialized filter manufacturers are enhancing global reach and technical capabilities.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Water Treatment Dominance: Over 30% of market value is attributed to municipal and industrial water/wastewater filtration, driven by urbanization and water scarcity.

Air Filtration Growth: HVAC, indoor air quality (IAQ), and industrial emissions controls account for nearly 25% of demand, buoyed by pandemic-era health concerns and air-quality regulations.

Automotive Filtration Shift: Engine air, oil, and cabin air filters remain core, but EV cooling and battery thermal management filters are a fast-growing niche (CAGR >10%).

Membrane Technologies: Reverse osmosis and ultrafiltration membranes are premium segments growing at 7–8% annually, used in desalination, ultrapure water, and bioprocessing.

Smart Filters: Embedded sensors and connectivity for pressure differential, particulate count, and predictive replacement schedules are gaining traction among industrial end-users.

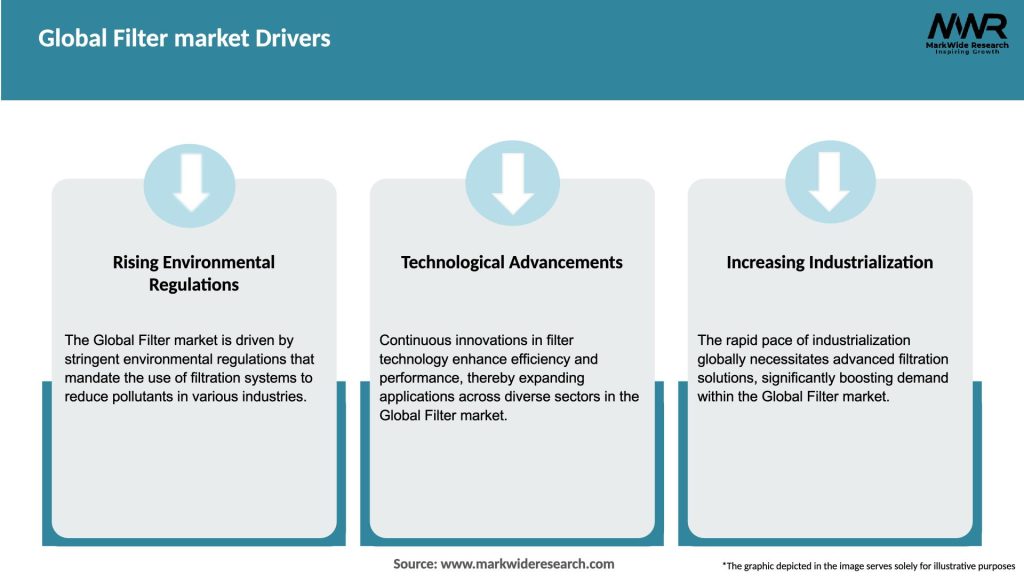

Market Drivers

Regulatory Pressure: Stringent EPA, EU Industrial Emissions Directive (IED), and local water-quality regulations compel end-users to adopt higher-efficiency filtration.

Health & Safety Awareness: Post-COVID-19 concerns over airborne pathogens have increased investment in HEPA and ULPA filtration for commercial and residential applications.

Resource Scarcity: Water scarcity in regions like the Middle East, India, and California drives desalination and large-scale water reuse plants relying on advanced membranes.

Industrial Expansion: Growth in pharmaceuticals, electronics, and food & beverage processing requires precise filtration solutions to maintain product purity standards.

Electrification of Transport: EV thermal management needs specialized filters for coolant circuits and battery packs, creating new automotive filter sub-segments.

Market Restraints

High Capital Costs: Advanced membrane systems and high-efficiency gas filters involve significant upfront investment, slowing adoption in cost-sensitive projects.

Maintenance Complexity: Sophisticated filters require regular monitoring, cleaning, or cartridge replacement—posing operational challenges in remote or continuous-process settings.

Feedstock Volatility: Raw materials like polymer resins, nonwovens, and activated carbon are subject to price swings, affecting filter media costs.

Competition from Alternatives: Emerging non-membrane water treatment (e.g., capacitive deionization) and electrostatic precipitators in air handling introduce alternative technologies.

Supply-Chain Disruptions: Global logistics challenges and semiconductor shortages (for smart filters) can delay equipment delivery and system integration.

Market Opportunities

Nanofiber and Electrospun Media: High-efficiency, low-pressure-drop filter media for both liquid and gas filtration, enabling finer micron ratings with energy savings.

Digital Maintenance Services: Recurring-revenue models around remote monitoring, predictive maintenance, and filter-as-a-service offerings.

Point-of-Use & Portable Systems: Rising demand for home water purification units and portable air purifiers in emerging markets.

Hybrid Filters: Combined functions (e.g., particulate + gas adsorption) in single modules simplify systems and reduce footprint.

Circular Economy Initiatives: Filter recycling and regeneration services for activated carbon, membranes, and metal housings to improve sustainability and reduce waste.

Market Dynamics

M&A Activity: Consolidation among large filter OEMs and chemical companies expands product portfolios, geographic reach, and R&D capabilities.

OEM Partnerships: Co-development agreements between filter media suppliers and end-equipment manufacturers ensure optimal integration and performance.

Open-Architecture Controls: Interoperable sensor and control platforms encourage third-party smart filter retrofits and add-on services.

Decentralized Manufacturing: Regional filter assembly and media production reduce lead times and adapt to local regulatory requirements.

Industry Standards Evolution: ISO 16890 (air filters) and ASTM norms for liquid filtration drive uniform performance metrics and facilitate global trade.

Regional Analysis

Asia Pacific: Largest share (>35%) driven by China and India’s infrastructure boom, rapid urbanization, and industrial capacity expansion.

North America: Early adopter of smart filtration and stringent air/water quality norms supports steady growth in residential and commercial segments.

Europe: Mature market with rigorous environmental standards and advanced refurbishment/regeneration services for industrial filters.

Latin America: Infrastructure upgrades in Brazil and Mexico propel municipal water treatment and industrial filtration adoption.

Middle East & Africa: Desalination dominance and oil & gas sector growth spur demand for high-capacity membrane systems and hydrocarbon-resistant filters.

Competitive Landscape

Leading Companies in the Global Filter Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

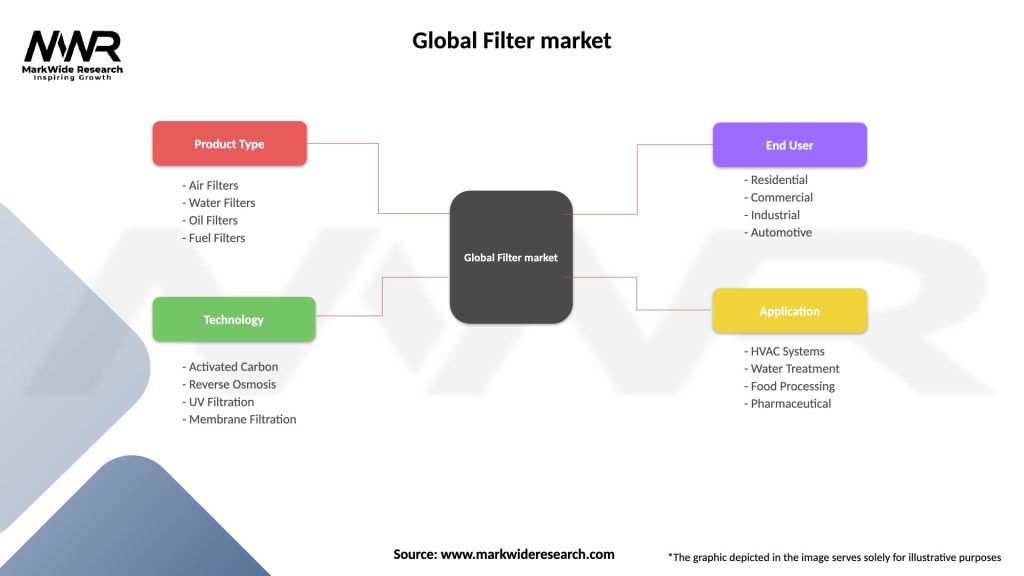

Segmentation

The global filter market can be segmented based on type, application, and end-user industries. By type, the market can be categorized into air filters, water filters, oil filters, fuel filters, and others. The application segment includes industrial filtration, HVAC systems, automotive, oil and gas, pharmaceuticals, food and beverage, and others. The end-user industries comprise manufacturing, utilities, automotive, oil and gas, healthcare, and others.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a mixed impact on the filter market. While certain sectors such as healthcare, pharmaceuticals, and water treatment experienced increased demand for filters, other industries faced temporary disruptions due to lockdowns and supply chain disruptions. However, the pandemic also highlighted the critical role of filters in maintaining hygiene and preventing the spread of airborne contaminants.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the global filter market looks promising, with steady growth expected in the coming years. The increasing need for clean and purified fluids and gases, coupled with stringent regulations regarding pollution control and workplace safety, will drive the demand for filters. Technological advancements and innovations in filter materials and designs will further enhance the performance and efficiency of filters.

Conclusion

The global filter market plays a crucial role in various industries by ensuring the removal of impurities and contaminants from fluids and gases. With increasing awareness about the importance of clean and filtered products, the market is witnessing significant growth. However, challenges such as high initial costs and maintenance expenses need to be addressed. By embracing innovation, focusing on sustainability, and collaborating with end-users, companies can capitalize on the opportunities and navigate the competitive landscape of the global filter market successfully.

What is Filter?

Filters are devices or materials used to remove impurities or unwanted components from liquids or gases. They are widely used in various applications, including water treatment, air purification, and industrial processes.

What are the key players in the Global Filter market?

Key players in the Global Filter market include companies such as Donaldson Company, Inc., Parker Hannifin Corporation, and 3M Company, among others.

What are the main drivers of growth in the Global Filter market?

The main drivers of growth in the Global Filter market include increasing demand for clean air and water, stringent environmental regulations, and advancements in filtration technology. These factors are pushing industries to adopt more efficient filtration solutions.

What challenges does the Global Filter market face?

The Global Filter market faces challenges such as high initial costs of advanced filtration systems and the need for regular maintenance. Additionally, the presence of alternative technologies can hinder market growth.

What opportunities exist in the Global Filter market?

Opportunities in the Global Filter market include the growing trend towards sustainability and eco-friendly products, as well as the expansion of industries such as pharmaceuticals and food processing that require high-quality filtration solutions.

What are the current trends in the Global Filter market?

Current trends in the Global Filter market include the development of smart filters with IoT capabilities, increased use of nanotechnology in filter materials, and a shift towards biodegradable filter options. These innovations are enhancing efficiency and sustainability.

Global Filter market

| Segmentation Details | Description |

|---|---|

| Product Type | Air Filters, Water Filters, Oil Filters, Fuel Filters |

| Technology | Activated Carbon, Reverse Osmosis, UV Filtration, Membrane Filtration |

| End User | Residential, Commercial, Industrial, Automotive |

| Application | HVAC Systems, Water Treatment, Food Processing, Pharmaceutical |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Global Filter Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at