444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The global electronic contract assembly market is a rapidly growing sector within the electronics industry. It involves the outsourcing of electronic manufacturing services (EMS) to specialized contract manufacturers. These contract manufacturers provide services such as design, assembly, testing, and packaging of electronic components and products on behalf of original equipment manufacturers (OEMs). The market for electronic contract assembly has witnessed significant growth in recent years due to the increasing complexity of electronic devices and the need for cost-effective and efficient manufacturing processes.

Meaning

Electronic contract assembly refers to the practice of outsourcing the manufacturing and assembly of electronic components and products to third-party contract manufacturers. OEMs, instead of producing electronic products in-house, collaborate with contract manufacturers to streamline the manufacturing process, reduce costs, and focus on their core competencies such as product design and marketing. The contract manufacturers, equipped with specialized knowledge and advanced facilities, take care of the entire production cycle, from sourcing components to assembling and testing the final product.

Executive Summary

The global electronic contract assembly market is experiencing substantial growth, driven by factors such as the increasing demand for consumer electronics, advancements in technology, and the need for efficient manufacturing processes. The market provides numerous opportunities for both OEMs and contract manufacturers to collaborate and benefit from each other’s expertise. However, there are challenges in terms of maintaining quality standards, managing supply chains, and dealing with intellectual property rights. The market’s future outlook remains positive, with continued growth expected as the electronics industry continues to evolve.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

The following factors are driving the growth of the global electronic contract assembly market:

Market Restraints

Despite the positive growth prospects, the global electronic contract assembly market faces some challenges and restraints:

Market Opportunities

The global electronic contract assembly market presents several opportunities for industry participants and stakeholders:

Market Dynamics

The global electronic contract assembly market is driven by various dynamic factors, including technological advancements, changing consumer preferences, and evolving regulatory landscape. These dynamics influence the market trends, opportunities, and challenges faced by industry participants. Technological advancements, such as AI, IoT, and 5G, are shaping the future of the electronics industry and driving the demand for electronic contract assembly services. OEMs are increasingly relying on contract manufacturers with specialized expertise to navigate the complexities of these technologies and bring innovative products to market.

Changing consumer preferences, such as the demand for personalized and connected devices, are also influencing the market dynamics. OEMs need to collaborate with contract manufacturers capable of delivering customized and IoT-enabled solutions to meet these evolving consumer demands. The regulatory landscape surrounding the electronics industry, including environmental regulations and labor standards, continues to evolve. OEMs and contract manufacturers must stay abreast of these regulations and ensure compliance to mitigate risks and maintain their reputation in the market.

Additionally, geopolitical factors, such as trade policies and tariffs, can impact the global electronic contract assembly market. Changes in trade agreements and international relations can influence the cost of components, manufacturing locations, and supply chain strategies.

Regional Analysis

The global electronic contract assembly market can be analyzed based on regional segments, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Each region has its unique market characteristics, opportunities, and challenges.

Competitive Landscape

Leading Companies in Global Electronic Contract Assembly Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

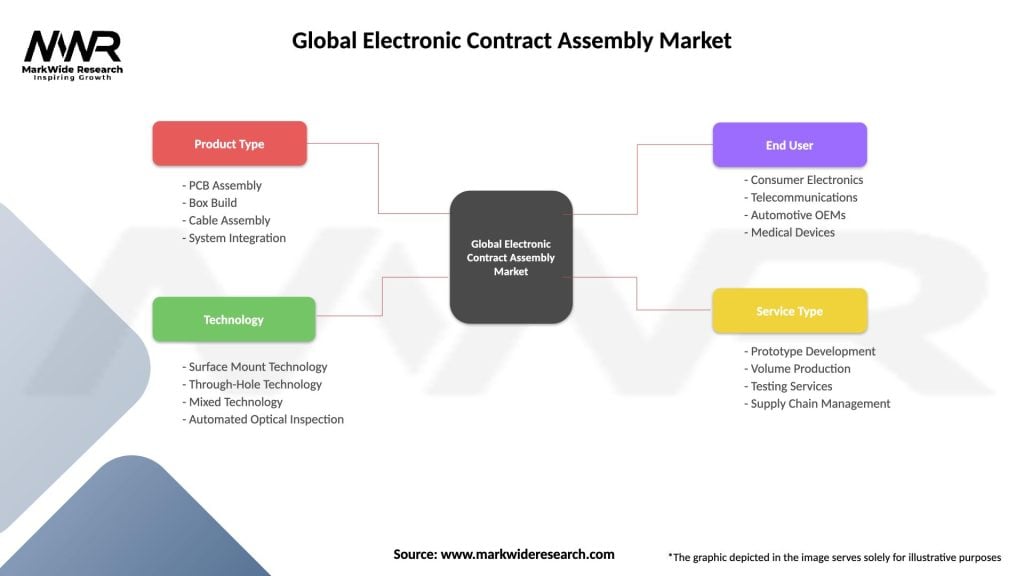

Segmentation

The electronic contract assembly market can be segmented based on various factors, including service type, end-use industry, and geography. Common segmentation criteria include:

Segmentation allows for a better understanding of the market dynamics within specific service types, end-use industries, and geographic regions. It helps industry participants and stakeholders identify target markets and tailor their strategies accordingly.

Category-wise Insights

Each category offers specific advantages and caters to different requirements of OEMs. Understanding these categories can help OEMs choose the most appropriate type of electronic contract assembly service for their specific needs.

Key Benefits for Industry Participants and Stakeholders

The global electronic contract assembly market offers several key benefits for industry participants and stakeholders:

Understanding these key benefits can assist industry participants and stakeholders in making informed decisions and leveraging the advantages offered by the electronic contract assembly market.

SWOT Analysis

A SWOT analysis provides a comprehensive assessment of the strengths, weaknesses, opportunities, and threats in the global electronic contract assembly market.

Strengths:

Weaknesses:

Opportunities:

Threats:

Understanding the SWOT analysis helps industry participants and stakeholders identify strengths, address weaknesses, capitalize on opportunities, and mitigate threats in the electronic contract assembly market.

Market Key Trends

The global electronic contract assembly market is influenced by several key trends that shape the industry’s dynamics:

These key trends reflect the evolving needs of OEMs, advancements in technology, and changing market dynamics. Contract manufacturers must stay abreast of these trends and adapt their strategies and capabilities accordingly to remain competitive in the market.

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the global electronic contract assembly market. The outbreak disrupted supply chains, caused manufacturing slowdowns, and affected consumer demand. However, it also highlighted the importance of electronic devices and accelerated digital transformation across industries, creating both challenges and opportunities for the market.

During the pandemic, the demand for consumer electronics, remote work devices, and healthcare-related electronic devices surged. Contract manufacturers faced challenges in meeting this increased demand while dealing with supply chain disruptions, labor shortages, and operational restrictions. However, the market demonstrated resilience and adaptability, with contract manufacturers implementing safety measures, remote work policies, and contingency plans to continue operations.

The pandemic also accelerated trends such as telecommuting, telemedicine, e-commerce, and online education, driving the demand for electronic devices and components. Contract manufacturers played a crucial role in supporting OEMs in meeting this demand and enabling the smooth functioning of essential industries.

Additionally, the pandemic highlighted the importance of diversifying the supply chain and reducing dependencies on single regions or countries. OEMs and contract manufacturers are reevaluating their supply chain strategies and exploring options to enhance resilience and mitigate future risks.

Overall, while the COVID-19 pandemic presented challenges, it also emphasized the critical role of electronic contract assembly in enabling the digital economy and provided opportunities for innovation and growth in the market.

Key Industry Developments

The global electronic contract assembly market has witnessed several key industry developments in recent years. These developments have shaped the market landscape and influenced the strategies of industry participants:

These key industry developments reflect the evolving nature of the electronic contract assembly market and the strategies adopted by industry participants to stay competitive and meet the changing needs of OEMs.

Analyst Suggestions

Based on the current market dynamics and trends, analysts suggest the following strategies for industry participants and stakeholders in the global electronic contract assembly market:

By implementing these suggestions, industry participants and stakeholders can position themselves for growth, innovation, and long-term success in the global electronic contract assembly market.

Future Outlook

The future outlook for the global electronic contract assembly market remains positive. The market is expected to witness steady growth driven by factors such as the increasing demand for consumer electronics, advancements in technology, and the need for cost-effective and efficient manufacturing processes. The rapid pace of technological advancements, including AI, IoT, 5G, and robotics, will continue to drive the market. Contract manufacturers that can adapt to these advancements and offer specialized services in these areas will be well-positioned for growth. The demand for sustainable manufacturing practices and environmentally friendly solutions will continue to shape the market. Contract manufacturers that prioritize sustainability and offer green manufacturing solutions will have a competitive edge.

The COVID-19 pandemic has highlighted the importance of electronic contract assembly in enabling the digital economy. The market will continue to play a critical role in supporting industries such as healthcare, telecommunications, and consumer electronics. Collaborative partnerships and strategic alliances between OEMs and contract manufacturers will be crucial for driving innovation, enhancing product quality, and meeting the evolving needs of end consumers. Overall, the global electronic contract assembly market is expected to witness sustained growth in the coming years, driven by technological advancements, increasing demand for electronic devices, and the need for efficient manufacturing solutions.

Conclusion

The global electronic contract assembly market is experiencing significant growth, driven by factors such as the increasing demand for consumer electronics, technological advancements, and the need for cost-effective and efficient manufacturing processes. The market provides opportunities for both OEMs and contract manufacturers to collaborate and benefit from each other’s expertise. While the market presents numerous opportunities, there are challenges in maintaining quality standards, managing supply chains, and protecting intellectual property rights. However, industry participants can overcome these challenges by focusing on technological expertise, sustainability practices, and collaborative partnerships.

What is Electronic Contract Assembly?

Electronic Contract Assembly refers to the process of outsourcing the manufacturing and assembly of electronic components and systems to specialized companies. This practice allows businesses to focus on their core competencies while leveraging the expertise of contract manufacturers in areas such as design, production, and supply chain management.

What are the key players in the Global Electronic Contract Assembly Market?

Key players in the Global Electronic Contract Assembly Market include companies like Foxconn, Jabil, and Flextronics, which provide a range of services from PCB assembly to complete product manufacturing. These companies are known for their advanced manufacturing capabilities and global reach, among others.

What are the main drivers of growth in the Global Electronic Contract Assembly Market?

The main drivers of growth in the Global Electronic Contract Assembly Market include the increasing demand for consumer electronics, the rise of IoT devices, and the need for cost-effective manufacturing solutions. Additionally, advancements in automation and technology are enhancing production efficiency.

What challenges does the Global Electronic Contract Assembly Market face?

The Global Electronic Contract Assembly Market faces challenges such as supply chain disruptions, fluctuating material costs, and the need for compliance with various regulations. These factors can impact production timelines and overall profitability.

What opportunities exist in the Global Electronic Contract Assembly Market?

Opportunities in the Global Electronic Contract Assembly Market include the growing trend of miniaturization in electronics, the expansion of electric vehicles, and the increasing adoption of smart technologies. These trends are driving demand for specialized assembly services.

What trends are shaping the Global Electronic Contract Assembly Market?

Trends shaping the Global Electronic Contract Assembly Market include the shift towards sustainable manufacturing practices, the integration of AI and machine learning in production processes, and the increasing focus on supply chain transparency. These trends are influencing how companies approach contract assembly.

Global Electronic Contract Assembly Market

| Segmentation Details | Description |

|---|---|

| Product Type | PCB Assembly, Box Build, Cable Assembly, System Integration |

| Technology | Surface Mount Technology, Through-Hole Technology, Mixed Technology, Automated Optical Inspection |

| End User | Consumer Electronics, Telecommunications, Automotive OEMs, Medical Devices |

| Service Type | Prototype Development, Volume Production, Testing Services, Supply Chain Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Global Electronic Contract Assembly Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at