444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Global Ductless Fume Hoods Market is a rapidly evolving segment within the laboratory and industrial safety equipment industry. Ductless fume hoods are essential devices used in laboratories and industrial settings to control and capture hazardous fumes, vapors, and chemicals. These hoods offer a safer and more flexible alternative to traditional ducted fume hoods, as they do not require complex ducting systems. This comprehensive analysis explores the intricacies of the Ductless Fume Hoods Market, covering its meaning, executive summary, key market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, benefits for industry participants, SWOT analysis, key trends, the impact of Covid-19, industry developments, analyst suggestions, future outlook, and a conclusive summary.

Meaning

Ductless fume hoods are containment devices designed to protect users and the environment from hazardous fumes, chemicals, and vapors. They use filtration systems to capture and neutralize contaminants, providing a safe working environment in laboratories and industrial facilities.

Executive Summary

The Global Ductless Fume Hoods Market is experiencing significant growth, driven by increasing awareness of workplace safety, stringent regulations, and advancements in filtration technology. Ductless fume hoods offer several advantages, including cost-effectiveness, ease of installation, and environmental friendliness. However, the market faces challenges related to the proper maintenance and certification of these hoods.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Regulatory Push: Growing enforcement of indoor air quality and worker safety laws across North America, Europe, and Asia-Pacific is compelling labs to upgrade or retrofit ventilation systems, favoring ductless solutions in retrofits where ducts are impractical.

R&D Expansion: With global R&D expenditure topping USD 2 trillion, especially in pharmaceuticals and biotechnology, labs require versatile fume hoods that accommodate changing chemical workflows without extensive HVAC redesign.

Green Laboratories: Sustainability benchmarks (e.g., LEED certification, My Green Lab) reward energy-efficient equipment; ductless hoods help labs minimize conditioned air losses.

Technological Advances: Novel sorbent materials—such as impregnated activated carbons for specific compounds, nanofiber HEPA media for ultrafine particles, and hybrid molecular‑sieve/carbon filters—extend hood applicability to a wider range of chemistries.

Digitalization: Embedded sensors for differential pressure, VOC concentration, and filter loading, coupled with networked dashboards, improve safety compliance and reduce unexpected downtime.

Market Drivers

Safety Regulations & Standards: Authorities globally are tightening lab safety requirements, making effective fume containment non‑negotiable.

Cost & Time Efficiency: Lower installation costs and minimal downtime during setup make ductless hoods attractive in academic and small‑to‑medium enterprise (SME) environments.

Flexibility & Mobility: Labs that frequently reconfigure—or sites with multiple tenants—benefit from the ease of relocating ductless units.

Energy Savings: By recirculating treated air, labs reduce HVAC loads, a critical factor given that fume hoods traditionally account for up to 70% of lab energy use.

Emerging Markets: Rapid expansion of pharmaceutical and biotech research in Asia-Pacific and Latin America is fueling demand for modern lab infrastructure.

Market Restraints

Chemical Compatibility Limitations: Not all chemicals can be safely captured by standard filter media; labs working with strong oxidizers or high‑concentration acids often require ducted hoods.

Filter Maintenance Costs: Frequent replacement of sorbent cartridges and HEPA filters can raise operational expenses.

Perception & Habits: Established labs sometimes mistrust recirculating systems, favoring traditional ducted hoods despite higher installation costs.

Space Constraints: While ductless hoods require no ducts, the filter stages do add depth and weight, which can be challenging for compact workspaces or mobile benches.

Market Opportunities

Advanced Filter Media Development: R&D into catalysts, metal‑organic frameworks (MOFs), and molecular sieves could enable safe handling of broader chemical classes.

Modular & Hybrid Systems: Combining ducted exhaust for certain workflows with ductless recirculation for routine work could appeal to multi‑purpose labs.

Digital & Predictive Maintenance: AI algorithms predicting filter exhaustion and scheduling replacements can optimize uptime and reduce costs.

Custom Solutions: Tailored mini‑hoods for point‑of‑use or specialty tasks—like PCR setup or nanoparticle work—present niche growth areas.

Growth in Education: Increasing enrollment in STEM programs across Asia and the Middle East spurs demand for safe, cost‑effective lab equipment.

Market Dynamics

Supply Side: Innovation in polymer technologies for housings, nanofiber media for ULPA filtration, and 3D‑printed components is reducing costs and enabling rapid prototyping of new hood designs.

Demand Side: Decentralized labs (pharma, cosmetics, forensics, electronics) needing quick rollouts with minimal structural work are gravitating toward ductless units.

Economic Factors: High energy prices and sustainability mandates strengthen the value proposition of recirculating hoods.

Policy Factors: Green building certifications and lab accreditation standards increasingly reference lab ventilation efficiency and safety metrics.

Regional Analysis

North America: Largest market share, driven by strict OSHA standards, high R&D expenditure, and green lab initiatives.

Europe: Strong growth due to EU regulations on workplace exposure limits (e.g., REACH), widespread LEED and BREEAM uptake.

Asia-Pacific: Fastest growth rate with expanding pharmaceutical/biotech hubs in China, India, South Korea, and Singapore, coupled with rising academic R&D.

Latin America: Emerging installations in Brazil, Mexico, and Chile’s universities and CROs.

Middle East & Africa: Growing STEM investments in GCC countries and South Africa’s research institutions present nascent opportunities.

Competitive Landscape

Leading Companies in the Global Ductless Fume Hoods Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

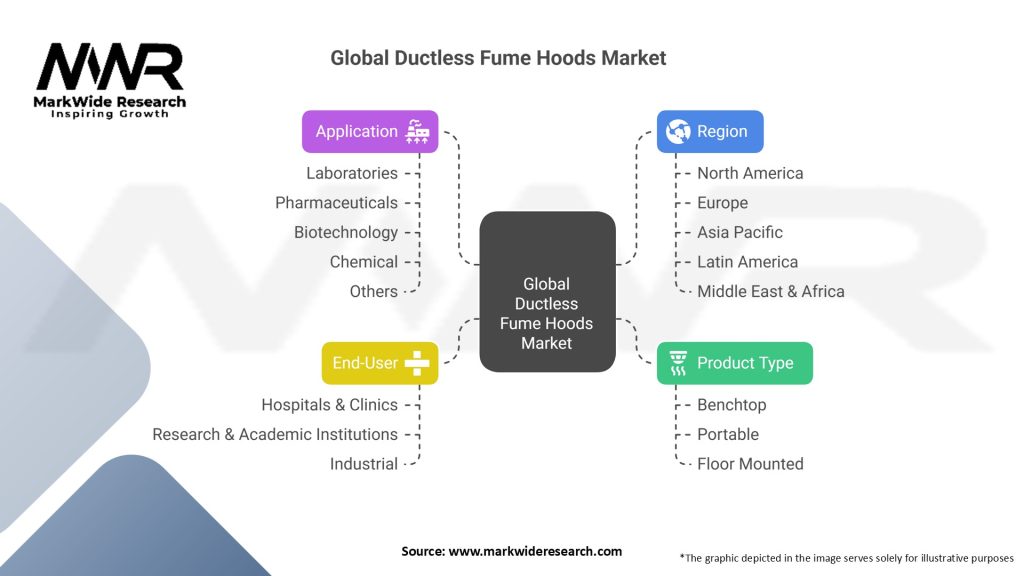

Segmentation

By Application: Chemistry labs, pharmaceutical research, educational labs, electronics manufacturing, environmental testing, veterinary research, and specialty applications (e.g., radioisotope work).

By End‑User: Academic institutions, pharmaceutical & biotechnology companies, chemical manufacturers, electronics & semiconductor firms, government & research organizations, and hospitals & clinics.

By Technology: Passive inlet hoods, low‑profile ductless benches, mobile recirculating units, and custom containment enclosures.

By Filter Type: Activated carbon, impregnated carbon (acid/solvent specific), HEPA/ULPA, combination sorbent/particle cartridges.

By Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

Category-wise Insights

Activated Carbon Hoods: Best for organic vapors; low maintenance but limited acid/oxidizer capture.

Impregnated Carbon Systems: Tailored for specific chemistries (e.g., formaldehyde, acid gases); higher cost but broader applicability.

HEPA/ULPA‑Only Units: Ideal for particulate containment in dusty or bio‑lab environments; not for gaseous hazards.

Combination Systems: Multi‑stage filters handling both gases and particulates; premium segments in pharmaceutical and specialty R&D labs.

Key Benefits for Stakeholders

Cost Savings: Lower installation and operational expenses vs. ducted systems.

Enhanced Safety: Effective capture of fumes protects lab personnel and maintains compliance.

Operational Flexibility: Rapid redeployment and minimal lab downtime.

Energy Efficiency: Reduced HVAC load aligns with sustainability goals and lowers utility bills.

Regulatory Compliance: Easier adherence to exposure limits and air quality standards.

Space Optimization: Suitable for modular labs and retrofits without extensive construction.

SWOT Analysis

Strengths:

Portability and flexible installation

Energy and cost savings

Tailored filter solutions for diverse chemistries

Weaknesses:

Limited chemical compatibility

Ongoing filter maintenance costs

Perception issues vs. traditional ducted hoods

Opportunities:

Smart monitoring & predictive maintenance

Emerging market expansion (Asia, Latin America)

Hybrid ducted/ductless systems for multi‑use labs

Threats:

Regulatory changes mandating ducted exhaust for certain hazards

Volatile carbon media prices

Competition from improved ducted alternatives (e.g., variable‑air‑volume hoods)

Market Key Trends

IoT & Industry 4.0 Integration: Remote monitoring of sash position, airflow velocity, filter saturation, and ambient VOC levels.

Green Lab Certification: Labs aiming for LEED, WELL, and My Green Lab certifications increasingly specify ductless hoods.

Hybrid Ventilation Models: Combining low‑flow ducted capture with recirculating benches to optimize performance and cost.

Compact & Mobile Designs: Benchtop recirculating hoods and cart‑mounted units for point‑of‑use containment.

Advanced Sorbent Technologies: Use of metal‑organic frameworks (MOFs) and nano‑structured carbons for enhanced adsorption capacities.

Covid-19 Impact

Supply Chain Disruptions: Initial filter and component shortages prompted local stockpiling and alternative sourcing strategies.

Safety Emphasis: Heightened focus on lab biosafety accelerated adoption of fume hoods with HEPA/ULPA capability for aerosol containment during pathogen research.

Funding Shifts: Government stimulus packages directed R&D labs to upgrade infrastructure, including lab ventilation.

Remote Monitoring: The pandemic underscored the value of IoT‑enabled equipment for minimal on‑site staffing and remote diagnostics.

Key Industry Developments

New Product Launches: Several vendors introduced smart ductless hoods with integrated digital dashboards in 2023–24.

Collaborative HVAC Packages: Partnerships between hood manufacturers and HVAC firms to offer turnkey lab ventilation solutions.

Expanded Filter Portfolios: Launch of broad‑spectrum “universal” cartridges capable of adsorbing both polar and non‑polar vapors.

Regulatory Guidelines: Publication of guidelines for ductless hood use under NSF/ANSI 49 and EN 14175 standards, clarifying performance and application scopes.

Mergers & Acquisitions: Consolidation in niche lab equipment sectors, with larger players acquiring specialized ductless hood companies to broaden portfolios.

Analyst Suggestions

Invest in Smart Capabilities: Integrate cloud‑based monitoring and predictive analytics to differentiate offerings.

Expand Emerging Market Footprint: Establish local partnerships in Asia-Pacific and Latin America to capture high-growth potential.

Educate End Users: Launch training programs and workshops to dispel misconceptions and demonstrate safe chemical compatibility.

Develop Hybrid Models: Offer modular systems that combine recirculation with optional duct connections for labs with mixed chemical usage.

Focus on Sustainability: Promote lifecycle analyses showing energy and carbon savings to appeal to green labs and institutional ESG goals.

Future Outlook

The global ductless fume hoods market is projected to grow from USD 500 million in 2023 to over USD 900 million by 2030, at a 7.5% CAGR, driven by:

Expanding R&D activities in biotech and pharma

Retrofit opportunities in aging educational and government labs

Green lab mandates pushing energy‑efficient equipment

Advances in filter technology broadening chemical compatibility

While ductless hoods will never fully replace ducted systems—especially for high‑hazard chemistries—their niche in flexible, low‑cost, energy‑saving lab ventilation will continue to strengthen. Manufacturers that combine advanced filter media, digital monitoring, and flexible designs tailored to emerging market needs will capture the greatest share of this expanding sector.

Conclusion

Ductless fume hoods have emerged as a pivotal innovation in laboratory safety and ventilation, offering a cost‑effective, flexible, and energy‑efficient alternative to conventional ducted systems. Fueled by tightening safety regulations, green lab initiatives, and the rapid growth of pharmaceutical and biotech R&D, the global ductless fume hoods market is poised for robust expansion over the next decade.

In conclusion, the Global Ductless Fume Hoods Market offers significant opportunities for growth and innovation. Despite challenges related to maintenance and competition from traditional ducted hoods, ductless fume hoods remain essential for ensuring workplace safety and environmental sustainability. Industry participants must prioritize innovation, market expansion, and user education to thrive in this dynamic and evolving market.

What are ductless fume hoods?

Ductless fume hoods are ventilation devices designed to filter and recirculate air, providing a safe working environment by removing harmful fumes and vapors. They are commonly used in laboratories, chemical processing, and educational institutions.

Who are the key players in the Global Ductless Fume Hoods Market?

Key players in the Global Ductless Fume Hoods Market include companies like Labconco, Thermo Fisher Scientific, and Esco Technologies, among others.

What are the main drivers of growth in the Global Ductless Fume Hoods Market?

The growth of the Global Ductless Fume Hoods Market is driven by increasing safety regulations in laboratories, the rising demand for efficient ventilation solutions, and the expansion of research and development activities across various industries.

What challenges does the Global Ductless Fume Hoods Market face?

Challenges in the Global Ductless Fume Hoods Market include the high initial cost of installation, the need for regular maintenance, and competition from traditional ducted fume hoods that may offer higher performance in certain applications.

What opportunities exist in the Global Ductless Fume Hoods Market?

Opportunities in the Global Ductless Fume Hoods Market include advancements in filtration technology, the growing trend of sustainable laboratory practices, and the increasing adoption of fume hoods in emerging markets.

What trends are shaping the Global Ductless Fume Hoods Market?

Trends in the Global Ductless Fume Hoods Market include the integration of smart technology for monitoring air quality, the development of energy-efficient models, and a shift towards customizable solutions to meet specific laboratory needs.

Global Ductless Fume Hoods Market

| Segmentation Details | Description |

|---|---|

| Product Type | Benchtop, Portable, Floor Mounted |

| Application | Laboratories, Pharmaceuticals, Biotechnology, Chemical, Others |

| End-User | Hospitals & Clinics, Research & Academic Institutions, Industrial |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Global Ductless Fume Hoods Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at