444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The global digital therapeutic devices market is witnessing significant growth and is poised to expand at a substantial rate in the coming years. Digital therapeutic devices, also known as digital therapeutics or digiceuticals, are software-based interventions designed to treat medical conditions. These devices utilize digital technologies, such as mobile apps, virtual reality, artificial intelligence, and wearable devices, to deliver therapeutic interventions to patients. They offer a range of benefits, including improved patient engagement, personalized treatment plans, real-time monitoring, and remote access to healthcare professionals.

Meaning

Digital therapeutic devices are a new and innovative approach to healthcare that complement traditional medical treatments. They provide evidence-based interventions that are designed to prevent, manage, or treat various medical conditions. These devices are backed by rigorous clinical research and are typically regulated by healthcare authorities to ensure their safety and efficacy. Unlike traditional pharmaceutical treatments, digital therapeutic devices focus on delivering therapy through software applications, allowing patients to actively participate in their own healthcare management.

Executive Summary

The global digital therapeutic devices market is experiencing robust growth, driven by the increasing prevalence of chronic diseases, rising healthcare costs, and the growing need for personalized and accessible healthcare solutions. These devices have the potential to revolutionize healthcare delivery by providing cost-effective and scalable interventions that can be easily accessed by patients anytime and anywhere. As a result, the market is attracting significant investments from both established healthcare companies and emerging start-ups, leading to intense competition and rapid technological advancements.

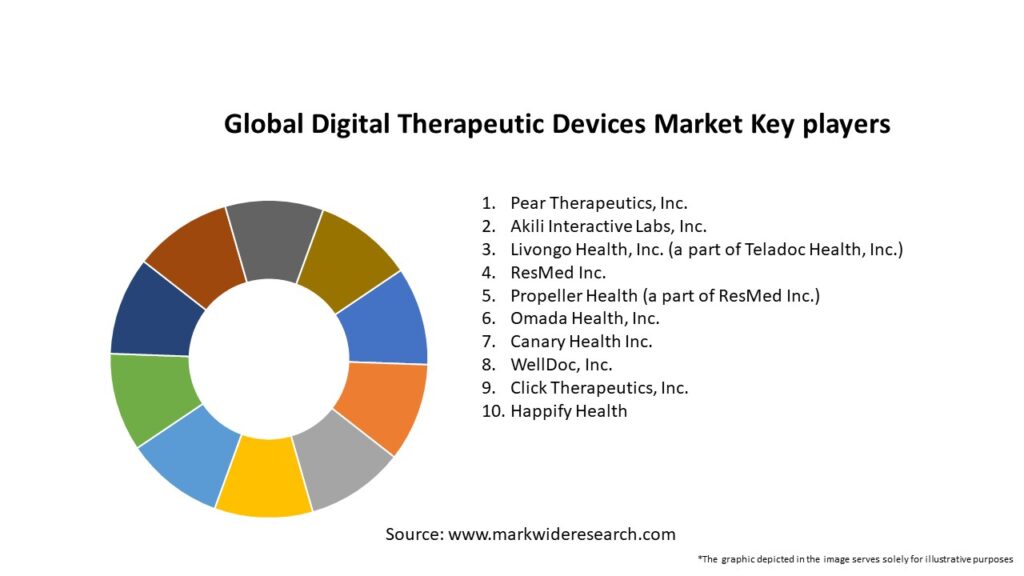

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Digital therapeutics are increasingly recognized as prescribable medical interventions, not just wellness tools. Integration with electronic health records (EHRs) and clinician prescribing platforms is becoming a necessity. Clinical validation continues to be critical—DTx providers invest in randomized controlled trials and real-world outcome studies to build credibility. Payors, including health systems and insurers, are starting to reimburse DTx under specific codes or care pathways, especially when tied to measurable outcomes such as HbA1c reduction or symptom alleviation. Collaboration between DTx developers and pharmaceutical companies continues to grow, enabling digital support adjuncts to medications that improve adherence, monitor effects, or deliver behavioral guidance. Engagement patterns matter: high dropout remains a risk, so gamification, coaching, and nudges are commonly built into DTx to improve retention and outcomes.

Market Drivers

Key drivers for growth include:

Rising chronic disease burden and healthcare costs, pushing demand for scalable, affordable care solutions.

Regulatory clarity and acceptance, such as DTx receiving CE marks or FDA clearance, which validates therapeutic claims.

Telehealth expansion, which opens digital care channels and normalizes remote treatment delivery.

Reimbursement momentum, with payers piloting and beginning to reimburse prescribable digital therapies.

Patient-centric care models, where self-guided therapies complement in-person treatment and empower patient engagement.

Market Restraints

Despite momentum, challenges persist:

Regulatory fragmentation, as different jurisdictions impose varying evidentiary standards and approval paths.

Reimbursement and coverage hurdles, where DTx must demonstrate outcomes and economic value to gain sustained reimbursement.

Digital access and literacy barriers, limiting reach among older or underserved populations.

Skepticism among clinicians and payers, who may question long-term adherence and efficacy in real-world settings.

Data privacy concerns, as sensitive health data is collected, transmitted, and stored through digital platforms.

Market Opportunities

Growth opportunities include:

Rx-DTx combination therapies, where digital interventions are prescribed alongside medications to enhance outcomes.

International expansion, targeting developing markets with high-tech infrastructure and unmet chronic care needs.

Expansion into prevention and healthy aging, using DTx for early-stage interventions in lifestyle and wellness management.

Integration with remote monitoring ecosystems, creating comprehensive digital care pathways combining data from wearables, sensors, and therapeutic feedback.

Enterprise-level partnerships, where health systems, insurers, or employers deploy DTx across populations with outcome-linked contracting.

Market Dynamics

Competition is evolving—from early disruptors with app-based tools to large digital health companies offering full-scale therapeutic platforms and payer-ready delivery models. Some pharmaceutical giants are co-developing DTx solutions or acquiring digital health startups to complement drug portfolios. Technology dynamics emphasize data analytics, behavioral science integration, and AI personalization. GTM strategies increasingly resemble pharma deployment—with formulary placement, provider education, reimbursement support, and outcomes tracking. Multi-stakeholder engagement (patients, providers, payers, regulators) is now essential to scale. Ultimately, value-based care models are reinforcing the role of DTx as outcome-linked, scalable interventions.

Regional Analysis

North America (US, Canada): Most active DTx region, with regulatory pathways (FDA 510(k), de novo) established, payer pilots growing, and strong investor and academic activity.

Europe (Western & Northern Europe): CE-marked DTx proliferate; countries like Germany offer digital health app reimbursement (DiGA model), accelerating adoption. The UK and Scandinavia are also advancing digital health frameworks.

Asia-Pacific: Markets such as Japan, South Korea, Australia, and Singapore show growing interest, though regulatory frameworks are emerging. Chronic disease prevalence and aging populations fuel demand, especially where mobile penetration is high.

Latin America: Early-stage, but growing need for scalable chronic and mental health solutions. DTx providers experiment with pilot programs in Brazil and Mexico.

Middle East & Africa: Limited adoption at present, but significant potential in Gulf Cooperation Council (GCC) nations with high smartphone adoption and digital health ambitions.

Competitive Landscape

Leading Companies in the Global Digital Therapeutic Devices Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

By Therapeutic Area: Mental health (e.g., CBT for anxiety, depression), chronic disease management (e.g., diabetes, hypertension), respiratory (e.g., COPD, asthma), musculoskeletal (e.g., back pain, rehab), neurology (e.g., MS, ADHD), oncology supportive care, and prevention/wellness.

By Device Type: Mobile apps; web-based platforms; wearables plus software; integrated care platforms (multi-modal systems).

By Delivery Model: Prescription-only; over-the-counter digital therapeutics; clinician-guided; self-administered.

By End User: Healthcare providers/hospitals; payers/insurers; employers; direct-to-consumer platforms.

By Region: North America; Europe; Asia-Pacific; Latin America; Middle East & Africa.

Category-wise Insights

Mental Health DTx: Among the most mature category, offering CBT and mood tracking for conditions like insomnia, depression, anxiety, often demonstrating outcomes via RCTs.

Chronic Disease Management: DTx for diabetes deliver lifestyle coaching, monitoring, and glucose tracking; integrated programs often bundled with devices or coaching.

Respiratory and Rehab: DTx combined with inhaler sensors, home-based rehab programs, and breathing coaching deliver improved adherence and symptom tracking.

Musculoskeletal & Pain Management: Digital physiotherapy, pain coping programs, and guided exercises help reduce opioid reliance and encourage self-management.

Oncology Support: DTx for symptom tracking, fatigue management, nausea control, or mental health support help improve quality of life during treatment.

Key Benefits for Industry Participants and Stakeholders

Patients: Increased access, personalized digital support, greater engagement, and convenience—especially in remote or underserved areas.

Healthcare Providers: Augmented care offerings, real-time patient data, enhanced adherence, and reduced appointment load or readmissions.

Payers/Insurers: Lower costs via improved outcomes, chronic disease control, and reduced acute care utilization.

Pharma Companies: Enhanced adherence to therapy, additional value through companion DTx, and differentiation in therapeutic offerings.

Employers and Health Systems: Population-level interventions that can improve employee well-being, reduce absenteeism, and fulfill digital health mandates.

SWOT Analysis

Strengths:

Scalable, cost-effective delivery of therapeutic interventions.

Evidence-backed efficacy with clinical validation.

Remote, patient-friendly, and adaptable to telehealth paradigms.

Weaknesses:

Regulatory and reimbursement uncertainty in many markets.

Retention and adherence challenges impacting outcomes.

Digital divide and limited engagement in certain populations.

Opportunities:

Integration with pharmacotherapy (Rx + DTx) and remote monitoring solutions.

Expansion into emerging markets with chronic disease burdens.

Value-based contracting linking reimbursement to outcomes.

Threats:

Privacy, data security, and regulatory compliance risks.

Skepticism or slow adoption among traditional providers and payers.

Competitive fragmentation and dilution of therapeutic credibility.

Market Key Trends

Evolving reimbursement models, such as Germany’s DiGA program, which validate digital health interventions.

Rx-DTx combination therapies, as pharma firms collaborate to create therapeutic ecosystems.

Real-world evidence building, using patient-reported outcomes and analytics to demonstrate long-term efficacy.

Interoperability and EHR integration, ensuring seamless prescribing and monitoring.

Engagement strategies, including gamification, coaching, adaptive personalization, and artificial intelligence to improve retention.

Key Industry Developments

Regulatory breakthroughs, such as FDA clearance or fast-track pathways for digital therapeutics.

Strategic pharma partnerships, where drug companies jointly develop or distribute DTx (e.g., for chronic conditions).

Scale-up of major DTx platforms, extending global reach via global health system agreements or payer partnerships.

Trials of outcomes-based reimbursement, where payers reimburse DTx contingent upon demonstrated patient benefit.

Consolidation and acquisitions, as established digital health or therapeutic companies acquire DTx firms to expand portfolios.

Analyst Suggestions

Build strong clinical evidence, via RCTs and longitudinal studies, to earn regulatory and payer trust.

Engage providers and payers early, co-develop workflows that support prescribing, monitoring, billing, and follow-up.

Design for adherence, using behavioral science, personalization, and feedback loops to drive sustained engagement.

Strategize global expansion with localized regulatory pathways, starting with early-mover jurisdictions.

Consider outcomes-based pricing, aligning revenue with realized clinical and economic outcomes to promote uptake.

Future Outlook

Over the next decade, the Global Digital Therapeutic Devices Market is projected to mature into a recognized pillar of evidence-based, value-driven care. DTx will become standard options within disease management pathways, prescribed alongside or integrated into care delivery. Integration with biometric and sensor data, virtual coaching, and data analytics will enable dynamic customization of therapeutic regimens. Reimbursement frameworks will mature globally, with more markets adopting standardized pathways for DTx prescription and coverage. Asia-Pacific and Latin America will emerge as growth frontiers as digital infrastructure strengthens. Ultimately, DTx platforms will converge with broader digital health ecosystems—telehealth, remote monitoring, and predictive analytics—creating cohesive, personalized, and scalable care networks.

Conclusion

The Global Digital Therapeutic Devices Market is rapidly evolving from a nascent digital frontier into a core component of modern healthcare delivery. By offering scalable, validated, and personalized therapies, DTx empower patients, extend provider reach, and bend the cost curve in chronic and mental health management. As regulatory frameworks, payer models, and clinical integration improve, and as evidence of efficacy strengthens, DTx stand to transform how therapeutic care is delivered. Companies that prioritize rigorous evidence, interoperability, patient engagement, and payer collaboration will lead this new chapter—delivering digital-first treatments that are accessible, effective, and embedded within the future of global health.

What is Digital Therapeutic Devices?

Digital therapeutic devices are software-driven interventions designed to prevent, manage, or treat medical conditions. They often include applications that provide therapeutic interventions for various health issues, such as mental health disorders, chronic diseases, and substance abuse.

What are the key players in the Global Digital Therapeutic Devices Market?

Key players in the Global Digital Therapeutic Devices Market include Pear Therapeutics, Omada Health, and WellDoc, among others. These companies are known for their innovative digital solutions that cater to various health conditions and improve patient outcomes.

What are the main drivers of growth in the Global Digital Therapeutic Devices Market?

The growth of the Global Digital Therapeutic Devices Market is driven by increasing prevalence of chronic diseases, rising demand for personalized medicine, and advancements in technology. Additionally, the growing acceptance of digital health solutions among patients and healthcare providers contributes to market expansion.

What challenges does the Global Digital Therapeutic Devices Market face?

The Global Digital Therapeutic Devices Market faces challenges such as regulatory hurdles, data privacy concerns, and the need for clinical validation. Additionally, the integration of these devices into existing healthcare systems can be complex and resource-intensive.

What opportunities exist in the Global Digital Therapeutic Devices Market?

Opportunities in the Global Digital Therapeutic Devices Market include the potential for partnerships with healthcare providers, expansion into emerging markets, and the development of new therapeutic applications. The increasing focus on mental health and wellness also presents significant growth potential.

What trends are shaping the Global Digital Therapeutic Devices Market?

Trends shaping the Global Digital Therapeutic Devices Market include the rise of artificial intelligence in therapy applications, increased use of mobile health technologies, and a shift towards value-based care. These trends are enhancing patient engagement and improving treatment adherence.

Global Digital Therapeutic Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Mobile Apps, Wearable Devices, Software Platforms, Cloud Solutions |

| End User | Patients, Healthcare Providers, Payers, Employers |

| Technology | Artificial Intelligence, Machine Learning, Blockchain, Telehealth |

| Application | Chronic Disease Management, Mental Health, Rehabilitation, Preventive Care |

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at