444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The global crane and hoist market has witnessed steady growth in recent years. Cranes and hoists are essential equipment used in various industries for lifting, moving, and transporting heavy loads. These machines offer efficiency, safety, and increased productivity, which are crucial factors driving their demand worldwide. This comprehensive market analysis will provide insights into the key trends, drivers, restraints, opportunities, and dynamics shaping the global crane and hoist market.

Crane and hoist systems are mechanical devices used for vertical and horizontal movement of heavy objects in industries such as construction, manufacturing, shipping, and logistics. Cranes are typically larger and more complex machines, designed for heavier loads and longer reach, while hoists are smaller and used for lifting loads vertically within a limited area. Together, they form an integral part of the material handling industry, facilitating efficient and safe operations.

Executive Summary:

The executive summary of this analysis provides a concise overview of the global crane and hoist market, including its size, growth rate, and key highlights. It offers a snapshot of the market landscape, key findings, and major trends, giving readers a quick understanding of the market’s current state and future prospects.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Infrastructure projects and urbanization in emerging economies are creating substantial demand for tower cranes and heavy-duty gantry cranes.

Automation trends in manufacturing and warehousing are boosting adoption of electric chain and wire rope hoists with integrated controls.

IoT-enabled crane monitoring solutions are gaining traction, allowing real-time load tracking, predictive diagnostics, and remote safety oversight.

Rental and aftermarket services are growing rapidly, as end users seek cost flexibility and reduced maintenance burdens.

Sustainability mandates are prompting OEMs to develop energy-efficient hoist drives and regenerative braking systems.

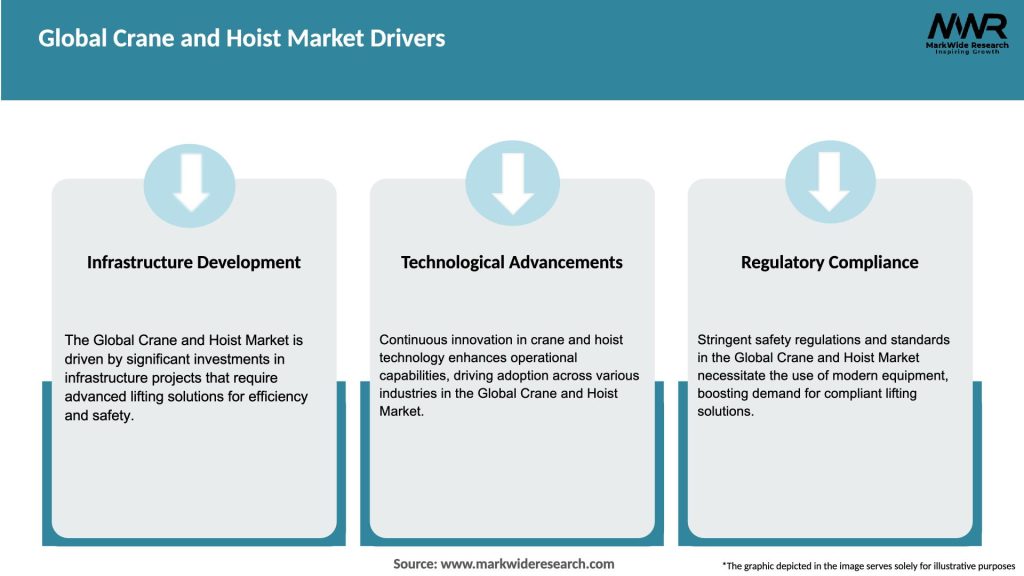

Market Drivers

Infrastructure Development: Government-funded transportation, power, and urban redevelopment projects necessitate large-capacity cranes.

Industrial Automation: Smart factory initiatives increase demand for precision hoists and crane systems with automated positioning and safety interlocks.

E-commerce & Logistics: Expansion of distribution centers drives adoption of compact overhead cranes and jib hoists for rapid order fulfillment.

Technological Advancements: Integration of IoT sensors, AI-based load monitoring, and remote-control interfaces enhances equipment reliability and user safety.

Rental Services: Growing crane and hoist rental market offers flexibility to contractors and manufacturers, lowering capital expenditure barriers.

Market Restraints

High Capital Costs: Initial purchase and installation of large-capacity cranes require significant investment, limiting adoption in cost-sensitive sectors.

Regulatory Compliance: Varying safety and certification standards across regions complicate design and approval processes for global OEMs.

Skilled Labor Shortage: Operation and maintenance of advanced lifting equipment demand specialized training, which is in short supply in many markets.

Maintenance Complexity: Sophisticated systems with electronic controls and hydraulic circuits require rigorous upkeep to prevent downtime.

Supply Chain Disruptions: Dependence on steel, semiconductors, and precision components exposes manufacturers to raw-material price volatility and delivery delays.

Market Opportunities

Retrofitting & Upgrades: Upgrading legacy crane fleets with modern drives, controls, and safety features offers a high-margin aftermarket segment.

Lightweight Materials: Use of high-strength alloys and composites can reduce crane deadweight and enable higher load-to-weight ratios.

Modular Design: Prefabricated, modular crane components streamline installation in remote or constrained sites.

Service-Based Models: Outcome-based contracts—charging per lifting cycle or uptime guarantee—unlock recurring revenue streams for OEMs.

Emerging Regions: Sub-Saharan Africa and Southeast Asia present nascent demand as industrialization and infrastructure spending accelerate.

Market Dynamics

Digital Transformation: OEMs are embedding telematics and cloud-based analytics into cranes and hoists to offer predictive maintenance and usage optimization.

Consolidation Trends: Mergers and acquisitions among mid-tier suppliers are creating vertically integrated players capable of delivering end-to-end lifting solutions.

Collaborative Robotics: Lightweight jib cranes paired with collaborative robots (cobots) are emerging in light assembly and repetitive material-handling tasks.

Standardization Efforts: Industry bodies are working toward unified safety protocols and interoperability standards to simplify global compliance.

Circular Economy: Manufacturing-as-a-service models encourage remanufacturing and component reuse, reducing environmental impact and lowering life-cycle costs.

Regional Analysis

Asia-Pacific: Dominates market volume, led by China’s construction boom and India’s Smart Cities Mission; low-cost manufacturing base attracts OEM investments.

North America: Focuses on fleet modernization, automation integration, and rental services; U.S. infrastructure bills are boosting demand.

Europe: Emphasis on green technologies—energy recuperation, zero-emission drives—and strict safety/regulatory enforcement drives replacement cycles.

Latin America: Growing port expansions and mining operations spur gantry crane and heavy-duty hoist uptake; economic volatility tempers growth.

Middle East & Africa: Mega-projects in oil & gas, stadiums, and urban development create niche demand; political instability and import dependencies pose challenges.

Competitive Landscape:

Leading Companies in the Global Crane and Hoist Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

By Crane Type: Overhead Bridge, Gantry, Jib, Tower, Mobile/Truck-Mounted.

By Hoist Type: Electric Chain, Wire Rope, Manual, Hydraulic.

By Industry: Construction, Manufacturing, Warehousing & Logistics, Energy & Utilities, Mining.

By Power Source: Electric, Hydraulic, Pneumatic, Manual.

By Region: Asia-Pacific, North America, Europe, Latin America, Middle East & Africa.

Category-wise Insights

Overhead Bridge Cranes: Preferred in factories for point-to-point material transfer; evolving toward digital controls and anti-sway systems.

Gantry Cranes: Widely used in ports and shipyards for container handling; demand growing for rail-mounted and rubber-tire variants.

Tower Cranes: Essential for urban high-rise construction; modular design and rapid-erection features are key differentiators.

Electric Chain Hoists: Popular in light-industry and assembly lines; portable, energy-efficient, and cost-effective for mid-range loads.

Manual Hoists: Retain relevance in maintenance and remote locations where power access is limited; emerging into ratchet lever variants for ergonomic use.

Key Benefits for Industry Participants and Stakeholders

Operational Efficiency: Automated positioning and load-sensing reduce cycle times and minimize manual handling risks.

Enhanced Safety: Integrated overload protection, emergency stop functions, and real-time diagnostics help prevent accidents.

Total Cost of Ownership: Predictive maintenance and energy-efficient drives lower long-term operating expenses.

Scalability: Modular, prefabricated crane solutions allow rapid capacity expansion on project sites.

Regulatory Compliance: Adherence to ISO 4301 and FEM standards streamlines global deployment and certification.

SWOT Analysis

Strengths:

Essential role in diverse industries ensures stable demand.

Rapid innovation in digital and energy-saving technologies.

Weaknesses:

High capital investment and long installation cycles.

Complexity in maintaining sophisticated, sensor-laden systems.

Opportunities:

Growth of rental and service models offering flexible access.

Adoption of lightweight composites reducing structural deadweight.

Threats:

Volatile steel and component costs affecting OEM margins.

Regulatory divergence across regions complicating global rollouts.

Market Key Trends

Smart Lifting Ecosystems: Platforms integrating cranes, hoists, and fleet management software for holistic asset optimization.

Autonomous Cranes: Pilot projects for driverless gantry cranes in constrained environments like ports and yards.

Lightweight Materials: Use of advanced alloys and carbon-fiber composites to increase payload-to-weight ratios.

Augmented Reality Training: AR-based operator training modules reduce onboarding time and enhance safety compliance.

Circular Supply Chains: Focus on remanufacturing crane components and offering life-extension refurbishments to customers.

Covid-19 Impact:

The COVID-19 pandemic has had a significant impact on various industries, including the crane and hoist market. This section analyzes the effects of the pandemic on market growth, demand patterns, supply chain disruptions, and industry recovery. It also explores the strategies adopted by market players to overcome the challenges and thrive in the post-pandemic landscape.

Key Industry Developments:

This section highlights the key developments and innovations in the crane and hoist industry. It includes product launches, mergers and acquisitions, collaborations, partnerships, and investments. These developments provide insights into the industry’s growth trajectory and the strategies employed by key players to gain a competitive edge.

Analyst Suggestions:

Based on the comprehensive analysis conducted, our analysts provide valuable suggestions for industry participants and stakeholders. These suggestions include strategic recommendations, market entry strategies, investment opportunities, and potential areas for innovation and differentiation. Implementing these suggestions can help businesses thrive in the competitive crane and hoist market.

Future Outlook:

The future outlook section offers insights into the projected growth and opportunities in the global crane and hoist market. It takes into account emerging technologies, regulatory frameworks, market trends, and customer expectations. This section assists industry participants in planning their future business strategies and capitalizing on the evolving market landscape.

Conclusion:

In conclusion, the global crane and hoist market presents significant growth potential, driven by factors such as industrialization, infrastructure development, and the need for efficient material handling solutions. However, challenges related to cost, safety regulations, and competition from alternative solutions need to be addressed. By understanding the market dynamics, regional trends, and emerging technologies, industry participants can position themselves for success and capitalize on the opportunities in the market.

What is the Global Crane and Hoist?

The Global Crane and Hoist refers to equipment used for lifting and moving heavy loads in various industries, including construction, manufacturing, and shipping. These machines are essential for enhancing operational efficiency and safety in material handling.

Who are the key players in the Global Crane and Hoist Market?

Key players in the Global Crane and Hoist Market include Konecranes, Terex Corporation, Liebherr Group, and Manitowoc Company, among others. These companies are known for their innovative solutions and extensive product offerings in the lifting equipment sector.

What are the main drivers of growth in the Global Crane and Hoist Market?

The main drivers of growth in the Global Crane and Hoist Market include the increasing demand for automation in material handling, the expansion of construction activities, and the rising need for efficient logistics solutions across various industries.

What challenges does the Global Crane and Hoist Market face?

The Global Crane and Hoist Market faces challenges such as high maintenance costs, the need for skilled operators, and stringent safety regulations that can impact operational efficiency. Additionally, fluctuations in raw material prices can affect production costs.

What opportunities exist in the Global Crane and Hoist Market?

Opportunities in the Global Crane and Hoist Market include the growing trend towards smart cranes equipped with IoT technology, the increasing focus on sustainability in construction practices, and the expansion of infrastructure projects in emerging economies.

What trends are shaping the Global Crane and Hoist Market?

Trends shaping the Global Crane and Hoist Market include the adoption of electric and hybrid cranes for reduced emissions, advancements in automation and control systems, and the integration of safety features to enhance operator protection and efficiency.

Global Crane and Hoist Market:

| Segmentation Details | Description |

|---|---|

| Product Type | Mobile Cranes, Fixed Cranes, Hoists |

| End-use Industry | Construction, Manufacturing, Mining & Excavation, Energy & Utilities, Others |

| Operation Mode | Manual, Electric, Hydraulic |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Global Crane and Hoist Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at