444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The global continuous glucose monitoring systems market is experiencing significant growth due to the rising prevalence of diabetes worldwide. Continuous glucose monitoring (CGM) systems are innovative devices that monitor blood glucose levels in real-time, providing valuable insights for individuals with diabetes and healthcare professionals. These systems offer a convenient and efficient alternative to traditional methods of glucose monitoring, such as fingerstick tests.

Meaning

Continuous glucose monitoring systems involve the use of sensors that are inserted under the skin to measure glucose levels in interstitial fluid. The sensors collect data at regular intervals, which is then transmitted wirelessly to a receiver or smartphone application. Users can easily track their glucose levels, identify patterns, and make informed decisions regarding medication, diet, and lifestyle adjustments. The data collected by CGM systems can also be shared with healthcare providers for better disease management.

Executive Summary

The global continuous glucose monitoring systems market is expected to witness robust growth in the coming years. Factors such as the increasing prevalence of diabetes, technological advancements in CGM devices, and growing awareness about the benefits of real-time glucose monitoring are driving market growth. Additionally, rising healthcare expenditure, favorable reimbursement policies, and a growing emphasis on preventive healthcare are further contributing to market expansion.

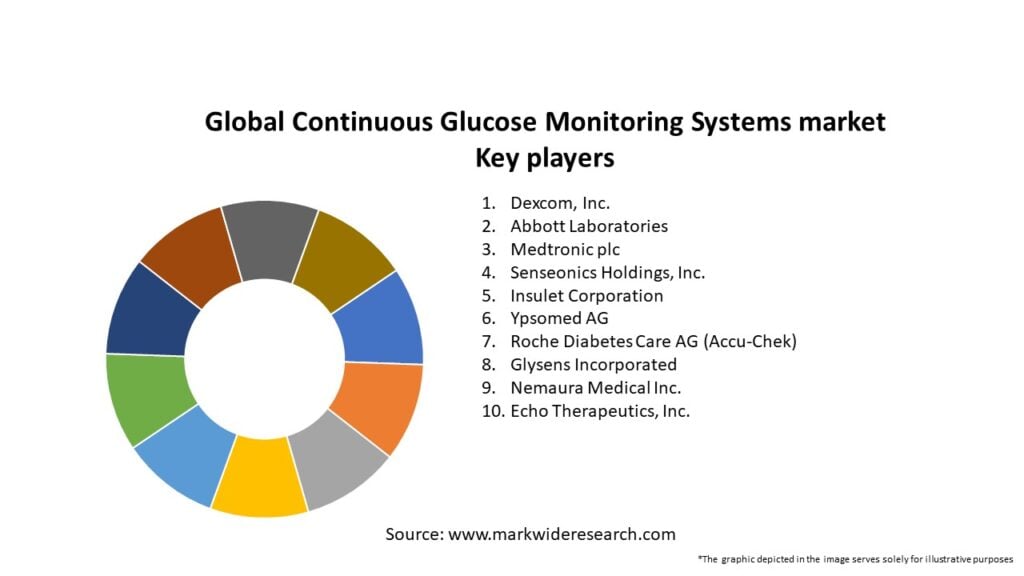

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The continuous glucose monitoring systems market is characterized by intense competition among key players, striving to gain a significant market share. Continuous technological advancements, product launches, and strategic partnerships are common strategies employed by manufacturers to strengthen their market position. Moreover, increasing focus on research and development activities to enhance the accuracy and usability of CGM systems is driving market dynamics.

Regional Analysis

The continuous glucose monitoring systems market is geographically segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America dominates the market, owing to the high prevalence of diabetes, advanced healthcare infrastructure, and favorable reimbursement policies. Europe follows closely, with increasing adoption of CGM systems in countries like Germany, the UK, and France. The Asia Pacific region is expected to witness significant growth due tothe increasing diabetic population in countries such as China and India, coupled with rising healthcare expenditure and improving access to healthcare services.

Competitive Landscape

Leading Companies in the Global Continuous Glucose Monitoring Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The continuous glucose monitoring systems market can be segmented based on component, end-user, and region. By component, the market can be divided into sensors, transmitters, and receivers. End-users of CGM systems include hospitals and clinics, home healthcare settings, and ambulatory surgical centers.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the continuous glucose monitoring systems market. On one hand, the increased focus on healthcare and the growing demand for remote patient monitoring have accelerated the adoption of CGM systems. On the other hand, disruptions in the supply chain, temporary closure of manufacturing facilities, and reduced healthcare spending have posed challenges for market players.

Key Industry Developments

Analyst Suggestions

Future Outlook

The global continuous glucose monitoring systems market is poised for significant growth in the coming years. Technological advancements, increasing prevalence of diabetes, and the growing demand for real-time glucose monitoring are the key factors driving market expansion. With ongoing research and development activities, the market is expected to witness further innovations, such as closed-loop systems and integration with advanced data analysis techniques. Untapped markets in emerging economies and expanding applications beyond diabetes management offer lucrative opportunities for industry players.

Conclusion

The global continuous glucose monitoring systems market is witnessing rapid growth due to the increasing prevalence of diabetes and advancements in technology. These systems provide real-time glucose data, enabling individuals with diabetes to manage their condition effectively and make informed decisions about their treatment plans. However, challenges such as high costs, reliability concerns, and limited accessibility in certain regions need to be addressed. With continuous innovation, strategic partnerships, and expanding reimbursement policies, the market is expected to flourish in the future, offering improved diabetes management and better quality of life for patients.

What is Continuous Glucose Monitoring Systems?

Continuous Glucose Monitoring Systems are medical devices that provide real-time measurements of glucose levels in the body, allowing for better management of diabetes. These systems typically include a small sensor placed under the skin that continuously tracks glucose levels and sends data to a monitor or smartphone app.

What are the key players in the Global Continuous Glucose Monitoring Systems market?

Key players in the Global Continuous Glucose Monitoring Systems market include Dexcom, Abbott Laboratories, Medtronic, and Senseonics, among others. These companies are known for their innovative technologies and extensive product offerings in glucose monitoring.

What are the growth factors driving the Global Continuous Glucose Monitoring Systems market?

The growth of the Global Continuous Glucose Monitoring Systems market is driven by the increasing prevalence of diabetes, advancements in technology, and the rising demand for personalized healthcare solutions. Additionally, the growing awareness of diabetes management among patients contributes to market expansion.

What challenges does the Global Continuous Glucose Monitoring Systems market face?

The Global Continuous Glucose Monitoring Systems market faces challenges such as high costs of devices, regulatory hurdles, and the need for continuous calibration. These factors can limit accessibility and adoption among patients, particularly in developing regions.

What opportunities exist in the Global Continuous Glucose Monitoring Systems market?

Opportunities in the Global Continuous Glucose Monitoring Systems market include the development of more affordable devices, integration with digital health platforms, and expansion into emerging markets. These trends can enhance patient engagement and improve diabetes management.

What trends are shaping the Global Continuous Glucose Monitoring Systems market?

Trends shaping the Global Continuous Glucose Monitoring Systems market include the rise of smartphone connectivity, the use of artificial intelligence for data analysis, and the development of non-invasive monitoring technologies. These innovations are expected to enhance user experience and improve health outcomes.

Global Continuous Glucose Monitoring Systems market

| Segmentation Details | Description |

|---|---|

| Product Type | Wearable Devices, Handheld Monitors, Smartphone Applications, Transmitters |

| Technology | Flash Glucose Monitoring, Real-Time Monitoring, Continuous Glucose Sensors, Integrated Insulin Delivery |

| End User | Diabetic Patients, Healthcare Providers, Research Institutions, Home Care Settings |

| Distribution Channel | Online Retail, Pharmacies, Hospitals, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at