444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The global commercial aircraft windows and windshields market is a crucial segment of the aviation industry that has witnessed significant growth over the years. The market is highly competitive and is driven by factors such as the increasing demand for fuel-efficient and lightweight aircraft, rising air travel, and the need for enhanced passenger comfort and safety.

The global commercial aircraft windows and windshields market is expected to grow at a CAGR of over 4% during the forecast period of 2021-2026. The market is expected to be driven by the increasing demand for new aircraft from the emerging economies of Asia-Pacific and the Middle East.

Meaning

Aircraft windows and windshields are critical components of an aircraft that provide a clear view of the outside environment to pilots and passengers. These components are designed to withstand extreme weather conditions, such as high winds, turbulence, and extreme temperatures, and must be resistant to damage from bird strikes, hail, and other debris.

Executive Summary

The global commercial aircraft windows and windshields market is expected to witness steady growth during the forecast period of 2021-2026. The market is driven by factors such as the increasing demand for fuel-efficient and lightweight aircraft, rising air travel, and the need for enhanced passenger comfort and safety.

The market is highly competitive and is dominated by key players such as Gentex Corporation, Saint-Gobain Sully, GKN Aerospace Services Limited, and PPG Industries Inc. These players are focusing on product innovation, strategic partnerships, and mergers and acquisitions to maintain their position in the market.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The global commercial aircraft windows and windshields market is expected to be driven by factors such as the increasing demand for fuel-efficient and lightweight aircraft, rising air travel, and the need for enhanced passenger comfort and safety. The market is highly competitive, and key players are focusing on product innovation, strategic partnerships, and mergers and acquisitions to maintain their position in the market.

The Asia-Pacific region is expected to witness significant growth during the forecast period, driven by the increasing demand for new aircraft from emerging economies such as India and China. North America and Europe are also expected to witness steady growth, driven by the presence of key players and established aviation industries in these regions.

Market Drivers

The increasing demand for fuel-efficient and lightweight aircraft is a key driver of the global commercial aircraft windows and windshields market. Manufacturers are focusing on developing new materials and technologies to reduce the weight of aircraft, which in turn reduces fuel consumption and operating costs.

The increasing number of air passengers globally is driving the demand for new aircraft and aircraft components, including windows and windshields. The growth of low-cost carriers and the increasing number of air travelers from emerging economies are expected to drive the demand for new aircraft in the coming years.

The need for enhanced passenger comfort and safety is a critical driver of the global commercial aircraft windows and windshields market. Manufacturers are focusing on developing new materials and technologies to improve passenger comfort, reduce noise levels, and enhance safety features such as anti-glare coatings and bird strike protection.

Market Restraints

The high manufacturing and maintenance costs associated with aircraft windows and windshields are a key restraint of the global commercial aircraft windows and windshields market. The complex manufacturing process, stringent safety regulations, and high cost of raw materials are driving up the cost of these components, which in turn is increasing the cost of new aircraft.

The stringent safety regulations and certification requirements for aircraft components, including windows and windshields, are a major restraint of the global commercial aircraft windows and windshields market. These regulations increase the complexity of the manufacturing process and add to the cost of these components, which in turn is passed on to the customers.

The certification processes for new aircraft and aircraft components can be lengthy and complex, which is a key restraint of the global commercial aircraft windows and windshields market. These processes can delay the introduction of new products and technologies to the market, leading to lost opportunities and increased costs for manufacturers.

Market Opportunities

The growing demand for advanced materials and technologies in the aviation industry is a significant opportunity for the global commercial aircraft windows and windshields market. Manufacturers are focusing on developing new materials such as lightweight composites and advanced coatings to enhance the performance and safety features of aircraft windows and windshields.

The increasing focus on sustainability in the aviation industry is a significant opportunity for the global commercial aircraft windows and windshields market. Manufacturers are focusing on developing new materials and technologies that are environmentally friendly and reduce the carbon footprint of aircraft.

The emerging economies of Asia-Pacific and the Middle East are significant opportunities for the global commercial aircraft windows and windshields market. The increasing demand for air travel from these regions is driving the demand for new aircraft, which in turn is driving the demand for aircraft components such as windows and windshields.

Market Dynamics

The global commercial aircraft windows and windshields market is highly dynamic and competitive, with key players focusing on product innovation, strategic partnerships, and mergers and acquisitions to maintain their position in the market.

The market is driven by factors such as the increasing demand for fuel-efficient and lightweight aircraft, rising air travel, and the need for enhanced passenger comfort and safety. The market is also constrained by factors such as high manufacturing and maintenance costs, stringent safety regulations, and long certification processes.

Regional Analysis

The global commercial aircraft windows and windshields market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

North America and Europe are mature markets for the global commercial aircraft windows and windshields market, driven by the presence of key players and established aviation industries in these regions. The Asia-Pacific region is expected to witness significant growth during the forecast period, driven by the increasing demand for new aircraft from emerging economies such as India and China.

Competitive Landscape

Leading Companies in the Global Commercial Aircraft Windows and Windshields Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

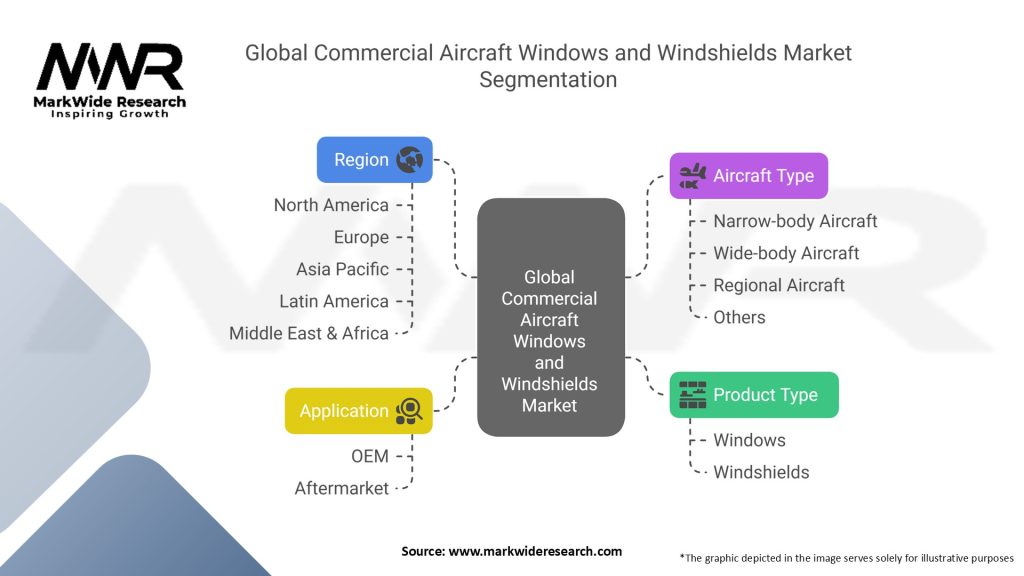

Segmentation

The global commercial aircraft windows and windshields market is segmented by product type, material type, aircraft type, and region.

By product type, the market is segmented into windows and windshields.

By material type, the market is segmented into glass, polycarbonate, and acrylic.

By aircraft type, the market is segmented into narrow-body, wide-body, and regional jets.

By region, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

Category-wise Insights

By product type, the windows segment is expected to dominate the global commercial aircraft windows and windshields market during the forecast period. The growth of this segment can be attributed to the increasing demand for larger windows to enhance passenger comfort and the rising demand for panoramic windows for improved views.

By material type, the glass segment is expected to dominate the global commercial aircraft windows and windshields market during the forecast period. Glass is a widely used material in the aviation industry due to its high optical clarity, scratch resistance, and durability.

By aircraft type, the narrow-body segment is expected to dominate the global commercial aircraft windows and windshields market during the forecast period. The growth of this segment can be attributed to the increasing demand for short-haul flights and the rising popularity of low-cost carriers.

By region, North America is expected to dominate the global commercial aircraft windows and windshields market during the forecast period. The growth of this region can be attributed to the presence of key players and established aviation industries in this region.

Key Benefits for Industry Participants and Stakeholders

The growing demand for advanced materials and technologies in the aviation industry is a significant opportunity for manufacturers of commercial aircraft windows and windshields. Manufacturers can develop new materials such as lightweight composites and advanced coatings to enhance the performance and safety features of aircraft windows and windshields.

The increasing number of air passengers globally is driving the demand for new aircraft and aircraft components, including windows and windshields. Manufacturers can capitalize on this opportunity by developing new products and technologies that meet the evolving needs of the aviation industry.

The emerging economies of Asia-Pacific and the Middle East are significant opportunities for manufacturers of commercial aircraft windows and windshields. The increasing demand for air travel from these regions is driving the demand for new aircraft, which in turn is driving the demand for aircraft components such as windows and windshields.

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

The aviation industry is increasingly focusing on developing lightweight materials and technologies to improve fuel efficiency and reduce carbon emissions. Manufacturers of commercial aircraft windows and windshields are also exploring new materials such as lightweight composites and advanced coatings to enhance the performance and safety features of these components.

The demand for panoramic windows is increasing among airlines and passengers, as they provide a better view of the outside environment and enhance passenger comfort. Manufacturers are developing new technologies to produce larger and more durable panoramic windows for aircraft.

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the global commercial aircraft windows and windshields market, as it has led to a sharp decline in air travel and a decrease in demand for new aircraft.

The pandemic has also disrupted global supply chains and manufacturing operations, leading to delays in the delivery of aircraft components such as windows and windshields. As a result, manufacturers have had to adjust their production schedules and supply chain strategies to adapt to the changing market conditions.

However, with the rollout of vaccines and the easing of travel restrictions, the aviation industry is expected to recover gradually in the coming years, leading to an increase in demand for new aircraft and aircraft components.

Key Industry Developments

In February 2021, Gentex Corporation launched a new dimmable aircraft window technology that allows passengers to adjust the tint of their windows to block out sunlight and reduce glare. The technology also reduces the need for traditional window shades and improves the passenger experience.

In June 2021, PPG Industries Inc. announced the acquisition of Tikkurila, a leading provider of coatings and paints in the Nordic region. The acquisition is expected to enhance PPG’s presence in the aviation industry and strengthen its product portfolio.

In November 2020, Saint-Gobain Sully announced the development of a new anti-icing coating for aircraft windows and windshields. The new coating is designed to reduce the buildup of ice and snow on aircraft windows, improving visibility and safety during flight.

Analyst Suggestions

Manufacturers of commercial aircraft windows and windshields should focus on product innovation and the development of advanced materials and technologies to meet the evolving needs of the aviation industry. This includes the development of lightweight materials, advanced coatings, and new safety features.

Manufacturers should explore opportunities in emerging markets such as Asia-Pacific and the Middle East, which are experiencing significant growth in air travel and demand for new aircraft. This includes developing new partnerships and supply chain strategies to meet the needs of these markets.

Manufacturers should embrace sustainability in their product development and manufacturing processes, focusing on environmentally friendly materials and technologies that reduce the carbon footprint of aircraft.

Future Outlook

The global commercial aircraft windows and windshields market is expected to witness steady growth during the forecast period of 2021-2026. The market is driven by factors such as the increasing demand for fuel-efficient and lightweight aircraft, rising air travel, and the need for enhanced passenger comfort and safety.

Manufacturers are expected to focus on product innovation, the development of advanced materials and technologies, and strategic partnerships to maintain their position in the market. The Asia-Pacific region is expected to witness significant growth during the forecast period, driven by the increasing demand for new aircraft from emerging economies such as India and China.

Conclusion

The global commercial aircraft windows and windshields market is a critical segment of the aviation industry that has witnessed significant growth over the years. The market is highly competitive and is driven by factors such as the increasing demand for fuel-efficient and lightweight aircraft, rising air travel, and the need for enhanced passenger comfort and safety.

Manufacturers are focusing on product innovation, the development of advanced materials and technologies, and strategic partnerships to maintain their position in the market. The Asia-Pacific region is expected to witness significant growth during the forecast period, driven by the increasing demand for new aircraft from emerging economies such as India and China.

What are Commercial Aircraft Windows and Windshields?

Commercial Aircraft Windows and Windshields are specialized components designed to provide visibility, safety, and structural support in aircraft. They are engineered to withstand high pressure, temperature changes, and impacts.

What are the key companies in the Global Commercial Aircraft Windows and Windshields Market?

Key companies in the Global Commercial Aircraft Windows and Windshields Market include PPG Aerospace, GKN Aerospace, Saint-Gobain, and Gentex Corporation, among others.

What are the main drivers of growth in the Global Commercial Aircraft Windows and Windshields Market?

Drivers include rising demand for commercial air travel, fleet expansion by airlines, and increasing investments in aircraft safety and design.

What challenges does the Global Commercial Aircraft Windows and Windshields Market face?

Challenges include high replacement costs, stringent aviation safety regulations, and limited suppliers for advanced materials.

What opportunities exist in the Global Commercial Aircraft Windows and Windshields Market?

Opportunities lie in developing lightweight composite windows, expanding aftermarket services, and demand for advanced anti-fog and anti-scratch technologies.

What trends are shaping the Global Commercial Aircraft Windows and Windshields Market?

Trends include use of smart glass technology, increased focus on energy efficiency, and development of self-healing materials.

Global Commercial Aircraft Windows and Windshields Market

| Segmentation | Details |

|---|---|

| Product Type | Windows, Windshields |

| Aircraft Type | Narrow-body Aircraft, Wide-body Aircraft, Regional Aircraft, Others |

| Application | OEM, Aftermarket |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Global Commercial Aircraft Windows and Windshields Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at