444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The global cloud-based solutions for drug discovery, development and manufacturing market represents a transformative shift in pharmaceutical innovation, leveraging advanced computing technologies to accelerate therapeutic breakthroughs. This dynamic sector encompasses comprehensive digital platforms that enable pharmaceutical companies, biotechnology firms, and research institutions to conduct virtual drug screening, molecular modeling, clinical trial management, and manufacturing optimization through scalable cloud infrastructure.

Market dynamics indicate robust expansion driven by increasing demand for cost-effective research methodologies and accelerated time-to-market for new therapeutics. The integration of artificial intelligence, machine learning, and high-performance computing within cloud environments has revolutionized traditional drug development paradigms, offering unprecedented capabilities for data analysis, predictive modeling, and collaborative research initiatives.

Industry adoption has accelerated significantly, with pharmaceutical giants and emerging biotech companies increasingly migrating their research and development operations to cloud-based platforms. This transition is supported by growing confidence in cloud security, regulatory compliance frameworks, and the demonstrated ability to achieve 40-60% reduction in computational costs while maintaining data integrity and intellectual property protection.

Regional distribution shows North America maintaining market leadership with approximately 45% market share, followed by Europe at 28% and Asia-Pacific demonstrating the fastest growth trajectory at 12.5% CAGR. The market encompasses diverse solution categories including drug discovery platforms, clinical trial management systems, regulatory compliance tools, and manufacturing execution systems, all delivered through secure, scalable cloud architectures.

The cloud-based solutions for drug discovery, development and manufacturing market refers to the comprehensive ecosystem of software-as-a-service (SaaS), platform-as-a-service (PaaS), and infrastructure-as-a-service (IaaS) offerings specifically designed to support pharmaceutical research, development, and production activities through remote, scalable computing resources.

Core functionality encompasses virtual laboratory environments, molecular simulation platforms, clinical data management systems, regulatory submission portals, and manufacturing workflow optimization tools. These solutions enable pharmaceutical organizations to access powerful computational resources, specialized software applications, and collaborative research environments without maintaining extensive on-premises infrastructure.

Key characteristics include on-demand scalability, pay-per-use pricing models, enhanced data security protocols, regulatory compliance frameworks, and seamless integration capabilities with existing pharmaceutical research and development workflows. The technology facilitates real-time collaboration among global research teams while maintaining strict data governance and intellectual property protection standards.

Market transformation in pharmaceutical research and development has been fundamentally altered by cloud-based solutions, creating unprecedented opportunities for innovation acceleration and cost optimization. The convergence of advanced analytics, artificial intelligence, and cloud computing has established new benchmarks for drug discovery efficiency and development timeline compression.

Strategic advantages delivered by cloud-based platforms include enhanced computational power access, improved collaboration capabilities, reduced infrastructure costs, and accelerated regulatory compliance processes. Organizations utilizing these solutions report 35-50% improvement in research productivity and significant reductions in time-to-market for new therapeutic compounds.

Technology integration encompasses machine learning algorithms for drug target identification, predictive modeling for clinical trial outcomes, blockchain for supply chain transparency, and advanced analytics for manufacturing optimization. These integrated capabilities enable pharmaceutical companies to make data-driven decisions throughout the entire drug development lifecycle.

Market participants include established technology providers, specialized pharmaceutical software companies, and emerging startups focused on niche applications. The competitive landscape is characterized by continuous innovation, strategic partnerships, and increasing investment in artificial intelligence and machine learning capabilities.

Strategic market insights reveal fundamental shifts in pharmaceutical research methodologies and operational approaches. The following key observations define current market dynamics:

Primary growth drivers propelling market expansion include increasing pressure to reduce drug development costs and timelines while maintaining safety and efficacy standards. The pharmaceutical industry faces mounting challenges related to patent cliffs, regulatory complexity, and rising research and development expenses, creating strong demand for innovative solutions that can optimize operational efficiency.

Technological advancement in artificial intelligence and machine learning has created unprecedented opportunities for drug discovery acceleration. Cloud-based platforms provide the computational power necessary to process vast datasets, conduct complex molecular simulations, and identify potential therapeutic targets with greater accuracy and speed than traditional methods.

Regulatory evolution supporting digital transformation initiatives has removed historical barriers to cloud adoption in pharmaceutical research. Regulatory agencies increasingly recognize the benefits of digital technologies and have developed frameworks that facilitate secure, compliant use of cloud-based solutions for drug development activities.

Collaboration requirements in modern pharmaceutical research necessitate platforms that enable seamless data sharing and joint research initiatives among global teams, academic institutions, and commercial partners. Cloud-based solutions provide the infrastructure necessary to support these collaborative relationships while maintaining data security and intellectual property protection.

Cost pressures facing pharmaceutical companies drive adoption of solutions that can reduce infrastructure expenses while improving research productivity. Organizations report achieving 25-40% cost reduction in computational resources through cloud migration while gaining access to more advanced analytical capabilities.

Security concerns remain a significant barrier to widespread cloud adoption in pharmaceutical research, despite advances in encryption and data protection technologies. Organizations continue to express reservations about storing sensitive intellectual property and proprietary research data in third-party cloud environments, particularly for early-stage drug discovery activities.

Regulatory uncertainty in some jurisdictions creates hesitation among pharmaceutical companies considering cloud migration for regulated activities. While regulatory frameworks are evolving to accommodate cloud-based solutions, inconsistencies across different markets and ongoing clarification needs create implementation challenges.

Integration complexity with existing pharmaceutical research infrastructure presents technical and operational challenges. Many organizations operate legacy systems that require significant modification or replacement to achieve seamless cloud integration, creating implementation barriers and potential disruption to ongoing research activities.

Data sovereignty requirements in certain regions mandate local data storage and processing, limiting the flexibility and cost advantages typically associated with global cloud deployments. These requirements can increase complexity and costs while reducing the scalability benefits of cloud-based solutions.

Skills gap in cloud technologies and data analytics within pharmaceutical organizations creates implementation and optimization challenges. The need for specialized expertise in cloud architecture, data science, and pharmaceutical research creates recruitment and training requirements that can slow adoption rates.

Emerging market expansion presents significant growth opportunities as pharmaceutical companies in developing regions increasingly adopt cloud-based solutions to compete in global markets. These organizations seek cost-effective access to advanced research capabilities without substantial infrastructure investments, creating demand for scalable, affordable cloud platforms.

Artificial intelligence integration offers transformative potential for drug discovery and development acceleration. Cloud-based platforms that incorporate advanced AI and machine learning capabilities can provide competitive advantages through improved target identification, optimized clinical trial design, and enhanced manufacturing process optimization.

Personalized medicine advancement creates opportunities for specialized cloud-based solutions that can process genomic data, biomarker information, and patient-specific datasets to support precision therapeutic development. These applications require sophisticated analytical capabilities and secure data handling that cloud platforms can provide efficiently.

Regulatory technology evolution enables development of integrated compliance and submission platforms that streamline regulatory processes while maintaining audit trail integrity. Organizations that can provide comprehensive regulatory technology solutions within cloud environments will capture significant market share.

Partnership opportunities between cloud providers, pharmaceutical companies, and academic institutions create potential for innovative collaborative platforms that accelerate research while sharing costs and risks. These partnerships can drive market expansion while advancing pharmaceutical innovation.

Competitive dynamics within the market are characterized by rapid innovation cycles, strategic acquisitions, and increasing specialization in pharmaceutical-specific applications. Established technology companies are expanding their healthcare portfolios while specialized pharmaceutical software providers are enhancing their cloud capabilities to remain competitive.

Technology evolution continues to reshape market dynamics as advances in quantum computing, edge computing, and 5G connectivity create new possibilities for pharmaceutical research acceleration. These technological developments enable more sophisticated modeling capabilities and real-time data processing that can transform drug development methodologies.

Customer expectations are evolving toward comprehensive, integrated platforms that can support entire drug development lifecycles rather than point solutions for specific research activities. This trend drives consolidation and partnership activities as providers seek to offer complete solution portfolios.

Pricing pressures intensify as cloud solutions become commoditized in certain segments, forcing providers to differentiate through specialized functionality, superior performance, or enhanced security features. Organizations that can demonstrate clear return on investment and competitive advantages will maintain pricing power.

Regulatory influence continues to shape market dynamics as agencies develop more specific guidance for cloud-based pharmaceutical research activities. These regulatory developments can create opportunities for compliant solutions while potentially restricting certain applications or deployment models.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into cloud-based solutions for drug discovery, development, and manufacturing. The research approach combines primary data collection through industry expert interviews, secondary research from authoritative sources, and quantitative analysis of market trends and competitive dynamics.

Primary research activities include structured interviews with pharmaceutical executives, cloud technology providers, regulatory experts, and academic researchers involved in drug development activities. These interviews provide insights into adoption patterns, implementation challenges, technology preferences, and future market directions that inform strategic analysis.

Secondary research sources encompass industry publications, regulatory guidance documents, academic research papers, company financial reports, and technology vendor documentation. This comprehensive information base ensures thorough understanding of market dynamics, competitive positioning, and technological developments affecting market growth.

Quantitative analysis utilizes statistical modeling techniques to project market growth rates, segment performance, and regional distribution patterns. Data validation processes ensure accuracy and reliability of numerical insights while sensitivity analysis examines potential variations in growth scenarios.

Expert validation through industry advisory panels confirms research findings and provides additional context for market interpretations. This validation process ensures that research conclusions accurately reflect current market conditions and future growth prospects.

North American dominance in the cloud-based pharmaceutical solutions market reflects the region’s concentration of major pharmaceutical companies, advanced technology infrastructure, and supportive regulatory environment. The United States leads adoption with approximately 38% regional market share, driven by significant research and development investments and early cloud technology adoption among pharmaceutical organizations.

European market development demonstrates strong growth momentum, particularly in countries with established pharmaceutical industries such as Germany, Switzerland, and the United Kingdom. The region benefits from harmonized regulatory frameworks through the European Medicines Agency and increasing collaboration among pharmaceutical companies, research institutions, and technology providers.

Asia-Pacific expansion represents the fastest-growing regional market, with countries like China, India, and Japan investing heavily in pharmaceutical research capabilities and digital transformation initiatives. The region’s growth is supported by government initiatives promoting biotechnology development and increasing adoption of cloud technologies across industries.

Latin American emergence shows promising development as pharmaceutical companies in Brazil, Mexico, and Argentina seek cost-effective solutions to enhance research capabilities. Cloud-based platforms provide access to advanced analytical tools and collaborative research environments that would otherwise require substantial infrastructure investments.

Middle East and Africa present emerging opportunities as governments and private organizations invest in healthcare infrastructure development and pharmaceutical research capabilities. These regions benefit from cloud solutions that provide access to global research networks and advanced analytical capabilities without extensive local infrastructure requirements.

Market leadership is distributed among several categories of providers, including global cloud infrastructure companies, specialized pharmaceutical software vendors, and emerging technology startups focused on specific drug development applications. The competitive environment is characterized by continuous innovation, strategic partnerships, and increasing specialization in pharmaceutical-specific requirements.

Leading market participants include:

Competitive strategies focus on developing specialized pharmaceutical applications, enhancing security and compliance capabilities, and forming strategic partnerships with pharmaceutical companies and research institutions. Providers increasingly invest in artificial intelligence and machine learning capabilities to differentiate their offerings and provide superior analytical capabilities.

Innovation trends include development of integrated platforms that support entire drug development lifecycles, enhanced collaboration tools for global research teams, and advanced security features that address pharmaceutical industry concerns about intellectual property protection and data sovereignty.

Technology-based segmentation reveals distinct market categories based on cloud deployment models and service types. The market encompasses software-as-a-service (SaaS) solutions that provide ready-to-use applications, platform-as-a-service (PaaS) offerings that enable custom application development, and infrastructure-as-a-service (IaaS) solutions that provide scalable computing resources.

Application-focused segments include:

Deployment model segmentation distinguishes between public cloud solutions that leverage shared infrastructure, private cloud deployments that provide dedicated resources, and hybrid cloud approaches that combine both models to address specific security and performance requirements.

End-user segmentation encompasses pharmaceutical companies, biotechnology firms, contract research organizations, academic research institutions, and regulatory agencies. Each segment has distinct requirements for functionality, security, compliance, and integration capabilities that influence solution selection and implementation approaches.

Drug Discovery Solutions represent the largest market segment, driven by the computational intensity of molecular modeling, virtual screening, and target identification activities. These solutions provide access to high-performance computing resources and specialized software applications that enable pharmaceutical companies to accelerate early-stage research while reducing costs.

Clinical Development Platforms demonstrate strong growth as pharmaceutical companies seek to optimize clinical trial management, improve patient recruitment, and streamline regulatory submission processes. Cloud-based solutions enable real-time data collection, advanced analytics, and enhanced collaboration among global clinical research teams.

Manufacturing Optimization solutions gain traction as pharmaceutical companies focus on operational efficiency, quality management, and supply chain optimization. These platforms provide real-time monitoring, predictive analytics, and process optimization capabilities that improve manufacturing performance while ensuring regulatory compliance.

Regulatory Technology emerges as a specialized segment addressing the complex requirements for regulatory submission management, compliance monitoring, and audit trail maintenance. These solutions streamline regulatory processes while ensuring data integrity and traceability throughout the drug development lifecycle.

Data Analytics Platforms experience rapid growth as pharmaceutical companies recognize the value of advanced analytics, artificial intelligence, and machine learning for drug development acceleration. These solutions provide sophisticated analytical capabilities that enable data-driven decision making and predictive modeling throughout the research and development process.

Pharmaceutical companies benefit from reduced infrastructure costs, enhanced computational capabilities, and improved collaboration opportunities through cloud-based solutions. Organizations report achieving 30-45% reduction in IT infrastructure expenses while gaining access to more advanced analytical tools and scalable computing resources that support innovation acceleration.

Research institutions gain access to enterprise-grade research platforms and collaborative environments that enable participation in global research initiatives without substantial infrastructure investments. Cloud solutions provide academic researchers with access to the same advanced tools used by major pharmaceutical companies, leveling the competitive landscape.

Contract research organizations enhance their service offerings and operational efficiency through cloud-based platforms that enable seamless client collaboration, real-time data sharing, and advanced analytical capabilities. These solutions help CROs differentiate their services while improving project delivery timelines and quality.

Technology providers expand their market opportunities by developing specialized pharmaceutical applications and forming strategic partnerships with industry participants. The growing demand for cloud-based solutions creates revenue opportunities while enabling providers to develop deep expertise in pharmaceutical research and development requirements.

Regulatory agencies benefit from improved submission quality, enhanced data transparency, and streamlined review processes enabled by standardized cloud-based platforms. These solutions facilitate more efficient regulatory oversight while maintaining data integrity and audit trail requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration represents the most significant trend transforming cloud-based pharmaceutical solutions. Advanced AI and machine learning algorithms are being incorporated into drug discovery platforms, enabling more accurate target identification, optimized compound design, and predictive modeling for clinical trial outcomes. Organizations utilizing AI-enhanced platforms report 50-70% improvement in research productivity and faster identification of promising therapeutic candidates.

Hybrid Cloud Adoption emerges as the preferred deployment model for pharmaceutical companies seeking to balance security requirements with operational flexibility. This approach enables organizations to maintain sensitive data in private cloud environments while leveraging public cloud resources for computational-intensive activities and collaboration initiatives.

Real-time Analytics capabilities are becoming standard requirements as pharmaceutical companies demand immediate insights from research data and operational metrics. Cloud platforms increasingly provide streaming analytics, real-time dashboards, and automated alerting systems that enable rapid decision-making and proactive issue resolution.

Blockchain Integration gains momentum for supply chain transparency, data integrity verification, and intellectual property protection. Pharmaceutical companies explore blockchain-enabled cloud solutions to ensure data authenticity, track compound development history, and facilitate secure collaboration with external partners.

Edge Computing implementation addresses latency and data sovereignty requirements by processing data closer to research facilities and manufacturing sites. This trend enables real-time processing while maintaining compliance with local data regulations and reducing bandwidth requirements for large dataset transfers.

Strategic partnerships between major cloud providers and pharmaceutical companies continue to reshape the competitive landscape. These collaborations focus on developing specialized solutions, enhancing security capabilities, and creating integrated platforms that address specific pharmaceutical research and development requirements.

Regulatory guidance evolution provides clearer frameworks for cloud adoption in pharmaceutical research activities. Recent guidance documents from major regulatory agencies address data integrity, system validation, and audit trail requirements, reducing uncertainty and facilitating broader cloud adoption across the industry.

Technology acquisitions by established players consolidate market capabilities and expand solution portfolios. Major cloud providers and pharmaceutical software companies acquire specialized startups to enhance their artificial intelligence capabilities, regulatory compliance features, and industry-specific functionality.

Investment acceleration in pharmaceutical technology startups creates innovation opportunities and competitive pressure on established providers. Venture capital funding for cloud-based pharmaceutical solutions has increased significantly, supporting development of next-generation platforms and specialized applications.

Standardization initiatives promote interoperability and data exchange among different cloud platforms and pharmaceutical research systems. Industry consortiums work to establish common data formats, API standards, and security protocols that facilitate seamless integration and collaboration.

MarkWide Research analysis indicates that pharmaceutical companies should prioritize cloud solutions that provide comprehensive security frameworks, regulatory compliance capabilities, and seamless integration with existing research infrastructure. Organizations that invest in hybrid cloud strategies will achieve optimal balance between security requirements and operational flexibility while maintaining competitive advantages.

Technology selection should emphasize platforms that incorporate artificial intelligence and machine learning capabilities, as these technologies will become increasingly critical for maintaining research competitiveness. Companies should evaluate solutions based on their ability to support entire drug development lifecycles rather than focusing on point solutions for specific activities.

Implementation strategies should include comprehensive change management programs, staff training initiatives, and phased migration approaches that minimize disruption to ongoing research activities. Organizations that invest in internal cloud expertise and establish clear governance frameworks will achieve better implementation outcomes and faster return on investment.

Partnership considerations should focus on providers that demonstrate deep pharmaceutical industry knowledge, strong regulatory compliance capabilities, and commitment to long-term innovation investment. Companies should evaluate potential partners based on their ability to support future growth requirements and evolving regulatory landscapes.

Risk management approaches should address data security, vendor dependency, and regulatory compliance concerns through comprehensive due diligence, contract negotiations, and ongoing monitoring programs. Organizations that establish clear risk mitigation strategies will achieve more successful cloud implementations and better long-term outcomes.

Market expansion will continue at an accelerated pace as pharmaceutical companies increasingly recognize the strategic advantages of cloud-based solutions for research and development activities. MarkWide Research projects sustained growth driven by ongoing digital transformation initiatives, regulatory support for cloud adoption, and continuous technology innovation in artificial intelligence and analytics capabilities.

Technology evolution will focus on enhanced artificial intelligence integration, quantum computing applications, and advanced security features that address pharmaceutical industry concerns about intellectual property protection. These developments will enable more sophisticated drug discovery capabilities and accelerated development timelines while maintaining data security and regulatory compliance.

Regional growth patterns will see continued North American leadership while Asia-Pacific markets demonstrate the fastest expansion rates. Emerging markets will increasingly adopt cloud-based solutions as pharmaceutical industries develop and governments invest in healthcare infrastructure and research capabilities.

Competitive dynamics will intensify as technology providers develop more specialized pharmaceutical applications and form strategic partnerships with industry participants. Market consolidation through acquisitions and partnerships will create more comprehensive solution portfolios while increasing competitive pressure on standalone providers.

Innovation acceleration will drive development of next-generation platforms that integrate multiple drug development functions, provide real-time collaboration capabilities, and deliver advanced predictive analytics. Organizations that successfully leverage these innovations will achieve significant competitive advantages in drug discovery and development efficiency, with industry leaders reporting 60-80% improvement in overall research productivity through comprehensive cloud platform adoption.

The global cloud-based solutions for drug discovery, development and manufacturing market represents a fundamental transformation in pharmaceutical research methodologies, offering unprecedented opportunities for innovation acceleration, cost optimization, and collaborative research advancement. The convergence of cloud computing, artificial intelligence, and specialized pharmaceutical applications has created a dynamic ecosystem that enables organizations to achieve superior research outcomes while reducing infrastructure expenses and operational complexity.

Market growth momentum remains strong across all regions and application segments, driven by increasing recognition of cloud solutions’ strategic value and evolving regulatory frameworks that support digital transformation initiatives. The successful implementation of these technologies by leading pharmaceutical companies demonstrates clear competitive advantages and return on investment, encouraging broader industry adoption and continued innovation investment.

Future success in this market will depend on providers’ ability to deliver comprehensive, secure, and compliant solutions that address the unique requirements of pharmaceutical research and development. Organizations that can effectively integrate artificial intelligence capabilities, maintain robust security frameworks, and provide seamless collaboration tools will capture the greatest market opportunities while supporting the pharmaceutical industry’s mission to develop life-saving therapeutics more efficiently and effectively.

What is Cloud-based Solutions for Drug Discovery, Development and Manufacturing?

Cloud-based solutions for drug discovery, development, and manufacturing refer to digital platforms that leverage cloud computing to enhance the efficiency and effectiveness of pharmaceutical research and production processes. These solutions facilitate data sharing, collaboration, and advanced analytics in drug development.

What are the key players in the Global Cloud-based Solutions for Drug Discovery, Development and Manufacturing Market?

Key players in the Global Cloud-based Solutions for Drug Discovery, Development and Manufacturing Market include companies like IBM, Oracle, and Veeva Systems, which provide innovative cloud solutions tailored for the pharmaceutical industry, among others.

What are the growth factors driving the Global Cloud-based Solutions for Drug Discovery, Development and Manufacturing Market?

The growth of the Global Cloud-based Solutions for Drug Discovery, Development and Manufacturing Market is driven by the increasing need for efficient drug development processes, the rise in R&D spending, and the demand for real-time data access and collaboration among research teams.

What challenges does the Global Cloud-based Solutions for Drug Discovery, Development and Manufacturing Market face?

Challenges in the Global Cloud-based Solutions for Drug Discovery, Development and Manufacturing Market include data security concerns, regulatory compliance issues, and the integration of cloud solutions with existing legacy systems in pharmaceutical companies.

What opportunities exist in the Global Cloud-based Solutions for Drug Discovery, Development and Manufacturing Market?

Opportunities in the Global Cloud-based Solutions for Drug Discovery, Development and Manufacturing Market include the potential for personalized medicine, advancements in artificial intelligence for drug discovery, and the growing trend of outsourcing R&D activities to cloud-based platforms.

What trends are shaping the Global Cloud-based Solutions for Drug Discovery, Development and Manufacturing Market?

Trends shaping the Global Cloud-based Solutions for Drug Discovery, Development and Manufacturing Market include the increasing adoption of machine learning and AI technologies, the shift towards decentralized clinical trials, and the emphasis on data interoperability and collaboration across the drug development ecosystem.

Global Cloud-based Solutions for Drug Discovery, Development and Manufacturing Market

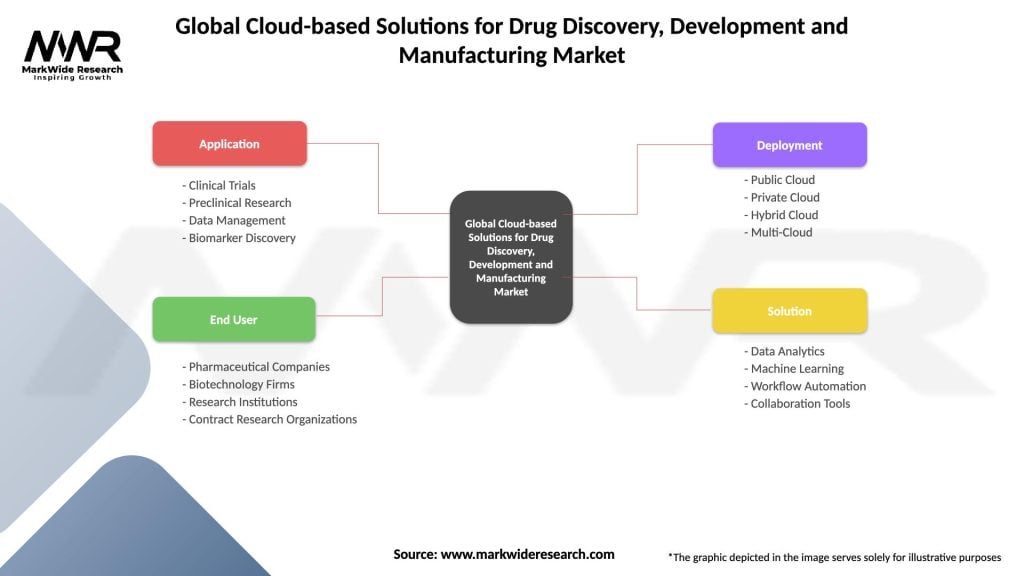

| Segmentation Details | Description |

|---|---|

| Application | Clinical Trials, Preclinical Research, Data Management, Biomarker Discovery |

| End User | Pharmaceutical Companies, Biotechnology Firms, Research Institutions, Contract Research Organizations |

| Deployment | Public Cloud, Private Cloud, Hybrid Cloud, Multi-Cloud |

| Solution | Data Analytics, Machine Learning, Workflow Automation, Collaboration Tools |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Global Cloud-based Solutions for Drug Discovery, Development and Manufacturing Market

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at