Key Market Insights

-

Nutraceutical Dominance: Dietary supplements, particularly those targeting venous health and antioxidant support, represent the largest application segment, with global revenues exceeding USD 350 million in 2024.

-

Cosmetic Growth: Buckwheat extract’s anti-inflammatory and photoprotective properties are driving its inclusion in sunscreen lotions and anti-aging creams, with the cosmetics segment growing at a 7% CAGR.

-

Clean-Label Demand: Over 60% of food and beverage manufacturers cite consumer preference for natural, non-synthetic antioxidants as the primary reason for replacing synthetic preservatives with buckwheat extract.

-

Asia Pacific Leadership: China, Japan, and South Korea collectively account for roughly 55% of production capacity, leveraging established buckwheat cultivation and cost-effective processing facilities.

-

Regulatory Recognition: In 2023, the European Food Safety Authority (EFSA) acknowledged rutin’s cardiovascular benefits, bolstering buckwheat extract’s appeal in EU markets.

Market Drivers

-

Health & Wellness Trends: Consumers are increasingly seeking functional ingredients that deliver clinically validated benefits, such as improved circulation and oxidative-stress reduction—both linked to buckwheat flavonoids.

-

Gluten-Free Movement: Rising diagnoses of celiac disease and non-celiac gluten sensitivity are prompting manufacturers of baked goods and snacks to incorporate buckwheat extract as a nutrient-rich, wheat-free ingredient.

-

Natural Cosmetic Actives: The clean-beauty movement favors plant-based antioxidants; buckwheat extract’s soothing and UV-shielding properties make it an attractive additive for dermo-cosmetic lines.

-

Sustainable Sourcing: Buckwheat’s short growing cycle and adaptability to marginal soils support sustainable agriculture initiatives, aligning with consumer demand for eco-friendly ingredients.

-

Scientific Validation: An expanding body of clinical and preclinical research—demonstrating buckwheat extract’s efficacy in glycemic control, anti-inflammation, and endothelial function—is boosting formulators’ confidence.

Market Restraints

-

Raw Material Variability: Geographic and seasonal differences in buckwheat polyphenol content can lead to batch-to-batch inconsistency, challenging standardization efforts.

-

Extraction Costs: Advanced methods (e.g., supercritical CO₂) improve purity but entail high CAPEX and operational expenses, limiting adoption by smaller processors.

-

Regulatory Complexity: While EFSA and FDA have recognized certain health claims, other jurisdictions impose stringent novel-food or botanical-extract regulations, delaying market entry.

-

Sensory Challenges: At higher inclusion rates, buckwheat extract can impart a slight bitterness or dark coloration—factors that require additional formulation efforts in foods and beverages.

-

Competition from Alternatives: Other flavonoid-rich extracts (e.g., grape seed, green tea) vie for market share in antioxidant and circulatory health applications, necessitating clear differentiation.

Market Opportunities

-

Enzyme-Assisted Extraction: Emerging technologies that employ cell-wall-degrading enzymes can boost flavonoid yield while reducing solvent usage and processing time.

-

Personalized Nutrition: Integration of buckwheat extract into DNA-based supplement programs targeting individual cardiovascular risk profiles represents an untapped niche.

-

Pet Nutrition: Demand for natural joint-health and antioxidant ingredients in premium pet-food and treat formulations is opening new application avenues.

-

Functional Beverages: Ready-to-drink (RTD) teas and juices fortified with buckwheat extract appeal to health-conscious millennials and Gen Z consumers seeking on-the-go wellness solutions.

-

Collaborative R&D: Partnerships between academic institutions and ingredient suppliers can accelerate clinical trials, supporting novel health claims and new product launches.

Market Dynamics

-

Vertical Integration: Leading players are acquiring or partnering with buckwheat farmers to secure raw-material quality and traceability from field to extract.

-

Green Chemistry Adoption: Sustainability imperatives are pushing a shift from petrochemical solvents to water or CO₂-based extraction, aligning with ESG goals.

-

Premiumization Trend: Consumers are willing to pay a price premium for standardized, high-potency extracts with documented provenance and antioxidant capacity.

-

Digital Marketing Channels: E-commerce platforms and social media influencers are playing a central role in educating end-users about buckwheat extract’s benefits and best uses.

-

Formulation Innovation: Encapsulation and nano-emulsion technologies are mitigating sensory drawbacks, enabling clearer, tasteless, and more bioavailable formulations.

Regional Analysis

-

Asia Pacific: The largest market by volume; robust buckwheat cultivation in China and Korea underpins a thriving extract-production ecosystem, while Japan leads in high-value cosmetic applications.

-

North America: Rapid growth in nutraceutical and gluten-free food segments is accelerating demand; U.S. manufacturers are investing in clinical research and branding.

-

Europe: Stringent novel-food regulations slow new entrants but established players benefit from EFSA-approved health claims and a mature clean-label movement.

-

Latin America: Emerging as a growth frontier, particularly in Brazil and Argentina, where local buckwheat farming is expanding and extract producers are emerging.

-

Middle East & Africa: Limited current production but growing import demand for functional-food ingredients and premium cosmetics is attracting supplier interest.

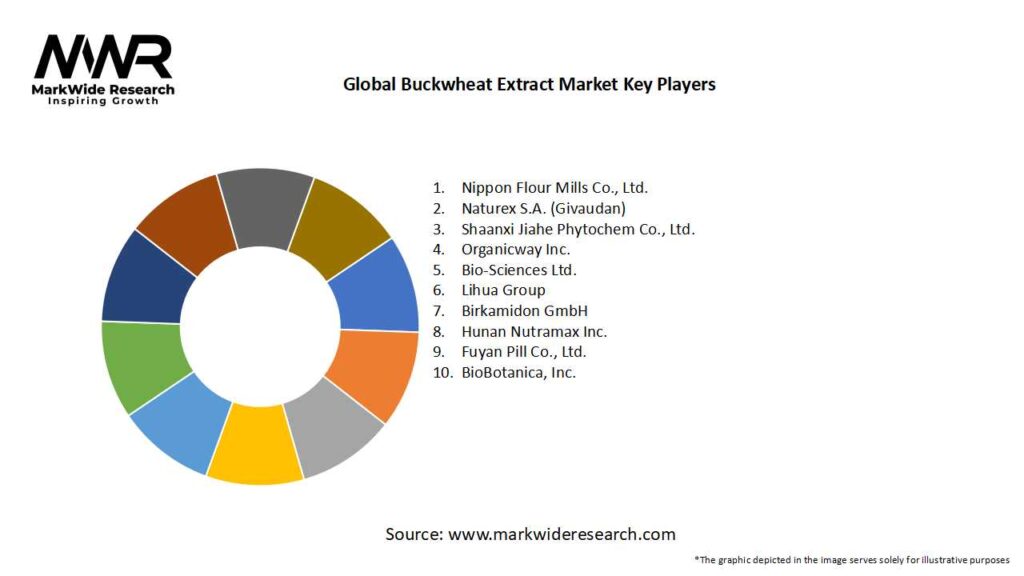

Competitive Landscape

Leading Companies in the Global Buckwheat Extract Market:

- Nippon Flour Mills Co., Ltd.

- Naturex S.A. (Givaudan)

- Shaanxi Jiahe Phytochem Co., Ltd.

- Organicway Inc.

- Bio-Sciences Ltd.

- Lihua Group

- Birkamidon GmbH

- Hunan Nutramax Inc.

- Fuyan Pill Co., Ltd.

- BioBotanica, Inc.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

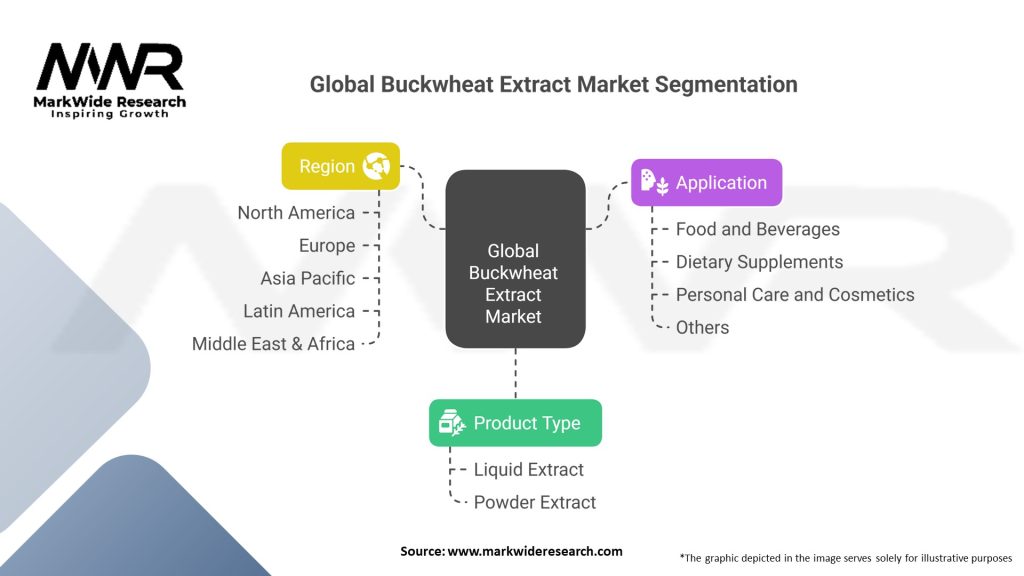

Segmentation

-

By Formulation: Powder, Liquid, Encapsulated Powder, Nano-emulsion

-

By Extraction Method: Aqueous, Ethanol-Water, Supercritical CO₂, Enzyme-Assisted

-

By Application: Nutraceuticals, Functional Foods & Beverages, Cosmetics & Personal Care, Pharmaceuticals, Animal Nutrition

-

By Distribution Channel: Direct Sales, Distributors & Wholesalers, E-commerce

Category-wise Insights

-

Nutraceutical Powders: Standardized to 10–95% rutin; popular in capsules and tablets for venous health and antioxidant support.

-

Liquid Concentrates: Often 20–40% flavonoid content; used in tinctures and functional shots where rapid absorption is desired.

-

Cosmetic Serums: Typically 5–15% extract in non-aqueous bases, deployed for UV protection and anti-redness formulations.

-

Functional Beverages: Microencapsulated powders minimize off-notes, enabling clean-label teas, juices, and sports drinks.

-

Animal Feed Additives: Low-dose powders (0.5–2% inclusion) targeting poultry and swine for improved gut health and oxidative stability.

Key Benefits for Industry Participants and Stakeholders

-

Differentiated Health Claims: Backed by rutin’s EFSA-approved benefits, brands can credibly market circulatory and antioxidant advantages.

-

Versatile Formulation: Compatible with dry and liquid systems, enabling broad product innovation across categories.

-

Clean-Label Positioning: Plant-based, GMO-free, and sustainably sourced credentials resonate with modern consumer values.

-

Regulatory Support: Established safety profile and approved usage levels in key markets streamline product development.

-

Supply-Chain Traceability: Vertical integration and blockchain-enabled provenance tools bolster brand transparency and trust.

SWOT Analysis

Strengths:

-

Scientifically supported health benefits (rutin, flavonoids).

-

Multi-industry applications from food to cosmetics.

-

Alignment with gluten-free and clean-label trends.

Weaknesses:

-

Sensory constraints at high inclusion rates.

-

Higher cost relative to commodity antioxidants (e.g., ascorbic acid).

-

Regulatory variability across regions.

Opportunities:

-

Innovative extraction technologies reducing cost and increasing purity.

-

Growth in personalized nutrition and telehealth supplement programs.

-

Expanding pet-nutrition applications for joint and vascular health.

Threats:

-

Competition from established botanical extracts (grape seed, green tea).

-

Feedstock supply risks from weather variability and cultivation area shifts.

-

Potential shifts in consumer interest toward new “superfood” ingredients.

Market Key Trends

-

Green Extraction: Uptake of enzyme-assisted and supercritical-CO₂ processes to meet sustainability benchmarks.

-

Encapsulation Solutions: Nano- and microencapsulation enhancing bioavailability and masking off-notes for beverage and dairy applications.

-

Digital Traceability: Use of QR codes and blockchain to verify origin, extraction method, and flavonoid content.

-

Co-Branding Collaborations: Nutraceutical and cosmetic brands partnering with ingredient suppliers for co-branded “buckwheat extract” lines.

-

Functional Snack Innovation: Inclusion of buckwheat extract in protein bars, granolas, and nut mixes as an antioxidant booster.

Covid-19 Impact

The pandemic heightened consumer focus on immune health and natural antioxidants, leading to a surge in buckwheat-extract supplement sales in 2020–21. Supply-chain disruptions prompted suppliers to diversify sourcing regions and invest in local cultivation initiatives. As markets normalized, growth stabilized but remained above pre-2020 levels, reflecting sustained interest in plant-based health solutions.

Key Industry Developments

-

INDENA launched RutinLight™ in 2023, a supercritical-CO₂ extract standardized to 95% total flavonoids with minimal solvent residues.

-

Euromed and Plameca entered a supply alliance in 2024 to co-develop cosmetic-grade buckwheat extract for EU and APAC markets.

-

Synthite scaled up enzyme-assisted extraction capacity, reducing processing time by 30% while boosting rutin yield by 15%.

-

Arjuna Natural introduced a microencapsulated powder with 60% rutin content, optimized for RTD beverage inclusion without off-flavors.

Analyst Suggestions

-

Optimize Sensory Profiles: Invest in masking agents and encapsulation to broaden inclusion rates in mainstream foods and drinks.

-

Expand Clinical Research: Sponsor human trials on glycemic control and cognitive benefits to unlock new health-claim opportunities.

-

Diversify Supply Base: Cultivate buckwheat in emerging geographies (e.g., Eastern Europe, South America) to mitigate climate risks.

-

Leverage Digital Platforms: Educate end-users through webinars, social media, and branded micro-sites on buckwheat extract’s unique benefits.

-

Explore Co-Formulations: Develop synergistic blends with complementary botanicals (e.g., hawthorn, grape seed) to target multi-marker health niches.

Future Outlook

The Global Buckwheat Extract market is expected to grow at a mid-single-digit CAGR through 2030, propelled by expanding functional-food and clean-beauty segments, rising disposable incomes in emerging markets, and continued demand for scientifically validated, plant-based nutraceutical ingredients. Advances in green extraction, encapsulation, and supply-chain transparency will enhance product appeal and broaden adoption. Ultimately, buckwheat extract’s versatility—spanning health supplements to skincare—positions it as a resilient ingredient in the evolving global ingredients landscape.

Conclusion

In conclusion, the Global Buckwheat Extract market sits at the nexus of health, sustainability, and innovation. By leveraging cutting-edge extraction methods, diversified applications, and robust clinical backing, stakeholders can capture growth across multiple sectors. As consumer preferences continue to favor natural, effective, and traceable ingredients, buckwheat extract is well-positioned to emerge as a cornerstone botanical in next-generation nutraceutical, food, and cosmetic formulations.