444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The global blood gas and electrolyte analyzer market represents a critical segment within the medical diagnostics industry, experiencing unprecedented growth driven by increasing healthcare demands and technological advancements. These sophisticated diagnostic instruments play an essential role in modern healthcare facilities, enabling rapid and accurate analysis of blood samples to determine pH levels, gas concentrations, and electrolyte balances. The market encompasses a diverse range of products from portable point-of-care devices to high-throughput laboratory analyzers, serving hospitals, clinics, and diagnostic centers worldwide.

Market expansion is particularly notable in emerging economies where healthcare infrastructure development continues to accelerate. The integration of advanced technologies such as artificial intelligence and cloud connectivity has transformed traditional blood gas analysis, making these systems more efficient and user-friendly. Current market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate of 6.8% across various regional markets.

Healthcare digitization trends have significantly influenced market development, as medical facilities increasingly adopt automated diagnostic solutions to improve patient outcomes and operational efficiency. The growing prevalence of chronic diseases, aging populations, and the need for rapid diagnostic capabilities in emergency care settings continue to drive demand for advanced blood gas and electrolyte analyzers globally.

The blood gas and electrolyte analyzer market refers to the comprehensive ecosystem of medical diagnostic devices designed to measure critical blood parameters including pH, partial pressure of oxygen and carbon dioxide, and various electrolyte concentrations such as sodium, potassium, and chloride. These analyzers provide healthcare professionals with essential information for patient diagnosis, treatment monitoring, and clinical decision-making across multiple medical specialties.

Modern blood gas analyzers utilize advanced electrochemical sensors and sophisticated software algorithms to deliver precise measurements within minutes of sample collection. The market encompasses various product categories including benchtop analyzers for high-volume laboratories, portable devices for point-of-care testing, and specialized systems for critical care environments. These instruments have become indispensable tools in emergency departments, intensive care units, operating rooms, and clinical laboratories worldwide.

Market significance extends beyond mere device sales to include comprehensive service offerings, consumables, and software solutions that support ongoing analyzer operations. The ecosystem includes maintenance contracts, quality control materials, calibration solutions, and data management systems that ensure optimal device performance and regulatory compliance throughout the product lifecycle.

Strategic market analysis reveals a dynamic and rapidly evolving blood gas and electrolyte analyzer landscape characterized by technological innovation, expanding applications, and increasing global healthcare demands. The market demonstrates strong growth momentum across all major geographic regions, with particularly robust expansion in Asia-Pacific and Latin American markets where healthcare infrastructure investments continue to accelerate.

Key market drivers include the rising incidence of respiratory diseases, cardiovascular conditions, and metabolic disorders that require frequent blood gas monitoring. The ongoing shift toward point-of-care testing has created significant opportunities for portable analyzer manufacturers, with point-of-care segment growth reaching 8.2% annually. Additionally, the integration of connectivity features and data management capabilities has enhanced the value proposition of modern analyzers.

Competitive dynamics within the market are intensifying as established medical device manufacturers compete with emerging technology companies offering innovative solutions. Market leaders are focusing on product differentiation through enhanced automation, improved user interfaces, and comprehensive service offerings. The trend toward consolidation in healthcare systems has also influenced purchasing decisions, with buyers increasingly seeking integrated diagnostic solutions from single vendors.

Future market prospects remain highly favorable, supported by ongoing technological advancements, expanding clinical applications, and growing awareness of the importance of rapid diagnostic capabilities in improving patient outcomes and reducing healthcare costs.

Market intelligence reveals several critical insights that define the current and future trajectory of the blood gas and electrolyte analyzer industry:

Market segmentation analysis indicates that hospital-based applications continue to dominate demand, while ambulatory care centers and home healthcare settings represent emerging growth opportunities. The integration of artificial intelligence and machine learning capabilities is expected to further enhance analyzer performance and clinical utility.

Primary growth drivers propelling the blood gas and electrolyte analyzer market forward encompass a complex interplay of demographic, technological, and healthcare delivery factors that continue to expand market opportunities globally.

Aging population demographics represent a fundamental driver, as elderly patients typically require more frequent monitoring of blood gas and electrolyte levels due to increased susceptibility to respiratory, cardiovascular, and metabolic conditions. This demographic shift is particularly pronounced in developed markets where healthcare systems are adapting to serve growing elderly populations with chronic conditions requiring ongoing diagnostic monitoring.

Chronic disease prevalence continues to escalate worldwide, with conditions such as chronic obstructive pulmonary disease, diabetes, and kidney disease requiring regular blood gas and electrolyte analysis for effective management. The global burden of these conditions is driving sustained demand for both laboratory-based and point-of-care analyzers across various healthcare settings.

Emergency care expansion has created significant demand for rapid diagnostic capabilities, as emergency departments and urgent care facilities require immediate access to critical blood parameters for patient triage and treatment decisions. The ability to obtain results within minutes rather than hours has become essential for optimal patient care in emergency situations.

Technological advancement in analyzer design and functionality continues to drive market growth by expanding the range of applications and improving ease of use. Modern analyzers offer enhanced accuracy, reduced sample volumes, and integrated quality control features that make them more attractive to healthcare facilities seeking to improve diagnostic capabilities while controlling costs.

Significant market challenges continue to impact the growth trajectory of the blood gas and electrolyte analyzer market, requiring strategic responses from manufacturers and healthcare organizations to overcome adoption barriers and operational limitations.

High capital costs associated with advanced analyzer systems represent a primary restraint, particularly for smaller healthcare facilities and those in resource-constrained environments. The initial investment required for sophisticated analyzers, combined with ongoing maintenance and consumable costs, can create financial barriers that limit market penetration in certain segments.

Regulatory complexity surrounding medical device approval and compliance requirements continues to challenge manufacturers, particularly those seeking to enter new geographic markets. The extensive documentation, clinical validation, and quality system requirements necessary for regulatory approval can significantly extend product development timelines and increase costs.

Technical expertise requirements for analyzer operation and maintenance can limit adoption in facilities lacking specialized laboratory personnel. While manufacturers continue to develop more user-friendly systems, the need for proper training and ongoing technical support remains a consideration for many healthcare organizations.

Reimbursement limitations in certain healthcare systems can impact the economic viability of frequent blood gas and electrolyte testing, potentially constraining demand growth in markets where reimbursement policies do not adequately cover diagnostic testing costs. These financial constraints can influence purchasing decisions and utilization patterns across different healthcare settings.

Emerging opportunities within the blood gas and electrolyte analyzer market present significant potential for growth and innovation, driven by evolving healthcare needs, technological capabilities, and expanding global market access.

Point-of-care testing expansion represents one of the most promising opportunities, as healthcare systems increasingly recognize the value of rapid diagnostic capabilities in improving patient outcomes and operational efficiency. The development of more portable, user-friendly analyzers suitable for use in diverse healthcare settings continues to open new market segments and applications.

Telemedicine integration offers substantial opportunities for analyzer manufacturers to develop connected devices that support remote patient monitoring and consultation capabilities. The growing acceptance of telehealth services, accelerated by recent global health challenges, has created demand for diagnostic devices that can transmit results directly to healthcare providers for remote interpretation.

Emerging market penetration presents significant growth opportunities as developing countries continue to invest in healthcare infrastructure and expand access to diagnostic services. These markets often represent untapped potential for both basic and advanced analyzer systems, with emerging market adoption rates increasing by 12.4% annually.

Artificial intelligence integration offers opportunities to enhance analyzer capabilities through predictive analytics, automated quality control, and intelligent result interpretation. The incorporation of AI technologies can improve diagnostic accuracy while reducing the skill level required for effective analyzer operation, potentially expanding the addressable market.

Home healthcare applications represent an emerging opportunity as healthcare systems seek to reduce costs while maintaining quality care through patient monitoring in home settings. The development of simplified, reliable analyzers suitable for home use could create entirely new market segments.

Complex market dynamics shape the blood gas and electrolyte analyzer industry through the interaction of technological innovation, regulatory requirements, competitive pressures, and evolving healthcare delivery models that continue to influence market development and strategic positioning.

Technology evolution remains a primary dynamic force, with continuous improvements in sensor technology, data processing capabilities, and user interface design driving product differentiation and market competition. Manufacturers must balance innovation with reliability and cost-effectiveness to maintain competitive positions in an increasingly sophisticated market.

Healthcare consolidation trends are influencing purchasing patterns and vendor relationships, as larger healthcare systems seek to standardize diagnostic equipment across multiple facilities. This consolidation creates opportunities for comprehensive service providers while potentially limiting market access for smaller, specialized manufacturers.

Regulatory harmonization efforts across different geographic regions are gradually reducing barriers to international market expansion, enabling manufacturers to leverage economies of scale and accelerate global product launches. However, ongoing regulatory evolution continues to require significant compliance investments and strategic planning.

Value-based healthcare initiatives are shifting focus from device acquisition costs to total cost of ownership and clinical outcomes, influencing how healthcare organizations evaluate and select analyzer systems. This trend favors manufacturers that can demonstrate clear clinical and economic benefits through comprehensive value propositions.

Supply chain considerations have gained increased importance, with healthcare organizations seeking reliable suppliers capable of ensuring consistent product availability and service support. The ability to maintain robust supply chains and service networks has become a critical competitive differentiator in the market.

Comprehensive research methodology employed in analyzing the blood gas and electrolyte analyzer market incorporates multiple data sources, analytical techniques, and validation processes to ensure accuracy and reliability of market insights and projections.

Primary research activities include extensive interviews with industry executives, healthcare professionals, and key opinion leaders across various market segments and geographic regions. These interviews provide valuable insights into market trends, competitive dynamics, and future growth opportunities that complement quantitative data analysis.

Secondary research encompasses analysis of industry publications, regulatory filings, company financial reports, and academic research to establish comprehensive market understanding. This research foundation supports the identification of key market drivers, restraints, and emerging trends that influence market development.

Market sizing methodology utilizes multiple approaches including top-down analysis based on healthcare spending patterns and bottom-up analysis based on device installations and utilization rates. Cross-validation of these approaches ensures robust market estimates and growth projections.

Competitive analysis methodology examines company strategies, product portfolios, market positioning, and financial performance to assess competitive dynamics and identify market leaders. This analysis includes evaluation of both established medical device manufacturers and emerging technology companies entering the market.

Regional analysis approach considers local healthcare infrastructure, regulatory environments, economic conditions, and demographic factors that influence market development in different geographic regions. This regional perspective enables identification of high-growth markets and expansion opportunities.

Geographic market distribution reveals significant variations in blood gas and electrolyte analyzer adoption, growth patterns, and competitive dynamics across major regional markets, reflecting differences in healthcare infrastructure, economic development, and regulatory environments.

North American market maintains the largest market share globally, driven by advanced healthcare infrastructure, high healthcare spending, and early adoption of innovative diagnostic technologies. The region benefits from well-established reimbursement systems and strong demand for point-of-care testing solutions, with the United States representing approximately 68% of regional market share.

European market dynamics are characterized by stringent regulatory requirements, emphasis on quality and reliability, and growing focus on cost-effective healthcare delivery. The region shows strong demand for automated laboratory systems and integrated diagnostic solutions, with Germany, France, and the United Kingdom representing the largest individual markets within the region.

Asia-Pacific region demonstrates the highest growth potential, driven by rapidly expanding healthcare infrastructure, increasing healthcare spending, and growing awareness of advanced diagnostic capabilities. China and India represent the largest growth opportunities, with regional growth rates exceeding 9.2% annually in key market segments.

Latin American markets show increasing adoption of blood gas and electrolyte analyzers, supported by healthcare system modernization efforts and growing middle-class populations seeking improved healthcare services. Brazil and Mexico lead regional market development, while smaller markets show significant growth potential.

Middle East and Africa represent emerging markets with substantial long-term growth potential, driven by healthcare infrastructure investments and increasing focus on diagnostic capabilities. The region shows particular interest in portable and point-of-care solutions suitable for diverse healthcare environments.

Market competition within the blood gas and electrolyte analyzer industry is characterized by intense rivalry among established medical device manufacturers and emerging technology companies, each seeking to differentiate their offerings through innovation, service quality, and comprehensive value propositions.

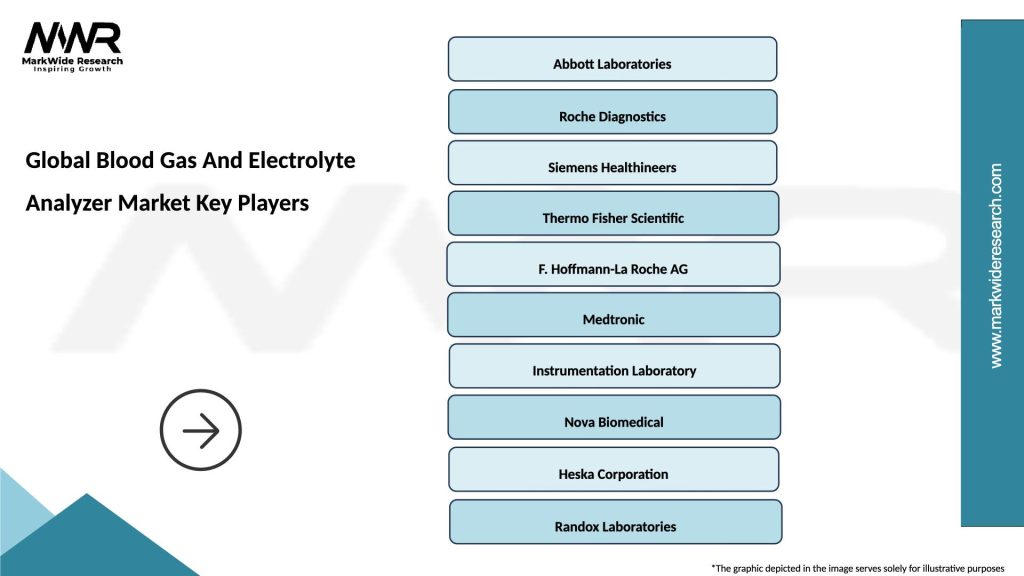

Leading market participants include several major medical device manufacturers that have established strong positions through extensive product portfolios, global distribution networks, and comprehensive service capabilities:

Competitive strategies focus on product innovation, service excellence, and market expansion through both organic growth and strategic acquisitions. Companies are investing heavily in research and development to incorporate advanced technologies such as artificial intelligence, connectivity features, and enhanced automation capabilities.

Market positioning varies among competitors, with some focusing on high-volume laboratory applications while others emphasize point-of-care testing or specialized clinical applications. The ability to provide comprehensive solutions including analyzers, consumables, and services has become increasingly important for competitive success.

Market segmentation analysis reveals distinct categories within the blood gas and electrolyte analyzer market, each characterized by specific requirements, growth patterns, and competitive dynamics that influence strategic positioning and product development priorities.

By Product Type:

By Application:

By End User:

By Technology:

Detailed category analysis provides specific insights into market dynamics, growth patterns, and competitive positioning within each major segment of the blood gas and electrolyte analyzer market.

Benchtop Analyzer Category continues to dominate laboratory applications, with healthcare facilities preferring these systems for high-volume testing requirements. These analyzers offer comprehensive testing menus, advanced automation features, and integration capabilities with laboratory information systems. Market demand is driven by the need for efficient, accurate testing in centralized laboratory environments, with laboratory segment representing 58% of total market share.

Portable Analyzer Segment demonstrates the highest growth potential, driven by increasing demand for point-of-care testing capabilities across various healthcare settings. These devices offer the advantage of immediate results at the patient bedside, enabling faster clinical decision-making and improved patient outcomes. Emergency departments and intensive care units represent primary applications for portable analyzers.

Hospital Application Category remains the largest end-user segment, encompassing various departments including emergency medicine, critical care, surgery, and laboratory services. Hospitals require comprehensive analyzer solutions that can support diverse clinical applications while maintaining high accuracy and reliability standards.

Point-of-Care Testing Applications are experiencing rapid expansion as healthcare providers recognize the clinical and economic benefits of immediate diagnostic capabilities. This segment benefits from technological advances that have made portable analyzers more reliable, accurate, and user-friendly, enabling broader adoption across various healthcare settings.

Emerging Technology Categories including artificial intelligence integration and cloud connectivity are creating new market opportunities and competitive differentiators. These advanced features enhance analyzer capabilities while providing valuable data insights for healthcare organizations seeking to optimize diagnostic operations and improve patient care quality.

Comprehensive value proposition of modern blood gas and electrolyte analyzers extends beyond basic diagnostic capabilities to encompass operational efficiency, clinical outcomes, and economic benefits that create value for various industry participants and stakeholders.

Healthcare Providers Benefits:

Manufacturer Advantages:

Patient Benefits:

Strategic analysis of the blood gas and electrolyte analyzer market reveals key strengths, weaknesses, opportunities, and threats that influence market dynamics and competitive positioning across the industry.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends shaping the blood gas and electrolyte analyzer market reflect broader healthcare industry evolution, technological advancement, and changing clinical practice patterns that influence product development and market strategies.

Connectivity and Data Integration represent a dominant trend, with healthcare organizations increasingly demanding analyzers that can seamlessly integrate with electronic health records and laboratory information systems. Modern analyzers feature wireless connectivity, cloud-based data storage, and real-time result transmission capabilities that enhance workflow efficiency and clinical decision-making.

Artificial Intelligence Integration is emerging as a significant trend, with manufacturers incorporating AI algorithms for predictive maintenance, automated quality control, and intelligent result interpretation. These capabilities reduce the skill level required for analyzer operation while improving diagnostic accuracy and operational efficiency.

Miniaturization and Portability continue to drive product development, with manufacturers developing increasingly compact analyzers suitable for point-of-care applications. This trend is particularly important for emergency care settings and resource-limited environments where traditional laboratory infrastructure may not be available.

Sustainability Focus is becoming increasingly important, with healthcare organizations seeking analyzers that minimize environmental impact through reduced reagent consumption, recyclable components, and energy-efficient operation. Manufacturers are responding with eco-friendly product designs and sustainable manufacturing practices.

Value-Based Healthcare Alignment influences purchasing decisions, with healthcare organizations evaluating analyzers based on total cost of ownership, clinical outcomes, and operational efficiency rather than initial acquisition costs. This trend favors manufacturers that can demonstrate clear clinical and economic benefits through comprehensive value propositions.

Regulatory Harmonization across different geographic regions is facilitating global market expansion and reducing barriers to international product launches. This trend enables manufacturers to leverage economies of scale and accelerate worldwide commercialization of innovative analyzer systems.

Recent industry developments highlight the dynamic nature of the blood gas and electrolyte analyzer market, with significant innovations, strategic initiatives, and market expansion activities shaping competitive dynamics and future growth prospects.

Product Innovation Initiatives have focused on enhancing analyzer capabilities through advanced sensor technology, improved user interfaces, and integrated quality control features. Leading manufacturers have introduced next-generation systems with reduced sample volumes, faster result turnaround times, and enhanced connectivity capabilities that address evolving healthcare needs.

Strategic Acquisitions and Partnerships have reshaped the competitive landscape, with major medical device companies acquiring specialized analyzer manufacturers to expand their diagnostic portfolios and market reach. These transactions reflect the strategic importance of blood gas analysis capabilities within comprehensive diagnostic solutions.

Regulatory Approvals for innovative analyzer systems have accelerated market introduction of advanced technologies, including AI-enabled systems and next-generation sensor platforms. MarkWide Research analysis indicates that regulatory approval timelines have improved, enabling faster commercialization of innovative diagnostic solutions.

Market Expansion Activities have intensified in emerging markets, with manufacturers establishing local distribution networks, service capabilities, and manufacturing facilities to support growing demand in developing countries. These investments reflect long-term commitment to global market development and accessibility.

Technology Collaborations between analyzer manufacturers and software companies have resulted in enhanced data management capabilities, predictive analytics features, and integrated diagnostic platforms that provide comprehensive solutions for healthcare organizations.

Quality and Compliance Enhancements have been implemented across the industry in response to evolving regulatory requirements and quality standards. Manufacturers have invested in advanced quality systems, clinical validation studies, and post-market surveillance capabilities to ensure product safety and effectiveness.

Strategic recommendations for blood gas and electrolyte analyzer market participants focus on leveraging emerging opportunities while addressing key challenges that influence long-term success and competitive positioning in this dynamic market environment.

Technology Investment Priorities should emphasize artificial intelligence integration, connectivity features, and user interface improvements that enhance analyzer capabilities while reducing operational complexity. Companies should prioritize development of systems that can adapt to evolving clinical needs and integrate seamlessly with existing healthcare infrastructure.

Market Expansion Strategies should focus on emerging markets where healthcare infrastructure development creates significant growth opportunities. Successful expansion requires understanding of local healthcare needs, regulatory requirements, and economic conditions that influence product adoption and market penetration strategies.

Service Excellence represents a critical competitive differentiator, with healthcare organizations increasingly valuing comprehensive support capabilities including training, maintenance, and technical assistance. Companies should invest in service infrastructure and capabilities that ensure optimal analyzer performance throughout the product lifecycle.

Partnership Development with healthcare systems, technology companies, and distribution partners can accelerate market access and enhance value propositions. Strategic alliances enable companies to leverage complementary capabilities and expand their reach in target markets more effectively than independent efforts.

Regulatory Compliance should be prioritized to ensure successful product approvals and market access across different geographic regions. Companies should invest in regulatory expertise and quality systems that support efficient approval processes and ongoing compliance requirements.

Customer-Centric Innovation should guide product development priorities, with focus on addressing specific clinical needs, operational challenges, and economic pressures faced by healthcare organizations. Understanding customer requirements and developing targeted solutions creates competitive advantages and market differentiation opportunities.

Long-term market prospects for the blood gas and electrolyte analyzer industry remain highly favorable, supported by fundamental healthcare trends, technological advancement, and expanding global access to diagnostic capabilities that create sustained growth opportunities across multiple market segments.

Technology evolution will continue to drive market development, with artificial intelligence, machine learning, and advanced connectivity features becoming standard capabilities rather than premium options. These technologies will enhance diagnostic accuracy, operational efficiency, and clinical utility while reducing the skill level required for effective analyzer operation.

Market expansion in developing countries represents the most significant growth opportunity, with healthcare infrastructure investments and increasing healthcare spending creating demand for both basic and advanced analyzer systems. According to MWR projections, emerging markets are expected to account for an increasing share of global demand, with growth rates potentially reaching 11.5% annually in key regions.

Point-of-care testing will continue to expand as healthcare systems recognize the clinical and economic benefits of immediate diagnostic capabilities. This trend will drive development of increasingly sophisticated portable analyzers that rival laboratory systems in terms of accuracy and testing capabilities while maintaining ease of use and reliability.

Integration trends will result in more comprehensive diagnostic platforms that combine blood gas analysis with other critical diagnostic parameters, creating one-stop solutions for healthcare providers. This integration will enhance clinical utility while simplifying procurement and operational management for healthcare organizations.

Sustainability considerations will become increasingly important, with manufacturers developing eco-friendly products and healthcare organizations prioritizing environmentally responsible diagnostic solutions. This trend will influence product design, manufacturing processes, and end-of-life management strategies throughout the industry.

Market consolidation may continue as larger medical device companies seek to expand their diagnostic capabilities through acquisitions of specialized analyzer manufacturers. This consolidation could result in more comprehensive product portfolios and enhanced global market reach for leading industry participants.

The global blood gas and electrolyte analyzer market represents a dynamic and essential segment of the medical diagnostics industry, characterized by strong growth prospects, continuous technological innovation, and expanding clinical applications across diverse healthcare settings. Market analysis reveals a robust ecosystem driven by fundamental healthcare needs, demographic trends, and technological advancement that create sustained demand for sophisticated diagnostic capabilities.

Market fundamentals remain strong, supported by aging populations, increasing chronic disease prevalence, and growing emphasis on rapid diagnostic capabilities in emergency and critical care settings. The shift toward point-of-care testing and the integration of advanced technologies such as artificial intelligence and connectivity features continue to expand market opportunities and enhance the value proposition of modern analyzer systems.

Competitive dynamics reflect a mature but evolving market where established medical device manufacturers compete through innovation, service excellence, and comprehensive solution offerings. The ability to provide integrated diagnostic platforms that address diverse clinical needs while maintaining operational efficiency has become increasingly important for competitive success.

Future growth prospects are particularly favorable in emerging markets where healthcare infrastructure development creates significant opportunities for market expansion. The ongoing evolution toward more portable, user-friendly, and technologically advanced analyzer systems positions the industry for continued growth and innovation in response to evolving healthcare needs and clinical practice patterns worldwide.

What is Blood Gas And Electrolyte Analyzer?

Blood Gas and Electrolyte Analyzers are medical devices used to measure the levels of gases and electrolytes in the blood, which are critical for diagnosing and monitoring various health conditions, including respiratory and metabolic disorders.

What are the key players in the Global Blood Gas And Electrolyte Analyzer Market?

Key players in the Global Blood Gas And Electrolyte Analyzer Market include Abbott Laboratories, Siemens Healthineers, Roche Diagnostics, and Thermo Fisher Scientific, among others.

What are the growth factors driving the Global Blood Gas And Electrolyte Analyzer Market?

The growth of the Global Blood Gas And Electrolyte Analyzer Market is driven by the increasing prevalence of chronic diseases, advancements in diagnostic technologies, and the rising demand for point-of-care testing in emergency and critical care settings.

What challenges does the Global Blood Gas And Electrolyte Analyzer Market face?

Challenges in the Global Blood Gas And Electrolyte Analyzer Market include high costs of advanced analyzers, the need for skilled personnel to operate these devices, and stringent regulatory requirements that can delay product approvals.

What opportunities exist in the Global Blood Gas And Electrolyte Analyzer Market?

Opportunities in the Global Blood Gas And Electrolyte Analyzer Market include the development of portable and user-friendly devices, integration of artificial intelligence for improved accuracy, and expansion into emerging markets with growing healthcare infrastructure.

What trends are shaping the Global Blood Gas And Electrolyte Analyzer Market?

Trends in the Global Blood Gas And Electrolyte Analyzer Market include the increasing adoption of telemedicine, the rise of home healthcare solutions, and innovations in sensor technology that enhance the precision and speed of blood analysis.

Global Blood Gas And Electrolyte Analyzer Market

| Segmentation Details | Description |

|---|---|

| Product Type | Portable Analyzers, Bench-top Analyzers, Handheld Analyzers, Modular Analyzers |

| Technology | Electrochemical, Optical, Spectrophotometric, Mass Spectrometry |

| End User | Hospitals, Diagnostic Laboratories, Research Institutions, Emergency Care Centers |

| Application | Critical Care, Anesthesia, Neonatology, Blood Transfusion |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Global Blood Gas And Electrolyte Analyzer Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at