Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Material Shifts: There is a clear trend from heavy copper/brass radiators toward lightweight aluminum cores and plastic tanks, driven by fuel‑efficiency regulations.

-

Design Innovation: Microchannel and flat‑tube technologies provide higher thermal performance per unit volume, enabling more compact and efficient cooling modules.

-

Electrification Impact: Hybrid and electric vehicles incorporate additional radiators for battery, inverter, and electric motor cooling—expanding radiator applications beyond internal‑combustion engine cooling.

-

Aftermarket Resilience: As vehicles remain on the road longer in mature markets, the replacement radiator segment continues to grow, supported by strong OEM part branding and independent aftermarket suppliers.

-

Regional Variations: Asia‑Pacific dominates demand due to vehicle production hubs and rising ownership; North America and Europe focus on high‑performance and EV applications, while Latin America and Africa are emerging aftermarket growth areas.

Market Drivers

-

Rising Vehicle Production: Continued expansion of automotive manufacturing, especially in China, India, and Southeast Asia, increases demand for radiators.

-

Stricter Emission Standards: Regulations (e.g., Euro 7, CAFE in the U.S.) push manufacturers to enhance engine thermal management to optimize combustion efficiency and reduce pollutants.

-

Shift to Lightweight Vehicles: Automakers seek aluminum radiators and composite cores to meet fuel‑economy targets, driving material innovation.

-

Electrification of Powertrains: Growth in hybrid and electric vehicles necessitates dedicated radiators for battery and power electronics, creating new market segments.

-

Aftermarket Expansion: Longer vehicle lifespans and increased DIY maintenance fuel replacement radiator demand.

Market Restraints

-

Raw Material Volatility: Aluminum price fluctuations can impact manufacturing costs and profit margins.

-

Technological Substitution: Emerging thermal management solutions (e.g., two‑phase cooling, immersion cooling for EVs) may reduce reliance on traditional radiator designs.

-

High Capital Investment: Developing advanced radiator technologies requires significant R&D and retooling costs, limiting smaller players.

-

Intense Competition: A fragmented supplier base and price sensitivity in many markets exert downward pressure on margins.

-

Regulatory Uncertainty: Changes in environmental and trade policies can affect supply chains and cost structures.

Market Opportunities

-

Advanced Materials: Adoption of phase‑change materials and graphene‑enhanced composites can boost radiator efficiency and lifespan.

-

Digital Manufacturing: 3D printing and automated assembly lines can reduce production lead times and customize radiator designs for niche applications.

-

Emerging Markets: Rapid motorization in Africa and Latin America presents growth potential for both OEM and aftermarket radiators.

-

Integration with A/C Systems: Combined radiator‑condenser units optimize under‑hood packaging and reduce assembly complexity.

-

Retrofit for Electrification: Upgrading existing vehicles to hybrid or mild‑hybrid powertrains requires new thermal management components, including specialized radiators.

Market Dynamics

-

Supply Side: Major radiator producers are expanding capacity in Asia, investing in lightweight technology lines, and forging supplier agreements for high‑quality aluminum. Economies of scale and vertical integration (raw aluminum smelting to finished radiator assembly) improve cost control.

-

Demand Side: Customers—OEMs and tier‑1 suppliers—demand higher efficiency, smaller form factors, and integrated cooling solutions. Aftermarket consumers favor reliability, brand reputation, and cost-effectiveness. Growth in fleet vehicles (trucks, buses) also drives robust radiator replacement volumes.

-

Economic Factors: Global GDP growth, oil prices, and automotive sales directly influence radiator demand. Inflationary pressures on raw materials can slow price‑sensitive markets, while government incentives for EVs accelerate radiator innovation in advanced cooling applications.

Regional Analysis

-

Asia‑Pacific: The largest market, driven by China (dominant OEM hub), India’s growing vehicle ownership, and Southeast Asia’s expanding manufacturing base. Local content requirements bolster domestic radiator producers.

-

North America: Focus on high‑performance, heavy-duty, and electric vehicle radiators. The U.S. market benefits from strong aftermarket networks and investment in next‑gen thermal systems for EVs.

-

Europe: A mature market with stringent CO₂ regulations prompting lightweight, high‑efficiency radiator adoption. Germany, France, and the U.K. lead in R&D and high‑value radiator exports.

-

Latin America: Emerging market characterized by aging vehicle fleets and rapid motorization, driving strong aftermarket demand. Economic volatility and import duties influence supplier strategies.

-

Middle East & Africa: Early‑stage market with potential in commercial vehicles and SUVs. Infrastructure investments and urbanization support growth, though political instability may pose risks.

Competitive Landscape

Leading Companies in the Global Automotive Radiator Market:

- Denso Corporation

- Valeo SA

- Mahle GmbH

- Modine Manufacturing Company

- Calsonic Kansei Corporation

- Sanden Holdings Corporation

- Delphi Technologies

- NRF BV

- Spectra Premium Industries Inc.

- CSF Radiators

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

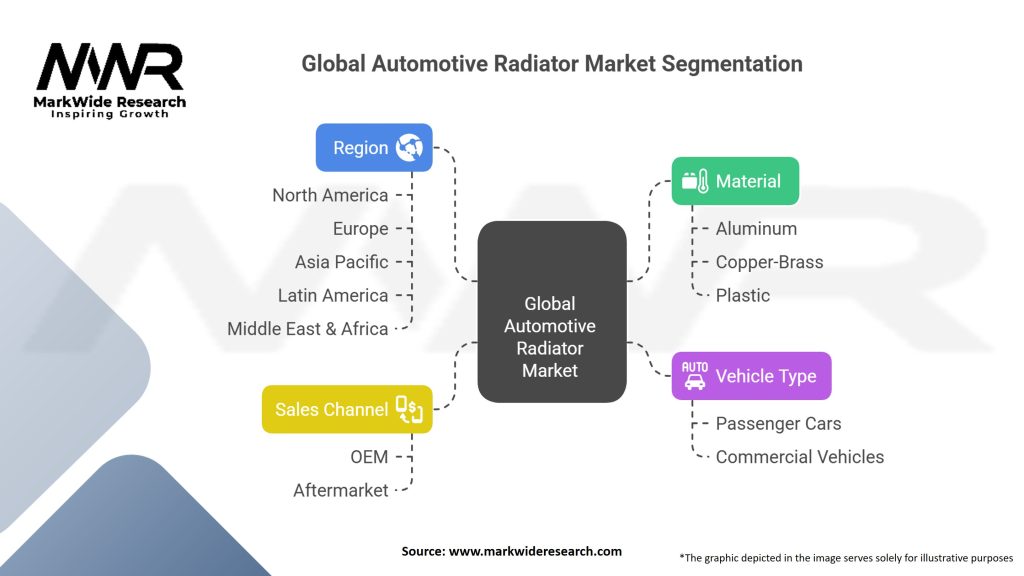

Segmentation

-

By Vehicle Type: Passenger Cars; Light Commercial Vehicles; Heavy Commercial Vehicles; Buses; Off‑Highway Vehicles.

-

By Material: Aluminum; Copper‑Brass; Plastic‑Composite.

-

By Technology: Tube‑and‑Fin; Microchannel; Flat‑Tube; Two‑Phase.

-

By Application: Engine Cooling; Battery Thermal Management (EV/Hybrid); Transmission Oil Cooling; HVAC Condenser Integration.

-

By Channel: OEM; Aftermarket.

-

By Region: Asia‑Pacific; North America; Europe; Latin America; Middle East & Africa.

Category-wise Insights

-

Engine Cooling Radiators: Traditional segment, shifting to aluminum microchannel designs for higher efficiency and reduced weight.

-

EV Battery & Power Electronics Cooling: Nascent but fastest‑growing, requiring high‑precision radiators integrated with liquid‑cooling loops.

-

HVAC Integration: Combined radiator‑condenser modules optimize space underhood and streamline assembly.

-

Heavy‑Duty & Commercial Applications: Demand rugged, high‑capacity radiators; focus on enhanced heat rejection for high‑load operations.

Key Benefits for Industry Participants and Stakeholders

-

Performance & Efficiency: Advanced radiator designs enable reduced fuel consumption and emissions, aligning with regulatory and OEM targets.

-

Cost Savings: Lightweight materials and integrated modules reduce assembly labor and material costs over vehicle lifecycle.

-

Product Differentiation: High‑value thermal solutions—especially for EVs—allow suppliers to differentiate and command premium pricing.

-

Aftermarket Revenue: Extended vehicle lifetimes drive sustained replacement radiator demand, providing stable aftermarket revenues.

-

Global Footprint: Regional manufacturing and localized supply chains enhance responsiveness and reduce logistics costs.

SWOT Analysis

-

Strengths: Established demand from global automotive production; evolving high‑tech applications in EV thermal management; mature aftermarket network.

-

Weaknesses: Sensitivity to raw material (aluminum) price swings; high R&D and capital expenditures; fragmented supplier base in some regions.

-

Opportunities: Electrification and hybridization; integration with advanced materials (phase‑change, graphene); digital manufacturing and 3D‑printed heat exchangers; expansion in emerging markets.

-

Threats: Disruptive cooling technologies (immersion, heat pipes); stringent environmental regulations on manufacturing emissions; geopolitical tensions affecting trade; intensified competition driving margin pressures.

Market Key Trends

-

Miniaturization & Microchannel Core Adoption: Higher thermal performance in smaller packages to optimize under‑hood space.

-

Integration with Cooling Loops: Single‑unit radiator‑condenser assemblies for HVAC and engine, reducing complexity.

-

Advanced Materials: Phase‑change alloys and graphite‑enhanced polymers for better heat transfer and weight reduction.

-

Additive Manufacturing: 3D‑printed radiator prototypes offering rapid design iteration and bespoke cooling solutions.

-

Smart Radiators: Embedded sensors and IoT connectivity for real‑time coolant monitoring, predictive maintenance, and adaptive cooling control.

Covid-19 Impact

The pandemic disrupted vehicle production and supply chains in 2020–2021, causing temporary radiator capacity underutilization and raw material shortages. However, accelerated consumer shift to personal vehicles and renewed emphasis on hygiene (fresh cabin air) boosted demand for HVAC‑integrated radiators. The crisis also highlighted supply chain vulnerabilities, leading companies to diversify manufacturing footprints and invest in digital supply‑chain monitoring. As production recovered, the market resumed growth, underpinned by the EV acceleration spurred by government stimulus packages.

Key Industry Developments

-

Strategic Partnerships: Joint ventures between radiator specialists and EV OEMs to co‑develop battery cooling solutions.

-

Capacity Expansion: New radiator assembly plants in Mexico, Thailand, and Eastern Europe to serve North American, Asia, and EU markets respectively.

-

Technology Collaborations: Alliances with material science startups to integrate phase‑change materials into core designs.

-

Aftermarket Digitization: Launch of digital platforms offering radiator selection, diagnostics, and direct‑to‑consumer ordering.

-

Regulatory Compliance Initiatives: Adoption of ISO 14001 and LEED‑certified manufacturing plants to reduce environmental footprint.

Analyst Suggestions

-

Diversify Material Sourcing: Secure long‑term aluminum supply agreements and explore recycled materials to mitigate price volatility.

-

Invest in EV Thermal Solutions: Prioritize R&D for battery and power electronics radiators to capture high‑growth EV segment.

-

Leverage Digital Tools: Implement IoT‑enabled sensors in radiators for condition monitoring and aftermarket service upselling.

-

Expand Aftermarket Direct Channels: Build e‑commerce capabilities and strengthen relationships with independent repair shops.

-

Pursue Strategic M&A: Acquire regional specialists and technology startups to broaden product portfolio and geographic reach.

Future Outlook

The Global Automotive Radiator Market is set for sustained growth driven by vehicle production expansion, rising EV adoption, and ongoing innovations in thermal management. Forecasts project the market to surpass USD 15 billion by 2030, with the EV cooling segment growing at double‑digit rates. Suppliers who invest in lightweight materials, microchannel cores, and digital manufacturing will lead the next wave of efficiency gains. Moreover, integration of radiators into holistic thermal management systems—encompassing engines, batteries, HVAC, and power electronics—will redefine OEM architectures. Globalization of production, matched with localized aftermarket services, will ensure balanced growth across mature and emerging markets. By embracing advanced technologies and strategic partnerships, radiator manufacturers are poised to play a pivotal role in the automotive industry’s transition to cleaner, smarter, and more connected mobility solutions.

Conclusion

The Global Automotive Radiator Market stands at the intersection of traditional engine cooling and cutting‑edge thermal management for electrified powertrains. While the core function—dissipating heat—remains unchanged, the technology, materials, and integration paradigms are undergoing a seismic shift. Radiator suppliers must adapt to heightened performance demands, cost targets, and sustainability goals by innovating in microchannel designs, lightweight composites, and intelligent cooling controls. At the same time, the aftermarket offers a stable revenue base through replacement and retrofit opportunities. As the automotive industry accelerates toward electrification, digitalization, and shared mobility, advanced radiator technologies will be instrumental in ensuring vehicle efficiency, reliability, and passenger comfort—cementing the radiator’s role as a cornerstone of automotive thermal management well into the future.