Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Automotive Production Trends: Global light vehicle production is expected to surpass 90 million units by 2030, driving continuous demand for ERW tubes in body-in-white, suspension, and exhaust systems.

-

Lightweighting Imperative: Automakers aim to reduce vehicle curb weights by 10–15% to meet Corporate Average Fuel Economy (CAFE) standards and EU CO₂ targets, positioning high-strength plain carbon ERW tubes as a cost-effective lightweighting solution.

-

EV Adoption: The shift toward electric powertrains alters tube requirements—battery enclosures and lightweight structural frames increasingly use plain carbon ERW tubes alongside advanced high-strength steels.

-

Technological Advancements: Innovations such as tandem ERW mills, high-frequency welding, and inline heat treatment improve weld integrity and mechanical properties while enhancing production throughput.

-

Regional Production Hubs: Asia-Pacific dominates with over 50% of global output, led by China’s expansive automotive industry; North America and Europe follow, buoyed by reshoring and nearshoring trends.

Market Drivers

-

Stringent Emissions and Efficiency Regulations: CAFE, Euro 7, and China 6 emission norms necessitate lightweight designs, boosting ERW tube adoption for structural components.

-

Rising Vehicle Production in Emerging Economies: India, Southeast Asia, and Latin America’s growing automotive markets fuel tube consumption for both domestic assemblers and export-oriented manufacturers.

-

Growth of SUV and Truck Segments: Heavier vehicles require robust yet lightweight tubular solutions for frames and suspensions, elevating plain carbon ERW tube demand.

-

Cost-Effective Manufacturing: ERW tubes offer lower capital and operating costs compared to seamless tubes, appealing to OEMs and Tier 1 suppliers seeking budget-friendly lightweighting.

-

Infrastructure Investment: Expanding highway and mass transit projects indirectly support the automotive supply chain, sustaining demand for tubes in commercial vehicles.

Market Restraints

-

Raw Material Price Volatility: Steel sheet price fluctuations impact ERW tube manufacturing margins and can deter small-to-mid-tier producers.

-

Competition from Advanced Materials: Aluminum, carbon fiber, and composite tubes, though costlier, offer superior weight savings, pressuring plain carbon tube market share in niche applications.

-

Technical Barriers in High-Strength Grades: Meeting ultra-high strength requirements (>700 MPa) with plain carbon compositions is challenging, limiting usage in next‑gen lightweight structures.

-

Quality and Standardization Issues: Variability in wall thickness and weld consistency across low-end producers can lead to quality concerns, prompting OEMs to prefer reputable suppliers.

-

Environmental Regulations on Steelmaking: Stringent emissions targets for steel production can increase capex for tube mills to adopt cleaner energy sources, raising overall costs.

Market Opportunities

-

Electrification-Driven Applications: EV chassis, battery housings, and thermal management systems create new avenues for tailored ERW tube solutions.

-

Integration with Industry 4.0: Deploying IoT-enabled sensors and AI‑driven process controls in ERW mills can optimize quality, reduce defects, and lower production costs.

-

Lightweight Multi‑Material Systems: Hybrid tubes combining plain carbon ERW backbones with aluminum or polymer inserts offer balanced strength and weight, opening new product lines.

-

Aftermarket Replacement Demand: The growing vehicle parc, especially in North America and Europe, drives refurbishment and replacement of worn tubular chassis and exhaust components.

-

Tier 2/Tier 3 Supplier Expansion: Supporting regional parts makers in emerging markets through joint ventures and licensing of ERW technology can broaden market reach.

Market Dynamics

-

Supply Side Dynamics:

-

Capacity Expansion: Major tube manufacturers are commissioning new ERW lines in India, Mexico, and Eastern Europe to capture regional automotive growth.

-

Technological Upgrades: Adoption of high-frequency welding and inline nondestructive testing improves tube integrity and reduces scrap rates.

-

-

Demand Side Dynamics:

-

OEM Partnerships: Close collaboration between tube suppliers and automotive OEMs enables customized tube geometries and coatings for corrosion protection.

-

Consumer Preferences: Increased demand for SUVs and trucks, especially in North America, amplifies usage of sturdy yet lightweight tubular frames and exhausts.

-

-

Economic Factors:

-

Cost Sensitivity: Automotive manufacturers’ drive to control bill of materials (BOM) costs favors the cheaper ERW tubes over seamless alternatives.

-

Trade Policies: Tariffs and trade agreements (e.g., USMCA, EU steel safeguard measures) influence regional sourcing strategies for ERW tubes.

-

Regional Analysis

-

Asia-Pacific:

-

Dominant Market Share: China’s domestic auto production (>30 million units/year) underpins over half of the global plain carbon ERW tube output.

-

Investment Hub: Rapid expansion of tube mills in India and Southeast Asia aligns with local OEM capacity growth and export opportunities.

-

-

North America:

-

Reshoring Trends: US and Mexico tube plants benefit from automakers’ nearshoring strategies, ensuring shorter lead times and supply chain resilience.

-

SUV & Pickup Demand: High penetration of light trucks and SUVs in the US market drives robust demand for chassis and exhaust tubes.

-

-

Europe:

-

Lightweighting Push: Stringent EU CO₂ standards accelerate adoption of high‑strength plain carbon ERW tubes in structural applications.

-

Tech Integration: European tube mills lead in Industry 4.0 implementation, enabling predictive maintenance and process optimization.

-

-

Latin America:

-

Growing Vehicle Production: Brazil and Argentina’s automotive sectors drive regional demand, though capacity constraints persist.

-

Imports vs. Domestic: Domestic tube production supplemented by imports from China and US to meet OE and aftermarket needs.

-

-

Middle East & Africa:

-

Emerging Automotive Clusters: Recent Ford and Stellantis investments in Morocco and Egypt spark demand for local ERW tube production.

-

Infrastructure Projects: Expansion of commercial vehicle fleets for logistics and public transport indirectly supports ERW tube consumption.

-

Competitive Landscape

Leading Companies in the Global Automotive Plain Carbon ERW Tubes Market:

- ArcelorMittal

- Nippon Steel Corporation

- JFE Steel Corporation

- Tata Steel Limited

- Hyundai Steel Co.

- United States Steel Corporation

- POSCO

- SeAH Steel Corporation

- AK Tube LLC

- Webco Industries Inc.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

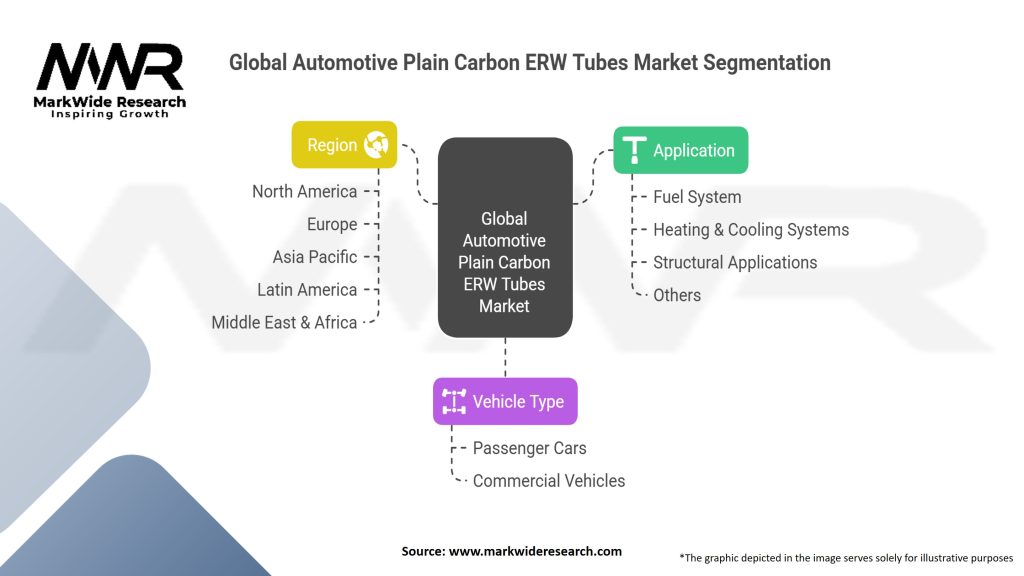

Segmentation

-

By Tube Grade:

-

Standard Grades: ASTM A513, EN 10305‑3—used for general structural and exhaust applications.

-

High-Strength Grades: Yield strength ≥550 MPa—adopted for lightweight chassis components.

-

-

By Wall Thickness:

-

Thin-Walled (≤1.5 mm): Common in HVAC and minor structural parts.

-

Medium-Walled (1.5–3 mm): Predominant in chassis, subframes.

-

Thick-Walled (>3 mm): Heavy-duty OEM and aftermarket exhaust systems.

-

-

By Application:

-

Chassis Components: Frame rails, cross-members, seat frames.

-

Exhaust Systems: Manifolds, pipes, resonators.

-

Steering & Suspension: Control arms, strut housings.

-

Aftermarket & Accessories: Off-road roll cages, custom exhaust kits.

-

-

By Vehicle Type:

-

Passenger Cars

-

Light Commercial Vehicles (LCVs)

-

Sports Utility Vehicles (SUVs)

-

Heavy Commercial Vehicles (HCVs)

-

-

By Region:

-

Asia-Pacific

-

North America

-

Europe

-

Latin America

-

Middle East & Africa

-

Category-wise Insights

-

Chassis Components: Demand driven by structural integrity and crashworthiness standards; high-strength tube grades gaining share.

-

Exhaust Systems: Corrosion resistance and thermal fatigue properties critical; plain carbon ERW tubes often coated or lined for durability.

-

Steering & Suspension: Requires tight dimensional tolerances; advanced ERW mills with inline ultrasonic testing ensure quality.

-

Aftermarket & Accessories: Custom tube bending and coating services expand revenue streams beyond OE volumes.

Key Benefits for Industry Participants and Stakeholders

-

Cost Efficiency: ERW process yields high output per hour and minimal scrap, reducing unit costs.

-

Supply Chain Proximity: Regional tube mills shorten lead times and mitigate trade barrier impacts.

-

Technical Collaboration: Co-development with OEMs fosters tube designs optimized for manufacturing and performance.

-

Sustainability Credentials: Plain carbon ERW tubes can incorporate recycled steel and support OEMs’ circular economy goals.

-

Aftermarket Growth: Expanded service offerings—cut-to-length, bending, coating—diversify revenues beyond OE supply.

SWOT Analysis

-

Strengths:

-

High-volume, low-cost production; wide applications in automotive; established global supply base.

-

-

Weaknesses:

-

Raw material cost exposure; quality variations among mid-tier producers; limited advantage in ultra‑light platforms.

-

-

Opportunities:

-

Electrification requiring new tube architectures; digitalized mill operations; regional capacity expansions in emerging markets.

-

-

Threats:

-

Alternative materials erosion; volatile steel prices; trade policy disruptions; consolidation favoring large integrated players.

-

Market Key Trends

-

Digital Manufacturing: AI‑powered quality control and predictive maintenance in ERW mills improve yield and lower downtime.

-

Hybrid Material Systems: Combining plain carbon tubes with polymeric or aluminum inserts for multi‑material lightweighting.

-

Automated Tube Forming Lines: Greater automation from coil handling to end‑product packaging enhances throughput and consistency.

-

Environmental Pressure: Adoption of electric arc furnace (EAF) steel and renewable energy in mills to cut CO₂ footprint.

-

Aftermarket Customization: Increasing consumer demand for performance accessories drives small-batch, bespoke tube fabrication.

Covid-19 Impact

-

Supply Chain Disruptions: Temporary mill shutdowns and logistics bottlenecks impacted tube availability in 2020–21, prompting supply chain diversification.

-

Automotive Production Fluctuations: OEM plant closures led to tube order volatility, but recovery post-2021 spurred capacity rebalancing.

-

Acceleration of Automation: Workforce limitations during pandemic peaks accelerated ERW mill automation to ensure continuity.

-

Shift to Local Sourcing: Disruptions prompted OEMs to qualify multiple regional tube suppliers, enhancing supply chain resilience.

Key Industry Developments

-

Mill Commissioning: New ERW lines inaugurated in India (Jindal), Mexico (Tenaris), and Eastern Europe (TMK) to meet regional OEM demand.

-

Advanced Welding Tech: Introduction of high-frequency welding with integrated laser seam inspection for sub-0.5 mm wall tolerance.

-

Sustainability Initiatives: Tube producers partnering with steelmakers shifting to EAF and HBI feedstocks to reduce lifecycle emissions.

-

Collaboration Projects: Joint R&D programs between OEMs and tube makers to co-develop ultra‑high strength plain carbon grades.

-

Digital Twins: Pilot deployments of digital twin technology in ERW mills to simulate process changes and optimize production parameters.

Analyst Suggestions

-

Invest in Digitalization: Adopt Industry 4.0 tools—IoT sensors, cloud analytics—to optimize mill operations and reduce scrap rates.

-

Expand Regional Footprint: Prioritize greenfield or brownfield ERW capacity in fast-growing markets (India, Mexico, Southeast Asia) to capture OEM localization trends.

-

Diversify Material Offerings: Develop hybrid tube solutions or high-strength plain carbon grades for advanced lightweighting programs.

-

Enhance Sustainability: Collaborate with upstream steelmakers on low‑carbon steel sourcing to meet OEM Scope 3 emission targets.

-

Strengthen Aftermarket Services: Grow cut-to-length, bending, and coating capabilities to capitalize on aftermarket automotive and industrial demand.

Future Outlook

The global automotive plain carbon ERW tubes market is set for steady expansion, underpinned by:

-

Sustained Vehicle Production Growth: Continued global light vehicle growth, particularly in emerging markets and EV segments.

-

Lightweighting Mandates: Stricter fuel economy and emission standards drive higher adoption of lightweight tube solutions.

-

Technological Innovation: Ongoing improvements in ERW welding, inline NDT, and digital control systems will enhance quality and reduce costs.

-

Electrification Impact: EV chassis and battery enclosures present new design requirements and growth avenues for plain carbon ERW tubes.

-

Sustainability Focus: OEMs’ carbon reduction commitments will favor low‑carbon steel and efficient tube manufacturing practices.

Conclusion

The global automotive plain carbon ERW tubes market remains a cornerstone of automotive engineering, balancing cost, performance, and manufacturing efficiency. As OEMs pursue aggressive lightweighting, electrification, and sustainability initiatives, plain carbon ERW tubes will continue to evolve in composition, manufacturing technology, and application scope. By embracing digital transformation, regional capacity expansion, and strategic collaboration across the value chain, tube producers can capitalize on market growth opportunities and navigate competitive pressures. With a robust outlook driven by rising vehicle volumes, regulatory mandates, and technological advancements, the plain carbon ERW tubes market is well-positioned for continued innovation and expansion through 2030 and beyond.