444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The global automotive hydraulic brake market is a rapidly growing sector within the automotive industry. Hydraulic brakes play a critical role in ensuring driving safety and performance, making them an indispensable component in vehicles. This comprehensive analysis provides insights into the market’s current state, key trends, drivers, restraints, opportunities, and future outlook.

Meaning

Automotive hydraulic brakes are braking systems that utilize hydraulic fluid pressure to transmit force from the brake pedal to the brake pads or shoes. This pressure generates friction, allowing the vehicle to slow down or come to a complete stop. The hydraulic brake system consists of various components, including master cylinders, brake calipers, wheel cylinders, brake lines, and brake fluid reservoirs.

Executive Summary

The global automotive hydraulic brake market has witnessed substantial growth in recent years, primarily driven by the increasing demand for passenger and commercial vehicles worldwide. The market’s expansion is further fueled by advancements in technology, such as anti-lock braking systems (ABS) and electronic stability control (ESC), which enhance safety and control.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

ABS/EBD Penetration: Nearly 100% of new passenger cars in North America, Europe, and China now feature ABS/EBD, driving demand for compatible hydraulic components.

EV & HEV Growth: While regenerative braking reduces brake wear, hydraulic systems remain essential for emergencies and low‑speed control, sustaining hydraulic brake demand even as EV penetration rises.

Lightweighting Trends: Adoption of aluminum and composite calipers and integration of master cylinder and electronic control units into single brake control modules are reducing overall vehicle weight and improving packaging.

Regional Dynamics: Asia‑Pacific holds the largest share (>40%) due to high vehicle production and lower per‑unit system cost; North America and Europe focus on premium/high‑performance systems; Latin America and MEA are emerging markets with growing new vehicle uptake.

Aftermarket & Reman: Strong aftermarket demand for replacement brake pads, discs, and calipers—particularly in mature markets—provides stable revenue streams alongside OEM supply.

Market Drivers

Stringent Safety Regulations: Mandates such as UN‑R13 (brake assist), UN‑R13H (EBS for heavy vehicles), and 2022 EU requirements for advanced braking systems in new vehicles.

Rising Vehicle Production: Global passenger car and commercial vehicle production is forecast to grow at ~4% annually, with China, India, and Southeast Asia leading.

Electrification Trends: EV/HEV adoption requires advanced hydraulic systems that integrate seamlessly with regenerative braking and redundant safety circuits.

Premiumization: Increasing consumer demand for high‑performance and luxury vehicles fuels adoption of multi‑piston calipers, ceramic‑coated rotors, and electronically controlled hydraulic units.

Urbanization & Road Safety: Growing urban populations and vehicle miles traveled accentuate the need for reliable braking systems to reduce accidents and improve traffic safety.

Market Restraints

Raw Material Costs: Price fluctuations in steel, aluminum, and specialty alloys used in calipers and rotors affect manufacturing margins.

Technical Complexity: Integration of hydraulics with electronics (ECUs, sensors) increases R&D and calibration costs, requiring skilled engineers and stringent validation.

Alternative Technologies: Rising interest in electromechanical brakes (brake‑by‑wire) and air disc brakes for heavy‑duty applications could substitute traditional hydraulics in the long term.

Regulatory Hurdles: Varying homologation and testing requirements across jurisdictions slow down global product launches and add compliance costs.

Market Opportunities

Electro‑Hydraulic Systems: Development of brake‑by‑wire and electro‑hydraulic brake boosters that reduce vacuum pump reliance in EVs and hybrids.

3D‑Printed Components: Additive manufacturing for complex, lightweight brake calipers that reduce weight and improve performance.

Connected & Autonomous Vehicles (CAVs): Integration of hydraulic brakes with advanced driver‑assist (ADAS) systems for precise remote braking control in semi‑autonomous and autonomous driving.

Aftermarket Expansion: Development of premium and performance aftermarket brake kits in emerging markets where new vehicle sales are rising.

Sustainable Materials: Research into bio‑based brake fluids and coatings to improve environmental footprint and reduce lifecycle emissions.

Market Dynamics

Supply Side: Consolidation among tier‑1 suppliers (Bosch‑ZF, Continental‑advics joint ventures), vertical integration by OEMs, and localization of production facilities in key growth markets.

Demand Side: Consumer preference for vehicles with advanced safety features and premium driving dynamics; fleet operators seeking total cost of ownership (TCO) reductions via longer service intervals and better performance.

Economic & Policy: Infrastructure investments in emerging economies, shifting trade tariffs on auto parts, and incentives for EV adoption shape brake system requirements.

Regional Analysis

North America: Strong demand for pickups and SUVs drives high‑performance brake adoption; aftermarket for performance brakes remains robust.

Europe: Premium segment leadership fosters advanced brake technologies; regulations demand continued innovation in brake safety and emissions.

Asia‑Pacific: Volume market with rising mid‑segment and luxury vehicle sales; cost‑optimized hydraulic brake systems dominate.

Latin America: Growing new vehicle sales and used car aging boost replacement brake parts market.

Middle East & Africa: Infrastructure development and increasing vehicle fleet size create aftermarket and OEM opportunities, though political and economic volatility pose risks.

Competitive Landscape

Leading Companies in the Global Automotive Hydraulic Brake Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

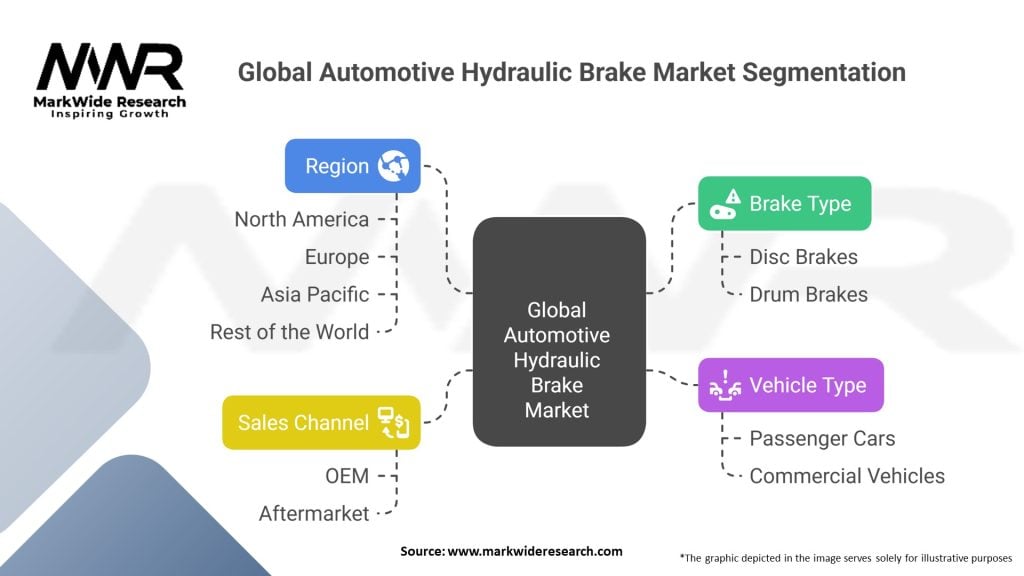

Segmentation

By Vehicle Type:

Passenger Cars

Light Commercial Vehicles (LCVs)

Heavy Commercial Vehicles (HCVs)

Two‑Wheelers (limited)

By Component:

Master Cylinder & Brake Booster

Brake Caliper

Brake Disc/Drum

Hydraulic Control Unit (for ABS/EBD/ESC)

Brake Lines & Hoses

Brake Fluid

By Technology:

Conventional Hydraulic Brakes

Electro‑Hydraulic Brakes (Brake‑by‑Wire)

Integrated Brake Control Modules

By Distribution Channel:

OEM

Aftermarket (Tier‑2 & Tier‑3)

By Region:

North America

Europe

Asia‑Pacific

Latin America

Middle East & Africa

Category-wise Insights

Master Cylinder & Brake Booster: Shift to electric vacuum pumps in EVs drives development of electro‑hydraulic booster units.

Brake Calipers: Monoblock aluminum calipers in premium segment; iron calipers remain prevalent in mass‑market vehicles due to cost.

Discs/Drums: Ventilated and coated discs for heat dissipation in performance applications; drums persist in entry‑level and commercial vehicles.

HCUs: Increasing integration of ABS/EBD/ESC control valves and sensors into compact hydraulic modules.

Key Benefits for Industry Participants and Stakeholders

Enhanced Safety & Compliance: Meeting global safety mandates (NCAP, UN‑R13) and reducing liability through superior brake performance.

Performance Differentiation: OEMs can leverage high‑performance brake systems as a selling point in premium and sports segments.

Cost Optimization: Improved hydraulic system integration reduces parts count and assembly costs.

Aftermarket Revenue: Stable replacement cycle for brake pads, rotors, and fluid ensures recurring revenue.

Technological Leadership: Early movers in electro‑hydraulic and brake‑by‑wire systems gain competitive edge in emerging EV/CAV markets.

SWOT Analysis

Strengths: Established technology with proven reliability; high safety impact; strong aftermarket demand.

Weaknesses: Dependency on raw material costs; moderate innovation cycle compared to electrification trends.

Opportunities: Brake‑by‑wire, lightweight materials, EV backup systems, CAV integration.

Threats: Shift to full electromechanical braking systems; regulatory changes; potential consolidation.

Market Key Trends

Electro‑Hydraulic Brake Boosters: Replacing vacuum boosters in EVs to eliminate engine‑driven vacuum reliance.

Integration with ADAS & CAV: Direct interface between hydraulic brake systems and electronic control strategies for autonomous emergency braking.

Lightweight Materials: Carbon‑ceramic rotors in ultra‑performance cars; aluminum calipers in luxury segments.

Coatings & Surface Treatments: DLC and zirconia coatings on pistons and rotors to reduce wear and noise.

Digital Twins & Predictive Maintenance: Use of sensors and machine learning to monitor brake pad life and fluid quality.

Covid-19 Impact

Production Disruptions: Temporary OEM plant shutdowns delayed launch of new brake systems.

Supply Chain Strain: Global logistics delays and component shortages pressured just‑in‑time braking part supplies.

Shift in Mobility: Reduced travel during lockdowns dampened short‑term brake replacement volumes, but resumed growth with mobility recovery.

Acceleration of Electrification: Pandemic recovery plans in EU/China emphasized EV adoption, reinforcing need for advanced hydraulic backup systems.

Key Industry Developments

ZF’s Electric Brake Booster (iBooster): Adopted by major OEMs in EVs and hybrids to integrate regenerative braking with hydraulic backup.

Brembo & HPFP Partnerships: Joint ventures to develop carbon‑ceramic and composite brake systems for ultra‑premium EVs.

Bosch Pressure Sensor Integration: Embedding brake line pressure sensors for real‑time brake health monitoring.

Aisin’s Compact HCUs: Modular hydraulic control units tailored for Asia‑Pacific compact cars.

Continental’s Brake‑by‑Wire Demo: Showcased fully electronic braking on demonstration autonomous shuttle.

Analyst Suggestions

Invest in Brake‑by‑Wire R&D: To capture future demand in autonomous and electric vehicles, develop high‑reliability electro‑hydraulic actuators and controls.

Localize Production: Establish regional manufacturing in growth markets (India, Southeast Asia) to mitigate tariffs and reduce lead times.

Expand Aftermarket Offerings: Leverage dealer networks and digital platforms for predictive maintenance services and premium replacement kits.

Collaborate with ADAS Developers: Co‑develop integrated braking and sensor fusion solutions for Level‑2+ autonomous functions.

Optimize Cost via Materials Innovation: Explore advanced composites and coatings to reduce weight and extend part lifecycles.

Future Outlook

The global automotive hydraulic brake market is set to evolve through 2030:

Sustained Growth: Despite electric mobility proliferation, hydraulic brakes will remain mandatory, growing at ~5% CAGR in line with overall vehicle production.

EV Adaptation: 30–40% of new EVs will adopt electro‑hydraulic boosters, creating a sizeable sub‑segment.

Autonomy Integration: By 2028, >20% of new passenger cars will feature brake‑by‑wire capabilities integrated with level‑2+ ADAS systems.

Lightweighting Focus: Average braking system weight reduction of 10–15% through material and design innovations.

Aftermarket Stability: Replacement part revenue will track vehicle parc growth, particularly in emerging markets with aging fleets.

Conclusion

Hydraulic brake systems continue to be a cornerstone of vehicle safety and performance, even as the automotive industry undergoes electrification and automation. Their inherent reliability, precise control, and integration flexibility ensure that hydraulic brakes will remain indispensable—both as primary systems and as critical backups—well into the era of electric and autonomous vehicles.

The global automotive hydraulic brake market plays a crucial role in ensuring vehicle safety and performance. With a focus on technological advancements, expansion into emerging markets, and collaboration with industry stakeholders, companies can navigate market dynamics and capitalize on growth opportunities. The future outlook for the market remains positive, driven by factors such as rising vehicle production, advancements in brake system technology, and increasing emphasis on safety regulations.

What is the Global Automotive Hydraulic Brake?

The Global Automotive Hydraulic Brake refers to a braking system that uses hydraulic fluid to transfer force from the brake pedal to the brake components, providing effective stopping power in vehicles. This system is widely used in various automotive applications due to its reliability and efficiency.

Who are the key players in the Global Automotive Hydraulic Brake Market?

Key players in the Global Automotive Hydraulic Brake Market include companies such as Bosch, Continental AG, and ZF Friedrichshafen AG, which are known for their advanced braking technologies and innovations, among others.

What are the main drivers of growth in the Global Automotive Hydraulic Brake Market?

The main drivers of growth in the Global Automotive Hydraulic Brake Market include the increasing demand for vehicle safety features, advancements in braking technology, and the rising production of electric and hybrid vehicles that require efficient braking systems.

What challenges does the Global Automotive Hydraulic Brake Market face?

Challenges in the Global Automotive Hydraulic Brake Market include the high cost of advanced braking systems, the need for regular maintenance, and competition from alternative braking technologies such as electric brakes.

What opportunities exist in the Global Automotive Hydraulic Brake Market?

Opportunities in the Global Automotive Hydraulic Brake Market include the growing trend towards automation in vehicles, the development of smart braking systems, and the increasing focus on sustainability and eco-friendly materials in brake manufacturing.

What trends are shaping the Global Automotive Hydraulic Brake Market?

Trends shaping the Global Automotive Hydraulic Brake Market include the integration of advanced driver-assistance systems (ADAS), the shift towards lightweight materials for improved fuel efficiency, and the adoption of regenerative braking technologies in electric vehicles.

Global Automotive Hydraulic Brake Market

| Segmentation | Details |

|---|---|

| Brake Type | Disc Brakes, Drum Brakes |

| Vehicle Type | Passenger Cars, Commercial Vehicles |

| Sales Channel | OEM (Original Equipment Manufacturer), Aftermarket |

| Region | North America, Europe, Asia Pacific, Rest of the World |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Global Automotive Hydraulic Brake Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at