444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The global automotive cup holder market represents a vital segment within the automotive interior components industry, characterized by continuous innovation and evolving consumer preferences. This specialized sector encompasses the design, manufacturing, and distribution of beverage holding solutions integrated into vehicle interiors across passenger cars, commercial vehicles, and specialty automotive applications. Automotive cup holders have transformed from simple convenience features into sophisticated components incorporating advanced materials, adjustable mechanisms, temperature control capabilities, and aesthetic designs that complement premium vehicle interiors. The market demonstrates steady growth driven by increasing global vehicle production, rising consumer expectations for interior comfort and convenience, and technological advancements enabling multifunctional cup holder systems.

Manufacturing capabilities span diverse materials including plastics, metals, and composite materials, with production processes incorporating injection molding, thermoforming, and precision assembly techniques. Regional dynamics reveal strong demand across established automotive markets while emerging economies experience rapid growth as vehicle ownership expands and consumer preferences evolve toward enhanced comfort features. According to MarkWide Research analysis, the sector is experiencing consistent expansion with projected growth at a CAGR of 5.8% through the forecast period. Industry participants range from specialized automotive interior suppliers to integrated tier-one manufacturers serving multiple vehicle platforms globally, creating a competitive landscape characterized by innovation, quality excellence, and cost efficiency.

The global automotive cup holder market refers to the worldwide industry encompassing the design, production, distribution, and integration of beverage container holding devices installed in automotive vehicles. This includes fixed and adjustable cup holders, retractable systems, heated and cooled variants, and multifunctional holders incorporating storage compartments, wireless charging capabilities, and other integrated features enhancing vehicle interior functionality and passenger convenience.

Market evolution in automotive cup holders reflects broader transformations in vehicle interior design philosophy and consumer lifestyle preferences. The sector has progressed from basic aftermarket accessories to essential original equipment manufacturer (OEM) components featuring sophisticated engineering and premium materials. Key growth drivers include increasing vehicle production volumes, rising consumer demand for comfort and convenience features, premiumization trends in automotive interiors, and technological innovations enabling enhanced functionality. The market landscape features diverse stakeholders including specialized interior component manufacturers, integrated automotive suppliers, material technology providers, and design consultancies supporting product development.

Manufacturing challenges encompass material selection balancing durability with cost efficiency, design integration within constrained interior spaces, and meeting diverse regulatory requirements across global markets. Consumer preferences increasingly favor versatile cup holders accommodating various beverage container sizes, premium aesthetic finishes, and integrated features like temperature control and wireless device charging. Automotive manufacturers recognize cup holder design as an important element of overall interior perceived quality, with approximately 78% of consumers considering cup holder functionality when evaluating vehicle interiors according to industry research. Technology integration expands cup holder capabilities beyond simple beverage holding to include smart features, illumination, and connectivity with vehicle infotainment systems. The manufacturing ecosystem demonstrates increasing sophistication with dedicated tooling, advanced materials, and comprehensive testing protocols ensuring product reliability and customer satisfaction throughout vehicle lifecycles.

Critical market dynamics shaping the automotive cup holder landscape include:

Multiple catalysts propel growth in the global automotive cup holder market. Rising vehicle production globally creates fundamental demand for automotive interior components with each new vehicle requiring multiple cup holder units across front, rear, and potentially third-row seating positions. Consumer lifestyle changes increasingly emphasize on-the-go beverage consumption with commuters, families, and professionals regularly consuming coffee, water, and other beverages while driving, elevating cup holder importance. Premium vehicle segment expansion drives demand for sophisticated cup holder designs incorporating high-quality materials, integrated features, and aesthetic designs complementing luxury interior environments.

SUV and crossover popularity benefits the market as these vehicle categories typically feature more extensive interior space enabling multiple cup holder installations with enhanced functionality. Coffee culture proliferation across global markets increases the frequency and variety of beverages consumed in vehicles, creating demand for versatile cup holder designs accommodating diverse container types and sizes. Technology integration trends create opportunities for innovative cup holders incorporating wireless charging capabilities, USB ports, and connectivity features appealing to tech-savvy consumers. Comfort and convenience prioritization by automotive manufacturers recognizing that interior features significantly influence purchase decisions drives investment in thoughtful cup holder design and placement. Family vehicle considerations emphasize cup holder quantity and accessibility, with multi-passenger vehicles requiring comprehensive beverage holding solutions throughout the cabin. Temperature control features gain traction with consumers valuing heated cup holders for hot beverages and cooled holders for cold drinks, particularly in extreme climate regions. Aftermarket opportunities expand as vehicle owners seek to upgrade basic factory cup holders or add supplementary units, with the aftermarket segment achieving approximately 15% market share and growing steadily as vehicle ownership durations extend.

Significant challenges constrain market growth despite favorable overall dynamics. Space constraints in vehicle interiors create design limitations, particularly in smaller vehicles where interior real estate must balance numerous competing requirements limiting cup holder size and placement options. Cost pressures from automotive manufacturers continually seeking to reduce vehicle production costs affect component pricing, challenging suppliers to maintain profitability while meeting quality expectations. Design complexity increases as cup holders must accommodate expanding ranges of beverage container sizes while maintaining compact dimensions when not in use, requiring sophisticated mechanical solutions. Material performance requirements demand components withstand temperature extremes, repeated use cycles, chemical exposure from beverage spills, and UV radiation while maintaining appearance and functionality throughout vehicle lifecycles.

Regulatory considerations around interior safety, material emissions, and recyclability vary across markets, requiring manufacturers to develop region-specific variants increasing development costs and inventory complexity. Alternative transportation trends including ride-sharing and autonomous vehicle development may influence future interior design philosophies and cup holder requirements, creating uncertainty for long-term product planning. Quality expectations from consumers remain high with cup holder failures or inadequate performance generating disproportionate customer dissatisfaction relative to component cost. Integration challenges with increasingly complex center console designs incorporating gear selectors, control interfaces, and storage compartments compete for space and complicate cup holder packaging. Customization demands across vehicle trim levels and regional markets require manufacturers to manage extensive product variants while maintaining production efficiency. Competition intensity among suppliers creates margin pressure as automotive manufacturers leverage competitive bidding processes to minimize component costs, with pricing pressure averaging 2-3% annually across the industry.

Substantial opportunities exist for market participants across the value chain. Smart cup holder development incorporating sensors, heating and cooling capabilities, and integration with vehicle systems creates premium product opportunities commanding higher margins while differentiating supplier capabilities. Sustainable materials adoption enables suppliers to meet automotive manufacturer environmental goals while potentially appealing to environmentally conscious consumers willing to pay premiums for sustainable products. Emerging market expansion offers significant growth potential as countries like India, Southeast Asian nations, and African markets experience rising vehicle ownership and consumer preferences evolve toward comfort features. Electric vehicle proliferation creates opportunities to reimagine cup holder integration within new interior architectures freed from traditional powertrain packaging constraints. Luxury segment focus provides opportunities for suppliers capable of delivering premium materials, sophisticated mechanisms, and integrated features meeting high-end vehicle requirements. Modular design approaches enable cost-efficient platform strategies serving multiple vehicle programs while accommodating customization for specific applications.

Aftermarket innovation through development of universal fit, easy-installation cup holder solutions serves vehicle owners seeking to upgrade or supplement factory equipment. Wireless charging integration represents a growing opportunity as smartphone usage in vehicles increases and consumers value convenient charging solutions integrated into cup holder locations. Temperature control technology advancement makes heated and cooled cup holders more cost-effective and reliable, expanding their application beyond luxury segments into mainstream vehicles. Aesthetic customization including ambient lighting, premium finishes, and personalization options appeals to consumers seeking to enhance interior ambiance and express individual preferences. Commercial vehicle applications remain underserved relative to passenger vehicles, creating opportunities for specialized solutions addressing professional driver needs and fleet operator requirements.

Complex interactions between technological, consumer, and industry forces shape market evolution. Design trend cycles influence cup holder styling and integration approaches as overall interior design philosophies shift between minimalist, technology-focused, and traditional luxury aesthetics. Vehicle electrification impacts cup holder design opportunities as traditional center console areas housing transmission components become available for alternative purposes including enhanced cup holder installations. Consumer beverage preferences evolve with cold brew coffee, specialty teas, and large insulated containers becoming more prevalent, requiring cup holders to accommodate larger diameter containers than traditional designs. Connectivity integration blurs boundaries between traditional cup holders and multifunctional compartments as manufacturers incorporate charging capabilities, storage features, and control interfaces.

Supply chain relationships between cup holder manufacturers and automotive OEMs increasingly emphasize long-term partnerships with early design involvement rather than purely transactional component supply arrangements. Manufacturing location decisions balance proximity to automotive assembly plants against labor cost considerations and regional market access requirements. Quality perception impacts on overall vehicle satisfaction remain significant despite cup holders representing small percentages of total vehicle value, with poor cup holder design cited in approximately 12% of customer complaints about interior quality. Platform consolidation among automotive manufacturers creates opportunities for suppliers to achieve economies of scale across multiple vehicle models while requiring flexibility to accommodate brand-specific aesthetic requirements. Safety considerations influence design parameters as regulators and manufacturers ensure cup holders do not interfere with vehicle operation, airbag deployment, or occupant egress during emergencies. Climate adaptation requires cup holders to perform reliably across extreme temperature ranges from arctic cold to desert heat while maintaining structural integrity and smooth operation.

Comprehensive research underpinning this analysis employed multiple methodologies ensuring accuracy and market insight. Primary research included structured interviews with automotive interior suppliers, tier-one manufacturers, vehicle design engineers, and purchasing managers providing firsthand perspectives on market dynamics and competitive positioning. Secondary research synthesized information from automotive production statistics, supplier financial reports, patent filings, and industry publications to understand technological trends and market sizing. Market modeling utilized automotive production forecasts across vehicle segments and regions, applying cup holder content per vehicle estimates to generate comprehensive market size projections. Competitive analysis evaluated major suppliers assessing their product portfolios, manufacturing capabilities, customer relationships, and strategic priorities. Consumer research review examined automotive satisfaction studies, interior quality ratings, and consumer preference surveys to understand cup holder importance and desired features.

Technology assessment evaluated emerging materials, manufacturing processes, and functional innovations to project future market developments. Regional analysis examined market characteristics across major automotive manufacturing regions considering production volumes, vehicle preferences, and regulatory environments. Value chain mapping identified key stakeholders from material suppliers through component manufacturers to automotive OEMs, understanding relationships and value distribution. Trend analysis evaluated historical market development patterns to identify cycles and structural changes influencing future trajectories. Expert validation involved consulting with automotive interior designers, materials specialists, and industry analysts to verify findings and challenge assumptions, ensuring the analysis reflects practical market realities and accounts for nuanced factors affecting cup holder market development.

Asia-Pacific dominates global production volumes with approximately 48% market share, driven by massive automotive manufacturing concentrations in China, Japan, South Korea, and India. China represents the single largest market reflecting its position as the world’s largest automotive producer and consumer, with domestic suppliers increasingly developing sophisticated cup holder technologies serving both local and international customers. India demonstrates rapid growth as vehicle production expands and consumer preferences evolve toward enhanced interior features even in entry-level vehicle segments. Japan contributes technological innovation with suppliers developing advanced cup holder mechanisms and materials influencing global product development directions. North America maintains significant market presence with approximately 22% global share, characterized by preference for larger vehicles like SUVs and pickup trucks typically featuring more extensive cup holder installations.

United States consumers particularly value cup holder functionality with market research consistently identifying beverage holding as among the most important interior convenience features. Mexico emerges as an important manufacturing location for automotive components including cup holders, serving both domestic production and export markets. Europe represents a mature market with sophisticated design requirements and strong emphasis on premium materials and aesthetic integration. Germany influences global standards through its luxury automotive manufacturers demanding high-quality cup holder designs with refined mechanisms and premium finishes. Eastern European countries host increasing automotive component manufacturing supporting both regional vehicle production and Western European assembly plants. Latin America shows moderate growth potential with Brazil representing the primary market, though economic volatility and vehicle affordability challenges limit premium feature adoption. Middle East demonstrates specific requirements for cup holders capable of maintaining cold beverage temperatures in extreme heat conditions. Africa remains an emerging market with limited current volumes but long-term potential as vehicle ownership increases across the continent’s growing middle-class populations.

The competitive environment features diverse participants with varying strategies and capabilities:

By Product Type: The market segments into fixed cup holders permanently installed in specific locations, retractable cup holders that extend when needed and retract when not in use, adjustable cup holders featuring expandable mechanisms accommodating various container sizes, and multifunctional cup holders integrating additional features like wireless charging or storage compartments. Fixed designs dominate volume applications while retractable systems serve premium segments where interior aesthetics and space optimization justify additional complexity and cost.

By Material: Classification includes plastic cup holders utilizing various polymer formulations balancing cost and performance, metal cup holders offering premium aesthetics and enhanced durability, and composite material designs combining multiple materials to optimize specific performance characteristics. Plastic materials represent the majority of applications due to design flexibility, cost efficiency, and adequate performance for most requirements.

By Vehicle Type: Market applications span passenger cars including sedans, hatchbacks, and coupes; sport utility vehicles and crossovers; pickup trucks; commercial vehicles including vans and light trucks; and specialty vehicles including recreational vehicles, marine applications, and off-road equipment. SUV and crossover segments demonstrate the strongest growth reflecting overall automotive market trends.

By Technology: Segments include basic cup holders providing simple beverage holding functionality, heated cup holders maintaining warm beverage temperatures, cooled cup holders utilizing thermoelectric cooling, and smart cup holders incorporating sensors, illumination, or connectivity features. Basic cup holders dominate current volumes while temperature-controlled variants represent the fastest-growing subsegment.

By Sales Channel: Distribution channels include original equipment manufacturer (OEM) supply directly to automotive manufacturers for factory installation and aftermarket sales through automotive parts retailers, online platforms, and specialty accessory providers serving vehicle owners seeking supplementary or replacement cup holders.

Adjustable Cup Holders represent an increasingly important category addressing consumer frustration with fixed-size designs that accommodate some containers poorly. Expansion mechanisms typically utilize spring-loaded grippers, adjustable diameter rings, or flexible material inserts adapting to container dimensions. Design challenges include maintaining secure holding across the size range while ensuring smooth operation and durability through repeated adjustment cycles. Consumer acceptance remains high for adjustable designs despite typically higher costs relative to fixed alternatives.

Temperature-Controlled Cup Holders constitute a premium category growing rapidly as technology costs decline and consumer awareness increases. Heated variants utilize resistive heating elements or Peltier devices maintaining coffee and tea at optimal drinking temperatures during commutes. Cooled cup holders employ thermoelectric cooling technology keeping beverages cold without requiring ice or external refrigeration. Energy consumption considerations require efficient designs minimizing electrical load on vehicle systems while delivering meaningful temperature control performance.

Illuminated Cup Holders enhance interior ambiance and nighttime usability through integrated LED lighting. Ambient lighting designs provide subtle illumination complementing overall interior lighting schemes in premium vehicles. Functional illumination improves visibility facilitating beverage placement and retrieval in low-light conditions. Customization options allowing color selection appeal to consumers seeking personalized interior environments, with illuminated cup holders achieving 30% higher satisfaction ratings compared to non-illuminated alternatives in premium segments.

Wireless Charging Cup Holders represent an innovative category addressing smartphone charging needs while maximizing interior space efficiency. Integration challenges include ensuring adequate cooling for charging components, accommodating various device sizes, and maintaining charging efficiency despite positioning variations. Consumer adoption grows as wireless charging becomes standard on more smartphone models and consumers value convenient charging locations.

Commercial Vehicle Cup Holders serve professional drivers spending extended periods in vehicles, requiring robust designs withstanding intensive use. Durability requirements exceed passenger vehicle standards given higher usage frequencies and potentially harsh operating environments. Specialized features for commercial applications include larger capacities for oversized beverage containers, secure holding during vehicle motion, and easy cleaning to maintain hygiene standards.

Automotive Manufacturers gain opportunities to differentiate vehicle offerings through thoughtful cup holder design and placement, enhancing interior perceived quality at relatively modest cost. Consumer satisfaction data consistently identifies convenient, functional cup holders as contributing positively to overall vehicle evaluations and purchase recommendations.

Component Suppliers benefit from relatively stable demand tied to vehicle production volumes with opportunities for margin enhancement through innovative product offerings and value-added features. Long-term supply relationships with automotive manufacturers provide business predictability enabling strategic investments in capacity and capability development.

Material Technology Providers find attractive markets for advanced polymers, sustainable materials, and specialty coatings as cup holder designs evolve toward enhanced functionality and aesthetic sophistication. Performance requirements for chemical resistance, temperature stability, and durability drive adoption of engineered materials commanding premium pricing.

Design Consultancies participate in vehicle interior development programs where cup holder integration represents an important element of overall user experience design, creating recurring engagement opportunities across multiple vehicle programs.

Aftermarket Retailers benefit from consumer demand for supplementary cup holders and upgrades to factory-installed units, with the aftermarket representing a stable revenue stream less cyclical than new vehicle production.

Consumers ultimately benefit from continuous innovation delivering enhanced functionality, improved aesthetics, and greater versatility in cup holder designs, contributing meaningfully to daily vehicle use satisfaction and convenience.

Strengths:

Weaknesses:

Opportunities:

Threats:

Multifunctional Integration transforms cup holders from single-purpose beverage holders into versatile compartments serving multiple functions. Wireless charging integration becomes increasingly common as smartphone ownership reaches saturation and consumers expect convenient device charging throughout vehicle interiors. Storage combination designs incorporate compartments for coins, cards, or small items alongside beverage holding capability, maximizing utility of available console space. Control interface integration in some premium designs places vehicle controls or infotainment interfaces within cup holder surrounds optimizing ergonomic reach and visual orientation.

Sustainable Materials Adoption accelerates as automotive manufacturers pursue environmental objectives and consumers increasingly value sustainability. Recycled plastic content grows in cup holder applications with some manufacturers achieving over 50% recycled material incorporation without compromising performance or aesthetics. Bio-based polymers derived from renewable resources provide alternatives to petroleum-based materials, though cost and performance considerations limit current adoption. Design for recyclability influences material selection and assembly approaches facilitating end-of-life vehicle recycling and circular economy objectives.

Aesthetic Sophistication elevates cup holder design as an integral element of overall interior ambiance rather than purely functional components. Premium finishes including soft-touch materials, metallic accents, and ambient lighting create visual and tactile quality impressions contributing to luxury vehicle differentiation. Minimalist designs with clean lines and concealed mechanisms appeal to consumers preferring uncluttered interior aesthetics. Customization options enabling personalization through color selection, illumination choices, or trim variations support mass customization strategies.

Size Versatility Enhancement responds to expanding beverage container diversity with consumers using everything from small espresso cups to large insulated tumblers. Expandable mechanisms automatically adjust to container dimensions providing secure holding across wide size ranges. Depth adjustability accommodates tall containers while preventing shorter vessels from sitting too low for convenient access. Universal fit designs in aftermarket applications utilize flexible materials or innovative geometries adapting to various container shapes and sizes.

Temperature Management Technology expands from luxury segments toward mainstream applications as component costs decline and consumer awareness grows. Heated cup holders maintain optimal coffee temperatures during commutes addressing consumer frustration with rapidly cooling beverages. Thermoelectric cooling keeps cold beverages chilled without requiring ice or external power sources, particularly valuable in hot climate regions. Energy efficiency improvements reduce electrical consumption making temperature control features more practical across vehicle segments.

Recent years have witnessed numerous significant developments influencing market trajectories. Major automotive manufacturers elevated cup holder design priority within interior development programs, recognizing consumer satisfaction impacts and competitive differentiation opportunities. Technology partnerships between cup holder manufacturers and wireless charging companies created integrated solutions optimizing both beverage holding and device charging functionality. Material innovations delivered improved chemical resistance, enhanced tactile properties, and sustainable alternatives meeting evolving performance and environmental requirements. Design competitions sponsored by automotive companies generated creative cup holder concepts exploring unconventional approaches to beverage holding and multifunctional integration.

Patent activity increased significantly with manufacturers protecting innovative mechanisms, material applications, and integrated feature implementations. Quality standards evolved through industry collaboration establishing more rigorous testing protocols for durability, chemical resistance, and temperature performance. Consumer feedback mechanisms implemented by automotive manufacturers provided detailed insights into cup holder satisfaction drivers informing next-generation product development. Aftermarket innovation flourished with entrepreneurs developing creative supplementary cup holder solutions addressing specific use cases underserved by factory installations. Manufacturing automation advanced with suppliers investing in robotic assembly systems improving consistency while reducing labor costs in competitive market environments. Sustainability commitments from major automotive manufacturers established clear expectations for recycled content, recyclability, and environmental performance influencing supplier material selection and process development.

Strategic positioning for cup holder suppliers should emphasize differentiation through innovation rather than competing purely on cost for commodity products. Value-added features including temperature control, wireless charging, and sophisticated mechanisms justify premium pricing while creating competitive moats against low-cost competition. Early engagement with automotive manufacturer design teams provides opportunities to influence interior architecture decisions ensuring optimal cup holder integration from initial concept stages.

Technology investment decisions should balance current platform optimization against development of next-generation capabilities. Modular design approaches enable cost-efficient product families serving multiple vehicle programs while accommodating customization for specific applications. Material technology partnerships access emerging sustainable materials and advanced polymers maintaining competitiveness as automotive environmental standards evolve.

Geographic expansion strategies should target emerging automotive markets where vehicle ownership growth creates fundamental demand increases. Local manufacturing presence in high-growth regions reduces logistics costs while demonstrating commitment to regional automotive industries and potentially accessing preferential sourcing consideration. Regulatory expertise across markets enables efficient product adaptation meeting varying regional requirements without extensive redesign.

Quality excellence represents a critical success factor given cup holder visibility and frequent use generating outsized customer satisfaction impacts. Robust testing protocols ensuring reliable performance across temperature extremes, chemical exposures, and mechanical cycling prevent field failures damaging supplier reputation. Continuous improvement programs systematically address quality issues and incorporate lessons learned into future product generations.

Aftermarket opportunities merit consideration as supplementary business diversification given less cyclical demand patterns and direct consumer relationships. Universal fit designs maximizing vehicle compatibility and easy installation address broad market segments without extensive product proliferation. Online distribution enables cost-efficient market access and direct consumer feedback informing product development.

Long-term prospects for the automotive cup holder market remain positive supported by fundamental vehicle production growth and continuous feature enhancement. MWR projects sustained moderate expansion with the sector achieving steady growth as automotive production recovers from recent disruptions and emerging markets contribute increasing demand. Electric vehicle proliferation creates opportunities for innovative cup holder designs within reimagined interior architectures, though fundamental beverage holding needs persist across propulsion technologies.

Technology convergence continues blurring boundaries between cup holders and multifunctional compartments as wireless charging, storage, and control interfaces integrate within traditional cup holder locations. Premium feature democratization sees capabilities initially exclusive to luxury segments diffusing toward mainstream applications as costs decline and consumer expectations evolve. Smart features incorporating sensors, illumination, and connectivity emerge gradually though adoption pace depends on cost trajectories and demonstrated consumer value.

Manufacturing evolution emphasizes automation, sustainable materials, and flexible production systems accommodating increasing product variety without proportional cost increases. Supply chain optimization through strategic supplier partnerships, regional manufacturing networks, and inventory management systems enhances responsiveness while controlling costs. Digital tools including simulation, virtual prototyping, and data analytics improve design efficiency and manufacturing quality.

Consumer preferences continue evolving with expectations for versatility, aesthetic quality, and integrated functionality growing across vehicle segments. Beverage container diversity expands further as consumer habits shift toward specialty beverages, reusable containers, and health-conscious alternatives requiring adaptable cup holder designs. Sustainability consciousness among consumers influences purchase decisions with environmentally responsible materials and manufacturing processes becoming meaningful differentiators.

Market consolidation may occur selectively as larger suppliers acquire specialized capabilities or regional manufacturers, though the sector maintains sufficient diversity supporting numerous independent players. Competitive dynamics balance pressures toward commoditization for basic products against opportunities for differentiation through innovation and premium features. Pricing trajectories face continued pressure from automotive manufacturer cost reduction initiatives, though value-added features command premium positioning offsetting basic product margin compression.

Regulatory landscapes evolve with potential new requirements around interior material safety, recyclability, and environmental performance influencing design parameters and material selection. Autonomous vehicle development creates uncertainty around future interior configurations and cup holder requirements as vehicle cabins potentially transform toward mobile living spaces with different beverage holding needs. Mobility service growth through ride-sharing and subscription models may influence design priorities emphasizing cleanability, durability, and rapid serviceability over traditional consumer preferences.

The global automotive cup holder market represents a mature yet continuously evolving segment within the automotive interior components industry, characterized by stable fundamental demand and ongoing innovation opportunities. Essential functionality ensures cup holders remain standard equipment across virtually all vehicle types while consumer expectations drive continuous improvement in design, materials, and integrated features. Despite facing challenges including intense cost pressure, space constraints, and commoditization risks for basic products, the market demonstrates resilience through innovation and adaptation to changing consumer preferences. Diverse stakeholders including specialized component manufacturers, integrated automotive suppliers, and aftermarket participants collectively advance product capabilities while maintaining cost competitiveness.

Regional dynamics reveal strong demand across established markets and significant growth potential in emerging automotive economies as vehicle ownership expands globally. Technology integration transforms cup holders from simple beverage receptacles into multifunctional compartments incorporating wireless charging, temperature control, and sophisticated adjustment mechanisms enhancing user convenience. Sustainability considerations increasingly influence material selection and manufacturing processes as automotive industry environmental commitments drive adoption of recycled content and recyclable designs. Premium segment growth creates opportunities for sophisticated cup holder designs featuring high-quality materials, ambient lighting, and integrated features commanding improved margins.

The global automotive cup holder market exemplifies how seemingly simple automotive components continue evolving through thoughtful engineering, material innovation, and consumer insight, contributing meaningfully to overall vehicle interior satisfaction. As the automotive industry navigates transformation through electrification, connectivity, and changing mobility patterns, cup holder manufacturers demonstrate adaptability ensuring their products remain relevant and valued components enhancing the daily vehicle experience for consumers worldwide. The sector’s outlook remains fundamentally positive supported by vehicle production growth, premium feature adoption, and continuous innovation addressing evolving consumer needs and preferences in an increasingly sophisticated automotive marketplace.

What is the Global Automotive Cup Holder?

The Global Automotive Cup Holder refers to a component in vehicles designed to hold cups, bottles, and other beverages securely while driving, enhancing convenience and safety for passengers and drivers alike.

What are the key companies in the Global Automotive Cup Holder Market?

Key companies in the Global Automotive Cup Holder Market include Continental AG, Faurecia, and Lear Corporation, among others.

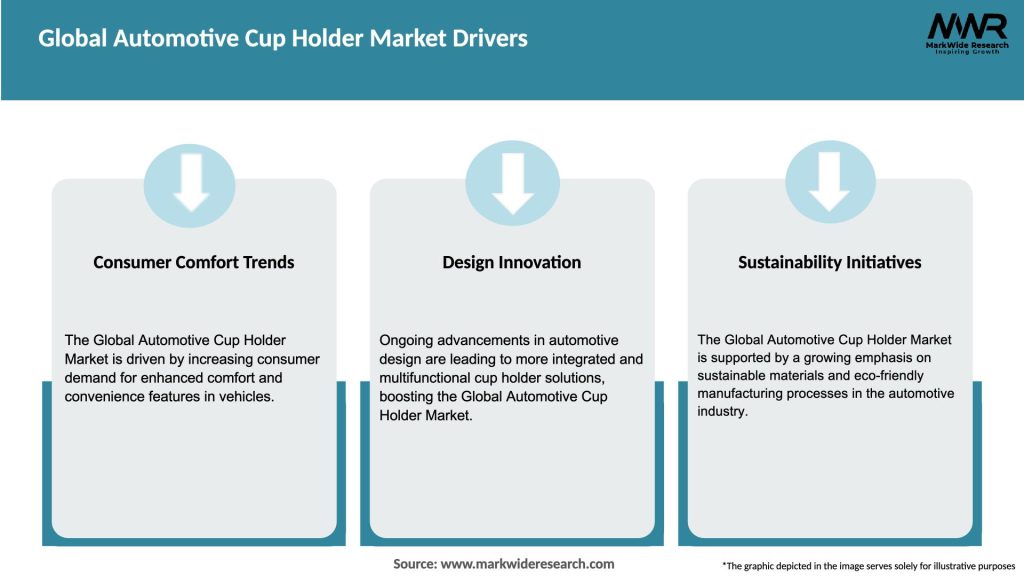

What are the growth factors driving the Global Automotive Cup Holder Market?

The growth of the Global Automotive Cup Holder Market is driven by increasing consumer demand for convenience features in vehicles, the rise in vehicle production, and the trend towards more personalized automotive interiors.

What challenges does the Global Automotive Cup Holder Market face?

Challenges in the Global Automotive Cup Holder Market include the need for innovative designs to meet diverse consumer preferences and the impact of fluctuating raw material prices on production costs.

What opportunities exist in the Global Automotive Cup Holder Market?

Opportunities in the Global Automotive Cup Holder Market include the development of multifunctional cup holders that integrate technology, such as wireless charging, and the growing trend of electric vehicles that may require new designs.

What trends are shaping the Global Automotive Cup Holder Market?

Trends in the Global Automotive Cup Holder Market include the increasing use of sustainable materials in production, the rise of smart cup holders with temperature control features, and the customization of cup holders to fit various vehicle models.

Global Automotive Cup Holder Market

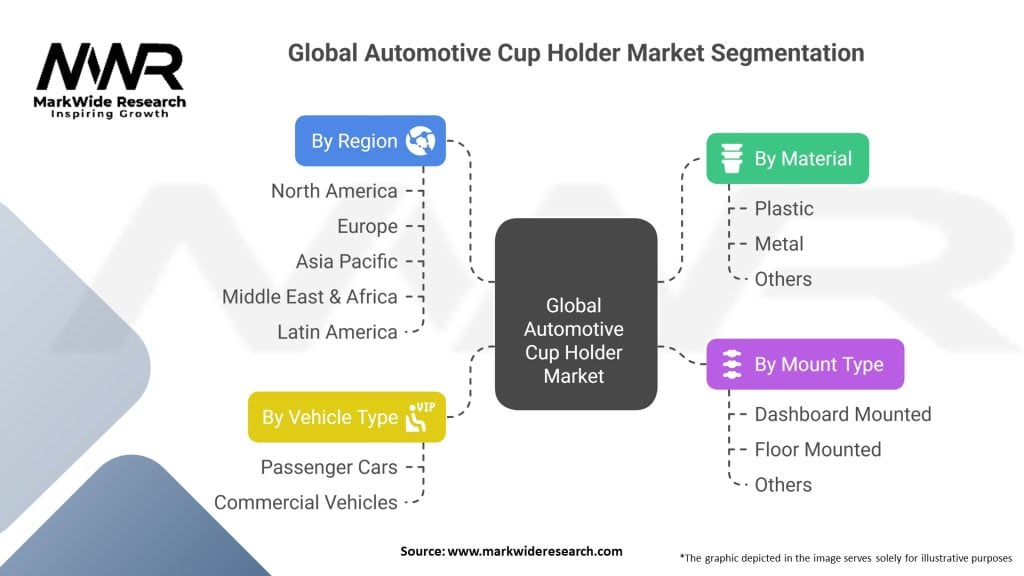

| Segmentation Details | Description |

|---|---|

| By Material | Plastic, Metal, Others |

| By Mount Type | Dashboard Mounted, Floor Mounted, Others |

| By Vehicle Type | Passenger Cars, Commercial Vehicles |

| By Region | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

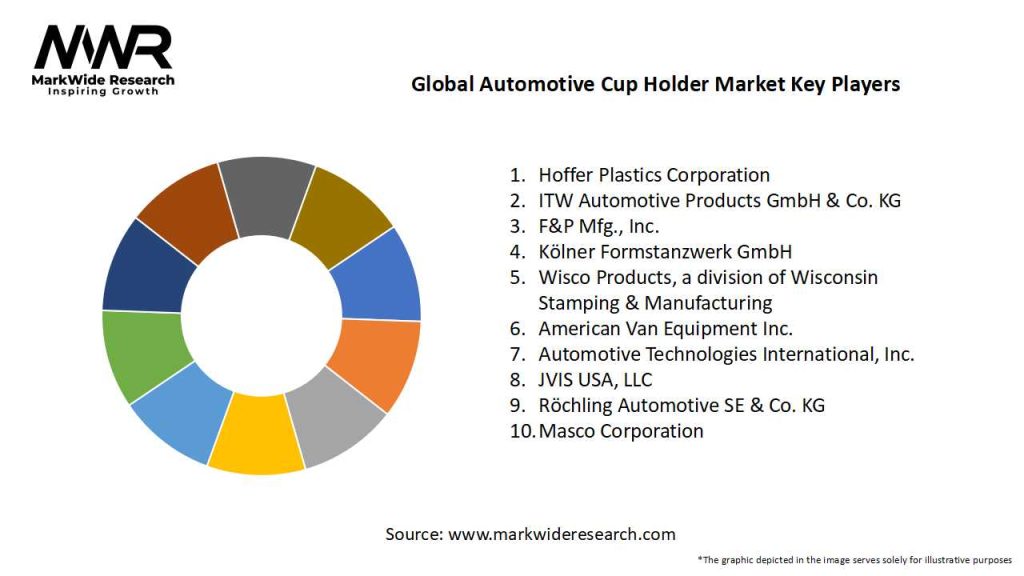

Leading companies in the Global Automotive Cup Holder Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at