444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The Global Anti Money Laundering (AML) market is witnessing significant growth due to the increasing concerns over financial frauds and illicit activities across various industries. AML refers to a set of regulations, procedures, and technologies aimed at detecting and preventing money laundering and terrorist financing activities. The market for AML solutions and services has gained traction in recent years, driven by the rising adoption of digital payment systems, stringent government regulations, and the need for enhanced risk management practices.

Anti Money Laundering (AML) refers to the measures taken by governments, financial institutions, and other organizations to detect, prevent, and deter money laundering activities. Money laundering involves the process of making illegally-gained proceeds appear legal by disguising the true source of funds. AML regulations require businesses to implement robust systems and processes to identify and report suspicious transactions, conduct customer due diligence, and maintain comprehensive records to aid law enforcement agencies in their efforts to combat financial crimes.

Executive Summary

The Global Anti Money Laundering market is experiencing rapid growth as organizations across industries recognize the importance of implementing effective AML measures. The increasing sophistication of financial crimes, coupled with regulatory pressures, has propelled the demand for AML solutions and services. This executive summary provides an overview of the market, highlighting key insights, drivers, restraints, opportunities, and trends shaping the AML landscape. Additionally, it discusses the impact of the COVID-19 pandemic on the market and presents future outlook and analyst suggestions for industry participants and stakeholders.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Dynamics

The Global Anti Money Laundering market is characterized by intense competition among key players who offer a wide range of solutions and services to meet the diverse needs of organizations across industries. The market dynamics are influenced by factors such as technological advancements, regulatory landscape, market consolidation, and strategic partnerships. Key players focus on product innovation, partnerships, and mergers and acquisitions to strengthen their market position and expand their customer base.

Regional Analysis

The AML market is segmented into several regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America dominates the market due to stringent AML regulations imposed by regulatory authorities such as the Financial Crimes Enforcement Network (FinCEN) and the Office of Foreign Assets Control (OFAC). Europe also holds a significant market share due to the implementation of the Fifth Anti-Money Laundering Directive (5AMLD) by the European Union. Asia Pacific is expected to witness rapid growth due to increasing regulatory compliance requirements and the expanding financial sector in countries like China and India.

Competitive Landscape

Leading companies in the Global Anti Money Laundering market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

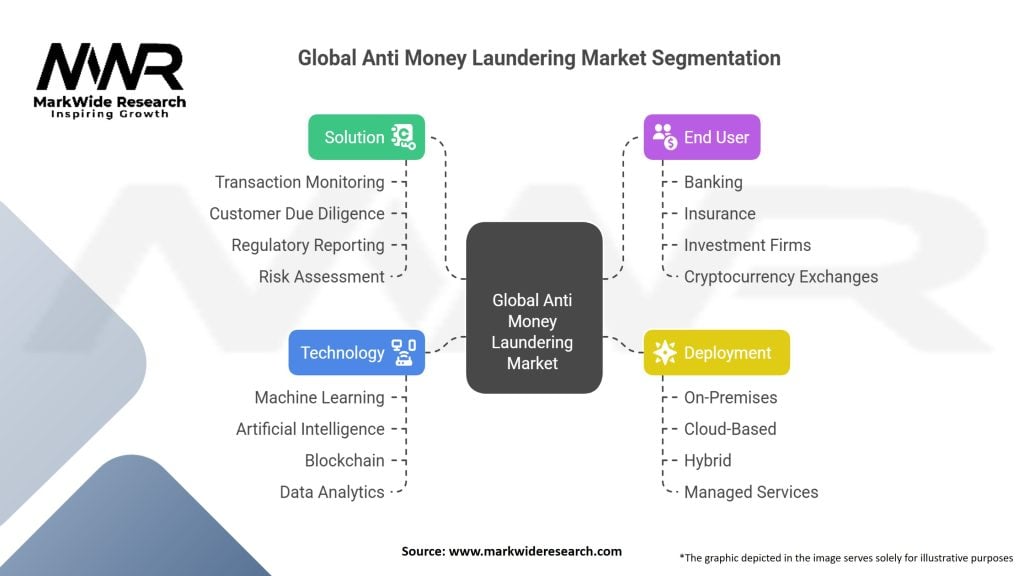

Segmentation

The AML market can be segmented based on the type of solution, deployment mode, organization size, and end-user industry. Solutions include transaction monitoring systems, customer due diligence systems, compliance management software, and sanctions screening systems. Deployment modes comprise on-premises and cloud-based solutions. Organization size can be categorized into small and medium-sized enterprises (SMEs) and large enterprises. End-user industries include banking, financial services, insurance, gaming and gambling, healthcare, and others.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the global AML market. The rapid shift towards remote work and increased digital transactions has created new avenues for money laundering activities. Organizations have faced challenges in adapting their AML measures to the changing landscape, leading to an increased focus on technological advancements, remote compliance monitoring, and enhanced risk assessment tools.

Regulators have also responded by issuing guidelines and recommendations to address the evolving risks associated with the pandemic. Financial institutions and businesses are investing in AML solutions and strengthening their risk management practices to combat the heightened threat of money laundering and financial crimes during the pandemic. The use of advanced technologies such as AI, ML, and data analytics has become even more crucial in detecting and preventing fraudulent activities in the remote and digital environment.

Moreover, the pandemic has highlighted the importance of agility and flexibility in AML processes. Organizations have focused on implementing agile compliance frameworks that can adapt to rapidly changing regulatory requirements and emerging risks. Remote customer due diligence and digital onboarding processes have gained prominence to ensure compliance while maintaining social distancing measures.

The COVID-19 pandemic has also underscored the significance of international cooperation in combating money laundering. Financial institutions, regulatory bodies, and law enforcement agencies have intensified their collaboration and information sharing to detect and disrupt illicit financial flows associated with the pandemic, such as fraudulent schemes targeting government stimulus programs.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Global Anti Money Laundering market is expected to witness continued growth in the coming years. The increasing volume of digital transactions, regulatory pressures, and the need for enhanced risk management practices will drive the demand for AML solutions and services. The integration of advanced technologies, such as AI, ML, blockchain, and data analytics, will further revolutionize the AML landscape, enabling more accurate and efficient detection of money laundering activities.

Organizations will need to adapt to the evolving regulatory environment and invest in comprehensive AML strategies that encompass robust compliance management, transaction monitoring, customer due diligence, and sanctions screening. The focus on user-friendly interfaces, real-time monitoring, and agile compliance frameworks will persist to meet the changing needs and challenges of the AML landscape.

Conclusion

The Global Anti Money Laundering market is experiencing significant growth driven by the increasing concerns over financial crimes, stringent regulatory requirements, and technological advancements. Organizations across industries are recognizing the importance of implementing effective AML measures to detect and prevent money laundering activities, safeguard their reputation, and comply with regulatory requirements.

Technological innovations such as AI, ML, blockchain, and data analytics are transforming the AML landscape by enabling more accurate and efficient detection of suspicious transactions and patterns. The integration of these advanced technologies enhances risk management practices and improves operational efficiency.

What is Anti Money Laundering?

Anti Money Laundering (AML) refers to the regulations and procedures aimed at preventing the illegal practice of generating income through criminal activities. It encompasses various measures that financial institutions and other regulated entities must implement to detect and report suspicious activities.

What are the key players in the Global Anti Money Laundering market?

Key players in the Global Anti Money Laundering market include companies such as FICO, SAS Institute, and Oracle, which provide software solutions for compliance and monitoring. Additionally, firms like NICE Actimize and Amlify are also significant contributors to this sector, among others.

What are the main drivers of growth in the Global Anti Money Laundering market?

The growth of the Global Anti Money Laundering market is driven by increasing regulatory requirements, the rise in financial crimes, and the need for enhanced compliance solutions. Additionally, advancements in technology, such as AI and machine learning, are facilitating more effective monitoring and reporting.

What challenges does the Global Anti Money Laundering market face?

The Global Anti Money Laundering market faces challenges such as the complexity of regulations across different jurisdictions and the high costs associated with implementing AML solutions. Furthermore, the evolving tactics of money launderers pose ongoing difficulties for compliance efforts.

What opportunities exist in the Global Anti Money Laundering market?

Opportunities in the Global Anti Money Laundering market include the development of innovative technologies that enhance detection capabilities and the growing demand for AML solutions in emerging markets. Additionally, partnerships between technology providers and financial institutions can lead to more effective compliance strategies.

What trends are shaping the Global Anti Money Laundering market?

Trends shaping the Global Anti Money Laundering market include the increasing use of artificial intelligence for transaction monitoring and the integration of blockchain technology for enhanced transparency. Moreover, there is a growing focus on real-time data analytics to improve the efficiency of AML processes.

Global Anti Money Laundering market

| Segmentation Details | Description |

|---|---|

| Solution | Transaction Monitoring, Customer Due Diligence, Regulatory Reporting, Risk Assessment |

| End User | Banking, Insurance, Investment Firms, Cryptocurrency Exchanges |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

| Technology | Machine Learning, Artificial Intelligence, Blockchain, Data Analytics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Global Anti Money Laundering market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at