444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The global accounting and financial close software market is witnessing significant growth and is expected to continue its upward trajectory in the coming years. Accounting and financial close software solutions have become essential tools for businesses to streamline their financial processes, improve accuracy, and enhance efficiency. These software solutions help organizations automate repetitive tasks, ensure compliance with accounting standards, and provide real-time visibility into financial data.

Accounting and financial close software refers to a set of technological tools and applications designed to automate and streamline the financial close process. It encompasses various functions such as financial reporting, general ledger management, reconciliations, journal entries, and intercompany accounting. These software solutions integrate with existing financial systems, allowing organizations to manage and track financial transactions from start to finish.

Executive Summary

The global accounting and financial close software market is experiencing rapid growth, driven by the increasing demand for efficient financial processes, the need for accurate financial reporting, and the rising complexity of financial operations. The market is characterized by the presence of numerous software vendors offering a wide range of solutions to cater to the diverse needs of organizations across different industries.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

The accounting and financial close software market is propelled by several key drivers, including:

Market Restraints

Despite the significant growth opportunities, the accounting and financial close software market faces certain challenges:

Market Opportunities

The accounting and financial close software market offers several lucrative opportunities for vendors and industry participants:

Market Dynamics

The accounting and financial close software market is driven by various dynamics that shape its growth and development. These dynamics include market trends, customer preferences, technological advancements, and regulatory changes.

One of the key market dynamics is the increasing adoption of cloud-based accounting and financial close software. Cloud-based solutions offer several advantages, such as remote accessibility, scalability, and cost-effectiveness. Organizations are increasingly embracing cloud technology to streamline their financial processes and eliminate the need for on-premises infrastructure.

Another important dynamic is the integration of accounting and financial close software with emerging technologies. Vendors are incorporating AI, ML, and robotic process automation (RPA) capabilities into their software solutions. These technologies enable intelligent data analysis, predictive modeling, and automation of repetitive tasks, further enhancing the efficiency and accuracy of financial processes.

Additionally, the market dynamics are influenced by changing customer preferences. Organizations are looking for software solutions that are user-friendly, intuitive, and customizable to their specific needs. Vendors that can provide flexible and adaptable software offerings have a competitive advantage in meeting these customer demands.

Furthermore, regulatory changes and compliance requirements significantly impact the accounting and financial close software market. As regulations evolve, organizations need software solutions that can adapt and ensure compliance with changing standards. Vendors that stay up-to-date with regulatory changes and offer compliant solutions are well-positioned to cater to this market need.

The market dynamics also include the competitive landscape. The accounting and financial close software market is highly competitive, with numerous vendors offering a wide range of solutions. Key players in the market are engaging in strategic partnerships, acquisitions, and product innovations to strengthen their market position and gain a competitive edge. This competitive environment drives continuous innovation and improvement in software offerings.

Regional Analysis

The accounting and financial close software market exhibits regional variations in terms of market size, growth rate, and adoption. The regional analysis provides insights into the market landscape across different geographies, highlighting key trends and factors influencing market growth.

Understanding the regional variations and market dynamics is crucial for vendors and industry participants to devise effective strategies and tailor their offerings to specific market requirements.

Competitive Landscape

Leading companies in the Global Accounting And Financial Close Software market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

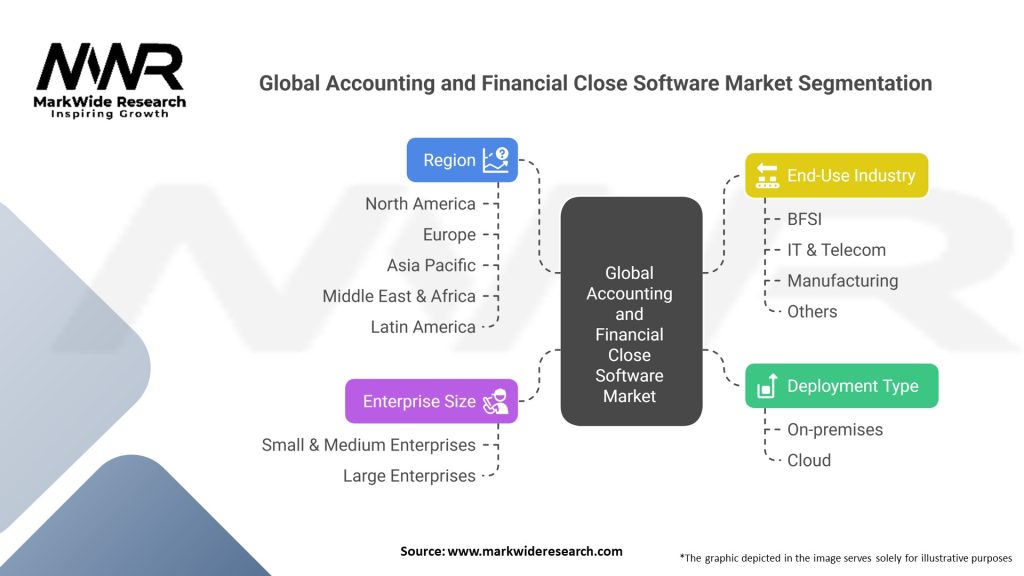

Segmentation

The accounting and financial close software market can be segmented based on various factors, including deployment type, organization size, industry vertical, and region. This segmentation helps in understanding the specific needs and preferences of different customer segments and allows vendors to tailor their solutions accordingly.

Understanding the specific requirements of different customer segments allows vendors to develop targeted marketing strategies, product features, and pricing models to cater to their unique needs.

Category-wise Insights

Within the accounting and financial close software market, different categories offer specific functionalities and features to address various aspects of financial management. Some key categories include:

By understanding the specific categories and their functionalities, organizations can choose the software solutions that best meet their requirements and streamline their financial operations.

Key Benefits for Industry Participants and Stakeholders

The adoption of accounting and financial close software offers several benefits to industry participants and stakeholders:

By leveraging the benefits of accounting and financial close software, industry participants and stakeholders can optimize their financial processes, improve decision-making, and achieve greater operational efficiency.

SWOT Analysis

A SWOT analysis helps organizations identify their strengths to leverage, weaknesses to address, opportunities to capitalize on, and threats to mitigate. By understanding these factors, organizations can develop strategies that align with market trends and customer demands.

Market Key Trends

The accounting and financial close software market is influenced by several key trends that shape its growth and future outlook:

Covid-19 Impact

Key Industry Developments

The accounting and financial close software market has witnessed several notable industry developments:

Analyst Suggestions

Based on market trends and observations, analysts offer the following suggestions for organizations and stakeholders in the accounting and financial close software market:

Future Outlook

The future of the accounting and financial close software market looks promising, driven by ongoing digital transformation initiatives, the need for efficient financial processes, and the increasing adoption of cloud-based solutions. The market is expected to witness advancements in AI, ML, and automation capabilities, enabling intelligent data analysis, predictive modeling, and further streamlining of financial operations.

With the growing emphasis on data security, vendors will continue to enhance security measures and ensure compliance with data privacy regulations. Integration with emerging technologies and ecosystem platforms will enable seamless data flow and collaboration across different systems, providing organizations with comprehensive financial management solutions.

Furthermore, the market will see increased customization for industry-specific needs, empowering organizations to address unique challenges and requirements. The focus on user experience will remain a priority, with vendors continuously improving software interfaces, workflows, and accessibility on mobile devices.

Conclusion

The accounting and financial close software market is witnessing significant growth as organizations recognize the importance of automation, accuracy, and compliance in financial management. With the adoption of these software solutions, businesses can streamline their financial processes, improve efficiency, and ensure accurate financial reporting.

The market offers a wide range of software solutions catering to different deployment types, organization sizes, and industry verticals. Organizations should carefully evaluate their requirements, considering factors such as scalability, security, user experience, and regulatory compliance when selecting an accounting and financial close software solution.

What is Accounting And Financial Close Software?

Accounting And Financial Close Software refers to tools and applications designed to streamline and automate the financial closing process, ensuring accuracy and compliance in financial reporting. These solutions help organizations manage their accounting tasks efficiently, from data consolidation to report generation.

What are the key players in the Global Accounting And Financial Close Software market?

Key players in the Global Accounting And Financial Close Software market include Oracle, SAP, and BlackLine, which offer comprehensive solutions for financial management and reporting. These companies provide various features such as automation, analytics, and compliance tools, among others.

What are the main drivers of growth in the Global Accounting And Financial Close Software market?

The main drivers of growth in the Global Accounting And Financial Close Software market include the increasing need for automation in financial processes, the demand for real-time financial reporting, and the growing emphasis on regulatory compliance. Organizations are adopting these solutions to enhance efficiency and reduce errors.

What challenges does the Global Accounting And Financial Close Software market face?

Challenges in the Global Accounting And Financial Close Software market include data security concerns, integration issues with existing systems, and the complexity of financial regulations. These factors can hinder the adoption and effectiveness of accounting software solutions.

What opportunities exist in the Global Accounting And Financial Close Software market?

Opportunities in the Global Accounting And Financial Close Software market include the rise of cloud-based solutions, which offer scalability and flexibility, and the increasing adoption of artificial intelligence for enhanced data analysis. These trends can lead to more innovative and efficient financial management practices.

What trends are shaping the Global Accounting And Financial Close Software market?

Trends shaping the Global Accounting And Financial Close Software market include the integration of advanced analytics and machine learning capabilities, the shift towards remote work necessitating cloud solutions, and a focus on user-friendly interfaces. These trends are driving the evolution of financial software solutions.

Global Accounting And Financial Close Software Market:

| Segmentation | Details |

|---|---|

| Deployment Type | On-premises, Cloud |

| Enterprise Size | Small & Medium Enterprises, Large Enterprises |

| End-Use Industry | BFSI, IT & Telecom, Manufacturing, Others |

| Region | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Global Accounting And Financial Close Software market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at