444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The global 3D position and acoustic sensor market is a rapidly growing industry that encompasses advanced technologies and systems used for measuring and analyzing spatial positioning and acoustic characteristics in various applications. These sensors play a crucial role in sectors such as aerospace, defense, automotive, healthcare, and consumer electronics, among others. They enable accurate and real-time tracking, mapping, and detection of objects and provide valuable insights for decision-making processes.

Meaning

3D position and acoustic sensors are electronic devices that capture and interpret positional and acoustic data in three-dimensional space. These sensors utilize advanced technologies such as ultrasonic, laser, and infrared to detect and measure the distance, orientation, and sound characteristics of objects. By combining data from multiple sensors, they generate precise and comprehensive spatial information, enabling enhanced situational awareness and improved operational efficiency.

Executive Summary

The global 3D position and acoustic sensor market are witnessing significant growth due to the increasing demand for accurate spatial information in various industries. The market is driven by advancements in sensor technologies, the rising adoption of automation and robotics, and the growing need for improved safety and security measures. Additionally, the emergence of Internet of Things (IoT) and artificial intelligence (AI) technologies is further fueling market growth by enabling seamless integration and data analysis.

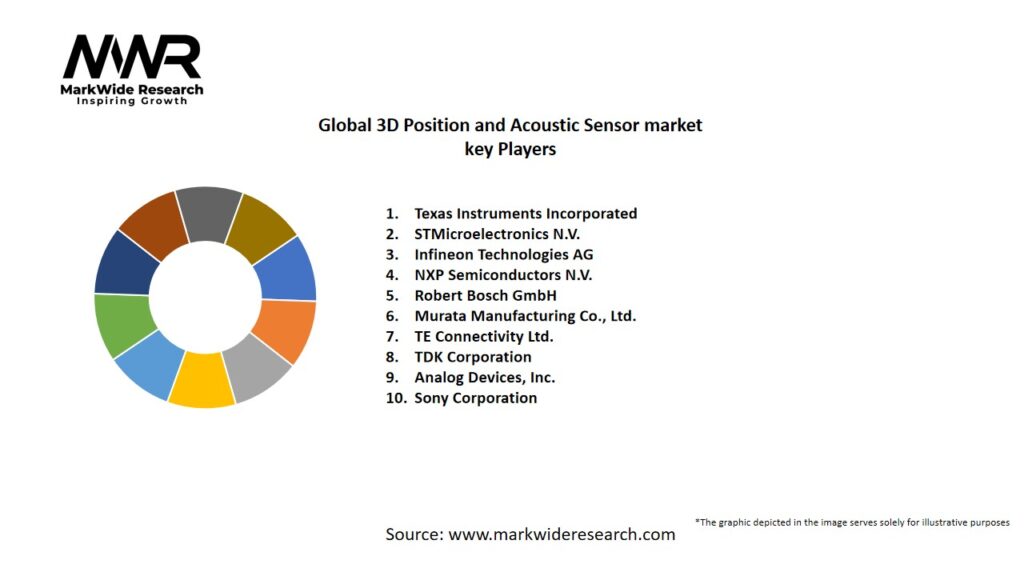

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The global 3D position and acoustic sensor market are characterized by intense competition and technological advancements. Market players are focusing on research and development activities to introduce innovative products and gain a competitive edge. Collaboration and strategic partnerships with other industry participants are also common strategies to expand market reach and cater to diverse application requirements.

Furthermore, regulatory standards and certifications play a significant role in the market. Compliance with industry standards and regulations ensures product reliability, interoperability, and safety. Market players need to stay updated with evolving standards and invest in obtaining necessary certifications to gain customer trust and confidence.

Regional Analysis

The 3D position and acoustic sensor market exhibit a strong presence across major regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America holds a significant market share, driven by technological advancements, extensive research and development activities, and the presence of key market players. Europe follows closely, owing to the widespread adoption of automation and robotics in various industries.

Asia Pacific is expected to witness substantial growth due to the rapid industrialization in countries like China and India. The region offers immense market potential due to the increasing investments in infrastructure development, smart city projects, and automotive manufacturing. Latin America and the Middle East and Africa regions are also projected to experience steady growth, driven by the expanding industrial sectors and infrastructure investments.

Competitive Landscape

Leading companies in the Global 3D Position and Acoustic Sensor market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The global 3D position and acoustic sensor market can be segmented based on technology, application, and end-use industry.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a mixed impact on the global 3D position and acoustic sensor market. While certain industries faced disruptions and economic challenges, others witnessed increased demand due to the changing market dynamics and emerging needs.

Despite the short-term challenges, the market is expected to recover and witness sustained growth in the post-pandemic period. The increasing focus on automation, remote monitoring, and digital transformation across industries will drive the demand for 3D position and acoustic sensors.

Key Industry Developments

Analyst Suggestions

Future Outlook

The global 3D position and acoustic sensor market are poised for substantial growth in the coming years. Advancements in sensor technologies, integration with AI and machine learning, and the increasing adoption of automation and robotics will be key factors driving market expansion. The demand for 3D position and acoustic sensors will continue to rise across various industries, including automotive, aerospace, healthcare, and consumer electronics. Applications in autonomous vehicles, robotics, and virtual/augmented reality will particularly contribute to market growth.

Additionally, the expansion of IoT and the development of smart cities will create new avenues for sensor deployment. The focus on sustainability and energy efficiency will shape future sensor designs and manufacturing processes.

Conclusion

The global 3D position and acoustic sensor market are witnessing significant growth and technological advancements, driven by increasing automation, the adoption of AI and IoT, and the demand for enhanced safety and security measures. These sensors offer precise spatial information and sound analysis, enabling accurate object detection, navigation, and immersive user experiences.

While challenges such as high implementation costs and data privacy concerns exist, the market presents numerous opportunities for industry participants. Integration with AI, expanding applications in emerging economies, and the emergence of virtual and augmented reality are among the key growth drivers.

What is 3D Position and Acoustic Sensor?

3D Position and Acoustic Sensors are devices that measure spatial positioning and sound levels in various environments. They are widely used in applications such as robotics, automotive systems, and environmental monitoring.

What are the key players in the Global 3D Position and Acoustic Sensor market?

Key players in the Global 3D Position and Acoustic Sensor market include companies like Bosch Sensortec, Honeywell International, and STMicroelectronics, among others.

What are the growth factors driving the Global 3D Position and Acoustic Sensor market?

The growth of the Global 3D Position and Acoustic Sensor market is driven by the increasing demand for automation in industries, advancements in sensor technology, and the rising adoption of smart devices in consumer electronics.

What challenges does the Global 3D Position and Acoustic Sensor market face?

The Global 3D Position and Acoustic Sensor market faces challenges such as high development costs, the complexity of sensor integration, and competition from alternative technologies.

What opportunities exist in the Global 3D Position and Acoustic Sensor market?

Opportunities in the Global 3D Position and Acoustic Sensor market include the expansion of IoT applications, the growth of smart cities, and the increasing use of these sensors in healthcare for patient monitoring.

What trends are shaping the Global 3D Position and Acoustic Sensor market?

Trends shaping the Global 3D Position and Acoustic Sensor market include the miniaturization of sensors, the integration of AI for enhanced data processing, and the development of multi-functional sensors that combine various sensing capabilities.

Global 3D Position and Acoustic Sensor Market:

| Segmentation | Details |

|---|---|

| Sensor Type | Position Sensor, Acoustic Sensor |

| End-Use Industry | Consumer Electronics, Automotive, Healthcare, Industrial, Others |

| Region | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Global 3D Position and Acoustic Sensor market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at