444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The glass product market has witnessed significant growth in recent years, driven by the increasing demand from various industries such as construction, automotive, packaging, and electronics. Glass products are known for their versatility, durability, and aesthetic appeal, making them a popular choice among consumers. This market analysis aims to provide an in-depth understanding of the glass product market, including key insights, market drivers, restraints, opportunities, and future outlook.

Meaning

The glass product market refers to the industry that involves the manufacturing, distribution, and sale of various products made from glass. These products encompass a wide range of items, including bottles, containers, windows, mirrors, tableware, laboratory glassware, and architectural glass. Glass products are made by heating a mixture of silica, soda ash, and limestone to a high temperature until it melts and then cooling it rapidly to form a solid material.

Executive Summary

The glass product market has experienced robust growth in recent years, driven by factors such as increasing urbanization, infrastructure development, and technological advancements. The market is highly competitive, with numerous players vying for market share. Key trends in the industry include the growing demand for energy-efficient glass products, eco-friendly manufacturing processes, and the adoption of advanced glass technologies. However, the market also faces challenges such as fluctuating raw material prices and environmental concerns related to glass production.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

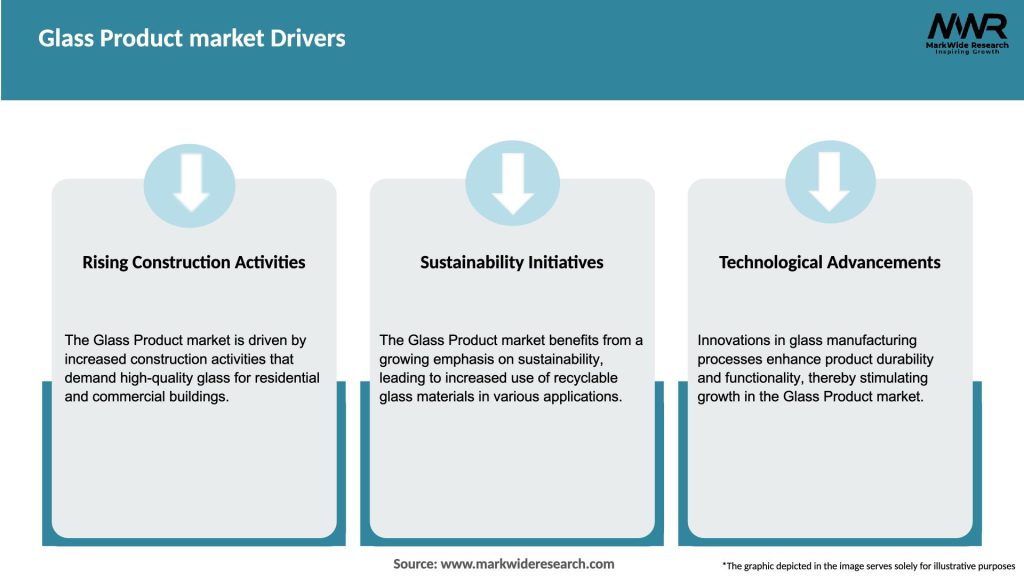

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The glass product market is dynamic and influenced by various factors, including technological advancements, consumer preferences, economic conditions, and regulatory policies. Understanding the market dynamics is crucial for stakeholders to make informed decisions and stay competitive in the evolving market landscape.

Technological advancements play a significant role in shaping the glass product market. Innovations in glass manufacturing technologies, such as float glass and glass tempering processes, have revolutionized the industry. Additionally, advancements in coating technologies, surface treatments, and digital printing techniques have expanded the range of functionalities and aesthetics offered by glass products.

Consumer preferences and evolving trends also drive the market dynamics. Consumers are increasingly seeking energy-efficient and sustainable products, which has led to the development and adoption of eco-friendly glass products. The demand for customization and personalized products is also influencing the market, with manufacturers offering a wide range of colors, patterns, and designs to cater to diverse consumer preferences.

Economic conditions and demographic factors play a significant role in the glass product market. Economic growth, urbanization, and rising disposable incomes drive the demand for glass products in residential, commercial, and industrial sectors. Demographic factors such as population growth, changing lifestyles, and urbanization patterns impact the demand for construction, automotive, and consumer goods, which, in turn, affect the glass product market.

Regulatory policies and environmental considerations also shape the market dynamics. Governments worldwide are implementing regulations and standards to promote energy efficiency, sustainability, and recycling in the glass industry. Manufacturers are required to comply with these regulations, which often influence their production processes, product designs, and environmental practices.

Regional Analysis

The glass product market exhibits regional variations influenced by factors such as economic development, construction activities, consumer preferences, and industry landscape. Analyzing regional dynamics is essential to identify growth opportunities and understand market trends specific to different geographies.

North America

North America is a mature market for glass products, driven by robust construction and automotive sectors. The United States, in particular, dominates the regional market due to its large-scale infrastructure development projects and high consumer spending on construction and renovation activities. The demand for energy-efficient glass products, such as low-emissivity glass, is also increasing in the region due to the focus on sustainability and regulatory requirements. The packaging industry in North America also contributes to the demand for glass containers and bottles.

Europe

Europe is a prominent market for glass products, characterized by a strong emphasis on sustainability and energy efficiency. The region has stringent regulations and standards for construction materials, driving the adoption of energy-efficient glass in buildings. Countries like Germany, France, and the United Kingdom have a well-established glass industry and are known for their technological advancements in glass manufacturing. The automotive sector in Europe also contributes to the demand for glass products, particularly for vehicle manufacturing.

Asia Pacific

Asia Pacific is a rapidly growing market for glass products, driven by factors such as urbanization, infrastructure development, and industrial growth. Countries like China, India, Japan, and South Korea are key contributors to the regional market. The construction industry in Asia Pacific is a major consumer of glass products, with increasing demand for high-performance architectural glass, windows, and facades. The automotive sector in the region also fuels the demand for automotive glass. Additionally, the packaging industry, driven by the rising middle class and changing consumer lifestyles, offers growth opportunities for glass container manufacturers.

Latin America

Latin America represents a developing market for glass products, with Brazil, Mexico, and Argentina being the key countries contributing to the regional market. Urbanization, infrastructure projects, and increasing consumer spending are driving the demand for glass products in the construction and packaging sectors. The automotive industry in the region also presents growth opportunities for automotive glass manufacturers.

Middle East and Africa

The Middle East and Africa region exhibit varying dynamics in the glass product market. Countries like the United Arab Emirates, Saudi Arabia, and Qatar are witnessing significant infrastructure development, driving the demand for architectural glass, facades, and windows. The construction of commercial buildings, hotels, and stadiums for events like the FIFA World Cup and the Dubai Expo contribute to the demand for glass products. Additionally, the automotive industry in the region presents opportunities for automotive glass manufacturers, given the increasing vehicle sales.

Competitive Landscape

Leading companies in the Glass Product market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

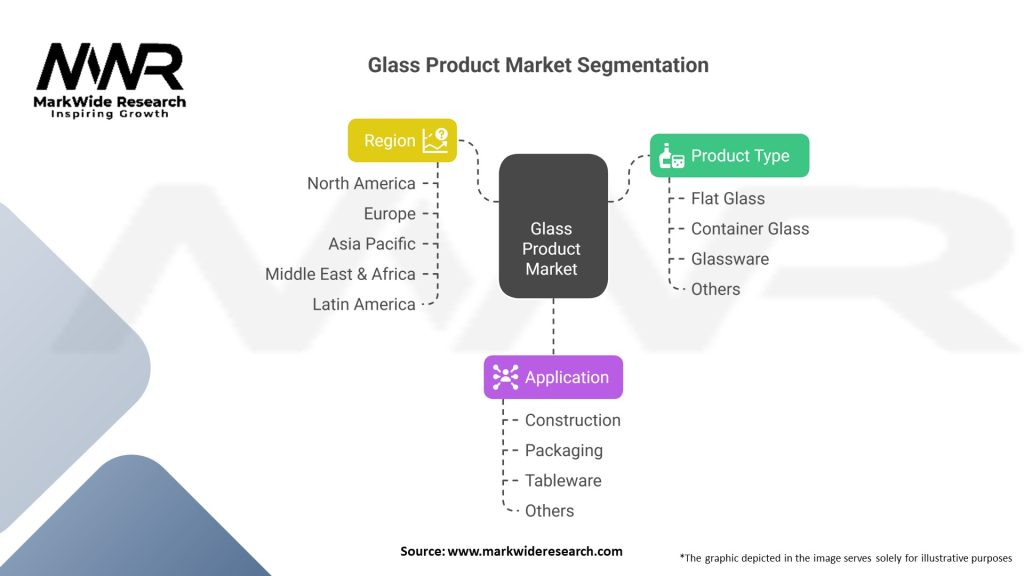

Segmentation

The glass product market can be segmented based on various factors, including product type, application, and end-user industry. Understanding the market segmentation helps in analyzing specific segments’ growth potential and identifying target markets.

By Product Type:

By Application:

By End-user Industry:

Category-wise Insights

Flat Glass:

Flat glass is a major segment in the glass product market, characterized by its widespread application in the construction and automotive industries. It includes various types of glass, such as float glass, tempered glass, laminated glass, and low-emissivity glass. Float glass, known for its superior optical clarity and flatness, is extensively used in windows, doors, and facades. Tempered glass, with its increased strength and safety properties, is used in automotive windshields, shower enclosures, and glass partitions. Laminated glass, consisting of two or more glass layers bonded together with an interlayer, offers enhanced security and is used in applications requiring impact resistance. Low-emissivity (Low-E) glass, coated with a thin metallic layer, provides excellent thermal insulation and is widely used in energy-efficient buildings.

The flat glass segment is driven by the growing construction activities, particularly in the residential and commercial sectors. The demand for energy-efficient and sustainable buildings has led to the increased adoption of low-emissivity glass and other energy-efficient glass products. In the automotive industry, flat glass is used in windshields, windows, and rear-view mirrors, driven by the increasing vehicle production worldwide. Additionally, advancements in glass technologies, such as the development of self-cleaning glass and smart glass, offer further growth opportunities for the flat glass segment.

Container Glass:

Container glass refers to glass products used for packaging applications, primarily for beverages, food, cosmetics, and pharmaceuticals. Glass bottles and jars are widely used in the packaging industry due to their impermeability, chemical inertness, and aesthetic appeal. The container glass segment benefits from the perception of glass as a premium and sustainable packaging material, particularly in industries that emphasize product quality and preservation.

The container glass segment is driven by the growing demand for packaged beverages, including alcoholic and non-alcoholic drinks. Glass bottles are preferred for their ability to preserve the taste, quality, and freshness of beverages. The pharmaceutical and cosmetics industries also contribute to the demand for glass containers, given the need for safe and hygienic packaging solutions. The increasing focus on sustainable packaging and the growing preference for eco-friendly materials further drive the demand for glass containers.

Glass Product Market Analysis

The glass product market has experienced significant growth in recent years, driven by a combination of factors such as increasing demand from various industries, technological advancements, and changing consumer preferences. This analysis aims to provide an overview of the glass product market, highlighting key benefits for industry participants and stakeholders, conducting a SWOT analysis, identifying market key trends, assessing the impact of Covid-19, examining key industry developments, presenting analyst suggestions, discussing the future outlook, and concluding with a summary of the findings.

Key Benefits for Industry Participants and Stakeholders

The glass product market offers several benefits for industry participants and stakeholders. Firstly, glass products are highly versatile and find applications across various sectors, including construction, automotive, packaging, and electronics. This broad market scope provides ample opportunities for manufacturers, suppliers, and distributors to cater to diverse customer needs.

Secondly, glass products are known for their durability, transparency, and aesthetic appeal. These qualities make them a preferred choice for consumers and end-users. Additionally, glass products are recyclable, contributing to sustainability efforts and enhancing their eco-friendly image.

Furthermore, technological advancements have led to the development of specialized glass products with improved properties. For instance, the introduction of tempered glass with enhanced strength and safety features has expanded its usage in the construction and automotive sectors. This continuous innovation in glass product manufacturing opens doors for research and development activities, fostering growth and profitability.

SWOT Analysis

A SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis provides valuable insights into the internal and external factors influencing the glass product market.

Market Key Trends

Several key trends are shaping the glass product market and influencing its growth trajectory. One prominent trend is the growing demand for energy-efficient glass products. With the focus on sustainable construction and reduced energy consumption, energy-efficient glass, such as low-emissivity (low-E) glass, is witnessing increased adoption. Low-E glass helps in regulating indoor temperatures and minimizing heat transfer, thereby reducing the need for excessive heating or cooling.

Another significant trend is the integration of smart glass technologies. Smart glass can switch between transparent and opaque states, providing privacy, controlling light transmission, and enhancing energy efficiency. The use of smart glass in automotive windows, electronic devices, and architectural applications is on the rise, driven by advancements in nanotechnology and electrochromic technologies.

Furthermore, the increasing demand for glass packaging, particularly in the food and beverage industry, is a noteworthy trend. Glass packaging offers several advantages, including preservation of product quality, visual appeal, and recyclability. As consumers become more conscious of sustainable packaging options, the demand for glass containers is expected to witness steady growth.

Covid-19 Impact

The glass product market, like many other industries, was significantly impacted by the Covid-19 pandemic. The initial outbreak and subsequent lockdown measures disrupted the global supply chains, leading to supply chain bottlenecks, production halts, and reduced consumer spending. The construction sector, a major consumer of glass products, experienced a slowdown due to project delays and reduced investments.

However, the market gradually recovered as restrictions eased and construction activities resumed. The increased focus on hygiene and cleanliness further fueled the demand for glass products in the healthcare sector, particularly for glass surfaces with antimicrobial properties. Moreover, the rising demand for packaged food and beverages during the pandemic boosted the sales of glass containers.

Key Industry Developments

The glass product market has witnessed several notable industry developments in recent years. One significant development is the introduction of advanced glass coatings. Manufacturers are investing in research and development to create coatings that improve the durability, scratch resistance and energy efficiency of glass products. These coatings also offer self-cleaning properties, reducing maintenance requirements. Another important development is the emergence of 3D glass printing technology. This technology allows the production of complex glass structures with high precision and customization. It has applications in architectural designs, healthcare equipment, and electronics, enabling the creation of innovative and intricate glass products.

Additionally, collaborations between glass manufacturers and technology companies have resulted in the development of smart glass products. The integration of sensors, connectivity, and control mechanisms into glass enables functionalities such as tinting, glare reduction, and energy management. These advancements have expanded the potential applications of glass in various industries.

Analyst Suggestions

Based on the analysis of the glass product market, several suggestions can be made to industry participants and stakeholders:

Future Outlook

The future of the glass product market looks promising, driven by several factors. The increasing demand for energy-efficient and sustainable materials in construction and packaging sectors will continue to fuel the growth of the glass product market. Technological advancements, such as smart glass and advanced coatings, will further expand the market potential.

Moreover, the rising adoption of glass products in emerging economies, driven by urbanization, infrastructure development, and changing consumer preferences, presents significant growth opportunities. The integration of glass with Internet of Things (IoT) technologies and the development of intelligent glass solutions will revolutionize industries such as automotive, electronics, and healthcare.

However, the glass product market will also face challenges, including competition from alternative materials and the need for continuous innovation to meet evolving customer requirements. Adapting to changing market dynamics, leveraging digitalization and automation, and investing in sustainable practices will be crucial for industry participants to stay competitive and capitalize on future opportunities.

Conclusion

In conclusion, the glass product market offers numerous benefits for industry participants and stakeholders, driven by its versatility, durability, and recyclability. A SWOT analysis highlights the market’s strengths, weaknesses, opportunities, and threats. Key trends such as energy-efficient glass, smart glass technologies, and glass packaging shape the market landscape. The Covid-19 pandemic had a significant impact on the market, but recovery has been observed. Industry developments in coatings, 3D glass printing, and smart glass offer new avenues for growth. Analyst suggestions emphasize sustainability, R&D, collaboration, energy efficiency, and supply chain resilience.

What is Glass Product?

Glass products refer to a wide range of items made from glass, including containers, tableware, and architectural elements. They are used in various applications such as construction, automotive, and consumer goods.

What are the key players in the Glass Product market?

Key players in the Glass Product market include companies like Corning Inc., Saint-Gobain, and Owens-Illinois, which are known for their innovative glass solutions and extensive product lines, among others.

What are the main drivers of growth in the Glass Product market?

The growth of the Glass Product market is driven by increasing demand in the construction and automotive industries, as well as a rising preference for sustainable packaging solutions. Additionally, advancements in glass technology are enhancing product performance.

What challenges does the Glass Product market face?

The Glass Product market faces challenges such as high production costs and competition from alternative materials like plastics and metals. Environmental regulations and the need for recycling also pose significant challenges.

What opportunities exist in the Glass Product market?

Opportunities in the Glass Product market include the growing trend towards eco-friendly packaging and the increasing use of glass in smart technologies. Innovations in glass manufacturing processes also present new avenues for growth.

What trends are shaping the Glass Product market?

Current trends in the Glass Product market include the rise of lightweight and energy-efficient glass solutions, as well as the integration of smart technologies in glass products. Additionally, there is a growing focus on sustainability and recycling initiatives.

Glass Product Market:

| Segmentation | Details |

|---|---|

| Product Type | Flat Glass, Container Glass, Glassware, Others |

| Application | Construction, Packaging, Tableware, Others |

| Region | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Glass Product market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at