444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Ghana mobile money market has witnessed significant growth in recent years, driven by the increasing adoption of mobile financial services in the country. Mobile money refers to the use of mobile phones for financial transactions, including sending and receiving money, paying bills, and making purchases. In Ghana, mobile money has become a popular alternative to traditional banking services, particularly in areas with limited access to physical banks.

Meaning

Mobile money refers to the use of mobile phones and related technologies to conduct financial transactions. It enables individuals to perform various financial activities such as sending and receiving money, paying bills, and accessing other financial services through their mobile devices. Mobile money services are typically provided by telecommunication companies, banks, or specialized mobile money operators. These services have gained popularity due to their convenience, accessibility, and affordability, making them an attractive option for individuals who are unbanked or underbanked.

Executive Summary

The Ghana mobile money market has experienced significant growth in recent years, driven by factors such as increasing mobile phone penetration, expanding agent networks, and supportive government regulations. The market offers immense opportunities for both existing players and new entrants to capitalize on the growing demand for mobile financial services in the country. However, there are also challenges to be addressed, such as ensuring security and trust in mobile money transactions. Overall, the market is poised for further growth and innovation in the coming years.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Ghana mobile money market is characterized by intense competition among mobile network operators, banks, and specialized mobile money operators. These players are continuously innovating to differentiate their offerings and gain a competitive edge. The market dynamics are influenced by factors such as changing consumer preferences, technological advancements, regulatory developments, and strategic collaborations.

The Ghana mobile money market is primarily concentrated in urban areas, where the majority of the population resides. However, there is immense potential for market expansion in rural and underserved regions. Efforts are being made to bridge the urban-rural divide by expanding agent networks and improving infrastructure. Mobile money operators are targeting specific regions with tailored marketing strategies to maximize their market penetration and tap into the unbanked population.

Competitive Landscape

Leading Companies in the Ghana Mobile Money Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

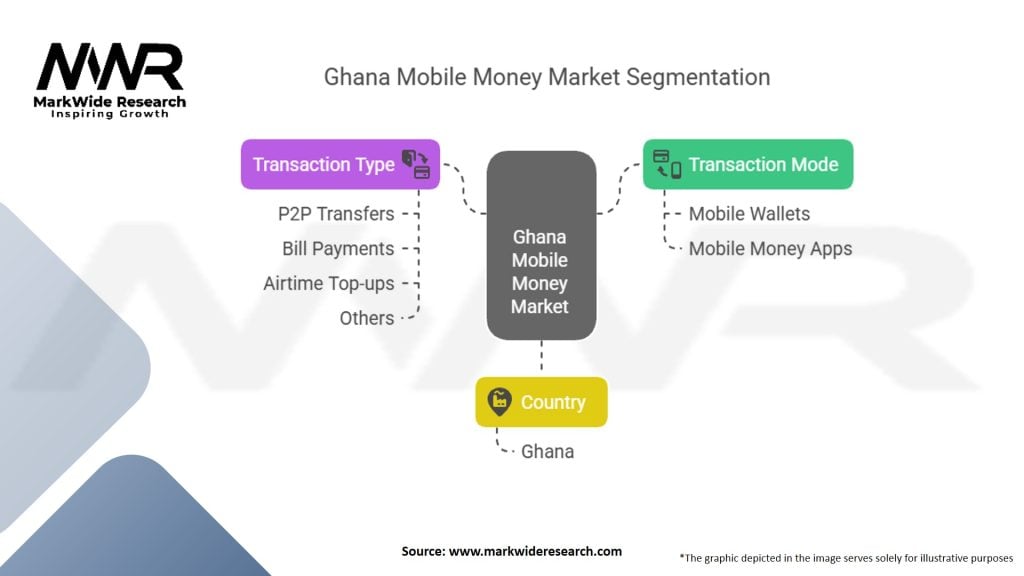

Segmentation

The Ghana mobile money market can be segmented based on user type, service type, and geographic location.

By user type, the market can be categorized into:

By service type, the market can be segmented into:

By geographic location, the market can be segmented into urban and rural areas, considering the variations in market penetration, network coverage, and user behavior.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the Ghana mobile money market. The restrictions imposed during the pandemic, including lockdowns and social distancing measures, have accelerated the adoption of mobile financial services. Individuals and businesses have increasingly relied on mobile money for contactless payments, remote transactions, and financial management. The pandemic has highlighted the importance of digital financial services and their role in ensuring business continuity and financial inclusion during challenging times.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Ghana mobile money market is promising. The market is expected to continue its growth trajectory, driven by factors such as increasing mobile phone penetration, expanding agent networks, and government support. With the ongoing digitization efforts and the evolving needs of consumers and businesses, mobile money services are likely to become even more integral to the financial ecosystem in Ghana. However, industry participants should remain vigilant about addressing security concerns, improving interoperability, and continuously innovating to stay ahead in this competitive landscape.

Conclusion

The Ghana mobile money market has experienced remarkable growth in recent years, driven by increasing mobile phone penetration, convenience, and accessibility. Mobile money services have contributed to financial inclusion by providing basic financial services to underserved populations. The market offers significant opportunities for industry participants and stakeholders to capitalize on the growing demand for mobile financial services. However, challenges related to security, interoperability, and financial literacy need to be addressed. By fostering innovation, strengthening security measures, and promoting collaboration, the Ghana mobile money market is poised for a bright future, contributing to the financial well-being and economic growth of the country.

What is Ghana Mobile Money?

Ghana Mobile Money refers to a digital payment system that allows users to send, receive, and store money using their mobile phones. It has transformed financial transactions in Ghana, enabling easier access to banking services for the unbanked population.

Who are the key players in the Ghana Mobile Money Market?

Key players in the Ghana Mobile Money Market include MTN Ghana, Vodafone Cash, and AirtelTigo Money. These companies provide various mobile money services, facilitating transactions and financial inclusion among users, among others.

What are the main drivers of growth in the Ghana Mobile Money Market?

The main drivers of growth in the Ghana Mobile Money Market include the increasing smartphone penetration, the rising demand for cashless transactions, and the government’s push for financial inclusion. These factors contribute to a growing user base and transaction volume.

What challenges does the Ghana Mobile Money Market face?

The Ghana Mobile Money Market faces challenges such as regulatory compliance issues, security concerns regarding fraud, and competition among service providers. These challenges can impact user trust and market stability.

What opportunities exist in the Ghana Mobile Money Market?

Opportunities in the Ghana Mobile Money Market include expanding services to rural areas, integrating with e-commerce platforms, and developing innovative financial products. These opportunities can enhance user engagement and market penetration.

What trends are shaping the Ghana Mobile Money Market?

Trends shaping the Ghana Mobile Money Market include the rise of agent networks, the integration of mobile money with banking services, and the adoption of blockchain technology for secure transactions. These trends are enhancing the overall efficiency and reach of mobile money services.

Ghana Mobile Money Market

| Segmentation | Details |

|---|---|

| Transaction Mode | Mobile Wallets, Mobile Money Apps |

| Transaction Type | Person-to-Person (P2P) Transfers, Bill Payments, Airtime Top-ups, Others |

| Country | Ghana |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Ghana Mobile Money Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at