444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Ghana automotive market represents a dynamic and rapidly evolving sector within West Africa’s economic landscape. Ghana’s automotive industry has experienced significant transformation over the past decade, driven by increasing urbanization, rising disposable incomes, and government initiatives to promote local manufacturing. The market encompasses vehicle assembly, importation, distribution, and aftermarket services, positioning Ghana as a strategic automotive hub in the region.

Market dynamics indicate robust growth potential, with the sector experiencing a 12.5% annual growth rate in vehicle registrations over recent years. The automotive landscape is characterized by a diverse mix of passenger vehicles, commercial trucks, motorcycles, and agricultural machinery. Import dependency remains high, with approximately 85% of vehicles entering the market through importation, while local assembly operations continue to expand their footprint.

Government support through the Ghana Automotive Development Policy has created favorable conditions for industry growth. The policy framework emphasizes local content development, skills training, and infrastructure improvement. Foreign investment has increased substantially, with international manufacturers establishing assembly plants and distribution networks throughout the country. The market’s strategic location provides access to neighboring West African markets, enhancing its regional significance.

The Ghana automotive market refers to the comprehensive ecosystem of vehicle manufacturing, assembly, importation, sales, and related services within Ghana’s borders. This market encompasses all motorized vehicles including passenger cars, commercial vehicles, motorcycles, and specialized automotive equipment. Market participants include manufacturers, assemblers, importers, dealers, financial institutions, and service providers who collectively contribute to the automotive value chain.

Industry scope extends beyond vehicle sales to include parts manufacturing, maintenance services, financing solutions, and insurance products. The market serves both domestic consumption and regional export opportunities, leveraging Ghana’s position as a gateway to West African markets. Automotive ecosystem development includes supporting industries such as steel production, rubber manufacturing, and electronics assembly that contribute to local content requirements.

Market definition also encompasses the regulatory framework governing vehicle standards, safety requirements, and environmental compliance. The sector operates within established trade policies, taxation structures, and import regulations that shape market dynamics and competitive positioning.

Ghana’s automotive sector demonstrates remarkable resilience and growth potential despite global economic challenges. The market has evolved from a purely import-dependent economy to one embracing local assembly and manufacturing capabilities. Key performance indicators show sustained expansion across multiple vehicle categories, with passenger vehicles maintaining the largest market share at approximately 60% of total registrations.

Strategic developments include the establishment of vehicle assembly plants by major international brands, creating employment opportunities and technology transfer. The government’s automotive policy has successfully attracted foreign direct investment while promoting local content development. Market accessibility has improved through expanded financing options and dealer network growth across urban and rural areas.

Competitive landscape features a mix of global automotive brands and local distributors, creating a dynamic marketplace with diverse product offerings. The sector benefits from Ghana’s stable political environment, improving infrastructure, and growing middle class. Future prospects remain positive, supported by demographic trends, urbanization patterns, and continued economic development initiatives.

Market intelligence reveals several critical insights shaping Ghana’s automotive landscape. Consumer preferences have shifted toward fuel-efficient vehicles, compact SUVs, and reliable transportation solutions that address local road conditions and economic considerations.

Economic growth serves as the primary catalyst for automotive market expansion in Ghana. Rising GDP per capita and expanding middle class demographics create increased purchasing power for vehicle acquisition. Urbanization trends contribute significantly to market growth, with urban population growth rate of approximately 3.4% annually driving transportation needs and vehicle ownership aspirations.

Infrastructure development projects, including road construction and maintenance programs, enhance vehicle utility and encourage ownership. The government’s commitment to improving transportation infrastructure creates favorable conditions for automotive market growth. Financial sector development has improved vehicle financing accessibility through expanded credit facilities and competitive loan products.

Government policy support through the Automotive Development Policy provides incentives for local assembly and manufacturing. Tax incentives, import duty reductions for completely knocked down kits, and skills development programs create an enabling environment. Regional integration initiatives within ECOWAS facilitate cross-border trade and expand market opportunities for automotive businesses.

Demographic advantages include a young population with increasing mobility needs and aspirations for vehicle ownership. Educational improvements and skills development enhance employment opportunities, supporting income growth and automotive affordability.

High import costs remain a significant challenge for the Ghana automotive market, with import duties and taxes increasing vehicle prices beyond many consumers’ reach. Currency fluctuations against major international currencies create pricing instability and affect import planning for dealers and distributors.

Infrastructure limitations in rural areas restrict market penetration and vehicle utility. Poor road conditions in certain regions increase maintenance costs and reduce vehicle lifespan, affecting total cost of ownership calculations. Limited financing options for lower-income segments restrict market accessibility despite growing demand.

Skills shortage in automotive technical services affects service quality and customer satisfaction. The lack of trained technicians and service personnel creates bottlenecks in after-sales support. Parts availability challenges, particularly for older vehicle models, increase maintenance costs and vehicle downtime.

Economic volatility and inflation pressures affect consumer purchasing power and payment capabilities. Regulatory compliance requirements for vehicle standards and environmental regulations increase operational costs for importers and assemblers. Competition from used vehicle imports creates pricing pressure on new vehicle sales, particularly in price-sensitive market segments.

Local assembly expansion presents substantial opportunities for automotive manufacturers seeking to establish regional production bases. Ghana’s strategic location and improving business environment attract international investment in assembly operations. Technology transfer opportunities exist through partnerships between international manufacturers and local companies.

Electric vehicle adoption represents an emerging opportunity as environmental awareness increases and charging infrastructure develops. Early market entry in electric mobility solutions could establish competitive advantages. Motorcycle market growth offers opportunities for manufacturers and distributors targeting transportation and delivery services.

After-sales services expansion creates opportunities for service providers, parts distributors, and training institutions. The growing vehicle population requires expanded maintenance and repair capabilities. Financial services innovation through digital lending platforms and flexible payment solutions can expand market accessibility.

Regional export potential leverages Ghana’s position to serve neighboring West African markets through local assembly and distribution networks. Agricultural mechanization drives demand for specialized vehicles and equipment, creating niche market opportunities. Public transportation modernization initiatives offer opportunities for commercial vehicle suppliers and service providers.

Supply chain dynamics in Ghana’s automotive market reflect the complex interplay between global manufacturing, regional assembly, and local distribution networks. Import dependency creates vulnerability to international supply disruptions while local assembly operations provide greater supply chain control and reduced lead times.

Competitive dynamics feature intense competition among established brands and emerging market entrants. Price competition remains significant, particularly in entry-level segments where consumers prioritize affordability over advanced features. Brand differentiation occurs through service quality, financing options, and local market adaptation.

Consumer behavior patterns show increasing sophistication in vehicle selection criteria, with buyers considering total cost of ownership, fuel efficiency, and resale value. Digital transformation influences purchasing processes, with online research and digital marketing becoming increasingly important.

Regulatory dynamics continue evolving with new vehicle standards, safety requirements, and environmental regulations. Market consolidation trends emerge as smaller dealers partner with larger networks to achieve economies of scale and improved service capabilities.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Ghana’s automotive sector. Primary research includes extensive interviews with industry stakeholders, including manufacturers, dealers, consumers, and government officials to gather firsthand market intelligence.

Secondary research incorporates analysis of government statistics, industry reports, trade publications, and economic indicators. Data triangulation methods validate findings across multiple sources to ensure accuracy and reliability. Market surveys capture consumer preferences, purchasing behaviors, and satisfaction levels across different demographic segments.

Industry expert consultations provide specialized insights into market trends, competitive dynamics, and future developments. Quantitative analysis examines vehicle registration data, import statistics, and economic indicators to identify patterns and trends. Qualitative research explores market dynamics, consumer motivations, and industry challenges through focus groups and in-depth interviews.

Market modeling techniques project future scenarios based on historical data, economic indicators, and policy developments. Validation processes ensure research findings align with market realities and stakeholder experiences.

Greater Accra Region dominates Ghana’s automotive market, accounting for approximately 45% of total vehicle registrations due to its economic significance and urban concentration. The region hosts major dealerships, assembly plants, and automotive service centers. Ashanti Region represents the second-largest market, contributing around 25% of national vehicle sales with Kumasi serving as a major commercial hub.

Western Region shows strong growth potential driven by oil and gas industry activities, mining operations, and port facilities. Commercial vehicle demand remains particularly strong in this region. Northern regions demonstrate increasing market penetration as infrastructure development and economic activities expand.

Regional distribution networks continue expanding to serve growing demand outside major urban centers. Rural market penetration increases gradually as road infrastructure improves and financing becomes more accessible. Coastal regions benefit from port activities and fishing industry transportation needs.

Regional preferences vary based on local economic activities, with mining regions favoring heavy-duty vehicles while agricultural areas show preference for pickup trucks and utility vehicles. Service network expansion follows market growth patterns, with authorized service centers establishing presence in secondary cities.

Market leadership in Ghana’s automotive sector features a diverse mix of international brands and local distributors competing across multiple vehicle segments. Competitive positioning varies significantly between passenger vehicle and commercial vehicle markets.

Competitive strategies emphasize local market adaptation, service quality improvement, and financing accessibility. Market share dynamics reflect brand loyalty, product reliability, and after-sales service quality as key differentiating factors.

Vehicle type segmentation reveals distinct market characteristics and growth patterns across different automotive categories. Passenger vehicles maintain the largest market share, driven by increasing urbanization and rising disposable incomes among middle-class consumers.

By Vehicle Type:

By Price Segment:

By Fuel Type:

Passenger vehicle category demonstrates steady growth with increasing consumer sophistication and feature expectations. Compact SUVs show the strongest growth trajectory, appealing to consumers seeking versatility and elevated driving position. Sedan popularity remains stable among traditional buyers, while hatchback demand grows in urban areas.

Commercial vehicle segment benefits from expanding logistics and transportation sectors. Light commercial vehicles experience strong demand from small businesses and delivery services. Heavy-duty trucks serve mining, construction, and long-distance transportation needs with consistent replacement demand.

Motorcycle category shows robust growth, particularly in rural areas and among young urban professionals. Delivery services expansion drives commercial motorcycle demand, while personal mobility needs support consumer segment growth. Electric motorcycles begin gaining attention as charging infrastructure develops.

Agricultural vehicle segment grows steadily with government mechanization initiatives and farmer income improvements. Tractor demand increases as agricultural productivity enhancement becomes priority. Specialized farming equipment imports rise with crop diversification and modern farming technique adoption.

Manufacturers and assemblers benefit from Ghana’s strategic location providing access to West African markets through regional trade agreements. Local assembly operations reduce import duties and transportation costs while enabling customization for local market preferences. Government incentives support investment in manufacturing capabilities and skills development.

Dealers and distributors enjoy expanding market opportunities driven by economic growth and urbanization trends. Service network expansion creates additional revenue streams through parts sales and maintenance services. Digital transformation opportunities enhance customer engagement and operational efficiency.

Financial institutions benefit from growing automotive financing demand and expanding credit market opportunities. Insurance providers experience increased policy demand as vehicle ownership grows. Technology providers find opportunities in vehicle connectivity, fleet management, and digital services.

Government stakeholders benefit from increased tax revenues, employment creation, and industrial development. Consumers enjoy improved vehicle accessibility, competitive pricing, and enhanced service quality through market competition and expansion.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation emerges as a dominant trend reshaping Ghana’s automotive market landscape. Online vehicle sales platforms gain popularity, enabling consumers to research, compare, and purchase vehicles through digital channels. Mobile applications for vehicle financing, insurance, and maintenance services enhance customer convenience and market accessibility.

Sustainability focus drives increasing interest in fuel-efficient vehicles and alternative energy solutions. Hybrid vehicle adoption grows among environmentally conscious consumers, while electric vehicle infrastructure development begins in major urban centers. Green financing options emerge to support eco-friendly vehicle purchases.

Local content development accelerates through government policy support and manufacturer investment. Skills development programs enhance local technical capabilities in automotive assembly and services. Technology transfer initiatives build local expertise and manufacturing capabilities.

Mobility-as-a-Service concepts gain traction in urban areas through ride-sharing and vehicle rental services. Fleet management solutions become increasingly sophisticated, incorporating GPS tracking, fuel monitoring, and predictive maintenance capabilities. Connected vehicle technologies begin appearing in premium segments, offering enhanced safety and convenience features.

Manufacturing investments have transformed Ghana’s automotive landscape with several major developments. Volkswagen Ghana established a vehicle assembly plant in Accra, marking significant foreign investment in local manufacturing capabilities. The facility produces various Volkswagen models for domestic and regional markets.

Government policy implementation through the Ghana Automotive Development Policy has created structured incentives for industry development. Tax incentives for completely knocked down kit imports encourage local assembly operations. Skills development initiatives include automotive technical training programs in partnership with international manufacturers.

Infrastructure development projects support automotive market growth through improved road networks and transportation facilities. Port facility upgrades enhance vehicle import capabilities and reduce logistics costs. Charging infrastructure pilots begin in major cities to support future electric vehicle adoption.

Financial sector innovations include specialized automotive financing products and digital lending platforms. Insurance product development offers comprehensive coverage options tailored to local market needs. Dealer network expansion continues across secondary cities and rural areas, improving market accessibility and service coverage.

Market participants should prioritize local market adaptation and customer-centric strategies to succeed in Ghana’s evolving automotive landscape. MarkWide Research analysis indicates that companies focusing on affordability, service quality, and local partnerships achieve stronger market positions and customer loyalty.

Investment strategies should emphasize long-term market development rather than short-term gains. Local assembly operations offer competitive advantages through reduced costs, government incentives, and market responsiveness. Partnership approaches with local distributors and service providers enhance market penetration and operational efficiency.

Technology adoption should balance advanced features with affordability considerations. Digital transformation initiatives in sales and service processes can differentiate brands and improve customer experience. Sustainability positioning becomes increasingly important as environmental awareness grows among consumers.

Risk management strategies should address currency volatility, supply chain disruptions, and regulatory changes. Diversification approaches across vehicle segments and market channels reduce dependency risks. Stakeholder engagement with government, financial institutions, and industry associations supports favorable business environment development.

Growth trajectory for Ghana’s automotive market remains positive, supported by favorable demographic trends, economic development, and government policy support. Market expansion is projected to continue at a steady growth rate of 8-10% annually over the next five years, driven by increasing urbanization and rising disposable incomes.

Local manufacturing capabilities are expected to expand significantly, with additional assembly plants and component manufacturing facilities planned. Technology integration will accelerate, bringing advanced safety features, connectivity options, and electric vehicle solutions to the market. MWR projections indicate that local assembly could account for 40% of vehicle supply by 2030.

Electric vehicle adoption will begin gaining momentum as charging infrastructure develops and government incentives support clean energy transportation. Digital transformation will reshape customer experience through online sales platforms, digital financing, and connected vehicle services.

Regional integration opportunities will expand as Ghana leverages its strategic position to serve West African markets through local production and distribution networks. Skills development initiatives will enhance local technical capabilities, supporting industry growth and technology transfer objectives.

Ghana’s automotive market stands at a pivotal transformation point, evolving from import dependency toward local manufacturing and assembly capabilities. The market demonstrates remarkable resilience and growth potential, supported by favorable demographics, economic development, and strategic government policies. Key success factors include local market adaptation, service quality excellence, and strategic partnerships with local stakeholders.

Industry participants who embrace digital transformation, sustainability initiatives, and customer-centric approaches will achieve competitive advantages in this dynamic market. The combination of growing consumer sophistication, expanding financing accessibility, and improving infrastructure creates favorable conditions for continued market expansion. MarkWide Research analysis confirms that Ghana’s automotive sector offers substantial opportunities for manufacturers, dealers, and service providers willing to invest in long-term market development strategies.

Future success will depend on balancing affordability with quality, leveraging technology for enhanced customer experience, and building robust local partnerships. As Ghana continues its economic development journey, the automotive market will play an increasingly important role in supporting mobility needs, economic growth, and regional integration objectives.

What is Automotive?

Automotive refers to the design, development, manufacturing, marketing, and selling of motor vehicles. This includes cars, trucks, buses, and motorcycles, which are essential for transportation and mobility in various sectors.

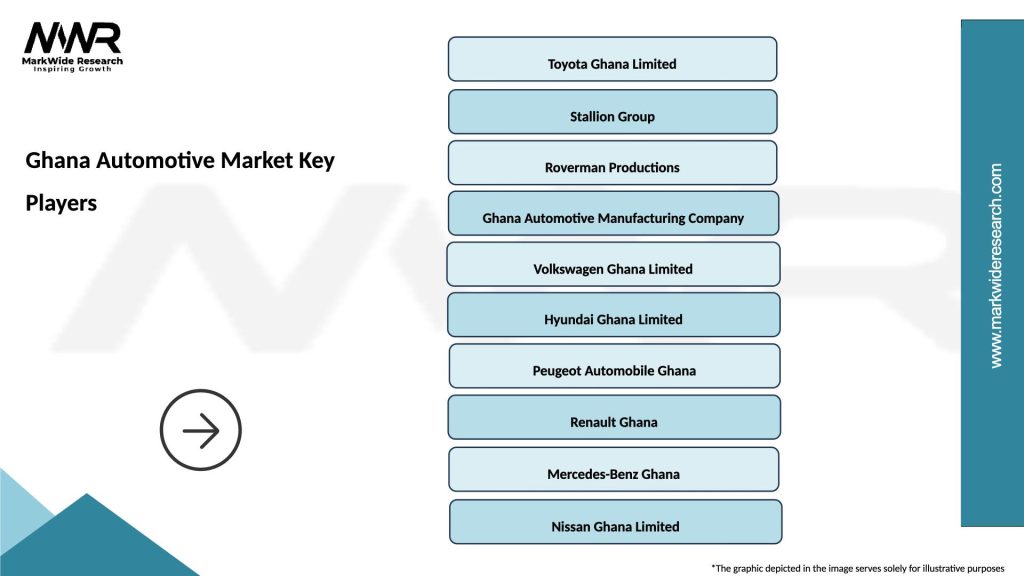

What are the key players in the Ghana Automotive Market?

Key players in the Ghana Automotive Market include Kantanka Automobile, Nissan Ghana, and Toyota Ghana, among others. These companies are involved in vehicle assembly, sales, and distribution within the country.

What are the growth factors driving the Ghana Automotive Market?

The growth of the Ghana Automotive Market is driven by increasing urbanization, rising disposable incomes, and a growing demand for personal and commercial vehicles. Additionally, government initiatives to promote local manufacturing contribute to market expansion.

What challenges does the Ghana Automotive Market face?

The Ghana Automotive Market faces challenges such as inadequate infrastructure, high import tariffs on vehicles, and limited access to financing for consumers. These factors can hinder the growth and accessibility of automotive products.

What opportunities exist in the Ghana Automotive Market?

Opportunities in the Ghana Automotive Market include the potential for electric vehicle adoption, growth in ride-sharing services, and the expansion of local manufacturing capabilities. These trends can enhance market dynamics and attract investment.

What trends are shaping the Ghana Automotive Market?

Trends in the Ghana Automotive Market include a shift towards sustainable transportation solutions, increased interest in electric vehicles, and the integration of advanced technologies in vehicles. These trends reflect a global movement towards greener and smarter mobility.

Ghana Automotive Market

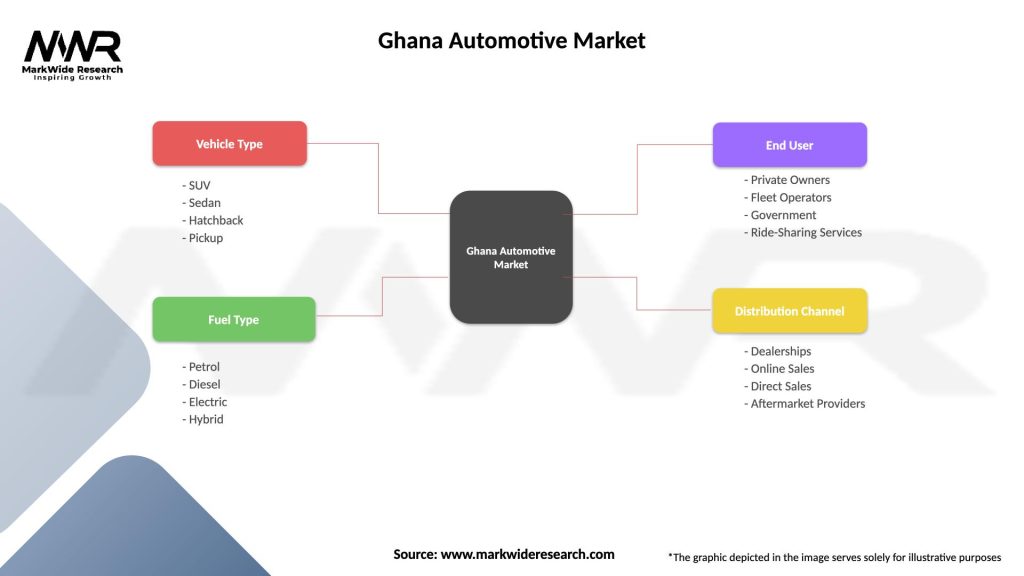

| Segmentation Details | Description |

|---|---|

| Vehicle Type | SUV, Sedan, Hatchback, Pickup |

| Fuel Type | Petrol, Diesel, Electric, Hybrid |

| End User | Private Owners, Fleet Operators, Government, Ride-Sharing Services |

| Distribution Channel | Dealerships, Online Sales, Direct Sales, Aftermarket Providers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Ghana Automotive Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at