444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany water treatment chemical market represents a critical component of the nation’s environmental infrastructure and industrial operations. Germany’s commitment to environmental sustainability and stringent water quality regulations has positioned the country as a leading market for advanced water treatment solutions. The market encompasses a comprehensive range of chemical products designed to purify, disinfect, and condition water across municipal, industrial, and residential applications.

Market dynamics in Germany are driven by the country’s robust manufacturing sector, aging water infrastructure, and increasing environmental awareness. The German water treatment chemical sector has experienced consistent growth, with adoption rates reaching 78% across industrial facilities and municipal treatment plants implementing advanced chemical treatment protocols. Regulatory compliance remains a primary driver, as Germany maintains some of the world’s most stringent water quality standards.

Industrial applications dominate the market landscape, with chemical processing, power generation, and manufacturing sectors representing the largest consumption segments. The market benefits from Germany’s position as Europe’s largest economy and its commitment to sustainable water management practices. Innovation trends focus on eco-friendly formulations, smart dosing systems, and integrated treatment solutions that optimize both performance and environmental impact.

The Germany water treatment chemical market refers to the comprehensive ecosystem of chemical products, technologies, and services designed to improve water quality across various applications within German territory. This market encompasses coagulants, flocculants, disinfectants, pH adjusters, corrosion inhibitors, and specialty chemicals used in municipal water treatment, industrial processes, and wastewater management systems.

Water treatment chemicals serve essential functions including removing contaminants, controlling microbial growth, preventing scale formation, and ensuring compliance with German and European Union water quality standards. The market includes both commodity chemicals and specialized formulations developed for specific industrial applications or challenging water conditions prevalent in different German regions.

Germany’s water treatment chemical market demonstrates remarkable resilience and growth potential, driven by stringent environmental regulations and industrial modernization initiatives. The market benefits from strong government support for water infrastructure upgrades and the country’s leadership in environmental technology development. Key market segments include municipal water treatment, industrial process water, and wastewater treatment applications.

Competitive dynamics feature both international chemical giants and specialized German companies offering innovative solutions. The market shows increasing preference for sustainable and bio-based treatment chemicals, with green chemistry adoption rates reaching 42% among major industrial users. Digital transformation initiatives are reshaping service delivery models, with smart monitoring and automated dosing systems gaining significant traction.

Regional variations exist across Germany’s federal states, with industrial regions like North Rhine-Westphalia and Baden-Württemberg showing higher consumption rates. The market outlook remains positive, supported by ongoing infrastructure investments and increasing focus on circular economy principles in water management.

Strategic insights reveal several critical trends shaping the German water treatment chemical market:

Primary market drivers propelling growth in Germany’s water treatment chemical sector stem from multiple interconnected factors. Regulatory enforcement represents the most significant driver, with German authorities maintaining strict compliance requirements for water quality across all sectors. The country’s commitment to environmental protection translates into consistent demand for effective treatment solutions.

Industrial expansion and modernization initiatives create substantial opportunities for water treatment chemical suppliers. Germany’s manufacturing sector, particularly automotive, chemical, and pharmaceutical industries, requires sophisticated water treatment protocols to maintain operational efficiency and regulatory compliance. Infrastructure aging across municipal systems necessitates upgraded treatment approaches and chemical solutions.

Environmental consciousness among German consumers and businesses drives demand for sustainable treatment options. The country’s leadership in environmental technology development creates a favorable market environment for innovative chemical solutions. Water scarcity concerns and climate change adaptation strategies further reinforce the importance of efficient water treatment and reuse technologies.

Market constraints in the German water treatment chemical sector include several challenging factors that impact growth potential. High regulatory compliance costs create barriers for smaller market participants and can slow innovation cycles for new chemical formulations. The extensive testing and approval processes required for new treatment chemicals can delay market entry and increase development expenses.

Price sensitivity among municipal customers, particularly smaller communities, limits adoption of premium treatment solutions. Budget constraints in public sector water utilities can restrict investment in advanced chemical treatment systems. Technical complexity associated with modern treatment chemicals requires specialized knowledge and training, creating implementation challenges for some operators.

Environmental regulations themselves can paradoxically constrain market growth by limiting the use of certain effective but environmentally questionable chemical formulations. Supply chain disruptions and raw material availability issues can impact product consistency and pricing stability in the German market.

Significant opportunities exist within Germany’s water treatment chemical market, driven by evolving industry needs and technological advancement. Green chemistry development presents substantial growth potential, with increasing demand for bio-based and environmentally sustainable treatment solutions. The market opportunity for eco-friendly alternatives shows annual growth rates of 12-15% in key segments.

Digital transformation initiatives create opportunities for integrated chemical and technology solutions. Smart dosing systems, predictive maintenance, and data-driven optimization services represent emerging market segments with significant potential. Industrial water reuse applications offer expanding opportunities as companies seek to reduce water consumption and environmental impact.

Export potential exists for German water treatment chemical companies, leveraging the country’s reputation for quality and innovation in environmental technology. Specialty applications in emerging industries like renewable energy and advanced manufacturing create niche market opportunities with premium pricing potential.

Market dynamics in Germany’s water treatment chemical sector reflect complex interactions between regulatory, technological, and economic factors. Supply chain optimization has become increasingly important, with companies focusing on local sourcing and production to reduce transportation costs and environmental impact. The market demonstrates supply chain efficiency improvements of 18% through strategic localization initiatives.

Competitive intensity varies across different chemical categories, with commodity products facing price pressure while specialty chemicals command premium pricing. Innovation cycles are accelerating, driven by environmental regulations and customer demands for more effective solutions. Partnership strategies between chemical suppliers and equipment manufacturers create integrated value propositions for end users.

Customer behavior shows increasing sophistication, with buyers demanding comprehensive performance data and lifecycle cost analysis. Service integration becomes a key differentiator, with successful companies offering technical support, training, and optimization services alongside chemical products.

Comprehensive research methodology employed in analyzing Germany’s water treatment chemical market incorporates multiple data sources and analytical approaches. Primary research includes extensive interviews with industry stakeholders, including chemical manufacturers, distributors, end users, and regulatory officials across Germany’s major industrial regions.

Secondary research encompasses analysis of industry reports, regulatory documents, trade publications, and company financial statements. Market sizing utilizes bottom-up and top-down approaches, incorporating production data, import/export statistics, and consumption patterns across different application segments.

Data validation processes ensure accuracy through triangulation of multiple sources and expert review panels. MarkWide Research methodology incorporates advanced statistical modeling and trend analysis to provide reliable market projections and insights for strategic decision-making.

Regional distribution across Germany reveals distinct patterns in water treatment chemical consumption and market dynamics. North Rhine-Westphalia represents the largest regional market, accounting for approximately 28% of national consumption, driven by its concentration of heavy industry and large urban centers. The region’s chemical and steel industries create substantial demand for specialized treatment solutions.

Baden-Württemberg follows as the second-largest market, with 22% market share, supported by its automotive and precision manufacturing sectors. The region demonstrates high adoption rates for advanced treatment technologies and sustainable chemical solutions. Bavaria contributes 18% of market demand, with diverse industrial applications and growing focus on environmental compliance.

Eastern German states show accelerating growth as infrastructure modernization continues. Saxony and Thuringia demonstrate increasing investment in water treatment upgrades, creating opportunities for chemical suppliers. Northern coastal regions face unique challenges related to saltwater intrusion and require specialized treatment approaches.

Competitive dynamics in Germany’s water treatment chemical market feature a mix of global leaders and specialized regional players. The market structure includes both large multinational corporations and focused German companies offering innovative solutions:

Market positioning strategies vary, with some companies focusing on cost leadership while others emphasize innovation and sustainability. Strategic partnerships and acquisitions shape competitive dynamics, as companies seek to expand capabilities and market reach.

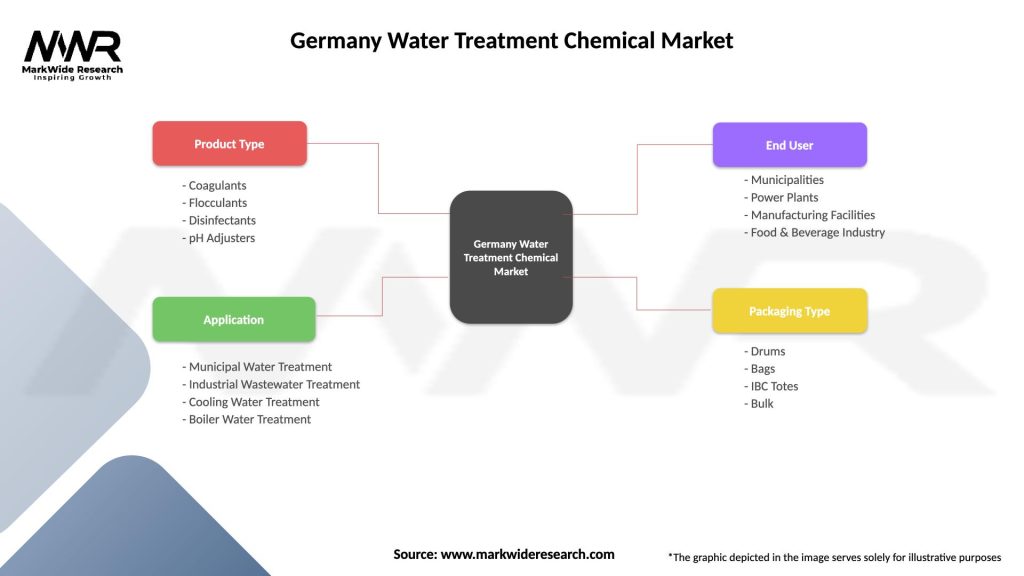

Market segmentation reveals diverse applications and product categories within Germany’s water treatment chemical sector:

By Product Type:

By Application:

Coagulants and flocculants represent the dominant product category, with aluminum and iron-based chemicals maintaining strong market positions. Innovation trends focus on organic and bio-based alternatives that offer improved performance with reduced environmental impact. The segment shows adoption rates of 85% across major municipal treatment facilities.

Disinfection chemicals demonstrate steady demand driven by public health requirements and regulatory compliance. Chlorine-based products remain prevalent, while alternative disinfection methods gain traction in specific applications. UV and ozone systems create demand for complementary chemical treatments.

Specialty chemicals for industrial applications show the highest growth potential, with customized formulations addressing specific process requirements. Membrane treatment chemicals represent an emerging category with significant growth prospects as membrane technology adoption increases.

Industry participants in Germany’s water treatment chemical market enjoy several strategic advantages and benefits:

End users benefit from improved operational efficiency, regulatory compliance assurance, and reduced environmental impact. Municipal utilities achieve cost optimization through advanced chemical treatment programs, while industrial customers gain process reliability and equipment protection.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend reshaping Germany’s water treatment chemical market. Bio-based alternatives gain market acceptance as companies seek to reduce environmental footprint while maintaining treatment effectiveness. The trend toward circular economy principles drives development of chemical recovery and reuse technologies.

Digitalization initiatives transform traditional chemical supply models through smart dosing systems and predictive analytics. Data-driven optimization enables precise chemical dosing and improved treatment efficiency. Remote monitoring capabilities reduce operational costs and improve system reliability.

Consolidation trends in the supplier landscape create larger, more capable organizations with enhanced R&D resources. Vertical integration strategies combine chemical supply with equipment and services for comprehensive solutions. Customization demand increases as customers seek tailored solutions for specific applications and conditions.

Recent industry developments highlight the dynamic nature of Germany’s water treatment chemical market. Regulatory updates continue to shape product development priorities, with new EU directives influencing chemical selection and application methods. Technology partnerships between chemical companies and equipment manufacturers create integrated solutions addressing complex treatment challenges.

Investment announcements in production capacity and R&D facilities demonstrate industry confidence in long-term growth prospects. Acquisition activity consolidates market participants and creates stronger competitive positions. Sustainability initiatives drive development of next-generation chemical formulations with improved environmental profiles.

Innovation breakthroughs in membrane-compatible chemicals and smart dosing technologies expand market opportunities. MarkWide Research analysis indicates that research and development spending has increased by 23% annually among leading market participants, reflecting commitment to technological advancement.

Strategic recommendations for market participants focus on positioning for long-term success in Germany’s evolving water treatment chemical landscape. Innovation investment should prioritize sustainable chemistry and digital integration capabilities. Companies should develop comprehensive portfolios combining traditional chemicals with advanced monitoring and optimization services.

Market expansion strategies should consider regional specialization opportunities and export potential leveraging German quality reputation. Partnership development with equipment manufacturers and engineering firms creates competitive advantages and customer value. Talent acquisition in digital technologies and green chemistry becomes critical for future competitiveness.

Customer engagement should emphasize total cost of ownership and sustainability benefits rather than initial chemical costs. Service integration provides differentiation opportunities and recurring revenue streams. Regulatory monitoring ensures proactive adaptation to changing compliance requirements.

Future prospects for Germany’s water treatment chemical market remain positive, supported by ongoing infrastructure investment and environmental protection priorities. Growth projections indicate continued expansion at steady annual rates of 4-6% across key market segments. Sustainability trends will increasingly influence product development and customer selection criteria.

Technology evolution will drive market transformation through smart systems integration and advanced chemical formulations. Regulatory developments will continue shaping market dynamics, with increasing emphasis on environmental protection and resource efficiency. MWR projections suggest that digital solution adoption will reach 60% of major facilities within the next five years.

Market structure evolution will likely feature continued consolidation and increased specialization. International expansion opportunities will grow as German companies leverage technological leadership and quality reputation. Circular economy integration will create new business models and revenue opportunities for innovative market participants.

Germany’s water treatment chemical market represents a mature yet dynamic sector with significant opportunities for growth and innovation. The market benefits from strong regulatory support, diverse industrial applications, and increasing environmental consciousness among customers and stakeholders. Sustainability transformation and digital integration emerge as key themes shaping future market development.

Competitive success will depend on companies’ ability to balance traditional chemical effectiveness with environmental responsibility and digital capabilities. Market participants that invest in sustainable chemistry, smart technologies, and comprehensive service offerings will be best positioned for long-term growth. The German market’s emphasis on quality and innovation creates opportunities for premium positioning and export expansion.

Strategic focus on regulatory compliance, customer partnership, and technological advancement will drive continued market evolution. As Germany maintains its leadership in environmental technology and sustainable development, the water treatment chemical market will continue serving as a critical component of the nation’s environmental infrastructure and industrial competitiveness.

What is Water Treatment Chemical?

Water treatment chemicals are substances used to treat water for various applications, including drinking water purification, wastewater treatment, and industrial processes. They help in removing impurities, controlling corrosion, and ensuring water quality.

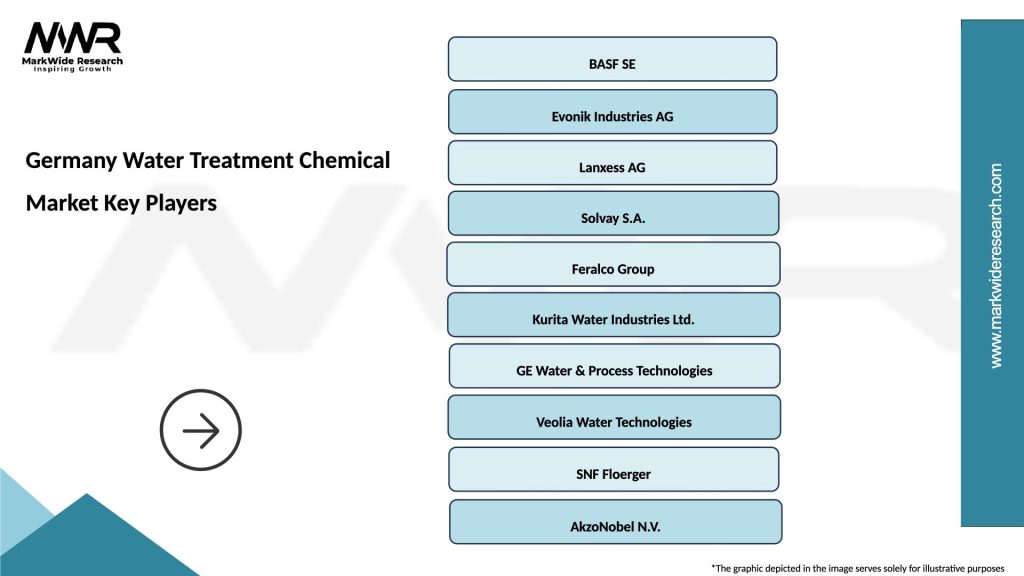

What are the key players in the Germany Water Treatment Chemical Market?

Key players in the Germany Water Treatment Chemical Market include BASF SE, Evonik Industries AG, and Kemira Oyj, among others. These companies are involved in the production and supply of various water treatment chemicals for different applications.

What are the growth factors driving the Germany Water Treatment Chemical Market?

The growth of the Germany Water Treatment Chemical Market is driven by increasing industrialization, stringent environmental regulations, and the rising demand for clean drinking water. Additionally, advancements in water treatment technologies are contributing to market expansion.

What challenges does the Germany Water Treatment Chemical Market face?

The Germany Water Treatment Chemical Market faces challenges such as fluctuating raw material prices and the need for compliance with strict environmental regulations. Moreover, the market must address the growing concerns regarding the environmental impact of certain chemicals.

What opportunities exist in the Germany Water Treatment Chemical Market?

Opportunities in the Germany Water Treatment Chemical Market include the development of eco-friendly chemicals and innovative treatment solutions. The increasing focus on sustainability and water conservation is also creating new avenues for growth.

What trends are shaping the Germany Water Treatment Chemical Market?

Trends in the Germany Water Treatment Chemical Market include the rising adoption of advanced treatment technologies, such as membrane filtration and UV disinfection. Additionally, there is a growing emphasis on digital solutions for monitoring and optimizing water treatment processes.

Germany Water Treatment Chemical Market

| Segmentation Details | Description |

|---|---|

| Product Type | Coagulants, Flocculants, Disinfectants, pH Adjusters |

| Application | Municipal Water Treatment, Industrial Wastewater Treatment, Cooling Water Treatment, Boiler Water Treatment |

| End User | Municipalities, Power Plants, Manufacturing Facilities, Food & Beverage Industry |

| Packaging Type | Drums, Bags, IBC Totes, Bulk |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Water Treatment Chemical Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at