444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Germany’s used cars market represents one of Europe’s most dynamic and sophisticated automotive sectors, characterized by robust consumer demand, advanced digital platforms, and comprehensive quality standards. The market demonstrates consistent growth patterns with annual expansion rates reaching 6.2% CAGR over recent years, driven by evolving consumer preferences and economic considerations.

Market dynamics in Germany reflect a mature automotive ecosystem where used vehicles account for approximately 78% of total vehicle transactions. This substantial proportion indicates strong consumer confidence in pre-owned vehicles, supported by rigorous inspection standards and transparent pricing mechanisms. The German used car landscape encompasses diverse segments, from premium luxury vehicles to economical compact cars, catering to varied demographic preferences.

Digital transformation has revolutionized the German used cars market, with online platforms facilitating 65% of initial vehicle searches. Traditional dealerships continue maintaining significant market presence while adapting to digital-first consumer behaviors. The integration of advanced technologies, including artificial intelligence for pricing algorithms and virtual inspection tools, enhances market efficiency and consumer trust.

Regional distribution across Germany shows concentrated activity in major metropolitan areas, with North Rhine-Westphalia, Bavaria, and Baden-Württemberg representing 52% of total market activity. These regions benefit from higher population density, stronger economic conditions, and established automotive infrastructure supporting both dealers and consumers.

The Germany used cars market refers to the comprehensive ecosystem encompassing the sale, purchase, and trade of pre-owned vehicles within German borders, including private transactions, dealership sales, and digital platform exchanges.

Market participants include authorized dealers, independent retailers, online platforms, auction houses, and private sellers, each contributing to a complex network that facilitates vehicle ownership transitions. The market encompasses various vehicle categories, from passenger cars and commercial vehicles to motorcycles and specialty automotive equipment.

Regulatory framework governing the German used cars market includes consumer protection laws, vehicle safety standards, emissions compliance requirements, and taxation policies that influence pricing structures and transaction processes. These regulations ensure market transparency while protecting consumer interests and maintaining environmental standards.

Economic significance extends beyond simple vehicle transactions, encompassing financing services, insurance products, maintenance contracts, and warranty provisions that create substantial value chains throughout the automotive sector. The market supports thousands of businesses and employment opportunities across Germany’s diverse regions.

Germany’s used cars market demonstrates remarkable resilience and growth potential, driven by strong consumer demand, technological innovation, and evolving mobility preferences. The market benefits from Germany’s position as Europe’s largest automotive market, with established infrastructure supporting efficient vehicle distribution and servicing networks.

Key growth drivers include increasing vehicle affordability concerns, environmental consciousness promoting longer vehicle lifecycles, and digital platform adoption facilitating transparent pricing and convenient purchasing processes. Consumer preference shifts toward sustainable transportation options contribute to 43% growth in hybrid and electric used vehicle sales.

Market segmentation reveals diverse opportunities across price ranges, vehicle types, and geographic regions. Premium vehicle segments maintain strong demand, while economy segments benefit from first-time buyer interest and urban mobility requirements. Commercial vehicle segments experience steady growth driven by e-commerce expansion and logistics sector development.

Competitive landscape features established players adapting to digital transformation while new entrants leverage technology-driven business models. Traditional dealerships invest in omnichannel strategies, while online platforms expand service offerings beyond simple vehicle listings to comprehensive transaction support.

Consumer behavior analysis reveals significant shifts in purchasing patterns, with buyers increasingly prioritizing value retention, fuel efficiency, and technology features over traditional status symbols. Research indicates that 71% of German consumers consider environmental impact when selecting used vehicles.

Economic considerations represent the primary driver for Germany’s used cars market growth, as consumers seek cost-effective transportation solutions amid rising new vehicle prices and economic uncertainty. The substantial price differential between new and used vehicles creates compelling value propositions for budget-conscious buyers.

Environmental awareness increasingly influences consumer decisions, with buyers recognizing that extending vehicle lifecycles through used car purchases reduces overall environmental impact compared to manufacturing new vehicles. This consciousness aligns with Germany’s sustainability goals and circular economy principles.

Technological advancement in used vehicle platforms enhances market accessibility and transparency. Advanced search algorithms, virtual inspection tools, and comprehensive vehicle history reports build consumer confidence while streamlining the purchasing process. Digital innovations reduce traditional barriers to used vehicle transactions.

Urban mobility trends drive demand for specific vehicle types, particularly compact cars and alternative fuel vehicles suitable for city driving and parking constraints. Germany’s expanding low-emission zones and congestion policies encourage consumers toward efficient used vehicles rather than new purchases.

Demographic shifts contribute to market expansion as younger consumers enter the automotive market with different priorities than previous generations. These buyers often prioritize functionality, technology features, and environmental considerations over traditional automotive status symbols.

Supply chain challenges affect used vehicle availability, particularly for popular models and specific age ranges. Limited inventory in certain segments creates pricing pressures and extends consumer search periods, potentially dampening market growth in affected categories.

Regulatory complexity surrounding emissions standards, safety requirements, and taxation policies creates uncertainty for both dealers and consumers. Frequent policy changes require continuous adaptation and may discourage some market participants from engaging in transactions.

Quality concerns persist among some consumers regarding used vehicle reliability and hidden defects. Despite improved inspection standards and warranty offerings, perception challenges continue affecting market penetration in certain demographic segments.

Financing limitations restrict market access for some consumers, particularly those with limited credit history or lower income levels. Traditional lending criteria may exclude potential buyers who could otherwise afford used vehicle ownership through alternative financing structures.

Competition from alternative mobility services, including car-sharing, ride-hailing, and public transportation improvements, reduces vehicle ownership demand in urban areas. These alternatives particularly appeal to younger demographics who might otherwise enter the used car market.

Electric vehicle transition creates substantial opportunities as early electric vehicle adopters begin trading their vehicles, establishing a growing segment of used electric and hybrid vehicles. This emerging market addresses environmental concerns while offering more affordable access to advanced automotive technologies.

Digital platform expansion offers opportunities for enhanced service integration, including virtual reality showrooms, augmented reality vehicle inspections, and artificial intelligence-powered matching systems that improve customer experience and operational efficiency.

Cross-border trade potential exists within the European Union, allowing German dealers and platforms to access broader inventory sources and customer bases. Harmonized regulations and digital infrastructure support expanded geographic reach for market participants.

Subscription and flexible ownership models present opportunities to attract consumers who prefer access over ownership. These innovative approaches can expand the addressable market while creating recurring revenue streams for service providers.

Data monetization opportunities emerge from comprehensive vehicle and consumer data collection, enabling personalized services, predictive maintenance offerings, and targeted marketing that enhance customer relationships and generate additional revenue streams.

Supply and demand equilibrium in Germany’s used cars market reflects complex interactions between new vehicle production cycles, consumer replacement patterns, and economic conditions. Market dynamics demonstrate cyclical patterns influenced by seasonal preferences, economic indicators, and regulatory changes.

Pricing mechanisms incorporate multiple factors including vehicle age, mileage, condition, brand reputation, and market demand. Advanced algorithms and market data analytics enable more accurate pricing while reducing information asymmetries between buyers and sellers.

Technology integration transforms traditional market dynamics through automated valuation models, digital inspection processes, and streamlined transaction workflows. These innovations reduce transaction costs while improving market efficiency and customer satisfaction levels.

Competitive pressures drive continuous innovation among market participants, leading to enhanced service offerings, improved customer experience, and more competitive pricing structures. Traditional players adapt to digital-first approaches while maintaining their established customer relationships.

Regulatory influence shapes market dynamics through emissions standards, safety requirements, and consumer protection measures. Policy changes create both challenges and opportunities, requiring market participants to maintain flexibility and adaptability in their business strategies.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Germany’s used cars market. Primary research includes surveys, interviews, and focus groups with market participants across the value chain, from consumers and dealers to platform operators and industry experts.

Secondary research incorporates analysis of industry reports, government statistics, trade association data, and academic studies to provide comprehensive market context. Data sources include automotive industry publications, economic indicators, and regulatory documentation that influence market conditions.

Quantitative analysis utilizes statistical modeling and trend analysis to identify patterns, correlations, and projections within the used cars market. Advanced analytics techniques process large datasets to extract meaningful insights about consumer behavior, pricing trends, and market dynamics.

Qualitative research provides deeper understanding of market motivations, challenges, and opportunities through structured interviews with industry stakeholders. Expert opinions and case studies offer valuable perspectives on market evolution and future development potential.

Data validation processes ensure research accuracy through triangulation of multiple sources, peer review procedures, and continuous monitoring of market developments. Regular updates incorporate new information and changing market conditions to maintain research relevance and reliability.

North Rhine-Westphalia dominates Germany’s used cars market with approximately 22% market share, driven by high population density, strong industrial base, and established automotive infrastructure. Major cities including Cologne, Düsseldorf, and Dortmund support active dealer networks and consumer demand.

Bavaria represents 18% of market activity, benefiting from economic prosperity, automotive manufacturing presence, and strong consumer purchasing power. Munich and surrounding regions demonstrate particular strength in premium vehicle segments and technology adoption.

Baden-Württemberg accounts for 16% of transactions, leveraging its position as Germany’s automotive manufacturing hub. Stuttgart and surrounding areas show high demand for both domestic and imported used vehicles, supported by automotive industry employment.

Lower Saxony and Hesse each contribute approximately 8% market share, with Hanover, Frankfurt, and surrounding regions providing steady demand across vehicle segments. These areas benefit from diverse economic bases and transportation infrastructure supporting market activity.

Eastern German states collectively represent 15% of market activity, showing continued growth as economic development progresses. Berlin, Dresden, and Leipzig emerge as significant regional centers with increasing consumer purchasing power and dealer presence.

Northern coastal regions including Hamburg and surrounding areas contribute 7% of market share, with unique preferences for practical vehicles suitable for maritime climate conditions and urban transportation requirements.

Market leadership in Germany’s used cars sector features a diverse mix of traditional dealerships, online platforms, and integrated automotive groups competing across multiple channels and customer segments.

Competitive strategies focus on digital transformation, customer experience enhancement, and service integration. Market leaders invest in technology platforms, data analytics, and omnichannel approaches to maintain competitive advantages.

By Vehicle Type:

By Price Range:

By Age Range:

Compact Cars dominate the German used vehicle market, representing the largest transaction volume due to urban driving preferences, parking convenience, and fuel efficiency considerations. Popular models include Volkswagen Golf, BMW 1 Series, and Audi A3, which maintain strong resale values and broad consumer appeal.

SUV and Crossover segments experience rapid growth, reflecting changing consumer preferences toward higher driving positions, perceived safety benefits, and versatile cargo capacity. German brands including BMW X-Series, Mercedes GLC, and Audi Q-Series lead this expanding category.

Electric and Hybrid vehicles represent the fastest-growing category, with 47% annual growth in transaction volumes. Early adopters trading their vehicles create supply for environmentally conscious consumers seeking affordable access to advanced powertrain technologies.

Premium Sedans maintain steady demand among business professionals and luxury-oriented consumers. BMW 3 Series, Mercedes C-Class, and Audi A4 demonstrate consistent market performance with predictable depreciation patterns and strong aftermarket support.

Commercial Vehicles benefit from e-commerce growth and small business expansion, with delivery vans and pickup trucks showing increased demand. Mercedes Sprinter, Volkswagen Crafter, and Ford Transit models lead commercial segment transactions.

Dealers and Retailers benefit from expanded market reach through digital platforms, improved inventory management systems, and enhanced customer relationship tools. Technology integration reduces operational costs while improving customer satisfaction and transaction efficiency.

Consumers gain access to comprehensive vehicle information, transparent pricing, and convenient purchasing processes. Digital platforms provide extensive choice, detailed vehicle histories, and integrated financing options that simplify the buying experience.

Financial Service Providers access expanded customer bases through integrated lending solutions and data-driven risk assessment tools. Partnership opportunities with dealers and platforms create new revenue streams and customer acquisition channels.

Technology Companies find opportunities in developing specialized solutions for automotive retail, including artificial intelligence pricing algorithms, virtual inspection tools, and customer relationship management systems tailored to used vehicle transactions.

Insurance Companies benefit from integrated service offerings and access to comprehensive vehicle data that improves risk assessment accuracy. Partnership opportunities with dealers and platforms create customer acquisition advantages and enhanced service delivery.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-First Consumer Behavior transforms how Germans research, evaluate, and purchase used vehicles. Online platforms become primary touchpoints, with consumers expecting comprehensive digital experiences including virtual tours, detailed specifications, and integrated transaction support throughout the purchasing journey.

Sustainability Focus drives increasing consumer interest in vehicle lifecycle extension, fuel-efficient models, and alternative powertrains. Environmental consciousness influences purchasing decisions, with buyers prioritizing vehicles that align with Germany’s climate goals and urban emission standards.

Subscription and Flexible Ownership models gain traction among urban consumers seeking vehicle access without traditional ownership commitments. These innovative approaches appeal particularly to younger demographics and city dwellers who value flexibility over asset ownership.

Data-Driven Pricing becomes standard practice as artificial intelligence and machine learning algorithms analyze market conditions, vehicle characteristics, and consumer behavior to optimize pricing strategies. This trend improves market efficiency while reducing information asymmetries.

Omnichannel Integration emerges as successful dealers combine online presence with physical locations, creating seamless customer experiences that leverage digital convenience with traditional automotive retail expertise and personal service.

Platform Consolidation accelerates as major players acquire smaller competitors and expand service offerings. MarkWide Research analysis indicates increasing market concentration among leading digital platforms seeking to achieve scale advantages and comprehensive service integration.

Artificial Intelligence Integration advances rapidly across pricing algorithms, customer matching systems, and predictive maintenance offerings. Machine learning applications improve market efficiency while enhancing customer experience through personalized recommendations and automated processes.

Blockchain Technology pilots emerge for vehicle history verification, ownership transfer documentation, and fraud prevention. These initiatives address transparency concerns while potentially reducing transaction costs and improving consumer confidence in used vehicle purchases.

Electric Vehicle Infrastructure expansion supports growing used electric vehicle adoption. Charging network development and battery technology improvements address range anxiety concerns that previously limited electric vehicle market penetration.

Regulatory Harmonization efforts within the European Union facilitate cross-border vehicle trade and standardize consumer protection measures. These developments create opportunities for market expansion while ensuring consistent quality standards.

Digital Transformation Acceleration remains critical for traditional dealers seeking to maintain competitive relevance. Investment in comprehensive online platforms, customer relationship management systems, and data analytics capabilities will determine long-term market success in an increasingly digital marketplace.

Service Integration Expansion offers significant opportunities for revenue diversification and customer retention. Dealers should consider comprehensive automotive service ecosystems including financing, insurance, maintenance, and warranty services that create recurring revenue streams and enhanced customer relationships.

Electric Vehicle Specialization presents early-mover advantages as the used electric vehicle market expands. Dealers developing expertise in electric vehicle sales, service, and customer education will capture growing market segments while building sustainable competitive advantages.

Data Strategy Development becomes essential for understanding customer preferences, optimizing inventory management, and personalizing service offerings. Companies should invest in data collection, analysis, and application capabilities that improve decision-making and customer experience.

Partnership Strategy Implementation enables market participants to access complementary capabilities and expanded customer bases. Strategic alliances with technology companies, financial service providers, and mobility platforms create synergistic opportunities for growth and innovation.

Market evolution in Germany’s used cars sector points toward continued digitalization, sustainability focus, and service integration. MWR projections indicate sustained growth driven by economic considerations, environmental awareness, and technological advancement that enhance market accessibility and efficiency.

Technology integration will accelerate across all market segments, with artificial intelligence, virtual reality, and blockchain technologies becoming standard tools for pricing, customer experience, and transaction security. These innovations will reduce costs while improving service quality and market transparency.

Electric vehicle adoption in the used market will expand significantly as early adopters begin trading their vehicles and charging infrastructure reaches critical mass. This transition creates new market dynamics while supporting Germany’s environmental objectives and consumer cost considerations.

Regulatory development will continue shaping market conditions through environmental standards, consumer protection measures, and digital commerce regulations. Market participants must maintain adaptability to navigate evolving policy landscapes while capitalizing on regulatory-driven opportunities.

Consumer behavior will increasingly favor digital-first experiences, sustainable transportation choices, and flexible ownership models. Successful market participants will adapt their strategies to address these evolving preferences while maintaining service quality and customer satisfaction.

Germany’s used cars market demonstrates remarkable resilience and growth potential, driven by strong consumer demand, technological innovation, and evolving mobility preferences. The market benefits from Germany’s position as Europe’s largest automotive market, with established infrastructure supporting efficient vehicle distribution and comprehensive service networks.

Key success factors include digital transformation capabilities, service integration strategies, and adaptability to changing consumer preferences. Market participants who embrace technology, focus on customer experience, and develop comprehensive service offerings will capture the greatest opportunities in this dynamic marketplace.

Future prospects remain positive, with continued growth expected across multiple segments and regions. The transition toward electric vehicles, expansion of digital platforms, and evolution of ownership models create substantial opportunities for innovation and market development.

Strategic positioning requires careful consideration of market trends, competitive dynamics, and regulatory developments. Companies that invest in technology, develop strong customer relationships, and maintain operational flexibility will achieve sustainable success in Germany’s evolving used cars market landscape.

What is Used Cars?

Used cars refer to pre-owned vehicles that have had one or more previous owners. In the context of the Germany Used Cars Market, these vehicles are often sold through dealerships, private sellers, or online platforms, catering to a diverse range of consumer needs and preferences.

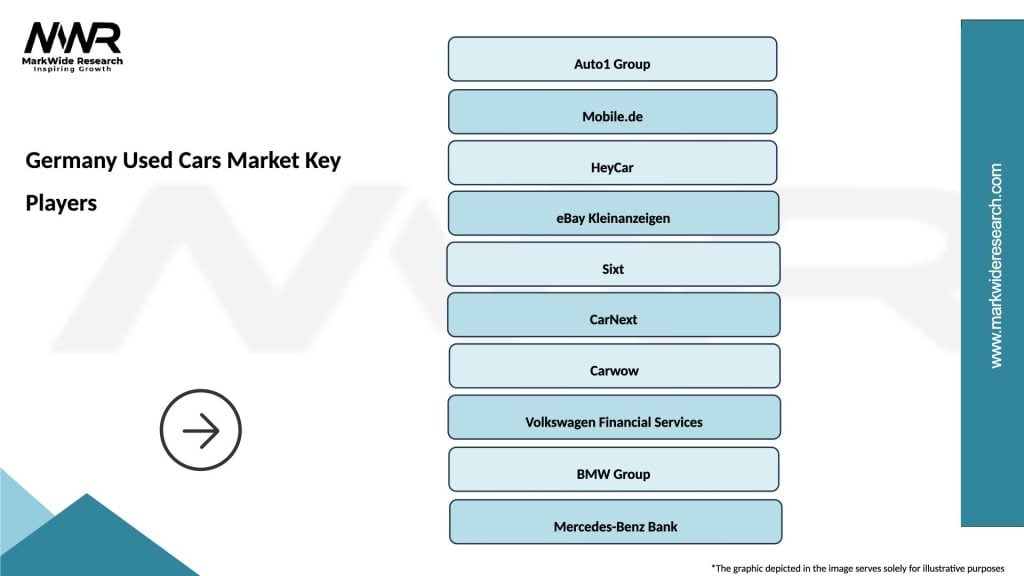

What are the key players in the Germany Used Cars Market?

Key players in the Germany Used Cars Market include AutoScout24, mobile.de, and HeyCar, which provide platforms for buying and selling used vehicles. These companies facilitate transactions and offer various services to enhance the customer experience, among others.

What are the main drivers of the Germany Used Cars Market?

The main drivers of the Germany Used Cars Market include the increasing demand for affordable transportation, the growing trend of sustainability encouraging the purchase of used vehicles, and the availability of financing options that make used cars more accessible to consumers.

What challenges does the Germany Used Cars Market face?

The Germany Used Cars Market faces challenges such as fluctuating vehicle prices, the impact of new car sales on used car availability, and regulatory changes that may affect emissions standards and vehicle inspections.

What opportunities exist in the Germany Used Cars Market?

Opportunities in the Germany Used Cars Market include the rise of online sales platforms, the potential for electric and hybrid used vehicles to attract eco-conscious consumers, and the increasing interest in certified pre-owned programs that offer warranties and quality assurances.

What trends are shaping the Germany Used Cars Market?

Trends shaping the Germany Used Cars Market include the growing popularity of digital marketplaces for buying and selling vehicles, the shift towards electric and hybrid models, and the increasing importance of vehicle history reports and transparency in transactions.

Germany Used Cars Market

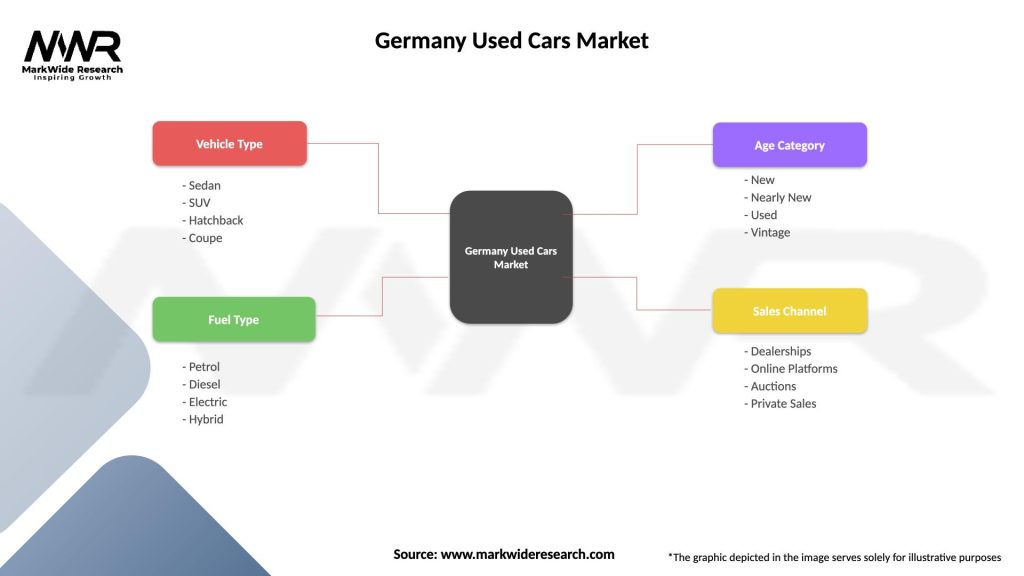

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Sedan, SUV, Hatchback, Coupe |

| Fuel Type | Petrol, Diesel, Electric, Hybrid |

| Age Category | New, Nearly New, Used, Vintage |

| Sales Channel | Dealerships, Online Platforms, Auctions, Private Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Used Cars Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at