444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Germany Travel Insurance market is a rapidly growing sector that provides financial protection to individuals against unforeseen events and risks while traveling. Travel insurance offers coverage for trip cancellation, medical expenses, baggage loss, and other travel-related emergencies. The market is driven by factors such as increasing international travel, rising awareness about travel risks, and the need for peace of mind while traveling. Travel insurance providers offer a range of policies tailored to meet the specific needs of travelers, ensuring they have a safe and secure journey.

Meaning

Travel insurance refers to a type of insurance policy that provides coverage and financial protection to individuals against risks and uncertainties while traveling. It offers reimbursement for expenses incurred due to trip cancellation or interruption, medical emergencies, baggage loss, travel delays, and other travel-related issues. Travel insurance aims to mitigate the financial burden and provide peace of mind to travelers, ensuring they are protected against unexpected events that may occur during their trip.

Executive Summary

The Germany Travel Insurance market is experiencing significant growth due to the increasing number of travelers and the growing awareness of travel risks. Travel insurance policies provide essential coverage and financial protection against a range of travel-related emergencies. The market is characterized by a wide variety of insurance providers offering different types of policies to cater to the diverse needs of travelers. The future of the Germany Travel Insurance market looks promising, with opportunities for innovation and growth driven by technological advancements, changing travel patterns, and evolving customer preferences.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

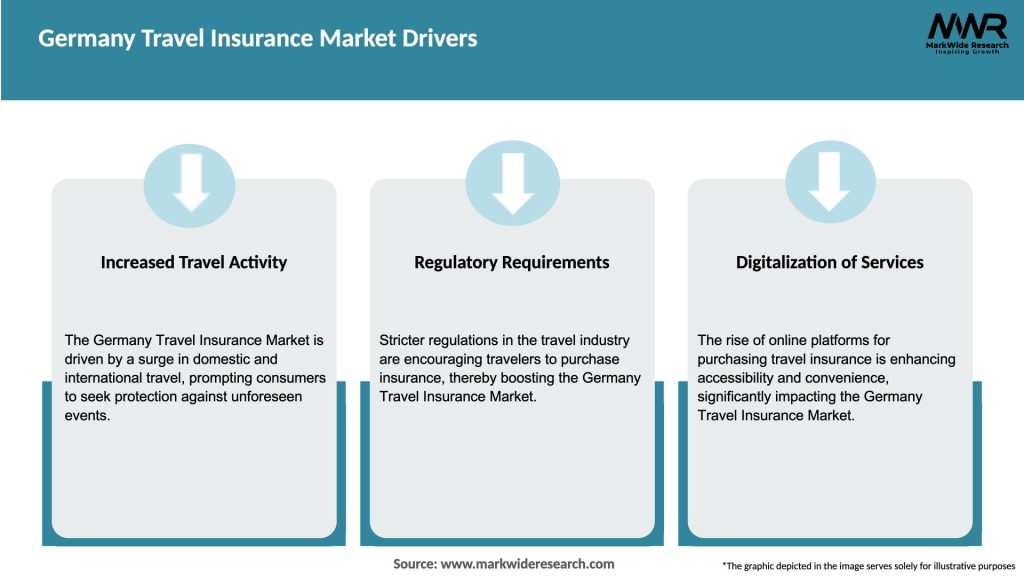

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Germany Travel Insurance market is characterized by intense competition among insurance providers, evolving customer preferences, and changing regulatory landscapes. The market dynamics are influenced by factors such as advancements in technology, shifting travel patterns, changing customer expectations, and regulatory developments.

Regional Analysis

Regional analysis of the Germany Travel Insurance market helps identify specific trends, customer preferences, and regulatory requirements in different regions of Germany. Regional variations in travel patterns, destinations, and risks influence the demand for travel insurance.

Competitive Landscape

Leading Companies in the Germany Travel Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Germany Travel Insurance market can be segmented based on various factors, including policy type, traveler type, and coverage options.

Segmenting the market based on these factors helps travel insurance providers understand specific customer needs, target the right customer segments, and tailor their policies and services accordingly.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the travel insurance industry. Travel restrictions, trip cancellations, and the heightened awareness of travel risks have led to changes in customer expectations and insurance requirements. The pandemic has highlighted the importance of travel insurance in providing coverage for medical emergencies and trip disruptions.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the Germany Travel Insurance market is optimistic, driven by the increasing number of travelers, growing awareness of travel risks, and technological advancements. The market is expected to witness innovative product offerings, personalized coverage options, and enhanced customer experiences. As travel patterns evolve and customer preferences change, travel insurance providers must adapt to emerging trends and customer needs to maintain a competitive edge.

Conclusion

The Germany Travel Insurance market offers essential financial protection and peace of mind to travelers. The market is driven by the increasing number of travelers, rising awareness of travel risks, and evolving customer expectations. Travel insurance providers offer a range of policies with customizable coverage options to meet the diverse needs of travelers. Technological advancements, collaborations with industry stakeholders, and personalized offerings are shaping the market’s future. Despite challenges such as perception barriers and lack of awareness, the Germany Travel Insurance market has significant growth potential. With the ongoing focus on customer experience, innovative product offerings, and efficient claims processing, the market is poised for continued expansion and development.

What is Travel Insurance?

Travel insurance provides coverage for unexpected events that may occur while traveling, such as trip cancellations, medical emergencies, lost luggage, and other travel-related issues. It is designed to protect travelers from financial losses and ensure peace of mind during their trips.

What are the key players in the Germany Travel Insurance Market?

Key players in the Germany Travel Insurance Market include Allianz, ERGO Group, and HanseMerkur, which offer a variety of travel insurance products tailored to different traveler needs, among others.

What are the main drivers of the Germany Travel Insurance Market?

The main drivers of the Germany Travel Insurance Market include the increasing number of international travelers, rising awareness of travel risks, and the growing demand for comprehensive travel protection among consumers.

What challenges does the Germany Travel Insurance Market face?

Challenges in the Germany Travel Insurance Market include regulatory complexities, competition from alternative insurance products, and the need for insurers to adapt to changing consumer preferences and travel behaviors.

What opportunities exist in the Germany Travel Insurance Market?

Opportunities in the Germany Travel Insurance Market include the expansion of digital insurance solutions, the rise of niche travel insurance products for specific demographics, and the potential for partnerships with travel agencies and platforms.

What trends are shaping the Germany Travel Insurance Market?

Trends shaping the Germany Travel Insurance Market include the increasing integration of technology in policy management, the rise of customizable insurance plans, and a growing focus on sustainability and eco-friendly travel options.

Germany Travel Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Single Trip, Annual Multi-Trip, Long-Stay, Backpacker |

| Customer Type | Business Travelers, Leisure Travelers, Students, Families |

| Coverage Type | Medical Expenses, Trip Cancellation, Lost Luggage, Personal Liability |

| Distribution Channel | Online Travel Agencies, Direct Sales, Insurance Brokers, Travel Agents |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Germany Travel Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at