444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany surveillance analog camera market represents a significant segment within the broader security technology landscape, demonstrating remarkable resilience and adaptation in an increasingly digital world. Analog surveillance systems continue to maintain their relevance across various sectors in Germany, driven by cost-effectiveness, reliability, and compatibility with existing infrastructure. The market has experienced steady growth, with adoption rates increasing by 12.5% annually as businesses and institutions recognize the value proposition of analog camera solutions.

Market dynamics in Germany reflect a unique blend of traditional security needs and modern technological requirements. While digital IP cameras dominate headlines, analog surveillance cameras maintain a substantial foothold, particularly in sectors requiring proven reliability and straightforward implementation. The German market’s preference for robust, long-lasting security solutions has contributed to sustained demand for analog camera systems, with market penetration reaching 38% across commercial and industrial applications.

Regional distribution across Germany shows concentrated adoption in industrial centers, with Bavaria and North Rhine-Westphalia leading in deployment rates. The market benefits from Germany’s strong manufacturing base and emphasis on security infrastructure, creating favorable conditions for analog surveillance technology growth. MarkWide Research analysis indicates that the German market’s stability and growth trajectory position it as a key European hub for analog surveillance solutions.

The Germany surveillance analog camera market refers to the comprehensive ecosystem of analog-based video surveillance technologies, systems, and services operating within German territory. This market encompasses traditional analog cameras that transmit video signals through coaxial cables to recording devices, representing a foundational technology in security infrastructure that continues to serve critical surveillance needs across diverse applications.

Analog surveillance cameras utilize continuous electrical signals to capture and transmit video footage, offering distinct advantages in terms of simplicity, cost-effectiveness, and compatibility with legacy systems. Unlike digital IP cameras, analog systems provide straightforward installation processes and reliable performance characteristics that appeal to organizations seeking proven security solutions without complex network requirements.

Market scope includes various analog camera types, from basic CCTV systems to advanced analog HD cameras, along with supporting infrastructure such as digital video recorders, monitors, and transmission equipment. The German market specifically reflects local preferences for quality engineering, regulatory compliance, and long-term reliability in security technology investments.

Strategic positioning of the Germany surveillance analog camera market reveals a mature yet evolving landscape characterized by steady demand and technological refinement. The market demonstrates resilience against digital transformation pressures, maintaining relevance through cost advantages and operational simplicity that resonate with German businesses and institutions prioritizing practical security solutions.

Key performance indicators highlight sustained growth momentum, with analog camera installations growing at 8.3% CAGR over recent years. This growth stems from diverse factors including retrofit projects, budget-conscious security upgrades, and specific applications where analog technology provides optimal performance characteristics. The market’s stability reflects Germany’s pragmatic approach to security technology adoption.

Competitive dynamics feature established manufacturers alongside emerging players, creating a balanced ecosystem that supports innovation while maintaining price competitiveness. German companies demonstrate particular strength in engineering robust analog solutions that meet stringent quality standards and regulatory requirements, contributing to the market’s overall health and sustainability.

Future trajectory suggests continued market evolution rather than decline, with analog technologies adapting to incorporate modern features while preserving core advantages. The integration of analog HD capabilities and hybrid system approaches positions the market for sustained relevance in Germany’s security landscape.

Primary market drivers encompass several interconnected factors that sustain demand for analog surveillance cameras in Germany:

Market segmentation reveals diverse application areas driving analog camera adoption, from industrial facilities requiring robust monitoring solutions to commercial establishments seeking cost-effective security coverage. The insights demonstrate that analog technology continues meeting specific market needs that digital alternatives cannot address as effectively.

Economic considerations represent the primary driving force behind analog camera market growth in Germany. Organizations across various sectors recognize the compelling value proposition offered by analog surveillance systems, particularly when balancing security requirements against budget constraints. The total cost of ownership for analog systems remains significantly lower than digital alternatives, encompassing initial equipment costs, installation expenses, and ongoing maintenance requirements.

Infrastructure advantages provide substantial momentum for market expansion, as many German facilities already possess coaxial cable networks suitable for analog camera deployment. This existing infrastructure eliminates the need for costly network upgrades required by IP camera systems, making analog solutions particularly attractive for retrofit projects and facility expansions. The compatibility factor reduces implementation timelines and minimizes disruption to ongoing operations.

Operational reliability drives continued adoption among German organizations that prioritize consistent performance over advanced features. Analog cameras demonstrate proven durability and straightforward troubleshooting procedures that align with German engineering principles emphasizing robust, maintainable systems. This reliability factor becomes particularly important in critical applications where surveillance system downtime could compromise security effectiveness.

Regulatory alignment supports market growth as analog systems readily comply with German data protection regulations and surveillance guidelines. The straightforward nature of analog technology simplifies compliance documentation and audit procedures, reducing administrative burden for organizations implementing surveillance systems. This regulatory compatibility provides confidence for businesses navigating complex legal requirements surrounding video surveillance.

Technological limitations present significant challenges for the analog camera market, particularly regarding image quality and advanced functionality expectations. Modern security requirements increasingly demand high-resolution imaging, intelligent analytics, and remote accessibility features that analog systems cannot deliver effectively. These limitations constrain market growth as organizations prioritize advanced capabilities over cost savings.

Digital transformation pressure creates headwinds for analog technology adoption as German businesses embrace comprehensive digitalization strategies. The trend toward integrated security platforms and IoT connectivity favors IP-based solutions that can seamlessly interface with broader technology ecosystems. This digital preference gradually erodes analog market share as organizations seek unified technology approaches.

Scalability constraints limit analog system expansion capabilities, particularly for large-scale surveillance deployments. The physical limitations of coaxial cable transmission and centralized recording requirements create bottlenecks that become problematic as surveillance needs grow. These scalability issues discourage organizations planning significant security infrastructure expansions from choosing analog solutions.

Future-proofing concerns influence purchasing decisions as organizations consider long-term technology viability. The perception that analog technology represents outdated infrastructure creates hesitation among decision-makers seeking sustainable security investments. This concern about technological obsolescence restrains market growth despite analog systems’ current effectiveness in specific applications.

Hybrid system integration presents substantial opportunities for analog camera market expansion through solutions that combine analog reliability with digital capabilities. German manufacturers are developing innovative approaches that leverage existing analog infrastructure while incorporating modern features such as remote monitoring and basic analytics. These hybrid solutions address market demands for advanced functionality without requiring complete system replacement.

Niche application focus offers growth potential in specialized markets where analog technology provides distinct advantages. Industrial environments with harsh conditions, electromagnetic interference concerns, or specific regulatory requirements often favor analog solutions over digital alternatives. Targeting these niche applications allows analog camera manufacturers to maintain market relevance while commanding premium pricing for specialized solutions.

Retrofit market expansion represents a significant opportunity as German businesses seek to upgrade aging surveillance systems cost-effectively. The substantial installed base of older analog systems creates ongoing demand for modern analog cameras that provide improved performance while maintaining infrastructure compatibility. This retrofit market offers steady revenue streams for manufacturers focusing on evolutionary rather than revolutionary technology improvements.

Export market development provides growth opportunities for German analog camera manufacturers leveraging their reputation for quality engineering. International markets, particularly in developing regions, continue showing strong demand for cost-effective analog surveillance solutions. German companies can capitalize on their technical expertise and quality reputation to expand beyond domestic markets and achieve sustainable growth.

Supply chain dynamics in the German analog camera market reflect a mature ecosystem with established relationships between manufacturers, distributors, and end users. The market benefits from local production capabilities that ensure consistent supply availability and support rapid response to customer requirements. German manufacturers maintain competitive advantages through engineering expertise and quality control processes that differentiate their products in global markets.

Pricing dynamics demonstrate the market’s competitive nature, with manufacturers balancing cost pressures against quality expectations. The analog camera market experiences steady pricing pressure from digital alternatives, requiring manufacturers to optimize production efficiency while maintaining product quality. Price competition has intensified as market maturity reduces differentiation opportunities, forcing companies to focus on value-added services and specialized applications.

Technology evolution within the analog camera market focuses on incremental improvements rather than revolutionary changes. Manufacturers continue enhancing image quality, durability, and integration capabilities while preserving the fundamental advantages that make analog systems attractive. This evolutionary approach maintains market relevance without disrupting the core value proposition that drives analog camera adoption.

Customer behavior patterns reveal pragmatic decision-making processes that prioritize proven performance over cutting-edge features. German customers demonstrate loyalty to analog solutions when they meet specific requirements effectively, creating stable demand patterns that support market sustainability. The market benefits from customer preferences for long-term relationships with reliable suppliers rather than frequent technology changes.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Germany surveillance analog camera market. Primary research initiatives include extensive surveys of end users, distributors, and manufacturers to gather firsthand perspectives on market trends, challenges, and opportunities. These primary data sources provide crucial insights into customer preferences, purchasing behaviors, and technology adoption patterns.

Secondary research components encompass analysis of industry publications, regulatory documents, and financial reports from key market participants. This secondary research provides historical context and validates primary research findings while identifying broader market trends and competitive dynamics. The combination of primary and secondary research methodologies ensures comprehensive market coverage and analytical depth.

Data validation processes include cross-referencing multiple sources and conducting follow-up interviews to verify key findings and resolve inconsistencies. Statistical analysis techniques ensure data accuracy and reliability while identifying significant trends and correlations within the market data. These validation procedures maintain research quality standards and support confident decision-making based on research findings.

Market modeling approaches utilize quantitative analysis techniques to project future market trends and identify growth opportunities. The research methodology incorporates economic indicators, technology adoption curves, and competitive analysis to develop realistic market forecasts. These modeling approaches provide stakeholders with actionable insights for strategic planning and investment decisions.

Bavaria region leads the German analog camera market with 28% market share, driven by strong industrial presence and manufacturing activity. The region’s concentration of automotive, aerospace, and precision manufacturing companies creates substantial demand for reliable surveillance solutions. Bavarian companies demonstrate particular preference for analog systems in production environments where electromagnetic interference and harsh conditions favor analog technology over digital alternatives.

North Rhine-Westphalia represents the second-largest regional market, accounting for 24% of national analog camera installations. The region’s industrial heritage and dense urban population create diverse surveillance requirements across manufacturing, logistics, and commercial applications. The area’s emphasis on cost-effective security solutions aligns well with analog camera value propositions, supporting sustained market growth.

Baden-Württemberg contributes 18% of the national market, reflecting the region’s technology-focused economy and quality-conscious approach to security investments. The area’s concentration of engineering companies and precision manufacturers creates demand for robust analog surveillance solutions that meet stringent performance requirements. Regional preferences for proven technology support analog camera adoption in critical applications.

Eastern German states collectively represent 15% of the analog camera market, with growth driven by infrastructure modernization and industrial development. These regions often favor cost-effective analog solutions for security upgrades, creating opportunities for market expansion. The emphasis on practical, reliable security solutions aligns with analog camera strengths in these developing markets.

Northern regions including Hamburg and Lower Saxony account for 15% of market activity, with strong demand from logistics, shipping, and industrial sectors. The regions’ focus on operational efficiency and cost management supports analog camera adoption in applications where advanced digital features are unnecessary. MWR analysis indicates continued growth potential in these pragmatic markets.

Market leadership in the German analog camera sector features a combination of established international manufacturers and specialized German companies that leverage local market knowledge and engineering expertise. The competitive environment emphasizes quality, reliability, and customer service rather than pure price competition, reflecting German market preferences for long-term value over short-term savings.

Key market participants include:

Competitive strategies focus on differentiation through quality, service, and specialized applications rather than price competition alone. German companies particularly emphasize engineering excellence and customer support to maintain market position against international competitors. The competitive landscape supports innovation while maintaining market stability through established customer relationships.

Market consolidation trends show gradual concentration as smaller players struggle to compete against larger manufacturers with comprehensive product portfolios and distribution networks. However, specialized niche players continue finding success by focusing on specific applications or customer segments where their expertise provides competitive advantages.

By Technology:

By Application:

By End User:

Traditional analog cameras maintain the largest market segment, representing 52% of total installations due to their proven reliability and cost-effectiveness. These systems continue serving applications where basic surveillance coverage meets security requirements without need for advanced features. The segment benefits from established supply chains and widespread technical expertise among installation professionals.

Analog HD cameras represent the fastest-growing segment with 22% annual growth rates as organizations seek improved image quality while preserving analog infrastructure investments. These systems provide resolution improvements comparable to early IP cameras while maintaining analog system advantages. The segment attracts customers seeking performance upgrades without complete system replacement.

Industrial applications dominate market demand, accounting for 45% of analog camera installations across German manufacturing and production facilities. Industrial environments favor analog systems due to electromagnetic interference resistance, harsh condition durability, and straightforward maintenance requirements. This segment provides stable demand patterns supporting market sustainability.

Commercial security applications represent 32% of market activity, driven by small and medium enterprises seeking affordable surveillance solutions. These customers prioritize cost-effectiveness and operational simplicity over advanced features, making analog cameras ideal for their security requirements. The segment demonstrates steady growth as businesses recognize security investment importance.

Retrofit installations constitute 38% of market activity as organizations upgrade aging surveillance systems while preserving existing infrastructure. This category provides significant opportunities for analog camera manufacturers as customers seek improved performance without extensive rewiring projects. The retrofit market supports sustained demand for analog solutions.

Manufacturers benefit from stable market demand and established customer relationships that provide predictable revenue streams and long-term business sustainability. The analog camera market offers opportunities for companies to leverage existing manufacturing capabilities while developing specialized solutions for niche applications. German manufacturers particularly benefit from quality reputation and engineering expertise that command premium pricing in domestic and export markets.

Distributors and integrators gain advantages from analog systems’ straightforward installation and maintenance requirements that reduce technical complexity and training needs. The established technology base allows distribution partners to offer comprehensive solutions with confidence while maintaining healthy profit margins. The market’s stability provides reliable business opportunities for channel partners.

End users receive significant value through cost-effective security solutions that meet surveillance requirements without unnecessary complexity or expense. Analog cameras provide reliable performance with minimal ongoing maintenance requirements, reducing total cost of ownership over system lifecycle. The technology’s maturity ensures stable operation and readily available technical support.

Technology partners find opportunities to develop complementary products and services that enhance analog system capabilities without requiring complete technology replacement. Integration opportunities with digital recording systems, remote monitoring platforms, and analytics software create additional revenue streams while extending analog system lifecycle and value.

Service providers benefit from ongoing maintenance and support opportunities that generate recurring revenue streams. The established analog technology base creates steady demand for installation, maintenance, and upgrade services that support sustainable service business models.

Strengths:

Weaknesses:

Opportunities:

Threats:

Analog HD adoption represents the most significant trend transforming the German surveillance analog camera market, with adoption rates increasing 35% annually as organizations seek improved image quality while preserving analog infrastructure investments. This trend bridges the gap between traditional analog limitations and modern surveillance requirements, providing enhanced resolution capabilities through existing coaxial cable networks.

Hybrid system integration emerges as a crucial trend enabling analog cameras to interface with digital recording and monitoring platforms. German companies increasingly implement solutions that combine analog camera reliability with digital system advantages, creating comprehensive surveillance platforms that maximize existing infrastructure value while incorporating modern capabilities.

Cost optimization focus drives continued analog camera adoption as German businesses prioritize security investment efficiency over advanced features. This trend particularly benefits small and medium enterprises seeking effective surveillance coverage within budget constraints, supporting sustained market demand for cost-effective analog solutions.

Specialized application targeting shows manufacturers focusing on niche markets where analog technology provides distinct advantages over digital alternatives. Industrial environments, harsh condition applications, and electromagnetic interference-sensitive locations increasingly favor analog solutions, creating specialized market segments with premium pricing opportunities.

Service-centric business models evolve as manufacturers and distributors emphasize ongoing support and maintenance services rather than pure equipment sales. This trend creates recurring revenue opportunities while strengthening customer relationships through comprehensive service offerings that extend analog system lifecycle and performance.

Technology advancement initiatives by German manufacturers focus on enhancing analog camera capabilities while preserving core advantages that drive market adoption. Recent developments include improved low-light performance, enhanced durability features, and integration capabilities that extend analog system functionality without compromising reliability or cost-effectiveness.

Strategic partnerships between analog camera manufacturers and digital technology providers create hybrid solutions that combine analog reliability with modern monitoring capabilities. These collaborations enable comprehensive surveillance platforms that leverage existing analog infrastructure while incorporating remote access, basic analytics, and digital recording features.

Market consolidation activities include acquisitions and mergers among analog camera manufacturers seeking to strengthen market position and expand product portfolios. These developments create larger, more competitive companies capable of investing in technology advancement while maintaining cost competitiveness in mature markets.

Regulatory compliance enhancements address evolving German data protection and surveillance requirements through improved analog system features and documentation. Manufacturers develop solutions that simplify compliance procedures while maintaining analog technology advantages, ensuring continued market viability under changing regulatory environments.

Export market expansion by German analog camera manufacturers targets international markets seeking reliable, cost-effective surveillance solutions. These initiatives leverage German engineering reputation and quality standards to capture market share in developing regions where analog technology remains highly relevant and competitive.

Strategic positioning recommendations emphasize focusing on analog technology strengths rather than competing directly with digital alternatives. MarkWide Research analysis suggests that manufacturers should target applications where analog advantages provide clear value propositions, including cost-sensitive installations, harsh environments, and retrofit projects requiring infrastructure compatibility.

Product development priorities should concentrate on evolutionary improvements that enhance analog camera performance while preserving core advantages. Analysts recommend investing in analog HD technology, durability enhancements, and integration capabilities that extend system lifecycle and customer value without compromising cost-effectiveness or operational simplicity.

Market segmentation strategies should identify and target niche applications where analog technology provides superior solutions compared to digital alternatives. Specialized markets including industrial surveillance, harsh environment monitoring, and electromagnetic interference-sensitive applications offer opportunities for premium pricing and sustainable competitive advantages.

Partnership development with digital technology providers creates opportunities to offer hybrid solutions that combine analog reliability with modern monitoring capabilities. These partnerships enable comprehensive surveillance platforms that maximize customer infrastructure investments while incorporating advanced features that enhance system value and competitiveness.

Service business expansion provides opportunities for recurring revenue generation and stronger customer relationships through comprehensive support offerings. Analysts suggest developing service-centric business models that emphasize ongoing maintenance, system optimization, and upgrade services that extend analog system lifecycle and customer satisfaction.

Market sustainability projections indicate continued viability for the German surveillance analog camera market through focused positioning and strategic adaptation. The market is expected to maintain steady growth rates of 6.2% CAGR over the next five years, driven by cost-conscious security investments and specialized applications where analog technology provides optimal solutions.

Technology evolution will likely focus on incremental improvements rather than revolutionary changes, with analog HD systems gaining market share as organizations seek enhanced performance while preserving infrastructure investments. The integration of analog cameras with digital recording and monitoring platforms will create hybrid solutions that extend market relevance and customer value.

Application diversification presents opportunities for market expansion into specialized sectors where analog technology advantages outweigh digital alternatives. Industrial surveillance, harsh environment monitoring, and cost-sensitive installations will continue driving demand for reliable analog solutions that meet specific performance requirements effectively.

Competitive dynamics will emphasize differentiation through quality, service, and specialized capabilities rather than price competition alone. German manufacturers are expected to maintain market leadership through engineering excellence and customer support while expanding into international markets seeking proven surveillance solutions.

Long-term viability depends on successful adaptation to changing market requirements while preserving analog technology’s core advantages. The market’s future success will rely on strategic positioning in applications where analog solutions provide superior value propositions compared to digital alternatives, ensuring sustained relevance in Germany’s evolving security landscape.

The Germany surveillance analog camera market demonstrates remarkable resilience and strategic positioning within the broader security technology landscape, maintaining relevance through focused applications and cost-effective solutions. Despite digital transformation pressures, analog surveillance systems continue providing substantial value for German organizations seeking reliable, straightforward security coverage without unnecessary complexity or expense.

Market fundamentals remain strong, supported by established infrastructure compatibility, proven reliability, and compelling cost advantages that resonate with pragmatic German business approaches. The market’s evolution toward analog HD systems and hybrid integration demonstrates successful adaptation to changing requirements while preserving core technology advantages that drive sustained adoption.

Strategic opportunities exist for manufacturers and stakeholders who recognize analog technology’s continued relevance in specialized applications and cost-sensitive installations. The market’s future success depends on strategic positioning that emphasizes analog strengths rather than attempting to compete directly with digital alternatives in inappropriate applications.

The Germany surveillance analog camera market represents a mature yet evolving sector that will continue serving critical security needs through focused positioning, strategic partnerships, and ongoing technology refinement. Organizations seeking cost-effective, reliable surveillance solutions will continue finding value in analog systems that meet their specific requirements effectively and efficiently.

What is Surveillance Analog Camera?

Surveillance Analog Camera refers to a type of video camera that transmits video signals over coaxial cables to a digital video recorder or monitor. These cameras are commonly used for security and surveillance purposes in various settings, including retail, transportation, and public spaces.

What are the key players in the Germany Surveillance Analog Camera Market?

Key players in the Germany Surveillance Analog Camera Market include companies like Bosch Security Systems, Hikvision, and Dahua Technology, which are known for their innovative surveillance solutions and extensive product ranges, among others.

What are the growth factors driving the Germany Surveillance Analog Camera Market?

The growth of the Germany Surveillance Analog Camera Market is driven by increasing security concerns, advancements in camera technology, and the rising demand for surveillance in sectors such as retail, transportation, and critical infrastructure.

What challenges does the Germany Surveillance Analog Camera Market face?

Challenges in the Germany Surveillance Analog Camera Market include concerns over privacy and data protection, the high cost of installation and maintenance, and competition from newer digital surveillance technologies.

What opportunities exist in the Germany Surveillance Analog Camera Market?

Opportunities in the Germany Surveillance Analog Camera Market include the integration of artificial intelligence for enhanced analytics, the growing trend of smart cities, and the increasing adoption of surveillance solutions in residential areas.

What trends are shaping the Germany Surveillance Analog Camera Market?

Trends in the Germany Surveillance Analog Camera Market include the shift towards high-definition video quality, the use of cloud storage for video data, and the increasing demand for remote monitoring capabilities.

Germany Surveillance Analog Camera Market

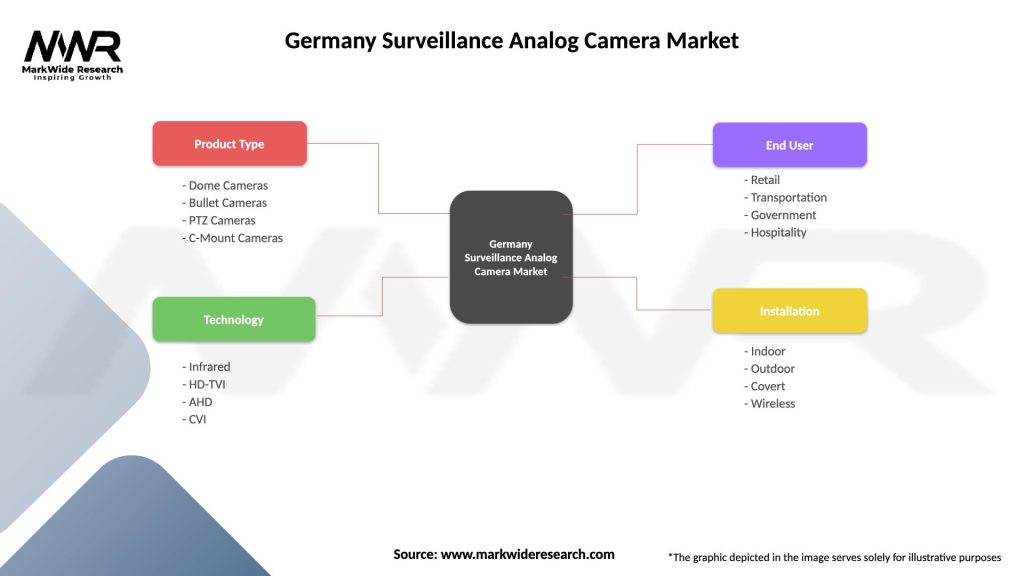

| Segmentation Details | Description |

|---|---|

| Product Type | Dome Cameras, Bullet Cameras, PTZ Cameras, C-Mount Cameras |

| Technology | Infrared, HD-TVI, AHD, CVI |

| End User | Retail, Transportation, Government, Hospitality |

| Installation | Indoor, Outdoor, Covert, Wireless |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Surveillance Analog Camera Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at