444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany sport nutrition market represents one of Europe’s most dynamic and rapidly expanding sectors within the broader health and wellness industry. Germany’s commitment to fitness culture, combined with increasing health consciousness among consumers, has positioned the nation as a leading market for sports nutrition products across the continent. The market encompasses a comprehensive range of products including protein supplements, energy drinks, pre-workout formulations, recovery products, and specialized nutritional solutions designed for athletes and fitness enthusiasts.

Market dynamics in Germany reflect a sophisticated consumer base that prioritizes quality, scientific backing, and ingredient transparency. The German sports nutrition landscape is characterized by strong regulatory frameworks, premium product positioning, and a growing emphasis on natural and organic formulations. Consumer preferences have evolved significantly, with increasing demand for plant-based proteins, clean-label products, and personalized nutrition solutions tailored to specific fitness goals and dietary requirements.

Growth trajectories indicate robust expansion driven by rising participation in fitness activities, growing awareness of nutritional supplementation benefits, and increasing disposable income among health-conscious consumers. The market demonstrates particularly strong performance in urban areas where fitness culture is deeply embedded in lifestyle choices. Digital transformation has also played a crucial role, with e-commerce platforms and direct-to-consumer brands gaining significant market share at approximately 28% annual growth in online sales channels.

The Germany sport nutrition market refers to the comprehensive ecosystem of nutritional products, supplements, and functional foods specifically designed to enhance athletic performance, support fitness goals, and optimize recovery processes for both professional athletes and recreational fitness enthusiasts. This market encompasses a diverse portfolio of products including protein powders, amino acid supplements, creatine formulations, energy bars, sports drinks, pre-workout supplements, and specialized recovery products.

Market definition extends beyond traditional supplementation to include functional foods, meal replacement products, and innovative delivery systems such as ready-to-drink beverages, gels, and convenient on-the-go formats. The German market is particularly characterized by stringent quality standards, comprehensive regulatory compliance, and consumer demand for scientifically validated products with transparent ingredient profiles and clear labeling.

Industry scope covers multiple distribution channels including specialty nutrition stores, fitness centers, pharmacies, supermarkets, and increasingly prominent online platforms. The market serves diverse consumer segments ranging from professional athletes and bodybuilders to weekend warriors, fitness enthusiasts, and health-conscious individuals seeking nutritional support for active lifestyles.

Germany’s sport nutrition market demonstrates exceptional growth momentum driven by fundamental shifts in consumer behavior, lifestyle preferences, and health awareness. The market has experienced consistent expansion with growth rates reaching 8.2% CAGR over recent years, positioning Germany as a key European hub for sports nutrition innovation and consumption.

Key market drivers include increasing fitness participation rates, growing awareness of nutritional supplementation benefits, rising disposable income, and expanding retail distribution networks. The market benefits from Germany’s strong manufacturing capabilities, robust regulatory framework, and sophisticated consumer base that values quality and scientific validation. Product innovation continues to drive market expansion with companies investing heavily in research and development to create advanced formulations addressing specific performance and health objectives.

Competitive landscape features a mix of international brands, domestic manufacturers, and emerging direct-to-consumer companies. Market leaders focus on product differentiation through premium ingredients, scientific backing, and targeted marketing strategies. Distribution channels have evolved significantly with online sales capturing approximately 35% market share and continuing to grow rapidly as consumers embrace digital shopping experiences and subscription-based purchasing models.

Future prospects remain highly positive with continued market expansion expected across all major product categories. The market is positioned to benefit from ongoing trends including personalized nutrition, plant-based formulations, sustainable packaging, and integration of technology in product development and consumer engagement strategies.

Consumer behavior analysis reveals significant shifts in purchasing patterns and product preferences within the German sports nutrition market. Modern consumers demonstrate increased sophistication in product selection, prioritizing ingredient quality, scientific validation, and brand transparency over price considerations alone.

Market maturation indicators suggest evolution from basic supplementation toward sophisticated nutritional strategies incorporating timing, dosage optimization, and synergistic ingredient combinations. This sophistication drives premium product adoption and supports sustained market growth across multiple consumer segments.

Primary growth drivers propelling the Germany sport nutrition market encompass demographic, lifestyle, and economic factors that create favorable conditions for sustained expansion. The convergence of health consciousness, fitness culture adoption, and disposable income growth establishes a robust foundation for market development.

Fitness culture proliferation represents the most significant driver with gym memberships and fitness activity participation reaching record levels across Germany. The integration of fitness into daily routines, supported by corporate wellness programs and government health initiatives, creates consistent demand for nutritional supplementation. Demographic trends show increasing participation across age groups, with particular growth among older adults seeking active aging solutions and younger consumers embracing fitness as lifestyle choice.

Health awareness elevation drives consumer interest in preventive nutrition and performance optimization. Growing understanding of nutrition’s role in fitness outcomes, recovery, and overall health motivates supplement adoption. Scientific research validation of sports nutrition benefits provides credibility and confidence for consumer purchasing decisions, particularly in Germany’s evidence-based consumer culture.

Economic prosperity enables discretionary spending on health and fitness products. Rising disposable income levels support premium product adoption and frequent purchase patterns. Urbanization trends concentrate health-conscious consumers in metropolitan areas with established fitness infrastructure and retail accessibility.

Digital transformation facilitates market access through e-commerce platforms, social media marketing, and direct-to-consumer brands. Online education and information sharing increase product awareness and purchasing confidence among consumers seeking nutritional solutions.

Regulatory complexity presents significant challenges for market participants navigating Germany’s stringent supplement regulations and European Union compliance requirements. Approval processes for new ingredients and health claims create barriers to innovation and market entry, particularly for smaller companies lacking regulatory expertise and resources.

Price sensitivity among certain consumer segments limits market penetration, especially for premium products requiring significant investment. Economic uncertainties and inflation pressures may impact discretionary spending on sports nutrition products. Competition intensity from established brands creates challenges for new market entrants seeking to establish market presence and consumer recognition.

Consumer skepticism regarding supplement efficacy and safety concerns may limit adoption among potential users. Negative publicity surrounding certain ingredients or products can impact overall market confidence. Information overload from conflicting nutritional advice and marketing claims may confuse consumers and delay purchasing decisions.

Distribution challenges include limited shelf space in traditional retail channels and high competition for premium positioning. Supply chain disruptions and ingredient sourcing difficulties can impact product availability and pricing stability, particularly for specialized or imported ingredients.

Seasonal fluctuations in fitness activity and supplement consumption create revenue variability for market participants. Cultural barriers among traditional consumers who prefer whole food nutrition over supplementation may limit market expansion in certain demographic segments.

Emerging opportunities within the Germany sport nutrition market reflect evolving consumer needs, technological advancement, and market gaps that present significant growth potential for innovative companies and products. These opportunities span product development, distribution channels, and consumer engagement strategies.

Personalized nutrition represents the most promising opportunity with advancing technology enabling customized supplement formulations based on individual genetic profiles, fitness goals, and dietary preferences. Digital integration through mobile apps, wearable devices, and AI-driven recommendations creates new engagement models and subscription-based revenue streams.

Plant-based expansion offers substantial growth potential as consumers increasingly adopt vegetarian and vegan lifestyles. The development of high-quality plant protein sources and innovative formulations addresses this growing market segment. Sustainable packaging initiatives align with environmental consciousness and create competitive differentiation opportunities.

Female market development presents significant untapped potential with targeted product formulations addressing women’s specific nutritional needs and fitness goals. Age-specific products for older adults seeking active aging solutions represent another underserved segment with substantial growth prospects.

Functional food integration creates opportunities for sports nutrition benefits in everyday food products, expanding market reach beyond traditional supplement consumers. Professional partnerships with fitness centers, sports teams, and healthcare providers offer new distribution channels and credibility enhancement.

Export opportunities leverage Germany’s reputation for quality manufacturing to serve neighboring European markets and establish international presence for domestic brands.

Market dynamics in the Germany sport nutrition sector reflect complex interactions between supply-side factors, demand-side influences, and regulatory environment changes that shape competitive landscape and growth trajectories. Dynamic equilibrium between innovation, consumer preferences, and market competition drives continuous evolution in product offerings and business strategies.

Supply chain optimization has become increasingly critical with companies investing in vertical integration, strategic partnerships, and alternative sourcing strategies to ensure ingredient quality and availability. Manufacturing capabilities within Germany provide competitive advantages through quality control, regulatory compliance, and reduced logistics costs for domestic distribution.

Consumer education plays a pivotal role in market dynamics with companies investing heavily in content marketing, scientific research communication, and professional endorsements to build credibility and drive adoption. Brand loyalty development requires consistent quality delivery, transparent communication, and ongoing innovation to maintain competitive positioning.

Pricing strategies reflect premium positioning trends with consumers demonstrating willingness to pay higher prices for proven quality and efficacy. Value proposition emphasis shifts from cost competition toward benefit delivery and outcome achievement, supporting sustainable profit margins for quality-focused companies.

Technology integration transforms market dynamics through e-commerce platforms, digital marketing, and data analytics capabilities that enable targeted consumer engagement and personalized product recommendations. Innovation cycles accelerate with companies launching new products at increasing frequency to maintain market relevance and consumer interest.

Comprehensive research methodology employed in analyzing the Germany sport nutrition market incorporates multiple data sources, analytical frameworks, and validation processes to ensure accuracy and reliability of market insights. Primary research components include consumer surveys, industry expert interviews, and stakeholder consultations providing firsthand market intelligence and trend identification.

Secondary research encompasses extensive analysis of industry reports, company financial statements, regulatory filings, and academic publications to establish market context and historical trends. Data triangulation methods validate findings across multiple sources ensuring consistency and reliability of market assessments and projections.

Quantitative analysis utilizes statistical modeling, trend analysis, and market sizing methodologies to establish growth rates, market share distributions, and forecasting models. Qualitative insights derive from expert interviews, focus groups, and observational research providing context and explanation for quantitative findings.

Market segmentation analysis employs demographic, psychographic, and behavioral criteria to identify distinct consumer groups and their specific needs, preferences, and purchasing patterns. Competitive intelligence gathering includes product analysis, pricing studies, and strategic assessment of key market participants.

Validation processes include peer review, expert consultation, and cross-reference verification to ensure accuracy and credibility of research findings. Continuous monitoring systems track market developments and update analysis to reflect current market conditions and emerging trends.

Regional distribution within Germany’s sport nutrition market reveals significant variations in consumption patterns, product preferences, and growth rates across different geographic areas. Urban concentration dominates market activity with major metropolitan areas including Berlin, Munich, Hamburg, and Frankfurt accounting for approximately 58% of total market consumption.

Northern Germany demonstrates strong market presence driven by Hamburg’s commercial significance and coastal lifestyle preferences emphasizing outdoor activities and fitness culture. The region shows particular strength in endurance sports nutrition and marine-based protein products. Consumer preferences lean toward premium products with emphasis on sustainability and environmental responsibility.

Southern Germany leads market growth with Munich and surrounding areas showing the highest per-capita consumption rates. The region benefits from higher disposable income levels, strong fitness culture, and proximity to Alpine sports activities. Bavaria’s market shows particular strength in traditional sports nutrition categories with growing interest in organic and natural formulations.

Western Germany including the Rhine-Ruhr metropolitan region represents the largest consumer base with diverse demographic profiles and established retail infrastructure. Industrial heritage supports strong manufacturing presence and supply chain capabilities for sports nutrition companies.

Eastern Germany shows the fastest growth rates as fitness culture adoption accelerates and disposable income levels rise. The region presents significant expansion opportunities for market participants seeking to establish presence in developing markets with growing consumer sophistication.

Rural areas demonstrate increasing market participation driven by online retail accessibility and growing health consciousness among non-urban populations seeking convenient nutrition solutions.

Competitive dynamics in the Germany sport nutrition market feature a diverse ecosystem of international corporations, domestic manufacturers, and emerging direct-to-consumer brands competing across multiple product categories and distribution channels. Market leadership positions are established through brand recognition, product quality, distribution reach, and consumer loyalty development.

Competitive strategies emphasize product differentiation through ingredient innovation, scientific validation, and targeted marketing approaches. Brand positioning varies from mass market accessibility to premium specialization, with successful companies developing clear value propositions aligned with specific consumer segments.

Innovation leadership drives competitive advantage through new product development, formulation improvements, and delivery system advancement. Companies invest significantly in research and development to maintain technological leadership and consumer interest.

Market segmentation within the Germany sport nutrition market reveals distinct consumer groups, product categories, and distribution channels that require tailored strategies and specialized approaches. Segmentation analysis provides critical insights for market participants seeking to optimize product development, marketing strategies, and resource allocation.

By Product Type:

By Consumer Type:

By Distribution Channel:

Protein supplements maintain market dominance with consistent growth driven by widespread adoption across diverse consumer segments. Whey protein continues as the preferred choice for most consumers, while plant-based alternatives show rapid growth at approximately 26% annual expansion reflecting dietary trend adoption and environmental consciousness.

Pre-workout categories demonstrate strong performance with consumers seeking energy enhancement and focus improvement for training sessions. Innovation focus emphasizes natural stimulants, cognitive enhancement ingredients, and improved taste profiles to attract broader consumer adoption beyond hardcore fitness enthusiasts.

Recovery products gain increasing recognition as consumers understand the importance of post-exercise nutrition for optimal results. Amino acid supplements particularly BCAA and EAA formulations show consistent growth with consumers seeking targeted recovery support and muscle preservation benefits.

Energy products evolve beyond traditional sports drinks toward sophisticated formulations addressing specific activity requirements. Convenience formats including ready-to-drink beverages and portable energy solutions gain popularity among time-conscious consumers seeking practical nutrition support.

Weight management products experience steady demand with consumers seeking comprehensive solutions combining fat burning, appetite control, and metabolic support. Natural formulations gain preference over synthetic alternatives as consumers prioritize ingredient safety and long-term health considerations.

Specialized categories including joint health, immune support, and cognitive enhancement supplements emerge as growth opportunities addressing holistic wellness needs beyond traditional performance enhancement.

Market participants in the Germany sport nutrition sector enjoy numerous strategic advantages and growth opportunities that support sustainable business development and competitive positioning. Stakeholder benefits extend across manufacturers, retailers, distributors, and service providers within the sports nutrition ecosystem.

Manufacturers benefit from Germany’s sophisticated consumer base that values quality and scientific validation, supporting premium pricing strategies and brand loyalty development. Regulatory environment provides clear guidelines and consumer confidence while protecting legitimate businesses from unfair competition through quality standards enforcement.

Retailers gain from consistent consumer demand and high-margin product categories that drive profitability and customer traffic. Cross-selling opportunities with fitness equipment, apparel, and related products create comprehensive revenue streams and enhanced customer lifetime value.

Distributors enjoy stable demand patterns and growing market size that support business expansion and investment in infrastructure improvements. Logistics optimization opportunities reduce costs and improve service levels through efficient supply chain management.

Consumers receive access to high-quality products, transparent labeling, and scientific validation that support fitness goals and health objectives. Product innovation provides continuously improving solutions addressing evolving needs and preferences.

Healthcare professionals benefit from evidence-based products that support patient wellness goals and complement medical treatment plans. Research institutions gain opportunities for collaboration and funding through industry partnerships focused on nutritional science advancement.

Economic benefits include job creation, tax revenue generation, and export opportunities that contribute to Germany’s economic growth and international competitiveness in the health and wellness sector.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends within the Germany sport nutrition market reflect evolving consumer preferences, technological advancement, and industry innovation that shape future market development. Trend analysis reveals fundamental shifts in product development, marketing strategies, and consumer engagement approaches.

Clean label movement dominates product development with consumers demanding transparent ingredient lists, minimal processing, and natural formulations. Ingredient sourcing transparency becomes critical with consumers seeking information about origin, sustainability, and ethical production practices.

Personalization revolution transforms product offerings through customized formulations based on individual genetic profiles, fitness goals, and dietary preferences. Technology integration enables personalized recommendations through mobile apps, wearable device data, and AI-driven analysis.

Plant-based expansion accelerates with innovative protein sources including pea, hemp, rice, and novel plant proteins addressing environmental concerns and dietary preferences. Sustainability focus extends beyond ingredients to packaging, manufacturing processes, and corporate responsibility initiatives.

Functional food integration blurs lines between traditional supplements and everyday food products with sports nutrition benefits incorporated into snacks, beverages, and meal components. Convenience emphasis drives development of ready-to-consume formats and on-the-go solutions.

Female-focused products gain prominence with formulations addressing women’s specific nutritional needs, hormonal considerations, and fitness goals. Age-specific solutions target different life stages from youth sports nutrition to active aging support.

Scientific validation becomes increasingly important with consumers seeking evidence-based products supported by clinical research and third-party testing for purity and potency verification.

Recent industry developments in the Germany sport nutrition market demonstrate accelerating innovation, strategic partnerships, and market expansion initiatives that reshape competitive dynamics and growth trajectories. Development tracking reveals significant investments in technology, product innovation, and market expansion strategies.

Product launches focus on advanced formulations incorporating cutting-edge ingredients, improved bioavailability, and enhanced taste profiles. Innovation emphasis includes sustained-release technologies, synergistic ingredient combinations, and novel delivery systems addressing specific consumer needs and preferences.

Strategic acquisitions consolidate market position with larger companies acquiring innovative brands, specialized manufacturers, and direct-to-consumer companies to expand product portfolios and market reach. Partnership development includes collaborations with fitness centers, sports teams, and healthcare providers to establish credibility and distribution channels.

Digital transformation initiatives include e-commerce platform development, mobile app launches, and social media marketing strategies targeting younger consumer demographics. Technology integration encompasses personalization algorithms, subscription services, and data analytics capabilities for improved customer engagement.

Sustainability initiatives address environmental concerns through eco-friendly packaging, carbon-neutral manufacturing, and sustainable ingredient sourcing. Regulatory compliance improvements ensure adherence to evolving standards and consumer safety requirements.

Market expansion activities include new product category development, geographic expansion within Germany, and international market entry strategies leveraging German quality reputation and manufacturing capabilities.

Strategic recommendations for market participants in the Germany sport nutrition sector emphasize innovation, differentiation, and consumer-centric approaches that support sustainable growth and competitive advantage. MarkWide Research analysis indicates several critical success factors for market participants seeking to optimize performance and market position.

Product development focus should prioritize clean label formulations, personalized nutrition solutions, and plant-based alternatives addressing evolving consumer preferences. Innovation investment in research and development capabilities ensures competitive positioning and market relevance in rapidly evolving market conditions.

Digital transformation represents essential investment area with e-commerce capabilities, data analytics, and customer relationship management systems supporting direct consumer engagement and market intelligence gathering. Omnichannel strategies integrate online and offline touchpoints for seamless customer experience and maximum market reach.

Brand building through scientific validation, transparency, and consumer education establishes credibility and loyalty in competitive market environment. Partnership development with fitness professionals, healthcare providers, and influencers enhances credibility and expands market reach through trusted recommendations.

Supply chain optimization ensures ingredient quality, cost management, and availability stability while supporting sustainability initiatives and regulatory compliance. Quality assurance systems maintain product integrity and consumer confidence through comprehensive testing and certification processes.

Market segmentation strategies should address specific consumer groups with targeted products, marketing messages, and distribution approaches optimized for each segment’s unique needs and preferences.

Future prospects for the Germany sport nutrition market remain highly positive with continued growth expected across all major product categories and consumer segments. Market evolution will be driven by technological advancement, consumer sophistication, and ongoing health consciousness trends that support sustained demand for high-quality sports nutrition products.

Growth projections indicate continued expansion with market growth rates expected to maintain 7.5% CAGR over the forecast period, driven by increasing fitness participation, product innovation, and expanding consumer base. Premium segment growth will outpace overall market expansion as consumers prioritize quality and efficacy over price considerations.

Technology integration will transform market dynamics through personalized nutrition solutions, AI-driven recommendations, and connected fitness ecosystems that provide comprehensive health and performance optimization. Digital platforms will capture increasing market share with online sales projected to reach 45% of total market within the forecast period.

Product innovation will focus on advanced formulations, novel ingredients, and improved delivery systems addressing specific performance goals and health objectives. Sustainability initiatives will become competitive differentiators with environmentally conscious consumers driving demand for eco-friendly products and packaging.

Market expansion opportunities include underserved demographic segments, emerging product categories, and international export potential leveraging Germany’s quality reputation. Regulatory evolution may create new opportunities for innovative ingredients and health claims while maintaining consumer safety standards.

Competitive landscape will continue evolving with new entrants, strategic partnerships, and consolidation activities reshaping market structure and competitive dynamics throughout the forecast period.

The Germany sport nutrition market represents a dynamic and rapidly expanding sector with exceptional growth prospects driven by fundamental shifts in consumer behavior, lifestyle preferences, and health consciousness. Market analysis reveals a sophisticated ecosystem characterized by premium product positioning, innovation leadership, and strong regulatory frameworks that support sustainable growth and consumer confidence.

Key success factors include product quality, scientific validation, brand credibility, and consumer-centric approaches that address evolving needs and preferences. The market benefits from Germany’s strong economic conditions, established fitness culture, and sophisticated consumer base that values quality and efficacy over price considerations alone.

Future opportunities encompass personalized nutrition solutions, plant-based product development, digital transformation, and market expansion initiatives that leverage technological advancement and changing consumer preferences. Strategic positioning through innovation, differentiation, and targeted marketing approaches will determine competitive success in this rapidly evolving market environment.

Market participants who invest in research and development, embrace digital transformation, and maintain focus on consumer needs will be best positioned to capitalize on growth opportunities and achieve sustainable competitive advantage in the Germany sport nutrition market. The convergence of health consciousness, technological advancement, and economic prosperity creates an exceptionally favorable environment for continued market expansion and industry development.

What is Sport Nutrition?

Sport Nutrition refers to the dietary practices and products designed to enhance athletic performance, recovery, and overall health for athletes and active individuals. It encompasses a range of products including protein supplements, energy bars, and hydration solutions tailored for various sports and fitness activities.

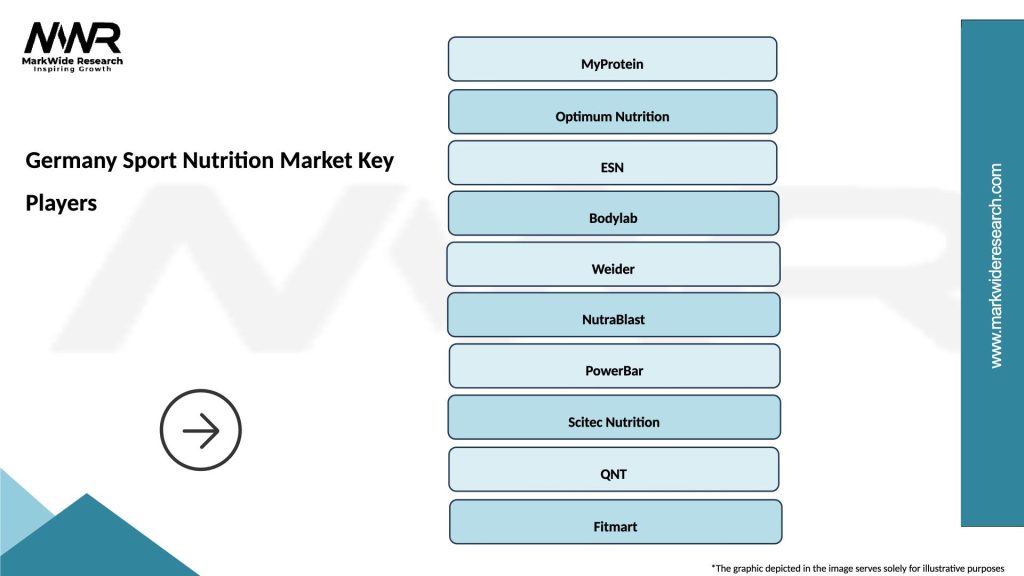

What are the key players in the Germany Sport Nutrition Market?

Key players in the Germany Sport Nutrition Market include companies like MyProtein, Optimum Nutrition, and ESN. These companies offer a variety of products aimed at athletes and fitness enthusiasts, focusing on quality and innovation among others.

What are the growth factors driving the Germany Sport Nutrition Market?

The Germany Sport Nutrition Market is driven by increasing health consciousness among consumers, a growing trend in fitness and sports participation, and the rising demand for convenient nutrition solutions. Additionally, the influence of social media on fitness trends plays a significant role.

What challenges does the Germany Sport Nutrition Market face?

Challenges in the Germany Sport Nutrition Market include regulatory hurdles regarding product labeling and health claims, as well as competition from unregulated supplements. Consumer skepticism about product efficacy and safety also poses a challenge.

What opportunities exist in the Germany Sport Nutrition Market?

Opportunities in the Germany Sport Nutrition Market include the potential for product innovation, such as plant-based and organic supplements, and the expansion of e-commerce platforms for better consumer access. Additionally, targeting niche markets like vegan athletes presents growth potential.

What trends are shaping the Germany Sport Nutrition Market?

Trends in the Germany Sport Nutrition Market include a shift towards clean label products, increased interest in personalized nutrition, and the incorporation of technology in product development. There is also a growing focus on sustainability and ethical sourcing in product ingredients.

Germany Sport Nutrition Market

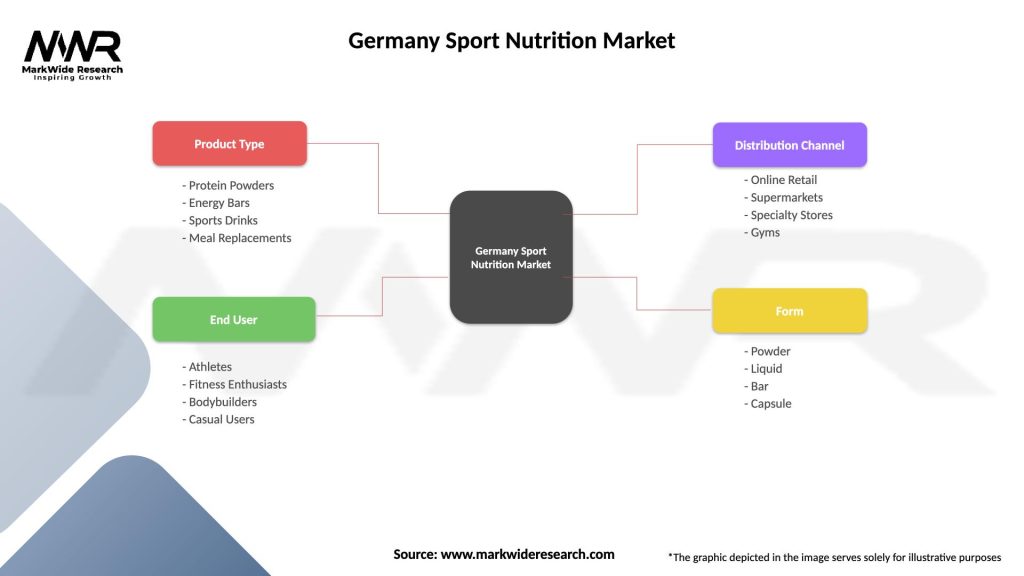

| Segmentation Details | Description |

|---|---|

| Product Type | Protein Powders, Energy Bars, Sports Drinks, Meal Replacements |

| End User | Athletes, Fitness Enthusiasts, Bodybuilders, Casual Users |

| Distribution Channel | Online Retail, Supermarkets, Specialty Stores, Gyms |

| Form | Powder, Liquid, Bar, Capsule |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Sport Nutrition Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at