444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany satellite imagery services market represents a rapidly evolving sector within the broader geospatial intelligence industry, characterized by increasing demand for high-resolution earth observation data across multiple industries. Germany’s strategic position as a technological leader in Europe has positioned the country at the forefront of satellite imagery adoption, with applications spanning from urban planning and agriculture to defense and environmental monitoring. The market demonstrates robust growth potential driven by advancements in satellite technology, decreasing costs of imagery acquisition, and growing awareness of the strategic value of geospatial data.

Market dynamics indicate that Germany’s satellite imagery services sector is experiencing unprecedented expansion, with adoption rates increasing by approximately 12.5% annually across various industry verticals. The integration of artificial intelligence and machine learning technologies with satellite imagery analysis has created new opportunities for automated data processing and real-time insights generation. Key market participants are investing heavily in next-generation satellite constellations and advanced analytics platforms to meet the growing demand for timely and accurate geospatial intelligence.

Industry transformation is being driven by the proliferation of small satellites and the democratization of space technology, making satellite imagery more accessible to small and medium enterprises. The German market benefits from strong government support for space technology development and a well-established aerospace industry that provides a solid foundation for market growth.

The Germany satellite imagery services market refers to the comprehensive ecosystem of companies, technologies, and services involved in the acquisition, processing, analysis, and distribution of satellite-based earth observation data within the German territory and for German-based organizations. This market encompasses various types of satellite imagery including optical, radar, hyperspectral, and thermal imagery, along with associated value-added services such as image processing, analytics, and custom application development.

Satellite imagery services involve the systematic collection of digital images of Earth’s surface captured by satellites orbiting the planet, which are then processed and analyzed to extract meaningful information for decision-making across multiple sectors. These services include raw imagery provision, processed data products, geospatial analytics, change detection services, and specialized applications tailored to specific industry requirements.

The market definition extends beyond simple image provision to include comprehensive geospatial intelligence solutions that combine satellite data with other data sources, advanced analytics, and domain expertise to deliver actionable insights for applications ranging from precision agriculture and urban development to disaster response and national security.

Germany’s satellite imagery services market stands as one of Europe’s most dynamic and technologically advanced geospatial intelligence sectors, driven by strong industrial demand and government support for space technology initiatives. The market exhibits exceptional growth momentum with increasing adoption across traditional sectors such as agriculture, forestry, and urban planning, while simultaneously expanding into emerging applications including autonomous vehicle development, insurance risk assessment, and supply chain monitoring.

Key market drivers include the country’s commitment to digital transformation initiatives, with approximately 78% of German enterprises now recognizing geospatial data as critical for operational efficiency. The integration of satellite imagery with Industry 4.0 concepts has created substantial opportunities for manufacturing optimization, infrastructure monitoring, and environmental compliance management. Government initiatives supporting space technology development and the European Space Agency’s programs have provided additional momentum for market expansion.

Technological advancement remains a central theme, with artificial intelligence-powered image analysis capabilities enabling automated feature extraction and real-time monitoring applications. The market benefits from Germany’s strong research and development ecosystem, with leading universities and research institutions contributing to innovation in satellite imagery processing and application development.

Strategic market insights reveal several critical trends shaping the Germany satellite imagery services landscape:

Primary market drivers propelling the Germany satellite imagery services market include the country’s strong commitment to technological innovation and digital transformation across all sectors of the economy. Government digitalization initiatives have created substantial demand for geospatial intelligence solutions, with federal and state agencies increasingly incorporating satellite imagery into their operational workflows for improved decision-making and service delivery.

Industrial automation trends represent another significant driver, as German manufacturing companies seek to optimize their operations through comprehensive monitoring and analysis capabilities. The integration of satellite imagery with Internet of Things sensors and artificial intelligence platforms enables predictive maintenance, supply chain optimization, and quality control applications that deliver measurable operational improvements.

Environmental regulations and sustainability requirements continue to drive demand for satellite-based monitoring solutions. German companies across various industries must comply with stringent environmental standards, creating consistent demand for satellite imagery services that support compliance reporting, environmental impact assessment, and sustainability monitoring initiatives.

Agricultural sector modernization has emerged as a particularly strong driver, with German farmers facing pressure to increase productivity while reducing environmental impact. Satellite imagery enables precision agriculture techniques that optimize resource utilization, reduce waste, and improve crop yields through data-driven farming practices.

Market restraints affecting the Germany satellite imagery services sector include the high initial investment costs associated with implementing comprehensive geospatial intelligence solutions. Small and medium enterprises often face budget constraints that limit their ability to adopt advanced satellite imagery services, particularly for specialized applications requiring custom analytics development or high-frequency monitoring capabilities.

Technical complexity represents another significant restraint, as many potential users lack the internal expertise required to effectively utilize satellite imagery data. The need for specialized knowledge in geospatial analysis, remote sensing principles, and data interpretation creates barriers to adoption, particularly among organizations without dedicated GIS or remote sensing capabilities.

Data privacy and security concerns continue to influence market development, especially for applications involving critical infrastructure or sensitive locations. German organizations must navigate complex regulatory requirements regarding data handling, storage, and sharing, which can complicate the implementation of satellite imagery solutions.

Weather dependency for optical satellite imagery creates operational challenges, particularly for applications requiring consistent monitoring capabilities. Cloud cover and atmospheric conditions can limit data availability, necessitating alternative approaches or complementary data sources that increase overall solution complexity and costs.

Emerging opportunities in the Germany satellite imagery services market are driven by the convergence of satellite technology with artificial intelligence, machine learning, and edge computing capabilities. Automated analysis platforms that can process satellite imagery in real-time and generate actionable insights without human intervention represent a significant growth opportunity, particularly for applications requiring rapid response or continuous monitoring.

Industry 4.0 integration presents substantial opportunities for satellite imagery service providers to develop specialized solutions for smart manufacturing applications. The combination of satellite imagery with industrial IoT data, production systems, and supply chain management platforms enables comprehensive operational intelligence that can drive significant efficiency improvements.

Climate change adaptation and environmental monitoring represent growing opportunity areas, as German organizations seek to understand and respond to changing environmental conditions. Satellite imagery services that support climate risk assessment, adaptation planning, and environmental impact monitoring are experiencing increased demand across both public and private sectors.

Autonomous vehicle development creates new opportunities for high-definition mapping and real-time environmental monitoring services. German automotive companies are investing heavily in autonomous driving technologies, creating demand for specialized satellite imagery services that support mapping, localization, and environmental awareness applications.

Market dynamics in the Germany satellite imagery services sector are characterized by rapid technological evolution and increasing integration with complementary technologies. The competitive landscape is evolving from traditional satellite operators toward comprehensive geospatial intelligence providers that combine imagery with analytics, artificial intelligence, and domain expertise to deliver complete solutions.

Customer expectations are shifting toward real-time or near-real-time imagery delivery, with users demanding faster turnaround times and more frequent updates. This trend is driving investment in new satellite constellations with shorter revisit times and improved data processing capabilities that can support time-sensitive applications.

Technology convergence is creating new market dynamics as satellite imagery providers integrate with cloud computing platforms, artificial intelligence services, and mobile applications. This convergence enables new business models and service delivery approaches that make satellite imagery more accessible to a broader range of users.

Pricing pressures continue to influence market dynamics, with increasing competition driving down the cost of basic imagery while creating opportunities for value-added services and specialized applications. According to MarkWide Research analysis, the average cost of satellite imagery has decreased by approximately 35% over the past five years, making these services accessible to a much broader market.

Research methodology for analyzing the Germany satellite imagery services market employs a comprehensive multi-source approach combining primary research, secondary data analysis, and industry expert consultations. Primary research activities include structured interviews with key market participants, including satellite imagery service providers, technology vendors, end-users across various industries, and government agencies involved in space technology development.

Secondary research encompasses analysis of industry reports, government publications, academic research, patent filings, and company financial disclosures to understand market trends, technological developments, and competitive dynamics. Data triangulation methods ensure accuracy and reliability of market insights by cross-referencing information from multiple independent sources.

Market sizing and forecasting utilize bottom-up and top-down approaches, analyzing demand patterns across different industry segments and application areas. Statistical modeling techniques incorporate historical growth patterns, technology adoption curves, and macroeconomic factors to project future market development scenarios.

Industry expert validation ensures research findings accurately reflect current market conditions and future prospects. Expert panels including technology leaders, industry analysts, and academic researchers provide critical review and validation of research conclusions and market projections.

Regional analysis of the Germany satellite imagery services market reveals significant variations in adoption patterns and growth rates across different states and metropolitan areas. Bavaria and Baden-Württemberg lead in market development, accounting for approximately 42% of total market activity, driven by strong aerospace industries, research institutions, and technology companies concentrated in these regions.

North Rhine-Westphalia represents another significant market region, with substantial industrial demand for satellite imagery services supporting manufacturing, logistics, and urban planning applications. The region’s dense industrial base and major metropolitan areas create consistent demand for geospatial intelligence solutions across multiple sectors.

Northern German states including Lower Saxony and Schleswig-Holstein show strong growth in agricultural applications, with farming operations increasingly adopting precision agriculture techniques supported by satellite imagery. The region’s extensive agricultural areas and progressive farming practices drive demand for crop monitoring, yield optimization, and environmental compliance solutions.

Eastern German states are experiencing rapid growth in satellite imagery adoption, supported by government digitalization initiatives and infrastructure development projects. These regions benefit from EU funding programs that support technology adoption and digital transformation initiatives, creating opportunities for satellite imagery service providers.

The competitive landscape of the Germany satellite imagery services market features a diverse mix of international satellite operators, specialized service providers, and technology companies offering comprehensive geospatial intelligence solutions. Market leadership is distributed among several key players, each with distinct strengths and market positioning strategies.

Competitive differentiation strategies focus on specialized applications, rapid delivery capabilities, integrated analytics platforms, and comprehensive customer support services. Companies are investing in artificial intelligence and machine learning capabilities to provide automated analysis and insights generation services.

Market segmentation of the Germany satellite imagery services market reveals distinct patterns across multiple dimensions including imagery type, application sector, end-user category, and service delivery model. By imagery type, optical imagery dominates the market with approximately 68% market share, followed by synthetic aperture radar imagery and hyperspectral imaging for specialized applications.

By application sector:

By service delivery model, cloud-based platforms are gaining significant traction, with approximately 55% of new implementations utilizing cloud delivery methods for improved accessibility and scalability.

Category-wise analysis reveals distinct growth patterns and adoption characteristics across different satellite imagery service categories. High-resolution optical imagery remains the most demanded category, driven by applications requiring detailed visual analysis and feature identification capabilities. This category benefits from continuous improvements in satellite sensor technology and decreasing costs of high-resolution imagery acquisition.

Synthetic Aperture Radar (SAR) imagery represents a rapidly growing category, particularly for applications requiring all-weather monitoring capabilities and ground deformation measurement. German industrial users increasingly recognize the value of SAR imagery for infrastructure monitoring, subsidence detection, and change analysis applications that cannot be effectively addressed with optical imagery alone.

Hyperspectral imagery constitutes a specialized but growing category, with applications in precision agriculture, mineral exploration, and environmental monitoring. Research institutions and specialized consulting firms drive demand in this category, utilizing hyperspectral data for advanced material identification and chemical composition analysis.

Video satellite imagery represents an emerging category with significant growth potential, enabling motion analysis and behavioral pattern identification for security, traffic monitoring, and industrial applications. This category benefits from advances in satellite technology that enable video capture capabilities from space-based platforms.

Industry participants in the Germany satellite imagery services market benefit from multiple value propositions that enhance operational efficiency, reduce costs, and enable new business opportunities. For satellite imagery service providers, the German market offers a sophisticated customer base with strong technical capabilities and willingness to adopt advanced geospatial intelligence solutions.

Technology vendors benefit from Germany’s strong research and development ecosystem, with opportunities to collaborate with leading universities, research institutions, and technology companies on innovative applications and solution development. The country’s commitment to digital transformation creates a supportive environment for technology innovation and commercialization.

End-user organizations gain significant operational advantages through satellite imagery adoption, including:

Government stakeholders benefit from improved public service delivery, enhanced security capabilities, and more effective resource management through satellite imagery integration into government operations and decision-making processes.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the Germany satellite imagery services landscape include the rapid adoption of artificial intelligence and machine learning technologies for automated image analysis and insights extraction. AI-powered platforms are enabling real-time processing of satellite imagery data, allowing users to receive actionable intelligence within hours of image capture rather than days or weeks required for traditional manual analysis.

Cloud-based service delivery has emerged as a dominant trend, with approximately 62% of new satellite imagery implementations utilizing cloud platforms for improved accessibility, scalability, and cost-effectiveness. This trend enables smaller organizations to access advanced satellite imagery capabilities without significant upfront infrastructure investments.

Integration with Internet of Things sensors and mobile applications is creating comprehensive monitoring solutions that combine satellite imagery with ground-based data collection. This trend enables more accurate and timely insights for applications ranging from precision agriculture to infrastructure monitoring.

Subscription-based pricing models are gaining popularity, replacing traditional per-image purchasing with ongoing service relationships that provide continuous access to imagery and analytics capabilities. MarkWide Research indicates that subscription models now account for approximately 45% of commercial satellite imagery transactions in the German market.

Recent industry developments in the Germany satellite imagery services market include significant investments in next-generation satellite constellations that provide improved temporal resolution and global coverage capabilities. Major satellite operators are launching new satellites specifically designed to serve European markets with enhanced capabilities for environmental monitoring and commercial applications.

Partnership formations between satellite imagery providers and technology companies are creating integrated solutions that combine imagery with artificial intelligence, cloud computing, and domain-specific applications. These partnerships enable more comprehensive solutions that address complete customer workflows rather than simply providing raw imagery data.

Government initiatives including the German Space Strategy 2023 and European Union space programs are providing substantial funding for satellite technology development and commercial applications. These initiatives support both technology advancement and market development through research funding and procurement programs.

Academic collaborations between German universities and satellite imagery companies are driving innovation in image processing algorithms, application development, and new use case identification. These collaborations contribute to Germany’s position as a leader in satellite imagery technology and applications development.

Industry analysts recommend that satellite imagery service providers focus on developing specialized solutions for high-value applications rather than competing solely on imagery cost and availability. Differentiation strategies should emphasize unique analytics capabilities, industry expertise, and integrated solution delivery that addresses complete customer workflows.

Technology investment priorities should focus on artificial intelligence and machine learning capabilities that enable automated analysis and real-time insights generation. Companies that can provide actionable intelligence rather than raw imagery data will capture greater value and build stronger customer relationships.

Market expansion strategies should target emerging application areas including autonomous vehicle development, insurance risk assessment, and supply chain monitoring. These sectors represent significant growth opportunities with less established competitive dynamics than traditional markets.

Partnership development with technology companies, system integrators, and industry specialists can accelerate market penetration and solution development. Strategic partnerships enable satellite imagery companies to access new markets and provide more comprehensive solutions without requiring extensive internal capability development.

The future outlook for the Germany satellite imagery services market remains highly positive, with continued growth expected across all major application segments and user categories. Technological advancement will continue to drive market expansion, with artificial intelligence, machine learning, and edge computing capabilities enabling new applications and improved service delivery models.

Market maturation is expected to result in increased standardization of service offerings and pricing models, making satellite imagery services more accessible to mainstream business users. The integration of satellite imagery with other data sources and business applications will create comprehensive intelligence platforms that become essential tools for decision-making across multiple industries.

Government support for space technology development and digital transformation initiatives will continue to provide favorable market conditions for growth and innovation. European Union space programs and German national initiatives will drive both technology advancement and market demand through research funding and procurement activities.

MWR projections indicate that the German market will maintain strong growth momentum, with adoption rates increasing by approximately 15% annually over the next five years as satellite imagery becomes increasingly integrated into standard business operations across multiple sectors. The convergence of satellite imagery with emerging technologies will create new market opportunities and drive continued expansion of the overall market ecosystem.

The Germany satellite imagery services market represents a dynamic and rapidly evolving sector with substantial growth potential driven by technological advancement, increasing demand across multiple industries, and strong government support for space technology development. Market fundamentals remain strong, with diverse application opportunities, improving technology capabilities, and expanding user base creating favorable conditions for continued expansion.

Key success factors for market participants include focus on specialized applications, integration of artificial intelligence and analytics capabilities, and development of comprehensive solutions that address complete customer workflows. The market rewards companies that can provide actionable intelligence and domain expertise rather than simply raw imagery data.

Future market development will be characterized by continued technology convergence, expanding application areas, and increasing integration with mainstream business applications. Organizations that can effectively leverage satellite imagery for operational improvement and strategic advantage will drive continued market growth and evolution, establishing Germany as a leading market for satellite imagery services in Europe and globally.

What is Satellite Imagery Services?

Satellite Imagery Services refer to the collection, processing, and distribution of images captured by satellites. These services are utilized in various applications such as agriculture, urban planning, and environmental monitoring.

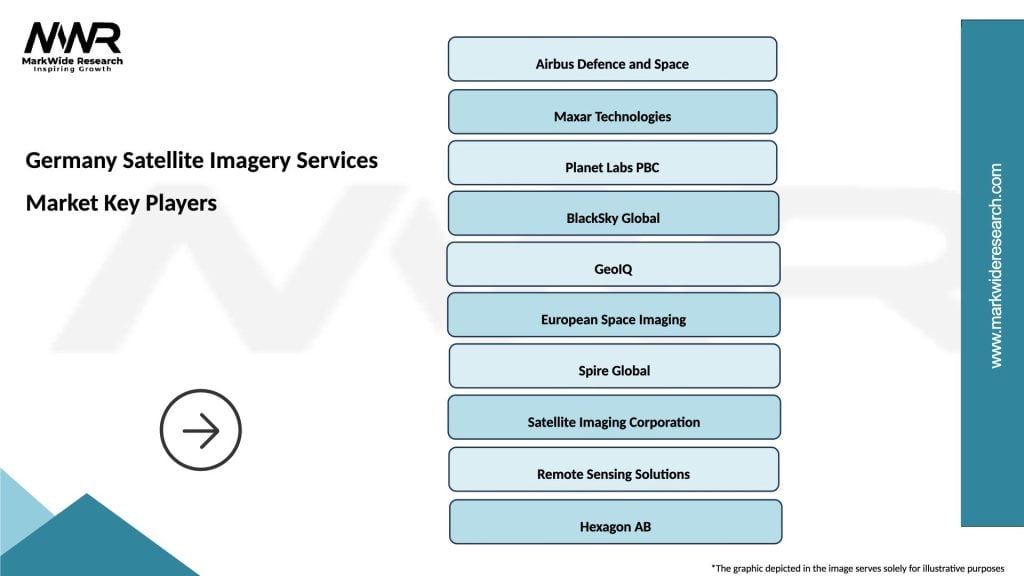

What are the key players in the Germany Satellite Imagery Services Market?

Key players in the Germany Satellite Imagery Services Market include Airbus Defence and Space, Maxar Technologies, and Planet Labs, among others. These companies provide advanced satellite imagery solutions for various sectors including defense, agriculture, and disaster management.

What are the growth factors driving the Germany Satellite Imagery Services Market?

The growth of the Germany Satellite Imagery Services Market is driven by increasing demand for geospatial data, advancements in satellite technology, and the rising need for environmental monitoring. Additionally, applications in smart city development and agriculture are contributing to market expansion.

What challenges does the Germany Satellite Imagery Services Market face?

The Germany Satellite Imagery Services Market faces challenges such as high operational costs, regulatory hurdles, and data privacy concerns. These factors can hinder the adoption of satellite imagery services across various industries.

What opportunities exist in the Germany Satellite Imagery Services Market?

Opportunities in the Germany Satellite Imagery Services Market include the integration of artificial intelligence for data analysis, the expansion of small satellite constellations, and increasing partnerships with governmental and non-governmental organizations for environmental projects.

What trends are shaping the Germany Satellite Imagery Services Market?

Trends shaping the Germany Satellite Imagery Services Market include the growing use of high-resolution imagery, the shift towards real-time data processing, and the increasing application of satellite data in climate change research. These trends are enhancing the capabilities and applications of satellite imagery services.

Germany Satellite Imagery Services Market

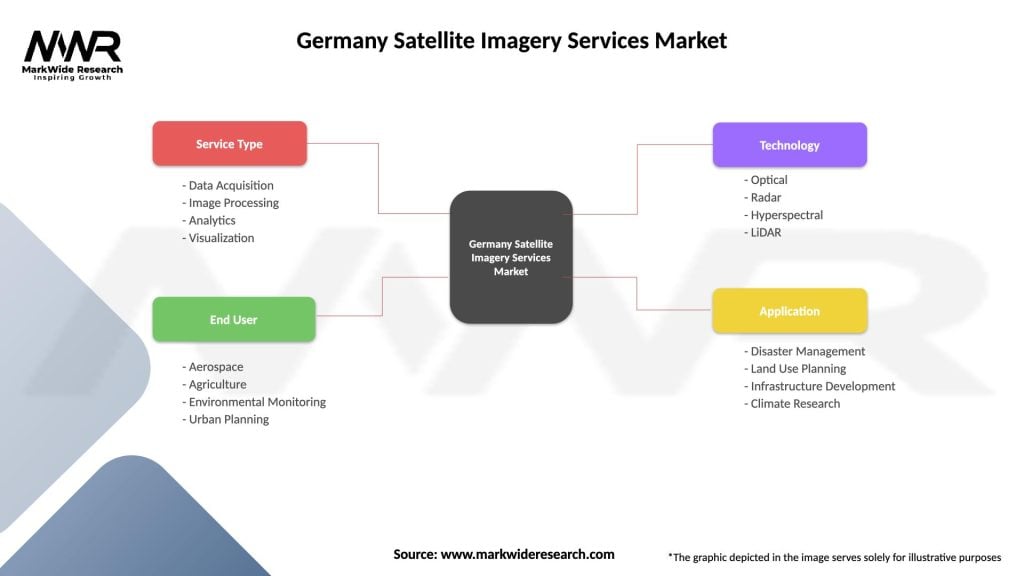

| Segmentation Details | Description |

|---|---|

| Service Type | Data Acquisition, Image Processing, Analytics, Visualization |

| End User | Aerospace, Agriculture, Environmental Monitoring, Urban Planning |

| Technology | Optical, Radar, Hyperspectral, LiDAR |

| Application | Disaster Management, Land Use Planning, Infrastructure Development, Climate Research |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Satellite Imagery Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at