444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany rigid plastic packaging market represents one of Europe’s most sophisticated and technologically advanced packaging sectors, characterized by exceptional innovation and sustainability initiatives. Market dynamics indicate robust growth driven by increasing demand from food and beverage, pharmaceutical, and consumer goods industries. The German market demonstrates significant expansion with projected growth rates of 4.2% CAGR through the forecast period, reflecting strong industrial manufacturing capabilities and consumer preference for durable packaging solutions.

Manufacturing excellence positions Germany as a leading producer of high-quality rigid plastic packaging solutions, with advanced production facilities utilizing cutting-edge technologies including injection molding, blow molding, and thermoforming processes. The market benefits from strong automotive sector integration, pharmaceutical industry growth, and increasing adoption of sustainable packaging materials. Regional distribution shows concentrated activity in industrial hubs including North Rhine-Westphalia, Bavaria, and Baden-Württemberg, accounting for approximately 68% of total production capacity.

Technological advancement drives market evolution through implementation of smart packaging solutions, barrier technologies, and recyclable material innovations. The sector demonstrates remarkable resilience with consistent performance across diverse application segments, supported by Germany’s position as Europe’s largest economy and manufacturing powerhouse.

The Germany rigid plastic packaging market refers to the comprehensive ecosystem encompassing manufacturing, distribution, and application of inflexible plastic containers, bottles, jars, trays, and specialized packaging solutions across multiple industries within German territory. This market includes various plastic materials such as polyethylene terephthalate (PET), high-density polyethylene (HDPE), polypropylene (PP), and polystyrene (PS) formed into rigid structures through advanced manufacturing processes.

Market scope encompasses primary packaging solutions that maintain structural integrity under normal handling conditions, providing protection, preservation, and presentation functions for consumer and industrial products. The definition includes bottles for beverages and chemicals, containers for food products, pharmaceutical packaging, automotive components, and industrial packaging applications manufactured within Germany’s borders or specifically designed for the German market.

Industry classification covers both commodity and specialty rigid plastic packaging products, ranging from standard containers to highly engineered solutions with specific barrier properties, tamper-evident features, and sustainable material compositions designed to meet stringent German regulatory requirements and consumer expectations.

Strategic analysis reveals the Germany rigid plastic packaging market as a cornerstone of the nation’s manufacturing economy, demonstrating consistent growth momentum and technological leadership in sustainable packaging innovations. The market exhibits strong fundamentals supported by robust domestic demand, export capabilities, and advanced manufacturing infrastructure that positions German companies as global leaders in packaging technology.

Key performance indicators highlight impressive market resilience with 85% capacity utilization across major production facilities and increasing investment in automation and digitalization initiatives. The sector benefits from Germany’s strategic location within Europe, providing access to over 500 million consumers and serving as a manufacturing hub for multinational corporations seeking high-quality packaging solutions.

Market transformation focuses on sustainability initiatives, with 72% of manufacturers implementing circular economy principles and investing in recyclable material technologies. The industry demonstrates strong collaboration between packaging manufacturers, brand owners, and recycling companies to develop comprehensive solutions that meet environmental regulations while maintaining product performance standards.

Competitive positioning shows German companies maintaining technological advantages through continuous research and development investments, strategic partnerships, and focus on premium market segments that value quality, innovation, and environmental responsibility over price competition.

Market intelligence reveals several critical insights shaping the Germany rigid plastic packaging landscape:

Market dynamics indicate strong correlation between packaging innovation and end-user industry growth, particularly in pharmaceutical, food and beverage, and automotive sectors that demand specialized packaging solutions with specific performance characteristics.

Primary growth drivers propelling the Germany rigid plastic packaging market include robust industrial manufacturing base, increasing consumer goods production, and strong export economy requiring high-quality packaging solutions. The automotive industry serves as a significant driver, demanding specialized rigid plastic components and packaging for automotive parts, lubricants, and chemicals with stringent quality requirements.

Food and beverage sector expansion drives substantial demand for rigid plastic packaging, particularly in dairy products, beverages, and processed foods where product protection and shelf-life extension are critical factors. The sector benefits from changing consumer lifestyles favoring convenience foods, single-serve portions, and premium product presentations that require sophisticated packaging solutions.

Pharmaceutical industry growth creates increasing demand for specialized rigid plastic packaging with tamper-evident features, child-resistant closures, and barrier properties essential for drug stability and safety. The sector’s expansion, driven by aging population and healthcare innovation, requires regulatory-compliant packaging meeting strict pharmaceutical standards.

E-commerce expansion significantly impacts packaging requirements, driving demand for durable rigid plastic packaging capable of withstanding shipping stresses while providing attractive product presentation for online retail channels. This trend accelerates adoption of innovative packaging designs optimized for both protection and consumer experience.

Sustainability regulations paradoxically drive market growth by encouraging innovation in recyclable and bio-based rigid plastic packaging solutions, creating opportunities for manufacturers investing in sustainable technologies and circular economy principles.

Environmental concerns represent the most significant restraint facing the Germany rigid plastic packaging market, with increasing consumer awareness and regulatory pressure regarding plastic waste and environmental impact. Public perception challenges require substantial investment in education and sustainable packaging solutions to maintain market acceptance and growth momentum.

Raw material price volatility creates ongoing challenges for manufacturers, particularly fluctuations in petroleum-based feedstock prices that directly impact production costs and profit margins. The market experiences supply chain disruptions affecting material availability and pricing stability, requiring strategic inventory management and supplier diversification.

Regulatory complexity increases compliance costs and operational challenges, particularly with evolving environmental regulations, packaging waste directives, and food contact material standards that require continuous adaptation of manufacturing processes and material specifications. Compliance requirements demand significant investment in testing, certification, and documentation systems.

Competition from alternative materials poses ongoing challenges, particularly from glass, metal, and paper-based packaging solutions that may offer superior environmental profiles or specific performance characteristics for certain applications. The market faces substitution pressure in segments where alternative materials provide comparable functionality with better sustainability credentials.

Economic uncertainties impact investment decisions and market growth, particularly during periods of economic downturn when customers may delay packaging upgrades or seek lower-cost alternatives that compromise quality and performance standards.

Sustainability innovation presents the most significant opportunity for Germany rigid plastic packaging market growth, with increasing demand for recyclable, bio-based, and circular economy solutions. Green packaging initiatives create opportunities for manufacturers developing advanced recycling technologies, biodegradable materials, and closed-loop packaging systems that address environmental concerns while maintaining performance standards.

Industry 4.0 integration offers substantial opportunities for operational efficiency improvements, quality enhancement, and cost reduction through smart manufacturing systems, predictive maintenance, and automated production processes. Digital transformation enables real-time monitoring, data analytics, and process optimization that improve competitiveness and customer satisfaction.

Export market expansion provides significant growth opportunities, particularly in emerging markets where German packaging technology and quality standards command premium positioning. International partnerships and joint ventures enable market entry and technology transfer opportunities that leverage Germany’s manufacturing expertise and reputation for quality.

Functional packaging development creates opportunities for value-added solutions including smart packaging with sensors, active packaging systems, and specialized barrier technologies that extend product shelf-life and enhance consumer experience. Innovation partnerships with end-user industries drive development of customized packaging solutions addressing specific market needs.

Pharmaceutical sector growth offers substantial opportunities for specialized rigid plastic packaging with advanced features including tamper-evidence, child resistance, and drug delivery integration. The sector’s expansion creates demand for high-value packaging solutions with superior margins and long-term customer relationships.

Market forces shaping the Germany rigid plastic packaging sector demonstrate complex interactions between technological advancement, regulatory requirements, and consumer preferences. Dynamic equilibrium exists between cost pressures and quality demands, with manufacturers continuously balancing efficiency improvements against investment in sustainable technologies and innovation initiatives.

Supply chain dynamics reflect Germany’s strategic position within European manufacturing networks, with efficient logistics systems and established supplier relationships enabling responsive customer service and competitive delivery times. The market benefits from integrated value chains connecting raw material suppliers, packaging manufacturers, and end-user industries through collaborative partnerships and long-term agreements.

Technology adoption cycles accelerate as manufacturers invest in automation, digitalization, and sustainable production technologies to maintain competitive advantages and meet evolving customer requirements. Innovation momentum drives continuous improvement in manufacturing processes, material properties, and packaging functionality that differentiate German products in global markets.

Regulatory dynamics create both challenges and opportunities, with environmental regulations driving innovation while compliance requirements increase operational complexity. The market demonstrates adaptive capacity through proactive engagement with regulatory development and investment in compliance systems that exceed minimum requirements.

Customer relationship dynamics evolve toward strategic partnerships and collaborative development programs, with packaging manufacturers working closely with brand owners to develop customized solutions that address specific market challenges and opportunities.

Comprehensive research approach employed for analyzing the Germany rigid plastic packaging market combines primary research, secondary data analysis, and industry expert consultations to ensure accurate and actionable market intelligence. Primary research methodology includes structured interviews with industry executives, manufacturing facility visits, and customer surveys to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research analysis encompasses extensive review of industry publications, government statistics, trade association reports, and company financial statements to establish market baseline data and validate primary research findings. Data triangulation ensures accuracy and reliability through cross-verification of information from multiple independent sources.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop market forecasts and identify key growth drivers and restraints. Quantitative analysis incorporates production data, trade statistics, and economic indicators to establish market size parameters and growth projections.

Industry expert validation provides critical review of research findings and market projections through consultation with packaging industry professionals, technology specialists, and regulatory experts. Peer review processes ensure research quality and methodological rigor throughout the analysis and reporting phases.

Continuous monitoring systems track market developments, regulatory changes, and competitive activities to maintain current and relevant market intelligence that supports strategic decision-making for industry participants and stakeholders.

North Rhine-Westphalia dominates the Germany rigid plastic packaging market with approximately 28% market share, benefiting from concentrated industrial activity, established manufacturing infrastructure, and proximity to major consumer markets. The region hosts numerous multinational packaging companies and serves as a hub for automotive and chemical industry packaging requirements.

Bavaria represents the second-largest regional market with 22% market share, characterized by strong pharmaceutical and food industry presence driving demand for specialized rigid plastic packaging solutions. The region demonstrates particular strength in high-value packaging applications requiring advanced barrier technologies and regulatory compliance.

Baden-Württemberg accounts for 18% market share with focus on automotive and precision engineering applications requiring specialized rigid plastic packaging solutions. The region’s manufacturing excellence and innovation culture drive development of advanced packaging technologies and sustainable material solutions.

Lower Saxony and Schleswig-Holstein combine for 15% market share, with strong food and beverage industry presence creating substantial demand for rigid plastic packaging in dairy, meat processing, and beverage applications. The regions benefit from agricultural production and food processing concentration.

Eastern German states collectively represent 17% market share with growing manufacturing activity and increasing investment in modern packaging production facilities. These regions demonstrate rapid growth potential supported by lower operational costs and strategic location for Eastern European market access.

Regional specialization patterns reflect local industry concentrations, with each region developing expertise in specific packaging applications and technologies that leverage local manufacturing capabilities and customer relationships.

Market leadership in the Germany rigid plastic packaging sector features a combination of large multinational corporations, specialized German manufacturers, and innovative technology companies competing across different market segments and applications. Competitive dynamics emphasize technological innovation, sustainability leadership, and customer service excellence rather than price competition alone.

Competitive strategies focus on differentiation through technological innovation, sustainable packaging solutions, and specialized applications that command premium pricing and long-term customer relationships. Market consolidation trends reflect economies of scale requirements and investment needs for advanced manufacturing technologies.

By Material Type:

By Application:

By Manufacturing Process:

Food and Beverage Category demonstrates the strongest growth momentum with increasing demand for convenient packaging solutions, portion control containers, and premium presentation formats. Innovation focus centers on extended shelf-life technologies, microwave-safe materials, and sustainable packaging options that meet consumer environmental expectations while maintaining food safety standards.

Pharmaceutical Category exhibits premium growth characteristics with specialized requirements including tamper-evident features, child-resistant closures, and barrier properties essential for drug stability. The category benefits from Germany’s strong pharmaceutical industry and increasing healthcare spending that drives demand for high-quality packaging solutions.

Personal Care Category shows consistent growth driven by premium cosmetic and toiletry products requiring attractive packaging with functional benefits. Design innovation focuses on user-friendly dispensing systems, refillable containers, and sustainable materials that appeal to environmentally conscious consumers.

Automotive Category demonstrates stable demand patterns with specialized applications for lubricants, chemicals, and automotive parts packaging. The category requires packaging solutions with chemical resistance, durability, and compliance with automotive industry standards for handling and storage.

Chemical Category maintains steady demand for industrial packaging with stringent safety requirements, chemical compatibility, and regulatory compliance for hazardous material handling. The category emphasizes durability, leak-proof designs, and proper labeling systems for safe transportation and storage.

Manufacturers benefit from Germany’s advanced industrial infrastructure, skilled workforce, and technological expertise that enable production of high-quality rigid plastic packaging solutions with competitive advantages in global markets. Operational benefits include access to cutting-edge manufacturing technologies, efficient supply chains, and established customer relationships across diverse industry sectors.

Brand Owners gain access to innovative packaging solutions that enhance product protection, extend shelf-life, and improve consumer experience while meeting sustainability requirements. Strategic advantages include partnership opportunities with technology-leading manufacturers and access to customized packaging solutions that differentiate products in competitive markets.

Consumers benefit from improved product quality, safety, and convenience through advanced packaging technologies that maintain product integrity and provide user-friendly features. Environmental benefits include access to recyclable packaging options and sustainable solutions that reduce environmental impact while maintaining product performance.

Investors find attractive opportunities in a stable, technology-driven market with strong fundamentals, consistent demand patterns, and growth potential driven by innovation and sustainability trends. Investment benefits include exposure to diverse end-user industries and companies with strong competitive positions and technological capabilities.

Suppliers benefit from stable demand patterns, long-term customer relationships, and opportunities for value-added services including technical support, customization, and supply chain optimization. Partnership opportunities enable collaboration in product development and market expansion initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Revolution represents the most significant trend transforming the Germany rigid plastic packaging market, with manufacturers investing heavily in recyclable materials, bio-based plastics, and circular economy solutions. Consumer pressure and regulatory requirements drive adoption of sustainable packaging technologies that maintain performance while reducing environmental impact.

Smart Packaging Integration gains momentum as manufacturers incorporate sensors, RFID tags, and interactive features that provide real-time information about product condition, authenticity, and usage instructions. Digital connectivity enables enhanced consumer engagement and supply chain visibility that adds value beyond traditional packaging functions.

Lightweighting Initiatives continue advancing through material optimization and design innovation that reduces packaging weight while maintaining structural integrity and performance characteristics. Resource efficiency improvements deliver cost savings and environmental benefits that appeal to both manufacturers and consumers.

Customization Demand increases as brand owners seek differentiated packaging solutions that enhance product positioning and consumer appeal. Flexible manufacturing systems enable cost-effective production of customized packaging designs that meet specific market requirements and brand identity objectives.

Automation Advancement accelerates adoption of robotic systems, automated quality control, and predictive maintenance technologies that improve production efficiency and product consistency. Industry 4.0 implementation enables real-time monitoring and optimization of manufacturing processes.

Barrier Technology Evolution focuses on developing advanced materials and coatings that extend product shelf-life, reduce food waste, and enable new packaging applications. Performance enhancement creates opportunities for premium packaging solutions with superior protective properties.

Sustainability Investments dominate recent industry developments, with major manufacturers announcing significant capital investments in recycling facilities, bio-based material production, and circular economy initiatives. Collaborative programs between packaging manufacturers, brand owners, and recycling companies create comprehensive solutions for plastic waste reduction and material recovery.

Technology Partnerships accelerate innovation through strategic alliances between packaging manufacturers and technology companies developing smart packaging solutions, advanced materials, and manufacturing automation systems. Research collaborations with universities and research institutions drive breakthrough innovations in sustainable packaging technologies.

Capacity Expansions reflect growing market demand and export opportunities, with manufacturers investing in new production facilities and equipment upgrades that enhance manufacturing capabilities and efficiency. Geographic expansion strategies target emerging markets while strengthening domestic market positions.

Regulatory Adaptations drive industry-wide changes in material selection, design practices, and manufacturing processes to comply with evolving environmental regulations and packaging waste directives. Proactive compliance strategies position companies advantageously for future regulatory developments.

Acquisition Activities consolidate market positions and expand technological capabilities through strategic acquisitions of specialized manufacturers, technology companies, and regional players. Market consolidation creates larger, more capable organizations with enhanced competitive positions.

Digital Transformation initiatives implement advanced manufacturing systems, data analytics, and customer relationship management technologies that improve operational efficiency and customer service capabilities. Digitalization investments enable real-time monitoring, predictive maintenance, and supply chain optimization.

Strategic Focus recommendations emphasize sustainability leadership as the primary competitive differentiator, with companies advised to invest aggressively in recyclable materials, bio-based plastics, and circular economy solutions. MarkWide Research analysis indicates that early movers in sustainability will capture premium market positions and customer loyalty as environmental regulations intensify.

Technology Investment priorities should focus on automation, digitalization, and smart packaging capabilities that improve operational efficiency and create new value propositions for customers. Industry 4.0 adoption enables competitive advantages through reduced costs, improved quality, and enhanced customer service capabilities.

Market Expansion strategies should leverage Germany’s reputation for quality and innovation to penetrate international markets, particularly in emerging economies where German packaging technology commands premium positioning. Export development provides growth opportunities beyond mature domestic markets.

Partnership Development recommendations include strategic alliances with technology companies, research institutions, and end-user industries to accelerate innovation and market development. Collaborative approaches enable access to new technologies, markets, and customer relationships that support sustainable growth.

Customer Engagement strategies should emphasize consultative selling, customized solutions, and value-added services that differentiate offerings beyond price competition. Relationship building creates sustainable competitive advantages and customer loyalty in competitive markets.

Risk Management approaches should address raw material price volatility, regulatory changes, and competitive pressures through diversification strategies, flexible manufacturing systems, and proactive compliance programs. Adaptive capabilities enable successful navigation of market uncertainties and changing conditions.

Market trajectory for the Germany rigid plastic packaging sector indicates continued growth driven by sustainability innovation, technological advancement, and expanding application opportunities. Long-term prospects remain positive despite environmental challenges, with successful companies adapting through sustainable material development and circular economy implementation.

Growth projections suggest sustained expansion at 4.5% CAGR through the next decade, supported by increasing demand from pharmaceutical, food and beverage, and specialty application segments. Market evolution will favor companies investing in sustainable technologies, automation, and customer-centric solutions that address changing market requirements.

Technology trends will continue transforming the industry through smart packaging integration, advanced barrier technologies, and sustainable material innovations that create new market opportunities and competitive advantages. Digital transformation will enable more efficient operations, better customer service, and enhanced product development capabilities.

Regulatory environment will increasingly favor sustainable packaging solutions, creating opportunities for companies leading in recyclable materials and circular economy practices while challenging traditional packaging approaches. Compliance excellence will become a competitive requirement rather than advantage.

Competitive landscape will likely experience continued consolidation as companies seek scale advantages, technological capabilities, and market access through strategic acquisitions and partnerships. Market leadership will depend on innovation capabilities, sustainability credentials, and customer relationship strength rather than size alone.

Investment opportunities will focus on companies demonstrating leadership in sustainable packaging solutions, technological innovation, and market expansion capabilities. MWR analysis suggests that successful companies will balance growth investments with operational efficiency improvements to maintain competitive positions in evolving markets.

The Germany rigid plastic packaging market represents a dynamic and evolving sector characterized by technological excellence, sustainability leadership, and strong competitive positioning within global markets. Market fundamentals remain robust despite environmental challenges, with successful companies adapting through innovation, sustainable practices, and customer-focused strategies that address changing market requirements.

Strategic opportunities abound for companies investing in sustainable packaging solutions, advanced manufacturing technologies, and international market expansion that leverage Germany’s reputation for quality and innovation. The sector’s transformation toward sustainability creates competitive advantages for early movers while challenging traditional approaches and business models.

Future success will depend on companies’ ability to balance growth objectives with environmental responsibilities, technological advancement with operational efficiency, and domestic market leadership with international expansion opportunities. The Germany rigid plastic packaging market continues evolving as a cornerstone of the nation’s manufacturing economy, providing essential packaging solutions while adapting to meet 21st-century sustainability and performance requirements.

What is Rigid Plastic Packaging?

Rigid plastic packaging refers to containers made from plastic that maintain their shape and do not deform under normal handling. This type of packaging is commonly used for products such as food, beverages, and consumer goods due to its durability and versatility.

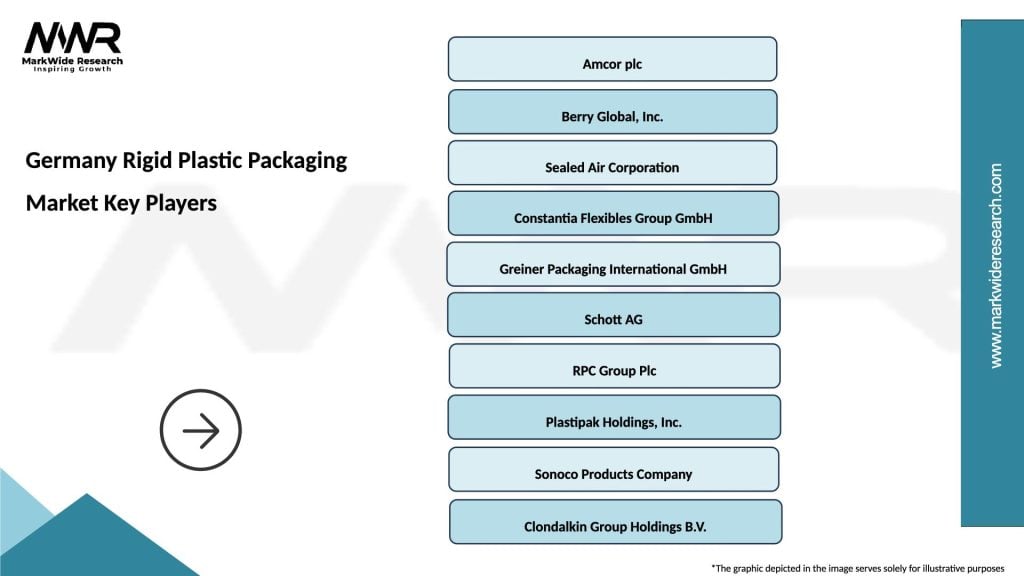

What are the key players in the Germany Rigid Plastic Packaging Market?

Key players in the Germany Rigid Plastic Packaging Market include companies like Amcor, Berry Global, and Sealed Air, which are known for their innovative packaging solutions and extensive product ranges, among others.

What are the growth factors driving the Germany Rigid Plastic Packaging Market?

The growth of the Germany Rigid Plastic Packaging Market is driven by increasing demand for convenience packaging, the rise in e-commerce, and a growing focus on sustainable packaging solutions. Additionally, the food and beverage sector’s expansion significantly contributes to market growth.

What challenges does the Germany Rigid Plastic Packaging Market face?

The Germany Rigid Plastic Packaging Market faces challenges such as stringent regulations regarding plastic use and recycling, competition from alternative packaging materials, and the need for innovation to meet changing consumer preferences.

What opportunities exist in the Germany Rigid Plastic Packaging Market?

Opportunities in the Germany Rigid Plastic Packaging Market include the development of biodegradable plastics, advancements in recycling technologies, and the increasing demand for customized packaging solutions tailored to specific consumer needs.

What trends are shaping the Germany Rigid Plastic Packaging Market?

Trends shaping the Germany Rigid Plastic Packaging Market include a shift towards sustainable materials, the integration of smart packaging technologies, and an emphasis on minimalistic design. These trends reflect changing consumer attitudes towards environmental responsibility and product transparency.

Germany Rigid Plastic Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Containers, Trays, Tubs |

| Material | Polyethylene, Polypropylene, Polystyrene, PET |

| End User | Food & Beverage, Personal Care, Household, Pharmaceuticals |

| Packaging Type | Flexible, Rigid, Resealable, Tamper-Evident |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Rigid Plastic Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at