444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany reinsurance market stands as one of Europe’s most sophisticated and influential risk transfer ecosystems, characterized by exceptional financial stability and innovative risk management solutions. German reinsurers have established themselves as global leaders in providing comprehensive coverage across diverse industry sectors, from traditional property and casualty lines to emerging cyber and climate-related risks. The market demonstrates remarkable resilience with consistent growth patterns, driven by increasing demand for risk diversification and capital optimization strategies among primary insurers.

Market dynamics indicate robust expansion with the sector experiencing a 6.2% annual growth rate in premium volumes over recent years. German reinsurance companies maintain approximately 23% market share within the European reinsurance landscape, reflecting their dominant position and expertise in risk assessment and pricing. The market’s strength lies in its diversified portfolio approach, encompassing both domestic and international exposures while maintaining strong regulatory compliance standards.

Technological advancement has become a cornerstone of market evolution, with digital transformation initiatives enhancing underwriting processes and risk modeling capabilities. Climate change adaptation represents a significant growth driver, as reinsurers develop innovative solutions to address emerging environmental risks and support sustainable business practices across various industries.

The Germany reinsurance market refers to the comprehensive ecosystem of companies and institutions that provide insurance coverage to primary insurance companies, effectively spreading risk across multiple entities to enhance financial stability and capacity. Reinsurance serves as insurance for insurers, enabling primary companies to underwrite larger policies, diversify their risk portfolios, and maintain adequate capital reserves to meet regulatory requirements and policyholder obligations.

German reinsurers operate through various business models including treaty reinsurance, facultative reinsurance, and alternative risk transfer mechanisms. Treaty arrangements involve automatic coverage for specified classes of business, while facultative reinsurance provides case-by-case risk evaluation and coverage decisions. The market encompasses both traditional reinsurance products and innovative capital market solutions that attract institutional investors seeking exposure to insurance-linked securities.

Risk transfer mechanisms within the German market include proportional and non-proportional arrangements, each serving distinct purposes in portfolio management and capital optimization. Proportional reinsurance involves sharing premiums and losses according to predetermined percentages, while non-proportional coverage provides protection against catastrophic losses exceeding specified retention levels.

Germany’s reinsurance sector represents a cornerstone of global risk management, distinguished by its financial strength, innovative product development, and comprehensive market coverage. The market has demonstrated exceptional resilience through various economic cycles, maintaining strong profitability metrics and capital adequacy ratios that exceed international benchmarks. Leading German reinsurers have successfully expanded their global footprint while maintaining strong domestic market positions.

Digital transformation initiatives have accelerated market evolution, with artificial intelligence and machine learning technologies enhancing underwriting accuracy and claims processing efficiency. The integration of advanced analytics has improved risk selection processes by approximately 35% efficiency gains in portfolio management and pricing optimization. Sustainable finance principles have gained significant traction, with environmental, social, and governance factors increasingly influencing investment and underwriting decisions.

Regulatory developments continue to shape market dynamics, with Solvency II requirements driving capital optimization strategies and risk management enhancements. The market has successfully adapted to evolving regulatory frameworks while maintaining competitive positioning in global markets. Cross-border expansion remains a key growth strategy, with German reinsurers establishing significant presence in emerging markets and developing economies.

Strategic positioning within the German reinsurance market reveals several critical success factors that distinguish leading players from competitors:

Market concentration analysis reveals that the top five German reinsurers control approximately 78% market share in domestic operations, while maintaining significant international presence across multiple continents. Specialty lines represent growing opportunities, with cyber insurance and renewable energy coverage experiencing rapid expansion.

Primary growth catalysts propelling the German reinsurance market forward encompass both traditional risk factors and emerging challenges that create new opportunities for risk transfer solutions. Climate change impacts have intensified demand for catastrophe coverage, with extreme weather events driving increased awareness of natural disaster risks among primary insurers and their corporate clients.

Digital transformation across industries has created substantial demand for cyber risk coverage, with German reinsurers developing sophisticated products to address evolving threats including ransomware, data breaches, and business interruption losses. The Internet of Things expansion and increased connectivity have simultaneously created new risk exposures and opportunities for parametric insurance solutions.

Regulatory compliance requirements continue driving demand for reinsurance solutions, as primary insurers seek to optimize their capital structures and meet solvency requirements efficiently. Basel III and Solvency II frameworks have created opportunities for capital-efficient reinsurance arrangements that help insurers manage regulatory capital more effectively.

Economic uncertainty and market volatility have increased demand for earnings stabilization through reinsurance arrangements. Geopolitical risks and trade tensions have created new categories of political risk insurance and trade credit coverage, expanding the addressable market for German reinsurers with international expertise.

Demographic trends including aging populations and urbanization patterns are driving demand for longevity risk transfer solutions and catastrophe coverage in densely populated areas. Infrastructure investment programs across Europe and emerging markets create opportunities for construction and engineering insurance coverage.

Competitive pressures within the German reinsurance market have intensified due to increased capital availability and new market entrants, including alternative capital providers and insurance-linked securities funds. Pricing competition has compressed margins in certain traditional lines of business, requiring reinsurers to focus on value-added services and specialized expertise to maintain profitability.

Regulatory complexity poses ongoing challenges, particularly for companies operating across multiple jurisdictions with varying compliance requirements. Capital requirements under evolving regulatory frameworks may constrain growth opportunities and require significant investments in risk management infrastructure and reporting capabilities.

Catastrophic loss volatility creates earnings unpredictability that can impact investor confidence and capital allocation decisions. Climate change introduces modeling uncertainties that complicate risk assessment and pricing decisions, particularly for long-term coverage arrangements.

Technology disruption presents both opportunities and challenges, as traditional business models face pressure from insurtech innovations and direct risk transfer mechanisms. Cybersecurity threats targeting reinsurance companies themselves create operational risks that require substantial investments in protective measures and incident response capabilities.

Economic downturns can reduce demand for insurance coverage and impact the financial strength of primary insurance clients, creating credit risks and reducing premium volumes. Interest rate volatility affects investment income and the present value of loss reserves, impacting overall profitability and capital adequacy.

Emerging risk categories present substantial growth opportunities for German reinsurers willing to invest in specialized expertise and innovative product development. Climate risk solutions represent a rapidly expanding market segment, with opportunities ranging from parametric weather coverage to transition risk insurance for companies adapting to low-carbon business models.

Digital economy risks continue expanding as businesses become increasingly dependent on technology infrastructure and data assets. Artificial intelligence liability coverage represents an emerging opportunity as AI adoption accelerates across industries, creating new categories of professional liability and product liability exposures.

Infrastructure modernization programs across Europe and developing markets create opportunities for construction and engineering coverage, while renewable energy projects require specialized insurance solutions for wind, solar, and other clean energy technologies.

Longevity risk transfer opportunities are expanding as pension funds and life insurers seek to manage demographic risks through innovative reinsurance arrangements. Pandemic risk coverage has gained prominence following recent global health crises, creating demand for business interruption and event cancellation coverage.

Capital market convergence offers opportunities to develop insurance-linked securities and other alternative risk transfer mechanisms that attract institutional investors. Microinsurance and parametric products for emerging markets represent growth opportunities aligned with sustainable development objectives.

ESG-focused products are gaining traction among environmentally conscious clients, creating opportunities for green bonds, sustainability-linked coverage, and environmental liability solutions. Supply chain disruption coverage has become increasingly relevant in an interconnected global economy.

Competitive dynamics within the German reinsurance market reflect a complex interplay of traditional relationships, technological innovation, and evolving client expectations. Market leadership increasingly depends on the ability to combine financial strength with specialized expertise and innovative risk solutions that address emerging client needs.

Pricing cycles continue to influence market dynamics, with hard market conditions in certain lines of business creating opportunities for margin expansion while soft market periods require focus on operational efficiency and value-added services. The market has demonstrated improved pricing discipline with rate increases of approximately 8.5% across key commercial lines.

Capital allocation strategies have evolved to emphasize return on equity optimization and efficient deployment of resources across geographic regions and business lines. Alternative capital sources including catastrophe bonds and collateralized reinsurance arrangements now represent approximately 15% market penetration in certain specialty lines.

Technology adoption has accelerated across the market, with digital platforms improving client interactions and streamlining transaction processing. Data analytics capabilities have enhanced risk selection and pricing accuracy, contributing to improved underwriting results and competitive positioning.

Consolidation trends continue shaping market structure, with strategic acquisitions and partnerships creating larger, more diversified entities capable of serving global client needs. Specialty focus has emerged as a key differentiator, with companies developing deep expertise in specific risk categories or geographic regions.

Comprehensive market analysis for the German reinsurance sector employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research involves extensive interviews with industry executives, regulatory officials, and market participants to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of financial statements, regulatory filings, industry reports, and academic studies to establish quantitative baselines and identify emerging patterns. Data triangulation techniques validate findings across multiple sources to ensure consistency and reliability of market assessments.

Quantitative analysis utilizes statistical modeling and econometric techniques to identify correlations between market variables and predict future trends. Qualitative research methods including focus groups and expert panels provide deeper insights into market dynamics and strategic considerations affecting industry participants.

Regulatory analysis examines current and proposed legislation, supervisory guidance, and international regulatory developments that may impact market structure and competitive dynamics. Technology assessment evaluates the impact of digital transformation initiatives on business models and operational efficiency.

Market segmentation analysis categorizes participants by size, specialization, geographic focus, and business model to identify distinct competitive groups and strategic positioning opportunities. Benchmarking studies compare German market characteristics with international peers to identify relative strengths and areas for improvement.

German reinsurance market demonstrates strong domestic foundations while maintaining significant international presence across multiple continents. Domestic operations benefit from a sophisticated insurance market, strong regulatory framework, and diverse industrial base that generates consistent demand for risk transfer solutions.

European expansion strategies have positioned German reinsurers as key players across the continent, with particular strength in Western European markets where regulatory harmonization and economic integration create opportunities for cross-border business development. Central and Eastern European markets represent growth opportunities as these economies develop and insurance penetration rates increase.

North American operations provide geographic diversification and access to the world’s largest reinsurance market, with German companies maintaining approximately 12% market share in specialized lines including cyber and environmental liability coverage. Lloyd’s of London participation enables access to international specialty markets and complex risk placements.

Asia-Pacific expansion has accelerated as German reinsurers seek growth opportunities in rapidly developing economies with increasing insurance demand. China and India represent particular focus areas, with local partnerships and joint ventures facilitating market entry and regulatory compliance.

Emerging markets across Africa and Latin America offer long-term growth potential, though political and economic volatility require careful risk management and local expertise. Microinsurance initiatives and parametric products designed for developing economies align with sustainable development objectives while creating new business opportunities.

Market leadership within the German reinsurance sector is characterized by a combination of financial strength, global reach, and specialized expertise across diverse risk categories. The competitive environment features both traditional reinsurance companies and innovative market entrants leveraging technology and alternative capital sources.

Competitive differentiation increasingly depends on specialized expertise, technological capabilities, and innovative product development rather than traditional factors such as size and financial strength alone. Digital transformation initiatives have become critical success factors, with leading companies investing heavily in data analytics, artificial intelligence, and automated underwriting platforms.

Strategic partnerships and joint ventures enable companies to access new markets, share risks, and develop innovative solutions that address evolving client needs. Alternative capital providers including pension funds and sovereign wealth funds are increasingly participating in reinsurance markets through insurance-linked securities and other structured products.

Business line segmentation within the German reinsurance market reflects diverse risk categories and client needs, with each segment exhibiting distinct characteristics, growth patterns, and competitive dynamics.

By Coverage Type:

By Client Segment:

By Geographic Focus:

Property catastrophe reinsurance represents the largest segment within the German market, driven by increasing natural disaster frequency and severity associated with climate change. Catastrophe modeling capabilities have become critical differentiators, with leading companies investing heavily in proprietary models and data analytics platforms to improve risk assessment accuracy.

Cyber reinsurance has emerged as one of the fastest-growing segments, with premium growth rates exceeding 25% annually as businesses recognize the increasing threat of cyberattacks and data breaches. German reinsurers have developed sophisticated cyber risk assessment capabilities and innovative coverage solutions addressing both first-party and third-party liability exposures.

Life and health reinsurance benefits from demographic trends including aging populations and increased life expectancy, creating demand for longevity risk transfer solutions. Pandemic risk coverage has gained prominence following recent global health crises, with reinsurers developing new products to address business interruption and mortality surge risks.

Climate risk solutions represent an emerging category with substantial growth potential, encompassing both physical risks from extreme weather events and transition risks associated with the shift to low-carbon economies. Parametric insurance products are gaining traction as they provide rapid claims settlement and transparent coverage triggers.

Professional liability and directors and officers coverage continue expanding as regulatory scrutiny increases and corporate governance standards evolve. Environmental liability represents another growth area as companies face increasing responsibility for environmental remediation and climate-related damages.

Primary insurers benefit significantly from German reinsurance market participation through enhanced capital efficiency, risk diversification, and access to specialized expertise. Capital relief enables insurers to write larger policies and expand their business volumes while maintaining regulatory compliance and financial stability.

Risk transfer mechanisms provide earnings stabilization by smoothing volatility from catastrophic losses and large claims. Technical expertise from reinsurers enhances primary insurers’ underwriting capabilities and risk management practices, particularly in specialized lines requiring advanced modeling and assessment techniques.

Corporate clients benefit from improved insurance capacity and more competitive pricing as reinsurance enables primary insurers to offer higher limits and broader coverage. Innovation in risk solutions provides businesses with new tools to manage emerging risks including cyber threats, climate change impacts, and supply chain disruptions.

Capital market investors gain access to insurance risks through alternative risk transfer mechanisms, providing portfolio diversification and attractive risk-adjusted returns. Insurance-linked securities offer institutional investors exposure to catastrophe risks with returns uncorrelated to traditional financial markets.

Economic stability benefits from a robust reinsurance market that helps maintain insurance availability and affordability during periods of market stress. Systemic risk reduction occurs as risks are distributed across multiple entities and geographic regions, preventing concentration that could threaten financial stability.

Innovation acceleration results from competitive pressures and client demands driving development of new products and services. MarkWide Research analysis indicates that companies investing in innovation report 18% higher profitability compared to traditional market participants.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation continues reshaping the German reinsurance landscape, with artificial intelligence and machine learning technologies revolutionizing underwriting processes and risk assessment capabilities. Automated underwriting platforms are reducing processing times by approximately 40% while improving risk selection accuracy and pricing precision.

ESG integration has become a dominant trend, with reinsurers incorporating environmental, social, and governance factors into investment and underwriting decisions. Sustainable finance principles are driving development of green bonds, sustainability-linked coverage, and climate risk solutions that align with global environmental objectives.

Parametric insurance products are gaining significant traction as they provide transparent coverage triggers and rapid claims settlement capabilities. Weather derivatives and catastrophe bonds are expanding beyond traditional applications to address supply chain disruptions, agricultural risks, and renewable energy project protection.

Cyber risk evolution continues driving product innovation as threat landscapes become more sophisticated and interconnected. Ransomware coverage and business interruption protection for cyber events represent rapidly growing segments with substantial premium potential.

Capital optimization strategies are becoming increasingly sophisticated, with reinsurers utilizing alternative capital sources and structured products to enhance return on equity while maintaining regulatory compliance. Sidecar arrangements and collateralized reinsurance structures provide flexible capital deployment options.

Cross-industry partnerships are emerging as reinsurers collaborate with technology companies, data providers, and other service organizations to enhance their capabilities and market reach. Insurtech integration enables access to innovative distribution channels and customer engagement platforms.

Regulatory evolution continues shaping market dynamics, with Solvency II refinements and international regulatory coordination efforts impacting capital requirements and risk management practices. IFRS 17 implementation has required significant investments in systems and processes while providing enhanced transparency in financial reporting.

Merger and acquisition activity has intensified as companies seek scale advantages and specialized capabilities to compete effectively in evolving markets. Strategic partnerships between traditional reinsurers and insurtech companies are creating innovative solutions and distribution channels.

Climate risk initiatives have gained momentum with the establishment of industry working groups and collaborative research programs addressing physical and transition risks. Catastrophe modeling enhancements incorporate climate change projections and improved data sources to enhance risk assessment accuracy.

Digitalization projects across the industry are modernizing legacy systems and enabling real-time data sharing between market participants. Blockchain applications are being piloted for claims processing and contract management to improve efficiency and transparency.

Alternative capital growth has accelerated with new insurance-linked securities issuances and innovative structures attracting institutional investors. Catastrophe bond markets have expanded to include new perils and geographic regions previously underserved by traditional reinsurance.

Talent development initiatives address skills gaps in data analytics, cyber risk assessment, and climate science as the industry evolves toward more technical and specialized expertise requirements. University partnerships and professional development programs are enhancing workforce capabilities.

Strategic positioning recommendations for German reinsurance market participants emphasize the importance of balancing traditional strengths with emerging opportunities. MWR analysis suggests that companies should prioritize investments in digital capabilities and data analytics while maintaining their core competencies in risk assessment and capital management.

Diversification strategies should focus on expanding into high-growth segments including cyber insurance, climate risk solutions, and emerging market opportunities. Geographic expansion into Asia-Pacific and Latin American markets offers substantial growth potential, though requires careful attention to local regulatory requirements and market dynamics.

Technology investment priorities should emphasize artificial intelligence applications for underwriting and claims processing, while developing comprehensive cyber security capabilities to protect against evolving threats. Partnership strategies with insurtech companies and data providers can accelerate innovation without requiring substantial internal development resources.

Capital management optimization should explore alternative capital sources and structured products that enhance return on equity while maintaining financial flexibility. ESG integration should be viewed as both a risk management imperative and a competitive differentiator in attracting environmentally conscious clients and investors.

Talent acquisition and development strategies should prioritize data science, climate risk assessment, and cyber security expertise to support business evolution. Cultural transformation initiatives may be necessary to support digital adoption and innovation-focused business models.

Regulatory engagement should be proactive, with companies participating in industry associations and regulatory consultations to influence policy development and ensure compliance readiness for evolving requirements.

Long-term growth prospects for the German reinsurance market remain positive, driven by increasing risk awareness, regulatory requirements, and emerging risk categories that create new business opportunities. Market evolution will likely accelerate as digital transformation initiatives mature and alternative capital sources become more integrated into traditional business models.

Climate change impacts will continue driving demand for innovative risk solutions, with physical risk coverage and transition risk insurance representing substantial growth opportunities. Parametric products and catastrophe bonds are expected to gain market share as clients seek transparent and efficient risk transfer mechanisms.

Technology adoption will reshape competitive dynamics, with companies successfully integrating artificial intelligence and machine learning gaining significant advantages in risk selection and pricing. Digital platforms will become essential for client engagement and transaction processing efficiency.

Regulatory developments will continue influencing market structure and competitive positioning, with international coordination efforts potentially creating new opportunities for cross-border business expansion. Capital requirements may evolve to reflect changing risk landscapes and technological capabilities.

Market consolidation trends are likely to continue as companies seek scale advantages and specialized capabilities. Strategic partnerships between traditional reinsurers and technology companies will become increasingly important for innovation and market access.

MarkWide Research projections indicate that companies investing in digital transformation and emerging risk solutions will experience growth rates exceeding 12% over the next five years, significantly outperforming traditional market participants focused solely on conventional business lines.

Germany’s reinsurance market stands at a pivotal juncture, combining traditional strengths in financial stability and risk management expertise with emerging opportunities in digital innovation and climate risk solutions. The market’s resilience and adaptability position it well for continued growth and global leadership in an evolving risk landscape.

Success factors for market participants will increasingly depend on their ability to integrate advanced technologies, develop specialized expertise in emerging risk categories, and maintain strong capital positions while pursuing strategic growth opportunities. Digital transformation and ESG integration represent critical imperatives that will distinguish market leaders from followers.

Future growth will be driven by expanding demand for cyber insurance, climate risk solutions, and alternative risk transfer mechanisms that attract institutional capital. German reinsurers are well-positioned to capitalize on these opportunities through their technical expertise, global reach, and strong financial foundations, ensuring continued market leadership in the global reinsurance ecosystem.

What is Reinsurance?

Reinsurance is a financial arrangement where one insurance company transfers a portion of its risk to another insurance company. This process helps insurers manage risk exposure and stabilize their financial performance.

What are the key players in the Germany Reinsurance Market?

The Germany Reinsurance Market features several prominent companies, including Munich Re, Hannover Re, and Swiss Re, which are known for their extensive reinsurance services and global reach, among others.

What are the main drivers of growth in the Germany Reinsurance Market?

Key drivers of growth in the Germany Reinsurance Market include increasing natural disaster occurrences, rising insurance premiums, and the growing complexity of risks in sectors like health and cyber insurance.

What challenges does the Germany Reinsurance Market face?

The Germany Reinsurance Market faces challenges such as regulatory changes, low-interest rates affecting profitability, and the need for innovative solutions to address emerging risks like climate change.

What opportunities exist in the Germany Reinsurance Market?

Opportunities in the Germany Reinsurance Market include the expansion of digital technologies for risk assessment, the development of new products for emerging risks, and increased collaboration with primary insurers to enhance coverage options.

What trends are shaping the Germany Reinsurance Market?

Trends in the Germany Reinsurance Market include a shift towards data analytics for risk management, the rise of insurtech companies offering innovative solutions, and a growing focus on sustainability and ESG factors in underwriting practices.

Germany Reinsurance Market

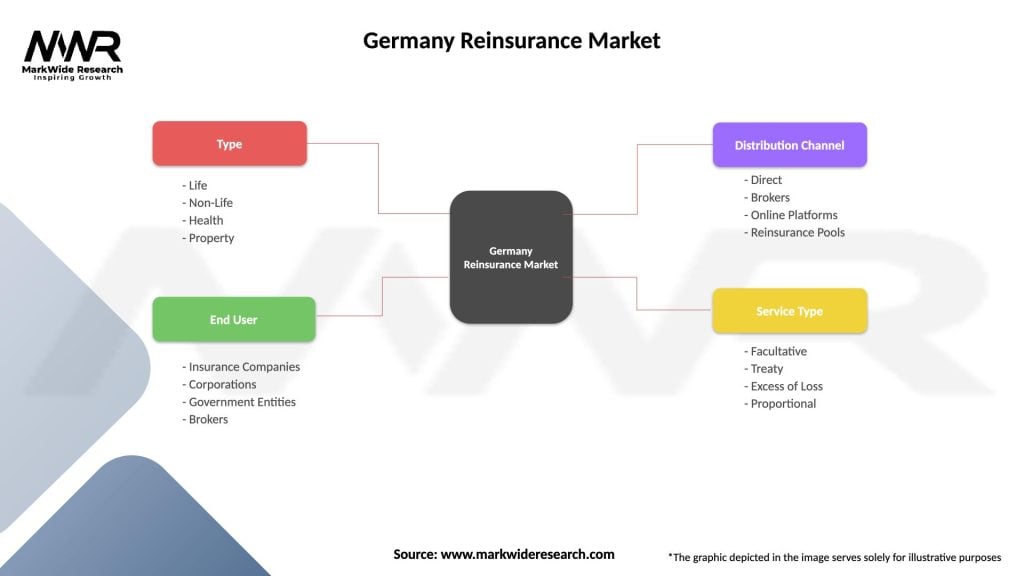

| Segmentation Details | Description |

|---|---|

| Type | Life, Non-Life, Health, Property |

| End User | Insurance Companies, Corporations, Government Entities, Brokers |

| Distribution Channel | Direct, Brokers, Online Platforms, Reinsurance Pools |

| Service Type | Facultative, Treaty, Excess of Loss, Proportional |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Reinsurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at