444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany Property & Casualty Insurance Market represents one of Europe’s most sophisticated and mature insurance landscapes, characterized by robust regulatory frameworks, technological innovation, and evolving consumer demands. Market dynamics indicate substantial growth potential driven by digitalization initiatives, climate-related risk management, and changing demographic patterns across the German insurance sector.

Digital transformation has emerged as a primary catalyst, with insurance companies investing heavily in artificial intelligence, machine learning, and automated claims processing systems. The market demonstrates remarkable resilience, with property insurance penetration rates reaching approximately 78% of eligible households, while casualty insurance maintains strong adoption across commercial and personal segments.

Regulatory compliance continues to shape market operations, with Solvency II requirements driving capital optimization strategies and risk management protocols. The German insurance market benefits from a diverse ecosystem of traditional insurers, mutual companies, and emerging insurtech startups, creating competitive dynamics that foster innovation and customer-centric solutions.

Climate change adaptation has become increasingly critical, with insurers developing sophisticated risk assessment models to address extreme weather events, flooding, and environmental liabilities. This focus on sustainability and resilience positions the German market as a leader in climate-conscious insurance practices within the European Union.

The Germany Property & Casualty Insurance Market refers to the comprehensive ecosystem of insurance products and services that protect individuals, businesses, and organizations against financial losses arising from property damage, liability claims, and various casualty risks within the German territory.

Property insurance encompasses coverage for residential homes, commercial buildings, industrial facilities, and personal belongings against perils such as fire, theft, natural disasters, and vandalism. This segment includes homeowners insurance, renters insurance, commercial property coverage, and specialized industrial property protection.

Casualty insurance provides protection against legal liability claims and covers various forms of third-party damages, including general liability, professional liability, product liability, and motor vehicle liability. These products serve both individual consumers and business entities across diverse industry sectors.

Market participants include traditional insurance companies, mutual insurers, reinsurance providers, insurance brokers, and digital insurance platforms that collectively serve millions of policyholders throughout Germany’s federal states.

Strategic positioning within the German insurance landscape reveals a market characterized by steady growth, technological advancement, and evolving risk profiles. The property and casualty insurance sector demonstrates remarkable stability while adapting to emerging challenges including cyber risks, climate change, and demographic shifts.

Key performance indicators highlight the market’s strength, with claims settlement ratios maintaining approximately 92% efficiency rates across major insurers. Digital adoption has accelerated significantly, with online policy purchases increasing by 34% annually among younger demographic segments.

Competitive dynamics showcase a balanced market structure featuring established German insurers alongside international players and innovative insurtech companies. This diversity creates opportunities for specialized products, enhanced customer experiences, and competitive pricing strategies that benefit consumers and businesses alike.

Future growth prospects remain positive, supported by economic stability, regulatory clarity, and increasing awareness of risk management importance across personal and commercial segments. The integration of advanced technologies and data analytics continues to drive operational efficiency and customer satisfaction improvements.

Market intelligence reveals several critical insights that define the current landscape and future trajectory of Germany’s property and casualty insurance sector:

Economic stability serves as a fundamental driver, with Germany’s robust economy supporting consistent demand for comprehensive insurance coverage across residential, commercial, and industrial sectors. Strong employment rates and disposable income levels enable sustained premium growth and policy expansion.

Regulatory framework strength provides market confidence through clear guidelines, consumer protection measures, and prudential supervision. The German Federal Financial Supervisory Authority (BaFin) maintains rigorous oversight that ensures market stability while encouraging innovation and competition.

Technological advancement accelerates market growth through improved operational efficiency, enhanced customer experiences, and innovative product development. Artificial intelligence, machine learning, and blockchain technologies enable more accurate risk assessment, streamlined claims processing, and personalized insurance solutions.

Climate change awareness drives increased demand for comprehensive property protection, particularly against extreme weather events, flooding, and environmental risks. Insurers respond with sophisticated risk modeling and adaptive coverage options that address evolving climate-related exposures.

Demographic trends influence market dynamics, with aging populations requiring specialized coverage while younger generations demand digital-first insurance experiences. These demographic shifts create opportunities for product innovation and service delivery enhancement.

Business expansion across German markets increases demand for commercial property and casualty insurance, supporting market growth through new policy acquisitions and coverage expansion among existing clients.

Intense competition creates pricing pressure that can limit profitability margins, particularly in commodity insurance lines where differentiation proves challenging. Price-sensitive consumers often prioritize cost over coverage comprehensiveness, affecting premium growth potential.

Regulatory complexity requires substantial compliance investments and operational adjustments that can strain resources, particularly for smaller insurers. Evolving regulations demand continuous adaptation and may limit operational flexibility in certain market segments.

Low interest rates impact investment returns on insurance reserves, affecting overall profitability and potentially limiting capacity for competitive pricing. Prolonged low-yield environments challenge traditional insurance business models that rely on investment income.

Cyber security threats pose increasing risks to insurance operations, requiring substantial investments in security infrastructure and potentially exposing insurers to significant liability claims. Data breaches and system vulnerabilities can damage reputation and customer trust.

Economic uncertainty during challenging periods can reduce demand for discretionary insurance coverage while increasing claims frequency in certain lines. Economic downturns may also affect customer retention and new business acquisition rates.

Climate change impacts create unpredictable loss patterns that challenge traditional actuarial models and may require significant reserve adjustments. Extreme weather events can generate substantial claims that affect profitability and capital adequacy.

Digital innovation expansion presents significant opportunities for insurers to develop new products, improve customer experiences, and optimize operational efficiency. Advanced technologies enable personalized insurance solutions, real-time risk monitoring, and automated claims processing that can differentiate market participants.

Emerging risk coverage creates opportunities for specialized insurance products addressing cyber risks, environmental liabilities, and new technology exposures. As businesses adopt innovative technologies and face evolving threats, demand for comprehensive coverage solutions continues growing.

Sustainability integration offers opportunities to develop green insurance products, support renewable energy projects, and attract environmentally conscious consumers. Sustainable insurance practices can enhance brand reputation while addressing growing market demand for responsible business practices.

Partnership development with insurtech companies, technology providers, and distribution partners can accelerate innovation and market reach expansion. Strategic collaborations enable traditional insurers to access new capabilities while maintaining market position.

Data monetization through advanced analytics and insights can create additional revenue streams while improving risk assessment accuracy. Sophisticated data analysis capabilities enable better pricing, enhanced customer segmentation, and improved loss prevention services.

Market expansion into underserved segments or geographic regions within Germany presents growth opportunities for insurers with appropriate capabilities and resources. Targeted market development can drive premium growth and customer base expansion.

Competitive intensity shapes market dynamics through continuous innovation, pricing strategies, and customer service improvements. Market participants must balance competitive positioning with profitability requirements while maintaining regulatory compliance and operational excellence.

Customer expectations evolution drives insurers to enhance digital capabilities, improve claims processing speed, and provide more personalized service experiences. Modern consumers demand seamless interactions, transparent pricing, and responsive customer support across all touchpoints.

Risk landscape changes require continuous adaptation of underwriting practices, product offerings, and risk management strategies. Emerging risks such as cyber threats, climate change impacts, and technological disruptions necessitate ongoing model refinement and coverage evolution.

Regulatory evolution influences market operations through new requirements, consumer protection measures, and prudential standards. According to MarkWide Research analysis, regulatory changes continue to shape market structure and competitive dynamics across the German insurance sector.

Technology integration accelerates operational transformation while creating new opportunities for efficiency gains and customer value creation. Insurers investing in advanced technologies demonstrate operational efficiency improvements of approximately 23% annually compared to traditional approaches.

Economic factors including interest rates, inflation, and economic growth patterns directly impact insurance market performance through investment returns, claims costs, and customer demand patterns. These macroeconomic influences require careful monitoring and strategic adaptation.

Comprehensive research approach combines quantitative analysis, qualitative insights, and industry expertise to provide accurate market assessment and strategic intelligence. Primary research includes extensive interviews with industry executives, regulatory officials, and market participants across the German insurance ecosystem.

Data collection methods encompass multiple sources including regulatory filings, company reports, industry publications, and proprietary databases. Statistical analysis techniques ensure data accuracy and reliability while identifying significant trends and patterns within the market.

Market modeling utilizes advanced analytical frameworks to assess market size, growth patterns, competitive dynamics, and future projections. Econometric models incorporate various factors including economic indicators, demographic trends, and regulatory changes that influence market performance.

Industry validation through expert consultations and peer review processes ensures research accuracy and relevance. Continuous monitoring of market developments and regular updates maintain research currency and strategic value for stakeholders.

Analytical frameworks include Porter’s Five Forces analysis, SWOT assessment, and competitive positioning evaluation to provide comprehensive market understanding. These methodologies enable strategic insights and actionable recommendations for market participants.

North Rhine-Westphalia represents the largest regional market, accounting for approximately 22% of national premium volume due to high population density, industrial concentration, and strong economic activity. The region’s diverse economy supports robust demand across property and casualty insurance segments.

Bavaria demonstrates strong market performance with significant commercial and industrial insurance demand driven by manufacturing excellence and technological innovation. The region’s economic prosperity supports premium growth and product sophistication across multiple insurance lines.

Baden-Württemberg showcases high insurance penetration rates supported by affluent demographics and strong industrial presence. The region’s focus on innovation and technology creates demand for specialized coverage solutions and advanced risk management services.

Berlin and surrounding areas exhibit dynamic growth patterns driven by startup activity, government presence, and urban development. The capital region demonstrates increasing demand for cyber insurance and modern risk management solutions.

Hamburg and northern regions benefit from maritime commerce, logistics activities, and renewable energy development that create specialized insurance requirements. These areas show particular strength in commercial property and marine-related casualty coverage.

Eastern German states continue developing insurance market maturity with growing penetration rates and increasing awareness of comprehensive risk management importance. These regions present opportunities for market expansion and customer education initiatives.

Market leadership is distributed among several major players, each with distinct competitive advantages and market positioning strategies:

Competitive strategies focus on digital transformation, customer experience enhancement, and specialized product development. Market participants invest heavily in technology infrastructure, data analytics capabilities, and distribution channel optimization to maintain competitive advantages.

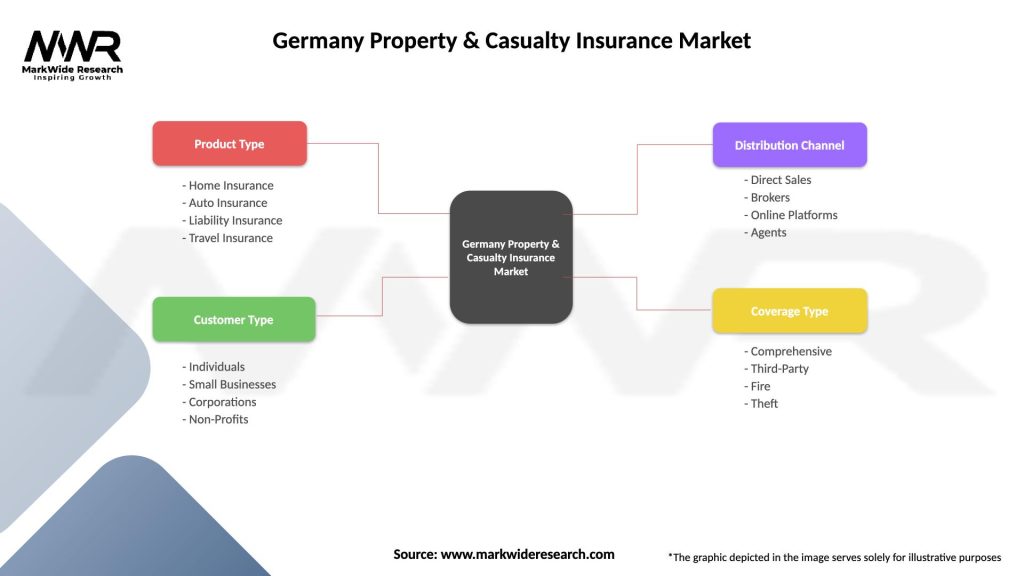

By Product Type:

By Customer Segment:

By Distribution Channel:

Residential Property Insurance demonstrates steady growth driven by homeownership rates and increasing property values. Coverage enhancements include smart home technology integration, climate risk protection, and comprehensive personal property coverage that addresses modern lifestyle needs.

Commercial Property Insurance shows robust demand from expanding businesses and industrial development projects. Specialized coverage for technology risks, business interruption, and supply chain disruptions has become increasingly important for commercial clients seeking comprehensive protection.

Motor Insurance undergoes transformation through telematics integration, usage-based pricing models, and electric vehicle coverage adaptation. MWR data indicates that telematics-based policies demonstrate 15% lower claims frequency compared to traditional coverage approaches.

Liability Insurance expands rapidly due to increasing litigation trends, regulatory requirements, and professional liability awareness. Cyber liability coverage has become essential, with adoption rates growing by approximately 28% annually across commercial segments.

Specialty Insurance Lines emerge as high-growth segments addressing unique risks including environmental liability, directors and officers coverage, and technology errors and omissions protection. These specialized products command premium pricing while serving critical risk management needs.

Insurance Companies benefit from market stability, regulatory clarity, and opportunities for technological advancement that enable sustainable growth and profitability. The German market provides a sophisticated customer base that values comprehensive coverage and professional service delivery.

Policyholders gain access to comprehensive protection, competitive pricing, and innovative coverage solutions that address evolving risk exposures. Strong regulatory oversight ensures consumer protection while promoting market competition that benefits end users.

Distribution Partners including agents and brokers benefit from diverse product portfolios, competitive commission structures, and technology support that enhances customer service capabilities. Digital tools and training programs improve distribution efficiency and customer satisfaction.

Reinsurance Companies find attractive opportunities in the German market through stable regulatory environment, sophisticated risk assessment capabilities, and diverse risk portfolios that support effective risk distribution and capital optimization.

Technology Providers benefit from increasing demand for insurance technology solutions, data analytics capabilities, and digital transformation services. The market’s openness to innovation creates opportunities for technology partnerships and solution development.

Regulatory Authorities maintain market stability through effective oversight while promoting competition and innovation that benefits consumers and supports economic growth throughout Germany’s insurance sector.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization acceleration transforms customer interactions, underwriting processes, and claims management through artificial intelligence, machine learning, and automated systems. Insurers implementing comprehensive digital strategies demonstrate significant improvements in operational efficiency and customer satisfaction metrics.

Sustainability integration becomes increasingly important as insurers develop environmental, social, and governance frameworks that influence underwriting decisions, investment strategies, and product development. Green insurance products and sustainable business practices attract environmentally conscious customers and investors.

Personalization advancement through data analytics and customer insights enables tailored insurance solutions, dynamic pricing models, and customized coverage options. Insurers leverage big data and predictive analytics to better understand customer needs and risk profiles.

Cyber insurance evolution addresses growing digital risks through comprehensive coverage solutions, risk assessment tools, and prevention services. As cyber threats become more sophisticated, insurance products adapt to provide effective protection and risk management support.

Climate risk management incorporates advanced weather modeling, flood risk assessment, and environmental impact analysis into underwriting and pricing decisions. Insurers develop sophisticated tools to assess and price climate-related risks more accurately.

Partnership strategies between traditional insurers and insurtech companies create opportunities for innovation, market expansion, and capability enhancement. Strategic collaborations enable rapid technology adoption and customer experience improvement.

Regulatory evolution continues shaping market operations through updated solvency requirements, consumer protection measures, and digital governance standards. Recent regulatory changes emphasize transparency, fair treatment of customers, and operational resilience requirements.

Technology investments accelerate across major insurers with significant resources allocated to artificial intelligence, blockchain technology, and advanced data analytics capabilities. These investments enable improved risk assessment, streamlined operations, and enhanced customer experiences.

Market consolidation through strategic acquisitions and partnerships reshapes competitive dynamics while creating opportunities for operational synergies and market expansion. Consolidation trends focus on technology capabilities, distribution networks, and specialized expertise.

Product innovation addresses emerging risks including cyber threats, climate change impacts, and new technology exposures. Insurers develop specialized coverage solutions that meet evolving customer needs and risk management requirements.

Distribution transformation through digital channels, direct-to-consumer platforms, and enhanced agent support systems improves market reach and customer accessibility. Multi-channel distribution strategies provide customers with flexible purchasing and service options.

Sustainability initiatives gain prominence as insurers implement environmental policies, support renewable energy projects, and develop climate-conscious underwriting practices. These initiatives align with broader societal goals while creating business opportunities.

Technology investment prioritization should focus on customer-facing applications, automated underwriting systems, and predictive analytics capabilities that provide competitive advantages. Insurers should develop comprehensive digital strategies that integrate technology across all business functions.

Risk management enhancement through advanced modeling techniques, data analytics, and emerging risk assessment capabilities will become increasingly critical. Companies should invest in sophisticated risk management tools that address climate change, cyber threats, and other evolving exposures.

Customer experience optimization requires seamless digital interactions, responsive customer service, and personalized insurance solutions. Insurers should prioritize customer journey mapping and experience design to maintain competitive positioning.

Partnership development with technology providers, insurtech companies, and distribution partners can accelerate innovation and market expansion. Strategic collaborations should focus on complementary capabilities and mutual value creation.

Sustainability integration should become a core business strategy encompassing product development, investment decisions, and operational practices. Companies should develop comprehensive environmental, social, and governance frameworks that support long-term success.

Market differentiation through specialized products, superior customer service, and innovative coverage solutions will become increasingly important in competitive markets. Insurers should identify unique value propositions that resonate with target customer segments.

Growth prospects remain positive for the German property and casualty insurance market, supported by economic stability, technological advancement, and evolving risk management needs. MarkWide Research projections indicate continued market expansion driven by digital transformation and emerging risk coverage demand.

Technology integration will accelerate across all market segments, with artificial intelligence, machine learning, and blockchain technologies becoming standard operational tools. Insurers embracing comprehensive digital transformation are expected to achieve competitive advantages of approximately 18% in operational efficiency compared to traditional approaches.

Regulatory evolution will continue shaping market structure through enhanced consumer protection measures, digital governance requirements, and sustainability reporting standards. These changes will create opportunities for well-prepared insurers while challenging those with limited adaptation capabilities.

Climate change adaptation will become increasingly critical as insurers develop sophisticated risk assessment tools and coverage solutions that address environmental exposures. Companies investing in climate risk management capabilities will be better positioned for long-term success.

Market consolidation trends are expected to continue through strategic acquisitions, partnerships, and joint ventures that create operational synergies and competitive advantages. Successful consolidation strategies will focus on technology capabilities, customer bases, and specialized expertise.

Customer expectations will continue evolving toward digital-first experiences, personalized solutions, and transparent pricing models. Insurers meeting these expectations through innovative products and superior service delivery will capture market share and customer loyalty.

The Germany Property & Casualty Insurance Market demonstrates remarkable resilience and growth potential within Europe’s most stable economic environment. Market participants benefit from sophisticated regulatory frameworks, advanced technology adoption, and evolving customer demands that create opportunities for innovation and expansion.

Strategic success in this market requires comprehensive digital transformation, sophisticated risk management capabilities, and customer-centric service delivery. Insurers that effectively balance traditional insurance expertise with modern technology solutions will achieve sustainable competitive advantages and market leadership positions.

Future market dynamics will be shaped by continued digitalization, climate change adaptation, emerging risk management, and regulatory evolution. Companies that proactively address these trends while maintaining operational excellence will thrive in Germany’s dynamic insurance marketplace.

Investment opportunities remain attractive for insurers, technology providers, and distribution partners who understand market complexities and customer needs. The German market’s stability, innovation capacity, and growth potential make it an essential component of European insurance strategies for the foreseeable future.

What is Property & Casualty Insurance?

Property & Casualty Insurance refers to a type of insurance that provides coverage for property loss and liability for damages to others. It encompasses various policies, including homeowners, auto, and commercial insurance, protecting individuals and businesses from financial losses due to unforeseen events.

What are the key players in the Germany Property & Casualty Insurance Market?

Key players in the Germany Property & Casualty Insurance Market include Allianz, Munich Re, and AXA. These companies offer a range of insurance products and services, catering to both individual and commercial clients, among others.

What are the main drivers of growth in the Germany Property & Casualty Insurance Market?

The main drivers of growth in the Germany Property & Casualty Insurance Market include increasing awareness of risk management, a rise in natural disasters prompting demand for coverage, and the expansion of e-commerce leading to higher liability needs for businesses.

What challenges does the Germany Property & Casualty Insurance Market face?

The Germany Property & Casualty Insurance Market faces challenges such as regulatory changes, increasing competition from insurtech companies, and the need to adapt to climate change impacts on risk assessment and pricing.

What opportunities exist in the Germany Property & Casualty Insurance Market?

Opportunities in the Germany Property & Casualty Insurance Market include the growth of digital insurance solutions, the potential for personalized insurance products, and the increasing demand for cyber insurance as businesses become more reliant on technology.

What trends are shaping the Germany Property & Casualty Insurance Market?

Trends shaping the Germany Property & Casualty Insurance Market include the integration of artificial intelligence in underwriting processes, the rise of usage-based insurance models, and a growing focus on sustainability and ESG factors in insurance offerings.

Germany Property & Casualty Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Home Insurance, Auto Insurance, Liability Insurance, Travel Insurance |

| Customer Type | Individuals, Small Businesses, Corporations, Non-Profits |

| Distribution Channel | Direct Sales, Brokers, Online Platforms, Agents |

| Coverage Type | Comprehensive, Third-Party, Fire, Theft |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Property & Casualty Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at