444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany plastic packaging films market represents a cornerstone of the European packaging industry, demonstrating remarkable resilience and continuous innovation in response to evolving consumer demands and sustainability requirements. Germany’s position as Europe’s largest economy has established it as a critical hub for plastic packaging film manufacturing, distribution, and technological advancement. The market encompasses a diverse range of applications spanning food and beverage packaging, pharmaceutical products, consumer goods, and industrial applications.

Market dynamics in Germany reflect a sophisticated balance between traditional packaging requirements and emerging sustainability mandates. The country’s robust manufacturing sector, coupled with stringent environmental regulations, has driven significant innovation in biodegradable and recyclable plastic packaging films. Growth projections indicate the market is expanding at a steady CAGR of 4.2%, primarily driven by increasing demand for flexible packaging solutions and advanced barrier properties.

Technological advancement remains a defining characteristic of Germany’s plastic packaging films sector, with manufacturers investing heavily in multi-layer film technologies, smart packaging solutions, and sustainable material alternatives. The market benefits from Germany’s strong chemical industry foundation and advanced manufacturing capabilities, positioning it as a leader in high-performance packaging film development across Europe.

The Germany plastic packaging films market refers to the comprehensive ecosystem of manufacturing, distribution, and application of thin plastic materials used for packaging purposes across various industries within German borders. These films are engineered polymer-based materials designed to protect, preserve, and present products while meeting specific performance criteria including barrier properties, mechanical strength, and aesthetic appeal.

Plastic packaging films in the German context encompass multiple polymer types including polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), polyvinyl chloride (PVC), and emerging bio-based alternatives. The market definition includes flexible films used in food packaging, shrink wraps, stretch films, barrier films, and specialty applications requiring specific functional properties.

German market characteristics emphasize quality, innovation, and environmental responsibility, distinguishing it from other regional markets through stringent quality standards and advanced technological integration. The market serves both domestic consumption needs and export requirements, leveraging Germany’s strategic position within the European Union for cross-border trade and distribution.

Germany’s plastic packaging films market demonstrates robust growth momentum driven by technological innovation, sustainability initiatives, and diverse application demands across multiple industries. Key market drivers include the expanding food and beverage sector, pharmaceutical industry growth, and increasing adoption of flexible packaging solutions that offer superior product protection and shelf-life extension.

Market segmentation reveals food packaging as the dominant application area, accounting for approximately 45% of total market share, followed by industrial applications and consumer goods packaging. Regional distribution shows concentration in industrial centers including North Rhine-Westphalia, Bavaria, and Baden-Württemberg, where major manufacturing facilities and end-user industries are located.

Sustainability trends are reshaping market dynamics, with 62% of manufacturers investing in recyclable and biodegradable film technologies to meet circular economy objectives. Competitive landscape features both multinational corporations and specialized German manufacturers, creating a dynamic environment that fosters innovation and technological advancement.

Future outlook indicates continued market expansion supported by digitalization trends, smart packaging integration, and growing demand for high-barrier films in pharmaceutical and food applications. Regulatory compliance remains a critical success factor, with manufacturers adapting to evolving environmental regulations and food safety standards.

Market intelligence reveals several critical insights that define Germany’s plastic packaging films landscape and future trajectory:

These insights collectively demonstrate Germany’s position as a mature yet dynamic market that balances traditional packaging requirements with emerging technological and environmental demands. Market participants benefit from strong domestic demand, advanced manufacturing capabilities, and strategic access to European markets.

Primary market drivers propelling Germany’s plastic packaging films sector encompass both traditional demand factors and emerging market trends that create sustained growth opportunities.

Food Industry Expansion represents the most significant driver, with Germany’s robust food processing sector requiring advanced packaging solutions for product preservation, shelf-life extension, and consumer convenience. Changing consumer preferences toward ready-to-eat meals, organic products, and premium food items drive demand for specialized barrier films and attractive packaging presentations.

E-commerce Growth has accelerated demand for protective packaging films, with online retail expansion requiring durable, lightweight, and cost-effective packaging solutions. Pharmaceutical Sector Development contributes substantially to market growth, as Germany’s position as a pharmaceutical manufacturing hub creates consistent demand for high-barrier, sterile packaging films meeting stringent regulatory requirements.

Sustainability Mandates paradoxically drive market growth by creating demand for innovative, environmentally-friendly packaging solutions. Technological advancement in recycling technologies and bio-based materials opens new market segments while addressing environmental concerns.

Export Opportunities within the European Union provide additional growth drivers, with German manufacturers leveraging quality reputation and technological capabilities to serve international markets. Industrial applications including automotive, electronics, and construction sectors contribute to diversified demand patterns that support market stability and growth.

Market constraints affecting Germany’s plastic packaging films sector present significant challenges that industry participants must navigate to maintain growth trajectories and competitive positioning.

Environmental Regulations impose increasingly stringent requirements on plastic packaging materials, creating compliance costs and limiting certain product applications. Single-use plastic restrictions in various German states and municipalities directly impact market demand for traditional packaging films, forcing manufacturers to invest heavily in alternative materials and technologies.

Raw Material Price Volatility significantly impacts profitability, with petroleum-based polymer prices subject to global oil market fluctuations and supply chain disruptions. Energy Costs in Germany remain among the highest in Europe, affecting manufacturing competitiveness and operational margins for plastic film producers.

Consumer Perception challenges regarding plastic packaging sustainability create market resistance and drive demand toward alternative packaging materials. Competition from Alternatives including paper-based packaging, glass, and metal containers limits market expansion in certain application segments.

Recycling Infrastructure limitations constrain the development of circular economy solutions, despite strong regulatory pressure for improved recyclability. Labor Shortages in skilled manufacturing positions affect production capacity and technological advancement capabilities across the industry.

International Competition from lower-cost producers in Eastern Europe and Asia creates pricing pressure on German manufacturers, particularly in commodity film segments where differentiation is limited.

Emerging opportunities within Germany’s plastic packaging films market present substantial potential for growth, innovation, and market expansion across multiple dimensions.

Sustainable Packaging Innovation represents the most significant opportunity, with growing demand for biodegradable, compostable, and recyclable packaging films. Bio-based Materials development offers manufacturers opportunities to capture premium market segments while meeting environmental objectives and regulatory requirements.

Smart Packaging Technologies create new market categories through integration of sensors, indicators, and digital connectivity features that enhance product safety, traceability, and consumer engagement. Active Packaging solutions incorporating antimicrobial properties, oxygen scavengers, and moisture control systems address growing food safety and quality preservation demands.

Pharmaceutical Packaging Growth offers high-value opportunities as Germany’s pharmaceutical sector expands and requires increasingly sophisticated packaging solutions for drug stability, patient safety, and regulatory compliance. Medical Device Packaging represents an adjacent opportunity with similar technical requirements and quality standards.

Export Market Expansion within Europe and globally provides growth opportunities for German manufacturers leveraging quality reputation and technological capabilities. Circular Economy Solutions including closed-loop recycling systems and waste-to-energy applications create new business models and revenue streams.

Digitalization Integration enables manufacturers to optimize production processes, improve quality control, and develop customized solutions for specific customer requirements, creating competitive advantages and premium pricing opportunities.

Market dynamics in Germany’s plastic packaging films sector reflect complex interactions between regulatory pressures, technological advancement, consumer preferences, and competitive forces that shape industry evolution.

Supply Chain Integration has intensified as manufacturers seek greater control over raw material costs and quality consistency. Vertical integration strategies connecting chemical producers with film manufacturers and packaging converters create more resilient business models and improved margin control.

Innovation Cycles have accelerated in response to sustainability pressures and technological opportunities, with product development timelines shortening from years to months for certain applications. Collaborative innovation between manufacturers, brand owners, and research institutions drives breakthrough developments in material science and processing technologies.

Regulatory Adaptation requires continuous investment in compliance capabilities and product reformulation to meet evolving environmental and safety standards. Market consolidation trends favor larger manufacturers with resources to invest in sustainable technologies and regulatory compliance systems.

Customer Relationship Evolution shifts toward partnership models where film manufacturers work closely with brand owners to develop customized solutions addressing specific performance, sustainability, and cost objectives. Digital transformation enables more responsive customer service and customized product development capabilities.

Competitive differentiation increasingly focuses on sustainability credentials, technical performance, and service capabilities rather than price alone, creating opportunities for premium positioning and value-based pricing strategies.

Research methodology employed for analyzing Germany’s plastic packaging films market incorporates comprehensive primary and secondary research approaches designed to provide accurate, actionable market intelligence.

Primary Research encompasses structured interviews with industry executives, manufacturing managers, procurement specialists, and technical experts across the plastic packaging films value chain. Survey methodologies capture quantitative data on market trends, technology adoption, sustainability initiatives, and competitive positioning from representative industry participants.

Secondary Research leverages authoritative industry publications, government statistics, trade association reports, and academic research to establish market context and validate primary findings. Data triangulation ensures accuracy and reliability through cross-verification of information from multiple independent sources.

Market Modeling utilizes statistical analysis and forecasting techniques to project market trends, segment growth, and competitive dynamics based on historical data and identified market drivers. Scenario analysis evaluates potential market outcomes under different regulatory, economic, and technological conditions.

Expert Validation involves review and feedback from industry specialists, academic researchers, and market analysts to ensure research findings accurately reflect market realities and emerging trends. Continuous monitoring of market developments ensures research remains current and relevant to market participants’ strategic planning needs.

Quality assurance protocols maintain research integrity through systematic data verification, bias elimination, and transparent methodology documentation that supports reliable decision-making by market participants.

Regional distribution within Germany’s plastic packaging films market reveals distinct geographic patterns influenced by industrial concentration, infrastructure availability, and market access considerations.

North Rhine-Westphalia dominates the market landscape, accounting for approximately 35% of national production capacity, benefiting from dense industrial infrastructure, chemical industry presence, and strategic logistics connectivity. Major manufacturing centers in Düsseldorf, Cologne, and Dortmund serve both domestic and export markets efficiently.

Bavaria represents the second-largest regional market with 22% market share, driven by strong automotive, electronics, and food processing industries that create diverse demand for specialized packaging films. Munich and Nuremberg serve as key distribution hubs connecting German production with Austrian and Eastern European markets.

Baden-Württemberg contributes 18% of market activity, leveraging its position as a technology and innovation center to specialize in high-performance and sustainable packaging film solutions. Stuttgart region benefits from automotive industry proximity and advanced manufacturing capabilities.

Lower Saxony and Schleswig-Holstein collectively account for 15% of market share, focusing on food packaging applications due to strong agricultural and food processing sectors. Hamburg’s port facilities provide crucial export infrastructure for German manufacturers serving international markets.

Eastern German states including Saxony, Thuringia, and Brandenburg represent emerging growth regions with 10% combined market share, benefiting from lower operational costs and proximity to Eastern European markets.

Competitive dynamics in Germany’s plastic packaging films market feature a diverse mix of multinational corporations, regional specialists, and innovative technology companies that create a dynamic and competitive environment.

Market competition intensifies around sustainability credentials, technical innovation, and customer service capabilities rather than price alone. Strategic partnerships between film manufacturers and end-user industries create competitive advantages through customized solution development and long-term supply agreements.

Innovation leadership becomes increasingly important as manufacturers differentiate through advanced barrier properties, smart packaging features, and sustainable material alternatives. Market consolidation trends favor companies with resources to invest in technology development and regulatory compliance capabilities.

Market segmentation analysis reveals distinct categories within Germany’s plastic packaging films market, each characterized by specific performance requirements, applications, and growth dynamics.

By Material Type:

By Application:

By Technology:

Category analysis provides detailed insights into specific market segments that drive Germany’s plastic packaging films industry growth and innovation.

Food Packaging Films represent the largest and most dynamic category, driven by Germany’s robust food processing industry and changing consumer preferences. Barrier films with enhanced oxygen and moisture protection properties experience particularly strong demand as food manufacturers seek to extend shelf life and reduce food waste. Sustainable alternatives including compostable and recyclable films gain market share as retailers and consumers prioritize environmental responsibility.

Pharmaceutical Packaging Films constitute a high-value category with stringent quality requirements and regulatory compliance demands. Blister packaging films and pouch materials require exceptional barrier properties, chemical resistance, and sterilization compatibility. Cold-form foils and tropical blister films serve specialized applications in drug packaging and medical device protection.

Industrial Packaging Films serve diverse applications across automotive, electronics, and manufacturing sectors with emphasis on protection, durability, and handling efficiency. Stretch films and shrink films dominate this category, providing cost-effective solutions for palletizing, bundling, and product protection during transportation and storage.

Specialty Films including smart packaging and active packaging solutions represent emerging categories with significant growth potential. Antimicrobial films, oxygen scavenger films, and indicator films address specific performance requirements in food safety and quality preservation applications.

Industry participants and stakeholders in Germany’s plastic packaging films market realize substantial benefits through strategic positioning and operational excellence within this dynamic sector.

Manufacturers benefit from Germany’s strong industrial base, advanced technology infrastructure, and skilled workforce that enable production of high-quality, innovative packaging solutions. Access to European markets through Germany’s central location and excellent logistics infrastructure provides significant competitive advantages for export-oriented strategies.

Brand Owners gain access to cutting-edge packaging technologies that enhance product protection, shelf appeal, and sustainability credentials. Collaborative innovation opportunities with German manufacturers enable development of customized solutions that differentiate products in competitive markets while meeting regulatory requirements.

Retailers benefit from advanced packaging solutions that improve product presentation, reduce waste, and meet consumer expectations for environmental responsibility. Supply chain efficiency improvements through optimized packaging design reduce logistics costs and inventory management complexity.

Consumers experience enhanced product quality, safety, and convenience through advanced packaging technologies that extend shelf life, provide tamper evidence, and improve handling characteristics. Sustainability initiatives address environmental concerns while maintaining product protection and quality standards.

Investors find attractive opportunities in a market characterized by steady growth, technological innovation, and increasing demand for sustainable solutions. Market stability supported by diverse application segments and strong domestic demand provides reliable investment returns.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends shaping Germany’s plastic packaging films market reflect broader industry evolution toward sustainability, digitalization, and enhanced functionality.

Sustainability Integration dominates market trends, with 78% of manufacturers investing in recyclable and biodegradable film technologies to meet circular economy objectives. Bio-based materials gain market acceptance as performance characteristics improve and cost differentials narrow compared to traditional petroleum-based films.

Smart Packaging Adoption accelerates across multiple application segments, incorporating sensors, indicators, and digital connectivity features that enhance product safety, traceability, and consumer engagement. Active packaging technologies including antimicrobial properties and oxygen scavenging capabilities address growing food safety and quality preservation demands.

Customization Demand increases as brand owners seek differentiated packaging solutions that enhance product appeal and market positioning. Digital printing integration enables shorter production runs and personalized packaging options that were previously economically unfeasible.

Lightweighting Initiatives drive development of thinner films with maintained or enhanced performance characteristics, reducing material usage and transportation costs while meeting sustainability objectives. Multi-layer technologies enable optimal property combinations in minimal material thickness.

Circular Economy Implementation creates new business models focused on packaging recovery, recycling, and reuse systems that extend material lifecycles and reduce environmental impact while creating additional revenue streams for manufacturers.

Recent industry developments demonstrate the dynamic nature of Germany’s plastic packaging films market and the continuous innovation driving sector evolution.

Sustainable Material Breakthroughs include successful commercialization of compostable films with performance characteristics comparable to traditional plastics, enabling broader adoption across food packaging applications. Chemical recycling technologies advance toward commercial viability, creating closed-loop systems for plastic packaging waste.

Digital Integration Advances encompass smart packaging solutions with embedded sensors and connectivity features that provide real-time product information and supply chain visibility. Blockchain integration enables enhanced traceability and authenticity verification for premium products and pharmaceutical applications.

Manufacturing Innovation includes implementation of artificial intelligence and machine learning technologies for quality control, process optimization, and predictive maintenance that improve efficiency and reduce waste. Automation expansion enhances production flexibility and reduces labor dependency.

Strategic Partnerships between film manufacturers, brand owners, and technology companies accelerate innovation development and market introduction of advanced packaging solutions. Acquisition activity consolidates market participants and creates integrated value chains from raw materials to finished packaging.

Regulatory Developments include implementation of extended producer responsibility programs and plastic packaging taxes that reshape market economics and drive sustainable innovation investments across the industry.

Strategic recommendations for market participants in Germany’s plastic packaging films sector focus on positioning for long-term success amid evolving market dynamics and regulatory requirements.

Sustainability Leadership should become a core strategic priority, with manufacturers investing in recyclable, biodegradable, and bio-based film technologies to meet regulatory requirements and consumer expectations. MarkWide Research analysis indicates that companies with strong sustainability credentials will capture premium market segments and achieve superior growth rates.

Innovation Investment in smart packaging technologies, active packaging solutions, and advanced barrier properties creates competitive differentiation and enables premium pricing strategies. Collaborative innovation partnerships with research institutions and technology companies accelerate development timelines and reduce investment risks.

Market Diversification across application segments and geographic regions reduces dependence on single markets and creates resilience against sector-specific challenges. Export market development leverages German quality reputation and technological capabilities to capture international growth opportunities.

Digital Transformation implementation across manufacturing processes, customer service, and supply chain management improves operational efficiency and enables customized solution development. Data analytics capabilities provide insights for product optimization and market trend identification.

Supply Chain Integration through strategic partnerships or vertical integration reduces raw material cost volatility and ensures quality consistency while improving margin control and customer service capabilities.

Future projections for Germany’s plastic packaging films market indicate continued evolution driven by sustainability imperatives, technological advancement, and changing consumer preferences that reshape industry dynamics.

Market growth is expected to maintain momentum with projected expansion at 4.5% CAGR over the next five years, supported by increasing demand for sustainable packaging solutions and advanced functionality features. Sustainable materials will capture an increasing market share, potentially reaching 25% of total volume by 2028 as performance characteristics improve and cost competitiveness increases.

Technology integration will accelerate, with smart packaging solutions becoming mainstream across food, pharmaceutical, and consumer goods applications. Digital connectivity features will enable new business models based on data collection, consumer engagement, and supply chain optimization.

Regulatory evolution will continue driving market transformation, with extended producer responsibility programs and circular economy mandates creating new requirements for packaging design, recyclability, and waste management. MWR projections suggest that regulatory compliance will become an increasingly important competitive differentiator.

International expansion opportunities will grow as German manufacturers leverage quality reputation and technological capabilities to serve emerging markets in Asia, Africa, and Latin America where packaging demand is expanding rapidly.

Industry consolidation is likely to continue as companies seek scale advantages, technology access, and geographic diversification through strategic acquisitions and partnerships that create integrated value chains and enhanced market positioning.

Germany’s plastic packaging films market represents a dynamic and evolving sector that successfully balances traditional packaging requirements with emerging sustainability and technology demands. Market fundamentals remain strong, supported by diverse application segments, advanced manufacturing capabilities, and strategic access to European and global markets.

Sustainability transformation emerges as the defining trend reshaping market dynamics, creating both challenges and opportunities for industry participants. Companies that embrace sustainable innovation, invest in advanced technologies, and develop circular economy solutions will capture premium market segments and achieve superior long-term performance.

Technological advancement continues driving market evolution through smart packaging solutions, advanced barrier properties, and digital integration capabilities that enhance functionality and create new value propositions. Innovation leadership becomes increasingly important for competitive differentiation and market positioning.

Strategic success in this market requires balancing operational excellence with innovation investment, sustainability leadership with cost competitiveness, and domestic market strength with international expansion opportunities. Market participants that successfully navigate these complex dynamics will benefit from sustained growth, premium positioning, and long-term competitive advantages in Germany’s evolving plastic packaging films landscape.

What is Plastic Packaging Films?

Plastic packaging films are thin layers of plastic used to wrap, protect, and preserve products. They are commonly used in food packaging, medical supplies, and consumer goods to enhance shelf life and maintain product integrity.

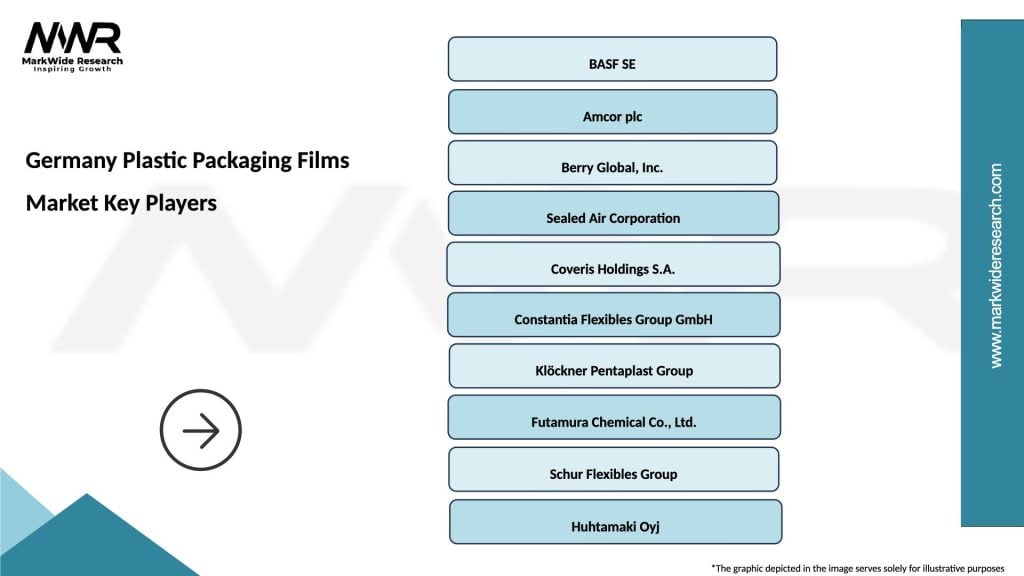

What are the key players in the Germany Plastic Packaging Films Market?

Key players in the Germany Plastic Packaging Films Market include BASF SE, Amcor plc, and Mondi Group, among others. These companies are known for their innovative packaging solutions and commitment to sustainability.

What are the growth factors driving the Germany Plastic Packaging Films Market?

The growth of the Germany Plastic Packaging Films Market is driven by increasing demand for convenient packaging solutions, the rise of e-commerce, and a focus on food safety and preservation. Additionally, advancements in film technology are enhancing product performance.

What challenges does the Germany Plastic Packaging Films Market face?

The Germany Plastic Packaging Films Market faces challenges such as environmental concerns regarding plastic waste and stringent regulations on plastic usage. These factors are prompting companies to seek sustainable alternatives and improve recycling processes.

What opportunities exist in the Germany Plastic Packaging Films Market?

Opportunities in the Germany Plastic Packaging Films Market include the development of biodegradable films and innovations in smart packaging technologies. These advancements can cater to the growing consumer demand for eco-friendly and functional packaging solutions.

What trends are shaping the Germany Plastic Packaging Films Market?

Trends in the Germany Plastic Packaging Films Market include a shift towards sustainable materials, increased use of multi-layer films for enhanced barrier properties, and the integration of digital printing technologies. These trends reflect the industry’s response to consumer preferences and regulatory pressures.

Germany Plastic Packaging Films Market

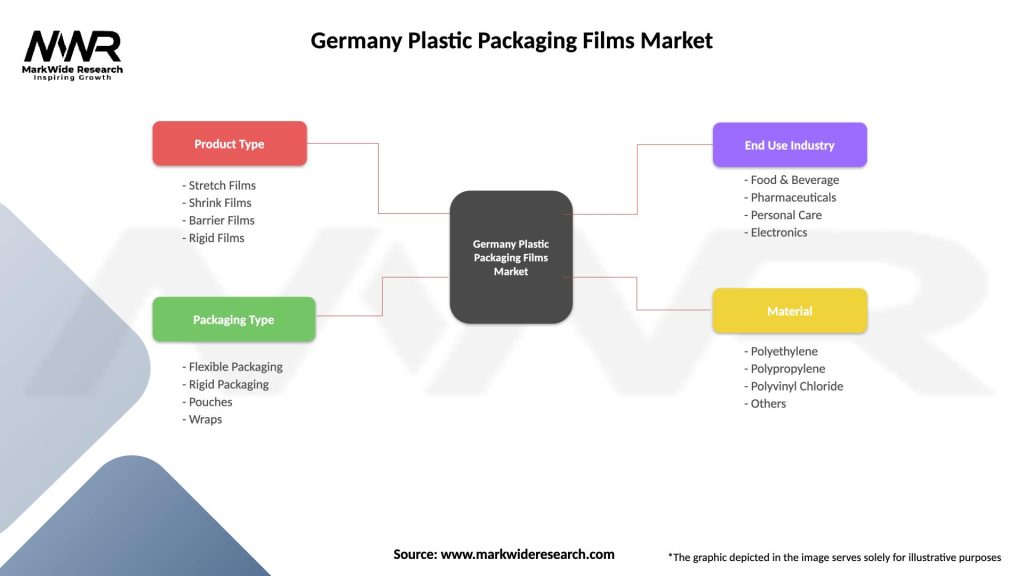

| Segmentation Details | Description |

|---|---|

| Product Type | Stretch Films, Shrink Films, Barrier Films, Rigid Films |

| Packaging Type | Flexible Packaging, Rigid Packaging, Pouches, Wraps |

| End Use Industry | Food & Beverage, Pharmaceuticals, Personal Care, Electronics |

| Material | Polyethylene, Polypropylene, Polyvinyl Chloride, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Plastic Packaging Films Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at