444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany pharmaceutical warehousing market stands as a cornerstone of Europe’s healthcare supply chain infrastructure, representing one of the most sophisticated and regulated pharmaceutical distribution networks globally. Germany’s position as Europe’s largest pharmaceutical market has driven unprecedented demand for specialized warehousing solutions that ensure drug safety, regulatory compliance, and efficient distribution across the continent.

Market dynamics indicate robust growth driven by increasing pharmaceutical production, expanding biotechnology sector, and stringent regulatory requirements for drug storage and handling. The market demonstrates exceptional resilience with growth rates of 6.2% CAGR projected through the forecast period, reflecting the critical importance of pharmaceutical logistics in Germany’s healthcare ecosystem.

Technological advancement has transformed traditional pharmaceutical warehousing into highly automated, temperature-controlled environments equipped with advanced tracking systems, robotics, and artificial intelligence. These innovations ensure pharmaceutical integrity while optimizing operational efficiency and reducing human error in critical drug handling processes.

Regulatory compliance remains the primary driver shaping warehouse design and operations, with German authorities enforcing strict GDP (Good Distribution Practice) guidelines that mandate specific storage conditions, documentation protocols, and quality assurance measures throughout the pharmaceutical supply chain.

The Germany pharmaceutical warehousing market refers to the comprehensive ecosystem of specialized storage facilities, distribution centers, and logistics infrastructure designed specifically for handling pharmaceutical products, medical devices, and healthcare supplies within Germany’s borders. This market encompasses temperature-controlled storage solutions, automated handling systems, regulatory compliance technologies, and specialized transportation networks that ensure pharmaceutical products maintain their efficacy and safety from manufacturer to end consumer.

Pharmaceutical warehousing differs significantly from conventional storage solutions due to stringent regulatory requirements, temperature sensitivity of products, security protocols, and traceability demands. These facilities must maintain precise environmental conditions, implement robust quality management systems, and ensure complete chain of custody documentation for all pharmaceutical products.

Market participants include third-party logistics providers, pharmaceutical manufacturers with dedicated distribution centers, specialized cold chain logistics companies, and technology providers offering warehouse management systems specifically designed for pharmaceutical applications.

Germany’s pharmaceutical warehousing market represents a critical component of the nation’s healthcare infrastructure, driven by the country’s position as Europe’s pharmaceutical manufacturing hub and gateway to continental markets. The market demonstrates consistent expansion fueled by increasing pharmaceutical production, growing biotechnology sector, and rising demand for specialized storage solutions.

Key growth drivers include the expansion of biologics and biosimilars requiring ultra-cold storage, increasing regulatory scrutiny demanding enhanced compliance capabilities, and the digitalization of pharmaceutical supply chains through advanced warehouse management systems. The market benefits from 78% adoption rate of automated storage solutions among major pharmaceutical distributors.

Market segmentation reveals strong demand across multiple pharmaceutical categories, with prescription drugs representing the largest segment, followed by over-the-counter medications, medical devices, and specialized biologics requiring controlled temperature environments. The cold chain segment demonstrates particularly robust growth with 8.4% annual expansion rate.

Competitive landscape features a mix of international logistics giants, specialized pharmaceutical distributors, and technology providers, all competing to offer comprehensive warehousing solutions that meet Germany’s stringent regulatory requirements while optimizing operational efficiency and cost-effectiveness.

Strategic market insights reveal several critical trends shaping Germany’s pharmaceutical warehousing landscape:

Primary market drivers propelling Germany’s pharmaceutical warehousing sector include the nation’s robust pharmaceutical manufacturing base, which produces approximately 25% of Europe’s pharmaceutical output. This manufacturing strength creates substantial demand for sophisticated warehousing solutions capable of handling diverse pharmaceutical products with varying storage requirements.

Regulatory requirements serve as a fundamental driver, with German authorities enforcing stringent GDP guidelines that mandate specific warehouse design standards, environmental controls, and documentation protocols. These regulations necessitate continuous investment in advanced warehousing infrastructure and technology solutions to maintain compliance and operational licenses.

Biotechnology expansion represents a significant growth driver, as Germany’s thriving biotech sector produces increasing volumes of temperature-sensitive biologics, vaccines, and personalized medicines requiring specialized cold chain storage solutions. The growing complexity of these products demands more sophisticated warehousing capabilities.

Digital transformation initiatives drive adoption of advanced warehouse management systems, IoT sensors, and automated handling equipment that enhance operational efficiency while ensuring pharmaceutical product integrity. These technological investments improve traceability, reduce errors, and optimize inventory management processes.

European distribution hub positioning leverages Germany’s central location and excellent transportation infrastructure to serve as a primary distribution point for pharmaceutical products throughout Europe, creating demand for large-scale, strategically located warehouse facilities.

Significant market restraints include the substantial capital investment requirements for establishing compliant pharmaceutical warehousing facilities. The specialized infrastructure, advanced environmental control systems, and regulatory compliance technologies require considerable upfront investment that can limit market entry for smaller players.

Regulatory complexity presents ongoing challenges, as pharmaceutical warehouses must navigate evolving GDP guidelines, environmental regulations, and safety protocols. Compliance costs and the need for continuous facility upgrades to meet changing regulatory standards can strain operational budgets and limit expansion capabilities.

Skilled workforce shortage affects the pharmaceutical warehousing sector, as operations require specialized personnel trained in pharmaceutical handling, regulatory compliance, and advanced warehouse technologies. The shortage of qualified professionals can limit operational capacity and increase labor costs.

Energy costs represent a significant operational constraint, particularly for cold chain facilities requiring continuous temperature control. Rising energy prices and sustainability requirements create pressure to invest in energy-efficient systems while maintaining strict environmental controls for pharmaceutical products.

Real estate limitations in strategic locations near major pharmaceutical manufacturing centers and transportation hubs can constrain expansion opportunities and increase facility costs, particularly in densely populated industrial regions where suitable warehouse space is limited.

Substantial market opportunities emerge from Germany’s growing biotechnology sector, which creates increasing demand for specialized ultra-cold storage solutions capable of maintaining temperatures as low as -80°C for advanced biologics and gene therapies. This segment offers premium pricing opportunities for specialized service providers.

Digital transformation initiatives present opportunities for technology integration, including blockchain-based traceability systems, AI-powered inventory optimization, and predictive maintenance solutions that enhance operational efficiency while ensuring regulatory compliance. These technologies can differentiate service providers in a competitive market.

Sustainability initiatives create opportunities for green warehousing solutions, including renewable energy systems, energy-efficient cooling technologies, and sustainable packaging solutions that reduce environmental impact while maintaining pharmaceutical product integrity. Companies investing in sustainable practices can capture environmentally conscious clients.

Regional expansion opportunities exist as German pharmaceutical companies increasingly serve Eastern European markets, creating demand for strategically located distribution centers that can efficiently serve these emerging markets while maintaining German quality standards and regulatory compliance.

Personalized medicine growth offers opportunities for specialized handling and storage solutions for customized pharmaceutical products, cell and gene therapies, and patient-specific treatments that require unique storage conditions and handling protocols.

Market dynamics in Germany’s pharmaceutical warehousing sector reflect the complex interplay between regulatory requirements, technological advancement, and evolving pharmaceutical industry needs. The market demonstrates remarkable stability due to the essential nature of pharmaceutical distribution, while simultaneously experiencing transformation through digitalization and automation initiatives.

Supply chain integration has become increasingly sophisticated, with pharmaceutical warehouses serving as critical nodes in complex distribution networks that span from raw material suppliers to end consumers. This integration requires advanced coordination capabilities and real-time visibility across the entire supply chain.

Quality assurance protocols continue evolving in response to regulatory updates and industry best practices, driving continuous investment in monitoring systems, documentation processes, and staff training programs. These quality initiatives ensure 99.8% product integrity rates throughout the warehousing process.

Competitive pressures intensify as pharmaceutical companies seek cost-effective warehousing solutions without compromising quality or compliance standards. This dynamic encourages innovation in operational efficiency, automation implementation, and value-added services that differentiate warehouse providers.

Technology adoption cycles accelerate as warehouse operators invest in advanced systems to maintain competitive advantages and meet evolving customer expectations for real-time visibility, predictive analytics, and seamless integration with pharmaceutical company systems.

Comprehensive research methodology employed for analyzing Germany’s pharmaceutical warehousing market incorporates multiple data collection approaches, including primary research through industry expert interviews, facility operator surveys, and pharmaceutical company assessments of warehousing requirements and satisfaction levels.

Secondary research components encompass analysis of regulatory filings, industry association reports, government statistics on pharmaceutical production and distribution, and technology provider case studies demonstrating warehouse automation implementations and performance improvements.

Market sizing methodology utilizes bottom-up analysis of warehouse capacity, utilization rates, and service pricing structures across different pharmaceutical segments, combined with top-down analysis of pharmaceutical industry growth trends and distribution requirements.

Competitive analysis framework evaluates warehouse operators based on facility capabilities, geographic coverage, technology integration, regulatory compliance records, and customer satisfaction metrics to provide comprehensive market positioning insights.

Trend identification processes incorporate analysis of emerging technologies, regulatory developments, pharmaceutical industry evolution, and sustainability initiatives that influence warehouse design, operations, and strategic positioning in the German market.

Regional distribution of Germany’s pharmaceutical warehousing infrastructure reflects the concentration of pharmaceutical manufacturing and strategic transportation corridors. North Rhine-Westphalia dominates with approximately 32% market share, leveraging its position as Germany’s pharmaceutical manufacturing center and proximity to major European markets.

Bavaria represents the second-largest regional market with 24% market share, driven by Munich’s biotechnology cluster and the region’s strong pharmaceutical research and development capabilities. The area’s advanced logistics infrastructure supports both domestic distribution and export operations to Southern European markets.

Hesse captures significant market share at 18%, benefiting from Frankfurt’s position as a major transportation hub and the presence of several pharmaceutical giants’ European headquarters. The region’s central location provides excellent access to both German domestic markets and international distribution networks.

Baden-Württemberg accounts for 15% market share, supported by the region’s strong pharmaceutical and medical device manufacturing base, particularly in the Stuttgart and Mannheim areas. The region’s proximity to Switzerland and France creates additional cross-border distribution opportunities.

Remaining regions including Berlin-Brandenburg, Lower Saxony, and other states collectively represent 11% market share, with emerging opportunities in Eastern German states as pharmaceutical companies expand operations and establish regional distribution centers to serve growing markets.

Competitive landscape in Germany’s pharmaceutical warehousing market features a diverse mix of international logistics providers, specialized pharmaceutical distributors, and technology-focused warehouse operators, each offering unique capabilities and service portfolios.

Market segmentation reveals distinct categories based on product types, storage requirements, and service levels offered within Germany’s pharmaceutical warehousing sector.

By Product Type:

By Storage Type:

By Service Level:

Prescription drugs category dominates the pharmaceutical warehousing market, representing the largest volume and value segment due to Germany’s extensive pharmaceutical manufacturing base and sophisticated healthcare system. This category requires the highest levels of regulatory compliance, security protocols, and quality assurance measures.

Biologics and biosimilars represent the fastest-growing category with 12.3% annual growth rate, driven by increasing biotechnology innovation and expanding therapeutic applications. This segment demands specialized ultra-cold storage capabilities and advanced handling protocols that command premium pricing.

Over-the-counter medications provide stable, high-volume business for warehouse operators, offering opportunities for operational efficiency improvements and automation implementation. This category benefits from standardized packaging and handling requirements that enable economies of scale.

Medical devices category shows consistent growth driven by Germany’s strong medical technology sector and aging population demographics. This segment requires diverse storage solutions ranging from ambient conditions to specialized environments for sensitive diagnostic equipment.

Vaccine storage has gained prominence following recent global health events, creating demand for specialized cold chain facilities capable of maintaining ultra-low temperatures and providing emergency distribution capabilities for public health initiatives.

Pharmaceutical manufacturers benefit from specialized warehousing solutions that ensure product integrity, regulatory compliance, and efficient distribution to healthcare providers. These facilities enable manufacturers to focus on core production activities while ensuring their products reach markets safely and efficiently.

Healthcare providers gain access to reliable pharmaceutical supply chains that ensure medication availability, reduce stockouts, and maintain product quality throughout the distribution process. Advanced warehouse systems provide real-time inventory visibility and predictable delivery schedules.

Patients ultimately benefit from improved medication access, enhanced product safety, and reduced costs through efficient distribution systems. Specialized warehousing ensures medications maintain their efficacy and safety from production to consumption.

Warehouse operators capture value through premium pricing for specialized pharmaceutical services, long-term customer relationships, and opportunities for technology differentiation. The regulated nature of pharmaceutical warehousing creates barriers to entry that protect established operators.

Technology providers benefit from growing demand for advanced warehouse management systems, automation solutions, and monitoring technologies specifically designed for pharmaceutical applications. This specialized market offers higher margins and longer-term partnerships.

Regulatory authorities benefit from enhanced pharmaceutical supply chain visibility, improved compliance monitoring, and reduced risks of product contamination or diversion through advanced warehousing systems and protocols.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation acceleration represents the most significant trend transforming Germany’s pharmaceutical warehousing sector, with operators investing heavily in robotic systems, automated storage and retrieval systems, and AI-powered inventory management solutions that enhance efficiency while reducing human error in critical pharmaceutical handling processes.

Cold chain expansion continues as a dominant trend driven by the growing biologics market and increasing vaccine distribution requirements. Warehouse operators are investing in ultra-low temperature storage capabilities and advanced monitoring systems to serve this high-value, specialized segment.

Digital integration accelerates across the sector, with warehouse management systems incorporating IoT sensors, blockchain technology, and real-time analytics to provide unprecedented visibility and control over pharmaceutical supply chains. These technologies enable predictive maintenance, optimized inventory management, and enhanced regulatory compliance.

Sustainability initiatives gain momentum as warehouse operators implement energy-efficient cooling systems, renewable energy sources, and sustainable packaging solutions to reduce environmental impact while maintaining pharmaceutical product integrity. Green certifications become increasingly important for competitive positioning.

Regulatory technology adoption increases as operators implement advanced compliance monitoring systems, automated documentation processes, and real-time quality assurance protocols to ensure adherence to evolving GDP guidelines and reduce regulatory risks.

Recent industry developments highlight the dynamic nature of Germany’s pharmaceutical warehousing sector, with major operators expanding capacity and upgrading facilities to meet growing demand for specialized storage solutions.

Technology partnerships between warehouse operators and software providers have accelerated, resulting in implementation of advanced warehouse management systems that integrate seamlessly with pharmaceutical company ERP systems and provide real-time supply chain visibility.

Regulatory updates from German authorities have prompted industry-wide facility upgrades and process improvements, with operators investing in enhanced environmental monitoring systems, improved security protocols, and advanced documentation systems to maintain compliance.

Sustainability certifications have become increasingly important, with leading warehouse operators achieving green building certifications and implementing renewable energy systems to reduce environmental impact while maintaining operational efficiency.

Capacity expansions continue across key regions, with major operators announcing new facility developments and existing warehouse upgrades to accommodate growing pharmaceutical production and distribution volumes throughout Germany and broader European markets.

MarkWide Research analysis suggests that pharmaceutical warehousing operators should prioritize technology investments in automation and digital integration to maintain competitive advantages and meet evolving customer expectations for efficiency and transparency.

Strategic recommendations include developing specialized capabilities in biologics handling and ultra-cold storage to capture premium pricing opportunities in the fastest-growing pharmaceutical segments. Operators should invest in staff training and facility upgrades to serve these demanding applications.

Sustainability initiatives should become a strategic priority, with operators implementing energy-efficient systems and pursuing green certifications to meet environmental regulations and customer sustainability requirements while reducing long-term operational costs.

Regional expansion strategies should focus on establishing strategic positions in emerging Eastern European markets while maintaining strong German domestic capabilities. This approach enables operators to serve pharmaceutical companies’ expanding geographic footprints.

Partnership development with technology providers, pharmaceutical manufacturers, and transportation companies can create integrated service offerings that provide greater value to customers and strengthen competitive positioning in an increasingly complex market environment.

Future market outlook for Germany’s pharmaceutical warehousing sector remains highly positive, with continued growth expected driven by expanding pharmaceutical production, increasing biotechnology innovation, and evolving distribution requirements. MWR projections indicate sustained growth rates of 6.8% annually through the next decade.

Technology evolution will continue transforming warehouse operations, with artificial intelligence, machine learning, and advanced robotics becoming standard components of pharmaceutical warehousing infrastructure. These technologies will enable unprecedented levels of efficiency, accuracy, and regulatory compliance.

Regulatory environment will likely become more stringent, requiring continuous investment in compliance capabilities and quality assurance systems. Operators that proactively invest in regulatory technology and staff training will maintain competitive advantages in this demanding environment.

Market consolidation may accelerate as smaller operators struggle to meet increasing technology and regulatory requirements, creating opportunities for larger, well-capitalized companies to expand market share through acquisitions and strategic partnerships.

Sustainability requirements will become increasingly important, with environmental regulations and customer demands driving adoption of green warehousing practices, renewable energy systems, and sustainable operational protocols throughout the pharmaceutical supply chain.

Germany’s pharmaceutical warehousing market represents a critical component of the nation’s healthcare infrastructure, demonstrating remarkable resilience and growth potential despite challenging regulatory requirements and operational complexities. The market’s strength derives from Germany’s position as Europe’s pharmaceutical manufacturing leader and the essential nature of pharmaceutical distribution services.

Market fundamentals remain strong, supported by continuous pharmaceutical innovation, expanding biotechnology sector, and growing demand for specialized storage solutions. The sector’s ability to adapt to evolving regulatory requirements while implementing advanced technologies positions it well for sustained growth and market leadership.

Strategic opportunities abound for warehouse operators willing to invest in technology, sustainability, and specialized capabilities. The growing biologics segment, digital transformation initiatives, and regional expansion possibilities offer multiple pathways for market participants to capture value and strengthen competitive positions.

Future success in Germany’s pharmaceutical warehousing market will depend on operators’ ability to balance regulatory compliance, operational efficiency, and customer service excellence while continuously investing in technology and sustainability initiatives that meet evolving market demands and stakeholder expectations.

What is Pharmaceutical Warehousing?

Pharmaceutical warehousing refers to the storage and management of pharmaceutical products, including medications and medical supplies, in facilities designed to maintain their integrity and compliance with regulatory standards. This sector plays a crucial role in the supply chain of the healthcare industry.

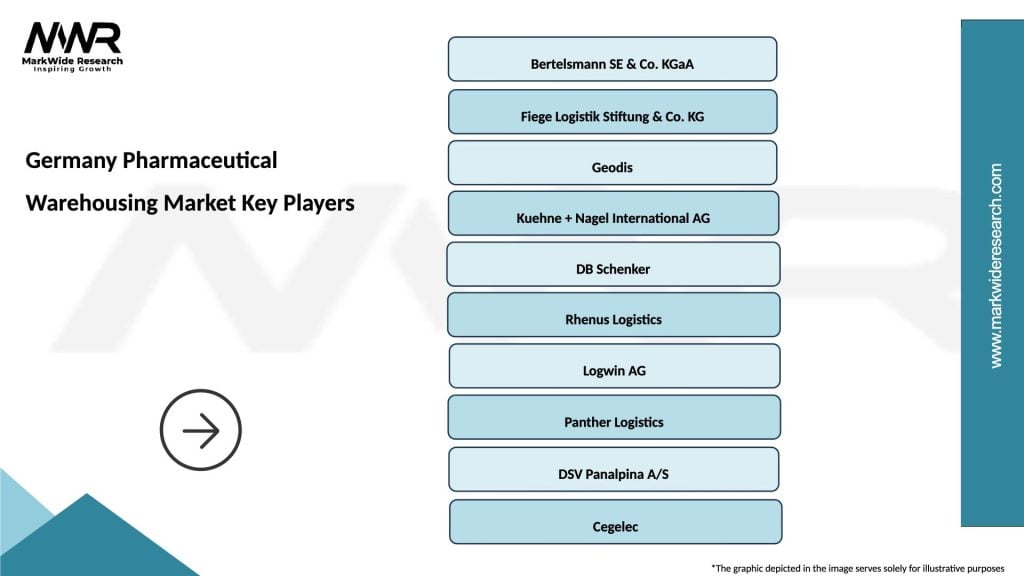

What are the key players in the Germany Pharmaceutical Warehousing Market?

Key players in the Germany Pharmaceutical Warehousing Market include companies like DHL Supply Chain, Kuehne + Nagel, and Geodis. These companies provide specialized logistics and warehousing solutions tailored to the pharmaceutical sector, among others.

What are the growth factors driving the Germany Pharmaceutical Warehousing Market?

The growth of the Germany Pharmaceutical Warehousing Market is driven by increasing demand for pharmaceuticals, advancements in supply chain technologies, and the need for efficient distribution networks. Additionally, the rise in e-commerce for healthcare products is contributing to market expansion.

What challenges does the Germany Pharmaceutical Warehousing Market face?

Challenges in the Germany Pharmaceutical Warehousing Market include stringent regulatory compliance requirements, the need for temperature-controlled storage, and the complexities of managing inventory for diverse pharmaceutical products. These factors can complicate operations and increase costs.

What opportunities exist in the Germany Pharmaceutical Warehousing Market?

Opportunities in the Germany Pharmaceutical Warehousing Market include the integration of automation and digital technologies to enhance efficiency, the expansion of cold chain logistics, and the growing trend of outsourcing warehousing services by pharmaceutical companies. These trends can lead to improved service delivery and cost savings.

What trends are shaping the Germany Pharmaceutical Warehousing Market?

Trends shaping the Germany Pharmaceutical Warehousing Market include the increasing adoption of smart warehousing solutions, the focus on sustainability practices, and the rise of omnichannel distribution strategies. These trends are influencing how pharmaceutical products are stored and delivered.

Germany Pharmaceutical Warehousing Market

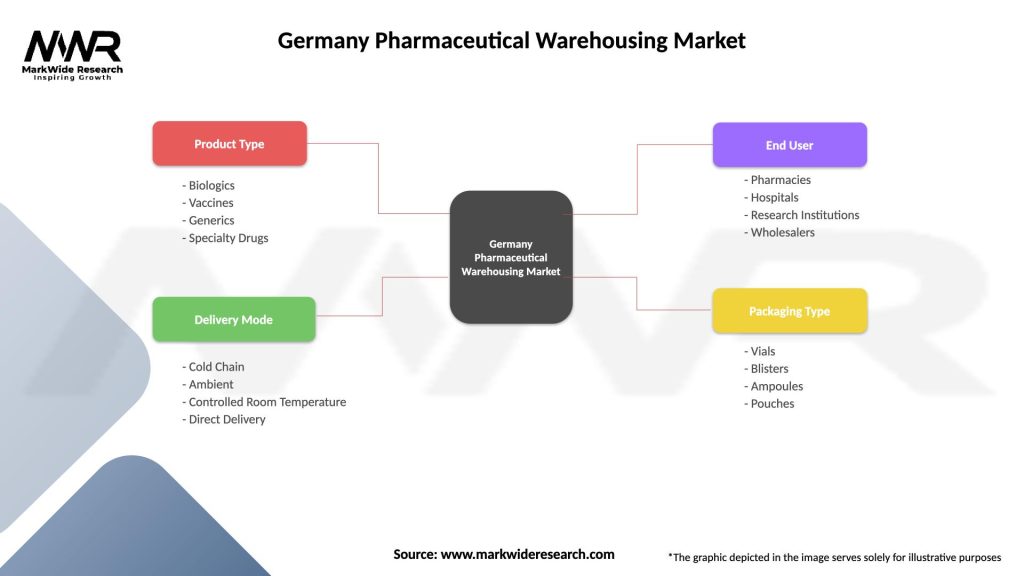

| Segmentation Details | Description |

|---|---|

| Product Type | Biologics, Vaccines, Generics, Specialty Drugs |

| Delivery Mode | Cold Chain, Ambient, Controlled Room Temperature, Direct Delivery |

| End User | Pharmacies, Hospitals, Research Institutions, Wholesalers |

| Packaging Type | Vials, Blisters, Ampoules, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Pharmaceutical Warehousing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at