444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Germany Pet Insurance market has witnessed substantial growth in recent years. Pet insurance refers to a type of insurance coverage that provides financial protection for pet owners in the event of unexpected veterinary expenses. It offers peace of mind to pet owners by covering medical bills, surgeries, medications, and other healthcare expenses related to their beloved furry companions. The market in Germany has gained traction due to the increasing awareness about pet health and the rising costs of veterinary care.

Meaning

Pet insurance is a specialized form of insurance that safeguards pet owners against the financial burden of unexpected medical expenses for their pets. It functions similarly to health insurance for humans, allowing pet owners to access quality veterinary care without worrying about the high costs involved. Pet insurance policies typically cover a range of services, including routine check-ups, vaccinations, surgeries, and emergency treatments. It provides pet owners with the necessary financial support to ensure their pets receive the best possible healthcare.

Executive Summary

The Germany Pet Insurance market has experienced significant growth in recent years, driven by the increasing pet ownership rates and rising awareness about the benefits of pet insurance. The market offers a wide range of policies to cater to the diverse needs of pet owners. With the rising costs of veterinary care, pet insurance has become an essential investment for many individuals and families in Germany. This executive summary provides a comprehensive overview of the market, highlighting key insights, drivers, restraints, opportunities, and market dynamics.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

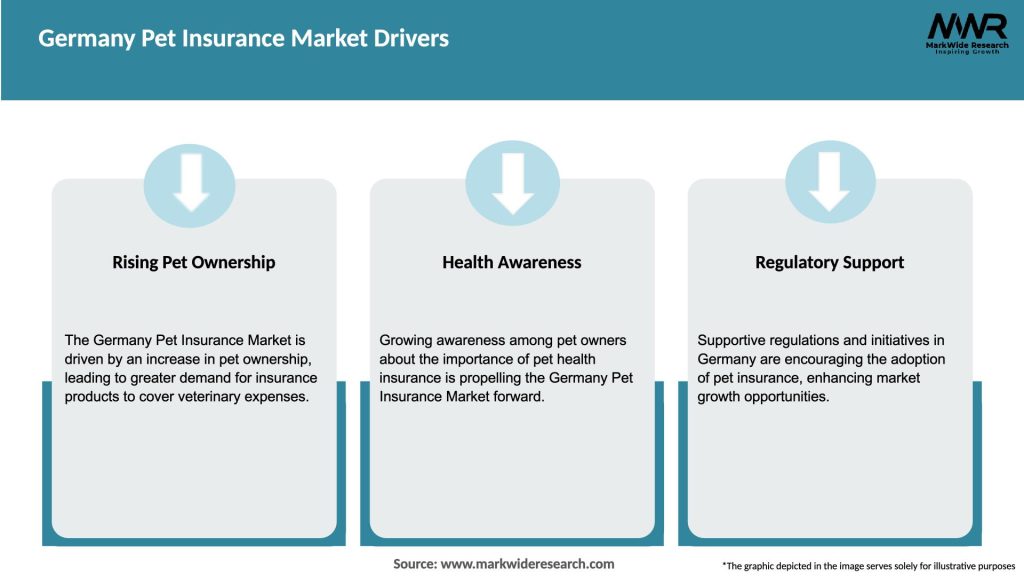

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Germany Pet Insurance market is characterized by dynamic factors that influence its growth and evolution. These dynamics include:

Regional Analysis

The Germany Pet Insurance market exhibits regional variations in terms of market size, growth rate, and customer preferences. The market can be segmented into different regions, including major cities and rural areas, each with its unique characteristics and customer demographics. Urban areas, with higher pet ownership rates and greater awareness about pet insurance, tend to contribute significantly to the overall market. However, rural areas present untapped potential, as there is room for increasing awareness and expanding insurance coverage to a larger pet-owning population.

Competitive Landscape

Leading Companies in the Germany Pet Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

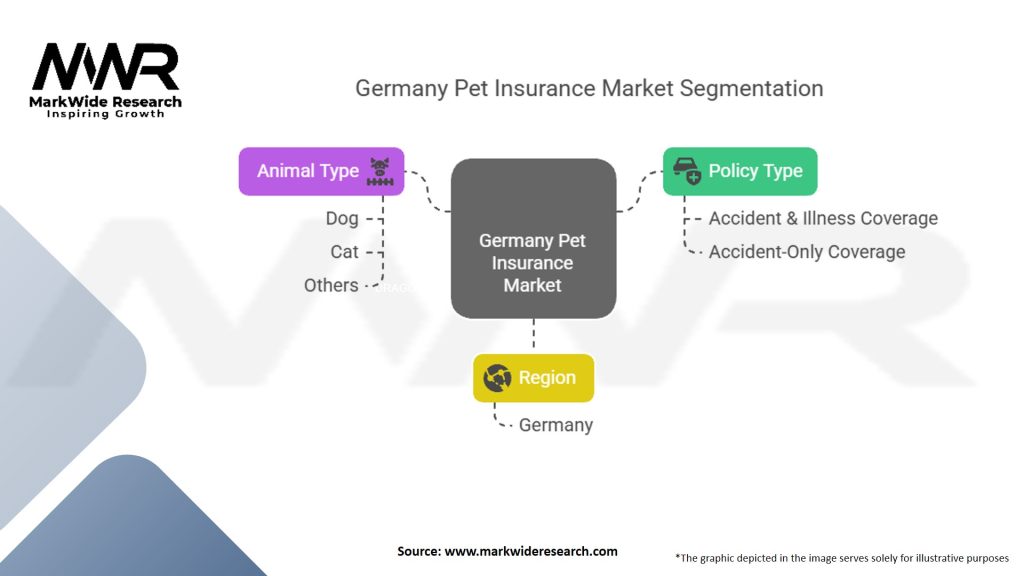

Segmentation

The Germany Pet Insurance market can be segmented based on various factors, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT analysis of the Germany Pet Insurance market helps evaluate its strengths, weaknesses, opportunities, and threats:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had both positive and negative impacts on the Germany Pet Insurance market.

Positive Impact:

Negative Impact:

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Germany Pet Insurance market appears promising. The market is expected to witness continued growth driven by factors such as increasing pet ownership rates, growing awareness about pet health, and rising veterinary costs. Insurance providers have the opportunity to capitalize on these trends by offering comprehensive and customizable policies that meet the evolving needs of pet owners. Technological advancements and partnerships with veterinary professionals will further enhance the market’s growth potential. However, challenges such as limited awareness and intense competition should be addressed to unlock the market’s full potential.

Conclusion

The Germany Pet Insurance market has experienced significant growth in recent years, driven by the increasing pet ownership rates and rising awareness about the benefits of pet insurance. The market offers a range of policies that cater to the diverse needs of pet owners. Rising veterinary costs and the importance of pet health have contributed to the increased adoption of pet insurance. While the market presents opportunities for expansion, challenges such as limited awareness and intense competition exist. By focusing on increasing awareness, personalizing policies, embracing technology, and collaborating with veterinary professionals, insurance providers can position themselves for success in the evolving pet insurance landscape. The future outlook for the market remains positive, with continued growth expected in the coming years.

What is the Germany Pet Insurance?

Germany Pet Insurance refers to policies that provide financial coverage for veterinary expenses, accidents, and illnesses for pets. These insurance plans help pet owners manage the costs associated with pet healthcare, ensuring that pets receive necessary medical attention without financial strain.

Who are the key players in the Germany Pet Insurance market?

Key players in the Germany Pet Insurance market include Allianz, AGILA, and Petplan, among others. These companies offer a variety of insurance products tailored to the needs of pet owners, contributing to the competitive landscape of the market.

What are the main drivers of growth in the Germany Pet Insurance market?

The main drivers of growth in the Germany Pet Insurance market include increasing pet ownership, rising awareness of pet health, and the growing trend of treating pets as family members. Additionally, advancements in veterinary medicine have led to higher treatment costs, prompting more pet owners to seek insurance.

What challenges does the Germany Pet Insurance market face?

The Germany Pet Insurance market faces challenges such as regulatory hurdles, market saturation, and the complexity of policy offerings. Additionally, some pet owners may be hesitant to invest in insurance due to a lack of understanding of the benefits or perceived high costs.

What opportunities exist in the Germany Pet Insurance market?

Opportunities in the Germany Pet Insurance market include the potential for product innovation, such as customizable policies and wellness plans. There is also a growing demand for insurance products that cover alternative therapies and preventive care, which can attract a broader customer base.

What trends are shaping the Germany Pet Insurance market?

Trends shaping the Germany Pet Insurance market include the rise of digital platforms for policy management and claims processing, as well as an increasing focus on customer-centric services. Additionally, there is a growing interest in sustainability and ethical practices within the pet insurance sector.

Germany Pet Insurance Market

| Segmentation | Details |

|---|---|

| Policy Type | Accident & Illness Coverage, Accident-Only Coverage |

| Animal Type | Dog, Cat, Others |

| Region | Germany |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Germany Pet Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at