444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany patient care monitoring market represents a dynamic and rapidly evolving healthcare technology sector that encompasses comprehensive solutions for continuous patient observation, vital sign tracking, and clinical data management. This sophisticated market has experienced remarkable growth driven by Germany’s advanced healthcare infrastructure, aging population demographics, and increasing emphasis on preventive care strategies. Healthcare providers across the country are increasingly adopting innovative monitoring technologies to enhance patient outcomes, reduce hospital readmissions, and optimize resource allocation.

Market dynamics indicate substantial expansion opportunities as German hospitals, clinics, and home healthcare services integrate advanced monitoring systems. The sector benefits from strong government support for healthcare digitization initiatives, with adoption rates reaching approximately 78% among major healthcare facilities. Technology integration has accelerated significantly, particularly in intensive care units, cardiac monitoring departments, and chronic disease management programs.

Regional distribution shows concentrated market activity in major metropolitan areas including Berlin, Munich, Hamburg, and Frankfurt, where leading medical centers drive innovation adoption. The market encompasses diverse monitoring solutions ranging from traditional bedside monitors to advanced wearable devices, remote patient monitoring systems, and artificial intelligence-powered analytics platforms.

The Germany patient care monitoring market refers to the comprehensive ecosystem of medical devices, software platforms, and integrated solutions designed to continuously observe, track, and analyze patient health parameters within German healthcare facilities and home care environments. This market encompasses vital sign monitoring equipment, cardiac rhythm analysis systems, respiratory monitoring devices, neurological assessment tools, and multi-parameter patient monitoring platforms.

Patient care monitoring involves the systematic collection, analysis, and interpretation of physiological data to support clinical decision-making, early intervention strategies, and ongoing patient safety protocols. These systems enable healthcare professionals to maintain continuous surveillance of patient conditions, detect critical changes in real-time, and coordinate appropriate therapeutic responses across various care settings.

Technology components include hardware devices such as monitors, sensors, and wearable equipment, alongside sophisticated software applications for data management, alert systems, and clinical workflow integration. The market also encompasses connectivity solutions, cloud-based platforms, and mobile applications that facilitate seamless information sharing between healthcare providers, patients, and caregivers.

Market expansion in Germany’s patient care monitoring sector reflects the country’s commitment to healthcare excellence and technological innovation. The market demonstrates robust growth potential driven by increasing chronic disease prevalence, healthcare digitization initiatives, and evolving patient care models that emphasize continuous monitoring and preventive interventions.

Key growth drivers include Germany’s aging population, with approximately 23% of citizens over 65 years old, creating substantial demand for comprehensive monitoring solutions. Healthcare providers are investing heavily in advanced monitoring technologies to address capacity constraints, improve patient outcomes, and enhance operational efficiency across diverse care environments.

Technology adoption has accelerated significantly, particularly in areas such as remote patient monitoring, artificial intelligence integration, and mobile health applications. German healthcare institutions are increasingly implementing integrated monitoring platforms that combine multiple physiological parameters, predictive analytics, and automated alert systems to support clinical decision-making processes.

Market segmentation reveals strong demand across hospital-based monitoring, home healthcare monitoring, and ambulatory care monitoring applications. The sector benefits from supportive regulatory frameworks, robust healthcare infrastructure, and increasing patient awareness regarding the benefits of continuous health monitoring for chronic disease management and preventive care strategies.

Strategic insights reveal several critical factors shaping the Germany patient care monitoring market landscape:

Demographic transformation serves as a primary market driver, with Germany’s rapidly aging population creating unprecedented demand for comprehensive patient monitoring solutions. The increasing prevalence of chronic conditions such as cardiovascular disease, diabetes, and respiratory disorders necessitates continuous monitoring capabilities to prevent complications and optimize treatment outcomes.

Healthcare digitization initiatives supported by government funding and regulatory frameworks accelerate the adoption of advanced monitoring technologies. German healthcare institutions receive substantial incentives to implement digital health solutions, creating favorable conditions for market expansion and technology integration across diverse care settings.

Quality improvement mandates from healthcare regulatory bodies drive demand for sophisticated monitoring systems that enhance patient safety, reduce medical errors, and improve clinical outcomes. Healthcare providers must demonstrate measurable improvements in patient care quality, making advanced monitoring technologies essential investments for maintaining competitive positioning.

Cost reduction pressures encourage healthcare organizations to adopt monitoring solutions that optimize resource utilization, reduce hospital readmissions, and enable early intervention strategies. Remote patient monitoring capabilities particularly appeal to healthcare administrators seeking to manage growing patient populations while controlling operational expenses.

Technology advancement in areas such as wearable devices, wireless connectivity, and cloud-based platforms creates new opportunities for innovative monitoring solutions. These technological developments enable more comprehensive, user-friendly, and cost-effective monitoring capabilities that appeal to both healthcare providers and patients.

High implementation costs represent a significant barrier for many healthcare facilities, particularly smaller hospitals and clinics with limited capital budgets. Advanced patient monitoring systems require substantial upfront investments in hardware, software, training, and infrastructure upgrades that may strain organizational resources.

Regulatory complexity in Germany’s healthcare sector creates challenges for monitoring technology vendors and healthcare providers. Stringent approval processes, compliance requirements, and documentation standards can delay product launches and increase development costs, potentially limiting market growth opportunities.

Data privacy concerns surrounding patient health information create hesitation among some healthcare providers and patients regarding comprehensive monitoring system adoption. German data protection regulations require robust security measures and patient consent protocols that may complicate implementation processes.

Technical integration challenges arise when healthcare facilities attempt to incorporate new monitoring systems with existing infrastructure. Legacy systems, incompatible software platforms, and complex workflow requirements can create implementation difficulties that discourage technology adoption.

Staff training requirements for advanced monitoring technologies demand significant time and resource investments from healthcare organizations. The need for comprehensive training programs, ongoing support, and workflow adaptation can create operational disruptions that healthcare administrators seek to minimize.

Remote patient monitoring presents substantial growth opportunities as healthcare providers seek to extend care beyond traditional facility boundaries. The growing acceptance of telemedicine and home healthcare services creates demand for sophisticated monitoring solutions that enable continuous patient observation in non-clinical environments.

Artificial intelligence integration offers significant potential for enhancing monitoring system capabilities through predictive analytics, automated alert systems, and clinical decision support tools. Healthcare providers increasingly value monitoring platforms that can identify potential complications before they become critical, enabling proactive intervention strategies.

Chronic disease management represents a rapidly expanding market segment as Germany’s population ages and chronic condition prevalence increases. Specialized monitoring solutions for specific conditions such as heart failure, diabetes, and chronic obstructive pulmonary disease create targeted growth opportunities for technology vendors.

Mobile health applications and wearable device integration provide new avenues for patient engagement and continuous monitoring capabilities. The growing consumer acceptance of health technology creates opportunities for monitoring solutions that bridge clinical and personal health management applications.

Healthcare system integration opportunities arise as German healthcare facilities seek comprehensive monitoring platforms that connect seamlessly with electronic health records, clinical workflow systems, and administrative platforms. Vendors offering integrated solutions can capture larger market shares and establish long-term customer relationships.

Competitive dynamics in the Germany patient care monitoring market reflect intense competition among established medical device manufacturers, emerging technology companies, and specialized monitoring solution providers. Market leaders focus on innovation, regulatory compliance, and comprehensive service offerings to maintain competitive advantages in this rapidly evolving sector.

Technology evolution drives continuous market transformation as new monitoring capabilities, improved accuracy, and enhanced user experiences become available. Healthcare providers increasingly expect monitoring systems to deliver efficiency improvements of 35-40% compared to traditional monitoring approaches, creating pressure for ongoing innovation.

Partnership strategies between technology vendors, healthcare providers, and research institutions accelerate market development and solution optimization. Collaborative relationships enable faster product development, clinical validation, and market penetration while reducing individual organizational risks and investment requirements.

Regulatory evolution continues to shape market dynamics as German healthcare authorities adapt regulations to accommodate new monitoring technologies while maintaining patient safety standards. These regulatory changes create both opportunities and challenges for market participants seeking to introduce innovative solutions.

Customer expectations evolve rapidly as healthcare providers become more sophisticated in their technology requirements and evaluation processes. Monitoring solution vendors must demonstrate clear clinical benefits, cost-effectiveness, and integration capabilities to succeed in this demanding market environment.

Comprehensive analysis of the Germany patient care monitoring market employs multiple research methodologies to ensure accurate, reliable, and actionable insights for industry stakeholders. The research approach combines quantitative data collection, qualitative interviews, and market observation techniques to develop a complete understanding of market dynamics and trends.

Primary research involves extensive interviews with healthcare administrators, clinical professionals, technology vendors, and regulatory experts across Germany’s healthcare sector. These discussions provide valuable insights into current challenges, technology adoption patterns, and future requirements that shape market development strategies.

Secondary research encompasses analysis of industry reports, regulatory documents, healthcare statistics, and technology trend publications to establish market context and validate primary research findings. This comprehensive approach ensures research conclusions reflect both current market conditions and emerging development patterns.

Market segmentation analysis examines various monitoring technology categories, application areas, and customer segments to identify specific growth opportunities and competitive dynamics. This detailed segmentation provides stakeholders with targeted insights for strategic planning and investment decision-making processes.

Trend analysis evaluates historical market development patterns, current growth trajectories, and future projection scenarios to support accurate forecasting and strategic planning initiatives. According to MarkWide Research analysis, this methodology provides reliable insights for market participants seeking to optimize their positioning strategies.

Geographic distribution across Germany reveals significant regional variations in patient care monitoring market development, with major metropolitan areas leading technology adoption and market growth. Northern regions including Hamburg and Bremen demonstrate strong market penetration rates of approximately 72% among major healthcare facilities, driven by advanced medical centers and research institutions.

Bavaria and Baden-Württemberg represent the largest regional markets, accounting for approximately 35% of total market activity due to their concentration of leading hospitals, medical technology companies, and research facilities. These regions benefit from strong healthcare infrastructure, government support for innovation, and proximity to major medical device manufacturers.

North Rhine-Westphalia demonstrates robust market growth driven by its large population, extensive healthcare network, and industrial base that supports medical technology development. The region’s healthcare facilities increasingly adopt advanced monitoring solutions to serve diverse patient populations and maintain competitive positioning.

Eastern German states show accelerating market development as healthcare modernization initiatives drive technology adoption and infrastructure improvements. Government funding programs specifically target these regions to ensure equitable access to advanced healthcare technologies, creating substantial growth opportunities for monitoring solution providers.

Rural healthcare markets present unique opportunities for remote patient monitoring solutions that can extend specialized care to underserved areas. Telemedicine initiatives and mobile health programs create demand for portable, easy-to-use monitoring technologies that support rural healthcare delivery models.

Market leadership in Germany’s patient care monitoring sector includes both international medical device manufacturers and specialized technology companies that focus on innovative monitoring solutions. The competitive environment reflects diverse approaches to market positioning, technology development, and customer service strategies.

Competitive strategies focus on technology innovation, regulatory compliance, customer service excellence, and strategic partnerships with healthcare providers. Market leaders invest heavily in research and development to maintain technological advantages while building comprehensive service networks to support customer requirements.

Technology-based segmentation reveals diverse monitoring solution categories serving different healthcare applications and patient populations:

By Product Type:

By Application:

By End User:

Hospital-based monitoring represents the largest market category, driven by increasing patient acuity, regulatory requirements for continuous observation, and technology advancement that enables more sophisticated monitoring capabilities. German hospitals invest heavily in integrated monitoring platforms that support clinical workflow optimization and patient safety improvement initiatives.

Cardiac monitoring solutions demonstrate particularly strong growth due to Germany’s aging population and increasing cardiovascular disease prevalence. Advanced cardiac monitoring systems with arrhythmia detection accuracy rates exceeding 95% become essential tools for preventing cardiac events and optimizing treatment outcomes in both hospital and home care settings.

Remote patient monitoring emerges as a rapidly expanding category as healthcare providers seek to extend care beyond traditional facility boundaries. These solutions enable continuous patient observation while reducing healthcare costs and improving patient satisfaction through home-based care delivery models.

Wearable monitoring devices gain significant traction among both healthcare providers and patients seeking convenient, continuous health tracking capabilities. Integration with smartphone applications and cloud-based platforms creates comprehensive monitoring ecosystems that support both clinical and personal health management objectives.

Artificial intelligence-enhanced monitoring represents an emerging category with substantial growth potential. These advanced systems provide predictive analytics, automated alert generation, and clinical decision support capabilities that enable proactive patient care and improved clinical outcomes.

Healthcare providers benefit significantly from advanced patient monitoring solutions through improved patient outcomes, enhanced operational efficiency, and reduced liability risks. Comprehensive monitoring systems enable early detection of patient deterioration, supporting timely interventions that prevent complications and reduce hospital readmissions.

Clinical staff experience improved workflow efficiency and enhanced decision-making capabilities through integrated monitoring platforms that consolidate patient data, automate routine tasks, and provide intelligent alerts for critical situations. These systems reduce documentation burden while improving care quality and patient safety outcomes.

Patients and families gain peace of mind through continuous monitoring that ensures rapid response to health changes while enabling greater mobility and independence. Home monitoring solutions particularly benefit patients with chronic conditions who prefer to receive care in familiar environments.

Healthcare administrators achieve cost reduction objectives through monitoring systems that optimize resource utilization, reduce unnecessary interventions, and prevent costly complications. MWR data indicates that comprehensive monitoring programs can reduce overall healthcare costs by 15-20% through improved efficiency and outcomes.

Technology vendors benefit from growing market demand, recurring revenue opportunities through service contracts, and potential for innovation-driven market expansion. The German market’s emphasis on quality and reliability creates opportunities for premium solution providers to establish long-term customer relationships.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation accelerates across Germany’s healthcare sector, driving demand for monitoring solutions that integrate seamlessly with electronic health records, clinical workflow systems, and administrative platforms. Healthcare providers prioritize monitoring technologies that support comprehensive digital health strategies and interoperability requirements.

Artificial intelligence integration becomes increasingly prevalent in patient monitoring systems, enabling predictive analytics, automated pattern recognition, and intelligent alert generation. These AI-enhanced capabilities help healthcare providers identify potential complications earlier and optimize treatment protocols for improved patient outcomes.

Remote patient monitoring experiences rapid adoption as healthcare providers seek to extend care beyond traditional facility boundaries while managing growing patient populations. The trend toward home-based care delivery creates substantial opportunities for portable, user-friendly monitoring solutions.

Wearable technology integration gains momentum as patients and healthcare providers recognize the benefits of continuous, non-invasive monitoring capabilities. Consumer acceptance of health wearables creates opportunities for clinical-grade monitoring solutions that bridge personal and professional healthcare applications.

Value-based care models drive demand for monitoring solutions that demonstrate clear return on investment through improved patient outcomes, reduced readmissions, and enhanced operational efficiency. Healthcare providers increasingly evaluate monitoring technologies based on their ability to support quality improvement and cost reduction objectives.

Regulatory advancement in Germany’s healthcare sector includes updated guidelines for digital health technologies, remote patient monitoring, and artificial intelligence applications in clinical settings. These regulatory developments create clearer pathways for monitoring technology approval while maintaining high safety and efficacy standards.

Technology partnerships between established medical device manufacturers and innovative technology companies accelerate the development of next-generation monitoring solutions. These collaborations combine clinical expertise with cutting-edge technology capabilities to create comprehensive monitoring platforms.

Healthcare digitization initiatives receive substantial government funding to support monitoring technology adoption across German healthcare facilities. These programs provide financial incentives and technical support for healthcare providers implementing advanced monitoring systems.

Clinical validation studies demonstrate the effectiveness of advanced monitoring technologies in improving patient outcomes and reducing healthcare costs. Research conducted at leading German medical centers provides evidence supporting broader adoption of innovative monitoring solutions.

Interoperability standards development enables better integration between monitoring systems and existing healthcare infrastructure. Industry collaboration on technical standards facilitates seamless data exchange and workflow integration across diverse healthcare environments.

Strategic positioning recommendations for market participants emphasize the importance of developing comprehensive monitoring solutions that address specific German healthcare requirements while maintaining competitive pricing and superior customer service. Companies should focus on building strong relationships with key healthcare providers and demonstrating clear value propositions.

Technology investment priorities should focus on artificial intelligence capabilities, remote monitoring functionality, and seamless integration with existing healthcare systems. MarkWide Research analysis suggests that companies investing in these areas will achieve competitive advantages of 25-30% over traditional monitoring solution providers.

Market entry strategies for new participants should emphasize regulatory compliance, clinical validation, and partnership development with established healthcare providers. Understanding Germany’s complex healthcare regulatory environment and building relationships with key decision-makers are essential for successful market penetration.

Customer engagement approaches should focus on demonstrating measurable benefits through pilot programs, clinical studies, and comprehensive training support. Healthcare providers require clear evidence of monitoring system effectiveness before making significant technology investments.

Innovation focus areas include predictive analytics, mobile health integration, and patient engagement capabilities that support comprehensive care delivery models. Companies developing solutions in these areas will be well-positioned to capitalize on evolving healthcare delivery trends and patient expectations.

Market expansion prospects for Germany’s patient care monitoring sector remain highly favorable, driven by demographic trends, technology advancement, and healthcare system evolution toward more comprehensive, patient-centered care delivery models. The market is projected to experience sustained growth with compound annual growth rates of 8-12% across various monitoring solution categories.

Technology evolution will continue to drive market transformation as artificial intelligence, machine learning, and advanced analytics become standard features in monitoring systems. These technological capabilities will enable more sophisticated patient care approaches and create new opportunities for innovative solution providers.

Healthcare integration trends suggest increasing demand for monitoring solutions that connect seamlessly with comprehensive digital health platforms, electronic health records, and clinical workflow systems. Vendors offering integrated solutions will capture larger market shares and establish stronger customer relationships.

Remote monitoring growth will accelerate as healthcare providers seek to extend care beyond traditional facility boundaries while managing capacity constraints and cost pressures. Home-based monitoring solutions will become increasingly sophisticated and widely adopted across diverse patient populations.

Regulatory evolution will continue to support market development while maintaining high safety and efficacy standards. Updated guidelines for digital health technologies and remote patient monitoring will create clearer pathways for innovation while ensuring patient protection and data security requirements.

The Germany patient care monitoring market represents a dynamic and rapidly expanding healthcare technology sector with substantial growth potential driven by demographic trends, technological innovation, and evolving care delivery models. Healthcare providers across Germany increasingly recognize the critical importance of comprehensive monitoring solutions for improving patient outcomes, enhancing operational efficiency, and meeting regulatory requirements.

Market opportunities abound for companies offering innovative monitoring technologies that address specific German healthcare needs while demonstrating clear value propositions through improved patient care and cost-effectiveness. The combination of advanced healthcare infrastructure, supportive regulatory frameworks, and growing demand for digital health solutions creates favorable conditions for sustained market expansion.

Success factors for market participants include technology innovation, regulatory compliance, customer relationship development, and comprehensive service offerings that support healthcare provider objectives. Companies that can demonstrate measurable improvements in patient outcomes while reducing operational costs will achieve competitive advantages in this demanding but rewarding market environment.

The future of Germany’s patient care monitoring market promises continued growth, technological advancement, and expanding opportunities for innovative solution providers committed to improving healthcare delivery and patient outcomes across diverse care settings.

What is Patient Care Monitoring?

Patient Care Monitoring refers to the systematic observation and assessment of patients’ health status using various technologies and methodologies to ensure timely interventions and improved outcomes.

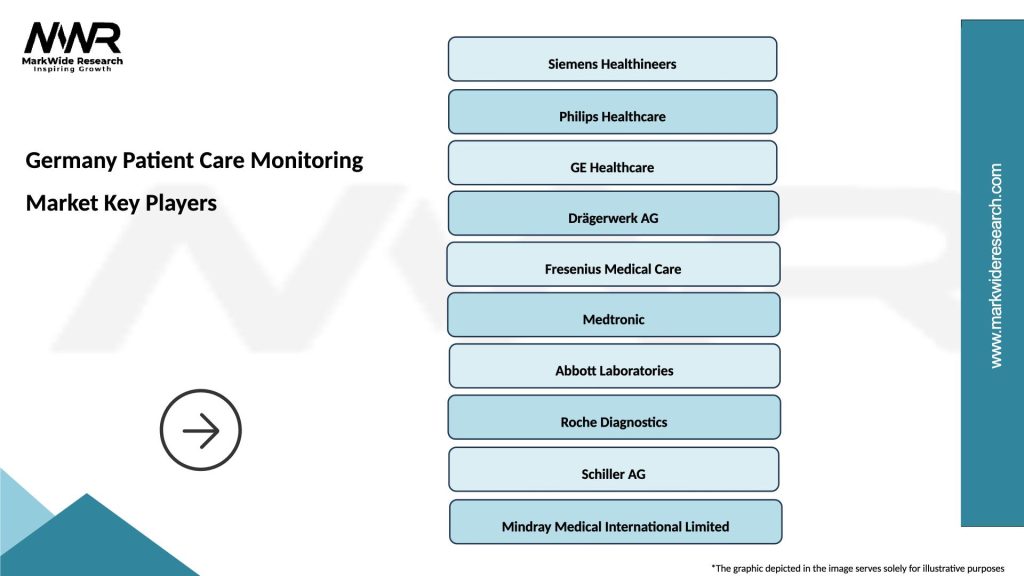

What are the key players in the Germany Patient Care Monitoring Market?

Key players in the Germany Patient Care Monitoring Market include Siemens Healthineers, Philips Healthcare, and GE Healthcare, among others.

What are the main drivers of growth in the Germany Patient Care Monitoring Market?

The main drivers of growth in the Germany Patient Care Monitoring Market include the increasing prevalence of chronic diseases, advancements in telehealth technologies, and the rising demand for remote patient monitoring solutions.

What challenges does the Germany Patient Care Monitoring Market face?

Challenges in the Germany Patient Care Monitoring Market include data privacy concerns, the high cost of advanced monitoring systems, and the need for interoperability among different healthcare technologies.

What opportunities exist in the Germany Patient Care Monitoring Market?

Opportunities in the Germany Patient Care Monitoring Market include the integration of artificial intelligence in monitoring systems, the expansion of home healthcare services, and the growing focus on personalized medicine.

What trends are shaping the Germany Patient Care Monitoring Market?

Trends shaping the Germany Patient Care Monitoring Market include the increasing adoption of wearable health devices, the shift towards value-based care, and the enhancement of data analytics capabilities in patient monitoring.

Germany Patient Care Monitoring Market

| Segmentation Details | Description |

|---|---|

| Product Type | Wearable Devices, Remote Monitoring Systems, Mobile Health Applications, Telehealth Solutions |

| End User | Hospitals, Home Care Providers, Rehabilitation Centers, Nursing Facilities |

| Technology | Bluetooth, Wi-Fi, Cellular, Cloud Computing |

| Application | Chronic Disease Management, Post-operative Care, Elderly Care, Mental Health Monitoring |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Patient Care Monitoring Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at