444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Germany parametric insurance market is a crucial segment within the insurance industry, offering innovative and customized solutions to businesses and individuals. Parametric insurance stands out by providing coverage based on predefined parameters rather than traditional loss assessment. In Germany, this market addresses diverse risk factors, providing a dynamic and responsive approach to insurance needs.

Meaning

Parametric insurance in Germany involves a unique approach to risk management. Unlike traditional insurance, which assesses losses after they occur, parametric insurance pays out based on predefined triggers, such as seismic activity, weather conditions, or economic indicators. This proactive model provides efficient and timely compensation, aligning with the specific needs of German businesses and individuals.

Executive Summary

The Germany parametric insurance market has gained significant traction in recent years, driven by a growing awareness of the advantages it offers in risk management. As businesses and individuals seek more responsive insurance solutions, parametric insurance provides a strategic alternative. This executive summary provides a condensed overview of the market dynamics, key benefits, and challenges.

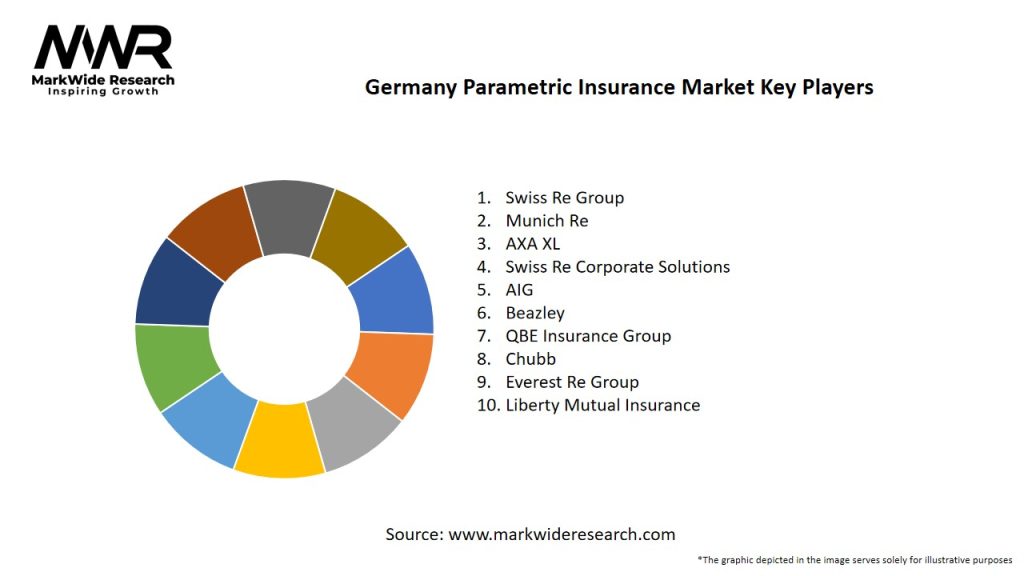

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Understanding the Germany parametric insurance market requires insight into its key dynamics:

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Germany parametric insurance market operates in a dynamic environment influenced by factors such as economic conditions, technological advancements, regulatory changes, and evolving risk landscapes. Adapting to these dynamics is essential for market participants to stay competitive and offer relevant solutions.

Regional Analysis

Regional variations in risk profiles and economic activities influence the dynamics of the parametric insurance market in Germany. Key regions, including urban centers, agricultural areas, and industrial zones, may exhibit distinct needs and preferences.

Competitive Landscape

Leading Companies in Germany Parametric Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

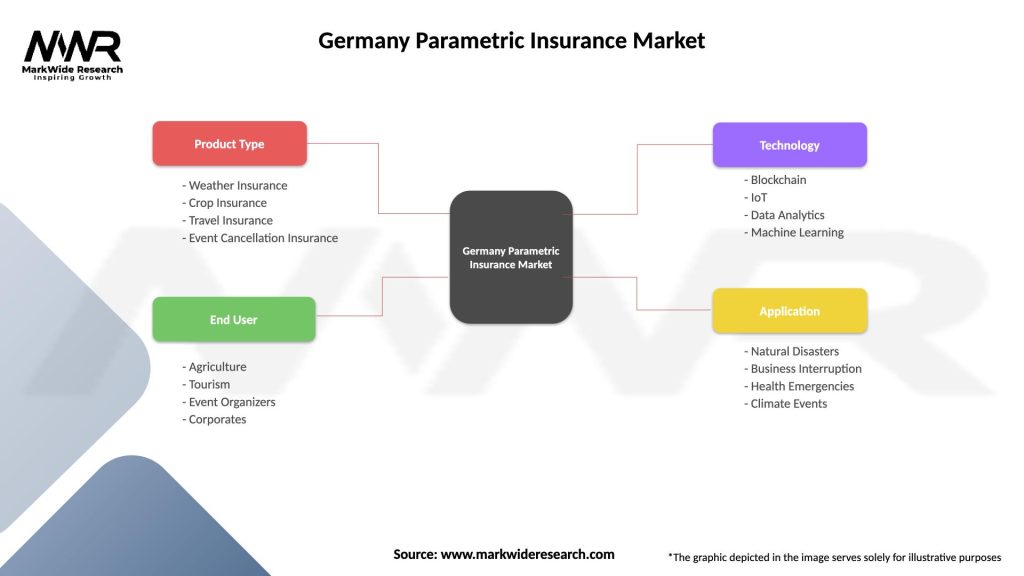

The parametric insurance market in Germany can be segmented based on various factors:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT analysis provides insights into the parametric insurance market’s strengths, weaknesses, opportunities, and threats:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has influenced the Germany parametric insurance market:

Key Industry Developments

Analyst Suggestions

Future Outlook

The Germany parametric insurance market is poised for significant growth in the future:

Conclusion

In conclusion, the Germany parametric insurance market stands as a dynamic and innovative segment within the broader insurance industry. Offering tailored solutions based on predefined parameters, parametric insurance addresses the unique risk landscape faced by businesses and individuals in Germany. While facing challenges related to data accuracy and perception, the market benefits from increasing adoption, technological advancements, and a supportive regulatory environment. The future outlook is promising, with opportunities for diversification, global integration, and sustained growth as businesses seek agile and responsive risk management solutions.

What is Parametric Insurance?

Parametric insurance is a type of insurance that pays out a predetermined amount based on the occurrence of a specific event, such as natural disasters or weather-related incidents, rather than on the actual loss incurred. This model is gaining traction in various sectors, including agriculture and travel, due to its speed and efficiency in claims processing.

What are the key players in the Germany Parametric Insurance Market?

Key players in the Germany Parametric Insurance Market include Munich Re, Allianz, and Swiss Re, which are known for their innovative insurance solutions. These companies are actively developing parametric products to address risks associated with climate change and natural disasters, among others.

What are the growth factors driving the Germany Parametric Insurance Market?

The growth of the Germany Parametric Insurance Market is driven by increasing awareness of climate risks, the need for faster claims processing, and the demand for customized insurance solutions. Additionally, advancements in technology and data analytics are enabling more precise risk assessments.

What challenges does the Germany Parametric Insurance Market face?

The Germany Parametric Insurance Market faces challenges such as regulatory hurdles, the complexity of designing effective parametric products, and the need for consumer education. Additionally, there may be skepticism regarding the reliability of payouts based on predefined parameters.

What opportunities exist in the Germany Parametric Insurance Market?

Opportunities in the Germany Parametric Insurance Market include the potential for expanding coverage to new sectors, such as renewable energy and infrastructure. There is also a growing interest in integrating parametric insurance with traditional insurance products to enhance risk management strategies.

What trends are shaping the Germany Parametric Insurance Market?

Trends shaping the Germany Parametric Insurance Market include the increasing use of technology for real-time data collection and analysis, the rise of climate-related insurance products, and a shift towards more flexible insurance solutions. These trends are influencing how insurers design and market their parametric offerings.

Germany Parametric Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Weather Insurance, Crop Insurance, Travel Insurance, Event Cancellation Insurance |

| End User | Agriculture, Tourism, Event Organizers, Corporates |

| Technology | Blockchain, IoT, Data Analytics, Machine Learning |

| Application | Natural Disasters, Business Interruption, Health Emergencies, Climate Events |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Germany Parametric Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at