444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany outdoor LED lighting market represents one of Europe’s most dynamic and technologically advanced segments within the broader lighting industry. Germany’s commitment to energy efficiency, environmental sustainability, and smart city initiatives has positioned the nation as a leading adopter of outdoor LED lighting solutions across various applications including street lighting, architectural illumination, and landscape lighting.

Market dynamics in Germany are characterized by strong government support for energy-efficient technologies, with municipalities actively replacing traditional lighting systems with LED alternatives. The market demonstrates robust growth potential, driven by increasing urbanization, infrastructure modernization projects, and stringent energy efficiency regulations. LED technology adoption has accelerated significantly, with penetration rates reaching 78% in major urban centers as cities prioritize sustainable lighting solutions.

Technological advancement continues to shape the German outdoor LED lighting landscape, with smart lighting systems and IoT integration becoming increasingly prevalent. The market benefits from Germany’s strong manufacturing base, innovative research capabilities, and supportive regulatory framework that encourages the adoption of energy-efficient lighting technologies across public and private sectors.

The Germany outdoor LED lighting market refers to the comprehensive ecosystem encompassing the design, manufacturing, distribution, and installation of light-emitting diode lighting systems specifically intended for exterior applications throughout German territories. This market includes street lighting, parking lot illumination, architectural lighting, sports facility lighting, and decorative outdoor lighting solutions.

LED technology in outdoor applications offers superior energy efficiency, longer operational lifespans, and enhanced controllability compared to traditional lighting technologies such as high-pressure sodium or metal halide lamps. The German market particularly emphasizes smart lighting capabilities, environmental sustainability, and integration with urban infrastructure management systems.

Market participants include international lighting manufacturers, local German companies, system integrators, municipal authorities, and private sector end-users who collectively drive demand for innovative outdoor LED lighting solutions that meet Germany’s high standards for quality, efficiency, and environmental responsibility.

Germany’s outdoor LED lighting market demonstrates exceptional growth momentum, supported by comprehensive government initiatives promoting energy efficiency and smart city development. The market benefits from strong regulatory support, with energy efficiency mandates driving widespread adoption across municipal and commercial applications.

Key market drivers include Germany’s ambitious climate goals, infrastructure modernization programs, and increasing focus on smart city technologies. The country’s commitment to reducing carbon emissions by 55% by 2030 has accelerated LED adoption rates across outdoor lighting applications. Municipal authorities represent the largest customer segment, actively upgrading street lighting systems to achieve energy savings and operational efficiency improvements.

Technological innovation remains central to market development, with German companies leading advancements in smart lighting controls, sensor integration, and adaptive lighting systems. The market shows strong potential for continued expansion, driven by ongoing urbanization, infrastructure investment, and increasing private sector adoption of energy-efficient outdoor lighting solutions.

Competitive dynamics feature both established international players and innovative German companies, creating a diverse ecosystem that fosters technological advancement and market growth. The market’s future outlook remains highly positive, supported by sustained government investment and growing awareness of LED lighting benefits.

Strategic insights reveal several critical factors shaping Germany’s outdoor LED lighting market development and future trajectory:

Market penetration analysis indicates that outdoor LED lighting has achieved significant adoption across German municipalities, with major cities leading implementation efforts and smaller communities following established best practices for energy-efficient lighting deployment.

Primary market drivers propelling Germany’s outdoor LED lighting market growth encompass regulatory, economic, and technological factors that create favorable conditions for sustained market expansion.

Government initiatives represent the most significant driver, with comprehensive energy efficiency programs and climate protection measures mandating the adoption of energy-efficient lighting technologies. German federal and state governments provide financial incentives, grants, and technical support for LED lighting upgrades, particularly in municipal applications where energy savings directly impact public budgets.

Environmental regulations continue strengthening, with Germany’s commitment to carbon neutrality driving aggressive energy efficiency targets. The country’s Energiewende (energy transition) policy framework specifically promotes LED adoption as part of broader sustainability initiatives. EU energy efficiency directives further reinforce regulatory pressure for lighting system upgrades.

Economic benefits provide compelling justification for LED adoption, with energy savings of 60-80% compared to traditional lighting technologies. Reduced maintenance costs, longer operational lifespans, and improved lighting quality create strong return on investment propositions for both public and private sector customers.

Technological advancement enables increasingly sophisticated outdoor lighting solutions, with smart controls, adaptive lighting, and IoT integration expanding LED lighting capabilities beyond basic illumination to comprehensive urban infrastructure management tools.

Market restraints present challenges that may limit the pace of outdoor LED lighting adoption across certain segments of the German market, requiring strategic approaches to overcome implementation barriers.

High initial investment costs remain a significant constraint, particularly for smaller municipalities and private sector customers with limited capital budgets. While LED lighting offers superior long-term economics, the upfront investment required for comprehensive lighting system upgrades can create financial barriers that delay implementation decisions.

Technical complexity associated with smart LED lighting systems presents implementation challenges, requiring specialized expertise for system design, installation, and ongoing maintenance. The integration of advanced controls, sensors, and communication technologies demands technical capabilities that may not be readily available in all market segments.

Compatibility issues with existing infrastructure can complicate LED upgrade projects, particularly in historic city centers where architectural preservation requirements limit lighting system modifications. Legacy infrastructure may require substantial modification or replacement to accommodate modern LED lighting systems effectively.

Market saturation in certain segments, particularly among early-adopting municipalities, may limit future growth opportunities as the most accessible upgrade projects are completed. Replacement cycles for recently installed LED systems will be significantly longer than traditional lighting technologies, potentially affecting long-term market dynamics.

Significant opportunities exist within Germany’s outdoor LED lighting market, driven by evolving technology capabilities, expanding application areas, and increasing market sophistication that creates new revenue streams and growth potential.

Smart city initiatives represent the most substantial opportunity, with German cities increasingly implementing comprehensive urban technology platforms that integrate LED lighting with traffic management, environmental monitoring, and public safety systems. IoT integration enables LED lighting infrastructure to serve as platforms for additional smart city services, creating value-added revenue opportunities.

Retrofit market expansion continues offering growth potential as older LED installations reach upgrade cycles and municipalities seek enhanced functionality through smart lighting system implementations. Second-generation LED upgrades focus on improved efficiency, advanced controls, and expanded connectivity capabilities.

Private sector adoption presents substantial untapped potential, with commercial, industrial, and residential customers increasingly recognizing LED lighting benefits. Corporate sustainability initiatives drive demand for energy-efficient outdoor lighting solutions that support environmental objectives and operational cost reduction.

Export opportunities leverage Germany’s technological leadership and manufacturing capabilities to serve international markets, particularly in developing regions where LED adoption rates remain low and German quality standards provide competitive advantages.

Market dynamics within Germany’s outdoor LED lighting sector reflect complex interactions between technological innovation, regulatory frameworks, competitive pressures, and evolving customer requirements that collectively shape market development patterns.

Supply chain evolution demonstrates increasing sophistication, with German manufacturers developing comprehensive capabilities spanning LED component production, fixture manufacturing, and system integration services. Local production capabilities reduce dependence on international suppliers while ensuring compliance with German quality standards and delivery requirements.

Competitive intensity continues increasing as both established lighting manufacturers and technology companies enter the outdoor LED market, driving innovation and competitive pricing. Market consolidation trends indicate strategic partnerships and acquisitions as companies seek to develop comprehensive solution capabilities.

Customer sophistication has evolved significantly, with buyers increasingly demanding integrated solutions that combine energy efficiency, smart controls, and long-term service support. Performance-based contracting models gain popularity, with customers seeking guaranteed energy savings and operational performance rather than simple product purchases.

Technology convergence accelerates as LED lighting systems integrate with telecommunications, environmental monitoring, and urban management platforms, creating opportunities for cross-industry collaboration and expanded value propositions that extend beyond traditional lighting applications.

Comprehensive research methodology employed for analyzing Germany’s outdoor LED lighting market incorporates multiple data sources, analytical approaches, and validation techniques to ensure accuracy and reliability of market insights and projections.

Primary research activities include extensive interviews with key market participants, including LED lighting manufacturers, system integrators, municipal procurement officials, and end-user customers across various application segments. Survey methodologies capture quantitative data on market trends, adoption patterns, and future investment intentions.

Secondary research encompasses analysis of government publications, industry reports, regulatory documents, and company financial statements to establish market context and validate primary research findings. Statistical analysis of energy consumption data, municipal budgets, and infrastructure investment patterns provides quantitative foundation for market assessments.

Market modeling techniques incorporate multiple variables including regulatory changes, technology advancement rates, economic conditions, and competitive dynamics to develop realistic growth projections and scenario analyses. Expert consultation with industry specialists ensures research findings reflect current market realities and emerging trends.

Data validation processes include cross-referencing multiple sources, statistical verification, and expert review to ensure research accuracy and reliability for strategic decision-making purposes.

Regional analysis reveals distinct patterns in outdoor LED lighting adoption across Germany’s diverse geographic and administrative regions, with varying levels of market development, investment priorities, and implementation approaches.

North Rhine-Westphalia leads regional market development, accounting for approximately 23% of national LED installations, driven by high urbanization rates, substantial municipal budgets, and strong industrial presence. Major cities including Cologne, Düsseldorf, and Dortmund have implemented comprehensive LED street lighting programs with advanced smart city integration.

Bavaria demonstrates strong market growth, particularly in Munich and surrounding metropolitan areas, with emphasis on high-quality LED solutions that meet stringent architectural and environmental standards. The region’s focus on technology innovation drives demand for advanced LED lighting systems with smart controls and IoT capabilities.

Baden-Württemberg shows robust adoption rates, supported by the region’s strong economic base and commitment to environmental sustainability. Stuttgart and Mannheim lead regional implementation efforts, with comprehensive municipal lighting upgrade programs achieving energy savings exceeding 65%.

Eastern German states present significant growth opportunities, with infrastructure modernization programs driving LED adoption across cities including Berlin, Dresden, and Leipzig. EU structural funds and federal support programs accelerate LED implementation in these regions, creating substantial market potential.

Northern coastal regions including Hamburg and Bremen focus on LED solutions capable of withstanding harsh weather conditions while providing reliable performance for port facilities, urban areas, and transportation infrastructure.

Competitive landscape analysis reveals a dynamic market structure featuring established international lighting manufacturers, innovative German companies, and specialized technology providers competing across various market segments and application areas.

Market competition intensifies as companies develop comprehensive solution capabilities combining LED hardware, smart controls, and service offerings. Strategic partnerships between lighting manufacturers and technology companies create integrated platforms that address evolving customer requirements for intelligent outdoor lighting systems.

Innovation focus areas include energy efficiency improvements, smart city integration, wireless connectivity, and adaptive lighting capabilities that respond to environmental conditions and usage patterns.

Market segmentation analysis provides detailed insights into various categories within Germany’s outdoor LED lighting market, enabling targeted strategies for different customer groups and application areas.

By Application:

By Technology:

By End User:

Street lighting dominates the German outdoor LED market, with municipalities prioritizing comprehensive upgrades to achieve energy savings and improve public safety. LED street lighting installations demonstrate average energy savings of 68% compared to traditional technologies, while providing superior light quality and reduced maintenance requirements.

Smart street lighting systems gain increasing adoption, with cities implementing connected infrastructure that enables remote monitoring, adaptive brightness control, and integration with traffic management systems. Sensor integration allows LED street lights to serve multiple functions including air quality monitoring, noise detection, and pedestrian counting.

Architectural lighting represents a high-value market segment, with German cities investing in LED solutions that enhance urban aesthetics while achieving energy efficiency objectives. Historic preservation requirements drive demand for specialized LED fixtures that provide appropriate illumination without compromising architectural integrity.

Commercial outdoor lighting shows strong growth potential as businesses recognize LED benefits for parking lots, building perimeters, and landscape illumination. Corporate sustainability initiatives increasingly drive LED adoption decisions, with companies seeking to reduce environmental impact and operational costs.

Sports facility lighting demands high-performance LED solutions capable of providing broadcast-quality illumination while achieving energy efficiency objectives. Professional sports venues lead adoption of advanced LED systems with precise light control and instant-on capabilities.

Industry participants and stakeholders across Germany’s outdoor LED lighting ecosystem realize substantial benefits from market participation, technological advancement, and strategic positioning within this dynamic sector.

Manufacturers benefit from strong market demand, technological leadership opportunities, and export potential leveraging German engineering reputation. Innovation capabilities enable premium positioning and differentiation in competitive markets, while scale economies support cost-effective production and market expansion.

Municipal authorities achieve significant operational benefits including energy cost reductions, maintenance savings, and improved public services. LED implementations typically deliver energy savings of 60-80% while providing better light quality and enhanced public safety through improved visibility and reliability.

System integrators capitalize on growing demand for comprehensive LED lighting solutions, developing service-based business models that provide ongoing value through maintenance, monitoring, and system optimization services. Smart city projects create opportunities for expanded service offerings and long-term customer relationships.

End users realize substantial benefits including reduced energy costs, improved lighting quality, enhanced safety, and environmental sustainability contributions. Commercial customers achieve operational cost reductions while supporting corporate sustainability objectives and improving property values.

Environmental stakeholders benefit from reduced energy consumption, lower carbon emissions, and decreased light pollution through properly designed LED lighting systems that support Germany’s climate protection goals and urban sustainability initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key trends shaping Germany’s outdoor LED lighting market reflect technological advancement, changing customer requirements, and evolving regulatory frameworks that drive market development and competitive dynamics.

Smart lighting integration represents the most significant trend, with LED systems increasingly incorporating IoT connectivity, sensor capabilities, and intelligent controls. Connected lighting platforms enable remote monitoring, predictive maintenance, and adaptive operation that optimizes energy consumption and lighting performance based on real-time conditions.

Circular economy principles gain prominence as manufacturers develop LED products designed for recyclability, component reuse, and sustainable lifecycle management. Product-as-a-Service models emerge, with customers purchasing lighting services rather than hardware, encouraging manufacturers to optimize product durability and performance.

Human-centric lighting concepts influence outdoor LED design, with systems incorporating circadian rhythm considerations and adaptive color temperature capabilities that support human health and well-being. Biodynamic lighting applications extend beyond indoor environments to outdoor spaces including parks, walkways, and residential areas.

Artificial intelligence integration enables predictive analytics, automated optimization, and intelligent decision-making within LED lighting systems. Machine learning algorithms analyze usage patterns, environmental conditions, and performance data to optimize lighting operations and predict maintenance requirements.

Sustainability focus intensifies with customers demanding comprehensive environmental performance including energy efficiency, material sustainability, and end-of-life recycling capabilities that support circular economy objectives and climate protection goals.

Recent industry developments demonstrate the dynamic nature of Germany’s outdoor LED lighting market, with significant technological advances, strategic partnerships, and regulatory changes shaping market evolution and competitive positioning.

Technology partnerships between lighting manufacturers and telecommunications companies accelerate smart city integration, with LED lighting infrastructure serving as platforms for 5G networks, IoT sensors, and urban data collection systems. Collaborative initiatives create comprehensive urban technology solutions that extend beyond traditional lighting applications.

Government initiatives include expanded funding programs for municipal LED upgrades, with federal and state authorities providing grants, low-interest loans, and technical assistance for lighting modernization projects. Climate protection funding specifically targets energy-efficient lighting as part of broader carbon reduction strategies.

Manufacturing investments by major lighting companies expand German production capabilities, with new facilities focusing on smart LED systems and advanced manufacturing technologies. Industry 4.0 integration enables flexible production systems capable of customizing LED solutions for specific customer requirements.

Research and development activities intensify, with German universities, research institutions, and companies collaborating on advanced LED technologies including improved efficiency, extended lifespans, and enhanced smart capabilities. Innovation clusters foster technology transfer and commercialization of breakthrough lighting technologies.

Standardization efforts advance through industry associations and regulatory bodies, establishing common protocols for smart lighting systems, interoperability requirements, and performance standards that support market development and customer confidence.

Strategic recommendations for market participants reflect comprehensive analysis of Germany’s outdoor LED lighting market dynamics, competitive positioning, and future development opportunities that require targeted approaches for sustainable success.

Technology investment priorities should focus on smart lighting capabilities, IoT integration, and artificial intelligence applications that differentiate products and create value-added service opportunities. R&D allocation toward human-centric lighting, adaptive systems, and sustainability features aligns with evolving customer requirements and regulatory expectations.

Market positioning strategies should emphasize comprehensive solution capabilities rather than individual product offerings, with companies developing integrated platforms that combine hardware, software, and services. Partnership development with technology companies, system integrators, and service providers creates competitive advantages and market access opportunities.

Customer engagement approaches should prioritize long-term relationships through performance-based contracting, comprehensive service offerings, and ongoing system optimization support. Municipal market development requires understanding of public procurement processes, budget cycles, and regulatory compliance requirements.

International expansion leveraging German technology leadership and quality reputation presents significant growth opportunities, particularly in developing markets with low LED penetration rates. Export strategies should emphasize technology transfer, local partnership development, and adaptation to regional requirements.

Sustainability integration throughout business operations, product development, and customer solutions supports market differentiation and alignment with German environmental objectives. Circular economy principles should guide product design, manufacturing processes, and end-of-life management strategies.

Future outlook for Germany’s outdoor LED lighting market remains highly positive, supported by sustained government commitment, technological advancement, and growing market sophistication that creates favorable conditions for continued expansion and innovation.

Market growth is expected to continue at robust rates, driven by ongoing infrastructure modernization, smart city development, and increasing private sector adoption. MarkWide Research analysis indicates that the market will maintain strong momentum through the next decade, with growth rates of 8.5% annually supported by technology advancement and expanding application areas.

Technology evolution will focus on enhanced connectivity, artificial intelligence integration, and sustainability improvements that create new value propositions and market opportunities. Smart lighting ecosystems will become increasingly sophisticated, providing comprehensive urban management capabilities that extend far beyond basic illumination.

Regulatory development will continue supporting LED adoption through enhanced energy efficiency requirements, climate protection measures, and smart city initiatives. EU-level coordination on lighting standards and sustainability requirements will create additional market drivers and harmonization opportunities.

Competitive dynamics will intensify as market maturity increases, with successful companies differentiating through technology innovation, service capabilities, and comprehensive solution offerings. Market consolidation may accelerate as companies seek scale advantages and expanded capability portfolios.

Export opportunities will expand as German companies leverage technology leadership and quality reputation to serve international markets, particularly in regions with developing infrastructure and growing urbanization rates that drive LED lighting demand.

Germany’s outdoor LED lighting market represents a dynamic and rapidly evolving sector characterized by strong growth potential, technological innovation, and comprehensive regulatory support that creates favorable conditions for sustained market development and competitive success.

Market fundamentals remain robust, with energy efficiency mandates, climate protection objectives, and smart city initiatives driving sustained demand for advanced LED lighting solutions across municipal, commercial, and industrial applications. The combination of government support, technological leadership, and sophisticated customer requirements positions Germany as a leading market for outdoor LED lighting innovation and adoption.

Technology advancement continues accelerating, with smart lighting capabilities, IoT integration, and artificial intelligence applications creating new value propositions and market opportunities that extend beyond traditional lighting functions. Industry participants who successfully navigate technological complexity and develop comprehensive solution capabilities will realize significant competitive advantages and growth opportunities.

Strategic success in this market requires understanding of regulatory requirements, customer needs, and technology trends that shape purchasing decisions and market development patterns. Companies that prioritize innovation, sustainability, and customer service while building strong partnerships and market presence will achieve sustainable competitive positioning in Germany’s dynamic outdoor LED lighting market.

What is Outdoor LED Lighting?

Outdoor LED Lighting refers to lighting solutions that utilize light-emitting diodes (LEDs) for outdoor applications, including street lighting, landscape lighting, and architectural illumination. These systems are known for their energy efficiency, longevity, and ability to provide bright illumination in various outdoor settings.

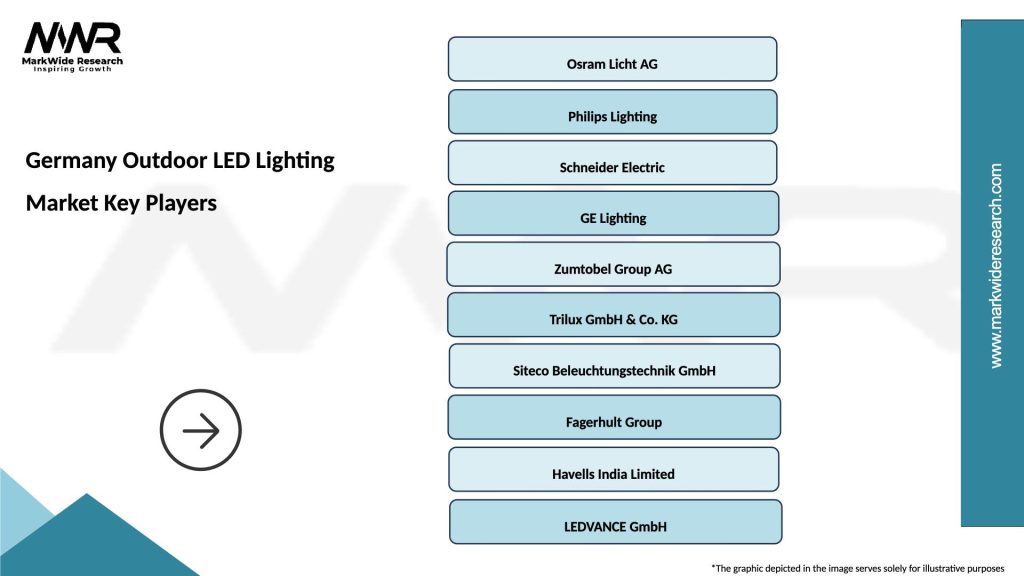

What are the key players in the Germany Outdoor LED Lighting Market?

Key players in the Germany Outdoor LED Lighting Market include Philips Lighting, Osram, Zumtobel Group, and Cree, among others. These companies are known for their innovative lighting solutions and significant contributions to the development of outdoor LED technologies.

What are the main drivers of the Germany Outdoor LED Lighting Market?

The main drivers of the Germany Outdoor LED Lighting Market include the increasing demand for energy-efficient lighting solutions, government initiatives promoting sustainable lighting, and the growing trend of smart city developments. These factors are pushing the adoption of LED technology in outdoor applications.

What challenges does the Germany Outdoor LED Lighting Market face?

The Germany Outdoor LED Lighting Market faces challenges such as high initial installation costs and the need for specialized knowledge for installation and maintenance. Additionally, competition from traditional lighting technologies can hinder the rapid adoption of LED solutions.

What opportunities exist in the Germany Outdoor LED Lighting Market?

Opportunities in the Germany Outdoor LED Lighting Market include the expansion of smart lighting systems and the integration of IoT technologies. As cities look to enhance public safety and reduce energy consumption, the demand for advanced outdoor LED solutions is expected to grow.

What trends are shaping the Germany Outdoor LED Lighting Market?

Trends shaping the Germany Outdoor LED Lighting Market include the increasing focus on sustainability and energy efficiency, the rise of smart lighting solutions, and the development of adaptive lighting systems that respond to environmental conditions. These trends are driving innovation and investment in outdoor LED technologies.

Germany Outdoor LED Lighting Market

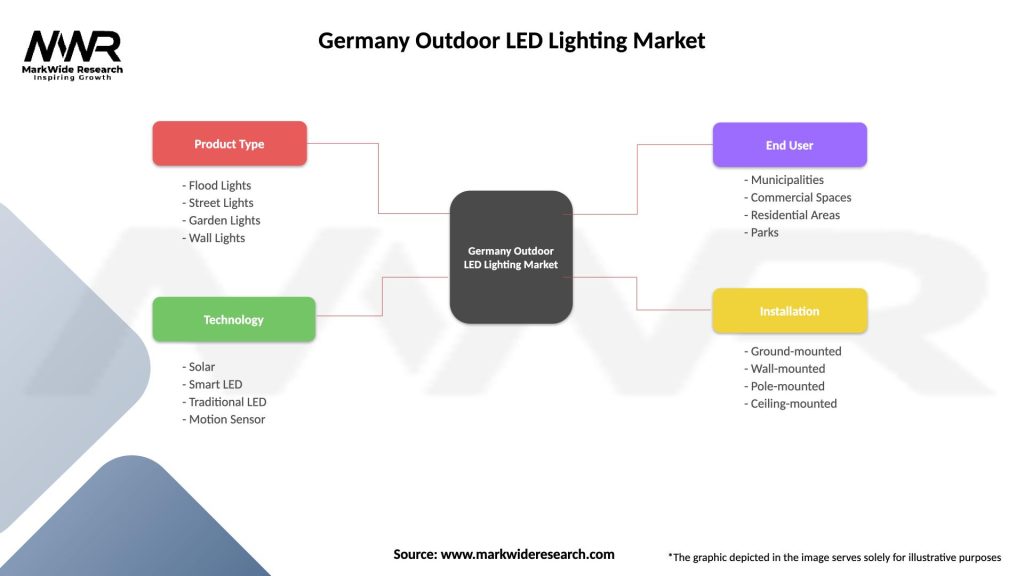

| Segmentation Details | Description |

|---|---|

| Product Type | Flood Lights, Street Lights, Garden Lights, Wall Lights |

| Technology | Solar, Smart LED, Traditional LED, Motion Sensor |

| End User | Municipalities, Commercial Spaces, Residential Areas, Parks |

| Installation | Ground-mounted, Wall-mounted, Pole-mounted, Ceiling-mounted |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Outdoor LED Lighting Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at