444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany non-dairy milk market represents one of Europe’s most dynamic and rapidly evolving segments within the alternative food industry. German consumers are increasingly embracing plant-based milk alternatives, driven by growing health consciousness, environmental sustainability concerns, and dietary preferences. The market encompasses a diverse range of products including oat milk, almond milk, soy milk, rice milk, and emerging alternatives like pea protein milk and hemp milk.

Market dynamics in Germany reflect a significant shift in consumer behavior, with the non-dairy milk segment experiencing robust growth at a compound annual growth rate (CAGR) of 8.2% over recent years. This expansion is particularly notable in urban areas where health-conscious millennials and Generation Z consumers are driving demand for sustainable and nutritious alternatives to traditional dairy products.

Retail penetration has reached impressive levels, with non-dairy milk products now available in over 85% of German supermarkets and specialty health food stores. The market’s maturation is evident through the diversification of product offerings, ranging from basic unsweetened varieties to premium organic formulations and innovative flavor combinations that cater to sophisticated consumer palates.

The Germany non-dairy milk market refers to the comprehensive ecosystem of plant-based milk alternatives that serve as substitutes for traditional cow’s milk in the German consumer market. These products are manufactured from various plant sources including nuts, grains, legumes, and seeds, processed to create beverages that mimic the texture, taste, and nutritional profile of conventional dairy milk.

Non-dairy milk alternatives encompass a broad spectrum of products designed to meet diverse consumer needs, from basic nutritional requirements to specific dietary restrictions such as lactose intolerance, veganism, and various food allergies. The market includes both domestic German production and imported products from other European Union countries and international suppliers.

Product categories within this market span from mainstream options like oat and almond milk to specialized formulations including protein-enriched varieties, organic certified products, and functional beverages fortified with vitamins, minerals, and other beneficial compounds. The market also includes both refrigerated and shelf-stable products, catering to different consumer preferences and usage occasions.

Germany’s non-dairy milk market has emerged as a cornerstone of the country’s plant-based food revolution, demonstrating exceptional resilience and growth potential. The market’s expansion is underpinned by fundamental shifts in consumer attitudes toward health, sustainability, and ethical consumption, with environmental consciousness driving approximately 42% of purchase decisions among German consumers.

Oat milk has established itself as the dominant category, capturing significant market share due to its creamy texture, neutral taste, and strong sustainability credentials. German consumers particularly appreciate oat milk’s local sourcing potential and lower environmental footprint compared to nut-based alternatives. Premium positioning has become increasingly important, with organic and specialty formulations commanding higher price points and stronger consumer loyalty.

Distribution channels have evolved rapidly, with traditional grocery retailers expanding their non-dairy offerings while specialized health food stores and online platforms capture growing market segments. The foodservice sector, including cafes, restaurants, and institutional catering, has also embraced non-dairy alternatives, further accelerating market penetration and consumer acceptance.

Innovation trends focus on improving taste profiles, enhancing nutritional content, and developing sustainable packaging solutions. German manufacturers are investing heavily in research and development to create products that not only match but exceed the sensory and nutritional qualities of traditional dairy milk.

Consumer demographics reveal that the German non-dairy milk market appeals to a broad spectrum of buyers, with particularly strong adoption among urban professionals aged 25-45. Health motivations represent the primary driver for initial product trial, while taste satisfaction and environmental benefits ensure continued consumption and brand loyalty.

Market maturation is evident through the sophistication of consumer preferences, with buyers increasingly seeking specific attributes such as protein content, vitamin fortification, and organic certification. Brand loyalty patterns indicate that consumers typically try multiple products before settling on preferred options, creating opportunities for both established and emerging brands.

Health consciousness serves as the primary catalyst driving Germany’s non-dairy milk market expansion. German consumers are increasingly aware of the potential health benefits associated with plant-based diets, including reduced cholesterol intake, improved digestive health, and lower risk of certain chronic diseases. Lactose intolerance affects approximately 15% of the German population, creating a substantial consumer base actively seeking dairy alternatives.

Environmental sustainability concerns have become increasingly influential in German consumer decision-making. The environmental impact of traditional dairy farming, including greenhouse gas emissions, water usage, and land requirements, has prompted environmentally conscious consumers to seek more sustainable alternatives. Carbon footprint awareness particularly resonates with German consumers, who often prioritize products with lower environmental impact.

Dietary diversification trends reflect growing interest in plant-based nutrition among German consumers. The rise of flexitarian, vegetarian, and vegan lifestyles has created sustained demand for high-quality non-dairy alternatives. Nutritional awareness has also increased, with consumers seeking products that provide adequate protein, vitamins, and minerals comparable to traditional dairy milk.

Product innovation continues to drive market expansion through improved taste profiles, enhanced nutritional content, and convenient packaging formats. German manufacturers have invested significantly in developing products that closely mimic the sensory characteristics of dairy milk while offering additional functional benefits.

Price premium remains a significant barrier to broader market adoption, with non-dairy milk alternatives typically costing 50-100% more than conventional dairy milk. This price differential particularly impacts price-sensitive consumer segments and limits penetration in certain demographic groups. Economic considerations become especially relevant during periods of inflation or economic uncertainty.

Taste preferences continue to challenge market expansion, as some consumers find plant-based alternatives lacking in the familiar taste and mouthfeel of traditional dairy milk. Sensory expectations developed through lifelong dairy consumption create high standards that plant-based products must meet to achieve widespread acceptance.

Nutritional concerns persist among certain consumer segments, particularly regarding protein content, calcium availability, and vitamin B12 levels in non-dairy alternatives. Nutritional adequacy questions, especially for children and elderly consumers, can limit adoption among health-conscious families seeking complete nutritional profiles.

Regulatory challenges occasionally impact product development and marketing, particularly regarding labeling requirements and nutritional claims. Industry standards for plant-based milk alternatives continue to evolve, creating compliance complexities for manufacturers and potential confusion among consumers.

Product innovation presents substantial opportunities for market expansion through the development of next-generation plant-based milk alternatives. Protein enhancement technologies offer potential for creating products with superior nutritional profiles, while flavor innovation can address taste preference challenges and attract new consumer segments.

Foodservice expansion represents a significant growth opportunity, with restaurants, cafes, and institutional catering increasingly incorporating non-dairy alternatives into their offerings. Coffee culture in Germany provides particular opportunities for oat and almond milk products that perform well in espresso-based beverages.

Export potential exists for German non-dairy milk manufacturers to expand into other European markets, leveraging Germany’s reputation for high-quality food products and sustainable manufacturing practices. International expansion can provide additional revenue streams and market diversification opportunities.

Functional formulations offer opportunities to create specialized products targeting specific consumer needs, such as sports nutrition, senior health, or children’s nutrition. Personalized nutrition trends suggest potential for customized non-dairy milk products tailored to individual dietary requirements and health goals.

Supply chain evolution reflects the market’s rapid growth and increasing sophistication. German manufacturers are developing more efficient production processes and establishing direct relationships with raw material suppliers to ensure consistent quality and competitive pricing. Local sourcing initiatives have gained prominence, with oat milk producers particularly benefiting from Germany’s strong agricultural sector.

Competitive intensity has increased significantly as both established food companies and innovative startups enter the non-dairy milk market. Brand differentiation strategies focus on unique selling propositions such as superior taste, enhanced nutrition, sustainable packaging, or specific dietary benefits. Market consolidation trends suggest that successful brands are gaining market share while less competitive products struggle to maintain relevance.

Consumer education efforts by manufacturers and retailers have improved market understanding and acceptance of non-dairy alternatives. Sampling programs, in-store demonstrations, and digital marketing campaigns have effectively introduced consumers to new products and usage occasions. Influencer partnerships and social media marketing have proven particularly effective in reaching younger consumer demographics.

Technology advancement continues to drive improvements in product quality, production efficiency, and cost competitiveness. Processing innovations enable manufacturers to create products with improved taste, texture, and nutritional profiles while reducing production costs and environmental impact.

Market analysis for the Germany non-dairy milk market employs comprehensive research methodologies combining quantitative and qualitative approaches. Primary research includes consumer surveys, focus groups, and in-depth interviews with key stakeholders including manufacturers, retailers, and industry experts. Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial statements.

Data collection methods utilize multiple sources to ensure accuracy and reliability. Consumer behavior analysis incorporates retail scanner data, online purchase patterns, and social media sentiment analysis to understand market trends and preferences. Industry expert interviews provide insights into market dynamics, competitive strategies, and future development prospects.

Market segmentation analysis examines various dimensions including product type, distribution channel, price point, and consumer demographics. Regional analysis considers differences in consumer preferences and market development across German states and urban versus rural areas. Competitive landscape assessment evaluates market share, product positioning, and strategic initiatives of key market participants.

Forecasting models incorporate historical data, current market trends, and expert opinions to project future market development. Scenario analysis considers various factors that could influence market growth, including economic conditions, regulatory changes, and technological developments.

Northern Germany demonstrates the strongest adoption rates for non-dairy milk alternatives, with cities like Hamburg and Bremen leading in per-capita consumption. Urban centers in this region show particularly high penetration of oat milk products, reflecting consumer preferences for locally-sourced and environmentally sustainable options. Retail density in northern regions supports broader product availability and consumer choice.

Southern Germany, including Bavaria and Baden-Württemberg, exhibits growing interest in premium and organic non-dairy milk products. Health consciousness in these regions drives demand for nutritionally enhanced formulations, while traditional food culture creates both opportunities and challenges for plant-based alternatives. Munich and Stuttgart serve as key markets for innovative product launches and premium positioning strategies.

Eastern Germany represents an emerging market with significant growth potential, though adoption rates currently lag behind western regions. Price sensitivity remains more pronounced in eastern markets, creating opportunities for value-oriented product positioning. Berlin stands out as an exception, with high adoption rates driven by its young, environmentally conscious population.

Western Germany, including North Rhine-Westphalia, shows balanced growth across all non-dairy milk categories. Industrial centers like Cologne and Düsseldorf demonstrate strong foodservice adoption, while suburban areas show increasing retail penetration. Distribution infrastructure in western regions supports efficient market coverage and product availability.

Market leadership in Germany’s non-dairy milk sector is characterized by a mix of international brands, domestic manufacturers, and innovative startups. Established players leverage their distribution networks and brand recognition to maintain market position, while emerging companies focus on innovation and niche market segments.

Competitive strategies focus on product differentiation, sustainable packaging, and targeted marketing campaigns. Innovation investments by leading companies emphasize taste improvement, nutritional enhancement, and functional ingredient additions. Partnership strategies with retailers and foodservice operators have become increasingly important for market access and consumer reach.

Product type segmentation reveals distinct consumer preferences and market dynamics across different plant-based milk categories. Oat milk dominates the market with approximately 38% market share, followed by almond milk, soy milk, and emerging alternatives like pea protein and hemp milk.

By Product Type:

By Distribution Channel:

By Price Segment:

Oat milk category demonstrates exceptional growth momentum, driven by its superior sensory characteristics and strong environmental positioning. German consumers particularly appreciate oat milk’s creamy texture and neutral taste, making it suitable for various applications from coffee beverages to cereal consumption. Local sourcing opportunities for oats resonate with consumers seeking to reduce food miles and support domestic agriculture.

Almond milk segment maintains strong positioning in the premium market, appealing to health-conscious consumers seeking low-calorie alternatives with distinctive taste profiles. Nutritional fortification with vitamins and minerals has become standard practice, addressing consumer concerns about nutritional adequacy. Flavor innovations including vanilla, chocolate, and seasonal varieties have expanded usage occasions and consumer appeal.

Soy milk category faces challenges from newer alternatives but maintains relevance through its high protein content and established consumer base. Organic soy milk products show stronger growth than conventional varieties, reflecting consumer preferences for sustainable and health-focused options. Taste improvements through processing innovations have addressed historical consumer concerns about beany flavors.

Emerging categories including pea protein milk, hemp milk, and blended formulations represent significant innovation opportunities. Functional benefits such as enhanced protein content, omega-3 fatty acids, and prebiotic ingredients appeal to health-conscious consumers seeking specific nutritional advantages.

Manufacturers benefit from the Germany non-dairy milk market through access to a growing consumer base with increasing purchasing power and brand loyalty. Product innovation opportunities enable companies to differentiate their offerings and command premium pricing, while sustainable positioning aligns with corporate social responsibility objectives and consumer values.

Retailers gain advantages through expanded product categories that attract health-conscious and environmentally aware consumers. Higher margins on non-dairy milk products compared to conventional dairy provide improved profitability, while category growth drives increased store traffic and basket size. Private label opportunities allow retailers to capture additional value and strengthen customer loyalty.

Suppliers of raw materials benefit from increased demand for oats, almonds, soy, and other plant-based ingredients. Long-term contracts with manufacturers provide revenue stability, while premium pricing for organic and specialty ingredients enhances profitability. Sustainable farming practices supported by the non-dairy milk industry contribute to environmental stewardship and rural economic development.

Consumers benefit from expanded choice, improved product quality, and alignment with personal health and environmental values. Nutritional benefits including reduced cholesterol and improved digestive health appeal to health-conscious individuals, while environmental benefits support sustainable consumption patterns. Taste improvements and product variety ensure satisfying alternatives to traditional dairy milk.

Strengths:

Weaknesses:

Opportunities:

Threats:

Protein enhancement has emerged as a dominant trend, with manufacturers increasingly focusing on developing plant-based milk alternatives that match or exceed the protein content of conventional dairy milk. Pea protein and soy protein fortification technologies enable products to deliver 8-10 grams of protein per serving, addressing consumer concerns about nutritional adequacy.

Sustainable packaging initiatives are gaining momentum as German consumers increasingly prioritize environmental impact in their purchasing decisions. Recyclable cartons, plant-based packaging materials, and reduced packaging waste have become key differentiators in the competitive landscape. Refillable packaging systems are being tested in select markets, appealing to zero-waste conscious consumers.

Functional formulations represent a growing trend, with manufacturers adding probiotics, omega-3 fatty acids, vitamins, and minerals to create products that offer specific health benefits beyond basic nutrition. Immune support formulations gained particular traction following health awareness increases, while digestive health products appeal to consumers seeking gut health benefits.

Flavor innovation continues to expand beyond traditional vanilla and chocolate varieties, with seasonal flavors, regional preferences, and exotic taste combinations attracting consumer interest. Barista-specific formulations designed for coffee applications have become increasingly sophisticated, with improved frothing capabilities and heat stability.

Local sourcing trends reflect German consumer preferences for domestically produced ingredients and reduced environmental impact. Regional oat suppliers and local manufacturing facilities support shorter supply chains and enhanced sustainability credentials.

Manufacturing capacity expansion has accelerated across Germany as companies respond to growing demand and seek to reduce production costs through economies of scale. MarkWide Research analysis indicates that several major manufacturers have announced significant facility investments to support market growth and improve supply chain efficiency.

Strategic partnerships between plant-based milk manufacturers and major German retailers have strengthened market access and promotional support. Exclusive product launches and co-marketing initiatives have become common strategies for building brand awareness and consumer trial. Foodservice partnerships with coffee chains and restaurant groups have expanded market reach and usage occasions.

Technology investments in processing equipment and quality control systems have improved product consistency and enabled cost reductions. Automation initiatives and digital manufacturing systems support scalable production while maintaining quality standards. Research and development investments focus on taste improvement, nutritional enhancement, and sustainable ingredient sourcing.

Regulatory developments including updated labeling requirements and nutritional standards have influenced product formulation and marketing strategies. Organic certification processes and sustainability standards have become increasingly important for market access and consumer acceptance.

Market consolidation activities including acquisitions and strategic alliances have reshaped the competitive landscape, with larger companies acquiring innovative startups to expand their product portfolios and market presence.

Product development should prioritize taste improvement and nutritional enhancement to address remaining consumer barriers to adoption. Sensory testing and consumer feedback integration are essential for developing products that meet German consumer expectations for dairy milk alternatives. Protein fortification and vitamin supplementation should be standard features rather than premium add-ons.

Pricing strategies need to balance profitability with market accessibility, particularly as the market matures and competition intensifies. Value positioning through larger package sizes, multipacks, and promotional pricing can help address price sensitivity while maintaining margins. Private label partnerships offer opportunities for volume growth and market penetration.

Distribution expansion should focus on underserved channels and regions, particularly in eastern Germany and rural areas where adoption rates remain lower. Online retail development and direct-to-consumer channels can provide additional growth opportunities and higher margins. Foodservice penetration requires specialized product formulations and dedicated sales efforts.

Sustainability messaging should be authentic and substantiated with concrete environmental benefits and certifications. Life cycle assessments and carbon footprint calculations provide credible support for environmental claims. Local sourcing initiatives can strengthen sustainability positioning while supporting domestic agriculture.

Innovation investments should focus on emerging categories like pea protein milk and functional formulations that address specific consumer needs. Collaborative research with universities and research institutions can accelerate product development and reduce costs.

Market growth is expected to continue at a robust pace, driven by sustained consumer interest in health and sustainability. Penetration rates are projected to increase from current levels to reach 25-30% of German households within the next five years. Category expansion into new plant-based sources and functional formulations will support continued growth and market development.

Technology advancement will enable significant improvements in product quality, production efficiency, and cost competitiveness. Processing innovations are expected to deliver products that closely match dairy milk in taste and texture while offering superior nutritional profiles. Sustainable packaging solutions will become standard rather than premium features.

Competitive dynamics will likely result in market consolidation as successful brands gain scale and less competitive products exit the market. Innovation leadership and brand differentiation will become increasingly important for maintaining market position. International expansion opportunities will provide growth avenues for successful German manufacturers.

Consumer sophistication will drive demand for more specialized and functional products, creating opportunities for premium positioning and niche market development. Personalized nutrition trends may lead to customized formulations tailored to individual dietary needs and health goals.

Regulatory environment evolution will likely support market growth through clearer standards and labeling requirements, while potential restrictions on dairy terminology may require marketing adaptations. Sustainability regulations could provide competitive advantages for environmentally superior products.

Germany’s non-dairy milk market represents a dynamic and rapidly evolving sector with substantial growth potential and strategic importance within the broader plant-based food industry. The market’s development reflects fundamental shifts in German consumer behavior, driven by health consciousness, environmental awareness, and dietary diversification trends that show no signs of reversing.

Market fundamentals remain strong, with continued innovation in product development, expanding distribution networks, and growing consumer acceptance creating a foundation for sustained growth. The success of oat milk as the dominant category demonstrates that plant-based alternatives can achieve mainstream acceptance when they deliver superior taste, sustainability credentials, and health benefits.

Strategic opportunities exist across multiple dimensions, from product innovation and market expansion to sustainability leadership and international growth. Companies that successfully navigate the balance between innovation, quality, and affordability while maintaining authentic sustainability positioning are likely to capture the greatest share of future market growth.

Future success in the Germany non-dairy milk market will depend on continued investment in research and development, strategic partnerships with retailers and foodservice operators, and authentic engagement with evolving consumer values around health, sustainability, and ethical consumption. The market’s trajectory suggests that plant-based milk alternatives will become an increasingly important and permanent component of the German food landscape.

What is Non-Dairy Milk?

Non-Dairy Milk refers to plant-based beverages that serve as alternatives to traditional dairy milk. These products are made from various sources such as almonds, soy, oats, and coconut, catering to consumers seeking lactose-free or vegan options.

What are the key players in the Germany Non-Dairy Milk Market?

Key players in the Germany Non-Dairy Milk Market include Alpro, Oatly, and Provamel, which offer a range of products catering to diverse consumer preferences. These companies focus on innovation and sustainability to meet the growing demand for plant-based alternatives among consumers.

What are the growth factors driving the Germany Non-Dairy Milk Market?

The Germany Non-Dairy Milk Market is driven by increasing health consciousness, a rise in lactose intolerance, and a growing trend towards veganism. Additionally, the demand for sustainable and environmentally friendly products is influencing consumer choices.

What challenges does the Germany Non-Dairy Milk Market face?

Challenges in the Germany Non-Dairy Milk Market include competition from traditional dairy products and potential supply chain issues related to sourcing raw materials. Consumer skepticism regarding the nutritional value of non-dairy alternatives can also pose a challenge.

What opportunities exist in the Germany Non-Dairy Milk Market?

Opportunities in the Germany Non-Dairy Milk Market include expanding product lines to include fortified options and flavors that appeal to a broader audience. Additionally, increasing distribution channels and online sales can enhance market reach.

What trends are shaping the Germany Non-Dairy Milk Market?

Trends in the Germany Non-Dairy Milk Market include the rise of organic and clean-label products, as well as innovations in packaging that promote sustainability. There is also a growing interest in functional beverages that offer added health benefits.

Germany Non-Dairy Milk Market

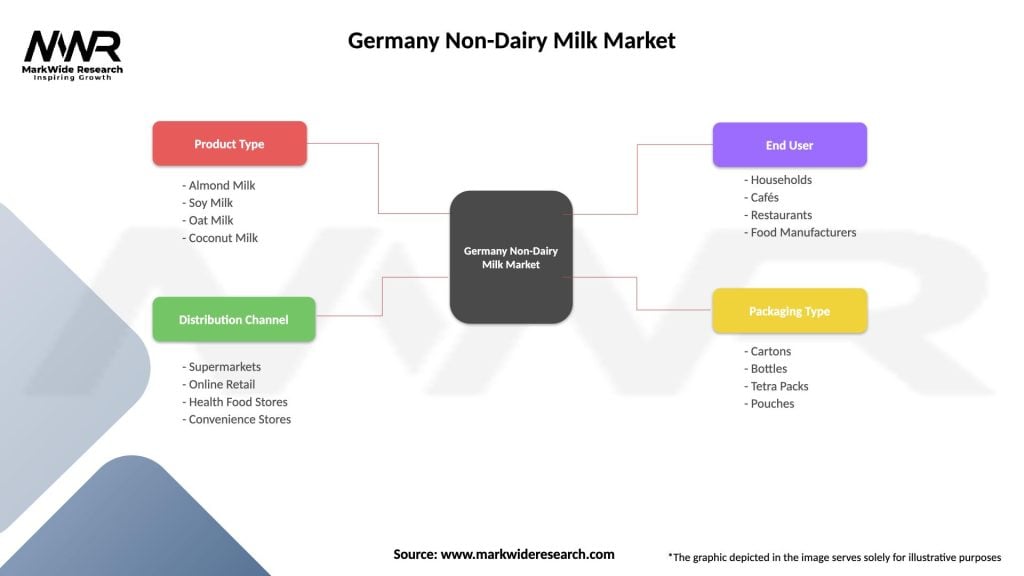

| Segmentation Details | Description |

|---|---|

| Product Type | Almond Milk, Soy Milk, Oat Milk, Coconut Milk |

| Distribution Channel | Supermarkets, Online Retail, Health Food Stores, Convenience Stores |

| End User | Households, Cafés, Restaurants, Food Manufacturers |

| Packaging Type | Cartons, Bottles, Tetra Packs, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Non-Dairy Milk Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at