444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany neo banking market represents a transformative segment within the country’s financial services landscape, characterized by digital-first banking solutions that challenge traditional banking models. Neo banks in Germany have emerged as innovative financial institutions that operate exclusively through digital platforms, offering streamlined services without physical branch networks. The market has experienced remarkable growth momentum with adoption rates increasing by 78% annually among German consumers seeking modern banking alternatives.

Digital transformation has fundamentally reshaped how German consumers interact with financial services, with neo banks capturing significant market attention through their user-centric approach and technological innovation. The sector demonstrates robust expansion driven by changing consumer preferences, regulatory support for fintech innovation, and the increasing digitalization of financial services across Germany. Market penetration continues to accelerate as traditional banking institutions face competitive pressure from these agile digital challengers.

German neo banks have successfully differentiated themselves through superior user experiences, transparent fee structures, and innovative product offerings that resonate with tech-savvy consumers and small businesses. The market encompasses various business models, from pure-play digital banks to hybrid solutions that combine digital convenience with selective physical touchpoints. Growth trajectories indicate sustained expansion with customer acquisition rates showing 65% year-over-year increases across leading neo banking platforms.

The Germany neo banking market refers to the ecosystem of digital-first financial institutions that provide banking services exclusively or primarily through mobile applications and online platforms, operating without traditional physical branch networks while leveraging advanced technology to deliver streamlined financial solutions to German consumers and businesses.

Neo banking represents a paradigm shift from conventional banking models, emphasizing customer experience, operational efficiency, and technological innovation. These institutions typically offer core banking services including current accounts, savings products, payment solutions, and lending services through intuitive digital interfaces. Market participants range from fully licensed banks to financial service providers partnering with established banking institutions to deliver regulated services.

Regulatory framework in Germany supports neo banking development through progressive fintech policies while maintaining robust consumer protection standards. The market operates within established European banking regulations, with many neo banks obtaining full banking licenses or partnering with licensed institutions to ensure compliance. Service delivery focuses on mobile-first experiences, real-time transaction processing, and personalized financial management tools that appeal to digitally native consumers.

Germany’s neo banking sector has established itself as a dynamic force within the European fintech landscape, driven by strong consumer demand for digital financial services and supportive regulatory environments. The market demonstrates exceptional growth potential with customer bases expanding rapidly across demographic segments, particularly among millennials and Generation Z consumers who prioritize digital convenience and transparent pricing structures.

Key market drivers include increasing smartphone penetration, growing dissatisfaction with traditional banking fees and services, and rising demand for personalized financial solutions. Neo banks have successfully captured market share by offering superior user experiences, competitive pricing, and innovative features that traditional banks struggle to match. Investment activity remains robust with venture capital funding supporting continued expansion and product development initiatives.

Competitive dynamics feature both domestic and international players competing for market position through differentiated service offerings and strategic partnerships. The sector benefits from favorable demographic trends with younger consumers showing 85% preference rates for digital banking solutions over traditional alternatives. Market maturation continues as regulatory clarity improves and consumer confidence in digital banking solutions strengthens across Germany.

Market intelligence reveals several critical insights shaping the Germany neo banking landscape. Consumer adoption patterns demonstrate accelerating acceptance of digital-only banking solutions, with urban populations leading adoption trends and rural areas showing increasing interest in mobile banking alternatives.

Market segmentation reveals distinct customer preferences across age groups, income levels, and usage patterns. Business model evolution continues as neo banks expand beyond basic banking services into lending, investment, and insurance products to capture greater wallet share and improve unit economics.

Digital transformation trends serve as the primary catalyst driving Germany’s neo banking market expansion. Consumer expectations have evolved significantly, with customers demanding seamless, intuitive, and always-available banking services that traditional institutions often struggle to deliver effectively. The proliferation of smartphones and improved internet infrastructure has created an environment conducive to digital banking adoption.

Cost efficiency advantages represent another significant driver, as neo banks operate with substantially lower overhead costs compared to traditional banks with extensive branch networks. These operational efficiencies enable competitive pricing strategies that appeal to cost-conscious consumers while maintaining healthy profit margins. Regulatory support for fintech innovation has created favorable conditions for new market entrants.

Changing demographics contribute substantially to market growth, with younger generations showing strong preferences for digital financial services. Millennial and Gen Z consumers demonstrate 92% satisfaction rates with neo banking services, significantly higher than traditional banking alternatives. Urbanization trends and increasing financial literacy further accelerate adoption rates across key demographic segments.

Technological advancement enables neo banks to offer superior user experiences through intuitive interfaces, real-time notifications, and advanced security features. Open banking regulations facilitate innovation by enabling secure data sharing and third-party integrations that enhance service offerings and customer value propositions.

Regulatory complexity presents significant challenges for neo banking market participants, particularly regarding compliance with evolving financial regulations and data protection requirements. Licensing procedures can be lengthy and expensive, creating barriers to entry for smaller fintech companies seeking to establish banking operations in Germany.

Consumer trust concerns remain a notable restraint, particularly among older demographics who may be hesitant to adopt digital-only banking solutions. Security perceptions and concerns about data privacy can limit adoption rates despite robust security measures implemented by neo banking platforms. Brand recognition challenges affect newer market entrants competing against established financial institutions with decades of market presence.

Funding requirements for sustained growth and regulatory compliance create financial pressures for neo banks, particularly during economic uncertainty when venture capital availability may be constrained. Customer acquisition costs have increased as competition intensifies, affecting profitability timelines for emerging players.

Technology infrastructure demands require substantial ongoing investments in cybersecurity, system reliability, and feature development to maintain competitive positioning. Talent acquisition challenges in specialized fintech roles can constrain growth capabilities and innovation potential for expanding neo banking operations.

Underserved market segments present substantial opportunities for neo banking expansion, particularly among small and medium enterprises seeking modern financial solutions. Business banking services represent a high-value opportunity where traditional banks often provide suboptimal experiences, creating space for innovative digital solutions.

Product diversification opportunities extend beyond basic banking into wealth management, insurance, and investment services. Cross-selling potential enables neo banks to increase customer lifetime value while providing comprehensive financial solutions. Partnership opportunities with e-commerce platforms, gig economy companies, and other digital services create new customer acquisition channels.

Geographic expansion within Germany offers growth potential as neo banks establish presence in smaller cities and rural areas currently underserved by digital banking options. International expansion opportunities exist across European markets with similar regulatory frameworks and consumer preferences.

Technological innovation continues creating opportunities through artificial intelligence, blockchain integration, and enhanced mobile capabilities. Sustainability focus appeals to environmentally conscious consumers, with 73% of German millennials preferring banks with strong environmental commitments. Financial inclusion initiatives can expand market reach while supporting social impact objectives.

Competitive intensity continues escalating as both domestic startups and international neo banks compete for German market share. Market dynamics reflect rapid innovation cycles, with successful features quickly adopted across platforms, creating pressure for continuous product development and differentiation strategies.

Customer expectations evolve rapidly, driven by experiences with leading technology companies and international fintech platforms. Service standards must continuously improve to maintain competitive positioning, with response times, feature availability, and user experience quality serving as key differentiators. Pricing pressure intensifies as competitors offer increasingly attractive terms to capture market share.

Regulatory evolution shapes market dynamics through new compliance requirements and opportunities for expanded service offerings. Open banking implementation creates both competitive threats and collaboration opportunities as traditional banks and fintech companies navigate changing market structures.

Technology advancement drives market evolution through improved capabilities and reduced operational costs. Data analytics enable more sophisticated customer segmentation and personalized service delivery, while automation technologies improve operational efficiency and reduce human error rates. Market consolidation trends may emerge as smaller players seek partnerships or acquisition opportunities to achieve sustainable scale.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Germany’s neo banking sector. Primary research includes extensive surveys of neo banking customers, interviews with industry executives, and focus groups with target demographic segments to understand preferences and usage patterns.

Secondary research encompasses analysis of regulatory filings, company financial reports, industry publications, and academic studies related to digital banking trends. Data collection methods include both quantitative and qualitative approaches to capture market dynamics, competitive positioning, and growth trajectories across different market segments.

Market sizing methodologies utilize bottom-up and top-down approaches, analyzing customer adoption rates, transaction volumes, and service penetration across demographic segments. Competitive analysis examines service offerings, pricing strategies, customer satisfaction metrics, and market positioning of key players in the German neo banking landscape.

Trend analysis incorporates historical data patterns, current market indicators, and forward-looking projections based on regulatory developments and technological advancement trajectories. Validation processes ensure data accuracy through cross-referencing multiple sources and expert review of findings and conclusions.

Geographic distribution of neo banking adoption across Germany reveals distinct regional patterns influenced by demographics, economic conditions, and digital infrastructure availability. Urban centers including Berlin, Munich, Hamburg, and Frankfurt demonstrate the highest adoption rates, with metropolitan areas accounting for approximately 68% of total neo banking customers.

Northern Germany shows strong adoption rates driven by tech-savvy populations and robust digital infrastructure, particularly in cities like Hamburg and Bremen. Southern regions including Bavaria and Baden-Württemberg demonstrate growing interest, supported by strong economic conditions and high smartphone penetration rates among younger demographics.

Eastern Germany presents emerging opportunities as digital infrastructure improvements and economic development create favorable conditions for neo banking adoption. Rural areas across all regions show increasing interest in digital banking solutions, particularly where traditional bank branch closures have reduced service availability.

Regional preferences vary regarding service features and provider selection, with some areas showing stronger preferences for domestic neo banks while others embrace international platforms. Market penetration continues expanding geographically as awareness increases and service quality improvements address initial adoption barriers across diverse regional markets.

Market leadership in Germany’s neo banking sector features a diverse mix of domestic startups and international players, each pursuing distinct strategies to capture market share and establish sustainable competitive advantages.

Competitive strategies vary significantly across market participants, with some focusing on comprehensive banking services while others specialize in specific customer segments or service categories. Product differentiation occurs through unique features, pricing models, and customer experience innovations that appeal to distinct market segments.

Market positioning strategies emphasize various value propositions including cost savings, superior user experience, innovative features, or specialized services for specific customer needs. Partnership approaches enable smaller players to compete effectively by leveraging established infrastructure and regulatory compliance capabilities.

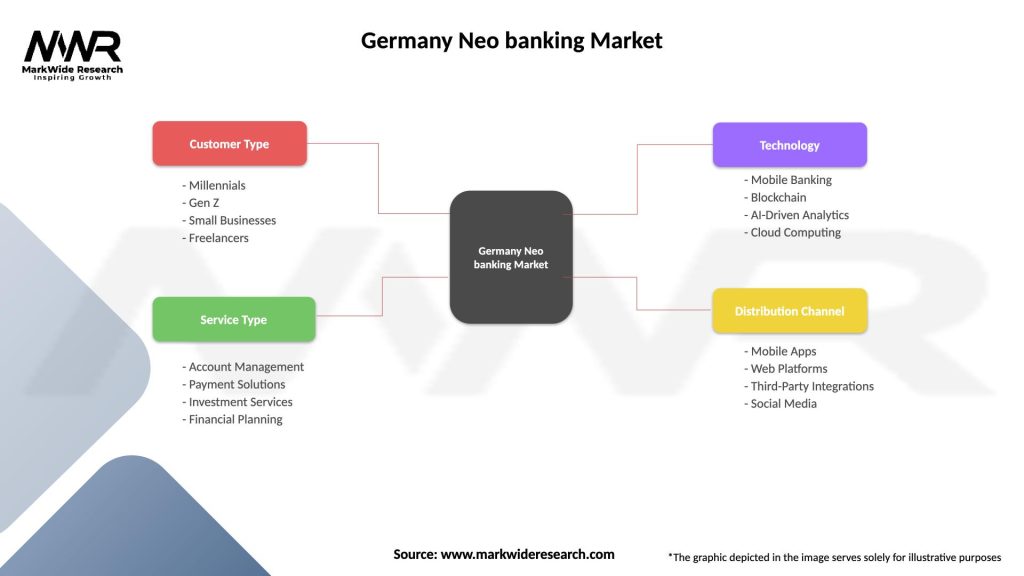

Market segmentation in Germany’s neo banking sector occurs across multiple dimensions, enabling targeted service delivery and specialized value propositions for distinct customer groups.

By Customer Type:

By Service Category:

By Technology Platform:

Personal banking services dominate the German neo banking market, with current accounts and payment solutions serving as primary entry points for customer acquisition. Account opening processes typically require less than 10 minutes, significantly faster than traditional banks, contributing to customer satisfaction rates exceeding 87% across leading platforms.

Business banking segment shows rapid growth as small enterprises seek modern financial solutions with transparent pricing and advanced features. SME adoption has increased substantially, driven by improved cash flow management tools, integrated accounting features, and competitive transaction fees that reduce operational costs.

Investment services represent a high-growth category as neo banks expand beyond basic banking into wealth management and trading services. Robo-advisory features and commission-free trading options appeal to younger investors seeking accessible investment platforms integrated with their primary banking relationships.

Lending products demonstrate strong potential as neo banks leverage advanced data analytics for credit assessment and risk management. Alternative lending approaches enable faster approval processes and more flexible terms compared to traditional bank lending, particularly appealing to underserved customer segments.

Premium services including metal cards, concierge services, and exclusive benefits create differentiation opportunities while improving unit economics through higher-value customer relationships. Subscription models for premium features show positive adoption trends with conversion rates reaching 34% among active users.

Customers benefit significantly from neo banking services through improved convenience, transparent pricing, and superior user experiences compared to traditional banking alternatives. Cost savings represent a primary advantage, with many neo banks offering fee-free basic services and competitive rates on premium features.

Enhanced functionality includes real-time transaction notifications, spending analytics, budgeting tools, and seamless international payment capabilities that improve financial management and control. Accessibility improvements enable 24/7 service availability and instant customer support through digital channels.

Neo banks themselves benefit from lower operational costs, faster product development cycles, and ability to rapidly scale services without physical infrastructure constraints. Data advantages enable personalized service delivery and improved risk management through advanced analytics capabilities.

Traditional financial institutions gain competitive insights and innovation inspiration from neo banking success, driving digital transformation initiatives and improved customer experience strategies. Partnership opportunities enable established banks to leverage fintech innovation while providing regulatory compliance and infrastructure support.

Regulatory authorities benefit from increased competition and innovation in financial services, promoting consumer choice and market efficiency. Economic impact includes job creation in fintech sectors and improved financial inclusion across demographic segments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents a dominant trend shaping Germany’s neo banking landscape, with platforms increasingly leveraging machine learning for personalized financial advice, fraud detection, and customer service automation. AI-powered features enhance user experiences while reducing operational costs and improving service quality.

Sustainability focus has emerged as a significant trend, with environmentally conscious consumers driving demand for green banking options and sustainable investment products. Carbon footprint tracking and sustainable spending insights appeal to younger demographics prioritizing environmental responsibility in financial decisions.

Open banking adoption continues accelerating, enabling enhanced service integration and third-party collaboration that expands functionality and customer value. API connectivity facilitates seamless integration with accounting software, e-commerce platforms, and other financial services.

Cryptocurrency integration shows growing importance as neo banks add digital asset trading and management capabilities to attract tech-savvy customers. Blockchain technology implementation improves transaction security and enables innovative payment solutions.

Subscription-based models gain traction as neo banks seek sustainable revenue streams beyond traditional banking fees. Premium tier adoption demonstrates positive growth momentum with conversion rates improving across major platforms.

Regulatory advancement continues shaping the German neo banking sector through progressive fintech policies and clearer compliance frameworks. Banking license approvals have accelerated, enabling more fintech companies to offer comprehensive banking services directly to consumers.

Strategic partnerships between neo banks and traditional financial institutions have increased, creating hybrid service models that combine fintech innovation with established banking infrastructure. Collaboration agreements enable faster market entry and reduced regulatory complexity for emerging players.

Investment activity remains robust despite global economic uncertainties, with German neo banks continuing to attract significant venture capital funding for expansion and product development initiatives. Funding rounds support international expansion plans and technology enhancement projects.

Product launches across the sector demonstrate continued innovation, with new features including advanced budgeting tools, investment platforms, and business banking solutions. Service expansion into lending and insurance products broadens revenue opportunities and customer value propositions.

Market consolidation activities include strategic acquisitions and mergers as companies seek to achieve scale and expand service capabilities. Technology acquisitions enable rapid capability enhancement and competitive positioning improvements.

Strategic focus on customer retention becomes increasingly critical as acquisition costs rise and competition intensifies. MarkWide Research analysis indicates that neo banks achieving superior customer lifetime value demonstrate stronger financial performance and sustainable growth trajectories.

Product diversification beyond basic banking services offers significant opportunities for revenue growth and competitive differentiation. Cross-selling strategies should emphasize integrated financial solutions that address comprehensive customer needs while maintaining service quality and user experience standards.

Partnership development with established financial institutions, technology companies, and service providers can accelerate growth while reducing operational risks and regulatory complexity. Strategic alliances enable access to new customer segments and expanded service capabilities.

Technology investment in artificial intelligence, cybersecurity, and mobile platform optimization remains essential for maintaining competitive positioning and meeting evolving customer expectations. Innovation focus should balance feature development with operational efficiency and regulatory compliance requirements.

Geographic expansion strategies should prioritize regions with favorable demographics and limited traditional banking presence, while ensuring adequate resources for market development and customer support. Market entry approaches should consider local preferences and regulatory requirements for successful expansion.

Long-term prospects for Germany’s neo banking market remain highly positive, driven by continued digital transformation trends and evolving consumer preferences toward mobile-first financial services. Market maturation is expected to continue with sustained growth rates projected at 12-15% annually over the next five years.

Technological advancement will continue driving innovation and service improvement, with artificial intelligence, blockchain integration, and enhanced mobile capabilities creating new opportunities for differentiation and customer value creation. Service sophistication is expected to increase substantially as platforms mature and expand capabilities.

Regulatory evolution will likely support continued market development through clearer frameworks and reduced barriers to entry, while maintaining robust consumer protection standards. European integration may create additional expansion opportunities as regulatory harmonization progresses across EU markets.

Competitive dynamics will intensify as traditional banks enhance digital capabilities and new entrants continue entering the market. Market consolidation may occur as smaller players seek partnerships or acquisition opportunities to achieve sustainable scale and competitive positioning.

Customer expectations will continue evolving toward more comprehensive and sophisticated financial services, driving product development and service enhancement across the sector. MWR projections suggest that successful neo banks will be those that effectively balance innovation with operational efficiency and regulatory compliance while maintaining superior customer experiences.

Germany’s neo banking market represents a dynamic and rapidly evolving sector that has fundamentally transformed the country’s financial services landscape. The market demonstrates exceptional growth potential driven by strong consumer demand for digital financial solutions, supportive regulatory frameworks, and continuous technological innovation that enhances service delivery and customer experiences.

Market participants have successfully established competitive positions through differentiated service offerings, superior user experiences, and innovative approaches to traditional banking challenges. The sector benefits from favorable demographic trends and increasing consumer acceptance of digital-only banking solutions, particularly among younger generations who prioritize convenience and transparency in financial services.

Future success in the German neo banking market will depend on continued innovation, strategic partnerships, and ability to adapt to evolving regulatory requirements while maintaining operational efficiency and customer satisfaction. The market outlook remains positive with sustained growth expected as digital transformation continues reshaping consumer expectations and financial service delivery models across Germany.

What is Neo banking?

Neo banking refers to digital-only banks that operate without physical branches, offering services such as online accounts, payment solutions, and financial management tools. These banks leverage technology to provide a seamless banking experience to consumers and businesses.

What are the key players in the Germany Neo banking Market?

Key players in the Germany Neo banking Market include N26, Revolut, and Tomorrow, which provide innovative banking solutions tailored to the needs of tech-savvy consumers. These companies focus on user-friendly interfaces and low-cost services, among others.

What are the growth factors driving the Germany Neo banking Market?

The Germany Neo banking Market is driven by factors such as the increasing adoption of smartphones, a growing preference for digital financial services, and the demand for enhanced customer experiences. Additionally, the rise of fintech innovations is contributing to market growth.

What challenges does the Germany Neo banking Market face?

Challenges in the Germany Neo banking Market include regulatory compliance, cybersecurity threats, and competition from traditional banks. These factors can hinder the growth and operational efficiency of neo banks.

What opportunities exist in the Germany Neo banking Market?

Opportunities in the Germany Neo banking Market include expanding services to underserved demographics, integrating advanced technologies like AI for personalized banking experiences, and partnerships with e-commerce platforms. These avenues can enhance customer engagement and market reach.

What trends are shaping the Germany Neo banking Market?

Trends in the Germany Neo banking Market include the rise of open banking, increased focus on sustainability in financial services, and the integration of cryptocurrency offerings. These trends are reshaping how consumers interact with their finances.

Germany Neo banking Market

| Segmentation Details | Description |

|---|---|

| Customer Type | Millennials, Gen Z, Small Businesses, Freelancers |

| Service Type | Account Management, Payment Solutions, Investment Services, Financial Planning |

| Technology | Mobile Banking, Blockchain, AI-Driven Analytics, Cloud Computing |

| Distribution Channel | Mobile Apps, Web Platforms, Third-Party Integrations, Social Media |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Neo banking Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at