444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany major home appliances market represents one of Europe’s most sophisticated and technologically advanced consumer durables sectors. German consumers demonstrate exceptional preference for premium, energy-efficient appliances that combine innovative technology with sustainable design principles. The market encompasses refrigerators, washing machines, dishwashers, cooking appliances, and air conditioning systems, with smart home integration driving significant transformation across all categories.

Market dynamics indicate robust growth driven by replacement demand, technological advancement, and increasing consumer focus on energy efficiency. The sector benefits from Germany’s strong economic foundation, high disposable income levels, and stringent environmental regulations that promote eco-friendly appliance adoption. Digital connectivity features and Internet of Things (IoT) integration are reshaping consumer expectations, with smart appliances experiencing adoption rates of approximately 35% annually among tech-savvy households.

Premium positioning characterizes the German market, where consumers prioritize quality, durability, and advanced functionality over price considerations. This preference supports sustained demand for high-end appliances from both domestic and international manufacturers, creating a competitive landscape focused on innovation and technological superiority.

The Germany major home appliances market refers to the comprehensive sector encompassing large household appliances designed for cooking, cleaning, food preservation, and climate control within residential settings. This market includes both built-in and freestanding appliances that serve essential household functions while incorporating advanced technology, energy efficiency features, and smart connectivity capabilities.

Major home appliances in the German context specifically include refrigerators and freezers, washing machines and dryers, dishwashers, cooking ranges and ovens, and heating, ventilation, and air conditioning (HVAC) systems. These products typically feature extended lifecycles, significant purchase investments, and integration with modern home automation systems that enhance convenience and operational efficiency.

Germany’s major home appliances market demonstrates exceptional resilience and innovation-driven growth, supported by strong consumer purchasing power and environmental consciousness. The sector benefits from Germany’s position as Europe’s largest economy, with households increasingly investing in premium, energy-efficient appliances that align with sustainability goals and technological advancement.

Key market characteristics include dominant preference for German-engineered products, rapid adoption of smart home technologies, and stringent energy efficiency requirements driving product development. The market experiences steady replacement demand cycles, with consumers typically upgrading appliances every 12-15 years while prioritizing brands known for reliability and innovation.

Digital transformation represents a critical growth driver, with connected appliances gaining market share at approximately 28% annually. Consumer preferences increasingly favor appliances offering remote monitoring, predictive maintenance, and integration with home automation systems, creating opportunities for manufacturers investing in IoT capabilities and artificial intelligence features.

Strategic market insights reveal several transformative trends shaping the Germany major home appliances landscape:

Primary growth drivers propelling the Germany major home appliances market include robust economic fundamentals, technological innovation, and evolving consumer lifestyle preferences. Replacement demand cycles provide consistent market foundation, as German households maintain appliances for extended periods before upgrading to more efficient, technologically advanced alternatives.

Environmental regulations significantly influence market dynamics, with EU energy labeling requirements and German sustainability initiatives driving consumer preference toward high-efficiency appliances. The government’s commitment to carbon neutrality by 2045 creates additional incentives for energy-efficient appliance adoption, supported by various rebate programs and tax incentives.

Smart home adoption accelerates market growth, with German consumers increasingly investing in connected appliances that offer remote monitoring, energy optimization, and predictive maintenance capabilities. The integration of artificial intelligence and machine learning technologies enhances appliance functionality while reducing operational costs and environmental impact.

Demographic trends including aging population, urbanization, and changing household compositions drive demand for specialized appliance features. Accessibility features, compact designs, and multi-functional capabilities address diverse consumer needs while supporting market expansion across different demographic segments.

Market challenges facing the Germany major home appliances sector include extended replacement cycles, high initial investment costs, and supply chain complexities. Consumer durability expectations result in longer appliance lifecycles, potentially limiting frequent replacement demand and requiring manufacturers to focus on market share capture rather than volume growth.

Economic uncertainties including inflation pressures, energy cost volatility, and geopolitical tensions create consumer hesitation regarding major appliance purchases. While German consumers maintain strong purchasing power, economic volatility can delay discretionary appliance upgrades and impact premium product segment performance.

Supply chain disruptions continue affecting appliance availability and pricing, with semiconductor shortages particularly impacting smart appliance production. Raw material cost fluctuations and logistics challenges create margin pressures for manufacturers while potentially extending delivery timeframes for consumers.

Regulatory complexity presents ongoing challenges, with evolving energy efficiency standards, safety requirements, and environmental regulations requiring continuous product development investments. Compliance costs and certification processes can limit smaller manufacturer participation while favoring established brands with extensive regulatory expertise.

Significant opportunities emerge from Germany’s leadership in sustainable technology adoption and smart home integration. Green technology advancement creates potential for manufacturers developing innovative energy-efficient appliances that exceed current regulatory requirements while delivering superior performance and cost savings.

Digital transformation opportunities include artificial intelligence integration, predictive analytics, and enhanced connectivity features that differentiate products in competitive markets. MarkWide Research analysis indicates substantial potential for appliances incorporating machine learning algorithms that optimize performance based on usage patterns and environmental conditions.

Circular economy initiatives present opportunities for manufacturers developing appliances with enhanced recyclability, modular designs, and extended service life. German consumers increasingly value sustainable product lifecycles, creating market potential for companies implementing comprehensive sustainability strategies throughout product development and manufacturing processes.

Health and wellness integration offers growth potential through appliances incorporating air purification, water filtration, and food safety monitoring capabilities. The COVID-19 pandemic heightened consumer awareness of home health considerations, creating sustained demand for appliances supporting healthier living environments.

Complex market dynamics shape the Germany major home appliances landscape through interactions between technological advancement, consumer preferences, regulatory requirements, and competitive positioning. Innovation cycles accelerate as manufacturers compete to introduce cutting-edge features while maintaining reliability and efficiency standards expected by German consumers.

Price positioning strategies reflect market segmentation between premium, mid-range, and value categories, with German consumers demonstrating willingness to invest in higher-priced appliances offering superior quality, advanced features, and extended warranties. This dynamic supports healthy profit margins for manufacturers focusing on innovation and quality excellence.

Distribution channel evolution includes growing online sales penetration, reaching approximately 22% of total appliance purchases, while traditional retail channels adapt through enhanced customer experience, expert consultation services, and integrated online-offline shopping experiences. Direct-to-consumer sales gain importance as manufacturers seek closer customer relationships and improved margin control.

Competitive intensity increases as international brands expand German market presence while domestic manufacturers leverage engineering excellence and brand heritage. Market consolidation trends create opportunities for strategic partnerships, technology sharing agreements, and enhanced global supply chain optimization.

Comprehensive research methodology employed for analyzing the Germany major home appliances market incorporates multiple data sources, analytical frameworks, and validation processes to ensure accuracy and reliability. Primary research activities include structured interviews with industry executives, retailer surveys, and consumer behavior studies across diverse demographic segments.

Secondary research components encompass industry reports, government statistics, trade association data, and manufacturer financial disclosures to establish market sizing, competitive positioning, and trend identification. Quantitative analysis utilizes statistical modeling, regression analysis, and forecasting methodologies to project market development scenarios and growth trajectories.

Market validation processes include expert panel reviews, cross-referencing multiple data sources, and sensitivity analysis to ensure research findings accuracy and reliability. Continuous monitoring systems track market developments, regulatory changes, and competitive activities to maintain current market intelligence and update analytical frameworks accordingly.

Data quality assurance measures include source verification, temporal consistency checks, and logical validation to eliminate inconsistencies and ensure research integrity throughout the analytical process.

Regional market distribution across Germany reveals distinct patterns reflecting economic development, urbanization levels, and consumer preferences. North Rhine-Westphalia represents the largest regional market, accounting for approximately 21% of national appliance sales, driven by high population density, industrial prosperity, and strong consumer purchasing power.

Bavaria and Baden-Württemberg demonstrate premium appliance preference, with consumers in these regions showing higher adoption rates for luxury and technologically advanced products. These areas benefit from robust economic conditions, high-tech industry presence, and consumer willingness to invest in quality appliances supporting modern lifestyle requirements.

Eastern German states experience accelerating market growth as economic development continues, with appliance replacement rates increasing and consumer preferences evolving toward premium products. Berlin and surrounding areas show particular strength in smart appliance adoption, reflecting younger demographics and technology-forward consumer attitudes.

Urban versus rural dynamics influence appliance preferences, with metropolitan areas favoring compact, multi-functional designs while rural regions prioritize larger capacity appliances and traditional functionality. These regional variations require targeted marketing strategies and product portfolio optimization to address diverse consumer needs effectively.

Competitive dynamics in the Germany major home appliances market feature intense rivalry between established domestic brands and international competitors seeking market share expansion. Market leadership remains concentrated among several key players with strong brand recognition and comprehensive product portfolios.

Competitive strategies emphasize technological differentiation, sustainability leadership, and customer experience enhancement to maintain market position and drive growth in mature market conditions.

Market segmentation analysis reveals diverse consumer preferences and application requirements across multiple categorization frameworks. Product category segmentation demonstrates varying growth rates and market dynamics across different appliance types.

By Product Category:

By Technology Level:

Refrigeration category insights reveal consumer preference for larger capacity models with advanced temperature control, energy efficiency ratings exceeding regulatory minimums, and smart features enabling remote monitoring. French door configurations and bottom-freezer designs gain popularity while traditional top-freezer models decline in market share.

Laundry appliance trends emphasize water and energy conservation, with front-loading washing machines maintaining market leadership through superior efficiency and gentler fabric care. Heat pump dryer technology experiences rapid adoption, achieving approximately 45% market penetration among new dryer purchases due to exceptional energy efficiency and reduced environmental impact.

Cooking appliance evolution reflects growing consumer interest in professional-quality home cooking, driving demand for induction cooktops, steam ovens, and multi-function cooking systems. Built-in appliance integration becomes increasingly important as kitchen design emphasizes seamless aesthetics and space optimization.

Dishwasher innovations focus on water efficiency, noise reduction, and flexible loading configurations to accommodate diverse dishware and cooking utensil requirements. Third rack designs and adjustable tine systems enhance functionality while maintaining compact footprints suitable for German kitchen dimensions.

Manufacturers benefit from Germany’s stable economic environment, sophisticated consumer base, and strong regulatory framework supporting innovation and quality excellence. Premium positioning opportunities enable healthy profit margins while encouraging continuous product development and technological advancement investments.

Retailers gain advantages through consistent replacement demand cycles, high-value transactions, and opportunities for comprehensive service offerings including installation, maintenance, and extended warranty programs. Omnichannel strategies combining online and offline experiences enhance customer engagement and market reach expansion.

Consumers receive benefits through access to world-class appliance technology, comprehensive warranty protection, and extensive after-sales service networks. Energy efficiency improvements deliver long-term cost savings while supporting environmental sustainability goals and reducing household carbon footprints.

Supply chain partners including component manufacturers, logistics providers, and service technicians benefit from stable demand patterns, premium product focus, and opportunities for specialized expertise development. Technology integration requirements create new business opportunities across the appliance ecosystem.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization acceleration represents the most significant trend reshaping the Germany major home appliances market, with manufacturers integrating artificial intelligence, machine learning, and IoT connectivity across product portfolios. Smart appliances now offer predictive maintenance, energy optimization, and remote diagnostics capabilities that enhance user experience while reducing operational costs.

Sustainability integration extends beyond energy efficiency to encompass circular economy principles, with manufacturers developing appliances using recyclable materials, modular designs, and extended service life capabilities. Carbon footprint reduction becomes a key purchasing criterion, with consumers increasingly evaluating lifecycle environmental impact alongside traditional performance metrics.

Health and wellness focus drives appliance innovation incorporating air purification, water filtration, and food safety monitoring features. MWR data indicates growing consumer interest in appliances supporting healthier home environments, particularly following increased health awareness from recent global events.

Customization and personalization trends enable consumers to configure appliances matching specific lifestyle requirements, aesthetic preferences, and functional needs. Modular appliance systems and customizable interfaces provide flexibility while maintaining manufacturing efficiency and cost effectiveness.

Recent industry developments highlight accelerating innovation and strategic positioning activities across the Germany major home appliances market. Technology partnerships between appliance manufacturers and software companies create enhanced smart home integration capabilities and improved user experience interfaces.

Manufacturing investments focus on automation, sustainability, and local production capabilities to reduce supply chain dependencies while maintaining quality standards. German manufacturers increasingly invest in domestic production facilities incorporating Industry 4.0 technologies and sustainable manufacturing processes.

Product launches emphasize energy efficiency improvements, smart connectivity features, and design innovations addressing evolving consumer preferences. Premium segment expansion continues as manufacturers introduce ultra-high-end appliances targeting affluent consumers seeking professional-grade performance and exclusive features.

Regulatory developments include updated energy labeling requirements, enhanced safety standards, and environmental regulations promoting sustainable product development and manufacturing practices. These changes drive industry-wide innovation while ensuring consumer protection and environmental responsibility.

Strategic recommendations for Germany major home appliances market participants emphasize innovation leadership, sustainability integration, and customer experience enhancement. Manufacturers should prioritize smart technology development, energy efficiency improvements, and circular economy principles to maintain competitive advantage in evolving market conditions.

Investment priorities should focus on artificial intelligence integration, predictive analytics capabilities, and enhanced connectivity features that differentiate products while delivering tangible consumer benefits. Research and development spending allocation toward sustainable materials, manufacturing processes, and product lifecycle optimization supports long-term market positioning.

Market expansion strategies should leverage German engineering reputation and quality standards to capture international opportunities while maintaining domestic market leadership. Brand positioning emphasizing reliability, innovation, and environmental responsibility resonates with target consumer segments across multiple markets.

Partnership opportunities with technology companies, sustainability organizations, and research institutions can accelerate innovation while sharing development costs and risks. Collaborative approaches to smart home integration, energy management, and circular economy implementation create competitive advantages through comprehensive solution offerings.

Future market prospects for the Germany major home appliances sector remain positive, supported by technological advancement, sustainability trends, and consumer preference for premium products. Market growth is projected to continue at a steady pace of approximately 4.2% annually over the next five years, driven by replacement demand and smart technology adoption.

Technology evolution will accelerate integration of artificial intelligence, machine learning, and advanced connectivity features across all appliance categories. MarkWide Research projections indicate that smart appliances will represent over 60% of new appliance sales by 2028, reflecting consumer acceptance of connected home technologies and their associated benefits.

Sustainability requirements will intensify, with circular economy principles becoming standard expectations rather than premium features. Regulatory developments will continue driving energy efficiency improvements while creating opportunities for manufacturers investing in sustainable product development and manufacturing processes.

Market consolidation may accelerate as smaller manufacturers face increasing development costs and regulatory compliance requirements. Strategic partnerships and technology sharing agreements will become more common as companies seek to maintain competitiveness while managing investment requirements for innovation and sustainability initiatives.

The Germany major home appliances market demonstrates remarkable resilience and innovation potential, positioning itself as a global leader in premium appliance technology and sustainable product development. Market fundamentals remain strong, supported by robust consumer purchasing power, technological advancement, and regulatory frameworks promoting energy efficiency and environmental responsibility.

Strategic opportunities abound for manufacturers embracing digitalization, sustainability integration, and customer experience enhancement. The convergence of smart home technologies, environmental consciousness, and premium quality expectations creates a favorable environment for companies investing in innovation and market differentiation strategies.

Future success will depend on manufacturers’ ability to balance technological advancement with reliability, sustainability with affordability, and global expansion with domestic market leadership. The Germany major home appliances market continues evolving toward a more connected, efficient, and environmentally responsible future, offering substantial opportunities for stakeholders committed to excellence and innovation.

What is Major Home Appliances?

Major home appliances refer to large machines used for household tasks, including refrigerators, washing machines, and ovens. These appliances are essential for daily living and significantly impact consumer convenience and lifestyle.

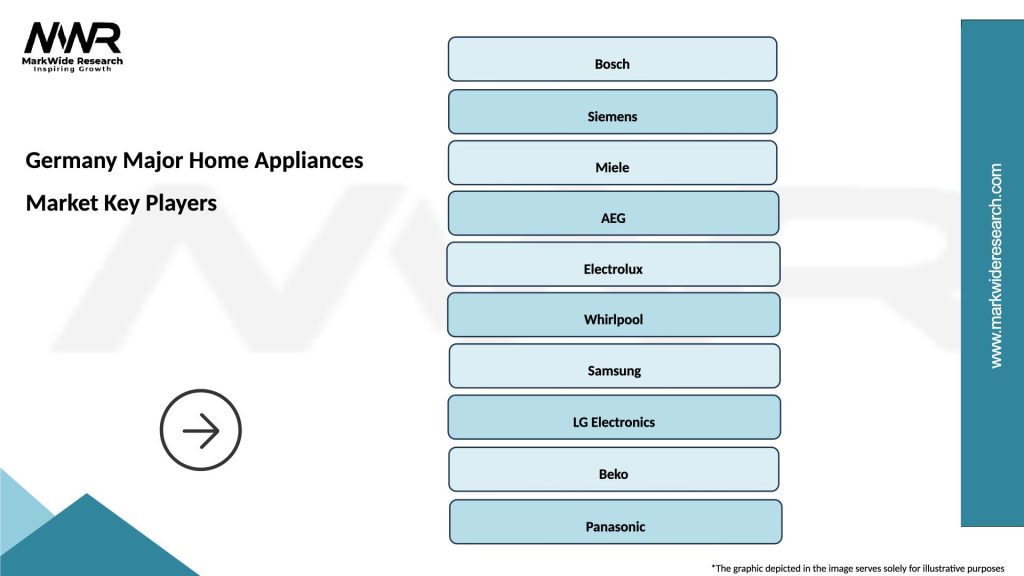

What are the key players in the Germany Major Home Appliances Market?

Key players in the Germany Major Home Appliances Market include Bosch, Siemens, and Miele, which are known for their innovative designs and energy-efficient products. These companies compete on technology, quality, and customer service, among others.

What are the growth factors driving the Germany Major Home Appliances Market?

The growth of the Germany Major Home Appliances Market is driven by increasing consumer demand for energy-efficient appliances, advancements in smart home technology, and a growing focus on sustainability. Additionally, urbanization and changing lifestyles contribute to the market’s expansion.

What challenges does the Germany Major Home Appliances Market face?

The Germany Major Home Appliances Market faces challenges such as intense competition, rising raw material costs, and regulatory compliance related to energy efficiency. These factors can impact profit margins and market entry for new players.

What opportunities exist in the Germany Major Home Appliances Market?

Opportunities in the Germany Major Home Appliances Market include the growing trend of smart appliances, increasing demand for eco-friendly products, and the potential for expansion in e-commerce sales channels. Companies can leverage these trends to enhance their market presence.

What trends are shaping the Germany Major Home Appliances Market?

Trends shaping the Germany Major Home Appliances Market include the rise of connected devices, a shift towards energy-efficient and sustainable products, and the increasing popularity of multifunctional appliances. These trends reflect changing consumer preferences and technological advancements.

Germany Major Home Appliances Market

| Segmentation Details | Description |

|---|---|

| Product Type | Refrigerators, Washing Machines, Dishwashers, Ovens |

| Technology | Smart Appliances, Energy Efficient, IoT Enabled, Traditional |

| End User | Residential, Commercial, Hospitality, Retail |

| Distribution Channel | Online Retail, Specialty Stores, Hypermarkets, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Major Home Appliances Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at