444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany household side by side refrigerator market represents a dynamic segment within the country’s premium home appliance industry, characterized by sophisticated consumer preferences and technological innovation. German households increasingly favor these spacious refrigeration solutions for their enhanced storage capacity, advanced cooling technologies, and modern aesthetic appeal. The market demonstrates robust growth patterns, with adoption rates increasing by 12% annually as consumers prioritize convenience and energy efficiency in their kitchen appliances.

Market dynamics in Germany reflect the nation’s strong economic foundation and consumer willingness to invest in high-quality home appliances. Side by side refrigerators have gained significant traction among German families, particularly those with larger households and modern kitchen designs. The segment benefits from technological advancements including smart connectivity features, improved energy efficiency ratings, and enhanced food preservation capabilities that align with German consumers’ quality-focused purchasing decisions.

Consumer preferences in Germany emphasize durability, energy efficiency, and innovative features, driving manufacturers to develop products that meet stringent European standards while incorporating cutting-edge technologies. The market experiences consistent growth momentum, supported by rising disposable incomes and increasing awareness of advanced refrigeration benefits among German households seeking premium kitchen solutions.

The Germany household side by side refrigerator market refers to the commercial ecosystem encompassing the manufacturing, distribution, and retail of dual-door refrigeration appliances specifically designed for residential use within German households, featuring vertical compartment separation with freezer and refrigerator sections positioned side by side.

Side by side refrigerators represent a premium category of home refrigeration appliances characterized by their distinctive vertical door configuration, typically offering larger storage capacity compared to traditional top-freezer or bottom-freezer models. These appliances feature advanced cooling systems, multiple temperature zones, and often incorporate smart technology integration to enhance user convenience and food preservation efficiency.

Market scope encompasses various product categories including standard side by side models, counter-depth variants, and smart-enabled versions with internet connectivity. The German market specifically focuses on products meeting European energy efficiency standards, incorporating environmentally friendly refrigerants, and designed to accommodate typical German household kitchen layouts and consumer preferences for high-quality, durable appliances.

Germany’s household side by side refrigerator market demonstrates exceptional growth potential driven by evolving consumer lifestyles, technological innovation, and increasing demand for premium kitchen appliances. The market benefits from Germany’s robust economic environment and consumers’ preference for high-quality, energy-efficient home appliances that offer superior functionality and modern design aesthetics.

Key market drivers include rising household incomes, changing family structures requiring larger storage capacity, and growing awareness of advanced refrigeration technologies. German consumers increasingly value features such as precise temperature control, smart connectivity, and energy efficiency, with energy-efficient models capturing 78% market preference among environmentally conscious buyers seeking sustainable appliance solutions.

Competitive landscape features established European manufacturers alongside global brands, all focusing on innovation and quality to meet German consumers’ exacting standards. The market shows strong growth trajectory supported by urbanization trends, kitchen renovation activities, and increasing adoption of smart home technologies that integrate seamlessly with modern German households’ digital ecosystems.

Market insights reveal several critical trends shaping Germany’s household side by side refrigerator landscape:

Consumer behavior analysis indicates that German households prioritize long-term value over initial purchase price, leading to sustained demand for premium side by side refrigerator models that offer superior performance, durability, and advanced features aligned with modern lifestyle requirements.

Primary market drivers propelling Germany’s household side by side refrigerator market include evolving demographic patterns and lifestyle changes that create increased demand for spacious, technologically advanced refrigeration solutions. Urban household growth and changing family structures contribute significantly to market expansion as consumers seek appliances that accommodate diverse storage needs and modern living requirements.

Economic prosperity in Germany enables consumers to invest in premium home appliances, with side by side refrigerators representing aspirational purchases that combine functionality with status appeal. The country’s strong employment rates and rising disposable incomes support sustained market growth, particularly in the premium segment where German consumers demonstrate willingness to pay for superior quality and innovative features.

Technological advancement serves as a crucial driver, with manufacturers introducing smart connectivity features, improved energy efficiency, and enhanced food preservation technologies. German consumers increasingly value appliances that integrate with smart home ecosystems, offer remote monitoring capabilities, and provide precise temperature control for optimal food storage conditions.

Kitchen renovation trends significantly impact market demand as homeowners upgrade their appliances during remodeling projects. The popularity of open-plan kitchen designs in German homes creates opportunities for side by side refrigerators that serve as focal points while providing substantial storage capacity and modern aesthetic appeal that complements contemporary interior design preferences.

Market restraints affecting Germany’s household side by side refrigerator market include space limitations in traditional German homes and apartments, where kitchen layouts may not accommodate the wider footprint required by side by side models. Architectural constraints in older buildings and compact urban living spaces can limit adoption rates, particularly in densely populated metropolitan areas where space optimization remains a primary concern.

Higher initial costs compared to traditional refrigerator models present affordability challenges for price-sensitive consumers, despite Germany’s overall economic prosperity. The premium pricing of side by side refrigerators, combined with installation requirements and potential kitchen modifications, can deter budget-conscious households from making the transition to these larger appliances.

Energy consumption concerns among environmentally conscious German consumers may limit adoption of larger refrigerator models, despite improvements in energy efficiency technology. Some consumers perceive side by side refrigerators as less environmentally friendly due to their size, although modern models often feature superior energy ratings compared to older, smaller appliances.

Market saturation in certain segments poses challenges for sustained growth, as households that have already invested in premium refrigeration solutions may delay replacement purchases. The durability and longevity of high-quality German and European appliances can extend replacement cycles, potentially slowing market turnover rates in established consumer segments.

Significant opportunities exist within Germany’s household side by side refrigerator market, particularly in the smart appliance segment where IoT integration and connected home technologies present substantial growth potential. German consumers’ increasing adoption of smart home systems creates demand for refrigerators that offer seamless connectivity, remote monitoring, and integration with digital lifestyle platforms.

Sustainability initiatives present opportunities for manufacturers to develop eco-friendly models using renewable materials, improved energy efficiency, and environmentally responsible manufacturing processes. German consumers’ strong environmental consciousness creates market demand for appliances that align with sustainability goals while maintaining superior performance and quality standards.

Customization trends offer opportunities for manufacturers to develop modular or customizable side by side refrigerator solutions that adapt to diverse German household needs and kitchen configurations. Flexible storage options, adjustable compartments, and personalized features can differentiate products in the competitive marketplace while addressing specific consumer preferences.

Replacement market potential remains substantial as older refrigerator models reach end-of-life and consumers seek energy-efficient upgrades. The opportunity to replace aging appliances with modern side by side models presents consistent market demand, particularly among households prioritizing energy savings and advanced functionality in their kitchen appliance investments.

Market dynamics in Germany’s household side by side refrigerator sector reflect complex interactions between consumer preferences, technological innovation, and competitive pressures. Supply chain efficiency plays a crucial role in market performance, with manufacturers focusing on streamlined distribution networks and responsive customer service to meet German consumers’ expectations for quality and reliability.

Competitive intensity drives continuous innovation as manufacturers strive to differentiate their products through advanced features, superior energy efficiency, and enhanced user experiences. The market benefits from healthy competition between established European brands and global manufacturers, resulting in improved product quality and competitive pricing strategies that benefit German consumers.

Regulatory environment significantly influences market dynamics through European Union energy efficiency standards, environmental regulations, and safety requirements. German consumers’ preference for compliant products creates market advantages for manufacturers who exceed regulatory requirements and demonstrate commitment to environmental responsibility and product safety.

Seasonal demand patterns affect market dynamics, with peak sales typically occurring during kitchen renovation seasons and holiday periods when consumers make significant appliance purchases. Understanding these cyclical patterns enables manufacturers and retailers to optimize inventory management, promotional strategies, and customer engagement initiatives to maximize market penetration and sales performance.

Comprehensive research methodology employed in analyzing Germany’s household side by side refrigerator market incorporates multiple data collection approaches to ensure accuracy and reliability of market insights. Primary research includes consumer surveys, retailer interviews, and manufacturer consultations to gather firsthand information about market trends, consumer preferences, and industry developments affecting the German market.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and economic indicators relevant to Germany’s home appliance sector. This approach provides historical context, market sizing information, and trend analysis that supports comprehensive understanding of market dynamics and competitive landscape factors influencing side by side refrigerator adoption.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert consultations, and statistical analysis techniques. The methodology incorporates both quantitative and qualitative research elements to provide balanced perspectives on market opportunities, challenges, and growth potential within Germany’s household appliance market.

Market segmentation analysis utilizes demographic data, consumer behavior studies, and purchasing pattern analysis to identify key market segments and growth opportunities. This comprehensive approach enables accurate market forecasting and strategic recommendations for stakeholders operating in Germany’s household side by side refrigerator market.

Regional analysis of Germany’s household side by side refrigerator market reveals significant variations in adoption rates and consumer preferences across different geographic areas. Northern Germany demonstrates strong market penetration with 35% regional market share, driven by higher household incomes, modern housing developments, and consumer preference for premium kitchen appliances in major metropolitan areas including Hamburg and Bremen.

Southern Germany represents the largest market segment, accounting for 42% of national demand, with Bavaria and Baden-Württemberg leading adoption rates due to economic prosperity, large household sizes, and cultural emphasis on quality home appliances. The region’s strong manufacturing base and high disposable incomes support sustained demand for premium side by side refrigerator models.

Western Germany shows steady market growth with 18% market share, particularly in North Rhine-Westphalia where urban households increasingly adopt modern appliances during kitchen renovations. The region benefits from established retail networks and consumer familiarity with premium home appliance brands, supporting consistent market expansion.

Eastern Germany presents emerging opportunities with 5% current market share but demonstrates rapid growth potential as economic development continues and household incomes rise. The region shows increasing interest in modern appliances, with side by side refrigerators gaining popularity among younger consumers and families upgrading their kitchen facilities in newly renovated homes.

Competitive landscape in Germany’s household side by side refrigerator market features a diverse mix of established European manufacturers and global appliance brands competing for market share through innovation, quality, and customer service excellence. Market leaders focus on developing products that meet German consumers’ exacting standards for durability, energy efficiency, and advanced functionality.

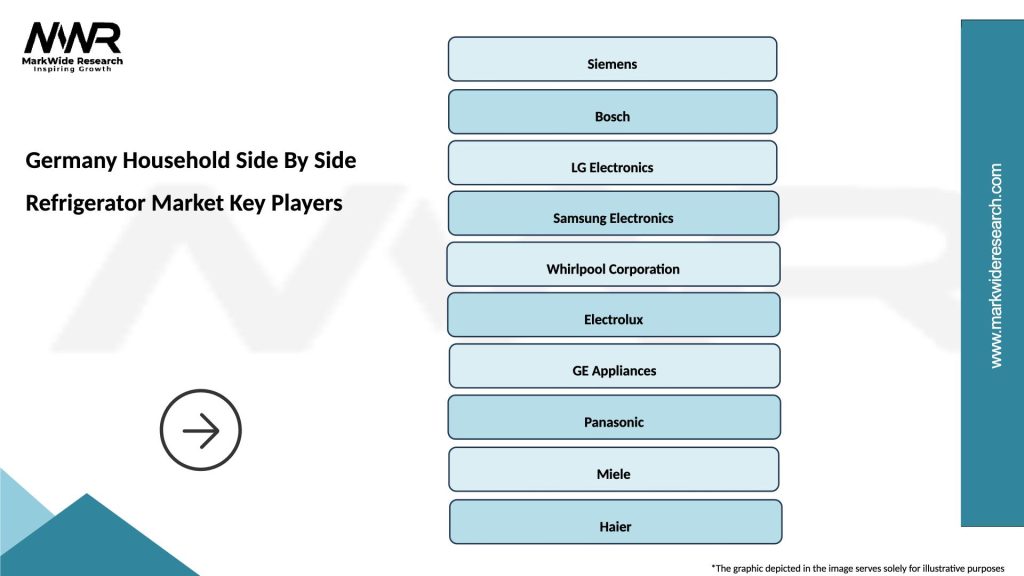

Key market players include:

Competitive strategies emphasize product differentiation through advanced features, superior energy efficiency, and comprehensive after-sales service. Manufacturers invest heavily in research and development to introduce innovative technologies that appeal to German consumers’ preferences for quality, reliability, and environmental responsibility in their appliance purchases.

Market segmentation analysis reveals distinct categories within Germany’s household side by side refrigerator market, each addressing specific consumer needs and preferences:

By Capacity:

By Technology:

By Price Range:

By Distribution Channel:

Category-wise analysis provides detailed insights into specific segments driving Germany’s household side by side refrigerator market growth and consumer adoption patterns:

Smart Connected Category: Represents the fastest-growing segment with 28% annual growth rate as German consumers increasingly embrace smart home technologies. These models feature Wi-Fi connectivity, smartphone apps for remote monitoring, and integration with home automation systems. Premium positioning appeals to tech-savvy consumers willing to invest in advanced functionality and convenience features.

Energy Efficient Category: Dominates consumer preferences with strong emphasis on environmental responsibility and long-term cost savings. Models featuring A+++ energy ratings and eco-friendly refrigerants align with German consumers’ sustainability values while providing superior performance and reduced operating costs over the appliance lifecycle.

Counter-Depth Category: Gains popularity among homeowners seeking built-in appearance without custom installation costs. These models offer seamless integration with kitchen cabinetry while maintaining side by side functionality, appealing to design-conscious consumers prioritizing aesthetic appeal and space optimization in modern German kitchens.

French Door Hybrid Category: Emerging segment combining side by side upper compartments with bottom freezer drawers, offering enhanced accessibility and storage flexibility. This innovative design appeals to German households seeking optimal food organization and energy efficiency through reduced cold air loss during frequent access.

Industry participants in Germany’s household side by side refrigerator market benefit from multiple growth opportunities and strategic advantages:

For Manufacturers:

For Retailers:

For Consumers:

Strengths:

Weaknesses:

Opportunities:

Threats:

Key trends shaping Germany’s household side by side refrigerator market reflect evolving consumer preferences and technological advancement:

Smart Connectivity Trend: Increasing integration of IoT capabilities enables remote monitoring, energy management, and predictive maintenance features. German consumers appreciate technology that enhances convenience while providing insights into appliance performance and energy consumption patterns.

Sustainability Emphasis: Growing focus on environmental responsibility drives demand for energy-efficient models using eco-friendly refrigerants and sustainable manufacturing processes. Consumers increasingly consider lifecycle environmental impact when making appliance purchasing decisions.

Design Customization: Rising interest in personalized aesthetics leads manufacturers to offer customizable finishes, handle options, and interior configurations that complement individual kitchen designs and personal preferences.

Health and Wellness Focus: Advanced food preservation technologies including specialized storage zones for different food types appeal to health-conscious German consumers seeking to maintain nutritional value and extend food freshness.

Space Optimization: Development of counter-depth models and flexible storage solutions addresses German households’ need for space-efficient appliances that maximize functionality without overwhelming kitchen layouts.

Voice Control Integration: Incorporation of voice assistant compatibility aligns with smart home trends, allowing hands-free operation and integration with existing digital ecosystems in modern German households.

Recent industry developments demonstrate significant innovation and market evolution within Germany’s household side by side refrigerator sector:

Technology Advancement: Major manufacturers have introduced AI-powered cooling systems that automatically adjust temperature and humidity levels based on stored food types and usage patterns. These intelligent systems optimize energy consumption while maintaining ideal storage conditions for different food categories.

Sustainability Initiatives: Leading brands have launched carbon-neutral manufacturing programs and introduced models using natural refrigerants with minimal environmental impact. These initiatives respond to German consumers’ environmental consciousness and regulatory requirements for sustainable appliance production.

Smart Home Integration: Enhanced connectivity features now include integration with popular smart home platforms, enabling seamless control through existing home automation systems. This development addresses German consumers’ growing adoption of comprehensive smart home solutions.

Design Innovation: Introduction of modular interior systems allows consumers to customize storage configurations based on changing needs. Flexible shelving, adjustable compartments, and specialized storage zones enhance functionality and user experience.

Energy Efficiency Improvements: New models achieve superior energy ratings through advanced insulation materials, improved compressor technology, and intelligent power management systems that significantly reduce electricity consumption compared to previous generations.

Service Enhancement: Manufacturers have expanded digital service platforms offering remote diagnostics, predictive maintenance alerts, and virtual customer support to improve user experience and appliance reliability throughout the product lifecycle.

Industry analysts recommend strategic approaches for stakeholders in Germany’s household side by side refrigerator market based on comprehensive market analysis and emerging trends. MarkWide Research analysis suggests that manufacturers should prioritize smart technology integration while maintaining focus on energy efficiency and build quality that German consumers expect from premium appliances.

Product Development Focus: Analysts recommend investing in modular design concepts that allow customization for different kitchen layouts and household needs. Developing counter-depth models with full-size capacity addresses space constraints while meeting German consumers’ preference for built-in aesthetics without custom installation costs.

Market Positioning Strategy: Emphasis on premium positioning with clear value proposition highlighting advanced features, energy efficiency, and long-term reliability aligns with German consumer preferences. Manufacturers should communicate total cost of ownership benefits including energy savings and durability to justify premium pricing.

Distribution Channel Optimization: Analysts suggest strengthening omnichannel presence combining traditional retail with enhanced online capabilities. Providing virtual product demonstrations, augmented reality kitchen planning tools, and comprehensive online support services can improve customer engagement and conversion rates.

Sustainability Leadership: Developing comprehensive sustainability programs including eco-friendly manufacturing, recyclable materials, and carbon-neutral operations will differentiate brands in the environmentally conscious German market. Clear communication of environmental benefits supports premium positioning and brand loyalty.

Service Excellence: Investing in comprehensive after-sales service including installation, maintenance, and customer support enhances brand reputation and customer satisfaction. German consumers value reliable service and technical expertise when investing in premium appliances.

Future outlook for Germany’s household side by side refrigerator market indicates sustained growth driven by technological innovation, evolving consumer preferences, and demographic trends supporting premium appliance adoption. Market projections suggest continued expansion with annual growth rates of 8-10% as smart home integration and sustainability features become standard expectations rather than premium options.

Technology evolution will likely focus on enhanced AI capabilities, improved energy efficiency, and seamless smart home integration. Future models may incorporate predictive food management systems that track inventory, suggest recipes, and automatically adjust storage conditions based on contents and usage patterns, appealing to German consumers’ appreciation for efficiency and convenience.

Sustainability trends will drive development of appliances with net-zero environmental impact throughout their lifecycle. Manufacturers investing in renewable energy manufacturing, recyclable materials, and circular economy principles will gain competitive advantages in the environmentally conscious German market.

Market segmentation will likely expand with specialized models targeting specific consumer needs such as wine storage, health-focused preservation, and compact luxury options for urban households. Customization capabilities may become standard features allowing consumers to personalize their appliances for specific lifestyle requirements.

Digital transformation will enhance customer experience through virtual reality showrooms, AI-powered product recommendations, and comprehensive digital service platforms. MWR analysis indicates that successful market participants will be those who effectively combine traditional German quality standards with innovative digital capabilities and sustainable practices.

Germany’s household side by side refrigerator market represents a dynamic and growing segment within the country’s premium home appliance industry, characterized by sophisticated consumer preferences, technological innovation, and strong economic fundamentals supporting sustained market expansion. The market benefits from German consumers’ willingness to invest in high-quality appliances that offer superior functionality, energy efficiency, and modern design aesthetics.

Key success factors for market participants include focus on smart technology integration, sustainability leadership, and comprehensive customer service that meets German consumers’ exacting standards for quality and reliability. The competitive landscape rewards innovation, with manufacturers who successfully combine traditional engineering excellence with cutting-edge features gaining market share and customer loyalty.

Future growth prospects remain positive, supported by demographic trends, kitchen renovation activities, and increasing adoption of smart home technologies. The market’s evolution toward more sustainable, connected, and customizable appliances aligns with broader consumer trends and regulatory requirements, creating opportunities for manufacturers who can effectively address these emerging needs while maintaining the quality standards that German consumers expect from premium home appliances.

What is Household Side By Side Refrigerator?

A Household Side By Side Refrigerator is a type of refrigerator that features two vertical compartments, one for refrigeration and one for freezing, allowing easy access to both sections. This design is popular for its convenience and efficient use of kitchen space.

What are the key players in the Germany Household Side By Side Refrigerator Market?

Key players in the Germany Household Side By Side Refrigerator Market include Bosch, Siemens, and Liebherr, which are known for their innovative designs and energy-efficient models. These companies compete on features such as smart technology and customizable storage options, among others.

What are the growth factors driving the Germany Household Side By Side Refrigerator Market?

The growth of the Germany Household Side By Side Refrigerator Market is driven by increasing consumer demand for energy-efficient appliances, rising disposable incomes, and a growing trend towards modern kitchen designs. Additionally, the popularity of smart home technology is influencing purchasing decisions.

What challenges does the Germany Household Side By Side Refrigerator Market face?

The Germany Household Side By Side Refrigerator Market faces challenges such as high competition among manufacturers and the rising costs of raw materials. Additionally, consumer preferences for compact and multifunctional appliances can limit the market for larger side-by-side models.

What opportunities exist in the Germany Household Side By Side Refrigerator Market?

Opportunities in the Germany Household Side By Side Refrigerator Market include the increasing trend of smart refrigerators with IoT capabilities and the growing focus on sustainability. Manufacturers can capitalize on these trends by developing eco-friendly models and integrating advanced technology.

What trends are shaping the Germany Household Side By Side Refrigerator Market?

Trends shaping the Germany Household Side By Side Refrigerator Market include the rise of energy-efficient models, the integration of smart technology, and a focus on customizable features. Consumers are increasingly looking for refrigerators that offer both functionality and aesthetic appeal.

Germany Household Side By Side Refrigerator Market

| Segmentation Details | Description |

|---|---|

| Product Type | Top Freezer, Bottom Freezer, French Door, Side By Side |

| Technology | Smart Refrigerators, Energy Efficient, Conventional, Dual Cooling |

| End User | Residential, Commercial, Hospitality, Retail |

| Distribution Channel | Online Retail, Specialty Stores, Hypermarkets, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Household Side By Side Refrigerator Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at