444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany geospatial analytics market represents a dynamic and rapidly evolving sector that leverages geographic information systems, satellite imagery, and location-based data to provide actionable insights across multiple industries. Germany’s position as Europe’s largest economy and its strong industrial base have created substantial demand for sophisticated geospatial solutions that support urban planning, logistics optimization, environmental monitoring, and digital transformation initiatives.

Market growth in Germany is being driven by increasing adoption of Internet of Things (IoT) technologies, smart city initiatives, and the country’s commitment to Industry 4.0 principles. The integration of artificial intelligence and machine learning with geospatial data has opened new possibilities for predictive analytics and automated decision-making processes. Government investments in digital infrastructure and the European Space Agency’s Copernicus program have further accelerated market development.

Key sectors driving demand include automotive manufacturing, where geospatial analytics supports autonomous vehicle development and supply chain optimization, and renewable energy, where location intelligence guides wind farm placement and solar panel installations. The market is experiencing robust growth at a compound annual growth rate of 12.3%, reflecting strong enterprise adoption and technological advancement across the region.

The Germany geospatial analytics market refers to the comprehensive ecosystem of technologies, services, and solutions that collect, process, analyze, and visualize geographic and location-based data to support decision-making across various industries and government sectors. This market encompasses geographic information systems (GIS), remote sensing technologies, global positioning systems (GPS), and advanced analytics platforms that transform spatial data into actionable business intelligence.

Geospatial analytics combines traditional mapping and surveying techniques with modern data science methodologies, enabling organizations to understand patterns, relationships, and trends that have geographic components. The technology integrates multiple data sources including satellite imagery, aerial photography, sensor networks, and crowdsourced information to create comprehensive spatial intelligence solutions.

Applications range from simple location mapping to complex predictive modeling that supports urban planning, disaster management, precision agriculture, and logistics optimization. The market includes both software solutions and professional services that help organizations implement and maintain geospatial analytics capabilities.

Germany’s geospatial analytics market is experiencing unprecedented growth driven by digital transformation initiatives, smart city development, and increasing recognition of location intelligence as a strategic business asset. The market benefits from Germany’s strong technology infrastructure, skilled workforce, and supportive regulatory environment that encourages innovation in spatial data applications.

Key market drivers include the proliferation of connected devices generating location data, government mandates for digital mapping and monitoring, and growing demand for real-time analytics in transportation and logistics sectors. The automotive industry’s focus on autonomous vehicles has created particularly strong demand for high-precision geospatial solutions, with automotive applications representing 28% of market demand.

Cloud-based solutions are gaining significant traction, offering scalability and cost-effectiveness that appeal to both large enterprises and small-to-medium businesses. The integration of artificial intelligence and machine learning technologies is enhancing the predictive capabilities of geospatial analytics, enabling more sophisticated applications in risk assessment, resource optimization, and strategic planning.

Competitive dynamics feature a mix of global technology leaders and specialized German companies that understand local market requirements and regulatory frameworks. The market is characterized by ongoing consolidation as larger players acquire niche specialists to expand their capabilities and market reach.

Market penetration across German industries reveals significant opportunities for continued expansion, with current adoption rates varying substantially by sector and organization size. The following insights highlight critical market dynamics:

Digital transformation initiatives across German enterprises are creating substantial demand for geospatial analytics solutions that support data-driven decision making. Organizations recognize that location intelligence provides competitive advantages through improved operational efficiency, better customer insights, and enhanced risk management capabilities.

Smart city development represents a major growth driver as German municipalities invest in intelligent infrastructure systems. These initiatives require sophisticated geospatial analytics to optimize traffic flow, manage energy consumption, monitor environmental conditions, and improve public services delivery. Government funding for smart city projects has increased by 22% over the past two years, directly benefiting geospatial analytics providers.

Industry 4.0 adoption in Germany’s manufacturing sector is driving demand for location-aware systems that optimize supply chains, track assets, and monitor production processes. The integration of geospatial data with industrial IoT platforms enables predictive maintenance, quality control, and resource optimization that improve overall equipment effectiveness.

Environmental monitoring requirements are expanding as Germany pursues ambitious climate goals and renewable energy targets. Geospatial analytics supports environmental impact assessments, pollution monitoring, and renewable energy site selection. The technology enables precise measurement and modeling of environmental factors that influence policy decisions and regulatory compliance.

Autonomous vehicle development by German automotive manufacturers requires high-precision mapping and real-time location intelligence. The technology supports navigation systems, safety features, and traffic management applications that are essential for autonomous driving capabilities.

Data privacy concerns and regulatory compliance requirements present significant challenges for geospatial analytics adoption in Germany. The General Data Protection Regulation (GDPR) and German Federal Data Protection Act impose strict requirements on location data collection, processing, and storage that increase implementation complexity and costs.

High implementation costs associated with comprehensive geospatial analytics solutions can be prohibitive for smaller organizations. The technology requires significant investments in software licenses, hardware infrastructure, data acquisition, and skilled personnel that may exceed available budgets for many potential users.

Technical complexity in integrating geospatial analytics with existing enterprise systems creates implementation challenges. Organizations often struggle with data format compatibility, system interoperability, and the technical expertise required to effectively deploy and maintain geospatial solutions.

Data quality issues can undermine the effectiveness of geospatial analytics applications. Inconsistent data sources, outdated information, and accuracy limitations in spatial datasets can lead to incorrect insights and poor decision-making outcomes that reduce confidence in the technology.

Skills shortage in the German market limits the availability of qualified professionals who can effectively implement and manage geospatial analytics solutions. The specialized knowledge required combines geography, data science, and domain expertise that is difficult to find and expensive to develop internally.

Artificial intelligence integration presents substantial opportunities for enhancing geospatial analytics capabilities. Machine learning algorithms can automate pattern recognition, improve prediction accuracy, and enable more sophisticated analysis of complex spatial relationships. AI-enhanced solutions are expected to capture 35% of new market demand over the next three years.

Edge computing deployment offers opportunities to bring geospatial processing closer to data sources, reducing latency and improving real-time analytics capabilities. This approach is particularly valuable for applications requiring immediate response times, such as autonomous vehicles and emergency response systems.

Sector-specific solutions represent significant growth opportunities as providers develop specialized applications for industries like agriculture, insurance, and retail. These tailored solutions address specific business challenges and regulatory requirements that generic platforms cannot effectively support.

Small and medium enterprise adoption offers substantial market expansion potential as cloud-based solutions make geospatial analytics more accessible and affordable. Simplified interfaces and pre-configured industry solutions can lower barriers to entry for organizations that previously could not justify the investment.

International expansion opportunities exist for German geospatial analytics companies to leverage their technical expertise and regulatory compliance experience in other European markets. The harmonization of EU regulations creates opportunities for cross-border solution deployment.

Technological convergence is reshaping the geospatial analytics landscape as traditional GIS capabilities merge with big data analytics, artificial intelligence, and cloud computing platforms. This convergence creates more powerful and accessible solutions while also intensifying competition among technology providers.

Customer expectations are evolving toward self-service analytics capabilities that enable business users to create their own geospatial insights without requiring technical expertise. This trend is driving development of intuitive user interfaces and automated analysis tools that democratize access to location intelligence.

Data ecosystem expansion continues as new sources of location-relevant information become available through IoT sensors, social media platforms, and crowdsourcing initiatives. The challenge for analytics providers is integrating these diverse data streams into coherent and actionable insights.

Competitive intensity is increasing as established GIS vendors face competition from cloud platform providers, business intelligence companies, and specialized analytics startups. This competition is accelerating innovation while also putting pressure on pricing and profit margins.

Partnership strategies are becoming more important as no single vendor can provide all the capabilities required for comprehensive geospatial analytics solutions. Strategic alliances between technology providers, data suppliers, and industry specialists are creating more complete offerings for end users.

Primary research activities for this market analysis included comprehensive surveys of geospatial analytics users across multiple industries in Germany, in-depth interviews with technology vendors and system integrators, and consultation with industry experts and government officials involved in spatial data initiatives.

Secondary research encompassed analysis of published market reports, government statistics, industry association data, and company financial reports. Patent analysis and technology trend monitoring provided insights into innovation directions and competitive positioning among market participants.

Market sizing methodology utilized bottom-up analysis based on user adoption rates, average spending per organization, and technology penetration across different industry segments. Cross-validation with top-down approaches ensured accuracy and reliability of growth projections.

Qualitative analysis incorporated expert opinions, case study development, and trend analysis to understand market dynamics beyond quantitative metrics. This approach provided deeper insights into customer motivations, technology preferences, and future market evolution patterns.

Data validation processes included triangulation of information sources, expert review panels, and statistical analysis to ensure research findings accurately reflect market conditions and trends in the German geospatial analytics sector.

North Rhine-Westphalia leads the German geospatial analytics market with 26% of national demand, driven by its concentration of manufacturing companies, logistics hubs, and urban centers. The region’s industrial base creates substantial demand for supply chain optimization, asset tracking, and operational analytics solutions.

Bavaria represents the second-largest regional market, accounting for 22% of total adoption, with particular strength in automotive and aerospace applications. Munich’s technology cluster and the presence of major automotive manufacturers drive innovation and investment in advanced geospatial solutions.

Baden-Württemberg shows strong market development with 18% market share, supported by its engineering and manufacturing expertise. The region’s focus on Industry 4.0 initiatives and smart manufacturing creates demand for integrated geospatial analytics platforms.

Berlin-Brandenburg is emerging as a significant market with 12% adoption rate, driven by government applications, startup activity, and smart city initiatives. The capital region’s role as a technology hub attracts investment in innovative geospatial solutions and applications.

Other regions including Hamburg, Hesse, and Saxony collectively represent the remaining market share, with particular strength in specific sectors such as maritime logistics, financial services, and renewable energy applications.

Market leadership in Germany’s geospatial analytics sector is distributed among several categories of providers, each bringing distinct capabilities and market approaches:

Competitive strategies focus on vertical market specialization, cloud platform development, and integration with emerging technologies such as artificial intelligence and IoT. Companies are investing heavily in user experience improvements and self-service analytics capabilities to expand their addressable market.

By Technology:

By Application:

By Industry Vertical:

Software Solutions dominate the market with 68% of total adoption, encompassing both traditional desktop GIS applications and modern cloud-based analytics platforms. The shift toward software-as-a-service models is accelerating as organizations seek to reduce infrastructure costs and improve scalability.

Professional Services represent 24% of market activity, including consulting, implementation, training, and ongoing support services. The complexity of geospatial analytics deployments creates substantial demand for expert services that ensure successful project outcomes.

Data and Content account for 8% of market spending, covering satellite imagery, aerial photography, demographic data, and other spatial datasets. The availability of high-quality, up-to-date spatial data is critical for effective analytics applications.

Cloud-based solutions are experiencing the fastest growth at 25% annually, driven by their accessibility, scalability, and lower total cost of ownership compared to traditional on-premise deployments. This trend is particularly strong among small and medium enterprises that lack internal IT resources for complex system management.

Mobile applications are becoming increasingly important as field workers require access to geospatial insights on smartphones and tablets. The development of mobile-optimized interfaces and offline capabilities is expanding the addressable market for geospatial analytics solutions.

Operational Efficiency improvements through geospatial analytics enable organizations to optimize resource allocation, reduce travel costs, and streamline business processes. Location intelligence helps identify inefficiencies and opportunities for process improvement that may not be apparent through traditional analysis methods.

Risk Management capabilities allow organizations to better understand and mitigate location-based risks including natural disasters, security threats, and regulatory compliance issues. Predictive modeling using spatial data helps organizations prepare for and respond to potential challenges.

Customer Insights derived from location data enable more effective marketing, improved service delivery, and better understanding of customer behavior patterns. Retailers and service providers use geospatial analytics to optimize store locations, target advertising, and improve customer experience.

Competitive Advantage emerges from the ability to make faster, more informed decisions based on comprehensive spatial intelligence. Organizations that effectively leverage geospatial analytics can identify opportunities and respond to market changes more quickly than competitors.

Regulatory Compliance benefits include automated reporting, environmental monitoring, and documentation of compliance activities. Geospatial analytics helps organizations meet regulatory requirements while reducing the administrative burden of compliance management.

Innovation Enablement through geospatial analytics supports the development of new products, services, and business models. The technology enables organizations to explore new market opportunities and create value-added services for customers.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration is transforming geospatial analytics by automating pattern recognition, improving prediction accuracy, and enabling more sophisticated analysis of complex spatial relationships. Machine learning algorithms can process vast amounts of location data to identify trends and insights that would be impossible to detect through manual analysis.

Real-time Analytics capabilities are becoming essential as organizations require immediate insights to support time-sensitive decision making. The integration of streaming data processing with geospatial analytics enables applications such as traffic management, emergency response, and supply chain optimization that depend on current information.

Cloud-Native Solutions are gaining dominance as organizations seek scalable, cost-effective alternatives to traditional on-premise deployments. Cloud platforms offer improved accessibility, automatic updates, and the ability to handle large-scale data processing without significant infrastructure investments.

Mobile-First Design reflects the growing importance of field-based workers who need access to geospatial insights on portable devices. Mobile applications with offline capabilities ensure that location intelligence is available regardless of connectivity constraints.

Industry Specialization is increasing as vendors develop solutions tailored to specific vertical markets with unique requirements and regulatory constraints. This trend creates opportunities for niche providers while also enabling more effective solutions for end users.

Data Democratization through self-service analytics tools enables business users to create their own geospatial insights without requiring technical expertise. This trend expands the addressable market while also changing the skills and training requirements for effective solution deployment.

Strategic Partnerships between technology providers, data suppliers, and industry specialists are creating more comprehensive solutions for end users. Recent collaborations have focused on combining geospatial analytics with IoT platforms, artificial intelligence capabilities, and industry-specific applications.

Acquisition Activity continues as larger technology companies acquire specialized geospatial analytics providers to expand their capabilities and market reach. These acquisitions often focus on specific technologies such as artificial intelligence, mobile applications, or vertical market expertise.

Government Initiatives including the European Space Agency’s Copernicus program and Germany’s Digital Strategy 2025 are creating new opportunities and requirements for geospatial analytics applications. Public sector investment in spatial data infrastructure supports market development across multiple industries.

Technology Innovations in areas such as edge computing, 5G connectivity, and augmented reality are creating new possibilities for geospatial analytics applications. These technologies enable more sophisticated and responsive solutions that were not previously feasible.

Regulatory Developments including updates to data protection laws and environmental monitoring requirements are shaping market demand and solution design. MarkWide Research analysis indicates that regulatory compliance requirements are driving 15% of new solution implementations.

Technology Vendors should focus on developing user-friendly interfaces and self-service capabilities that enable broader adoption across organizations. Investment in artificial intelligence and machine learning capabilities will be essential for maintaining competitive positioning in the evolving market.

Enterprise Users should develop comprehensive data strategies that address privacy requirements while maximizing the value of location intelligence. Organizations should also invest in training and skills development to ensure successful implementation and ongoing utilization of geospatial analytics solutions.

Government Agencies should continue investing in spatial data infrastructure and open data initiatives that support broader market development. Collaboration with private sector providers can accelerate innovation while ensuring public sector requirements are met.

System Integrators should develop specialized expertise in vertical markets and emerging technologies to differentiate their services. The complexity of modern geospatial analytics deployments creates opportunities for providers that can deliver comprehensive implementation and support services.

Investors should focus on companies that demonstrate strong technology capabilities, clear market positioning, and the ability to adapt to rapidly evolving customer requirements. The market offers substantial growth opportunities for well-positioned providers.

Market expansion is expected to continue at a robust pace as digital transformation initiatives accelerate across German industries. MarkWide Research projects that adoption rates will increase significantly over the next five years, driven by improving technology accessibility and growing recognition of location intelligence value.

Technology evolution will focus on artificial intelligence integration, real-time processing capabilities, and improved user experiences that make geospatial analytics accessible to non-technical users. The convergence of geospatial analytics with other emerging technologies will create new application possibilities and market opportunities.

Industry applications are expected to expand beyond traditional sectors as organizations across all industries recognize the value of location intelligence. Emerging applications in areas such as healthcare, education, and financial services will drive additional market growth.

Competitive dynamics will continue evolving as traditional GIS vendors compete with cloud platform providers, business intelligence companies, and specialized analytics startups. Success will depend on the ability to deliver comprehensive solutions that address specific customer requirements while maintaining competitive pricing.

Regulatory environment will continue shaping market development as privacy protection requirements and industry-specific regulations influence solution design and deployment approaches. Organizations that can effectively navigate regulatory requirements while delivering value will be best positioned for success.

Germany’s geospatial analytics market represents a dynamic and rapidly growing sector that is transforming how organizations understand and utilize location-based information. The combination of strong industrial demand, supportive government initiatives, and advancing technology capabilities creates substantial opportunities for continued market expansion and innovation.

Key success factors for market participants include the ability to deliver user-friendly solutions, integrate emerging technologies such as artificial intelligence, and address specific industry requirements while maintaining regulatory compliance. The shift toward cloud-based platforms and self-service analytics is democratizing access to geospatial intelligence and expanding the addressable market.

Future growth prospects remain strong as digital transformation initiatives accelerate and organizations increasingly recognize location intelligence as a strategic asset. The integration of geospatial analytics with IoT, artificial intelligence, and other emerging technologies will create new application possibilities and drive continued market evolution. Organizations that invest in geospatial analytics capabilities today will be well-positioned to capitalize on the expanding opportunities in Germany’s dynamic technology landscape.

What is Geospatial Analytics?

Geospatial Analytics refers to the collection, analysis, and visualization of data related to geographic locations. It is used in various applications such as urban planning, environmental monitoring, and transportation management.

What are the key players in the Germany Geospatial Analytics Market?

Key players in the Germany Geospatial Analytics Market include companies like Esri, Hexagon AB, and Trimble, which provide advanced geospatial solutions and technologies for various industries, among others.

What are the main drivers of growth in the Germany Geospatial Analytics Market?

The main drivers of growth in the Germany Geospatial Analytics Market include the increasing demand for location-based services, advancements in satellite imagery technology, and the growing need for data-driven decision-making in sectors like logistics and urban development.

What challenges does the Germany Geospatial Analytics Market face?

Challenges in the Germany Geospatial Analytics Market include data privacy concerns, the complexity of integrating geospatial data with existing systems, and the high costs associated with advanced analytics technologies.

What opportunities exist in the Germany Geospatial Analytics Market?

Opportunities in the Germany Geospatial Analytics Market include the expansion of smart city initiatives, the rise of IoT applications, and the increasing use of geospatial data in environmental sustainability efforts.

What trends are shaping the Germany Geospatial Analytics Market?

Trends shaping the Germany Geospatial Analytics Market include the integration of artificial intelligence with geospatial technologies, the growing use of real-time data analytics, and the increasing adoption of cloud-based geospatial solutions.

Germany Geospatial Analytics Market

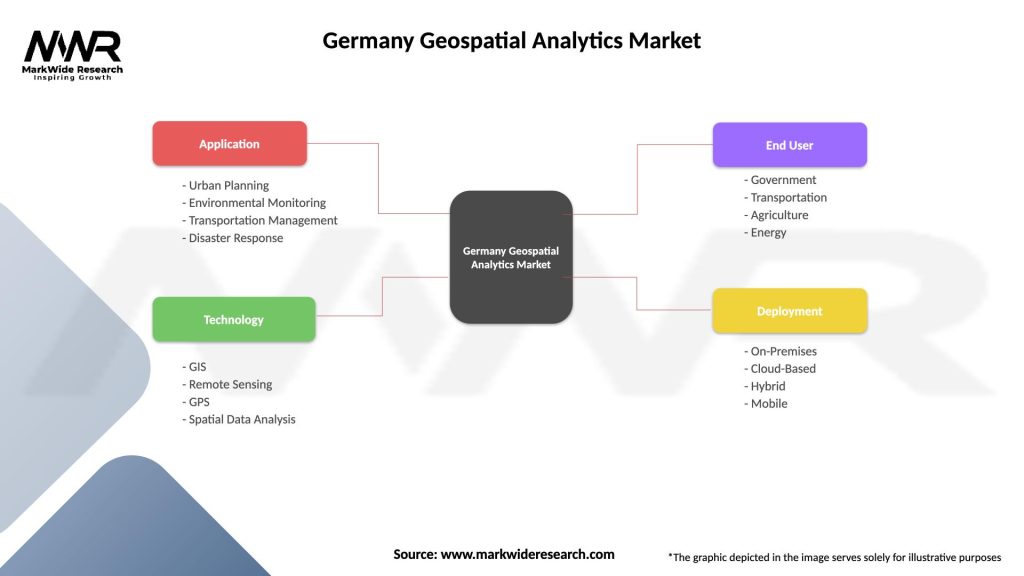

| Segmentation Details | Description |

|---|---|

| Application | Urban Planning, Environmental Monitoring, Transportation Management, Disaster Response |

| Technology | GIS, Remote Sensing, GPS, Spatial Data Analysis |

| End User | Government, Transportation, Agriculture, Energy |

| Deployment | On-Premises, Cloud-Based, Hybrid, Mobile |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Geospatial Analytics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at