444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany flooring market represents one of Europe’s most sophisticated and technologically advanced flooring sectors, characterized by exceptional quality standards, innovative manufacturing processes, and strong environmental consciousness. German flooring manufacturers have established themselves as global leaders in premium flooring solutions, combining traditional craftsmanship with cutting-edge technology to deliver products that meet the highest performance and aesthetic standards.

Market dynamics in Germany reflect the country’s robust construction industry, growing renovation activities, and increasing consumer preference for sustainable flooring materials. The market demonstrates remarkable resilience and continues expanding at a steady growth rate of 4.2% annually, driven by both residential and commercial construction projects. Premium flooring segments including luxury vinyl tiles, engineered hardwood, and advanced laminate flooring dominate the market landscape.

Regional distribution shows concentrated activity in major metropolitan areas such as Berlin, Munich, Hamburg, and Frankfurt, where construction activities remain robust. The market benefits from Germany’s position as a manufacturing hub, with approximately 78% of flooring products being domestically produced, ensuring quality control and reduced transportation costs.

The Germany flooring market refers to the comprehensive ecosystem encompassing the production, distribution, installation, and maintenance of various flooring materials and solutions within the German territory. This market includes residential, commercial, and industrial flooring applications, covering diverse product categories from traditional hardwood and ceramic tiles to innovative luxury vinyl planks and sustainable cork flooring.

Market scope extends beyond mere product sales to include specialized installation services, flooring accessories, underlayments, adhesives, and maintenance products. The German flooring market is distinguished by its emphasis on quality, durability, and environmental sustainability, reflecting the country’s stringent building standards and consumer preferences for long-lasting, eco-friendly solutions.

Germany’s flooring market stands as a cornerstone of the European flooring industry, demonstrating consistent growth patterns and technological innovation leadership. The market showcases remarkable diversity in product offerings, from traditional parquet flooring that reflects German heritage to modern luxury vinyl tiles incorporating advanced wear-layer technology.

Key market characteristics include strong domestic manufacturing capabilities, with German companies controlling significant market share in premium segments. The market benefits from robust construction activity, with residential renovations accounting for 62% of total flooring demand. Commercial applications continue expanding, particularly in office spaces, retail environments, and hospitality sectors.

Sustainability initiatives drive market evolution, with eco-friendly flooring options gaining substantial traction among environmentally conscious consumers. The integration of digital technologies in manufacturing processes and the growing popularity of click-lock installation systems represent significant market trends shaping future development.

Strategic market insights reveal several critical factors influencing Germany’s flooring market trajectory:

Construction industry growth serves as the primary driver for Germany’s flooring market expansion. Robust residential construction activities, coupled with extensive renovation projects in existing buildings, create sustained demand for diverse flooring solutions. Government initiatives promoting energy-efficient building standards further stimulate market growth by encouraging comprehensive renovation projects.

Consumer lifestyle changes significantly influence flooring preferences, with homeowners increasingly seeking durable, low-maintenance solutions that combine aesthetic appeal with practical functionality. The growing trend toward open-plan living spaces drives demand for seamless flooring transitions and versatile materials suitable for multiple room applications.

Technological advancements in flooring manufacturing enable the production of innovative products with enhanced performance characteristics. Advanced wear layers, improved scratch resistance, and realistic wood-look designs in luxury vinyl products attract consumers seeking premium aesthetics with superior durability.

Environmental consciousness among German consumers drives increasing demand for sustainable flooring materials, including certified wood products, recycled content flooring, and low-emission options that contribute to healthier indoor environments.

High material costs present significant challenges for market expansion, particularly affecting price-sensitive consumer segments. Premium flooring materials command substantial pricing premiums, potentially limiting market accessibility for budget-conscious consumers and smaller commercial projects.

Skilled labor shortages in the installation sector create bottlenecks in project completion timelines and may increase installation costs. The specialized nature of certain flooring installations requires experienced professionals, and the limited availability of skilled installers can constrain market growth.

Regulatory compliance requirements add complexity and costs to flooring product development and manufacturing processes. Stringent environmental regulations and building standards, while beneficial for quality assurance, may increase production costs and limit product innovation flexibility.

Economic uncertainties and fluctuating construction activity levels can impact flooring demand, particularly in commercial and industrial segments where project timelines may be extended or postponed during economic downturns.

Smart flooring technologies present substantial growth opportunities, with integrated sensors and connectivity features enabling advanced building management systems. These innovations appeal to tech-savvy consumers and commercial property managers seeking enhanced functionality and operational efficiency.

Sustainable product development offers significant market expansion potential, particularly in segments focused on recycled materials, renewable resources, and carbon-neutral manufacturing processes. Green building certifications increasingly require sustainable flooring options, creating dedicated market segments.

E-commerce platform development enables direct-to-consumer sales channels and enhanced customer engagement through virtual showrooms, augmented reality visualization tools, and online design consultation services. Digital transformation creates new revenue streams and improves market accessibility.

Export market expansion leverages Germany’s reputation for quality manufacturing to access international markets, particularly in emerging economies where premium flooring demand continues growing. Brand recognition and quality assurance provide competitive advantages in global markets.

Supply chain optimization plays a crucial role in market dynamics, with manufacturers focusing on efficient distribution networks and inventory management systems. The integration of digital technologies in supply chain operations improves delivery efficiency by approximately 23% while reducing operational costs.

Competitive landscape dynamics feature both established German manufacturers and international brands competing for market share. Innovation cycles accelerate as companies invest in research and development to differentiate their product offerings and maintain competitive positioning.

Consumer behavior patterns show increasing preference for online research and comparison shopping before making flooring purchase decisions. Digital influence on purchasing decisions has grown significantly, with online research influencing 71% of flooring purchases even when final transactions occur through traditional retail channels.

Seasonal demand fluctuations affect market dynamics, with peak installation periods typically occurring during spring and summer months when weather conditions favor construction and renovation activities. Understanding these patterns helps manufacturers and retailers optimize inventory management and marketing strategies.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive surveys of industry participants, including manufacturers, distributors, installers, and end-users across different market segments and geographic regions within Germany.

Secondary research components encompass analysis of industry reports, trade publications, government statistics, and company financial statements to establish market baselines and identify trends. MarkWide Research utilizes proprietary databases and analytical frameworks to process and interpret market data effectively.

Data validation processes include cross-referencing multiple sources, conducting expert interviews, and employing statistical analysis techniques to ensure data accuracy and reliability. Market modeling incorporates economic indicators, construction industry data, and consumer spending patterns to project future market developments.

Qualitative research methods include focus groups, in-depth interviews, and observational studies to understand consumer preferences, decision-making processes, and emerging trends that quantitative data alone cannot capture.

Northern Germany demonstrates strong market activity centered around Hamburg and Bremen, with significant commercial flooring demand driven by port facilities, logistics centers, and industrial applications. The region shows preference for durable, low-maintenance flooring solutions suitable for high-traffic environments.

Southern Germany including Bavaria and Baden-Württemberg represents the largest regional market segment, accounting for approximately 34% of total flooring demand. This region benefits from robust economic activity, high disposable incomes, and strong construction industry presence, driving demand for premium flooring products.

Western Germany encompassing North Rhine-Westphalia and Rhineland-Palatinate shows diverse market characteristics, with significant industrial flooring requirements and growing residential renovation activities. The region’s dense population and urban development create sustained flooring demand across multiple segments.

Eastern Germany continues experiencing growth in flooring demand as economic development and infrastructure improvements progress. Renovation of existing buildings and new construction projects drive market expansion, with increasing preference for modern flooring solutions replacing traditional materials.

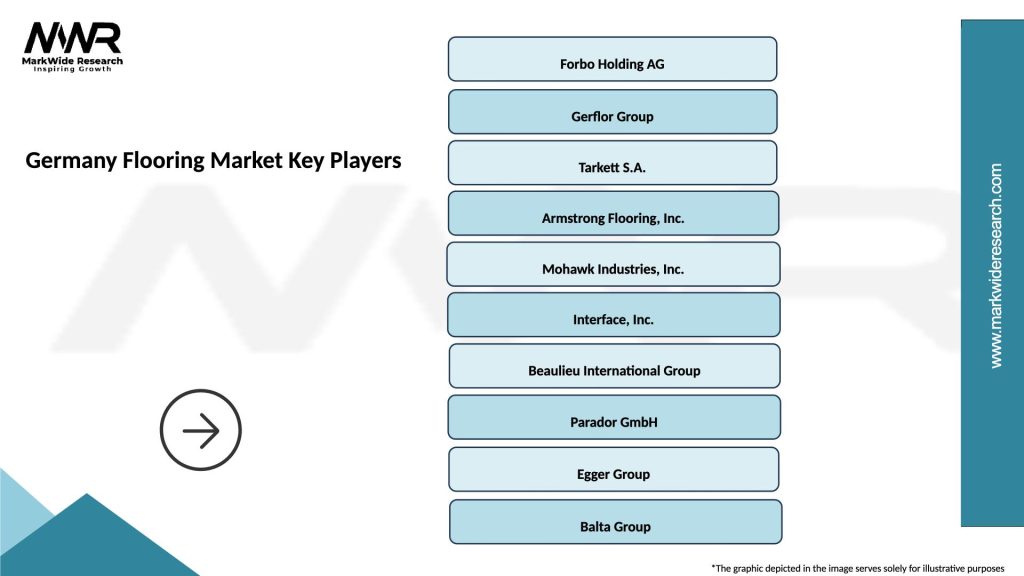

Market leadership features a combination of established German manufacturers and international flooring companies competing across different product segments and price points:

Competitive strategies focus on product innovation, sustainability initiatives, and enhanced customer service offerings. Companies invest significantly in research and development to maintain technological leadership and respond to evolving market demands.

By Product Type:

By Application:

Luxury Vinyl Flooring demonstrates exceptional growth momentum, with market share increasing to 28% of total flooring sales. Advanced manufacturing technologies enable realistic wood and stone textures while providing superior water resistance and durability. Click-lock installation systems simplify the installation process and reduce labor costs.

Laminate flooring maintains strong market position through continuous innovation in surface textures, edge treatments, and core technologies. German manufacturers lead in developing high-pressure laminate products with enhanced scratch resistance and authentic wood grain patterns.

Engineered hardwood appeals to consumers seeking authentic wood aesthetics with improved dimensional stability. Multi-layer construction techniques and advanced finishing processes create products suitable for various installation methods including floating, glue-down, and nail-down applications.

Ceramic tile segment benefits from technological advances in digital printing, enabling unlimited design possibilities and improved surface textures. Large-format tiles and ultra-thin profiles represent significant growth areas within this traditional flooring category.

Manufacturers benefit from Germany’s strong reputation for quality and innovation, enabling premium pricing strategies and access to international markets. Advanced manufacturing infrastructure and skilled workforce support efficient production processes and continuous product development initiatives.

Distributors and retailers leverage comprehensive product portfolios and strong brand recognition to serve diverse customer segments. Digital marketing tools and e-commerce platforms expand market reach and improve customer engagement capabilities.

Installation professionals benefit from growing market demand and opportunities for specialization in premium flooring systems. Training programs and certification processes enhance professional capabilities and service quality standards.

End-users gain access to world-class flooring products with superior performance characteristics, extensive design options, and comprehensive warranty coverage. German quality standards ensure long-term satisfaction and value retention.

Investors find attractive opportunities in a stable, growing market with established companies and emerging technology segments. The flooring industry’s resilience and essential nature provide defensive investment characteristics.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable manufacturing practices gain prominence as companies adopt circular economy principles, utilizing recycled materials and implementing carbon-neutral production processes. Life cycle assessments become standard practice for evaluating environmental impact and guiding product development decisions.

Digital visualization technologies transform the customer experience through augmented reality applications, virtual showrooms, and AI-powered design tools. These technologies enable customers to visualize flooring options in their actual spaces before making purchase decisions.

Hybrid flooring products combine multiple material technologies to achieve superior performance characteristics. These innovative products offer enhanced durability, improved comfort, and unique aesthetic properties that traditional single-material flooring cannot provide.

Wellness-focused flooring incorporates health-conscious features such as antimicrobial surfaces, air-purifying properties, and ergonomic comfort characteristics. These products appeal to health-conscious consumers and commercial applications prioritizing occupant wellbeing.

Manufacturing automation advances significantly improve production efficiency and quality consistency. Robotic systems and artificial intelligence integration optimize manufacturing processes while reducing labor requirements and production costs.

Product certification programs expand to include comprehensive sustainability metrics, indoor air quality standards, and performance benchmarks. These certifications help consumers make informed decisions and support premium product positioning.

Partnership strategies between flooring manufacturers and technology companies accelerate innovation in smart flooring solutions. Collaborative development efforts focus on integrating sensors, connectivity features, and data analytics capabilities into traditional flooring products.

Supply chain resilience improvements include diversification of raw material sources, development of local supplier networks, and implementation of advanced inventory management systems to mitigate disruption risks.

Market participants should prioritize investment in sustainable product development and manufacturing processes to align with evolving consumer preferences and regulatory requirements. MWR analysis indicates that sustainability-focused companies demonstrate superior long-term growth potential and market resilience.

Digital transformation initiatives require immediate attention to remain competitive in evolving market conditions. Companies should invest in e-commerce platforms, digital marketing capabilities, and customer relationship management systems to enhance market reach and customer engagement.

Strategic partnerships with technology companies, installation professionals, and distribution channels can accelerate market expansion and improve competitive positioning. Collaborative approaches enable resource sharing and risk mitigation while accessing new market segments.

International expansion opportunities should be evaluated carefully, considering market entry strategies that leverage German quality reputation while adapting to local market requirements and preferences. Export development programs can provide valuable support for market entry initiatives.

Market growth prospects remain positive, with continued expansion expected across multiple product segments and application areas. The integration of advanced technologies and sustainable practices will drive innovation and create new market opportunities over the next decade.

Consumer preferences will continue evolving toward premium, sustainable, and technologically advanced flooring solutions. Companies that successfully anticipate and respond to these preferences will achieve superior market positioning and growth performance.

Technological integration will accelerate, with smart flooring systems becoming mainstream in commercial applications and gradually penetrating residential markets. The convergence of flooring and building automation systems creates substantial growth potential.

Sustainability requirements will become increasingly stringent, driving innovation in recycled materials, renewable resources, and circular economy practices. Companies investing in sustainable technologies today will benefit from competitive advantages in future market conditions.

Market consolidation may occur as companies seek scale advantages and technological capabilities through mergers and acquisitions. Strategic consolidation can improve operational efficiency and accelerate innovation development.

Germany’s flooring market represents a dynamic and sophisticated industry characterized by quality excellence, technological innovation, and environmental responsibility. The market demonstrates resilience and growth potential despite facing challenges related to costs, labor availability, and competitive pressures.

Strategic opportunities abound for companies willing to invest in sustainable technologies, digital transformation, and customer-centric solutions. The combination of Germany’s manufacturing expertise, strong domestic demand, and export potential creates a favorable environment for long-term growth and profitability.

Future success will depend on companies’ ability to adapt to evolving market conditions, embrace technological innovations, and maintain focus on sustainability and quality standards that define the German flooring market’s reputation for excellence.

What is Flooring?

Flooring refers to the permanent covering of a floor, which can include materials such as hardwood, laminate, vinyl, tile, and carpet. It plays a crucial role in interior design and functionality across residential and commercial spaces.

What are the key players in the Germany Flooring Market?

Key players in the Germany Flooring Market include companies like Gerflor, Tarkett, and Forbo, which offer a variety of flooring solutions for both residential and commercial applications. These companies are known for their innovative designs and sustainable practices, among others.

What are the main drivers of the Germany Flooring Market?

The main drivers of the Germany Flooring Market include the growing demand for sustainable and eco-friendly flooring options, increasing urbanization, and the rise in home renovation activities. Additionally, advancements in flooring technology are enhancing product offerings.

What challenges does the Germany Flooring Market face?

The Germany Flooring Market faces challenges such as fluctuating raw material prices and intense competition among manufacturers. Additionally, the market must navigate changing consumer preferences and the need for compliance with environmental regulations.

What opportunities exist in the Germany Flooring Market?

Opportunities in the Germany Flooring Market include the increasing trend towards smart homes and the integration of technology in flooring solutions. There is also a growing interest in luxury vinyl tiles and sustainable materials, which can drive innovation.

What trends are shaping the Germany Flooring Market?

Trends shaping the Germany Flooring Market include the rise of multifunctional spaces that require versatile flooring solutions, the popularity of natural materials, and the increasing focus on health and wellness in flooring choices. Additionally, digitalization in design and sales processes is becoming more prevalent.

Germany Flooring Market

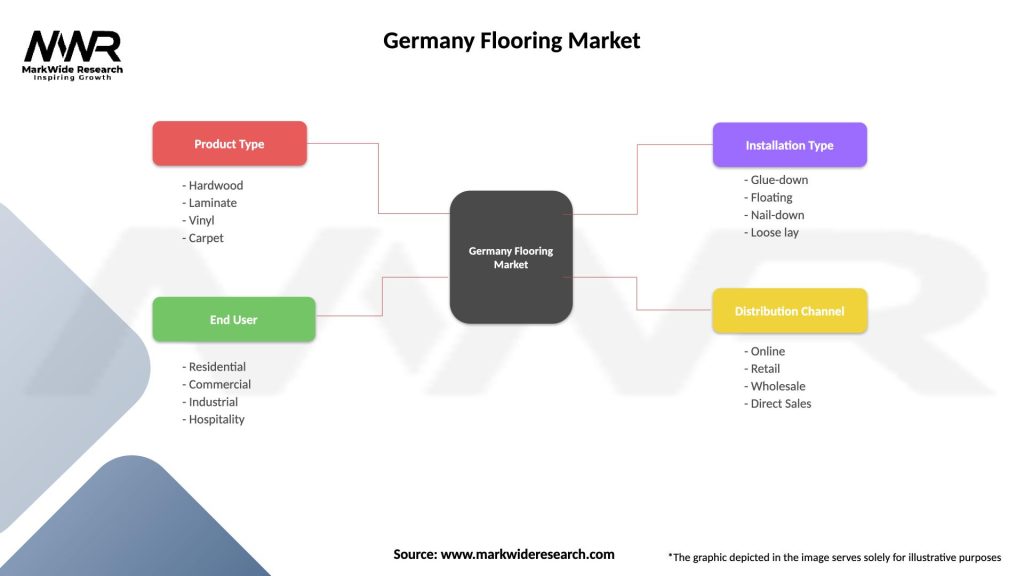

| Segmentation Details | Description |

|---|---|

| Product Type | Hardwood, Laminate, Vinyl, Carpet |

| End User | Residential, Commercial, Industrial, Hospitality |

| Installation Type | Glue-down, Floating, Nail-down, Loose lay |

| Distribution Channel | Online, Retail, Wholesale, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Flooring Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at