444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany flexible plastic packaging market represents a cornerstone of the European packaging industry, demonstrating remarkable resilience and continuous innovation across diverse sectors. Germany’s position as Europe’s largest economy has established it as a leading hub for advanced packaging solutions, with flexible plastic packaging experiencing robust growth driven by evolving consumer preferences and industrial demands. The market encompasses a comprehensive range of applications including food and beverage packaging, pharmaceutical containers, personal care products, and industrial applications.

Market dynamics indicate sustained expansion with the sector growing at a steady CAGR of 4.2%, reflecting strong domestic consumption and export opportunities. German manufacturers have consistently prioritized technological advancement and sustainability initiatives, positioning the country at the forefront of eco-friendly packaging innovations. The integration of advanced barrier technologies, smart packaging solutions, and recyclable materials has enhanced the market’s competitive advantage in both domestic and international markets.

Consumer behavior shifts toward convenience foods, e-commerce growth, and sustainable packaging preferences have significantly influenced market trajectories. The food and beverage segment maintains approximately 65% market share, while pharmaceutical and healthcare applications represent rapidly expanding segments with increasing demand for specialized barrier properties and tamper-evident features.

The Germany flexible plastic packaging market refers to the comprehensive ecosystem of manufacturers, suppliers, and distributors involved in producing flexible plastic-based packaging solutions within German borders and for export markets. Flexible plastic packaging encompasses pouches, bags, films, wraps, and other deformable containers made from various plastic polymers including polyethylene, polypropylene, polyester, and specialized barrier materials designed to protect, preserve, and present products across multiple industries.

This market segment distinguishes itself from rigid packaging through its adaptability, lightweight characteristics, and cost-effectiveness in manufacturing and transportation. German flexible packaging solutions incorporate advanced technologies such as multi-layer structures, metallized films, and innovative sealing mechanisms that provide superior product protection while maintaining material efficiency and reducing environmental impact through optimized resource utilization.

Germany’s flexible plastic packaging market demonstrates exceptional strength across multiple dimensions, establishing the country as a European leader in packaging innovation and manufacturing excellence. The market benefits from robust industrial infrastructure, advanced research and development capabilities, and strong consumer demand for high-quality packaging solutions. Key growth drivers include increasing demand for convenient food packaging, pharmaceutical sector expansion, and growing emphasis on sustainable packaging alternatives.

Market segmentation reveals diverse applications with food packaging representing the largest segment, followed by pharmaceutical and personal care applications. Technological advancement remains a critical differentiator, with German companies investing heavily in barrier technology improvements, smart packaging integration, and circular economy initiatives. The market’s resilience during economic uncertainties demonstrates its essential role in supporting various industries and consumer needs.

Competitive landscape features both established multinational corporations and innovative medium-sized enterprises, creating a dynamic environment that fosters continuous improvement and market expansion. Sustainability initiatives have gained significant momentum, with manufacturers increasingly adopting recyclable materials and developing biodegradable alternatives to meet evolving regulatory requirements and consumer expectations.

Strategic analysis reveals several critical insights that define the German flexible plastic packaging market’s current position and future trajectory:

Primary market drivers propelling the Germany flexible plastic packaging market include fundamental shifts in consumer behavior, technological advancement, and industrial requirements. Food industry transformation toward convenience foods, ready-to-eat meals, and extended shelf-life products has created substantial demand for advanced flexible packaging solutions that maintain product quality while providing consumer convenience.

E-commerce expansion has significantly influenced packaging requirements, with online retail growth driving demand for protective, lightweight, and cost-effective packaging solutions. The shift toward digital commerce has increased the need for packaging that withstands shipping stresses while maintaining product integrity and brand presentation. Pharmaceutical sector growth represents another crucial driver, with aging demographics and healthcare advancement requiring specialized packaging solutions with enhanced barrier properties and compliance features.

Sustainability mandates from both regulatory bodies and consumer preferences have accelerated innovation in eco-friendly packaging materials and circular economy solutions. German consumers demonstrate increasing environmental consciousness, with approximately 78% preferring products with sustainable packaging, driving manufacturers to develop recyclable and biodegradable alternatives. Technological advancement in material science and manufacturing processes continues to expand application possibilities and improve cost-effectiveness across various market segments.

Significant market restraints challenge the Germany flexible plastic packaging market’s growth potential, requiring strategic adaptation and innovative solutions. Environmental concerns regarding plastic waste and marine pollution have intensified regulatory scrutiny and consumer resistance to traditional plastic packaging solutions. Regulatory complexity surrounding packaging waste management, recycling requirements, and material restrictions creates compliance challenges for manufacturers and increases operational costs.

Raw material price volatility affects manufacturing costs and profit margins, particularly for petroleum-based polymers that form the foundation of flexible plastic packaging. Supply chain disruptions and geopolitical tensions can impact material availability and cost structures, creating operational uncertainties for manufacturers. Competition from alternative packaging materials including paper-based solutions, biodegradable polymers, and reusable containers presents ongoing market share challenges.

Consumer perception issues regarding plastic packaging sustainability continue to influence purchasing decisions, despite technological improvements in recyclability and environmental impact reduction. Investment requirements for advanced manufacturing equipment and sustainable material development strain financial resources, particularly for smaller manufacturers seeking to maintain competitive positions in evolving market conditions.

Emerging opportunities within the Germany flexible plastic packaging market present substantial potential for growth and market expansion across multiple dimensions. Circular economy initiatives create opportunities for innovative recycling technologies, closed-loop material systems, and partnerships with waste management organizations to develop comprehensive sustainability solutions. Smart packaging integration offers possibilities for incorporating sensors, RFID technology, and interactive features that enhance consumer engagement and supply chain visibility.

Pharmaceutical sector expansion presents significant opportunities for specialized packaging solutions, including child-resistant features, tamper-evident designs, and advanced barrier properties for sensitive medications. Export market development leverages Germany’s reputation for quality and innovation to expand into emerging markets seeking advanced packaging solutions. Customization capabilities enable manufacturers to develop tailored solutions for specific industry requirements and brand differentiation strategies.

Biodegradable material development represents a transformative opportunity to address environmental concerns while maintaining packaging functionality and cost-effectiveness. Partnership opportunities with food manufacturers, pharmaceutical companies, and retail chains create potential for long-term supply agreements and collaborative innovation projects. Digital printing advancement enables cost-effective short-run customization and enhanced brand presentation capabilities that appeal to diverse market segments.

Complex market dynamics shape the Germany flexible plastic packaging landscape through interconnected forces of supply, demand, innovation, and regulation. Supply-side dynamics involve raw material availability, manufacturing capacity, and technological capability development that influence market competitiveness and pricing structures. Demand-side factors include consumer preferences, industry requirements, and economic conditions that drive market growth and segment development.

Innovation dynamics create continuous market evolution through material science advancement, manufacturing process improvement, and sustainability solution development. MarkWide Research analysis indicates that companies investing in research and development achieve approximately 15% higher market share growth compared to those focusing solely on traditional manufacturing approaches. Competitive dynamics involve market positioning, pricing strategies, and differentiation approaches that determine individual company success and overall market structure.

Regulatory dynamics influence market direction through packaging waste legislation, recycling requirements, and safety standards that shape product development and manufacturing processes. Economic dynamics including currency fluctuations, energy costs, and labor market conditions affect operational efficiency and profitability across the market ecosystem. Environmental dynamics drive sustainability initiatives and influence consumer acceptance of packaging solutions, creating both challenges and opportunities for market participants.

Comprehensive research methodology employed for analyzing the Germany flexible plastic packaging market incorporates multiple data collection and analysis approaches to ensure accuracy and reliability. Primary research involves direct engagement with industry stakeholders including manufacturers, suppliers, distributors, and end-users through structured interviews, surveys, and focus group discussions. Secondary research encompasses analysis of industry reports, government publications, trade association data, and academic research to provide comprehensive market context.

Quantitative analysis utilizes statistical modeling, trend analysis, and forecasting techniques to project market growth, segment performance, and competitive positioning. Qualitative assessment examines market dynamics, consumer behavior patterns, and industry trends through expert interviews and observational research methods. Data validation processes ensure information accuracy through cross-referencing multiple sources and expert verification of findings and conclusions.

Market segmentation analysis employs detailed categorization approaches to understand specific segment characteristics, growth patterns, and competitive landscapes. Regional analysis examines geographic distribution patterns, local market conditions, and regional growth opportunities within the German market context. Competitive intelligence gathering provides insights into market positioning, strategic initiatives, and performance metrics of key industry participants.

Regional distribution within Germany’s flexible plastic packaging market reveals distinct patterns of concentration, specialization, and growth potential across different geographic areas. North Rhine-Westphalia represents the largest regional market, accounting for approximately 28% of national production, driven by its industrial concentration and proximity to major consumer markets. Bavaria demonstrates strong market presence with 22% market share, supported by advanced manufacturing capabilities and technology innovation centers.

Baden-Württemberg contributes significantly to market development through its focus on high-tech packaging solutions and automotive industry applications, representing 18% of market activity. Lower Saxony and Hesse combine to account for approximately 20% of market share, benefiting from strategic logistics locations and diverse industrial bases. Eastern German states show increasing market participation with 12% combined market share, driven by investment in modern manufacturing facilities and competitive labor costs.

Regional specialization patterns emerge with northern regions focusing on food packaging applications, southern areas emphasizing automotive and industrial packaging, and eastern regions developing export-oriented manufacturing capabilities. Infrastructure development and transportation networks support efficient distribution across regional markets and facilitate export activities to neighboring European countries.

Competitive landscape within the Germany flexible plastic packaging market features a diverse mix of multinational corporations, established domestic companies, and innovative medium-sized enterprises that create dynamic market conditions:

Market segmentation within the Germany flexible plastic packaging market reveals distinct categories based on material type, application, and end-user industries that demonstrate varying growth patterns and competitive dynamics.

By Material Type:

By Application:

Food packaging category dominates the German flexible plastic packaging market through diverse applications ranging from fresh produce protection to processed food preservation. Innovation focus within this category emphasizes extended shelf life, convenience features, and sustainable material alternatives that meet evolving consumer preferences. Barrier technology advancement enables superior product protection while maintaining material efficiency and cost-effectiveness.

Pharmaceutical packaging category demonstrates exceptional growth potential driven by aging demographics and healthcare sector expansion. Specialized requirements including child-resistant features, tamper-evident designs, and moisture barrier properties create opportunities for premium pricing and long-term customer relationships. Regulatory compliance necessitates continuous investment in quality systems and documentation processes that ensure market access and customer confidence.

Personal care category benefits from premiumization trends and increasing consumer focus on product presentation and functionality. Customization capabilities enable brand differentiation through unique packaging designs, special effects, and interactive features that enhance consumer engagement. Sustainability initiatives within this category drive development of refillable packaging systems and recyclable material alternatives that address environmental concerns while maintaining aesthetic appeal.

Industry participants in the Germany flexible plastic packaging market realize substantial benefits through strategic positioning and operational excellence. Manufacturers benefit from strong domestic demand, advanced infrastructure, and access to cutting-edge technology that supports competitive manufacturing operations and export opportunities. Cost optimization through efficient production processes and material utilization enables competitive pricing while maintaining quality standards.

Brand owners gain access to innovative packaging solutions that enhance product protection, extend shelf life, and improve consumer convenience while supporting sustainability objectives. Supply chain efficiency improvements through lightweight packaging reduce transportation costs and environmental impact while maintaining product integrity throughout distribution networks. Market differentiation opportunities through custom packaging designs and functional features support brand positioning and consumer loyalty development.

Consumers benefit from enhanced product quality, convenience features, and sustainable packaging options that align with environmental consciousness and lifestyle preferences. Stakeholder value creation occurs through job creation, tax revenue generation, and technology development that supports broader economic growth and innovation ecosystems. Environmental benefits emerge through material efficiency improvements, recycling initiatives, and development of biodegradable alternatives that reduce environmental impact.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend reshaping the Germany flexible plastic packaging market, with manufacturers increasingly adopting circular economy principles and developing recyclable material alternatives. Consumer demand for environmentally responsible packaging drives innovation in biodegradable polymers, compostable materials, and packaging design optimization that reduces material usage while maintaining functionality.

Smart packaging integration emerges as a transformative trend incorporating sensors, QR codes, and interactive features that enhance consumer engagement and supply chain visibility. Digital printing advancement enables cost-effective customization and shorter production runs that support brand differentiation and market responsiveness. Barrier technology improvement continues advancing through nanotechnology applications and multi-layer film development that extends product shelf life and reduces food waste.

E-commerce packaging adaptation influences design requirements with emphasis on shipping durability, unboxing experience, and return logistics optimization. MWR research indicates that approximately 42% of packaging innovations now incorporate e-commerce considerations in design and material selection. Automation integration within manufacturing processes improves efficiency and quality consistency while reducing labor dependency and operational costs.

Recent industry developments demonstrate the dynamic nature of the Germany flexible plastic packaging market and its continuous evolution toward sustainability and innovation. Major manufacturers have announced significant investments in recycling infrastructure and closed-loop material systems that support circular economy objectives while maintaining cost competitiveness.

Technology partnerships between packaging companies and material science organizations have accelerated development of biodegradable polymers and advanced barrier materials that address environmental concerns without compromising performance characteristics. Regulatory developments including extended producer responsibility legislation and packaging waste reduction targets have influenced strategic planning and investment priorities across the industry.

Merger and acquisition activity has increased consolidation within the market as companies seek to achieve scale advantages and technology integration capabilities. Digital transformation initiatives encompass manufacturing automation, supply chain optimization, and customer engagement platforms that enhance operational efficiency and market responsiveness. Sustainability certifications and eco-labeling programs have gained prominence as differentiation tools and consumer communication mechanisms.

Strategic recommendations for Germany flexible plastic packaging market participants emphasize sustainability leadership, technology innovation, and market diversification as key success factors. Investment priorities should focus on developing recyclable and biodegradable material alternatives that address environmental concerns while maintaining cost competitiveness and performance characteristics.

Market expansion strategies should leverage Germany’s reputation for quality and innovation to develop export opportunities in emerging markets seeking advanced packaging solutions. Partnership development with research institutions, technology providers, and end-user industries can accelerate innovation and create competitive advantages through collaborative product development initiatives.

Operational excellence through manufacturing automation, supply chain optimization, and quality system enhancement supports cost competitiveness and customer satisfaction in increasingly demanding market conditions. Digital transformation investments in smart manufacturing, customer relationship management, and data analytics capabilities enable responsive market adaptation and operational efficiency improvements. Sustainability communication strategies should effectively convey environmental benefits and circular economy contributions to support brand positioning and consumer acceptance.

Future market trajectory for the Germany flexible plastic packaging market indicates continued growth driven by innovation, sustainability advancement, and market diversification across multiple application segments. Technological evolution will focus on biodegradable material development, smart packaging integration, and manufacturing process optimization that enhances efficiency while reducing environmental impact.

Market growth projections suggest sustained expansion at approximately 4.5% CAGR over the next five years, supported by pharmaceutical sector growth, e-commerce packaging demand, and export market development. Sustainability initiatives will become increasingly critical for market success as regulatory requirements intensify and consumer preferences shift toward environmentally responsible packaging solutions.

Innovation focus areas will encompass circular economy solutions, digital packaging technologies, and specialized applications that address emerging market needs and regulatory requirements. MarkWide Research analysis indicates that companies investing in sustainability and innovation capabilities will achieve superior market positioning and growth performance compared to traditional manufacturers. Competitive landscape evolution will favor companies that successfully balance sustainability objectives with cost competitiveness and performance requirements across diverse market segments.

Germany’s flexible plastic packaging market demonstrates exceptional resilience and innovation capacity that positions it as a European leader in packaging technology and sustainability advancement. Market fundamentals remain strong with diverse application segments, advanced manufacturing capabilities, and continuous technology development supporting sustained growth and competitive positioning.

Sustainability transformation represents both the greatest challenge and opportunity for market participants, requiring strategic investment in circular economy solutions while maintaining cost competitiveness and performance standards. Innovation leadership through material science advancement, smart packaging integration, and manufacturing excellence will determine long-term success in evolving market conditions.

Future success will depend on companies’ ability to balance environmental responsibility with commercial viability while leveraging Germany’s technological strengths and market reputation to capture growth opportunities in domestic and international markets. The Germany flexible plastic packaging market is well-positioned to continue its leadership role in European packaging innovation while addressing global sustainability challenges through technological advancement and strategic market development.

What is Flexible Plastic Packaging?

Flexible plastic packaging refers to packaging made from flexible materials that can be easily shaped and molded. This type of packaging is commonly used for food, beverages, and consumer goods due to its lightweight and versatile nature.

What are the key players in the Germany Flexible Plastic Packaging Market?

Key players in the Germany Flexible Plastic Packaging Market include companies like Amcor, Berry Global, and Mondi Group, which are known for their innovative packaging solutions and extensive product ranges, among others.

What are the growth factors driving the Germany Flexible Plastic Packaging Market?

The growth of the Germany Flexible Plastic Packaging Market is driven by increasing consumer demand for convenient packaging, the rise of e-commerce, and a focus on sustainability in packaging materials.

What challenges does the Germany Flexible Plastic Packaging Market face?

Challenges in the Germany Flexible Plastic Packaging Market include regulatory pressures regarding plastic waste, competition from alternative packaging materials, and the need for continuous innovation to meet changing consumer preferences.

What opportunities exist in the Germany Flexible Plastic Packaging Market?

Opportunities in the Germany Flexible Plastic Packaging Market include the development of biodegradable packaging solutions, advancements in recycling technologies, and the growing trend of personalized packaging for brands.

What trends are shaping the Germany Flexible Plastic Packaging Market?

Trends in the Germany Flexible Plastic Packaging Market include the increasing use of smart packaging technologies, a shift towards minimalistic designs, and a heightened focus on reducing carbon footprints through sustainable practices.

Germany Flexible Plastic Packaging Market

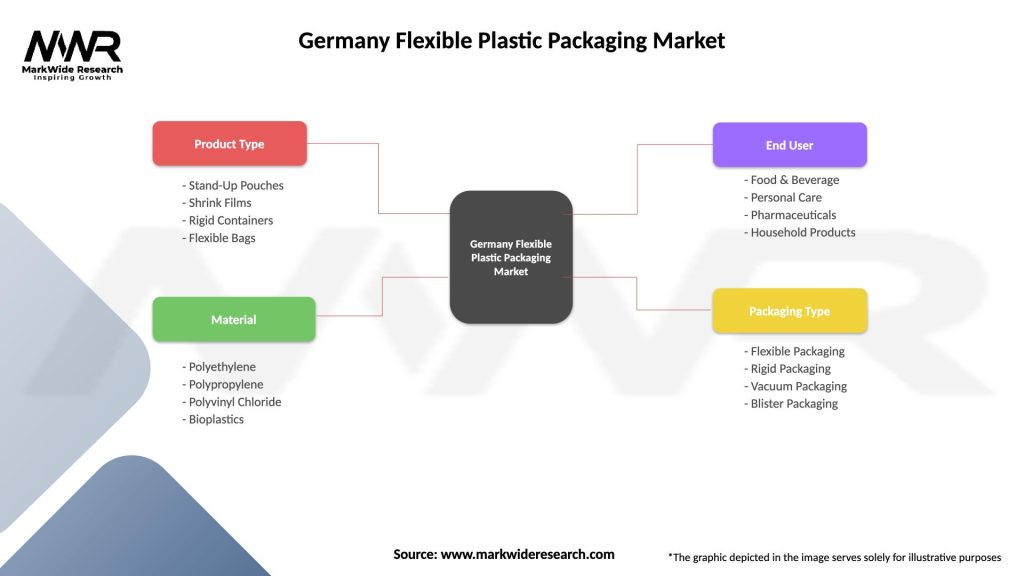

| Segmentation Details | Description |

|---|---|

| Product Type | Stand-Up Pouches, Shrink Films, Rigid Containers, Flexible Bags |

| Material | Polyethylene, Polypropylene, Polyvinyl Chloride, Bioplastics |

| End User | Food & Beverage, Personal Care, Pharmaceuticals, Household Products |

| Packaging Type | Flexible Packaging, Rigid Packaging, Vacuum Packaging, Blister Packaging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Flexible Plastic Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at