444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany fiberglass flooring market represents a dynamic and rapidly evolving segment within the European construction and industrial flooring industry. This specialized market encompasses various fiberglass-based flooring solutions designed for demanding environments where traditional flooring materials may fail to deliver adequate performance. Germany’s position as Europe’s largest economy and manufacturing hub has created substantial demand for high-performance flooring solutions across multiple industrial sectors.

Market dynamics in Germany are driven by the country’s robust industrial infrastructure, stringent safety regulations, and growing emphasis on sustainable construction practices. The fiberglass flooring sector has experienced consistent growth of approximately 6.2% annually, reflecting increasing adoption across chemical processing facilities, marine applications, food processing plants, and pharmaceutical manufacturing environments. This growth trajectory positions Germany as a leading market for advanced flooring technologies in Europe.

Industrial applications dominate the German market, with chemical and petrochemical facilities accounting for approximately 35% of total demand. The country’s extensive manufacturing base, particularly in automotive, machinery, and chemical industries, creates continuous demand for corrosion-resistant, durable flooring solutions that can withstand harsh operating conditions while maintaining safety standards.

The Germany fiberglass flooring market refers to the comprehensive ecosystem of fiberglass-reinforced plastic (FRP) flooring systems, grating solutions, and related infrastructure products specifically designed for industrial, commercial, and specialized applications within the German territory. These advanced flooring systems combine glass fiber reinforcement with polymer resins to create lightweight, corrosion-resistant, and highly durable surface solutions.

Fiberglass flooring systems encompass various product categories including molded grating, pultruded grating, structural shapes, handrails, and custom fabricated platforms. These solutions are engineered to provide superior performance characteristics compared to traditional materials like steel, aluminum, or concrete, particularly in environments exposed to chemicals, moisture, extreme temperatures, or heavy mechanical loads.

Market scope includes manufacturing, distribution, installation, and maintenance services for fiberglass flooring products across diverse end-user industries. The German market specifically emphasizes compliance with European safety standards, environmental regulations, and quality certifications that ensure optimal performance in demanding industrial applications.

Germany’s fiberglass flooring market demonstrates remarkable resilience and growth potential, driven by increasing industrialization, infrastructure modernization, and stringent safety requirements across multiple sectors. The market benefits from Germany’s position as Europe’s manufacturing powerhouse, creating sustained demand for high-performance flooring solutions that can withstand challenging operational environments.

Key market drivers include the country’s extensive chemical processing industry, growing emphasis on workplace safety, and increasing adoption of lightweight construction materials. The market has shown steady expansion with growth rates consistently exceeding 5.8% annually, reflecting strong underlying demand fundamentals and successful market penetration across traditional and emerging applications.

Competitive landscape features both international manufacturers and specialized German companies offering comprehensive product portfolios ranging from standard grating solutions to custom-engineered flooring systems. Market participants focus on innovation, quality certification, and local service capabilities to maintain competitive advantages in this specialized sector.

Future prospects remain highly favorable, with anticipated growth driven by infrastructure renewal projects, expansion of renewable energy facilities, and increasing adoption of advanced materials in construction and industrial applications. The market is expected to benefit from Germany’s commitment to sustainable development and technological innovation across industrial sectors.

Strategic insights reveal several critical factors shaping the German fiberglass flooring market landscape. Understanding these key dynamics provides essential context for market participants and stakeholders evaluating opportunities within this specialized sector.

Primary market drivers propelling growth in Germany’s fiberglass flooring sector reflect both macroeconomic trends and industry-specific factors that create sustained demand for advanced flooring solutions. These drivers establish the foundation for continued market expansion and technological advancement.

Industrial infrastructure modernization serves as a fundamental growth driver, with German manufacturing facilities increasingly upgrading aging infrastructure to meet contemporary safety, efficiency, and environmental standards. This modernization trend creates substantial replacement demand for traditional flooring materials, with fiberglass solutions offering superior performance characteristics and longer service life.

Regulatory compliance requirements significantly influence market demand, as German industrial facilities must adhere to stringent workplace safety, environmental protection, and operational efficiency standards. Fiberglass flooring systems provide inherent advantages in meeting these requirements through corrosion resistance, slip resistance, and reduced maintenance needs compared to conventional materials.

Chemical industry expansion continues driving market growth, with Germany maintaining its position as Europe’s largest chemical producer. The sector’s ongoing investment in new facilities and capacity expansions creates consistent demand for specialized flooring solutions capable of withstanding aggressive chemical environments while ensuring worker safety.

Sustainability initiatives increasingly favor fiberglass flooring solutions due to their durability, recyclability, and reduced environmental impact compared to traditional materials. German companies’ commitment to sustainable practices and circular economy principles supports adoption of long-lasting, environmentally responsible flooring alternatives.

Market restraints present challenges that may limit growth potential or create barriers to market expansion within Germany’s fiberglass flooring sector. Understanding these constraints enables stakeholders to develop appropriate strategies for market navigation and risk mitigation.

High initial investment costs represent a significant barrier for some potential users, particularly smaller industrial facilities or companies with limited capital budgets. While fiberglass flooring systems offer superior long-term value through reduced maintenance and extended service life, the upfront investment requirements can deter adoption among cost-sensitive market segments.

Technical complexity in installation and customization may limit market accessibility for certain applications or user groups. Fiberglass flooring systems often require specialized installation expertise, precise engineering calculations, and custom fabrication capabilities that may not be readily available in all market segments or geographic regions.

Competition from alternative materials continues challenging market growth, as traditional materials like steel grating, concrete, and specialized coatings offer established solutions with proven track records. Some end users may resist transitioning to fiberglass solutions due to familiarity with existing materials or concerns about performance in specific applications.

Economic sensitivity affects market demand during periods of reduced industrial investment or economic uncertainty. As fiberglass flooring systems are often considered capital expenditures rather than essential operational requirements, demand may fluctuate with broader economic conditions and industrial investment cycles.

Emerging opportunities within Germany’s fiberglass flooring market present significant potential for growth and market expansion across both traditional and innovative applications. These opportunities reflect evolving industry needs, technological advancement, and changing market dynamics.

Renewable energy infrastructure development creates substantial new market opportunities, particularly in offshore wind energy projects where fiberglass flooring systems offer ideal solutions for marine environments. Germany’s commitment to renewable energy expansion and offshore wind development provides a growing market for specialized flooring applications requiring corrosion resistance and lightweight properties.

Food and pharmaceutical industries present expanding opportunities due to increasing emphasis on hygiene, safety, and regulatory compliance. Fiberglass flooring systems offer advantages in these sectors through easy cleaning, chemical resistance, and compliance with strict sanitary standards required in food processing and pharmaceutical manufacturing facilities.

Infrastructure renewal projects across Germany’s aging industrial base create opportunities for fiberglass flooring adoption as facilities upgrade to meet contemporary standards. These projects often involve replacing traditional materials with advanced solutions that offer improved performance, reduced maintenance, and enhanced safety characteristics.

Export market expansion provides opportunities for German manufacturers to leverage their technological expertise and quality reputation in international markets. Growing demand for high-performance flooring solutions in developing economies and emerging industrial sectors creates potential for German companies to expand their market reach beyond domestic boundaries.

Market dynamics within Germany’s fiberglass flooring sector reflect complex interactions between supply-side factors, demand drivers, competitive forces, and regulatory influences that shape market behavior and evolution. MarkWide Research analysis indicates these dynamics create both challenges and opportunities for market participants.

Supply chain optimization has become increasingly important as manufacturers focus on reducing lead times, improving quality consistency, and enhancing customer service capabilities. German companies leverage advanced manufacturing technologies, strategic supplier relationships, and efficient distribution networks to maintain competitive advantages in this specialized market.

Technology innovation drives market evolution through development of enhanced resin systems, improved manufacturing processes, and advanced surface treatments that expand application possibilities. These innovations enable fiberglass flooring systems to penetrate new market segments while improving performance in existing applications.

Customer relationship management plays a crucial role in market dynamics, as fiberglass flooring solutions often require extensive technical consultation, custom design, and ongoing support services. Successful market participants invest in technical expertise, customer education, and comprehensive service capabilities to differentiate their offerings.

Price competition influences market dynamics, particularly in standard product categories where multiple suppliers offer similar solutions. However, the market increasingly values total cost of ownership, performance characteristics, and service quality over initial price considerations, creating opportunities for premium positioning strategies.

Research methodology employed in analyzing Germany’s fiberglass flooring market incorporates comprehensive primary and secondary research approaches designed to provide accurate, reliable, and actionable market intelligence. The methodology ensures thorough coverage of market segments, competitive landscape, and growth dynamics.

Primary research activities include extensive interviews with industry executives, technical specialists, end-user representatives, and distribution channel partners throughout Germany. These interviews provide insights into market trends, customer requirements, competitive dynamics, and future growth prospects from multiple stakeholder perspectives.

Secondary research encompasses analysis of industry publications, government statistics, trade association reports, company financial statements, and technical literature related to fiberglass flooring applications. This research provides quantitative data, historical trends, and contextual information supporting primary research findings.

Market sizing methodology utilizes bottom-up and top-down approaches to validate market estimates and growth projections. The analysis considers production capacity, consumption patterns, import/export data, and end-user demand across various application segments to ensure comprehensive market coverage.

Quality assurance processes include data triangulation, expert validation, and cross-verification of findings to ensure accuracy and reliability of market intelligence. The methodology incorporates multiple data sources and analytical approaches to minimize bias and enhance confidence in research conclusions.

Regional analysis of Germany’s fiberglass flooring market reveals significant variations in demand patterns, application preferences, and growth dynamics across different geographic areas. These regional differences reflect industrial concentration, economic activity levels, and local market characteristics.

North Rhine-Westphalia dominates the German market, accounting for approximately 28% of total demand, driven by the region’s extensive chemical, steel, and manufacturing industries. The area’s industrial concentration creates substantial demand for specialized flooring solutions in challenging operational environments, supporting both domestic consumption and export activities.

Bavaria represents the second-largest regional market with 18% market share, reflecting the state’s diverse industrial base including automotive, aerospace, and high-technology manufacturing sectors. The region’s emphasis on innovation and quality manufacturing aligns well with advanced fiberglass flooring applications requiring precision engineering and superior performance.

Baden-Württemberg contributes 16% of market demand, supported by the region’s strong automotive and mechanical engineering industries. The area’s focus on advanced manufacturing technologies and export-oriented production creates opportunities for high-performance flooring solutions in sophisticated industrial applications.

Lower Saxony and Schleswig-Holstein show growing market importance, particularly in offshore wind energy applications where fiberglass flooring systems provide ideal solutions for marine environments. These northern regions benefit from Germany’s renewable energy initiatives and coastal industrial development projects.

Competitive landscape in Germany’s fiberglass flooring market features a diverse mix of international manufacturers, specialized German companies, and regional suppliers offering comprehensive product portfolios and service capabilities. Market competition focuses on technical innovation, quality certification, and customer service excellence.

Market positioning strategies vary among competitors, with some focusing on broad product portfolios while others specialize in specific application segments or technical capabilities. Successful companies emphasize quality certification, technical expertise, and comprehensive customer support to differentiate their market offerings.

Market segmentation analysis reveals distinct categories within Germany’s fiberglass flooring market, each characterized by specific performance requirements, application needs, and growth dynamics. Understanding these segments enables targeted marketing strategies and product development initiatives.

By Product Type:

By Application:

By End-User Industry:

Category-wise analysis provides detailed insights into specific market segments, revealing unique characteristics, growth patterns, and competitive dynamics within Germany’s fiberglass flooring market. These insights enable targeted strategies for different product categories and applications.

Molded Grating Category represents the traditional foundation of the market, offering proven performance and cost-effectiveness for standard applications. This category maintains steady demand across established industrial sectors, with growth driven by replacement needs and infrastructure modernization projects. Market share for molded grating remains stable at approximately 42% of total volume.

Pultruded Grating Category demonstrates the strongest growth dynamics, reflecting increasing demand for high-performance solutions in demanding applications. This category benefits from technological advancement, superior strength characteristics, and expanding application possibilities. Growth rates in pultruded products consistently exceed 7.5% annually, indicating strong market acceptance.

Custom Fabrication Category shows significant potential as industrial facilities increasingly require application-specific solutions tailored to unique operational requirements. This category commands premium pricing and offers opportunities for value-added services including design consultation, installation support, and ongoing maintenance programs.

Structural Components Category supports overall market growth by providing comprehensive system solutions that integrate with fiberglass grating products. This category enables complete flooring system installations and creates opportunities for expanded customer relationships and higher project values.

Industry participants and stakeholders in Germany’s fiberglass flooring market realize substantial benefits through participation in this specialized sector. These benefits extend beyond immediate commercial returns to include strategic advantages and long-term value creation opportunities.

Manufacturers benefit from stable demand patterns, premium pricing opportunities, and strong customer relationships that characterize the fiberglass flooring market. The sector’s technical complexity creates barriers to entry that protect established players while rewarding innovation and quality excellence. Additionally, the market’s growth trajectory provides opportunities for capacity expansion and geographic market development.

Distributors and channel partners realize advantages through specialized product knowledge, technical service capabilities, and strong customer relationships that generate recurring business opportunities. The market’s emphasis on technical consultation and customer support creates value-added service opportunities that enhance profitability and competitive positioning.

End-user customers benefit from improved operational efficiency, reduced maintenance costs, and enhanced workplace safety through adoption of advanced fiberglass flooring solutions. These benefits translate into lower total cost of ownership, improved regulatory compliance, and enhanced operational reliability that supports business objectives.

Service providers including installation contractors, maintenance specialists, and engineering consultants benefit from growing demand for specialized services supporting fiberglass flooring applications. The market’s technical requirements create opportunities for specialized expertise and value-added services that command premium pricing.

SWOT analysis provides comprehensive evaluation of Germany’s fiberglass flooring market, examining internal strengths and weaknesses alongside external opportunities and threats that influence market development and competitive dynamics.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping Germany’s fiberglass flooring sector reflect broader industrial, technological, and social developments that influence demand patterns, product evolution, and competitive dynamics. MarkWide Research identifies several critical trends driving market transformation.

Sustainability Integration emerges as a dominant trend, with increasing emphasis on environmentally responsible materials, manufacturing processes, and end-of-life recyclability. German companies increasingly prioritize sustainable solutions that support circular economy principles while maintaining superior performance characteristics. This trend drives innovation in bio-based resins, recycling technologies, and sustainable manufacturing practices.

Digital Integration transforms market dynamics through adoption of digital design tools, predictive maintenance technologies, and smart monitoring systems that enhance fiberglass flooring performance and value proposition. These technologies enable optimized system design, proactive maintenance scheduling, and improved operational efficiency that appeals to technology-forward German industrial customers.

Customization Demand continues growing as industrial facilities seek application-specific solutions tailored to unique operational requirements, safety standards, and performance objectives. This trend favors manufacturers with strong engineering capabilities, flexible production systems, and comprehensive customer consultation services.

Safety Enhancement drives continuous improvement in slip resistance, fire performance, and structural integrity as German workplace safety standards become increasingly stringent. Market participants invest in advanced surface treatments, improved resin systems, and enhanced structural designs that exceed regulatory requirements while providing superior safety performance.

Industry developments within Germany’s fiberglass flooring market reflect ongoing innovation, strategic initiatives, and market evolution that shape competitive dynamics and growth prospects. These developments demonstrate the sector’s vitality and adaptation to changing market requirements.

Technology Advancement continues driving industry development through introduction of enhanced resin systems, improved manufacturing processes, and innovative surface treatments that expand application possibilities. Recent developments include fire-retardant formulations, enhanced UV resistance, and improved chemical compatibility that enable fiberglass flooring adoption in previously challenging applications.

Manufacturing Expansion reflects growing market confidence and demand expectations, with several manufacturers investing in additional production capacity, advanced equipment, and expanded product lines. These investments support market growth while improving supply chain reliability and customer service capabilities.

Strategic Partnerships between manufacturers, distributors, and end-users create collaborative relationships that enhance market development and customer satisfaction. These partnerships often involve technical collaboration, joint product development, and comprehensive service agreements that strengthen market positions and customer loyalty.

Certification Achievements demonstrate industry commitment to quality, safety, and environmental responsibility through attainment of relevant standards and certifications. Recent achievements include enhanced fire safety certifications, environmental compliance certifications, and quality management system improvements that support market credibility and customer confidence.

Analyst recommendations for stakeholders in Germany’s fiberglass flooring market emphasize strategic approaches that capitalize on market opportunities while addressing potential challenges and competitive pressures. These suggestions reflect comprehensive market analysis and industry expertise.

Market participants should prioritize investment in technical capabilities, customer service excellence, and product innovation to maintain competitive advantages in this specialized market. Focus on developing comprehensive solutions that address complete customer needs rather than individual product sales creates opportunities for enhanced customer relationships and improved profitability.

Manufacturers should consider expanding customization capabilities, enhancing sustainability credentials, and developing strategic partnerships that strengthen market positions. Investment in advanced manufacturing technologies, quality certifications, and technical expertise supports premium positioning and customer loyalty in demanding applications.

Distributors and channel partners should focus on technical education, customer consultation capabilities, and value-added services that differentiate their market offerings. Building specialized expertise in fiberglass flooring applications creates competitive advantages and supports premium pricing strategies.

End-user organizations should evaluate total cost of ownership, performance benefits, and strategic advantages when considering fiberglass flooring solutions. Comprehensive evaluation of long-term value proposition often reveals significant advantages over traditional materials despite higher initial investment requirements.

Future outlook for Germany’s fiberglass flooring market remains highly positive, supported by favorable industry trends, technological advancement, and growing recognition of fiberglass solutions’ superior performance characteristics. MWR projections indicate continued growth across multiple market segments and applications.

Growth projections suggest the market will maintain expansion rates of 6.5% to 7.2% annually over the next five years, driven by industrial infrastructure modernization, renewable energy development, and increasing adoption of advanced materials. This growth trajectory reflects both replacement demand from aging infrastructure and new applications in emerging sectors.

Technology evolution will continue driving market development through enhanced materials, improved manufacturing processes, and innovative applications that expand market opportunities. Expected developments include smart flooring systems with integrated monitoring capabilities, enhanced sustainability features, and improved performance characteristics for demanding applications.

Market expansion opportunities include growing penetration in food processing, pharmaceutical manufacturing, and renewable energy sectors where fiberglass flooring solutions offer unique advantages. Additionally, export opportunities in developing markets provide potential for German manufacturers to leverage their quality reputation and technical expertise.

Industry consolidation may occur as market maturity increases, creating opportunities for strategic acquisitions, partnerships, and market share expansion. Successful companies will likely be those that combine technical excellence, customer service capabilities, and strategic market positioning to capture emerging opportunities while maintaining competitive advantages.

Germany’s fiberglass flooring market represents a dynamic and growing sector within the European industrial materials landscape, characterized by strong fundamentals, technological innovation, and expanding application opportunities. The market benefits from Germany’s position as Europe’s manufacturing leader, creating sustained demand for high-performance flooring solutions across diverse industrial sectors.

Market analysis reveals favorable growth dynamics driven by industrial infrastructure modernization, stringent safety requirements, and increasing recognition of fiberglass solutions’ superior performance characteristics. The sector’s emphasis on technical excellence, quality certification, and customer service creates competitive advantages for established participants while presenting opportunities for innovative new entrants.

Future prospects remain highly encouraging, with anticipated growth supported by renewable energy development, sustainability initiatives, and ongoing industrial investment. The market’s evolution toward customized solutions, digital integration, and enhanced performance capabilities positions it well for continued expansion and value creation. Success in this specialized market requires commitment to technical excellence, customer service, and continuous innovation that addresses evolving industry needs and regulatory requirements.

What is Fiberglass Flooring?

Fiberglass flooring is a type of flooring material made from fiberglass-reinforced plastic, known for its durability, resistance to moisture, and ease of maintenance. It is commonly used in residential, commercial, and industrial applications due to its versatility and aesthetic appeal.

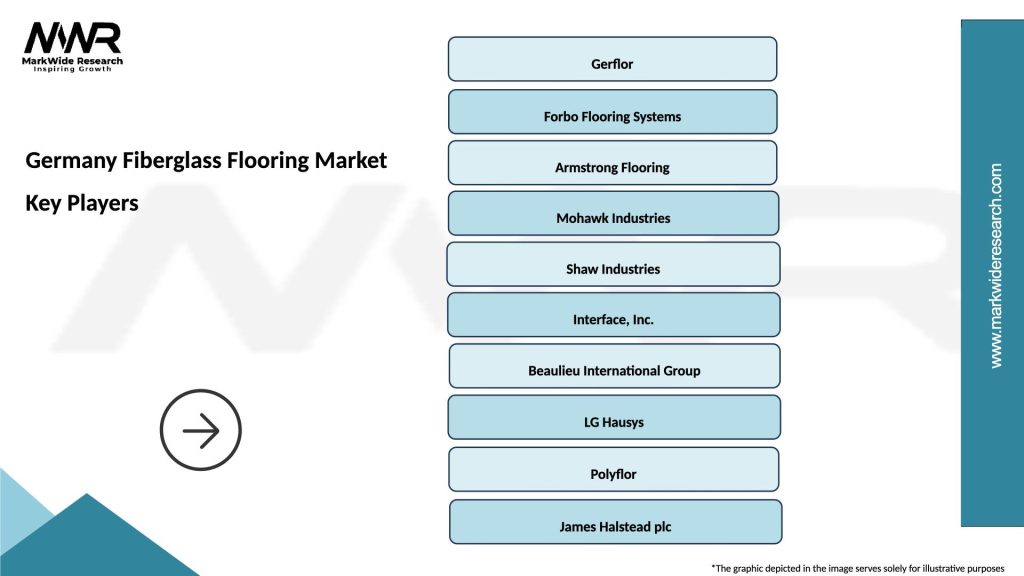

What are the key companies in the Germany Fiberglass Flooring Market?

Key companies in the Germany Fiberglass Flooring Market include Tarkett, Mohawk Industries, and Forbo Flooring Systems, among others. These companies are known for their innovative flooring solutions and extensive product ranges.

What are the growth factors driving the Germany Fiberglass Flooring Market?

The growth of the Germany Fiberglass Flooring Market is driven by increasing demand for durable and low-maintenance flooring solutions in both residential and commercial sectors. Additionally, the rise in construction activities and renovation projects contributes to market expansion.

What challenges does the Germany Fiberglass Flooring Market face?

The Germany Fiberglass Flooring Market faces challenges such as competition from alternative flooring materials and fluctuating raw material prices. Additionally, environmental concerns regarding the production and disposal of fiberglass products can impact market growth.

What opportunities exist in the Germany Fiberglass Flooring Market?

Opportunities in the Germany Fiberglass Flooring Market include the growing trend towards sustainable building practices and the increasing popularity of eco-friendly flooring options. Innovations in design and technology also present avenues for market growth.

What trends are shaping the Germany Fiberglass Flooring Market?

Trends shaping the Germany Fiberglass Flooring Market include the rising demand for customizable flooring solutions and the integration of smart technology in flooring products. Additionally, there is a growing focus on aesthetic appeal and sustainability in flooring choices.

Germany Fiberglass Flooring Market

| Segmentation Details | Description |

|---|---|

| Product Type | Sheet, Tile, Plank, Roll |

| End User | Residential, Commercial, Industrial, Institutional |

| Installation Method | Glue Down, Floating, Nail Down, Click Lock |

| Thickness | 2mm, 4mm, 6mm, 8mm |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Fiberglass Flooring Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at