444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany FA and ICS market represents a critical component of the nation’s industrial automation landscape, encompassing factory automation (FA) and industrial control systems (ICS) technologies. Germany’s position as Europe’s manufacturing powerhouse drives substantial demand for advanced automation solutions across diverse industrial sectors. The market demonstrates robust growth momentum with increasing adoption of Industry 4.0 principles and smart manufacturing technologies.

Manufacturing excellence remains at the core of Germany’s economic strength, with the FA and ICS market experiencing significant expansion driven by digital transformation initiatives. The integration of artificial intelligence, machine learning, and IoT technologies into traditional manufacturing processes has created unprecedented opportunities for automation providers. Market dynamics indicate sustained growth at approximately 6.2% CAGR through the forecast period, reflecting strong industrial investment in modernization.

Key market segments include automotive manufacturing, chemical processing, pharmaceutical production, and food and beverage industries, each driving unique automation requirements. The automotive sector particularly influences market trends, given Germany’s position as home to major global automotive manufacturers requiring sophisticated automation solutions.

The Germany FA and ICS market refers to the comprehensive ecosystem of factory automation and industrial control systems technologies deployed across German manufacturing and industrial facilities. Factory automation encompasses programmable logic controllers, human-machine interfaces, supervisory control systems, and robotic automation solutions that enhance production efficiency and quality control.

Industrial control systems represent the technological backbone enabling real-time monitoring, control, and optimization of industrial processes. These systems integrate SCADA systems, distributed control systems (DCS), and programmable automation controllers (PAC) to ensure seamless industrial operations. The market includes both hardware components and software solutions that facilitate intelligent manufacturing processes.

Digital transformation has expanded the traditional definition to include cloud-based automation platforms, edge computing solutions, and cybersecurity technologies specifically designed for industrial environments. Modern FA and ICS solutions emphasize connectivity, data analytics, and predictive maintenance capabilities that align with Industry 4.0 objectives.

Germany’s FA and ICS market demonstrates exceptional resilience and growth potential, driven by the nation’s commitment to maintaining global manufacturing leadership through technological innovation. Industrial digitalization initiatives have accelerated adoption of advanced automation technologies, with approximately 78% of German manufacturers implementing some form of smart manufacturing solutions.

Market expansion is particularly pronounced in automotive, chemical, and pharmaceutical sectors, where precision, efficiency, and regulatory compliance drive automation investments. The integration of artificial intelligence and machine learning capabilities into traditional control systems has created new value propositions for industrial operators seeking competitive advantages.

Investment patterns reveal strong preference for modular, scalable automation solutions that can adapt to evolving production requirements. Cybersecurity considerations have become increasingly important, with industrial operators prioritizing secure automation platforms that protect against evolving cyber threats while maintaining operational efficiency.

Regional distribution shows concentration in traditional manufacturing hubs including Baden-Württemberg, Bavaria, and North Rhine-Westphalia, where established industrial clusters drive sustained demand for advanced automation technologies.

Strategic market insights reveal several critical trends shaping the Germany FA and ICS landscape:

Primary market drivers propelling Germany’s FA and ICS market expansion include the nation’s strategic commitment to maintaining global manufacturing competitiveness through technological advancement. Industry 4.0 initiatives have created substantial momentum for automation adoption, with government support programs encouraging digital transformation across industrial sectors.

Labor market dynamics significantly influence automation investments, as skilled worker shortages drive manufacturers toward automated solutions that maintain production capacity while reducing dependency on manual labor. Demographic trends indicate continued workforce challenges, making automation essential for sustaining manufacturing output levels.

Regulatory compliance requirements across pharmaceutical, food processing, and chemical industries necessitate sophisticated control systems capable of ensuring product quality and safety standards. Environmental regulations additionally drive adoption of energy-efficient automation technologies that reduce industrial carbon footprints while maintaining operational performance.

Global competition pressures German manufacturers to optimize production efficiency and product quality through advanced automation technologies. Customer expectations for customized products and shorter delivery times require flexible manufacturing systems capable of rapid reconfiguration and adaptation.

Significant market restraints include substantial capital investment requirements for comprehensive automation system implementations, particularly challenging for small and medium-sized enterprises with limited financial resources. Implementation complexity associated with integrating advanced automation technologies into existing manufacturing infrastructure creates barriers for some industrial operators.

Cybersecurity concerns represent growing restraints as industrial operators balance connectivity benefits against potential security vulnerabilities. Legacy system integration challenges complicate automation upgrades, requiring extensive planning and potential production disruptions during implementation phases.

Skills gaps in industrial automation technologies limit adoption rates, as organizations struggle to find qualified personnel capable of implementing and maintaining sophisticated control systems. Training requirements for existing workforce add complexity and costs to automation projects.

Standardization challenges across different automation platforms and protocols create integration difficulties, particularly in multi-vendor environments requiring seamless interoperability between diverse system components.

Substantial market opportunities emerge from Germany’s position as a global leader in industrial automation technology development and export. Emerging technologies including artificial intelligence, machine learning, and advanced analytics create new value propositions for automation providers targeting sophisticated industrial applications.

Sustainability initiatives present significant opportunities for energy-efficient automation solutions that help industrial operators achieve environmental compliance while reducing operational costs. Circular economy principles drive demand for automation technologies supporting waste reduction and resource optimization.

Digital twin technologies offer substantial growth potential, enabling virtual simulation and optimization of industrial processes before physical implementation. Predictive maintenance solutions represent expanding opportunities as manufacturers seek to minimize unplanned downtime and extend equipment lifecycles.

Export opportunities leverage Germany’s reputation for high-quality automation technologies, with growing demand from emerging markets seeking to modernize industrial infrastructure. Service-based business models including automation-as-a-service create recurring revenue opportunities for technology providers.

Market dynamics reflect the complex interplay between technological advancement, industrial requirements, and economic factors shaping Germany’s FA and ICS landscape. Technology convergence between operational technology (OT) and information technology (IT) creates new possibilities for integrated automation solutions while introducing cybersecurity considerations.

Competitive dynamics intensify as traditional automation providers compete with technology companies entering industrial markets through cloud-based platforms and software solutions. Partnership strategies become increasingly important as companies collaborate to deliver comprehensive automation ecosystems addressing diverse customer requirements.

Customer behavior evolution shows increasing preference for outcome-based automation solutions that deliver measurable business results rather than simply providing technology components. Service integration becomes critical as customers seek comprehensive support throughout automation system lifecycles.

Innovation cycles accelerate as rapid technological advancement requires continuous product development and market adaptation. Investment patterns show growing emphasis on software and analytics capabilities complementing traditional hardware-focused automation solutions.

Comprehensive research methodology employed for analyzing Germany’s FA and ICS market incorporates multiple data collection and analysis approaches ensuring accurate market assessment. Primary research includes extensive interviews with industry executives, technology providers, and end-user organizations across key industrial sectors.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and company financial statements providing quantitative market insights. Market modeling techniques utilize statistical analysis and forecasting methodologies to project market trends and growth patterns.

Data validation processes ensure accuracy through cross-referencing multiple sources and expert review panels comprising industry specialists with extensive automation market experience. Qualitative analysis incorporates expert opinions and industry insights providing context for quantitative findings.

Regional analysis methodology examines state-level market dynamics, industrial concentration patterns, and local regulatory factors influencing automation adoption. Competitive analysis evaluates market positioning, technology capabilities, and strategic initiatives of key market participants.

Regional market distribution across Germany reveals significant concentration in traditional manufacturing centers, with Baden-Württemberg commanding approximately 28% market share due to its automotive and mechanical engineering industries. The region’s emphasis on precision manufacturing and innovation drives substantial automation investments.

Bavaria represents another critical market region, accounting for roughly 22% of national demand, with strong presence in automotive, aerospace, and technology sectors requiring sophisticated automation solutions. Munich and surrounding areas demonstrate particular strength in high-tech manufacturing applications.

North Rhine-Westphalia contributes approximately 18% of market activity, driven by chemical processing, steel production, and energy industries requiring robust industrial control systems. The region’s industrial heritage creates substantial opportunities for automation modernization projects.

Lower Saxony and Hesse collectively represent about 15% market share, with diverse industrial bases including automotive, pharmaceutical, and food processing sectors. Eastern German states show growing automation adoption as industrial development continues, representing emerging market opportunities with significant growth potential.

Competitive landscape in Germany’s FA and ICS market features both established industrial automation leaders and emerging technology providers offering innovative solutions. Market leadership remains concentrated among several key players with comprehensive automation portfolios.

Competitive strategies increasingly emphasize software capabilities, cloud integration, and service offerings complementing traditional hardware products. Innovation focus centers on artificial intelligence, machine learning, and cybersecurity capabilities addressing evolving customer requirements.

Market segmentation analysis reveals distinct categories based on technology type, application sector, and deployment model, each demonstrating unique growth patterns and customer requirements.

By Technology Type:

By Application Sector:

Hardware category continues to represent the largest market segment, encompassing controllers, sensors, actuators, and communication devices essential for industrial automation systems. Technology evolution toward more intelligent, connected devices drives premium pricing and enhanced functionality.

Software category demonstrates the fastest growth rate at approximately 8.5% annually, reflecting increasing emphasis on data analytics, artificial intelligence, and cloud-based automation platforms. Software integration becomes critical for realizing full automation system potential and enabling advanced capabilities.

Services category shows robust expansion as customers seek comprehensive support throughout automation system lifecycles. Maintenance services, system integration, and consulting represent growing revenue opportunities for automation providers. Digital services including remote monitoring and predictive maintenance gain particular traction.

Cloud-based solutions emerge as a distinct category with significant growth potential, offering scalability and reduced infrastructure requirements. Hybrid deployment models combining on-premises and cloud components provide flexibility for diverse industrial applications while addressing security concerns.

Manufacturing companies realize substantial benefits from FA and ICS implementation including enhanced production efficiency, improved product quality, and reduced operational costs. Operational excellence achievements through automation enable competitive advantages in global markets while supporting sustainability objectives.

Technology providers benefit from expanding market opportunities driven by digital transformation initiatives and Industry 4.0 adoption. Innovation partnerships with industrial customers create collaborative development opportunities for next-generation automation solutions addressing specific industry requirements.

System integrators experience growing demand for specialized expertise in implementing complex automation projects. Service opportunities expand as customers require ongoing support for sophisticated automation systems throughout their operational lifecycles.

Government stakeholders benefit from enhanced industrial competitiveness supporting economic growth and employment. Environmental benefits from energy-efficient automation technologies align with sustainability goals and regulatory objectives. Export opportunities for German automation technologies contribute to positive trade balances and international market presence.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming Germany’s FA and ICS market, with machine learning algorithms enabling predictive maintenance, quality optimization, and autonomous decision-making capabilities. AI-powered automation systems demonstrate superior performance in complex manufacturing environments requiring adaptive responses to changing conditions.

Edge computing adoption accelerates as industrial operators seek real-time data processing capabilities without relying on cloud connectivity. Edge devices enable immediate response to critical events while reducing bandwidth requirements and improving system reliability in industrial environments.

Cybersecurity enhancement becomes paramount as connected automation systems face evolving threat landscapes. Zero-trust security models and advanced threat detection capabilities integrate into automation platforms ensuring operational continuity while protecting against cyber attacks.

Sustainability integration drives development of energy-efficient automation technologies supporting environmental compliance and operational cost reduction. Green automation solutions optimize resource consumption while maintaining production performance, aligning with corporate sustainability objectives and regulatory requirements.

Recent industry developments highlight the dynamic nature of Germany’s FA and ICS market, with major technology providers announcing significant investments in research and development facilities. Innovation centers focusing on artificial intelligence and machine learning applications in industrial automation demonstrate commitment to technological leadership.

Strategic partnerships between traditional automation providers and technology companies create comprehensive ecosystems addressing diverse customer requirements. Collaboration initiatives enable integration of cloud computing, analytics, and cybersecurity capabilities into established automation platforms.

Acquisition activities reflect market consolidation trends as companies seek to expand technology portfolios and market presence. Technology acquisitions particularly focus on software capabilities, artificial intelligence, and cybersecurity solutions complementing existing hardware offerings.

Government initiatives supporting digital transformation and Industry 4.0 adoption provide favorable market conditions for automation technology deployment. Funding programs encourage small and medium-sized enterprises to implement advanced automation solutions, expanding market opportunities beyond large industrial corporations.

Market analysts recommend that automation providers prioritize software capabilities and service offerings to differentiate from commodity hardware competitors. MarkWide Research analysis suggests focusing on outcome-based solutions that deliver measurable business value rather than simply providing technology components.

Investment strategies should emphasize cybersecurity capabilities as industrial operators increasingly prioritize secure automation platforms. Security integration throughout automation system design becomes essential for market success rather than an afterthought addition.

Partnership development with technology companies, system integrators, and industry specialists creates comprehensive solution ecosystems addressing diverse customer requirements. Collaborative approaches enable faster innovation cycles and broader market reach than individual company efforts.

Geographic expansion strategies should leverage Germany’s reputation for high-quality automation technologies in emerging markets seeking industrial modernization. Export opportunities provide growth potential beyond domestic market limitations while establishing global market presence.

Future market outlook for Germany’s FA and ICS market remains highly positive, with sustained growth expected through continued Industry 4.0 adoption and digital transformation initiatives. Market expansion at approximately 6.8% CAGR reflects strong underlying demand drivers and technological advancement momentum.

Technology evolution toward more intelligent, autonomous automation systems will create new value propositions and market opportunities. Artificial intelligence and machine learning integration will become standard features rather than premium additions, fundamentally changing automation system capabilities and customer expectations.

Sustainability requirements will increasingly influence automation technology selection, with energy efficiency and environmental impact becoming critical decision factors. Circular economy principles will drive demand for automation solutions supporting waste reduction and resource optimization throughout industrial processes.

Service-based business models will gain prominence as customers seek outcome-based automation solutions with predictable costs and performance guarantees. MWR projections indicate service revenues could represent 40% of total market within the next decade, reflecting fundamental shifts in customer preferences and technology delivery models.

Germany’s FA and ICS market stands at the forefront of global industrial automation, driven by the nation’s commitment to manufacturing excellence and technological innovation. Market dynamics reflect strong growth momentum supported by Industry 4.0 initiatives, digital transformation requirements, and evolving customer expectations for intelligent automation solutions.

Technological advancement continues to reshape market opportunities, with artificial intelligence, edge computing, and cybersecurity capabilities becoming essential components of modern automation systems. Competitive landscape evolution toward software-centric solutions and service-based business models creates new value propositions while challenging traditional hardware-focused approaches.

Future success in this dynamic market requires comprehensive strategies addressing technology innovation, customer relationship development, and global market expansion. Germany’s position as both a leading automation technology developer and major industrial market provides unique advantages for companies capable of leveraging these strengths effectively in an increasingly competitive global landscape.

What is FA and ICS?

FA and ICS refer to Functional Automation and Industrial Control Systems, which are essential for optimizing manufacturing processes, enhancing operational efficiency, and ensuring safety in various industrial applications.

What are the key players in the Germany FA And ICS Market?

Key players in the Germany FA And ICS Market include Siemens AG, Schneider Electric, ABB, and Honeywell, among others.

What are the main drivers of growth in the Germany FA And ICS Market?

The main drivers of growth in the Germany FA And ICS Market include the increasing demand for automation in manufacturing, the need for energy efficiency, and the rising adoption of smart technologies in industrial processes.

What challenges does the Germany FA And ICS Market face?

Challenges in the Germany FA And ICS Market include the high initial investment costs, the complexity of integrating new systems with legacy equipment, and the need for skilled workforce to manage advanced technologies.

What opportunities exist in the Germany FA And ICS Market?

Opportunities in the Germany FA And ICS Market include the expansion of Industry Four Point Zero initiatives, the growing focus on sustainability, and the increasing use of IoT and AI technologies in industrial automation.

What trends are shaping the Germany FA And ICS Market?

Trends shaping the Germany FA And ICS Market include the rise of cloud-based solutions, the integration of cybersecurity measures in automation systems, and the shift towards more flexible and adaptive manufacturing processes.

Germany FA And ICS Market

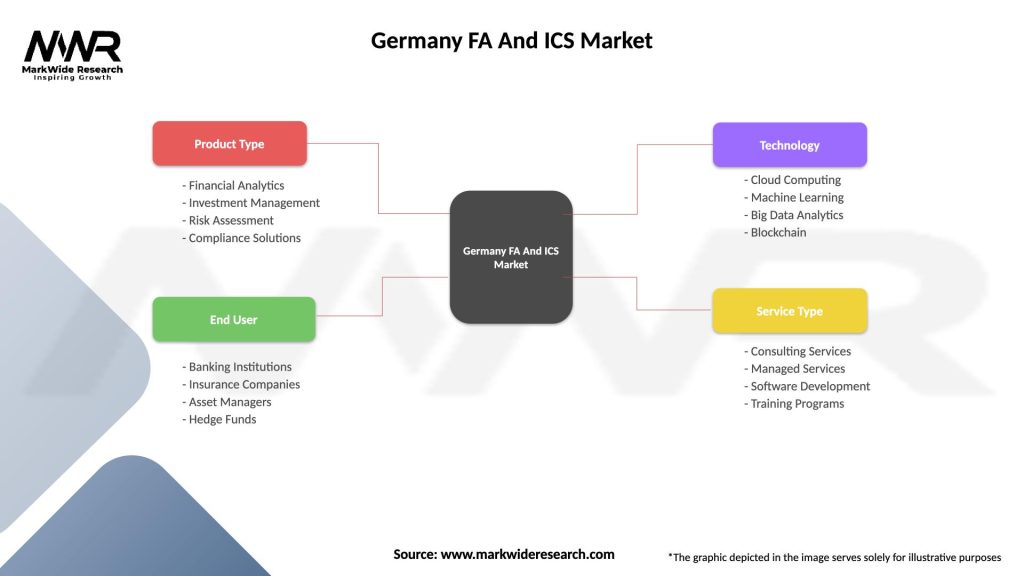

| Segmentation Details | Description |

|---|---|

| Product Type | Financial Analytics, Investment Management, Risk Assessment, Compliance Solutions |

| End User | Banking Institutions, Insurance Companies, Asset Managers, Hedge Funds |

| Technology | Cloud Computing, Machine Learning, Big Data Analytics, Blockchain |

| Service Type | Consulting Services, Managed Services, Software Development, Training Programs |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany FA And ICS Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at