444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany energy storage market represents one of Europe’s most dynamic and rapidly evolving sectors, driven by the country’s ambitious renewable energy transition and commitment to carbon neutrality. Germany’s energy storage landscape has experienced unprecedented growth as the nation continues its Energiewende initiative, fundamentally transforming how energy is generated, stored, and distributed across the country. The market encompasses a diverse range of technologies including battery energy storage systems, pumped hydro storage, compressed air energy storage, and emerging solutions like power-to-gas technologies.

Market dynamics in Germany are particularly influenced by the increasing penetration of renewable energy sources, with wind and solar power accounting for over 45% of electricity generation. This substantial renewable energy integration creates significant demand for energy storage solutions to address intermittency challenges and ensure grid stability. The German government’s supportive policy framework, including feed-in tariffs, storage subsidies, and grid modernization investments, has created a favorable environment for energy storage deployment across residential, commercial, and utility-scale applications.

Technological advancement remains a cornerstone of Germany’s energy storage market, with the country serving as a global hub for energy storage innovation and manufacturing. The market is experiencing robust growth at a compound annual growth rate of 12.5%, reflecting strong demand across multiple sectors and applications. Battery storage systems dominate the market landscape, particularly lithium-ion technologies, while emerging solutions like solid-state batteries and flow batteries are gaining traction for specific applications.

The Germany energy storage market refers to the comprehensive ecosystem of technologies, systems, and services designed to capture, store, and release electrical energy for later use within the German energy infrastructure. This market encompasses various storage technologies ranging from traditional pumped hydro storage to advanced battery systems, each serving specific applications in grid stabilization, renewable energy integration, and energy security enhancement.

Energy storage systems in Germany function as critical infrastructure components that enable the efficient management of electricity supply and demand, particularly in the context of variable renewable energy generation. These systems store excess energy during periods of high renewable generation and release it when demand exceeds supply or when renewable sources are unavailable. The market includes both stationary storage installations and mobile energy storage solutions, serving applications from residential solar-plus-storage systems to large-scale grid balancing services.

Market participants include technology manufacturers, system integrators, project developers, utilities, and end-users across residential, commercial, and industrial sectors. The German energy storage market operates within a complex regulatory framework that includes grid codes, safety standards, and market mechanisms designed to incentivize storage deployment while ensuring system reliability and safety.

Germany’s energy storage market stands at the forefront of the global energy transition, representing a critical component of the country’s strategy to achieve climate neutrality by 2045. The market has demonstrated remarkable resilience and growth, driven by increasing renewable energy penetration, supportive government policies, and technological innovations that continue to reduce costs while improving performance.

Key market drivers include the need for grid flexibility as renewable energy sources account for an increasing share of electricity generation, with solar and wind power experiencing annual growth rates exceeding 15%. The residential segment has emerged as a particularly strong growth area, with homeowners increasingly adopting solar-plus-storage systems to maximize energy independence and reduce electricity costs. Commercial and industrial applications are also expanding rapidly as businesses seek to optimize energy costs and enhance operational resilience.

Technological diversity characterizes the German market, with lithium-ion batteries maintaining market leadership while alternative technologies like flow batteries, compressed air energy storage, and power-to-gas solutions gain market share in specific applications. The market benefits from Germany’s strong manufacturing base and research capabilities, with numerous domestic companies leading innovation in energy storage technologies and system integration.

Future prospects remain highly positive, with market growth expected to accelerate as storage costs continue declining and new applications emerge. The integration of energy storage with electric vehicle charging infrastructure, industrial processes, and smart grid technologies presents significant opportunities for market expansion and technological advancement.

Strategic market insights reveal several critical trends shaping Germany’s energy storage landscape. The market demonstrates strong momentum across multiple segments, with residential storage installations experiencing particularly robust growth as homeowners seek energy independence and cost optimization.

Renewable energy integration serves as the primary driver for Germany’s energy storage market growth. The country’s commitment to phasing out nuclear power and reducing fossil fuel dependence has created unprecedented demand for storage solutions to manage the variability and intermittency of renewable energy sources. Wind and solar power generation capacity continues expanding rapidly, necessitating sophisticated storage systems to maintain grid stability and reliability.

Grid modernization requirements represent another significant market driver as Germany’s electrical infrastructure undergoes comprehensive transformation. The transition from centralized fossil fuel generation to distributed renewable energy requires advanced grid management capabilities, with energy storage playing a crucial role in providing ancillary services, frequency regulation, and voltage support. Transmission system operators increasingly rely on storage systems to manage grid congestion and optimize power flows.

Economic incentives and supportive policies continue driving market adoption across all segments. The German government’s storage subsidy programs, combined with favorable financing conditions and tax incentives, have significantly improved project economics. Feed-in tariff structures and net metering policies encourage residential and commercial storage adoption, while capacity markets and ancillary service revenues provide revenue streams for utility-scale installations.

Energy security concerns have gained prominence, particularly following recent geopolitical developments that highlighted Germany’s energy import dependence. Energy storage systems enhance energy security by enabling greater utilization of domestic renewable resources and reducing reliance on energy imports. This strategic consideration has elevated energy storage from an economic optimization tool to a national security priority.

High capital costs remain a significant barrier to widespread energy storage adoption, particularly for utility-scale projects and emerging technologies. While battery costs have declined substantially, the total system costs including power electronics, installation, and grid connection infrastructure still represent substantial investments. Many potential projects face financing challenges, especially in competitive market environments where revenue streams may be uncertain.

Regulatory complexity and evolving market rules create uncertainty for investors and developers. Germany’s energy market operates under complex regulatory frameworks that continue evolving as the energy transition progresses. Changes in grid codes, market mechanisms, and support schemes can impact project viability and create regulatory risk that may deter investment in certain market segments.

Technical challenges associated with grid integration and system optimization present ongoing constraints. Energy storage systems must meet stringent technical requirements for grid connection, safety, and performance. The complexity of integrating diverse storage technologies with existing grid infrastructure requires specialized expertise and can result in extended development timelines and increased costs.

Competition from alternative solutions may limit market growth in certain applications. Demand response programs, grid infrastructure upgrades, and improved forecasting capabilities can sometimes provide more cost-effective alternatives to energy storage for specific grid management needs. Additionally, the development of interconnection capacity with neighboring countries may reduce the need for domestic storage in some scenarios.

Sector coupling initiatives present substantial opportunities for energy storage market expansion. The integration of electricity, heating, and transportation sectors through technologies like power-to-heat, power-to-gas, and electric vehicle charging creates new applications and revenue streams for energy storage systems. These applications can significantly enhance the value proposition of storage investments by enabling multiple revenue streams and improving system utilization.

Industrial decarbonization represents a growing market opportunity as German manufacturing companies seek to reduce carbon emissions and energy costs. Energy storage systems can enable industrial facilities to optimize energy consumption, participate in demand response programs, and integrate renewable energy sources. The chemical, steel, and automotive industries present particularly significant opportunities for large-scale storage deployment.

Export market development offers substantial growth potential for German energy storage companies. The country’s technological leadership and project development expertise position German companies well for international expansion, particularly in European markets undergoing similar energy transitions. Export opportunities span both technology manufacturing and project development services.

Emerging technologies and applications continue creating new market opportunities. Developments in hydrogen storage, advanced battery chemistries, and hybrid storage systems open new market segments and applications. The integration of artificial intelligence and machine learning technologies enhances storage system optimization and creates additional value streams through improved forecasting and automated trading capabilities.

Supply chain evolution significantly influences market dynamics as Germany develops domestic manufacturing capabilities while managing global supply chain dependencies. The country has established strong positions in certain technology segments while remaining dependent on imports for critical components like battery cells. Supply chain resilience has become increasingly important, driving investments in domestic manufacturing and strategic partnerships.

Competitive landscape dynamics reflect the market’s maturation, with established players facing competition from new entrants and technology innovators. Traditional utility companies are expanding into storage services while technology companies develop integrated solutions. This competitive environment drives innovation and cost reduction while creating consolidation pressures in certain market segments.

Technology convergence is reshaping market dynamics as energy storage systems become increasingly integrated with other technologies. The convergence of storage with solar PV, electric vehicle charging, heat pumps, and smart home technologies creates new business models and value propositions. This integration trend requires companies to develop broader technological capabilities and partnership strategies.

Market mechanism evolution continues influencing competitive dynamics as regulators adapt market rules to accommodate increasing storage penetration. New market products, pricing mechanisms, and participation rules create opportunities while requiring market participants to adapt their business models and operational strategies. According to MarkWide Research analysis, these evolving market mechanisms are expected to drive storage utilization rates above 75% in the coming years.

Comprehensive market analysis methodology combines quantitative data collection with qualitative insights from industry stakeholders across the German energy storage value chain. Primary research includes structured interviews with technology manufacturers, system integrators, project developers, utilities, and end-users to understand market trends, challenges, and opportunities from multiple perspectives.

Data collection approaches encompass multiple sources including government statistics, industry associations, company financial reports, and project databases. Market sizing and forecasting utilize bottom-up and top-down methodologies to ensure accuracy and reliability. Technology assessment includes performance analysis, cost benchmarking, and competitive positioning across different storage technologies and applications.

Stakeholder engagement involves regular interaction with key market participants to validate findings and understand emerging trends. Expert interviews with technology developers, policy makers, and market analysts provide insights into future market developments and potential disruptions. Industry conference participation and workshop engagement ensure comprehensive market understanding.

Analytical frameworks incorporate scenario analysis, sensitivity testing, and risk assessment to provide robust market projections. Regional analysis considers local market conditions, regulatory environments, and competitive dynamics across different German states. Technology roadmap analysis evaluates the potential impact of emerging technologies and innovation trends on market development.

Northern Germany leads energy storage deployment, driven by extensive offshore wind development and grid integration requirements. The region benefits from strong wind resources and established renewable energy infrastructure, creating substantial demand for storage solutions to manage generation variability. Schleswig-Holstein and Lower Saxony demonstrate particularly strong market activity, with utility-scale storage projects supporting wind energy integration.

Southern Germany shows robust growth in residential and commercial storage applications, reflecting high solar energy penetration and favorable economic conditions. Bavaria and Baden-Württemberg account for approximately 40% of residential storage installations, driven by strong solar adoption rates and supportive regional policies. The region’s industrial base also creates significant opportunities for commercial and industrial storage applications.

Eastern Germany presents emerging opportunities as the region continues developing renewable energy resources and modernizing electrical infrastructure. The area benefits from available land for utility-scale projects and growing renewable energy capacity. Transmission infrastructure development creates additional demand for grid-scale storage solutions to manage power flows and maintain system stability.

Western Germany demonstrates strong market activity across all segments, benefiting from dense population centers, industrial activity, and established energy infrastructure. North Rhine-Westphalia represents a significant market for industrial storage applications, while urban areas show growing adoption of residential and commercial storage systems. The region’s energy-intensive industries create substantial opportunities for large-scale storage deployment.

Market leadership in Germany’s energy storage sector is distributed among domestic and international companies, each bringing distinct technological capabilities and market strategies. The competitive landscape reflects the market’s diversity, with different companies leading in specific technology segments and applications.

Competitive strategies vary significantly across market segments, with residential providers focusing on integrated solutions and customer service while utility-scale developers emphasize project execution capabilities and technology performance. Strategic partnerships and vertical integration are common approaches for market expansion and competitive differentiation.

Technology-based segmentation reveals the diverse range of energy storage solutions deployed across the German market, each serving specific applications and market requirements. Battery energy storage systems dominate market share while alternative technologies address specialized needs and longer-duration applications.

By Technology:

By Application:

By Capacity Range:

Residential storage category demonstrates the strongest growth momentum, driven by increasing solar PV adoption and favorable economics. German homeowners are increasingly viewing energy storage as essential infrastructure for maximizing solar energy utilization and achieving energy independence. The category benefits from declining system costs, improved battery performance, and innovative financing options that reduce upfront investment barriers.

Commercial storage applications show growing sophistication as businesses develop comprehensive energy management strategies. Companies are deploying storage systems not only for demand charge reduction but also for backup power, power quality improvement, and participation in grid services markets. The integration of storage with electric vehicle charging infrastructure represents a particularly dynamic growth area.

Utility-scale storage category is evolving rapidly as grid operators recognize storage as essential infrastructure for renewable energy integration. Projects are increasing in scale and duration, with some installations providing multiple grid services simultaneously. The category benefits from improving project economics and evolving market mechanisms that better compensate storage services.

Industrial storage applications are gaining traction as energy-intensive industries seek to optimize operations and reduce carbon emissions. Manufacturing facilities are deploying storage systems for load shifting, power quality improvement, and integration with on-site renewable generation. The chemical and steel industries represent particularly significant opportunities for large-scale industrial storage deployment.

Technology manufacturers benefit from Germany’s position as a leading energy storage market, providing opportunities for technology validation, scale development, and market expansion. The country’s sophisticated market requirements drive innovation while its strong industrial base supports manufacturing development. German market success often serves as a platform for international expansion and technology commercialization.

Utilities and grid operators gain access to flexible resources that enhance grid management capabilities and support renewable energy integration. Energy storage systems provide multiple grid services simultaneously, improving system efficiency and reliability while reducing infrastructure investment requirements. The technology enables utilities to defer traditional grid upgrades while maintaining service quality.

End-users across all segments benefit from improved energy economics, enhanced energy security, and reduced environmental impact. Residential customers achieve greater energy independence and cost savings, while commercial and industrial users optimize energy costs and improve operational resilience. MWR data indicates that storage adoption can reduce energy costs by 20-30% for typical residential users.

Policy makers and regulators benefit from energy storage’s contribution to energy transition objectives, grid stability, and energy security. Storage deployment supports renewable energy targets while maintaining system reliability and reducing infrastructure costs. The technology enables more efficient utilization of existing grid infrastructure while supporting decarbonization goals.

Financial institutions and investors gain access to a growing market with improving economics and multiple revenue streams. Energy storage projects offer attractive risk-return profiles with predictable cash flows from multiple sources including energy arbitrage, capacity payments, and ancillary services. The market’s growth trajectory and policy support provide confidence for long-term investments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization and smart integration represent fundamental trends reshaping the German energy storage market. Storage systems are increasingly incorporating artificial intelligence, machine learning, and advanced control systems to optimize performance and maximize value. Smart integration with other energy technologies creates new business models and revenue opportunities while improving overall system efficiency.

Hybrid system development is gaining momentum as developers combine multiple storage technologies or integrate storage with renewable generation and other energy assets. These hybrid approaches optimize performance across different applications and time scales while improving project economics. Solar-plus-storage systems dominate the residential market while utility-scale projects increasingly combine storage with wind or solar generation.

Service-oriented business models are emerging as companies shift from equipment sales to comprehensive service offerings. Energy-as-a-service models, virtual power plants, and aggregated storage services create new revenue streams while reducing customer investment barriers. These models enable smaller customers to access storage benefits while providing developers with recurring revenue streams.

Circular economy integration is becoming increasingly important as the market matures and early storage systems reach end-of-life. Battery recycling, second-life applications, and sustainable manufacturing practices are gaining prominence. German companies are developing comprehensive approaches to battery lifecycle management, creating competitive advantages while addressing environmental concerns.

Grid services evolution continues as system operators develop new market products and compensation mechanisms for storage services. Advanced grid services like synthetic inertia, black start capability, and congestion management create additional revenue opportunities for storage systems. The evolution toward more granular and location-specific grid services enhances storage value propositions.

Manufacturing capacity expansion represents a significant industry development as companies establish and expand production facilities in Germany. Several major battery manufacturers have announced substantial investments in German production capacity, reducing supply chain dependencies while supporting domestic job creation. These investments reflect confidence in long-term market growth and the strategic importance of local manufacturing capabilities.

Technology partnerships and collaborations are accelerating as companies seek to combine complementary capabilities and share development costs. Partnerships between battery manufacturers and system integrators, utilities and technology providers, and automotive companies and energy companies are creating new market opportunities and accelerating innovation.

Regulatory framework evolution continues with new market rules, grid codes, and support mechanisms designed to optimize storage deployment and market participation. Recent developments include improved market access for storage systems, new ancillary service products, and streamlined permitting processes. These regulatory improvements enhance market attractiveness while ensuring system safety and reliability.

Large-scale project announcements demonstrate growing market confidence and improving project economics. Several utility-scale storage projects exceeding 100 MWh capacity have been announced, representing significant scale increases compared to earlier deployments. These projects often combine multiple revenue streams and demonstrate the viability of storage as standalone grid infrastructure.

International expansion initiatives by German companies reflect market maturity and competitive strength. Leading German storage companies are expanding operations across Europe and globally, leveraging domestic expertise and technology leadership. These expansion efforts contribute to German export performance while establishing global market positions.

Strategic positioning recommendations emphasize the importance of developing comprehensive value propositions that address multiple customer needs and market applications. Companies should focus on integrated solutions that combine storage with other energy technologies while providing comprehensive services and support. Market success increasingly depends on the ability to deliver complete solutions rather than individual components.

Technology development priorities should focus on improving system performance, reducing costs, and enhancing integration capabilities. Investment in digital technologies, advanced control systems, and predictive maintenance capabilities can create competitive advantages while improving customer value. Companies should also consider emerging technologies like solid-state batteries and alternative storage chemistries for future market positioning.

Market entry strategies for new participants should consider partnership approaches and niche market focus rather than attempting to compete directly with established players across all segments. Specialized applications, regional markets, or specific technology segments may offer more accessible entry points while building market presence and capabilities.

Policy engagement remains critical for market participants as regulatory frameworks continue evolving. Active participation in industry associations, policy consultations, and standard-setting processes can help shape favorable market conditions while ensuring compliance with emerging requirements. Companies should also monitor policy developments in other markets for expansion opportunities.

Investment prioritization should balance short-term market opportunities with long-term strategic positioning. While current market growth creates immediate opportunities, companies must also invest in capabilities and technologies that will drive future market development. MarkWide Research analysis suggests that companies with balanced investment approaches achieve superior long-term performance compared to those focused solely on current market opportunities.

Market growth trajectory remains strongly positive with accelerating adoption expected across all market segments. The combination of declining costs, improving technology performance, and supportive policies creates favorable conditions for continued market expansion. Residential storage adoption is expected to reach penetration rates exceeding 50% of new solar installations within the next five years.

Technology evolution will continue driving market development with next-generation battery technologies, improved system integration, and enhanced digital capabilities. Solid-state batteries, advanced flow batteries, and hybrid storage systems are expected to gain market share while traditional lithium-ion technologies continue improving performance and reducing costs. Long-duration storage technologies will become increasingly important for seasonal energy storage and grid balancing.

Market structure transformation is anticipated as the industry matures and consolidation occurs in certain segments. Service-oriented business models will gain prominence while traditional equipment sales approaches may face margin pressure. Virtual power plants and aggregated storage services are expected to become significant market segments, creating new competitive dynamics and value chains.

Integration with emerging sectors will create new market opportunities and applications. The electrification of transportation, heating, and industrial processes will drive demand for storage solutions while creating new integration opportunities. Hydrogen production and storage integration represents a particularly significant long-term opportunity for the German market.

International market development will provide growth opportunities for German companies while potentially increasing competitive pressure in the domestic market. German technology leadership and project development expertise position the country well for export market success, while international competition may intensify in domestic market segments. The global energy transition creates substantial opportunities for German energy storage expertise and technology.

Germany’s energy storage market represents a dynamic and rapidly evolving sector that plays a crucial role in the country’s energy transition and climate objectives. The market has demonstrated remarkable growth and resilience, driven by strong renewable energy penetration, supportive government policies, and continuous technological advancement. With robust growth prospects across residential, commercial, and utility-scale applications, the German energy storage market is positioned to remain a global leader in energy storage deployment and innovation.

Market fundamentals remain strong with multiple drivers supporting continued growth including renewable energy integration requirements, grid modernization needs, and evolving customer demands for energy independence and cost optimization. The diverse technology landscape and competitive market structure foster innovation while providing customers with comprehensive solutions across all market segments. Policy support and regulatory framework development continue creating favorable conditions for market expansion while ensuring system safety and reliability.

Future success in the German energy storage market will depend on companies’ ability to adapt to evolving market conditions, develop integrated solutions, and capitalize on emerging opportunities in sector coupling and digitalization. The market’s maturation creates both opportunities and challenges, requiring strategic positioning and continuous innovation to maintain competitive advantages. As Germany continues its energy transition journey, energy storage will remain an essential technology for achieving climate objectives while maintaining energy security and economic competitiveness in the global marketplace.

What is Energy Storage?

Energy storage refers to the methods and technologies used to store energy for later use. This includes various systems such as batteries, pumped hydro storage, and thermal storage, which are essential for balancing supply and demand in energy systems.

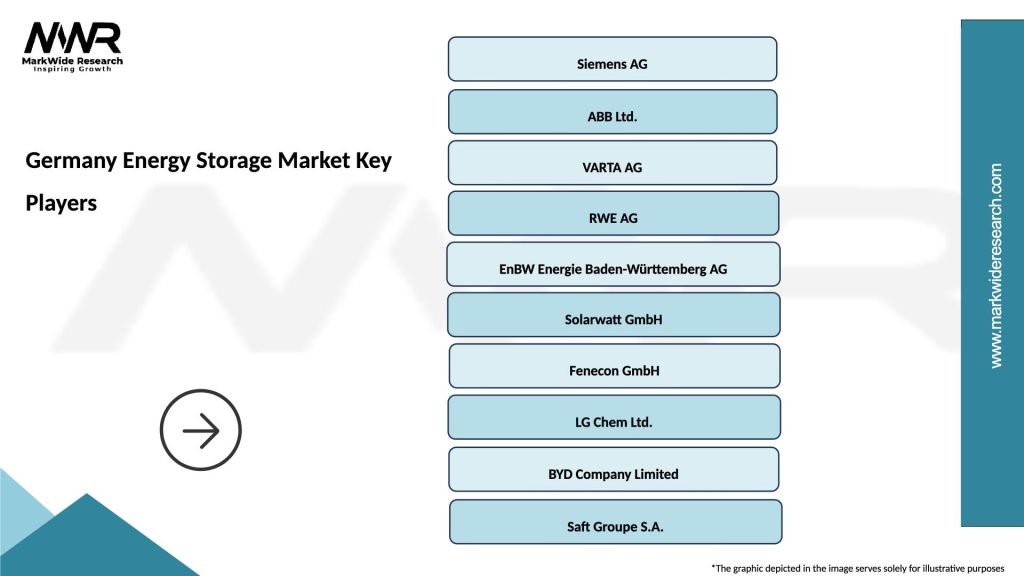

What are the key players in the Germany Energy Storage Market?

Key players in the Germany Energy Storage Market include companies like Siemens, Sonnen, and VARTA, which are involved in developing innovative storage solutions. These companies focus on enhancing energy efficiency and integrating renewable energy sources, among others.

What are the main drivers of the Germany Energy Storage Market?

The main drivers of the Germany Energy Storage Market include the increasing demand for renewable energy integration, the need for grid stability, and advancements in battery technologies. These factors contribute to the growth of energy storage solutions across various sectors.

What challenges does the Germany Energy Storage Market face?

The Germany Energy Storage Market faces challenges such as high initial investment costs, regulatory hurdles, and the need for technological advancements. These issues can hinder the widespread adoption of energy storage systems.

What opportunities exist in the Germany Energy Storage Market?

Opportunities in the Germany Energy Storage Market include the growing demand for electric vehicles, the expansion of renewable energy projects, and government incentives for energy storage solutions. These factors create a favorable environment for innovation and investment.

What trends are shaping the Germany Energy Storage Market?

Trends shaping the Germany Energy Storage Market include the rise of decentralized energy systems, increased use of lithium-ion batteries, and the integration of artificial intelligence for energy management. These trends are driving efficiency and sustainability in energy storage solutions.

Germany Energy Storage Market

| Segmentation Details | Description |

|---|---|

| Type | Battery Storage, Pumped Hydro, Flywheel, Compressed Air |

| Technology | Lithium-ion, Lead-acid, Sodium-sulfur, Redox Flow |

| End User | Utilities, Commercial, Residential, Industrial |

| Application | Peak Shaving, Frequency Regulation, Load Shifting, Backup Power |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Energy Storage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at