444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany electric vehicle charging equipment market represents one of Europe’s most dynamic and rapidly evolving sectors, driven by ambitious environmental policies and strong consumer adoption of electric mobility solutions. Germany’s commitment to achieving carbon neutrality by 2045 has positioned the country as a leader in electric vehicle infrastructure development, creating unprecedented opportunities for charging equipment manufacturers and service providers.

Market dynamics indicate robust growth across all charging categories, with DC fast charging solutions experiencing particularly strong demand. The market encompasses various charging technologies, from residential AC chargers to high-power commercial charging stations, each serving distinct segments of Germany’s expanding electric vehicle ecosystem. Government initiatives including substantial subsidies and regulatory support have accelerated market penetration, with charging infrastructure growing at approximately 45% annually across major metropolitan areas.

Regional distribution shows concentrated development in urban centers like Berlin, Munich, and Hamburg, while rural areas are experiencing accelerated infrastructure deployment through targeted government programs. The market benefits from Germany’s strong automotive manufacturing base, with major OEMs investing heavily in charging network partnerships and proprietary charging solutions to support their electric vehicle portfolios.

The Germany electric vehicle charging equipment market refers to the comprehensive ecosystem of hardware, software, and services required to power electric vehicles across residential, commercial, and public charging applications. This market encompasses charging stations, power management systems, network connectivity solutions, and associated installation and maintenance services that enable electric vehicle adoption throughout Germany.

Charging equipment categories include Level 1 AC chargers for basic residential use, Level 2 AC chargers for home and workplace applications, and DC fast chargers for commercial and highway applications. The market also includes smart charging solutions that integrate with grid management systems, renewable energy sources, and vehicle-to-grid technologies that represent the future of electric mobility infrastructure.

Market participants range from established electrical equipment manufacturers to innovative technology startups, creating a diverse competitive landscape that drives continuous innovation in charging speed, user experience, and grid integration capabilities.

Germany’s electric vehicle charging equipment market stands at the forefront of European electric mobility transformation, supported by comprehensive government policies and strong industrial partnerships. The market demonstrates exceptional growth momentum, with charging infrastructure expanding rapidly to meet increasing electric vehicle adoption rates across consumer and commercial segments.

Key market drivers include Germany’s National Charging Infrastructure Plan, which targets extensive charging network coverage, and substantial government funding programs that support both public and private charging infrastructure development. The market benefits from approximately 38% of new vehicle registrations being electric or hybrid vehicles, creating sustained demand for charging solutions.

Technology advancement focuses on ultra-fast charging capabilities, smart grid integration, and user-friendly payment systems that enhance the electric vehicle ownership experience. Major automotive manufacturers including Volkswagen Group, BMW, and Mercedes-Benz are investing heavily in charging infrastructure partnerships, while energy companies like E.ON and EnBW expand their charging networks nationwide.

Market segmentation reveals strong growth across residential, workplace, and public charging categories, with DC fast charging experiencing the highest growth rates due to consumer demand for rapid charging solutions during long-distance travel.

Strategic market insights reveal several critical trends shaping Germany’s electric vehicle charging equipment landscape:

Government policy support serves as the primary catalyst for Germany’s electric vehicle charging equipment market expansion. The federal government’s commitment to installing one million public charging points by 2030, backed by substantial funding programs, creates sustained market demand and investor confidence. Regulatory frameworks including the Alternative Fuels Infrastructure Directive and national building codes requiring charging infrastructure in new constructions drive systematic market growth.

Environmental consciousness among German consumers accelerates electric vehicle adoption, with approximately 72% of consumers considering electric vehicles for their next purchase. This consumer shift creates direct demand for residential and workplace charging solutions, while also driving public charging infrastructure requirements to support longer-distance travel and urban mobility needs.

Automotive industry transformation represents another crucial driver, as German automakers invest billions in electric vehicle development and supporting infrastructure. Volkswagen Group’s commitment to electric mobility, including the ID series and charging network investments, exemplifies how OEM strategies drive charging equipment demand across multiple market segments.

Energy sector evolution toward renewable sources creates synergies with electric vehicle charging, as utilities seek to optimize grid utilization and integrate distributed energy resources. Smart charging technologies enable demand response capabilities and renewable energy integration, making charging infrastructure an integral component of Germany’s energy transition strategy.

High infrastructure costs present significant challenges for charging equipment deployment, particularly for DC fast charging installations that require substantial electrical infrastructure upgrades and grid connections. Installation expenses including electrical work, permits, and site preparation can substantially increase total project costs, potentially limiting deployment in certain locations or market segments.

Grid capacity limitations in some regions constrain charging infrastructure expansion, requiring costly electrical grid upgrades to support high-power charging installations. Utility coordination and approval processes can extend project timelines, while peak demand management concerns may limit charging speeds during high-usage periods.

Technology standardization challenges persist despite industry progress, with different charging protocols and payment systems creating user confusion and limiting interoperability. Legacy infrastructure compatibility issues and varying connector standards can complicate charging network expansion and user adoption across different regions and operators.

Real estate constraints in dense urban areas limit charging station placement options, while property owner cooperation requirements can slow residential and workplace charging installations. Parking availability and space allocation challenges particularly affect urban charging infrastructure development where demand is highest.

Rural infrastructure development presents substantial growth opportunities as government programs target underserved areas with charging infrastructure investments. Highway charging corridors require extensive DC fast charging networks to support long-distance electric vehicle travel, creating opportunities for charging equipment manufacturers and network operators to establish strategic locations.

Commercial fleet electrification offers significant market potential as businesses transition delivery vehicles, service fleets, and employee transportation to electric alternatives. Depot charging solutions for commercial vehicles require specialized high-capacity charging systems and fleet management integration, representing a distinct market segment with substantial growth prospects.

Smart city integration creates opportunities for charging infrastructure to become part of comprehensive urban mobility solutions, including integration with public transportation, ride-sharing services, and traffic management systems. Multi-modal transportation hubs require sophisticated charging solutions that serve various vehicle types and user categories.

Energy storage applications through vehicle-to-grid technologies enable charging equipment to provide grid services and energy arbitrage opportunities. Bidirectional charging capabilities transform electric vehicles into distributed energy resources, creating new revenue streams for charging infrastructure operators and vehicle owners.

Supply chain dynamics in Germany’s electric vehicle charging equipment market reflect global semiconductor shortages and component availability challenges, while domestic manufacturing capabilities strengthen through strategic investments and partnerships. Local production of charging equipment components reduces supply chain risks and supports Germany’s industrial competitiveness in the growing electric mobility sector.

Competitive dynamics intensify as traditional electrical equipment manufacturers compete with specialized charging technology companies and new market entrants. Market consolidation trends emerge through strategic acquisitions and partnerships, while innovation cycles accelerate to meet evolving customer requirements for faster charging speeds and enhanced user experiences.

Regulatory dynamics continue evolving with updated building codes, grid connection standards, and interoperability requirements that shape market development. Policy coordination between federal, state, and local governments influences infrastructure deployment patterns and market access conditions for different charging equipment categories.

Technology dynamics drive continuous improvement in charging speeds, efficiency, and smart grid integration capabilities. Innovation cycles focus on reducing charging times, improving user interfaces, and developing advanced grid management features that optimize energy usage and costs for both operators and consumers.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Germany’s electric vehicle charging equipment market. Primary research includes extensive interviews with industry executives, government officials, and market participants across the charging infrastructure value chain, providing firsthand insights into market trends, challenges, and opportunities.

Secondary research incorporates analysis of government publications, industry reports, company financial statements, and regulatory documents to establish market context and validate primary research findings. Data triangulation methods ensure consistency and accuracy across multiple information sources, while statistical analysis identifies significant trends and correlations within market data.

Market modeling techniques project future market development based on historical trends, policy initiatives, and industry dynamics. Scenario analysis evaluates different growth trajectories under varying assumptions about government support, technology advancement, and consumer adoption rates.

Expert validation processes involve review of research findings by industry specialists and academic experts to ensure analytical rigor and practical relevance. Continuous monitoring of market developments enables regular updates to research findings and maintains current market intelligence for stakeholders.

North Rhine-Westphalia leads Germany’s charging infrastructure development with approximately 28% market share, driven by high population density, strong industrial presence, and extensive government support programs. Metropolitan areas including Cologne, Düsseldorf, and Dortmund demonstrate advanced charging network coverage, while rural regions benefit from targeted infrastructure development initiatives.

Bavaria represents the second-largest regional market, with Munich and surrounding areas showing exceptional charging infrastructure density and innovation in smart charging technologies. Automotive industry concentration in Bavaria drives workplace charging demand and supports advanced charging technology development through industry partnerships and research collaborations.

Baden-Württemberg demonstrates strong market growth through its automotive manufacturing base and technology innovation ecosystem. Stuttgart region benefits from Mercedes-Benz and Porsche investments in charging infrastructure, while university partnerships drive research and development in advanced charging technologies and grid integration solutions.

Eastern German states including Berlin, Brandenburg, and Saxony experience accelerated charging infrastructure development through federal support programs targeting regional development. Berlin’s urban mobility initiatives create substantial demand for public and workplace charging solutions, while highway corridors connecting eastern and western regions require extensive DC fast charging networks.

Northern coastal regions including Hamburg and Lower Saxony benefit from renewable energy integration opportunities and port-related commercial vehicle electrification initiatives. Wind energy abundance creates synergies with electric vehicle charging, enabling cost-effective renewable energy utilization and grid balancing services.

Market leadership in Germany’s electric vehicle charging equipment sector reflects a diverse ecosystem of established industrial companies, specialized charging technology providers, and emerging market entrants. Competitive positioning varies across different charging categories, with distinct leaders in residential, commercial, and public charging segments.

Strategic partnerships between charging equipment manufacturers, automotive OEMs, and energy companies create integrated market solutions and accelerate infrastructure deployment. Innovation competition focuses on charging speed improvements, user experience enhancement, and smart grid integration capabilities that differentiate market offerings.

By Charging Type:

By Application:

By Power Level:

Residential charging equipment dominates market volume with approximately 65% of installations, driven by home ownership patterns and government incentives for private charging infrastructure. Smart home integration becomes increasingly important as consumers seek charging solutions that optimize energy costs and integrate with renewable energy systems and home automation platforms.

Workplace charging solutions experience strong growth as employers recognize electric vehicle charging as an employee benefit and corporate sustainability initiative. Load management systems enable efficient power distribution across multiple charging points, while integration with building management systems optimizes energy usage and operational costs.

Public charging infrastructure focuses on user experience improvements and payment system integration to enhance accessibility and convenience. Location optimization strategies target high-traffic areas including shopping centers, restaurants, and entertainment venues where extended parking enables effective charging sessions.

Highway charging networks prioritize ultra-fast charging capabilities and reliability to support long-distance electric vehicle travel. Strategic corridor development ensures comprehensive coverage along major transportation routes, while redundancy planning maintains service availability during peak usage periods and equipment maintenance.

Fleet charging solutions require specialized equipment and software integration to support commercial vehicle operations and route optimization. Depot charging systems provide high-capacity charging for overnight fleet charging, while opportunity charging solutions support vehicles with high daily utilization requirements.

Equipment manufacturers benefit from sustained market growth driven by government policies and increasing electric vehicle adoption rates. Technology leadership in charging speed, efficiency, and smart grid integration creates competitive advantages and premium pricing opportunities in rapidly expanding market segments.

Energy companies gain new revenue streams through charging network operations and grid services enabled by smart charging technologies. Load management capabilities help optimize grid utilization and integrate renewable energy sources, while vehicle-to-grid technologies create additional value propositions for utility customers.

Automotive manufacturers enhance electric vehicle value propositions through charging infrastructure partnerships and integrated mobility solutions. Customer experience improvements through seamless charging access and payment integration support electric vehicle adoption and brand loyalty development.

Real estate developers increase property values and tenant satisfaction through charging infrastructure installation, while meeting evolving building code requirements and sustainability certifications. Future-proofing strategies ensure properties remain competitive as electric vehicle adoption accelerates across residential and commercial segments.

Government entities achieve environmental and economic development objectives through charging infrastructure deployment that supports electric vehicle adoption and reduces transportation emissions. Economic benefits include job creation in manufacturing, installation, and maintenance sectors, while reduced air pollution improves public health outcomes.

Strengths:

Weaknesses:

Opportunities:

Threats:

Ultra-fast charging technology advancement drives market evolution toward 350kW+ charging capabilities that enable rapid charging comparable to conventional fuel stops. Cooling system innovations and advanced power electronics enable sustained high-power charging while maintaining equipment reliability and user safety standards.

Smart charging integration with grid management systems enables dynamic load balancing and renewable energy optimization across charging networks. Artificial intelligence applications predict charging demand patterns and optimize energy distribution to minimize costs and grid impact while maximizing user satisfaction.

Payment system evolution toward contactless and app-based solutions improves user accessibility and reduces transaction friction. Roaming agreements between charging network operators enable seamless access across different charging providers, while subscription models offer predictable pricing for frequent users.

Vehicle-to-grid technology development enables bidirectional power flow that transforms electric vehicles into distributed energy storage resources. Grid stabilization services create additional revenue opportunities for charging infrastructure operators while supporting renewable energy integration and grid reliability.

Modular charging architecture enables scalable infrastructure deployment that can adapt to changing demand patterns and technology evolution. Upgrade capabilities allow existing charging stations to incorporate new features and higher power levels without complete equipment replacement.

Government policy updates include expanded funding programs and updated building codes that accelerate charging infrastructure deployment across residential and commercial applications. Regulatory harmonization efforts improve interoperability and reduce compliance complexity for charging equipment manufacturers and network operators.

Technology partnerships between automotive OEMs and charging infrastructure providers create integrated mobility solutions and exclusive charging access arrangements. Joint ventures combine automotive expertise with charging technology capabilities to develop next-generation charging solutions and user experiences.

Grid integration projects demonstrate advanced smart charging capabilities and vehicle-to-grid applications that support renewable energy integration and grid stability. Pilot programs test innovative charging technologies and business models that may shape future market development and regulatory frameworks.

International expansion by German charging equipment manufacturers leverages domestic market success and technology leadership to capture opportunities in emerging electric vehicle markets. Export initiatives supported by government trade programs help German companies establish global market presence and technology standards.

Research and development investments focus on next-generation charging technologies including wireless charging, battery swapping, and ultra-fast charging solutions. University partnerships and innovation centers accelerate technology development and commercialization timelines for breakthrough charging technologies.

MarkWide Research analysis indicates that market participants should prioritize smart charging technology development and grid integration capabilities to capture emerging opportunities in energy services and demand response applications. Investment strategies should focus on scalable charging solutions that can adapt to evolving power requirements and technology standards.

Strategic partnerships with automotive OEMs and energy companies provide access to integrated market opportunities and reduce competitive risks in rapidly evolving market segments. Collaboration approaches should emphasize complementary capabilities and shared infrastructure investments that accelerate market penetration and customer adoption.

Geographic expansion strategies should target underserved rural areas and emerging commercial applications where government support programs and market demand create favorable conditions for infrastructure deployment. Site selection criteria should prioritize locations with strong traffic patterns, electrical grid capacity, and supportive local policies.

Technology roadmap development should anticipate future charging requirements including higher power levels, improved user interfaces, and advanced grid integration features. Innovation investments should balance current market needs with emerging technology trends that may reshape charging infrastructure requirements.

Customer experience optimization through improved payment systems, network reliability, and user interface design creates competitive differentiation and supports premium pricing strategies. Service quality metrics should focus on charging speed, availability, and ease of use that directly impact customer satisfaction and repeat usage.

Market trajectory indicates sustained growth driven by accelerating electric vehicle adoption and continued government support for charging infrastructure development. Growth projections suggest the market will expand at approximately 42% CAGR through 2030, with DC fast charging experiencing the highest growth rates due to consumer demand for rapid charging solutions.

Technology evolution will focus on ultra-fast charging capabilities exceeding 350kW, wireless charging deployment, and advanced grid integration features that enable energy storage and grid services applications. Innovation cycles will accelerate as competition intensifies and customer expectations for charging speed and convenience continue rising.

Infrastructure density will increase substantially across all regions, with particular emphasis on rural area coverage and highway corridor development that enables comprehensive electric vehicle adoption. Network effects will strengthen as charging infrastructure reaches critical mass and supports long-distance electric vehicle travel throughout Germany and neighboring countries.

Market consolidation trends may emerge as successful companies acquire smaller competitors and expand their geographic coverage and technology capabilities. Strategic alliances between charging equipment manufacturers, network operators, and automotive companies will create integrated mobility solutions and comprehensive customer experiences.

International expansion opportunities will grow as German companies leverage domestic market success and technology leadership to capture opportunities in emerging electric vehicle markets across Europe and globally. Export potential for German charging technology and expertise represents significant long-term growth opportunities beyond the domestic market.

Germany’s electric vehicle charging equipment market represents a cornerstone of European electric mobility transformation, driven by comprehensive government support, strong industrial capabilities, and accelerating consumer adoption of electric vehicles. The market demonstrates exceptional growth potential across all segments, from residential charging solutions to ultra-fast highway charging networks that enable comprehensive electric vehicle adoption.

Strategic opportunities abound for market participants who can navigate the evolving technology landscape and capitalize on government support programs while building sustainable competitive advantages through innovation and customer experience excellence. Technology leadership in smart charging, grid integration, and ultra-fast charging capabilities will determine long-term market success as competition intensifies and customer expectations continue evolving.

Market dynamics favor companies that can deliver integrated solutions combining charging hardware, software platforms, and service capabilities that meet diverse customer needs across residential, commercial, and public charging applications. Future success will depend on adaptability to changing technology standards, regulatory requirements, and customer preferences while maintaining operational excellence and financial sustainability in a rapidly growing but increasingly competitive market environment.

What is Electric Vehicle Charging Equipment?

Electric Vehicle Charging Equipment refers to the devices and infrastructure used to charge electric vehicles, including home chargers, public charging stations, and fast chargers. These systems are essential for supporting the growing adoption of electric vehicles in various sectors, including personal transportation and commercial fleets.

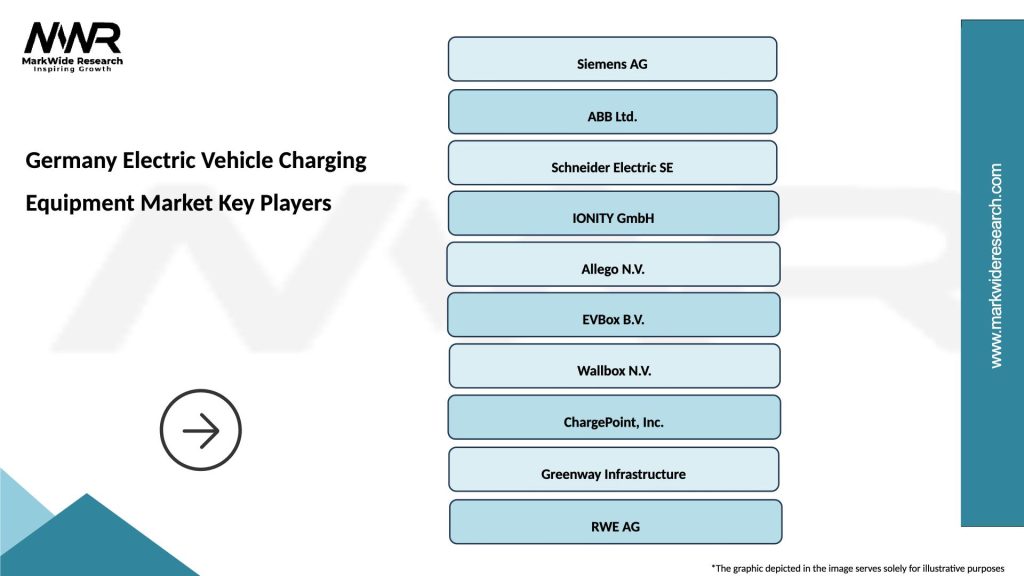

What are the key players in the Germany Electric Vehicle Charging Equipment Market?

Key players in the Germany Electric Vehicle Charging Equipment Market include companies like Siemens, ABB, and Schneider Electric, which provide a range of charging solutions. These companies are actively involved in developing innovative technologies to enhance charging efficiency and accessibility, among others.

What are the main drivers of the Germany Electric Vehicle Charging Equipment Market?

The main drivers of the Germany Electric Vehicle Charging Equipment Market include the increasing adoption of electric vehicles, government incentives for EV infrastructure, and the growing focus on reducing carbon emissions. Additionally, advancements in charging technology are making electric vehicle ownership more appealing.

What challenges does the Germany Electric Vehicle Charging Equipment Market face?

The Germany Electric Vehicle Charging Equipment Market faces challenges such as the high initial costs of installation, the need for extensive infrastructure development, and varying regulations across regions. These factors can hinder the rapid deployment of charging stations necessary to support EV growth.

What opportunities exist in the Germany Electric Vehicle Charging Equipment Market?

Opportunities in the Germany Electric Vehicle Charging Equipment Market include the expansion of charging networks, the integration of renewable energy sources, and the development of smart charging solutions. These trends can enhance user experience and promote sustainable transportation.

What trends are shaping the Germany Electric Vehicle Charging Equipment Market?

Trends shaping the Germany Electric Vehicle Charging Equipment Market include the rise of ultra-fast charging stations, the implementation of vehicle-to-grid technology, and the increasing use of mobile apps for locating charging stations. These innovations are aimed at improving convenience and efficiency for electric vehicle users.

Germany Electric Vehicle Charging Equipment Market

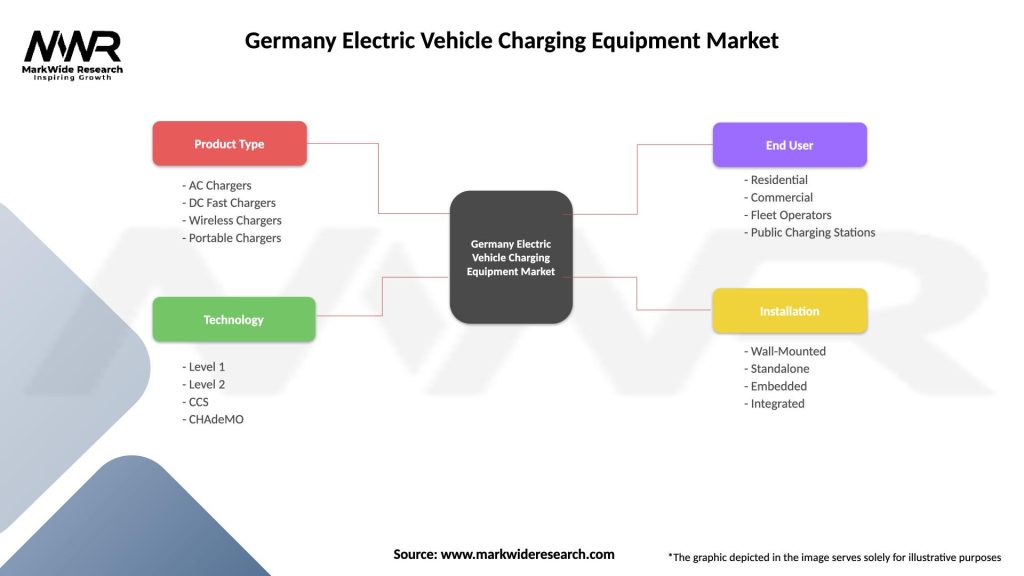

| Segmentation Details | Description |

|---|---|

| Product Type | AC Chargers, DC Fast Chargers, Wireless Chargers, Portable Chargers |

| Technology | Level 1, Level 2, CCS, CHAdeMO |

| End User | Residential, Commercial, Fleet Operators, Public Charging Stations |

| Installation | Wall-Mounted, Standalone, Embedded, Integrated |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Electric Vehicle Charging Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at