444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany dog health insurance market represents a rapidly evolving segment within the broader pet insurance industry, driven by increasing pet ownership rates and growing awareness of veterinary healthcare costs. German pet owners are increasingly recognizing the financial benefits of comprehensive health insurance coverage for their canine companions, leading to substantial market expansion across the country.

Market dynamics indicate that the German dog health insurance sector is experiencing robust growth, with adoption rates increasing by approximately 12.5% annually as more pet owners seek financial protection against unexpected veterinary expenses. The market encompasses various coverage options, from basic accident protection to comprehensive wellness plans that include routine care, preventive treatments, and specialized medical procedures.

Regional distribution shows that urban areas, particularly in major cities like Berlin, Munich, and Hamburg, account for approximately 68% of total market penetration, reflecting higher disposable incomes and greater awareness of pet insurance benefits among city dwellers. The market structure includes both traditional insurance companies expanding into pet coverage and specialized pet insurance providers offering tailored solutions for German dog owners.

Consumer behavior patterns demonstrate that German pet owners are becoming increasingly sophisticated in their insurance purchasing decisions, with premium coverage plans showing higher adoption rates among households with higher education levels and disposable income. The market benefits from Germany’s strong regulatory framework and consumer protection laws that ensure transparency and reliability in insurance offerings.

The Germany dog health insurance market refers to the comprehensive ecosystem of insurance products, services, and providers specifically designed to cover veterinary healthcare costs for dogs owned by German residents. This market encompasses various insurance policies that provide financial protection against unexpected medical expenses, routine healthcare costs, and specialized treatments for canine health conditions.

Dog health insurance in Germany typically includes coverage for accidents, illnesses, surgical procedures, diagnostic tests, medications, and in many cases, preventive care such as vaccinations and regular health checkups. The market operates within Germany’s established insurance regulatory framework, ensuring consumer protection and standardized coverage terms across different providers.

Market participants include traditional insurance companies, specialized pet insurance providers, veterinary service networks, and digital insurance platforms that offer streamlined policy management and claims processing. The ecosystem also encompasses veterinary clinics, animal hospitals, and pet healthcare service providers that work directly with insurance companies to facilitate coverage and claims processing.

Germany’s dog health insurance market is experiencing unprecedented growth as pet ownership continues to rise and veterinary costs increase across the country. The market has evolved from a niche offering to a mainstream financial product, with insurance penetration rates among dog owners reaching approximately 23% in 2024, representing significant growth potential as the market matures.

Key market drivers include rising veterinary costs, increased pet humanization trends, growing awareness of insurance benefits, and the expansion of digital insurance platforms that simplify policy purchase and management. German consumers are increasingly viewing their dogs as family members, leading to higher willingness to invest in comprehensive healthcare coverage.

Market segmentation reveals diverse coverage options ranging from basic accident-only policies to comprehensive wellness plans that include routine care, dental treatments, and alternative therapies. Premium policies with extensive coverage options are gaining traction among affluent pet owners, while budget-conscious consumers are driving demand for basic protection plans.

Competitive landscape features both established insurance companies expanding into pet coverage and specialized providers focusing exclusively on animal health insurance. Digital transformation is reshaping the market, with mobile apps and online platforms streamlining policy management, claims submission, and veterinary network access for German pet owners.

Market penetration analysis reveals significant growth opportunities, with current insurance adoption rates among German dog owners still substantially lower than in other developed markets. The following key insights shape market development:

Rising veterinary costs represent the primary driver of Germany’s dog health insurance market growth, with advanced medical treatments and specialized procedures becoming increasingly expensive. German pet owners face veterinary bills that can reach thousands of euros for complex treatments, making insurance coverage an attractive financial protection strategy.

Pet humanization trends are fundamentally reshaping consumer attitudes toward pet healthcare spending. German dog owners increasingly view their pets as family members, leading to higher willingness to invest in comprehensive healthcare coverage and premium insurance products that ensure access to the best available veterinary care.

Demographic shifts in pet ownership patterns are driving market expansion, with millennials and Generation Z consumers showing higher propensity to purchase insurance products for their pets. These younger demographics are more comfortable with digital insurance platforms and value the peace of mind that comprehensive coverage provides.

Veterinary industry evolution is creating new treatment options and specialized services that require substantial financial investment. Advanced diagnostic equipment, surgical procedures, and innovative treatments are becoming more widely available, increasing the potential financial exposure for pet owners and driving insurance demand.

Digital platform development is making pet insurance more accessible and user-friendly for German consumers. Mobile apps, online policy management, and streamlined claims processing are reducing barriers to insurance adoption and improving customer satisfaction with insurance products.

Limited market awareness continues to constrain growth potential, with many German dog owners still unaware of available insurance options or the financial benefits of coverage. Educational initiatives and marketing efforts are needed to increase consumer understanding of pet insurance value propositions.

Pre-existing condition exclusions represent a significant barrier for owners of older dogs or pets with known health issues. Insurance providers typically exclude coverage for conditions diagnosed before policy inception, limiting options for pets that would benefit most from insurance coverage.

Complex policy terms and varying coverage limitations can confuse consumers and create hesitation in purchasing decisions. German consumers value transparency and clear communication, making policy complexity a potential deterrent to market growth.

Waiting periods and coverage limitations in initial policy months can frustrate pet owners seeking immediate coverage for their dogs. These standard industry practices, while necessary for risk management, can discourage potential customers who need immediate coverage.

Premium cost concerns among price-sensitive consumers may limit market penetration, particularly in economic downturns or among households with multiple pets. Balancing affordable premiums with comprehensive coverage remains a key challenge for insurance providers.

Untapped rural markets present significant expansion opportunities for insurance providers willing to invest in market education and distribution channels outside major urban centers. Rural pet owners often face limited veterinary options and could benefit substantially from insurance coverage that provides access to specialized care.

Corporate partnership programs with employers offer opportunities to expand market reach through employee benefit packages. German companies increasingly recognize pet ownership as an employee wellness factor, creating opportunities for group insurance offerings and employer-subsidized coverage.

Breed-specific insurance products represent a growing opportunity as pet owners seek tailored coverage for their dogs’ specific health risks. Customized policies that address breed-specific conditions and health concerns can command premium pricing while providing superior value to customers.

Wellness program integration offers opportunities to expand beyond traditional insurance models into comprehensive pet health management. Preventive care programs, health monitoring services, and wellness incentives can differentiate providers and increase customer loyalty.

Digital health monitoring integration through wearable devices and health tracking applications presents opportunities for innovative insurance products that reward healthy behaviors and provide early intervention capabilities for pet health issues.

Supply-demand dynamics in the Germany dog health insurance market reflect growing consumer demand outpacing current market penetration rates, creating favorable conditions for sustained growth. Insurance providers are expanding product offerings and distribution channels to capture increasing demand from German pet owners.

Competitive intensity is increasing as traditional insurance companies enter the pet insurance market alongside specialized providers. This competition is driving innovation in coverage options, pricing strategies, and customer service capabilities, ultimately benefiting German consumers through improved product offerings.

Regulatory environment in Germany provides a stable foundation for market growth, with consumer protection laws ensuring transparency and reliability in insurance offerings. Regulatory compliance requirements create barriers to entry but also build consumer confidence in insurance products.

Technology adoption is reshaping market dynamics, with digital platforms enabling more efficient operations, improved customer experiences, and data-driven risk assessment capabilities. Insurance providers leveraging technology effectively are gaining competitive advantages in customer acquisition and retention.

Veterinary industry relationships are becoming increasingly important as insurance providers seek to build networks of preferred providers and streamline claims processing. Strong veterinary partnerships enhance customer satisfaction and operational efficiency for insurance companies.

Primary research methodology employed comprehensive data collection through structured surveys of German dog owners, veterinary professionals, and insurance industry participants. Survey instruments captured detailed information about insurance purchasing behaviors, coverage preferences, and market perceptions across diverse demographic segments.

Secondary research analysis incorporated extensive review of industry reports, regulatory filings, company financial statements, and market intelligence databases to establish baseline market conditions and competitive landscape dynamics. Historical trend analysis provided context for current market developments and future projections.

Expert interviews with veterinary professionals, insurance executives, and industry analysts provided qualitative insights into market trends, challenges, and opportunities. These interviews validated quantitative findings and provided deeper understanding of market dynamics affecting the Germany dog health insurance sector.

Data validation processes ensured accuracy and reliability of research findings through triangulation of multiple data sources and cross-verification of key market indicators. Statistical analysis techniques were applied to identify significant trends and correlations within the dataset.

Market modeling approaches utilized advanced analytical frameworks to project market growth scenarios and assess the impact of various market drivers and restraints on future development. Scenario planning methodologies provided insights into potential market evolution paths under different conditions.

Northern Germany demonstrates strong market penetration rates, with cities like Hamburg and Bremen showing approximately 28% insurance adoption among dog owners. The region benefits from higher disposable incomes, strong veterinary infrastructure, and greater awareness of insurance benefits among urban populations.

Southern Germany represents the largest market segment, with Bavaria and Baden-Württemberg accounting for significant market share due to high pet ownership rates and affluent consumer demographics. Munich and Stuttgart serve as key market centers with sophisticated veterinary services and insurance provider presence.

Western Germany shows moderate market development, with the Ruhr Valley and Rhine regions demonstrating steady growth in insurance adoption. Industrial heritage and diverse economic base provide stable foundation for market expansion, though penetration rates remain below national averages in some areas.

Eastern Germany presents emerging market opportunities with lower current penetration rates but growing interest in pet insurance products. Economic development and increasing disposable incomes in cities like Dresden and Leipzig are driving gradual market expansion in the region.

Berlin metropolitan area serves as a unique market segment with high pet ownership rates and strong consumer awareness of insurance benefits. The capital region shows above-average adoption rates and serves as a testing ground for innovative insurance products and digital platforms.

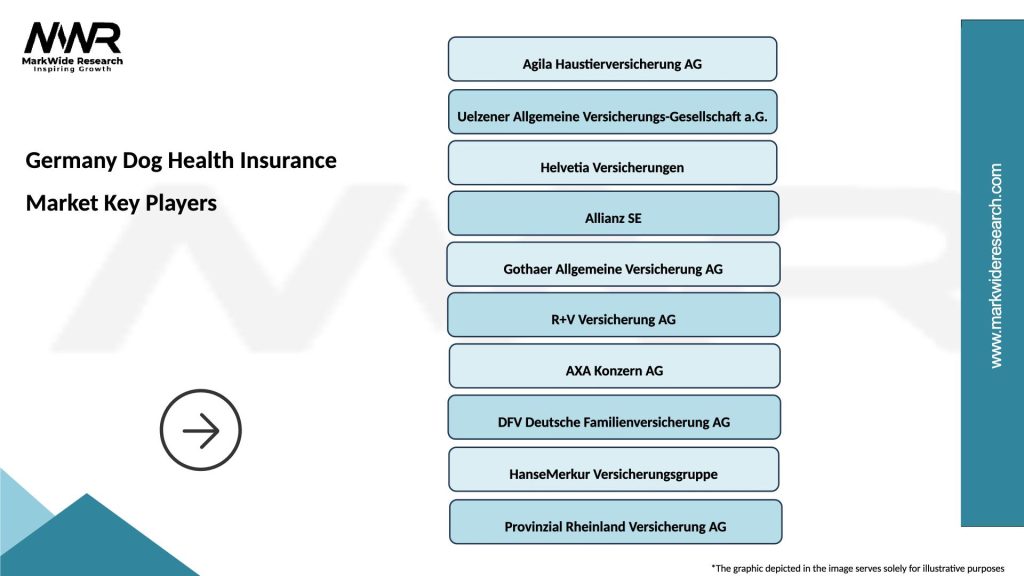

Market leadership is distributed among several key players, each bringing distinct strengths and market positioning strategies to the Germany dog health insurance sector:

Competitive strategies focus on differentiation through coverage comprehensiveness, pricing competitiveness, customer service excellence, and digital platform capabilities. Market leaders are investing in technology infrastructure, veterinary partnerships, and customer education initiatives to maintain competitive advantages.

Market consolidation trends are emerging as larger insurance companies acquire specialized pet insurance providers to expand market presence and gain expertise in animal health risk assessment. These consolidation activities are reshaping competitive dynamics and market structure.

By Coverage Type: The market segments into distinct coverage categories serving different consumer needs and price points:

By Dog Size: Insurance providers often segment policies based on dog size due to varying healthcare costs and risk profiles:

By Age Group: Policy terms and pricing vary significantly based on dog age at enrollment:

Premium Policy Segment demonstrates the strongest growth trajectory, with affluent German pet owners increasingly selecting comprehensive coverage options that include wellness benefits, alternative therapies, and unlimited annual coverage limits. This segment shows approximately 18% annual growth as consumers prioritize comprehensive healthcare protection for their dogs.

Basic Coverage Segment maintains steady demand among price-sensitive consumers seeking essential protection against major veterinary expenses. These policies typically focus on accident and emergency illness coverage, providing affordable entry points into the insurance market for budget-conscious pet owners.

Breed-Specific Policies are gaining traction as insurance providers develop specialized coverage options addressing the unique health risks associated with specific dog breeds. German Shepherds, Rottweilers, and other popular German breeds are driving demand for customized insurance solutions.

Digital-First Products represent a rapidly growing category, with mobile-native insurance platforms capturing increasing market share among younger consumers. These products emphasize user experience, streamlined claims processing, and digital customer service capabilities.

Corporate Group Policies are emerging as a significant category, with German employers increasingly offering pet insurance as an employee benefit. This segment shows strong growth potential as companies recognize pet ownership as a factor in employee satisfaction and retention.

Pet Owners benefit from financial protection against unexpected veterinary costs, access to comprehensive healthcare services, and peace of mind regarding their dogs’ medical needs. Insurance coverage enables pet owners to make healthcare decisions based on medical necessity rather than financial constraints, improving overall pet health outcomes.

Veterinary Professionals gain from increased client ability to afford recommended treatments, reduced financial barriers to preventive care, and streamlined payment processes through insurance partnerships. Veterinary practices benefit from more predictable revenue streams and improved client relationships when insurance coverage removes financial stress from treatment decisions.

Insurance Providers access a growing market segment with strong customer loyalty and recurring revenue potential. The pet insurance market offers opportunities for portfolio diversification, cross-selling with other insurance products, and building long-term customer relationships through comprehensive service offerings.

German Economy benefits from increased spending on veterinary services, job creation in the insurance and veterinary sectors, and improved animal welfare standards. The growing pet insurance market contributes to economic activity and supports the development of specialized veterinary services and facilities.

Regulatory Authorities gain from increased consumer protection in pet healthcare financing, standardized insurance practices, and improved transparency in veterinary cost structures. Regulated pet insurance markets provide better consumer outcomes and support overall animal welfare objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Transformation is revolutionizing the Germany dog health insurance market, with mobile apps and online platforms becoming standard customer service channels. Insurance providers are investing heavily in digital capabilities to streamline policy management, claims processing, and customer communication, resulting in improved satisfaction rates and operational efficiency.

Preventive Care Integration represents a significant trend as insurance providers expand coverage beyond traditional accident and illness protection to include routine healthcare services. Wellness programs, vaccination coverage, and preventive treatments are becoming standard features in premium policy offerings, reflecting consumer demand for comprehensive health management.

Personalized Coverage Options are gaining popularity as insurance providers leverage data analytics to offer customized policies based on dog breed, age, health history, and owner preferences. This trend toward personalization enables more accurate risk assessment and pricing while providing consumers with coverage options that better match their specific needs.

Veterinary Partnership Programs are expanding as insurance companies build networks of preferred providers to enhance customer experience and control costs. These partnerships often include direct billing arrangements, streamlined claims processing, and coordinated care management that benefits both pet owners and veterinary practices.

Sustainability Focus is emerging as insurance providers incorporate environmental and social responsibility considerations into their business models. Green initiatives, sustainable business practices, and community involvement programs are becoming important differentiators in the competitive landscape.

Technology Integration Initiatives are transforming how German pet insurance companies operate and serve customers. MarkWide Research analysis indicates that artificial intelligence and machine learning applications are being deployed for risk assessment, fraud detection, and customer service automation, improving operational efficiency by approximately 25%.

Regulatory Compliance Enhancements have strengthened consumer protection and market transparency in the German pet insurance sector. New regulations requiring clearer policy documentation and standardized coverage terms are building consumer confidence and supporting market growth.

Strategic Acquisitions are reshaping the competitive landscape as larger insurance companies acquire specialized pet insurance providers to gain market expertise and expand their customer base. These consolidation activities are creating more comprehensive service offerings and improved market coverage.

Product Innovation Launches include new coverage options for alternative therapies, behavioral training, and preventive care services. Insurance providers are expanding their offerings to address evolving consumer preferences and comprehensive pet healthcare needs.

Digital Platform Expansions are enabling insurance companies to reach new customer segments and improve service delivery. Mobile-first platforms and online policy management systems are becoming standard offerings across the industry, enhancing customer accessibility and satisfaction.

Market Education Investment should be prioritized by insurance providers to increase consumer awareness of pet insurance benefits and available coverage options. Educational campaigns targeting pet owners through veterinary clinics, pet stores, and digital channels can significantly expand market penetration rates.

Product Simplification Efforts are recommended to address consumer confusion regarding policy terms and coverage limitations. Clear, straightforward policy documentation and transparent pricing structures will improve customer confidence and purchase decisions.

Rural Market Development presents significant growth opportunities for insurance providers willing to invest in distribution channels and market education outside major urban centers. Partnerships with rural veterinary practices and agricultural organizations can facilitate market expansion.

Technology Investment Priorities should focus on customer-facing platforms that simplify policy management and claims processing. Mobile applications, online portals, and automated customer service capabilities are essential for competing effectively in the evolving market landscape.

Partnership Strategy Development with veterinary practices, pet retailers, and corporate employers can create new distribution channels and customer acquisition opportunities. Strategic partnerships enable insurance providers to reach target customers more effectively while providing added value to partners.

Market growth projections indicate continued expansion of the Germany dog health insurance market, with penetration rates expected to reach approximately 35% by 2030 as consumer awareness increases and product offerings become more comprehensive. The market is positioned for sustained growth driven by demographic trends, increasing veterinary costs, and evolving consumer attitudes toward pet healthcare.

Technology evolution will continue reshaping the market landscape, with artificial intelligence, telemedicine integration, and wearable device connectivity becoming standard features in premium insurance offerings. These technological advances will enable more personalized coverage options and proactive health management capabilities.

Regulatory developments are expected to further strengthen consumer protection and market transparency, potentially including standardized coverage definitions and enhanced disclosure requirements. These regulatory changes will likely benefit consumers while creating compliance challenges for insurance providers.

Competitive landscape evolution will see continued consolidation as larger players acquire specialized providers, alongside the emergence of new digital-native insurance companies targeting younger consumer segments. This dynamic competitive environment will drive innovation and improve customer value propositions.

Consumer behavior trends suggest increasing sophistication in insurance purchasing decisions, with pet owners seeking comprehensive coverage options and value-added services beyond basic insurance protection. MWR projections indicate that wellness-focused policies will represent approximately 45% of new policy sales by 2028, reflecting evolving consumer preferences for preventive healthcare approaches.

The Germany dog health insurance market stands at a pivotal point in its development, with strong growth fundamentals supported by increasing pet ownership, rising veterinary costs, and evolving consumer attitudes toward pet healthcare. Market penetration rates remain well below potential, indicating substantial opportunities for expansion across all consumer segments and geographic regions.

Digital transformation and technology integration are reshaping competitive dynamics, enabling more efficient operations and improved customer experiences while creating new opportunities for innovative service delivery. Insurance providers that successfully leverage technology capabilities while maintaining focus on customer needs and regulatory compliance will be best positioned for long-term success.

Strategic priorities for market participants should include consumer education, product simplification, rural market development, and strategic partnership formation to capture growth opportunities and build sustainable competitive advantages. The market’s evolution toward comprehensive wellness-focused coverage options reflects broader trends in pet humanization and healthcare consumerism.

Looking forward, the Germany dog health insurance market is expected to continue its growth trajectory, supported by favorable demographic trends, regulatory stability, and increasing consumer recognition of insurance value. Success in this evolving market will require adaptability, customer focus, and strategic investment in capabilities that address changing consumer needs and market dynamics.

What is Dog Health Insurance?

Dog health insurance is a type of coverage that helps pet owners manage veterinary costs for their dogs. It typically covers a range of services including routine check-ups, emergency care, and surgeries, ensuring that pet owners can provide necessary medical attention without financial strain.

What are the key players in the Germany Dog Health Insurance Market?

Key players in the Germany Dog Health Insurance Market include companies like Allianz, Petplan, and AGILA. These companies offer various plans tailored to different needs, providing coverage for accidents, illnesses, and preventive care, among others.

What are the growth factors driving the Germany Dog Health Insurance Market?

The growth of the Germany Dog Health Insurance Market is driven by increasing pet ownership, rising awareness of pet health, and the growing willingness of pet owners to invest in their pets’ well-being. Additionally, advancements in veterinary medicine are leading to higher treatment costs, prompting more owners to seek insurance.

What challenges does the Germany Dog Health Insurance Market face?

The Germany Dog Health Insurance Market faces challenges such as the lack of awareness among pet owners about the benefits of insurance and the complexity of policy terms. Additionally, some owners may be deterred by the perceived high costs of premiums and exclusions in coverage.

What opportunities exist in the Germany Dog Health Insurance Market?

Opportunities in the Germany Dog Health Insurance Market include the potential for product innovation, such as customizable plans and telemedicine services. There is also a growing trend towards integrating wellness programs that promote preventive care, which can attract more pet owners to consider insurance.

What trends are shaping the Germany Dog Health Insurance Market?

Trends shaping the Germany Dog Health Insurance Market include the increasing popularity of online policy management and claims processing. Additionally, there is a rise in demand for comprehensive coverage options that include alternative therapies and preventive care, reflecting a shift in consumer preferences towards holistic pet health.

Germany Dog Health Insurance Market

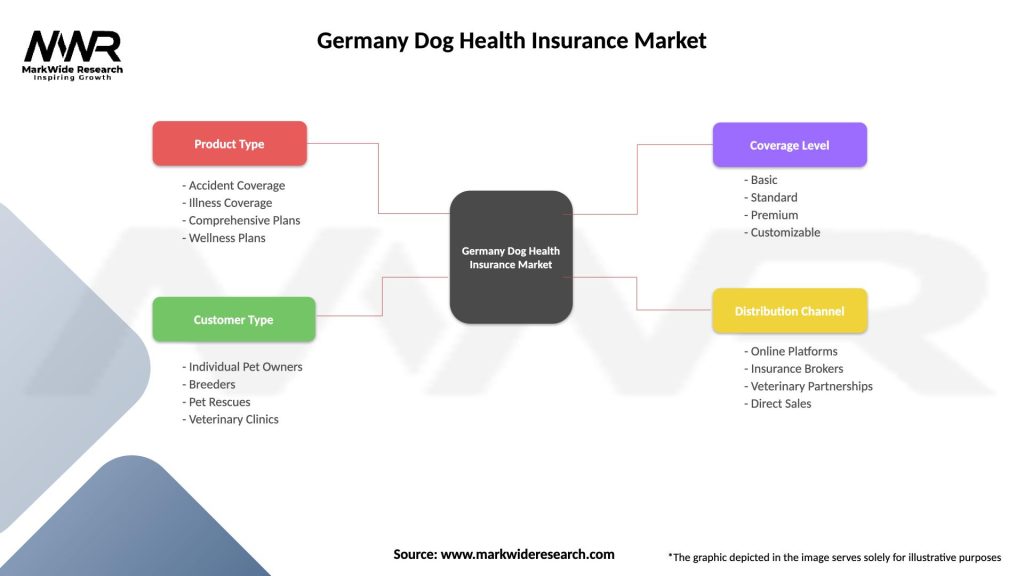

| Segmentation Details | Description |

|---|---|

| Product Type | Accident Coverage, Illness Coverage, Comprehensive Plans, Wellness Plans |

| Customer Type | Individual Pet Owners, Breeders, Pet Rescues, Veterinary Clinics |

| Coverage Level | Basic, Standard, Premium, Customizable |

| Distribution Channel | Online Platforms, Insurance Brokers, Veterinary Partnerships, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Dog Health Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at