444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany digital diabetes management market represents a transformative healthcare segment that leverages advanced technology to revolutionize diabetes care delivery across the nation. With Germany hosting one of Europe’s largest diabetic populations, the integration of digital solutions has become paramount in addressing the growing healthcare demands. Digital diabetes management encompasses a comprehensive ecosystem of mobile applications, continuous glucose monitoring systems, insulin delivery devices, and telemedicine platforms designed to enhance patient outcomes and reduce healthcare costs.

Market dynamics indicate robust growth driven by increasing diabetes prevalence, technological advancements, and supportive government healthcare policies. The German healthcare system’s emphasis on preventive care and digital health initiatives has created fertile ground for innovative diabetes management solutions. Healthcare providers are increasingly adopting digital platforms to deliver personalized care, monitor patient progress remotely, and optimize treatment protocols through data-driven insights.

Technology adoption rates in Germany’s diabetes care sector have accelerated significantly, with approximately 68% of healthcare facilities implementing some form of digital diabetes management solution. The market encompasses various stakeholders including healthcare providers, technology companies, pharmaceutical manufacturers, and insurance providers, all collaborating to create integrated care pathways that improve patient experiences and clinical outcomes.

The Germany digital diabetes management market refers to the comprehensive ecosystem of technology-enabled solutions, platforms, and services designed to support diabetes care delivery, patient monitoring, and treatment optimization within the German healthcare landscape. This market encompasses digital therapeutics, mobile health applications, continuous glucose monitoring systems, insulin management platforms, and integrated healthcare delivery systems that leverage data analytics and artificial intelligence to enhance diabetes care outcomes.

Digital diabetes management solutions integrate various technological components including wearable devices, smartphone applications, cloud-based platforms, and electronic health records to create seamless care experiences. These systems enable real-time glucose monitoring, medication adherence tracking, lifestyle management support, and remote patient monitoring capabilities that empower both patients and healthcare providers to make informed treatment decisions.

Market participants include established healthcare technology companies, emerging digital health startups, pharmaceutical manufacturers, medical device companies, and healthcare service providers who collaborate to deliver comprehensive diabetes management solutions tailored to the German healthcare system’s requirements and regulatory framework.

Germany’s digital diabetes management market demonstrates exceptional growth potential driven by increasing diabetes prevalence, technological innovation, and evolving healthcare delivery models. The market benefits from Germany’s robust healthcare infrastructure, supportive regulatory environment, and strong emphasis on digital health transformation initiatives that prioritize patient-centered care delivery.

Key market drivers include the rising incidence of Type 1 and Type 2 diabetes, aging population demographics, healthcare cost containment pressures, and growing patient demand for convenient, accessible care solutions. Approximately 42% of German diabetes patients actively use digital health tools to manage their condition, indicating strong market acceptance and adoption potential.

Technology segments experiencing rapid growth include continuous glucose monitoring systems, insulin delivery automation, mobile health applications, and telemedicine platforms. The market’s evolution is characterized by increasing integration between different technology platforms, enhanced data analytics capabilities, and improved user experience design that promotes sustained patient engagement.

Competitive landscape features a mix of established medical device manufacturers, innovative technology startups, and healthcare service providers who are developing comprehensive solutions that address the full spectrum of diabetes management needs. Strategic partnerships between technology companies and healthcare providers are becoming increasingly common to deliver integrated care solutions.

Market penetration analysis reveals significant opportunities for growth across various patient segments and healthcare settings. The following insights highlight critical market dynamics:

Diabetes prevalence escalation serves as the primary catalyst driving Germany’s digital diabetes management market expansion. The increasing incidence of both Type 1 and Type 2 diabetes across all age groups creates substantial demand for innovative management solutions that can deliver personalized, accessible care while reducing healthcare system burden.

Technological advancement acceleration enables the development of sophisticated diabetes management platforms that integrate artificial intelligence, machine learning, and predictive analytics to optimize treatment protocols. These technologies provide healthcare providers with actionable insights while empowering patients to take active roles in managing their conditions through intuitive, user-friendly interfaces.

Healthcare cost optimization pressures motivate healthcare systems to adopt digital solutions that demonstrate measurable return on investment through improved patient outcomes, reduced hospital readmissions, and enhanced care efficiency. Digital diabetes management platforms help healthcare providers deliver high-quality care while managing resource constraints and operational costs.

Patient empowerment trends reflect growing consumer demand for healthcare solutions that provide greater control, convenience, and accessibility. Modern diabetes patients seek technology-enabled tools that integrate seamlessly into their daily routines while providing real-time feedback and support for informed decision-making.

Regulatory support initiatives from German healthcare authorities encourage digital health innovation through favorable reimbursement policies, streamlined approval processes, and supportive regulatory frameworks that facilitate market entry for innovative diabetes management solutions.

Data privacy concerns represent significant challenges for digital diabetes management market growth, as patients and healthcare providers express apprehensions about sensitive health information security and compliance with stringent European data protection regulations. These concerns can limit adoption rates and require substantial investments in cybersecurity infrastructure.

Technology integration complexities pose barriers for healthcare providers attempting to implement digital diabetes management solutions within existing healthcare systems. Legacy infrastructure limitations, interoperability challenges, and staff training requirements can delay implementation timelines and increase adoption costs.

Digital literacy variations among patient populations create adoption disparities, particularly among older diabetes patients who may struggle with technology interfaces or lack confidence in using digital health tools. This demographic challenge requires targeted education and support programs to ensure equitable access to digital diabetes management benefits.

Reimbursement uncertainties continue to impact market growth as healthcare providers and patients navigate evolving insurance coverage policies for digital diabetes management solutions. Inconsistent reimbursement frameworks can limit patient access and reduce provider incentives for technology adoption.

Clinical validation requirements demand extensive research and regulatory approval processes that can delay market entry for innovative solutions. The need for robust clinical evidence demonstrating safety and efficacy creates barriers for smaller companies and extends product development timelines.

Artificial intelligence integration presents substantial opportunities for developing next-generation diabetes management platforms that provide predictive analytics, personalized treatment recommendations, and automated care adjustments. AI-powered solutions can analyze vast datasets to identify patterns and optimize treatment protocols for individual patients.

Telemedicine expansion creates opportunities for remote diabetes care delivery that extends healthcare access to underserved populations while reducing patient travel requirements and healthcare system costs. Virtual consultation platforms and remote monitoring capabilities enable continuous care delivery regardless of geographical constraints.

Wearable technology advancement offers opportunities for developing sophisticated monitoring devices that provide continuous health data collection and real-time feedback to patients and healthcare providers. Next-generation wearables can monitor multiple biomarkers simultaneously while maintaining user comfort and convenience.

Healthcare ecosystem partnerships enable comprehensive solution development through collaboration between technology companies, healthcare providers, pharmaceutical manufacturers, and insurance companies. These partnerships can create integrated care pathways that address the full spectrum of diabetes management needs.

Personalized medicine approaches leverage genetic testing, biomarker analysis, and individual patient data to develop customized treatment protocols that optimize outcomes while minimizing adverse effects. Personalized diabetes management solutions can significantly improve patient satisfaction and clinical results.

Technology evolution cycles drive continuous innovation in Germany’s digital diabetes management market, with emerging technologies regularly disrupting established solutions and creating new market segments. The rapid pace of technological advancement requires market participants to maintain agile development approaches and strategic partnerships to remain competitive.

Patient behavior shifts toward proactive health management create demand for comprehensive digital solutions that support lifestyle modifications, medication adherence, and continuous monitoring. Modern diabetes patients expect technology platforms that integrate seamlessly with their daily routines while providing actionable insights for improved health outcomes.

Healthcare delivery transformation emphasizes value-based care models that prioritize patient outcomes over service volume, creating opportunities for digital diabetes management solutions that demonstrate measurable clinical and economic benefits. This shift encourages innovation in outcome measurement and care optimization technologies.

Competitive intensity increases as established healthcare companies and innovative startups compete for market share through product differentiation, strategic partnerships, and comprehensive solution offerings. Market participants must balance innovation investments with operational efficiency to maintain sustainable growth trajectories.

Regulatory landscape evolution continues to shape market development through updated guidelines, reimbursement policies, and approval processes that influence product development strategies and market entry timelines. Successful market participants actively engage with regulatory authorities to ensure compliance and optimize market access strategies.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Germany’s digital diabetes management market dynamics. The research approach combines quantitative data analysis with qualitative insights gathered from industry stakeholders, healthcare providers, and patient populations.

Primary research activities include structured interviews with healthcare professionals, technology executives, and diabetes patients to gather firsthand insights into market trends, adoption barriers, and future opportunities. These interviews provide valuable perspectives on real-world implementation challenges and success factors.

Secondary research sources encompass healthcare industry reports, government publications, academic studies, and company financial disclosures to establish market context and validate primary research findings. This comprehensive approach ensures research conclusions are supported by multiple data sources and perspectives.

Data validation processes involve cross-referencing information from multiple sources, conducting follow-up interviews to clarify findings, and applying statistical analysis techniques to identify trends and patterns. This rigorous validation approach enhances research reliability and accuracy.

Market modeling techniques utilize advanced analytics to project future market trends, assess competitive dynamics, and evaluate growth opportunities across different market segments. These models incorporate various scenarios to provide comprehensive market outlook perspectives.

Northern Germany regions demonstrate strong adoption rates for digital diabetes management solutions, driven by high healthcare infrastructure development, technology-savvy populations, and supportive healthcare policies. Cities like Hamburg and Bremen lead in implementing comprehensive digital health initiatives that integrate diabetes management platforms with broader healthcare delivery systems.

Bavaria and Baden-Württemberg represent significant market opportunities due to their robust healthcare systems, high patient populations, and strong technology industry presence. These regions show approximately 72% adoption rates among healthcare providers for digital diabetes management platforms, indicating mature market development and continued growth potential.

North Rhine-Westphalia accounts for substantial market share given its large population base and extensive healthcare infrastructure. The region’s urban centers demonstrate high patient engagement with digital health solutions, while rural areas present opportunities for telemedicine and remote monitoring platform expansion.

Eastern German states show emerging market potential with increasing healthcare digitization investments and growing patient awareness of digital diabetes management benefits. These regions benefit from targeted government initiatives aimed at reducing healthcare disparities and improving access to innovative care solutions.

Metropolitan areas including Berlin, Munich, and Frankfurt serve as innovation hubs for digital diabetes management solution development and testing. These cities attract technology companies, healthcare startups, and research institutions that collaborate to advance diabetes care delivery through digital innovation.

Market leadership in Germany’s digital diabetes management sector is characterized by a diverse ecosystem of established healthcare technology companies, innovative startups, and traditional medical device manufacturers who are expanding their digital capabilities. The competitive environment encourages continuous innovation and strategic partnerships.

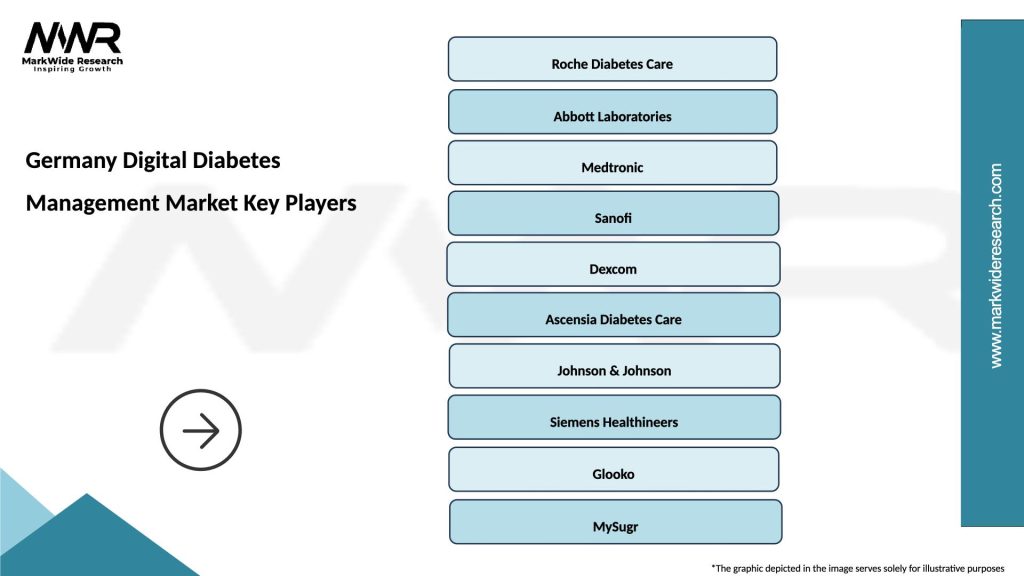

Key market participants include:

Competitive strategies focus on product differentiation through advanced technology integration, comprehensive care platform development, and strategic partnerships with healthcare providers and technology companies. Market participants invest heavily in research and development to maintain competitive advantages and address evolving patient needs.

Technology-based segmentation reveals distinct market categories that address different aspects of diabetes management and care delivery:

By Technology Type:

By Patient Type:

By End User:

Continuous glucose monitoring represents the fastest-growing category within Germany’s digital diabetes management market, driven by technological improvements that enhance accuracy, reduce calibration requirements, and extend sensor wear time. These systems provide patients with real-time glucose data and trend information that enables proactive management decisions.

Mobile health applications demonstrate strong user engagement rates, with approximately 85% of users actively utilizing tracking features for glucose monitoring, medication management, and lifestyle logging. Successful applications integrate gamification elements, social support features, and personalized coaching to maintain long-term user engagement.

Insulin delivery automation shows significant growth potential as hybrid closed-loop systems become more sophisticated and user-friendly. These systems combine continuous glucose monitoring with automated insulin delivery to reduce patient management burden while improving glycemic control outcomes.

Telemedicine platforms experienced accelerated adoption during healthcare digitization initiatives, with many patients and providers continuing to utilize virtual consultation capabilities for routine diabetes management appointments. These platforms reduce healthcare access barriers while maintaining care quality and continuity.

Data analytics solutions provide healthcare providers with population health insights, treatment optimization recommendations, and outcome prediction capabilities that support evidence-based care delivery and resource allocation decisions.

Healthcare providers benefit from digital diabetes management solutions through improved patient outcomes, enhanced care efficiency, and reduced administrative burden. These platforms enable remote patient monitoring, automated data collection, and evidence-based treatment adjustments that optimize resource utilization while maintaining high-quality care delivery.

Patients experience significant advantages including greater convenience, improved self-management capabilities, and enhanced quality of life through technology-enabled diabetes care. Digital solutions provide real-time feedback, educational resources, and support networks that empower patients to take active roles in managing their conditions.

Healthcare systems realize cost savings through reduced hospital readmissions, prevented complications, and optimized resource allocation enabled by digital diabetes management platforms. These solutions support value-based care initiatives while improving population health outcomes across diverse patient populations.

Technology companies access growing market opportunities through innovative product development, strategic partnerships, and expanding customer bases. The digital diabetes management market provides platforms for demonstrating technology value while contributing to meaningful healthcare improvements.

Insurance providers benefit from reduced claim costs, improved member health outcomes, and enhanced risk management capabilities through digital diabetes management program implementation. These solutions support preventive care initiatives while demonstrating measurable return on investment.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration emerges as a transformative trend reshaping Germany’s digital diabetes management landscape. AI-powered platforms provide predictive analytics, personalized treatment recommendations, and automated care adjustments that optimize patient outcomes while reducing healthcare provider workload. These intelligent systems learn from patient data patterns to deliver increasingly sophisticated care support.

Interoperability advancement drives market evolution as healthcare providers demand seamless integration between different technology platforms and existing healthcare systems. Standardized data exchange protocols and API development enable comprehensive care coordination while reducing implementation complexity and costs.

Patient-centric design becomes increasingly important as solution developers prioritize user experience, accessibility, and engagement features that promote sustained technology adoption. Modern diabetes management platforms incorporate intuitive interfaces, personalized content, and social support elements that address diverse patient needs and preferences.

Value-based care alignment influences product development strategies as healthcare systems emphasize outcome-based reimbursement models. Digital diabetes management solutions increasingly demonstrate measurable clinical and economic benefits that support healthcare provider adoption and insurance coverage decisions.

Remote monitoring expansion accelerates through advanced sensor technology, improved connectivity, and enhanced data analytics capabilities. These developments enable continuous patient monitoring while reducing healthcare facility visits and supporting preventive care initiatives that improve long-term health outcomes.

Strategic partnerships between technology companies and healthcare providers are reshaping market dynamics through collaborative solution development and integrated care delivery models. These partnerships combine technological expertise with clinical knowledge to create comprehensive diabetes management platforms that address real-world healthcare challenges.

Regulatory milestone achievements include expanded reimbursement coverage for digital diabetes management solutions and streamlined approval processes that accelerate market entry for innovative technologies. According to MarkWide Research analysis, these regulatory developments have contributed to increased market accessibility and adoption rates across Germany.

Technology breakthrough announcements feature next-generation continuous glucose monitoring systems with extended wear time, improved accuracy, and enhanced connectivity features. These innovations address key patient pain points while expanding market opportunities for technology providers and healthcare systems.

Investment activity increases as venture capital firms and strategic investors recognize the growth potential of digital diabetes management solutions. Funding rounds support research and development activities, market expansion initiatives, and strategic acquisition opportunities that consolidate market leadership positions.

Clinical evidence generation through large-scale studies demonstrates the effectiveness of digital diabetes management platforms in improving patient outcomes and reducing healthcare costs. These studies provide the evidence base necessary for expanded reimbursement coverage and healthcare provider adoption decisions.

Market participants should prioritize interoperability and integration capabilities when developing digital diabetes management solutions to ensure seamless adoption within existing healthcare systems. Investment in standardized data exchange protocols and API development will facilitate market penetration and customer satisfaction.

Healthcare providers are advised to develop comprehensive digital health strategies that incorporate diabetes management platforms as part of broader care transformation initiatives. Successful implementation requires staff training, workflow optimization, and patient education programs that support sustained technology adoption.

Technology companies should focus on user experience design and patient engagement features that promote long-term platform utilization. Solutions that incorporate behavioral science principles, gamification elements, and social support features demonstrate higher retention rates and clinical effectiveness.

Investment strategies should emphasize companies with strong clinical evidence, regulatory compliance capabilities, and scalable technology platforms that can adapt to evolving market requirements. Partnerships with established healthcare providers and technology companies offer reduced market entry risks and accelerated growth opportunities.

Policy makers can support market development through continued regulatory clarity, expanded reimbursement frameworks, and digital health infrastructure investments that reduce adoption barriers and promote innovation. Collaborative approaches with industry stakeholders ensure policies align with market realities and patient needs.

Market trajectory indicates continued robust growth driven by technological advancement, increasing diabetes prevalence, and evolving healthcare delivery models that prioritize patient-centered care. The German digital diabetes management market is positioned to become a European leader in innovative healthcare technology adoption and implementation.

Technology evolution will focus on artificial intelligence integration, predictive analytics capabilities, and personalized medicine approaches that optimize treatment outcomes for individual patients. Next-generation platforms will provide increasingly sophisticated care support while maintaining user-friendly interfaces and seamless healthcare system integration.

Market expansion opportunities include rural healthcare access improvement, elderly patient population engagement, and preventive care program development that addresses diabetes risk factors before clinical diagnosis. These opportunities require targeted solution development and strategic partnership approaches.

Competitive landscape evolution will likely feature increased consolidation as successful companies acquire complementary technologies and expand their comprehensive solution offerings. Market leaders will emerge through combination of technological innovation, clinical evidence generation, and strategic healthcare provider partnerships.

Growth projections suggest the market will experience sustained expansion with approximately 12-15% annual growth rates over the next five years, driven by continued technology adoption, expanding patient populations, and supportive regulatory environments. MWR analysis indicates that successful market participants will be those who can demonstrate measurable clinical and economic value while maintaining high levels of patient engagement and satisfaction.

Germany’s digital diabetes management market represents a dynamic and rapidly evolving healthcare segment that offers substantial opportunities for technology innovation, improved patient outcomes, and healthcare system optimization. The market’s growth trajectory is supported by strong healthcare infrastructure, supportive regulatory frameworks, and increasing patient demand for convenient, effective diabetes management solutions.

Key success factors for market participants include technological innovation, clinical evidence generation, healthcare system integration capabilities, and patient-centric solution design. Companies that can demonstrate measurable value through improved clinical outcomes and reduced healthcare costs will be best positioned to capture market opportunities and achieve sustainable growth.

Future market development will be characterized by continued technological advancement, expanded healthcare provider adoption, and increasing integration with broader digital health ecosystems. The convergence of artificial intelligence, predictive analytics, and personalized medicine approaches will create new possibilities for diabetes care delivery while addressing the growing healthcare demands of Germany’s aging population.

Strategic implications suggest that successful market participation requires comprehensive approaches that combine technological expertise, clinical knowledge, and healthcare system understanding. Collaborative partnerships between technology companies, healthcare providers, and regulatory authorities will be essential for realizing the full potential of digital diabetes management solutions in improving patient lives and healthcare system sustainability across Germany.

What is Digital Diabetes Management?

Digital Diabetes Management refers to the use of digital tools and technologies to help individuals manage their diabetes effectively. This includes mobile applications, wearable devices, and telehealth services that assist in monitoring blood glucose levels, medication adherence, and lifestyle changes.

What are the key players in the Germany Digital Diabetes Management Market?

Key players in the Germany Digital Diabetes Management Market include companies like Roche, Bayer, and Sanofi, which offer various digital solutions for diabetes management. These companies focus on innovative technologies to enhance patient care and improve health outcomes, among others.

What are the growth factors driving the Germany Digital Diabetes Management Market?

The growth of the Germany Digital Diabetes Management Market is driven by the increasing prevalence of diabetes, rising awareness about diabetes management, and advancements in technology. Additionally, the integration of artificial intelligence and data analytics in diabetes care is enhancing patient engagement and outcomes.

What challenges does the Germany Digital Diabetes Management Market face?

The Germany Digital Diabetes Management Market faces challenges such as data privacy concerns, regulatory hurdles, and the need for user-friendly interfaces. Additionally, the variability in patient adoption rates and the integration of digital tools into traditional healthcare systems can hinder market growth.

What opportunities exist in the Germany Digital Diabetes Management Market?

Opportunities in the Germany Digital Diabetes Management Market include the development of personalized diabetes management solutions and the expansion of telehealth services. Furthermore, partnerships between technology companies and healthcare providers can enhance service delivery and patient engagement.

What trends are shaping the Germany Digital Diabetes Management Market?

Trends shaping the Germany Digital Diabetes Management Market include the rise of mobile health applications, the use of continuous glucose monitoring systems, and the increasing focus on patient-centered care. Additionally, the integration of wearable technology is becoming more prevalent in diabetes management strategies.

Germany Digital Diabetes Management Market

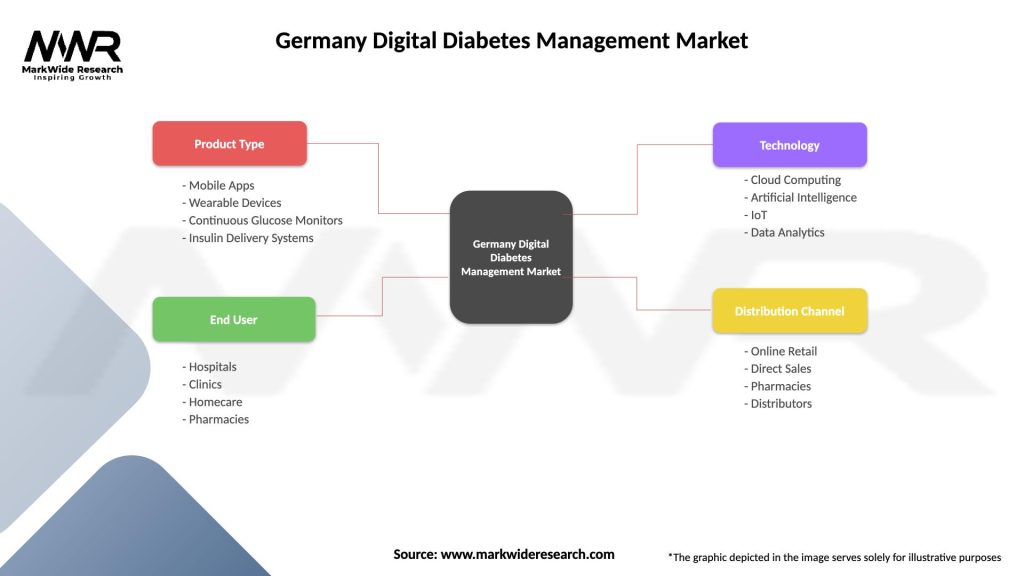

| Segmentation Details | Description |

|---|---|

| Product Type | Mobile Apps, Wearable Devices, Continuous Glucose Monitors, Insulin Delivery Systems |

| End User | Hospitals, Clinics, Homecare, Pharmacies |

| Technology | Cloud Computing, Artificial Intelligence, IoT, Data Analytics |

| Distribution Channel | Online Retail, Direct Sales, Pharmacies, Distributors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Digital Diabetes Management Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at